Reporting crypto staking rewards on taxes can be a complex process, especially for those new to the world of cryptocurrency. In this guide, we will provide a summary of the key considerations and reporting requirements associated with crypto staking taxes.

In the United States, the Internal Revenue Service (IRS) has issued guidance that treats crypto staking rewards in a similar manner to other forms of cryptocurrency income. For taxpayers who receive crypto staking rewards, it is important to recognize that these rewards may be considered taxable income. However, determining the fair market value of these rewards can be challenging, as crypto staking platforms may not provide regular statements or documentation

One case where crypto staking rewards are treated differently is Australia. The Australian Taxation Office identifies crypto staking rewards as ordinary income, which means they are subject to tax in the year they are acquired. This is a key difference that taxpayers must keep in mind when reporting their crypto staking rewards.

When it comes to reporting crypto staking rewards, it is important for taxpayers to consult with a tax professional to ensure compliance with local tax regulations. The exact treatment of crypto staking rewards may depend on factors such as the jurisdiction in which the taxpayer resides, the cost basis of the staked tokens, and the specific rules of the tax authorities. A tax professional will be able to provide guidance on the reporting requirements and help taxpayers determine the most appropriate way to report their crypto staking rewards.

In conclusion, reporting crypto staking rewards on taxes requires careful consideration and understanding of the relevant tax regulations. Taxpayers should seek professional advice to ensure compliance with tax laws and to maximize their tax deductions. By keeping accurate records of their crypto staking activities and seeking clarification from tax authorities when needed, individuals can ensure that they are reporting their crypto staking rewards correctly and avoiding any potential penalties.

Understanding Crypto Staking Rewards

Crypto staking rewards are the result of participating in a proof-of-stake (PoS) consensus mechanism. PoS is an alternative to proof-of-work (PoW), where individuals can earn rewards by holding and “staking” their cryptocurrencies. Staking involves locking up a certain amount of crypto in a wallet to support network security and validate transactions. Validators are chosen to create new blocks and are rewarded with staking rewards.

When it comes to taxes, taxpayers must consider how to report these staking rewards. Should they be treated as regular income? Are they taxed as capital gains? The answer may depend on the jurisdiction where the individual resides. Tax guidelines for crypto vary across different countries and regions.

Some countries, like the UK and parts of Europe, have issued guidelines regarding the taxation of crypto staking rewards. For example, in the UK, staking rewards are generally recognized as taxable income at the time they are received.

To calculate the amount of staking rewards earned, taxpayers will need to consider the market value of the crypto at the time it was earned. If the staking rewards are immediately sold, the gain or loss can be calculated based on the purchase price and the selling price.

If taxpayers are unsure about the exact tax treatment of their staking rewards, it is always recommended to seek guidance from a tax professional. They can provide clarification on the tax laws and regulations specific to the individual’s jurisdiction.

What are crypto staking rewards?

Crypto staking rewards are a type of written incentive that holders of certain digital assets, or coins, can earn by participating in the staking process. Staking involves holding and validating transactions on a proof-of-stake (PoS) blockchain protocol, which helps secure the network and maintain its operations.

The market recognizes staking rewards as a form of income, and it is therefore important to consider their treatment for tax purposes. When it comes to reporting crypto staking rewards on taxes, the process may vary depending on your local jurisdiction and how the country considers such rewards. In some cases, staking activities may be classified as a type of revenue, while in others, they may be considered as a capital gain.

If your country recognizes staking rewards as income, you will need to report them on your tax return. This includes calculating the value of the rewards earned, determining the market situation at the time of receipt, and potentially including them as taxable income. Additionally, you might be eligible to deduct any expenses related to staking, such as transaction fees, from your total rewards.

Daniel ‘Dominion-tax’ is an online protocol-focused tax expert who provides an overview of the tax implications of crypto staking rewards, as well as how to navigate the potentially complex legal landscape. According to ‘Dominion-tax’, it is important to emphasize that the specific tax treatment of staking rewards will depend on your local jurisdiction and how the country considers such rewards.

Overall, understanding the tax implications of crypto staking rewards is an important aspect of managing your digital assets. By recognizing the value of the rewards earned, determining the applicable taxation rules in your local jurisdiction, and following the guidelines provided by tax experts like Daniel ‘Dominion-tax’, you can better navigate the tax reporting process and ensure compliance with your country’s tax laws.

How do crypto staking rewards work?

Crypto staking rewards are the resulting incentives for individuals participating in the process of crypto staking. When an individual stakes their crypto, it means they lend or hold their funds in a wallet as collateral to support the operations of a blockchain network.

In return for their participation, individuals receive rewards in the form of additional tokens. These rewards are earned by validators who validate transactions and secure the network through the process of proof-of-stake, which is different from the proof-of-work method used in traditional blockchains, such as Bitcoin.

The process of earning staking rewards varies between different cryptocurrencies and platforms. Some platforms automatically distribute staking rewards to participants’ wallets on a daily basis, while others may require individuals to manually withdraw their rewards.

In case of tax-related issues, it’s important for individuals to keep track of their staking rewards. Although the tax treatment of crypto staking rewards can vary between jurisdictions, in countries like the USA and Canada, staking rewards are generally considered taxable income.

For tax purposes, individuals are required to report the value of the received staking rewards in the year they were received. This can be challenging since the value of cryptocurrencies can be volatile and may change over time. It is recommended to keep records of the market value of the received tokens at the time of receipt for future reference.

Additionally, individuals should be aware of the tax implications when they decide to sell or transfer the staked tokens they received as rewards. The sale or transfer of these tokens may result in capital gains or losses, depending on the price at the time of the transaction.

To ensure compliance with tax regulations, it is advisable to consult with a tax professional who is familiar with the specific tax laws related to crypto staking rewards in your jurisdiction.

Reporting Crypto Staking Rewards

Earning crypto staking rewards can be a lucrative endeavor, but it’s important to understand the specific financial implications and how to report them on your taxes. If you’re unsure about how to handle this type of income, here’s a guide that will provide you with the necessary information.

When it comes to reporting crypto staking rewards, the first thing you need to determine is whether they are considered ordinary income or capital gains. In most cases, these rewards are treated as ordinary income, similar to the interest you earn on a savings account or the dividends you receive from stocks.

To calculate the value of your staking rewards, you will need to know the fair market value of the crypto you receive. This can be a bit tricky as the value of cryptocurrencies fluctuates, but there are platforms like Coinpanda that can help with this process. Additionally, keep in mind that any fees you incur for staking will also factor into the calculation.

If you’re staking on platforms like Tezos or Qtum, the rewards you earn will most likely be in the form of more of the same cryptocurrency. In this case, you will need to determine the value of the rewards in US dollars at the time you received them. This will be the amount you report as income on your taxes.

As a general rule, staking rewards are taxable when they are realized. This means that if you choose to sell the rewards for fiat currency or another cryptocurrency, you will need to report the resulting profit as taxable income. On the other hand, if you hold onto the rewards without selling, they will not be subject to immediate taxation.

It’s important to note that the tax laws regarding crypto staking rewards may vary between countries. For example, in Europe, stakers may need to include the value of the rewards in their annual tax return. In the United States, there is currently no specific guidance on how to report staking rewards, but it’s advisable to consult with a tax professional to ensure compliance.

In conclusion, when it comes to reporting crypto staking rewards, there are several factors to consider, including the specific platform you use, the value of the rewards, and the local tax regulations. By keeping these guidelines in mind and seeking professional advice if needed, you can properly report your staking income and avoid any potential issues with the tax authorities.

Do you need to report staking rewards on taxes?

When it comes to cryptocurrency staking, one important question that arises is whether or not you need to report staking rewards on taxes. The answer to this question can vary depending on the country you are in and the specific regulations regarding cryptocurrency taxation in your country.

In most cases, staking rewards are considered as taxable income. This means that you need to report the rewards you receive from staking on your annual tax return. However, there may be some nuances regarding the reporting of staking rewards, such as whether the rewards are received as a refund or as a reward for supporting the network.

If you are unsure about the tax regulations in your country regarding staking rewards, it is recommended to seek the assistance of tax professionals who can provide an overview of the specific guidelines and regulations that apply to your situation.

In addition to the taxation aspect, it is also important to consider the liquidity of the rewards you receive from staking. Staked coins are generally not easily accessible for immediate withdrawal or conversion into other assets. This means that the rewards you receive may not have an immediate financial value until you are able to withdraw and sell them.

Furthermore, the total value of your staking rewards may fluctuate in the future based on factors such as changes in the crypto market and staking rates. This highlights the importance of keeping track of the rewards you receive and their value when you receive them, as this information may be needed for future tax reporting purposes.

In conclusion, while the specific reporting requirements for staking rewards on taxes can vary, it is generally agreed that stakers should be able to provide proof-of-stake (PoS) records and documentation to determine the value of the rewards they have received. Seeking clarification and guidance from tax professionals or referring to third-party published guidelines can help individuals and businesses navigate the taxation impact of staking operations in their respective countries.

Are crypto staking rewards considered taxable income?

When it comes to the taxation of crypto staking rewards, there is a lack of clarity and consistency in different jurisdictions around the world. However, in general, crypto staking rewards may be considered taxable income depending on the local tax laws and regulations.

In some countries, staking rewards are treated as a form of income and are subject to income tax. This means that individuals who receive staking rewards must report them as income when filing their tax returns. However, it is important to note that not all jurisdictions have explicit guidelines on how to treat staking rewards for tax purposes.

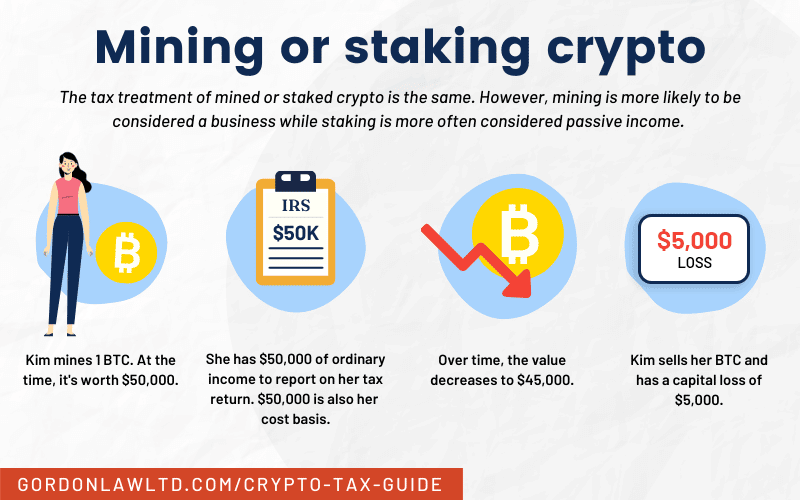

A key consideration when determining the tax treatment of staking rewards is whether they are classified as a form of income or as a capital gain. In some cases, staking rewards may be seen as similar to mining income, and therefore treated as ordinary income. However, in other cases, they may be viewed as a capital gain, similar to the appreciation in value of a cryptocurrency held.

It’s also worth noting that the tax treatment of staking rewards can vary depending on how they are received. For example, if staking rewards are received in the form of additional tokens, the fair market value of those tokens at the time of receipt may be considered as taxable income. On the other hand, if staking rewards are received in the same currency that is being staked, the tax treatment might be different.

Another aspect that can impact the taxation of staking rewards is the cost basis calculation. Similar to other forms of cryptocurrency transactions, the cost basis of staked tokens needs to be determined in order to accurately calculate any potential capital gains or losses when the tokens are sold or transferred. This can become more complex if there are multiple transactions or if the staked tokens are transferred to different wallets.

Overall, it’s important to consult with tax professionals or seek clarification from the relevant authorities in your jurisdiction to understand the specific tax implications of staking rewards. Tax laws and regulations can vary greatly from country to country, and it is essential to stay informed and compliant with the local tax requirements.

Calculating Tax Liability

Calculating tax liability for crypto staking rewards can be a complex process, as it involves considering several factors and alternative mechanisms.

An important aspect to consider is the fair market value of the rewards received. Since these rewards can take various forms, such as additional tokens or coins, their value must be determined for tax purposes. This value may be influenced by factors like the current market price or the exchange rate between different cryptocurrencies and fiat currencies.

One way to calculate the tax liability is through the use of third-party services or platforms that provide support for tax calculations. These services can help determine the fair market value of the rewards and consider any applicable tax regulations. For example, platforms like Coinpanda offer tools and services specifically designed for tracking and reporting cryptocurrency transactions and may be able to provide assistance in calculating tax liability.

It is also important to note that not all rewards received from staking activities may be taxable. Each jurisdiction and tax authority may have different regulations and criteria for determining what is considered taxable. For instance, some authorities may only tax the rewards once they are transferred or sold, while others may consider them taxable as soon as they are received.

In addition, the tax treatment of staking rewards may also vary depending on the specific blockchain or project involved. For example, in the case of Tezos (XTZ) staking, the rewards received are given in the form of additional XTZ tokens. These rewards may need to be considered as income and taxed accordingly.

It is always advisable to consult with a tax professional or accountant who is knowledgeable about cryptocurrency taxation to ensure compliance with local regulations. They can provide personalized advice and guidance based on the specific circumstances and jurisdiction of the individual taxpayer.

As regulations and guidelines surrounding cryptocurrency taxes continue to evolve, staying informed about any changes in tax laws and requirements is essential. Keeping accurate records and documentation of all crypto staking activities and rewards can also help in the tax reporting process.

How to calculate tax liability for staking rewards?

Calculating your tax liability for staking rewards involves understanding the taxation rules specific to your country or jurisdiction. The taxation of crypto-related operations varies around the world, so it is necessary to consult local tax laws and regulations or seek professional advice.

The taxation rules for crypto staking rewards can differ from country to country. In some cases, staking rewards may be treated as ordinary income, while in others they may be considered capital gains. It is important to note that the taxation of staking rewards depends on how they are received and disposed of.

When it comes to reporting staking rewards for tax purposes, it is crucial to keep accurate records of all transactions and activities related to your crypto staking. This includes the purchase of staking tokens, the staking process itself, as well as any disposals or transfers of the tokens.

In some cases, staking rewards received through blockchains that automatically distribute rewards may not show up as a separate transaction in your wallet. To validate your staking rewards for tax purposes, you may need to keep track of your staking activities and document the rewards received.

It is also important to note that the tax rates for staking rewards may differ from other financial activities. Some countries, such as Australia and the UK, have specific guidelines regarding the taxation of crypto assets. Seeking professional support or consulting relevant tax authorities can provide clarity on your specific situation.

Keep in mind that in some cases, staking rewards may be taxed once when received and again when the tokens are disposed of. The tax treatment of staking rewards can vary in different jurisdictions and depend on the individual’s tax situation.

In conclusion, calculating your tax liability for staking rewards involves understanding the specific taxation rules and regulations in your country or jurisdiction. Keeping accurate records of all staking activities and seeking professional advice can help ensure compliance with tax laws and regulations.

What tax rate applies to staking rewards?

When it comes to reporting staking rewards on taxes, the tax rate that applies can vary depending on the jurisdiction and the specific details of the staking process.

Under the current tax guidelines, staking rewards may be treated as ordinary income and taxed at the individual’s ordinary income tax rate. This means that the rewards would be subject to the same tax rate as the individual’s other sources of income.

However, it’s important to note that not all jurisdictions treat staking rewards the same way. Some countries may have alternative tax rates or processes for staking rewards, while others may not yet have clear guidelines on how to handle this type of cryptocurrency activity.

For example, in the United States, staking rewards can be seen as a form of income and therefore subject to income tax. However, if the rewards are locked up and not immediately accessible, then they may not be taxable until they are withdrawn. It’s always best to consult a tax professional or refer to your country’s tax regulations to understand how staking rewards are taxed in your specific case.

Reporting Staking Rewards to the IRS

Stakers who earn rewards through cryptocurrency staking may need to report these earnings to the IRS for tax purposes. While the IRS does not automatically track and tax these rewards, the responsibility falls on the staker to accurately report their earnings.

When it comes to reporting staking rewards, there are no exact guidelines provided by the IRS. This is because the court has not given a clear determination on how to categorize staking rewards for tax purposes. However, it is important to make an effort and declare these earnings to authorities to ensure compliance with tax laws.

In the USA, staking rewards may be treated as capital gains. Similarly to how other cryptocurrency gains are calculated, staking rewards can be considered as income received in exchange for participating in the blockchain network. The exact tax calculations and basis in which staking rewards are taxed can vary depending on the specific nuances of each protocol.

An example of a staking protocol is Tezos. Stakers on the Tezos network earn rewards by validating blocks and securing the network. When these stakers withdraw their rewards, the earned income can be subject to taxation. The IRS sees these rewards as income, and it is important for taxpayers to keep this in mind when calculating their tax obligations.

The amount of tax to be paid on staking rewards depends on various factors, including the taxpayer’s income level, tax bracket, and the duration of time for which the staked funds were held. Additionally, the local tax laws of the country or state in which the staker resides may also impact the tax calculations.

In Canada, for example, staking rewards are taxed based on a “dominion and control” test, meaning that the taxpayer must have full dominion and control over the rewards received. If the staker can’t demonstrate this, the rewards may not be taxed. It is important for stakers to understand the specific tax laws of their country or state to ensure compliance.

In summary, when it comes to reporting staking rewards on taxes, stakers must take into account the earnings received, the specific tax laws of their country or state, and the duration for which the funds were staked. While the IRS does not automatically track and tax these rewards, it is important for stakers to accurately report their earnings to ensure compliance with tax laws.

What forms do you need to report staking rewards to the IRS?

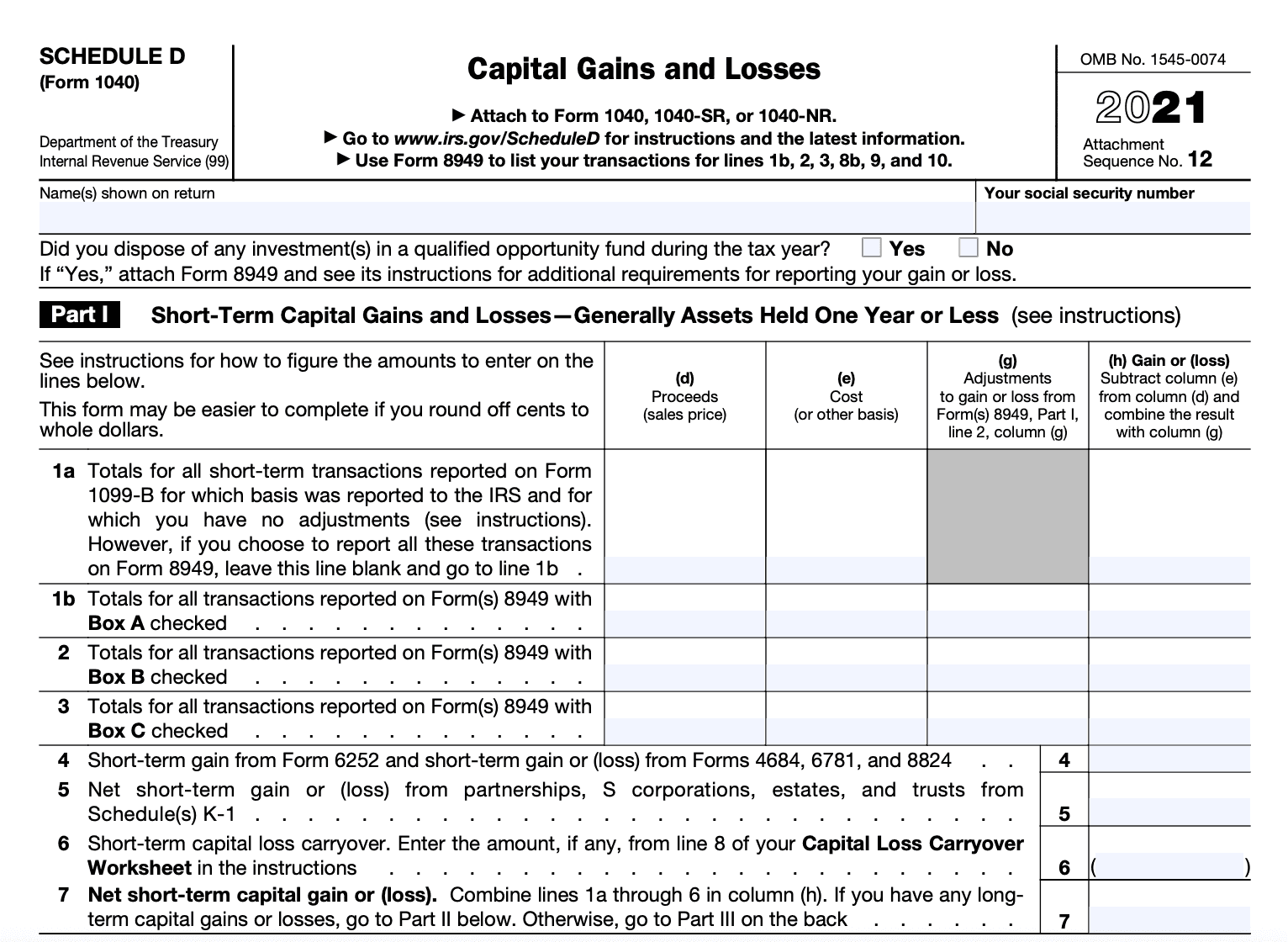

When it comes to reporting staking rewards to the IRS, there are a few forms that you may need to be aware of. Generally, the form you’ll need to report staking rewards is Form 1040, which is used for reporting your annual income tax return.

In most cases, the staking rewards you receive are considered taxable income. This means that you’ll need to report the amount of your staking rewards on your tax return and pay taxes on it. The amount of taxes you owe will vary depending on your income tax bracket and other factors.

It’s important to note that cryptocurrency taxes are still a developing area of regulation, and the rules and forms regarding staking rewards can vary. In some cases, the IRS may treat staking rewards as ordinary income, while in others it may be treated as a capital gain when you sell or dispose of the staked coins.

To determine how to properly report your staking rewards, it’s always a good idea to consult with a tax professional who is knowledgeable in cryptocurrency taxation. They will be able to guide you on the specific forms and reporting requirements that relate to your individual situation.

In conclusion, reporting staking rewards to the IRS can be a complex task due to the evolving nature of cryptocurrency taxation. It’s important to thoroughly research and understand the tax laws and regulations that apply to your jurisdiction. Consulting a tax professional will also help ensure that you are in compliance with the relevant tax requirements and that you properly report your staking rewards on your tax return.

Are there any penalties for not reporting staking rewards?

When it comes to reporting staking rewards on taxes, failure to do so can have consequences. While the penalties may vary depending on the country and specific situation, it is generally better to comply with tax regulations to avoid potential penalties.

In the Australian context, for example, if you do not report your staking rewards, you run the risk of attracting the attention of the Australian Taxation Office (ATO). The ATO has the authority to impose penalties and charges for non-compliance, including fines and interest charges on unpaid taxes.

It is important to note that staking rewards are considered taxable income, similar to the sale of other cryptocurrencies or traditional investments. Therefore, failing to report your staking rewards could be seen as an attempt to avoid paying taxes, which can lead to legal consequences.

Moreover, staking rewards received through participation in a staking pool or delegation service may have additional reporting requirements. In these cases, taxpayers should carefully consider how to report the rewards to comply with tax regulations.

It is also essential to keep accurate records of your staking rewards, as you may need to provide proof in case of an audit or legal proceedings. These records should include details such as the date of receipt, the amount received, the block schedule or transaction ID, and any transfers or sales made with the staked coins.

If you are unsure about how staking rewards should be reported on your taxes, it is recommended to consult with a tax professional or accountant who is familiar with cryptocurrency taxation. They can provide guidance on your specific situation and help determine the best approach to reporting staking rewards accurately.

Frequently Asked Questions:

How are crypto staking rewards taxed?

Crypto staking rewards are generally considered taxable income. The specific tax treatment can vary depending on the jurisdiction, but most countries treat staking rewards as ordinary income, similar to mining rewards or interest income.

Do I need to report staking rewards on my taxes?

Yes, you are usually required to report staking rewards on your taxes. Even if the staking rewards are not automatically reported to the tax authorities by the platform, it is still your responsibility to accurately report them as taxable income.

Are there any deductions or exemptions available for crypto staking rewards?

The availability of deductions or exemptions for crypto staking rewards depends on the tax laws of your jurisdiction. In some cases, you may be able to deduct expenses related to staking, such as transaction fees or hardware costs. However, it is best to consult with a tax professional or accountant to determine your specific eligibility for any deductions or exemptions.

Are there any situations where staking rewards are non-taxable?

There may be certain situations where staking rewards are non-taxable, but they are relatively rare. For example, if the staking rewards are below a certain threshold set by the tax authorities, they may be considered de minimis and not subject to taxation. Additionally, if you receive staking rewards as a gift or as part of a non-taxable event, they may not be subject to taxation. However, these situations can vary greatly depending on your jurisdiction, so it is important to consult with a tax professional or accountant for specific guidance.

Video:

How Crypto Staking Rewards Get Taxed | CryptoTrader Tax Expert

How is Crypto Mining & Staking Taxed? | CPA Q&A