Flash loans have become an integral part of the decentralized finance (DeFi) ecosystem, revolutionizing the way we think about borrowing and lending in the crypto world. But what exactly are flash loans and how do they work? In this comprehensive guide, we will dive deep into the concept of flash loans, exploring their benefits, risks, and how they are reshaping the financial landscape.

At its core, a flash loan is an instantly executed loan that allows users to borrow large amounts of assets without any collateral. Unlike traditional lending providers, which require borrowers to stake their assets as collateral, flash loans utilize a completely different system. This innovative concept was first introduced by the platform Aave and has since been adopted by other popular platforms like Uniswap.

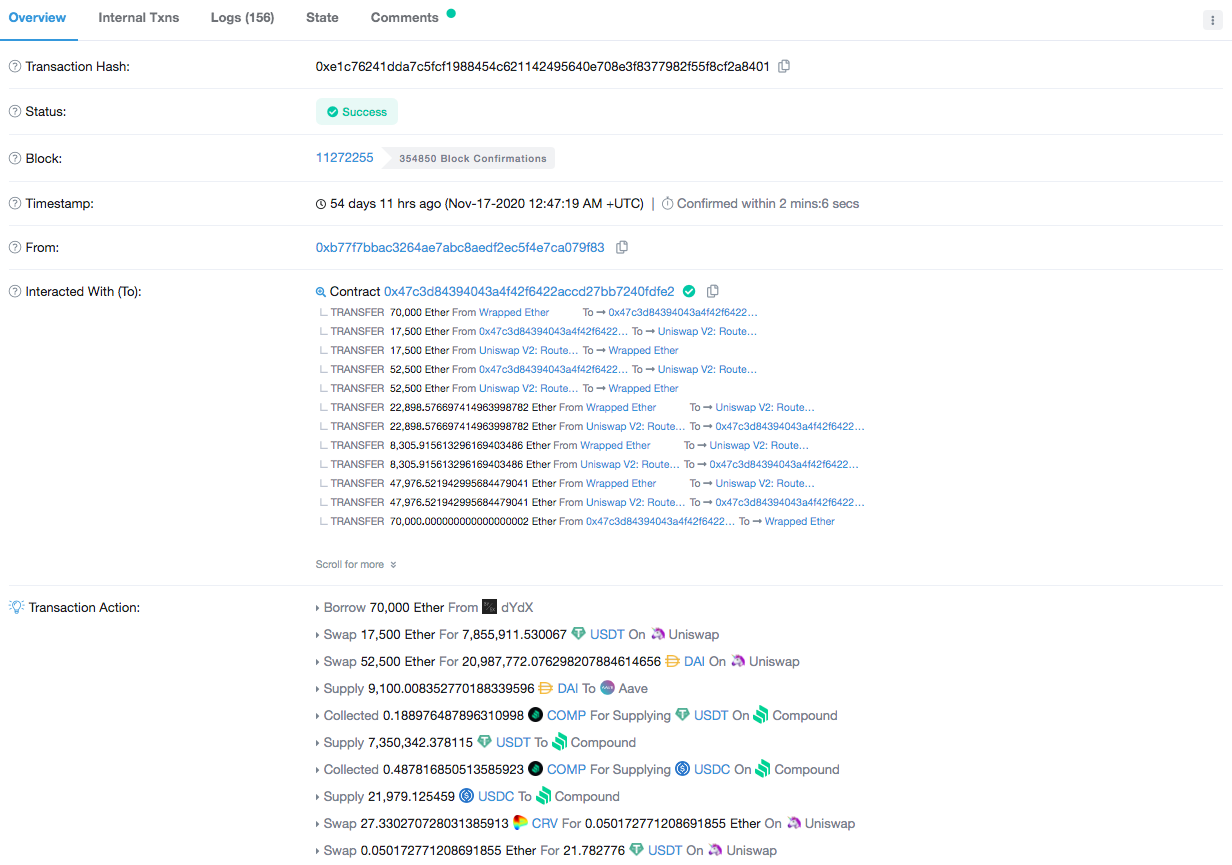

So, how does it work? Flash loans operate on the principle of arbitrage, taking advantage of price differences between different assets. Users can borrow a significant amount of cryptocurrency tokens, use them for various purposes like trading, liquidity provision, or even just for temporary access to funds, and then pay back the loan within the same transaction.

This new form of lending has proven to be incredibly useful for traders and developers who need funds for their operations. Flash loans have the potential to enable complex transactions that would otherwise be impossible or impractical with traditional banking systems. For example, a trader could use a flash loan to instantly buy and sell assets on different exchanges, taking advantage of price discrepancies.

In conclusion, flash loans are a game-changer for the DeFi space, offering a revolutionary way of borrowing and lending. By eliminating the need for collateralization and providing instant access to funds, flash loans have opened up a world of possibilities for developers, traders, and liquidity providers. As the DeFi ecosystem continues to expand, it is crucial to understand the mechanics and implications of flash loans to navigate this new frontier of finance.

Buy and Trade cryptocurrency on Liquid

If you are looking to buy and trade cryptocurrency, Liquid is a platform that offers a reliable and convenient way to do so. Liquid allows users to trade various tokens, including popular cryptocurrencies like Bitcoin and Ethereum, as well as other digital assets.

One of the key features of Liquid is its advanced trading system, which allows users to execute trades quickly and efficiently. The platform provides a user-friendly interface that makes it easy to navigate and monitor your trades in real time.

With Liquid, you can also easily convert your cryptocurrency into traditional currency, such as USD or EUR. This means that you can sell your crypto assets and receive the proceeds directly into your bank account.

Another useful feature of Liquid is its flash loan service. Flash loans are a concept popular within the DeFi sector, which allows users to borrow a large amount of cryptocurrency instantly, without the need for collateral. This means that users can access liquidity for various purposes, such as trading or arbitrage.

Liquid also offers a comprehensive range of trading tools and resources to help users make informed investment decisions. This includes advanced charting features, market analysis, and tutorials to educate users on different trading strategies.

In conclusion, Liquid is a reliable and user-friendly platform for buying and trading cryptocurrency. With its advanced trading system, flash loan service, and comprehensive range of trading tools, Liquid provides a convenient and efficient way for users to engage with the crypto market.

Liquid Loans: 0 Interest Free Liquidity on PulseChain

As the world of decentralized finance (DeFi) expands, new opportunities arise for borrowers and lenders alike. One such opportunity is the concept of liquid loans, which provide 0 interest free liquidity on PulseChain. But what exactly are liquid loans and how do they work?

Understanding Liquid Loans

Liquid loans on PulseChain allow borrowers to access funds without having to repay a minimum amount or provide collateral. In this case, the borrower can execute a flash loan, which is a type of loan that is borrowed and repaid within the same transaction.

Unlike traditional loans, liquid loans on PulseChain don’t require the borrower to stake any assets as collateral. Instead, the lender provides the requested amount of liquidity, with no interest charged on the loan. This makes liquid loans a highly appealing option for those who need immediate access to funds without facing high interest rates or liquidation risks.

How Liquid Loans Work on PulseChain

When a user wishes to borrow funds through liquid loans on PulseChain, they can simply execute a smart contract that interacts with the lending platform. The smart contract will report the amount of liquidity needed and the desired repayment terms.

Once the smart contract is executed, the lending platform will match the borrower with a lender who is willing to provide the requested liquidity. The lender will then transfer the funds to the borrower, with no interest or repayment obligations attached.

Once the borrower has successfully utilized the borrowed funds for their trading or other financial purposes, they can repay the loan at any time. There are no set repayment schedules or minimum repayment amounts on PulseChain’s liquid loans. The borrower can repay the loan in full or in parts, depending on their convenience and financial situation.

The Benefits and Opportunities of Liquid Loans

The 0 interest free nature of liquid loans on PulseChain opens up various opportunities for users. Borrowers can access liquidity without having to worry about interest rates eating into their profits or facing the risk of liquidation due to volatile markets.

Lenders, on the other hand, can provide liquidity to borrowers and earn a return by charging interest or fees for the service. This allows lenders to make use of their idle assets and earn passive income through lending activities.

Furthermore, PulseChain’s liquid loans have the potential to drive innovation and new use cases in the DeFi space. Traders can utilize borrowed funds to explore new investment opportunities or execute complex trading strategies, while developers can leverage liquid loans for building innovative DeFi applications and protocols.

The Future of Liquid Loans

As the Ethereum ecosystem continues to evolve and PulseChain gains traction, liquid loans are likely to become a popular financial product within the DeFi space. The 0 interest free nature of these loans provides a unique advantage compared to traditional lending options.

With the flexibility and convenience offered by liquid loans, users can leverage borrowed funds to meet their financial needs without having to deal with high interest rates or strict collateral requirements. This makes liquid loans an attractive option for both borrowers and lenders in the DeFi market.

In conclusion, liquid loans on PulseChain offer an innovative and efficient way to access liquidity without incurring interest charges or providing collateral. The future of DeFi looks promising with the emergence of liquid loans, paving the way for new opportunities and use cases within the decentralized finance ecosystem.

What are Flash Loans in DeFi?

Flash loans are a unique feature of decentralized finance (DeFi) platforms that offer users the opportunity to borrow a large amount of cryptocurrency without needing any collateral. In traditional banking systems, borrowers are required to provide collateral in order to secure a loan. However, in DeFi, flash loans are different. They allow users to borrow a specific amount of cryptocurrency and return it within the same transaction.

The introduction of flash loans has revolutionized the DeFi space by providing users with new opportunities for smart contract-based trading and arbitrage. With flash loans, users can take advantage of price discrepancies between different cryptocurrency platforms and execute profitable transactions instantly, without the need for their own capital. This is made possible because flash loans exploit the fact that transactions are only executed if the entire loan amount, plus any fees, can be repaid.

Flash loans work by leveraging the liquidity available on DeFi platforms. In a decentralized finance system, liquidity is provided by lenders who deposit their funds into a liquidity pool. These funds are then used by borrowers to execute transactions and take advantage of various DeFi opportunities. The lenders are rewarded with interest on their deposits, and the borrowers pay a fee for using the flash loan service.

Flash loans are particularly useful for projects that require a high amount of liquidity. By using flash loans, these projects can maintain a high loan-to-value ratio, which means they can borrow a larger amount of cryptocurrency compared to the value of the collateral they provide. This allows them to execute their plans more efficiently and quickly.

Bitget’s new Crypto Loans let users exchange low-demand tokens for liquid ones

Bitget is introducing a new feature called Crypto Loans that allows users to exchange low-demand tokens for liquid ones. This feature is particularly useful for individuals who hold tokens that have little trading interest or value in the market.

With Crypto Loans, users can borrow liquid tokens from the platform in exchange for their low-demand tokens. Once the loan is taken, the user can freely trade with the borrowed tokens and take advantage of any potential price changes in the market.

When using Crypto Loans, users need to provide sufficient collateral to secure the borrowed tokens. This collateralisation process helps ensure that the platform remains secure and that the borrowed tokens are protected.

The concept of Crypto Loans is similar to the flash loan concept in DeFi, where users can borrow assets without any upfront collateral. However, with Bitget’s Crypto Loans, a collateral is required to participate in the loan process, making it more secure for users.

The exchange between low-demand tokens and liquid ones happens on Bitget’s platform, which serves as an intermediary between the borrower and the lender. This allows users to access a wide range of liquid assets and execute the exchange instantly.

Bitget’s Crypto Loans offer an opportunity for individuals to borrow tokens that have higher trading value and liquidity. This can be particularly useful for individuals looking to participate in specific trading strategies or take advantage of price fluctuations in the market.

In conclusion, Bitget’s Crypto Loans feature allows users to exchange low-demand tokens for liquid ones, providing a useful opportunity for those who hold tokens with little trading interest. With the required collateralisation process and the ability to borrow and trade instantly, users can take advantage of the market and potentially increase their profits.

How do Flash Loans work

Flash Loans are a revolutionary concept in the DeFi space that has gained significant popularity in recent years. They allow users to borrow a significant amount of cryptocurrency without any collateral or credit check requirements.

So, how do Flash Loans work? When a user wants to take out a Flash Loan, they provide the required liquidity through a smart contract on a platform such as Bitget. This liquidity can come from different sources, including other users or liquidity providers. Once the required liquidity is obtained, the user can then buy or sell cryptocurrency, engage in derivatives trading, or perform any other operations within the DeFi sector.

One key feature of Flash Loans is that they need to be repaid within a single transaction. This means that the user must repay the borrowed amount, along with any fees and interest, before the transaction ends. If the user fails to repay the loan within the transaction, the loan will be automatically reversed, and any changes made during that transaction will be undone.

Flash Loans can be highly useful for users who need a significant amount of liquidity at a given moment, without having to put up collateral or face credit checks. It allows them to take advantage of short-term arbitrage opportunities or execute complex trading strategies, all without needing to have the required amount of capital upfront.

Unlike traditional loans, Flash Loans do not require any collaterlisation, reducing the risk for the borrower. However, they come with their own set of risks. For example, if the liquidity provider faces a sudden market crash or a hacking attack during the Flash Loan transaction, they may incur significant losses.

In conclusion, Flash Loans are a powerful tool in the DeFi sector that allows users to access liquidity without the need for collateral. They provide an opportunity for users to buy or sell cryptocurrency, engage in derivatives trading, and perform other operations with high liquidity, all in a single transaction. However, users must be aware of the risks involved and carefully assess the potential impact of market fluctuations before taking out a Flash Loan.

How Flash Loans differ from traditional loans

A traditional loan involves a series of operations where a borrower requests a certain amount of money and agrees to repay it with interest over a specified period of time. In exchange for the loan, the borrower typically provides collateral, such as a house or a car, which the lender can seize in case of default. This collateral secures the loan and provides a guarantee for the lender that they will be repaid.

Flash loans, on the other hand, are a relatively new concept in the decentralized finance (DeFi) sector. They allow users to borrow large amounts of cryptocurrency without the need for collateral, and the loan is only granted if the borrower can repay the entire amount within the same transaction. This means that the loan is instantly repaid in the same block it was received, or it is not granted at all.

Flash loans have gained popularity in the DeFi space due to their unique features and opportunities they provide. By building on platforms like Aave or Uniswap, users can take advantage of flash loans to perform complex arbitrage trades or other operations that would otherwise be impossible or require significant amounts of capital. This enables users to earn profits, exploit pricing discrepancies, and quickly move their cryptocurrency between different platforms, all without having to maintain a sizable balance of assets.

Since flash loans are secured by cryptocurrency and do not require collateral, borrowers face certain risks that are not present in traditional loans. One such risk is the possibility of a “liquidation penalty.” If the value of the borrowed tokens drops significantly during the course of the transaction, the borrower may be required to repay more tokens than they initially received. This can lead to substantial financial losses for the borrower.

Despite these risks, flash loans are a highly useful and innovative product in the DeFi sector. They provide liquidity to users who need it, allow for instant and complex transactions, and can be a powerful tool for traders and developers alike. Flash loans have opened up new possibilities for users to participate in decentralized finance, and their usage is expected to continue growing in the future.

Why do we need Flash Loans

Flash loans have become a vital tool in the decentralized finance (DeFi) space, revolutionizing the way we think about borrowing and lending in the cryptocurrency sector. They offer a wide range of benefits and opportunities for users, making them an essential feature in the ever-evolving world of DeFi.

One of the main advantages of flash loans is their speed and efficiency. Traditional lending and borrowing operations often involve tedious paperwork, credit checks, and collateral requirements. Flash loans, on the other hand, allow users to borrow large sums of money without the need for any collateral, all within a single transaction.

What sets flash loans apart from other types of loans is that they are only valid for the duration of a single transaction. This means that borrowers must return the loaned amount, as well as pay any interest or fees, before the transaction is successfully completed. If they fail to do so, the entire transaction is reversed, and the loan is nullified.

Flash loans provide immense flexibility to traders and investors in the crypto space. They can be used to take advantage of arbitrage opportunities, where users can borrow funds from one platform to execute a profitable trade on another exchange. Additionally, flash loans enable users to access liquidity needed for building and expanding their DeFi projects.

For those who are unable to obtain loans through traditional means, flash loans offer an alternative solution. Since flash loans do not require collateral or credit checks, they provide opportunities for individuals who may face difficulties in accessing traditional banking services or loans.

Another essential aspect of flash loans is their impact on the overall liquidity of the DeFi ecosystem. By allowing users to borrow and return funds within a single transaction, flash loans contribute to the efficiency and liquidity of DeFi platforms. This increased liquidity facilitates smoother trading and reduces slippage for users.

Flash loans have quickly gained popularity in the DeFi space. Many platforms and service providers, such as Aave, dYdX, and Bitget, offer flash loan products, attracting users with their convenient and efficient borrowing mechanism. As more users become aware of the opportunities provided by flash loans, their usage is expected to continue growing.

In conclusion, flash loans have emerged as a game-changing innovation in the DeFi sector. They offer a fast, flexible, and efficient way to borrow and lend funds in the cryptocurrency space, opening up new possibilities for traders, investors, and DeFi project developers.

Frequently Asked Questions:

How do flash loans work?

Flash loans allow users to borrow a large amount of funds from a DeFi platform without the need for any collateral. The loan needs to be executed and repaid within the same transaction. If the loan is not repaid, the entire transaction is reversed.

Why do we need flash loans?

Flash loans provide a unique opportunity for users to take advantage of arbitrage opportunities in the DeFi space. They allow users to borrow funds for a short period of time to execute trades, take advantage of price differences, and make a profit.

How flash loans differ from traditional loans?

Flash loans are different from traditional loans in several ways. Firstly, flash loans do not require any collateral, unlike traditional loans where collateral is necessary. Secondly, flash loans need to be executed and repaid within the same transaction, while traditional loans have a fixed repayment period.

What are Flash Loans in DeFi?

Flash loans in DeFi refer to the ability to borrow a large amount of funds from a DeFi platform, without collateral, and execute trades within the same transaction. These loans have gained popularity due to their potential for high-profit opportunities through arbitrage.

Introduction to flash loans

Flash loans are a relatively new concept in the world of decentralized finance (DeFi) that allows users to borrow a significant amount of funds without the need for collateral. These loans have gained attention due to their potential for arbitrage and profit-making opportunities within the DeFi ecosystem.

How flash loans differ from traditional loans?

Flash loans differ from traditional loans in terms of collateral requirements and repayment terms. Traditional loans require collateral, while flash loans do not. Additionally, flash loans need to be executed and repaid within the same transaction, whereas traditional loans have a fixed repayment period.

What are Flash Loans in DeFi?

Flash loans in DeFi refer to the ability to borrow a significant amount of funds from a DeFi platform without the need for collateral. These loans have gained popularity due to their potential for high-profit opportunities through arbitrage trading.

Video:

Lecture 13.6: DeFi Flash Loan Attacks

How do flash loans ensure the safety of the borrowed assets without collateral?

Flash loans are a game changer in the DeFi world. No collateral required and instant execution? It’s like magic! I’ve been able to make some serious profits by using flash loans to take advantage of price differences. Definitely worth exploring!

I find flash loans to be a game-changer for the DeFi space. It’s amazing how you can borrow large amounts of assets instantly without collateral. This opens up so many opportunities for trading and liquidity provision. The concept of arbitrage is fascinating and I’m excited to see how it continues to shape the crypto ecosystem.