When it comes to investing in cryptocurrencies, staking has become a popular choice for individuals around the world. Staking allows you to earn passive income by locking up your digital assets to support the network and validate transactions. One of the most well-known staking networks is Tezos (XTZ), which offers attractive staking rates and rewards for participants.

However, Tezos is not the only option available for staking. There are several other cryptocurrencies, including Avalanche (AVAX), Polygon (MATIC), Polkadot (DOT), Mina Protocol (MINA), and Celo (CELO), that offer staking opportunities. Each of these networks has its own unique features and benefits, making it important to research and understand the risks and rewards associated with each choice.

Staking generally operates on the proof-of-stake (PoS) consensus algorithm, meaning that participants who hold and stake a certain amount of a particular cryptocurrency can validate transactions and earn additional tokens as a result. The amount of staked tokens and the duration of the stake can contribute to the staking rewards, as well as the overall security and decentralization of the network.

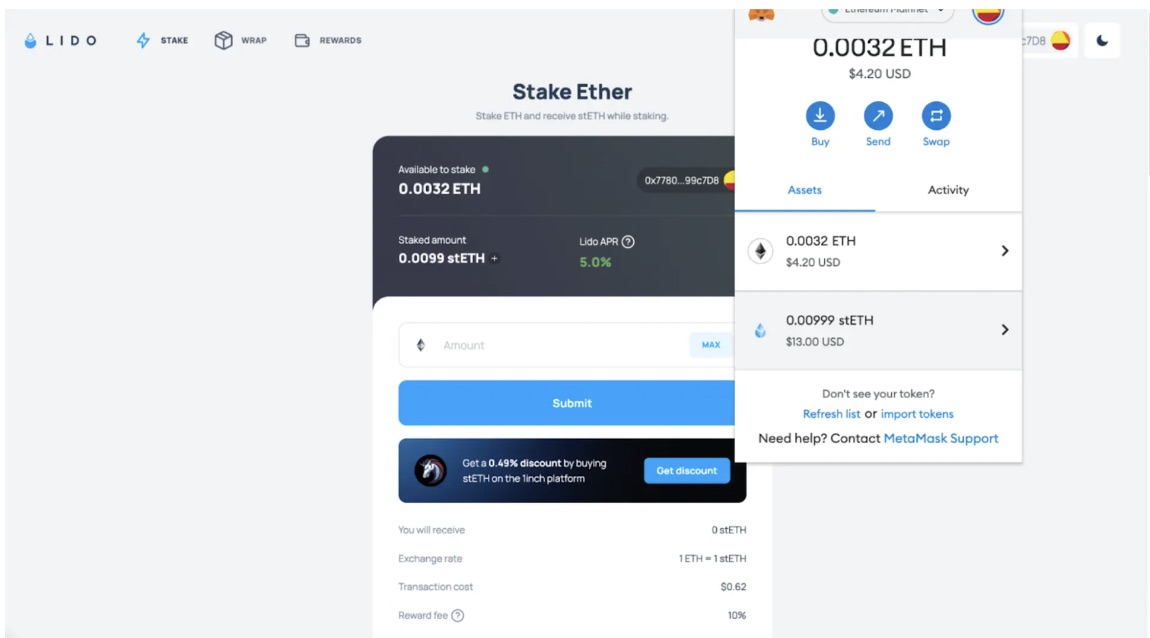

There are two main ways to stake your crypto assets: delegating to a staking pool or participating directly in the network. When you delegate, you join a staking pool where your tokens are combined with those of other participants. The pool then validates transactions on your behalf, and the rewards are distributed proportionally to each participant based on their staked amount. This is a good option for those who do not have the technical knowledge or the minimum stake required to participate directly.

On the other hand, if you choose to stake directly, you will need to run a node and hold the minimum stake required by the network. This method gives you more control over your staked tokens, but it also requires technical knowledge and constant monitoring. However, the potential rewards may be higher compared to delegating to a staking pool.

Before you start staking, it is important to understand the time-to-finality of the network you are supporting. Time-to-finality refers to the time it takes for a transaction to be confirmed and added to the blockchain. Each network has its own time-to-finality, and this can affect the speed at which you can unstake your tokens and access your earnings.

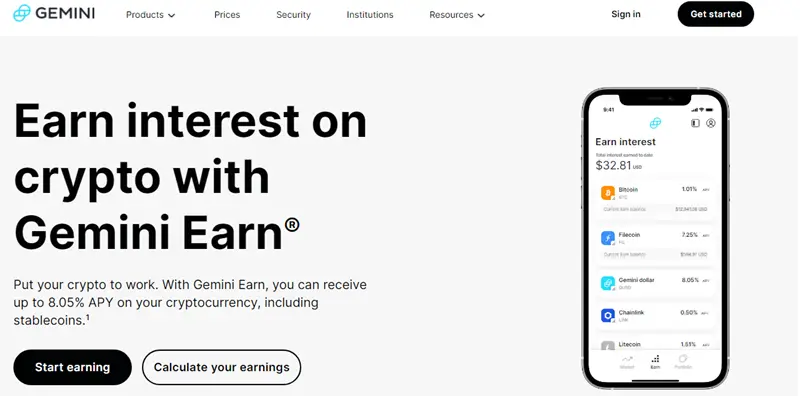

In order to maximize your staking earnings, you should also consider the annual percentage yield (APY) offered by the network. APY is the annual rate of return on your staked tokens, and it varies depending on factors such as network demand, token supply, and inflation rate. Researching and comparing APY rates across different networks can help you make an informed decision.

To summarize, staking your crypto assets can be a lucrative way to earn passive income while supporting the adoption and decentralization of blockchain networks. By understanding the different staking options available and the associated risks, you can decide which approach is most appropriate for you. Whether you choose to delegate to a staking pool or stake directly, make sure to research the rates, rewards, and time-to-finality of the network to make the most out of your staking experience.

The key takeaway is to do your own research and find the staking method and network that aligns with your investment goals and risk tolerance. Staking can be a great way to earn passive income in the crypto world, but it is important to understand the risks and make informed decisions. So, take the time to educate yourself and find the right staking opportunity that suits your needs.

What is Staking?

Staking is a popular method of earning passive income in the cryptocurrency world. It involves holding and locking up a certain amount of tokens in a wallet to support the operations of a blockchain network. In return, participants are rewarded with a percentage of the network’s earnings.

However, not all staking options are created equal. Some blockchains offer higher staking rates than others, making it important to carefully consider which networks to stake your tokens on. One such network is Avalanche, which boasts a high time-to-finality and uses a consensus protocol called Avalanche for validating transactions.

Staking tokens can be done either directly with the network or through a validator. Validators are entities that have a large number of tokens and support the network by validating transactions. They often charge a fee for their services, which you should factor into your staking calculations.

When staking, it is important to review the risks associated with the network and the validators you choose. While staking can be a secure way to earn passive income, there are risks involved. For example, if the network is not well supported or experiences technical difficulties, your staked assets could be at risk. Additionally, if you decide to unstake your tokens before the end of the staking period, you may face penalties or lose some of your potential earnings.

It is also worth noting that staking requires a minimum amount of tokens to participate. This minimum can vary between networks, so it is important to check the specific requirements before getting started. Furthermore, staking your tokens means you will not be able to trade them or use them for other purposes during the staking period, so it is important to calculate the opportunity cost of staking.

Overall, staking can be a lucrative way to earn passive income with your crypto assets. By carefully considering the staking rates, risks, and potential rewards, you can maximize your earnings and contribute to the growth and security of blockchain networks.

Crypto Staking vs Mining

When it comes to earning money with cryptocurrency, there are several options to choose from. Two of the most popular methods are crypto staking and mining. These methods offer different advantages and challenges, and understanding how they work is important for making the right choices.

What is Crypto Staking?

Crypto staking refers to the process of holding and locking digital coins in a network’s wallet to support the network’s operations. Stakers, or people who stake their coins, contribute to the security and success of the network, and in return, they earn valuable rewards. Staking has gained popularity in recent years, especially with the rise of decentralized finance (DeFi) and the increased use of proof-of-stake (PoS) protocols.

What is Mining?

Mining, on the other hand, involves using computational power to solve complex mathematical problems in order to validate transactions and create new blocks in a blockchain. Miners are rewarded with newly minted coins and transaction fees for their work. While mining was primarily associated with Bitcoin in its early years, now there are many cryptocurrencies that can be mined, such as Ethereum, Avalanche, Algorand, and Polygon.

Both crypto staking and mining have their advantages and challenges. Staking is generally considered less resource-intensive and more environmentally friendly compared to mining. It also allows users to easily earn passive income without the need for expensive mining equipment. In addition, staking means that your digital coins remain in your possession, and you can easily trade, sell, or transfer them.

However, staking also comes with its own challenges. One of the main challenges is the risk associated with locking your coins for a certain period of time. While staking can be profitable, it is important to consider whether the potential rewards outweigh the risk of locking your coins and potentially missing out on other investment opportunities.

Mining, on the other hand, requires a significant investment in specialized hardware and energy costs. It also requires technical knowledge and constant monitoring of the mining operation. However, mining can be highly profitable, especially if you mine popular cryptocurrencies like Bitcoin or Ethereum.

In conclusion, whether you choose crypto staking or mining, it is important to carefully consider the pros and cons of each method. Staking offers a potentially easier and more accessible way to earn passive income, while mining can be more profitable but requires more resources and technical expertise.

Benefits of Crypto Staking

When it comes to cryptocurrency staking, there are several factors that make it a beneficial investment strategy. Let’s dive into the benefits of crypto staking:

1. Higher Earnings Potential

One of the main advantages of crypto staking is the potential to earn higher returns on your investment. Cryptocurrencies like Ethereum or Polygon offer staking programs that allow you to earn passive income by participating in the network validation process.

2. Lower Risks Compared to Trading

Unlike trading or speculating on the price of cryptocurrencies, staking involves less risk. By staking your tokens, you can earn rewards without worrying about the volatile nature of the market. Staking allows you to earn a steady income regardless of short-term price fluctuations.

3. Increased Security and Network Stability

Staking plays a vital role in the security and stability of blockchain networks. As a validator, you help secure the network by verifying transactions and maintaining the blockchain. By participating in the staking process, you contribute to the decentralization of the network and make it more resistant to attacks.

4. Inflation Protection

Staking can be a great way to protect your investments against inflation. Crypto projects often offer staking rewards that are higher than the inflation rate of the token. By staking your tokens, you can ensure that your wealth grows at a rate that outpaces inflation, preserving its purchasing power over the long term.

5. Diversification and Flexibility

Crypto staking allows you to diversify your investment portfolio. Different projects offer various staking opportunities, each with their unique earning potential. This flexibility allows you to choose the most suitable staking options that align with your investment goals and risk tolerance.

6. Passive Income

By staking your cryptocurrencies, you can earn a passive income stream. Instead of letting your holdings sit idle, staking allows you to put your assets to work and generate consistent earnings over time. This can be especially beneficial if you believe in the long-term success of the project.

7. Community Participation

Staking offers the opportunity to actively participate in the crypto community. As a staker, you become an integral part of the network, helping to secure and validate transactions. This involvement can provide a sense of community and connection with other stakeholders.

In conclusion, crypto staking offers a variety of benefits, including higher earnings potential, lower risks compared to trading, increased security and network stability, inflation protection, diversification and flexibility, passive income generation, and community participation. It is important to understand the risks and rewards associated with staking before making a solid investment decision. Make sure to compare the staking options available and choose the one that best suits your financial goals and risk tolerance.

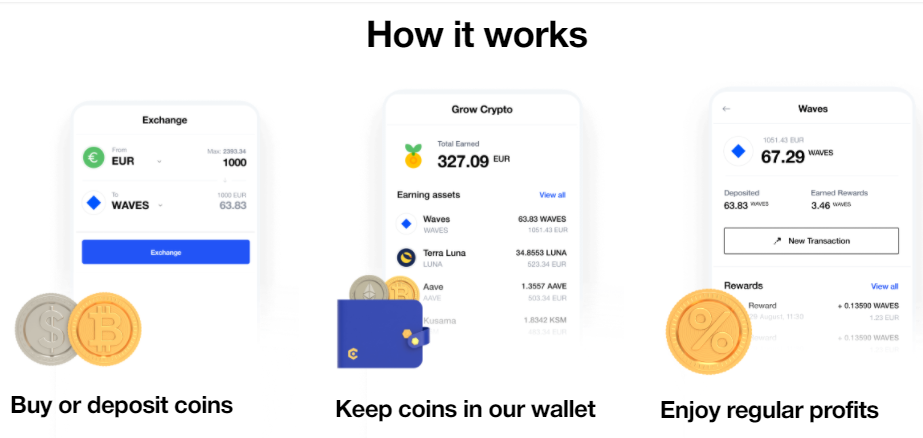

Passive Income

If you’ve been looking to earn a passive income, cryptocurrency staking is one of the most popular and profitable options available to you. Unlike active trading, staking allows you to earn rewards by simply holding onto your digital assets. This means you don’t have to constantly make trading decisions or actively manage your portfolio. Instead, by staking your coins, you can earn passive income while letting your investments grow.

When planning for passive income through staking, all you need to do is choose the best platform or network that supports staking contracts for your chosen cryptocurrency. You will need to stake a minimum amount of the cryptocurrency to participate, so it’s important to carefully consider the network’s requirements and the potential earnings you could generate. It’s also worth noting that the value of your original investment may fluctuate, depending on the market conditions.

One common staking mechanism is Proof-of-Stake (PoS), which requires validators to hold a certain amount of the cryptocurrency in order to validate blocks on the network. By staking your coins, you can become one of these validators and earn rewards for your participation. The higher the amount you stake, the higher the potential rewards you can earn.

Cardano (ADA) is a popular cryptocurrency for staking, which has its own staking mechanism called “delegated proof-of-stake” (DPoS). With Cardano, you can stake your coins to support the network and earn a share of the annual yield. This means that even if you don’t have the minimum amount required to become a validator directly, you can still earn passive income by delegating your stake to a trusted validator.

For those interested in staking, it’s important to check the staking rewards and the process for staking on the chosen platform or network. Some platforms may offer higher rewards than others, so it’s worth comparing the options available to you. Additionally, it’s important to keep in mind that staking involves locking up your assets for a certain period of time, which means you won’t be able to access or trade them until the staking period is over.

In summary, passive income through cryptocurrency staking can be a great way to earn a steady income without the need for active trading. By choosing the appropriate platform or network, carefully planning your staking strategy, and keeping an eye on the staking rewards, you can maximize your earnings and make the most of your digital assets. So why not consider staking as a way to earn passive income and start growing your wealth today?

Lower Transaction Fees

One of the key advantages of staking cryptocurrencies is the lower transaction fees compared to traditional financial systems. In the crypto world, transaction fees can be a significant factor when it comes to executing any kind of financial transaction. However, with staking, the fees are typically much lower, allowing users to save money and maximize their earnings.

Staking protocols often offer faster transaction speeds compared to other blockchain networks. For example, Binance launched its own staking protocol known as Binance Smart Chain (BSC) in 2020. With BSC, users can enjoy faster and more efficient transactions, reducing the time it takes to complete a transaction and ensuring quick access to their staked assets.

Lower transaction fees also make staking a more viable option for beginners who may not have a large amount of capital to invest in cryptocurrencies. With lower fees, it becomes easier for individuals to delegate their assets and start earning rewards without the need for a significant initial investment.

In addition to lower transaction fees, staking also provides the opportunity for long-term compounding gains. By staking their assets, individuals can earn additional rewards in the form of interest or yield. Over time, these rewards can compound, allowing individuals to generate even higher returns on their staked assets.

Another benefit of staking is the ability to participate in the governance of the blockchain network. Stakers often have voting rights, allowing them to have a say in important decisions regarding the future of the network. This can include voting on protocol upgrades, changes in transaction fees, and other technical aspects of the blockchain.

In conclusion, staking cryptocurrencies offers numerous benefits, one of which is lower transaction fees. This allows individuals to save money and maximize their earnings while enjoying faster transaction speeds. Staking also provides the opportunity for long-term compounding gains and the ability to participate in the governance of the blockchain network. These factors make staking a popular choice for both beginners and experienced cryptocurrency investors.

Near Protocol

Near Protocol is a blockchain platform that aims to solve scalability issues while offering high staking rates for crypto investors. With Near Protocol, you’re able to earn passive income by delegating your tokens to validator nodes.

The staking process on Near Protocol involves delegating your tokens to a validator, who then includes them in their consensus calculations. The more tokens you delegate, the higher your chances of being chosen as a validator and earning rewards.

One of the advantages of Near Protocol is that it has a robust consensus system called “Avalanche” that ensures high speed and security. This means that your tokens are kept safe while also contributing to the network’s success.

When calculating your potential earnings on Near Protocol, it’s important to consider the staking rewards, which are usually given in additional tokens. You can use compounding to maximize your earnings, depending on the duration of the staking period.

Choosing the best validator is a crucial decision. It’s recommended for beginners to delegate their tokens to validators that have a solid track record and low risk ranking. Different validators offer different staking rates and rewards, so it’s essential to do your research before making a decision.

Keeping your tokens in a secure wallet is also important. Near Protocol allows you to stake directly from your wallet, ensuring the safety of your assets. However, it’s always a good practice to evaluate the security measures of the wallet provider before making any transactions.

Overview of Near Protocol

Near Protocol is a blockchain platform that aims to provide scalable and user-friendly solutions for building decentralized applications (dApps). It is often referred to as the “bitcoin” or “solana” of the future, as it can handle up to 10,000 transactions per second and has a low transaction fee. Near Protocol uses a unique sharding mechanism that allows for parallel processing and faster confirmation times.

One of the best features of Near Protocol is its staking mechanism. Users can earn passive income by staking their NEAR tokens to become validators or by delegating their tokens to existing validators. Validators play an important role in securing the network and validating transactions. By staking or delegating their tokens, users can earn a share of the transaction fees and block rewards generated within the network.

Moreover, Near Protocol offers various benefits for users who stake or delegate their tokens. These benefits include higher staking rewards, the ability to vote on network proposals, and the opportunity to participate in on-chain governance. Staking or delegating NEAR tokens is a great way to earn passive income and actively contribute to the development of the Near Protocol ecosystem.

For those who are new to staking or delegating their tokens, Near Protocol provides a user-friendly interface that makes the process easy and straightforward. Users can join staking pools or find individual validators to delegate their tokens to. Near Protocol also offers a fixed staking period, which allows users to calculate their potential earnings in advance.

Overall, Near Protocol is a worthy investment for those who want to earn passive income with their crypto holdings. The platform offers a unique staking mechanism, high staking rewards, and a user-friendly interface. Whether you are a beginner or an experienced crypto user, Near Protocol is definitely worth considering.

Staking on Near Protocol

Staking on Near Protocol has gained popularity among individual crypto investors. Near Protocol, often referred to as NEAR, is a leading cryptocurrency that stands out among other coins. Its original Proof-of-Stake (PoS) mechanism allows individuals to stake their NEAR coins and earn guaranteed returns.

One of the reasons why staking on Near Protocol is so popular is because it supports a variety of cryptocurrencies. Investors can also stake their holdings in popular coins like Tezos (XTZ) and Algorand (ALGO), which further increases the earning potential. This wide range of options makes it a lucrative choice for individuals looking to maximize their crypto earnings.

Staking on Near Protocol gives individuals the opportunity to be part of the success of the platform. By staking their coins, they actively participate in the decision-making process of the Near Protocol network. This is done through voting, where stakers can have a say in the future development and direction of the cryptocurrency. It also helps to establish a widespread and decentralized network.

One of the key advantages of staking on Near Protocol is that it does not lock up the staked coins. Individuals can still freely use their staked coins for any other purpose while earning staking rewards. This flexibility allows individuals to take advantage of other investment opportunities or simply hold onto their coins without any limitations.

To stake on Near Protocol, individuals can easily find a validator or choose from various staking platforms. These platforms provide a user-friendly interface where individuals can take action and stake their coins directly. The staking process is straightforward and does not require any technical expertise, making it accessible to a wide range of investors.

In conclusion, staking on Near Protocol offers attractive earning potential for crypto investors. With support for a variety of cryptocurrencies, a decentralized decision-making process, and the flexibility to use staked coins freely, it is no wonder that staking on Near Protocol has become a popular choice among individuals.

Maximizing Earnings

When it comes to maximizing your earnings in the world of cryptocurrency staking, it’s important to consider your choices and make informed decisions. Staking is the next step to take after you’ve made your initial investment in a particular cryptocurrency, and it can prevent you from selling too early because of its profitable opportunities.

Staking allows you to earn a little extra from your continued investments, as it’s possible to generate higher returns than if you were to simply hold your cryptocurrency on an exchange. The process involves delegating your coins to a chosen validator, or running your own node, depending on the network you’re staking on.

One popular network for staking is Tezos (XTZ), which ranks among the top cryptocurrencies for staking. The process is explained right on the Tezos website and stands as a proof-of-stake blockchain, allowing you to delegate your XTZ directly to a validator and earn more in return. By choosing the right validator or running your own node, you’ll be able to maximize your earnings even further.

Many exchanges and platforms now offer staking services, providing investors with different ways to maximize their earnings. Binance, for example, allows you to purchase and stake various cryptocurrencies within their platform. By entering into staking agreements with different validators, Binance users can earn higher returns on their investments.

It’s important to know that not all staking opportunities are created equal. Some networks and validators may offer greater rewards, while others may have higher fees or less development activity. It’s up to the individual investor to do their research and choose wisely to maximize their earnings. Additionally, it’s worth noting that while staking can be a profitable way to earn passive income, it does come with risks. Nodes can go down or choose to exit the network, so diversifying your staking across multiple validators can help prevent major losses.

In summary, staking is an effective way to maximize your earnings in the cryptocurrency space. By choosing the right networks, validators, and platforms, you can generate higher returns on your investments. However, it’s important to do your due diligence and understand the risks involved. With careful consideration and strategic decision-making, you’ll be able to make the most of your staking opportunities and increase your earnings.

Choosing the Right Staking Pool

When it comes to staking cryptocurrency, one of the key decisions you need to make is selecting the right staking pool. With a wide range of options and platforms available, it’s important to consider various factors in order to maximize your earnings and ensure a solid return on your investment.

Platform Selection: Before choosing a staking pool, you should first consider the platform it uses. Platforms like Binance, Solana, and Tron are popular choices for staking due to their solid technical infrastructure and high-speed transactions. It’s important to know where the staking pool operates to ensure compatibility with your preferred platform.

Potential Yields: The main reason for staking cryptocurrency is to earn rewards, so it’s crucial to consider the potential yields offered by different staking pools. Some pools may provide higher rewards for specific coins, while others may offer lower but more reliable returns. Consider your goals and risk tolerance when evaluating potential earnings.

Staking Duration: Different staking pools may have varying staking durations, ranging from a few days to several months. Depending on your investment horizon and interest in keeping your coins locked up, you should select a pool with a staking duration that aligns with your needs.

Pool Size and Rewards: The size of a staking pool can impact your earnings. Larger pools may have more rewards to distribute among participants, but they also come with higher competition. Smaller pools, on the other hand, may offer higher individual rewards but with less overall liquidity.

Existing Rewards System: Before joining a staking pool, it’s important to understand how the pool’s rewards system works. Some pools may use a simple profit-sharing agreement, where rewards are distributed proportionally based on the amount each participant has staked. Others may incorporate additional factors such as buddy systems or compounding to increase overall returns.

Security and Transparency: When staking your cryptocurrency, security should be a top priority. Look for staking pools that have a proven track record, a transparent system, and robust security measures in place. This will ensure the safety of your funds and minimize the risk of losses.

Research and Reviews: Finally, conducting thorough research and reading reviews can provide valuable insights into the performance and reliability of different staking pools. Look for feedback from other users, consider the pool’s reputation, and evaluate the overall satisfaction of participants.

In conclusion, choosing the right staking pool is crucial to maximize your earnings and ensure a solid return on your investment. By considering factors such as the platform, potential yields, staking duration, pool size, rewards system, security, and conducting thorough research, you can make an informed decision and select the most profitable staking pool for your needs.

Understanding Staking Rewards

Staking has become a popular method for investors to earn passive income in the cryptocurrency world. By staking their coins, users can support the development and security of a blockchain network while earning returns on their investment. But how exactly does staking work and what are the steps to start earning staking rewards?

What is Staking?

In simple terms, staking refers to the process of holding and validating a certain amount of coins in a cryptocurrency network to support its operations. Stakers, also known as validators, lock up their coins for a certain period of time, which allows them to participate in the consensus mechanism of the network and help validate transactions.

In return for their support, stakers are rewarded with additional coins or tokens. The rewards can vary depending on factors such as the network’s inflation rate, the amount of coins staked, and the length of the staking agreement.

How to Stake Your Coins and Earn Rewards?

To start staking your coins and earning rewards, you’ll need to follow a few simple steps:

- Choose a cryptocurrency that supports staking. Many popular cryptocurrencies, including ADA, offer staking options.

- Find a staking platform or wallet that supports the coin you want to stake. Make sure to check the platform’s fees and security measures.

- Transfer your coins to the staking platform or wallet. This usually involves a small transaction fee.

- Select the amount of coins you want to stake and the length of the staking agreement.

- Confirm your staking action and wait for the staking process to start.

- After the staking period is over, you can claim your staking rewards.

It’s important to note that staking involves a certain level of risk, as the value of the staked coins can fluctuate. However, by carefully choosing which coins to stake and by diversifying your staking portfolio, you can minimize the risks and increase your chances of earning a stable income.

The Benefits of Staking

Staking offers several benefits for cryptocurrency investors:

- Passive Income: By staking their coins, users can earn passive income without the need for active trading or lending.

- Higher Returns: Staking often provides higher returns compared to traditional investment options such as savings accounts or bonds.

- Supporting the Network: Staking helps maintain the security and stability of a blockchain network by validating transactions.

- Long-Term Investment: Staking allows users to earn rewards over the long term, which can help grow their investment portfolio.

- Flexibility: Staked coins can usually be easily withdrawn or transferred, giving users the freedom to manage their staking positions.

Overall, staking offers a potentially lucrative opportunity for crypto enthusiasts to earn passive income and actively contribute to the growth and development of blockchain networks.

Frequently Asked Questions:

What is crypto staking?

Crypto staking is the process of holding and validating cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking, users earn rewards in the form of additional cryptocurrency.

How does staking help me earn more cryptocurrency?

By staking your cryptocurrency, you contribute to the security and stability of the blockchain network. In return, you earn rewards in the form of additional cryptocurrency, which can help you maximize your earnings.

What are the benefits of staking my crypto?

Staking your crypto allows you to earn passive income by simply holding your coins in a wallet. It is a secure way to earn more crypto and can be more profitable compared to other investment options.

Can I stake any type of crypto?

No, not all cryptocurrencies can be staked. Only cryptocurrencies that operate on proof-of-stake (PoS) or delegated proof-of-stake (DPoS) consensus mechanisms can be staked. Examples of stakable cryptocurrencies include Ethereum 2.0, Cardano, and Tezos.

How do I choose the best crypto staking platform?

When choosing a crypto staking platform, consider factors such as the platform’s reputation, security measures, staking rewards, and ease of use. It’s also important to research and compare different platforms to find the one that offers the best rates and benefits for staking.

Is staking my crypto safe?

Staking your crypto can be relatively safe if you choose a reputable platform and follow proper security measures. However, like any investment, there are risks involved, such as the possibility of hacking or technical issues. It’s important to do your research and only stake your crypto on trusted platforms.

Can I still access and use my crypto while staking?

Generally, you can still access and use your crypto while staking. However, some platforms may have certain restrictions or lock-up periods that limit your ability to withdraw or transfer your staked coins. It’s important to read and understand the terms and conditions of the staking platform you choose.

Video:

Best Crypto Staking Strategy for 2023!!

Top 5 Staking Rewards 99% of Beginners MISS OUT | Crypto Staking Calculator