The rapid rise of the DeFi (Decentralized Finance) ecosystem has revolutionized the way we think about traditional financial systems. With over a billion dollars locked into various DeFi protocols, it’s clear that this is not just a passing trend. DeFi provides a way for individuals to access financial markets and services without the need for banks or other centralized institutions.

One of the leading platforms within the DeFi ecosystem is Ethereum. Built on a blockchain, Ethereum allows for the creation of decentralized applications and smart contracts. This is how platforms such as WBTC (Wrapped Bitcoin) have emerged, which provide a way to bring Bitcoin into the Ethereum ecosystem. With WBTC, bitcoin holders can now participate in the decentralized financial markets without having to sell their bitcoin.

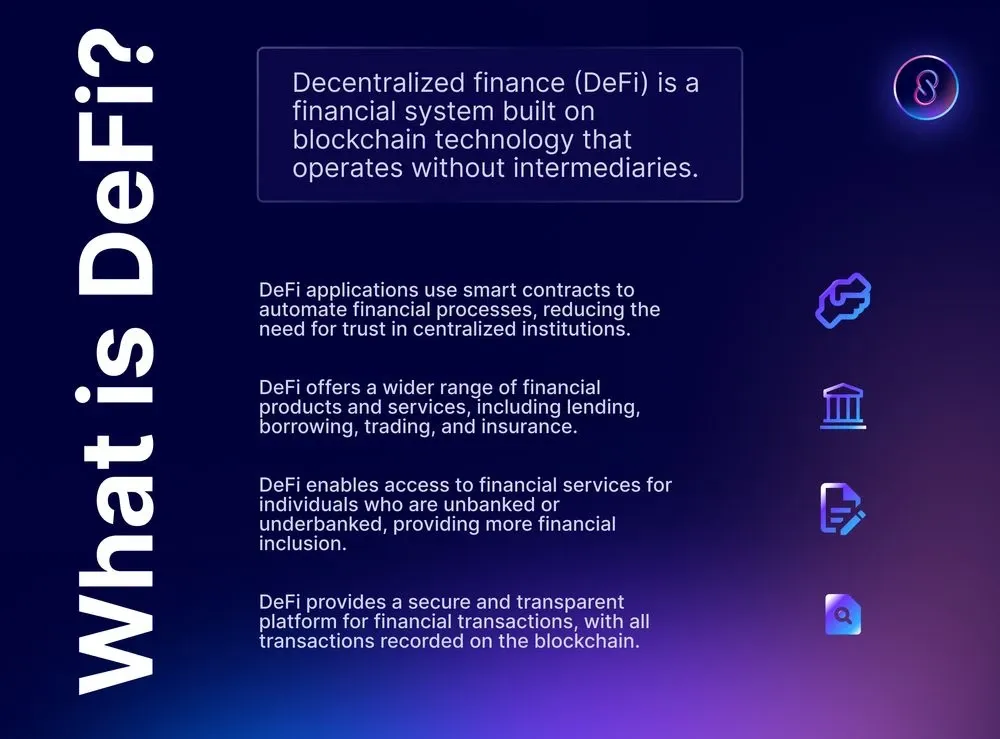

Decentralized Finance, or DeFi, is changing the way we exchange and store value. Unlike traditional financial systems, DeFi operates on a trustless, peer-to-peer basis, where the rules are defined by smart contracts. This means that there is no need to rely on intermediaries or trusted third parties. The DeFi ecosystem is built on the principles of transparency, open-source code, and permissionless access.

With DeFi, anyone can interact with financial instruments, such as lending and borrowing, in a decentralized manner. The system is not owned by any single entity or institution. Instead, it is governed by the community of users who participate in the ecosystem. This gives individuals more control over their own money and financial destiny, without having to rely on centralized institutions.

As we look to the future, it’s clear that DeFi will continue to play a leading role in disrupting traditional financial systems. The current rise of digital currencies, such as Bitcoin and Ethereum, have shown that there is a demand for alternative, decentralized forms of money. With the trust and security provided by blockchain technology, DeFi is poised to become the medium of exchange for the future.

The Current DeFi Ecosystem

The rise of Bitcoin and Ethereum has paved the way for the current DeFi ecosystem. Unlike traditional financial institutions, DeFi is built on decentralized blockchain technology, allowing users to interact with the ecosystem directly without the need for intermediaries. This medium of exchange and store of value has gained popularity as it offers a more transparent and secure way of managing financial transactions.

With a current market capitalization of over $100 billion, the DeFi ecosystem is revolutionizing the way we think about money. The rise of decentralized finance means that individuals can now take charge of their own financial future, without relying on central banks or traditional banking systems. Instead, users can access a wide range of financial services, such as lending and borrowing, decentralized exchanges, and yield farming, all within the DeFi ecosystem.

Ethereum is leading the way as the blockchain of choice for many DeFi projects. Its smart contract functionality allows developers to create complex financial applications that can be executed without the need for intermediaries. For example, users can trustlessly trade tokens through decentralized exchanges, such as Uniswap or SushiSwap, with the help of liquidity pools. Likewise, users can gain exposure to Bitcoin through wrapped Bitcoin (WBTC), an Ethereum-based token that represents Bitcoin.

However, the current DeFi ecosystem is not without its challenges. One of the main concerns is the issue of trust. While blockchain technology provides a decentralized and transparent system, there have been instances of hacking and exploits in the DeFi space. As the ecosystem continues to evolve, it is crucial for developers to prioritize security and implement robust measures to protect users’ funds.

In the future, the DeFi ecosystem has the potential to disrupt traditional financial systems on a global scale. With the ability to provide financial services to the unbanked and underbanked populations, DeFi can bridge the gap between the traditional monetary system and the digital currency revolution. As more individuals and institutions recognize the benefits of decentralized finance, the DeFi ecosystem will continue to grow, offering new opportunities and changing the way we view and interact with money.

The Rise of DeFi: How Ethereum Is Leading the Way

Ethereum has emerged as a leading platform in the world of decentralized finance (DeFi), revolutionizing the traditional financial system. DeFi refers to a new approach to financial services that seeks to provide a decentralized alternative to the current system, without the need for central institutions like banks.

At the heart of the rise of DeFi is the Ethereum blockchain. Ethereum has introduced smart contracts, which are self-executing contracts with the terms of the agreement directly written into lines of code. This allows for the creation of decentralized applications (dApps) that can perform a range of financial functions, from exchanging digital currencies to providing loans and yield farming.

One of the key components of the DeFi ecosystem on Ethereum is the ability to tokenize assets. This means that traditional assets, such as gold or fiat currency, can be represented on the blockchain as digital tokens. For example, wrapped Bitcoin (WBTC) is a tokenized version of Bitcoin that can be used within the Ethereum ecosystem.

DeFi has gained significant momentum due to its ability to provide greater accessibility, efficiency, and transparency compared to the current financial system. Without relying on intermediaries or central authorities, DeFi allows users to maintain full control over their assets and eliminates the need to trust third parties with their funds.

Furthermore, the rise of DeFi has opened up new opportunities for individuals to participate in the global financial markets. Individuals can now easily access a wide range of decentralized applications that offer services such as decentralized exchanges, lending platforms, and yield farming protocols. This has democratized access to financial services and has the potential to reshape the future of finance.

As the DeFi market continues to grow, Ethereum is leading the way in terms of adoption and development. With billions of dollars locked in DeFi protocols, Ethereum has proven its ability to handle the demands of a booming ecosystem. However, challenges such as scalability and high transaction fees still need to be addressed for the DeFi revolution to reach its full potential.

In conclusion

The rise of DeFi on the Ethereum blockchain is transforming the financial industry by offering a decentralized alternative that is accessible to anyone with an internet connection. By eliminating the need for trusted intermediaries and introducing innovative financial instruments, DeFi is changing the way we think about and interact with money. As the DeFi ecosystem continues to evolve, Ethereum remains at the forefront, leading the way towards a more inclusive and efficient financial system.

What’s the Future of Bitcoin DeFi

Bitcoin DeFi, also known as Decentralized Finance, is a current trend in the crypto industry that aims to transform the traditional financial system. Unlike traditional banks and financial institutions, Bitcoin DeFi operates on a decentralized blockchain network, such as Ethereum, allowing users to access financial services without relying on centralized intermediaries.

So, what’s the future of Bitcoin DeFi? As more people discover the benefits of DeFi and how it can revolutionize the way we transfer and store value, we can expect its popularity to rise. The current DeFi market already surpasses $60 billion in total value locked, and this number is likely to grow in the coming years.

The future of Bitcoin DeFi lies in its ability to provide a trustless and transparent financial ecosystem. By utilizing smart contracts and decentralized protocols, DeFi platforms can remove the need for intermediaries and enable individuals to have full control over their money. This means that users can directly exchange BTC for other digital assets, such as WBTC, and participate in lending, borrowing, and yield farming without relying on centralized exchanges or financial institutions.

Furthermore, Bitcoin DeFi opens up new opportunities for financial inclusion. People who may not have access to traditional banking services can now enter the DeFi ecosystem and take advantage of its benefits. In a world where billions of people are unbanked, Bitcoin DeFi offers a pathway to financial empowerment and economic freedom.

However, the future of Bitcoin DeFi also comes with challenges. As the ecosystem grows, scalability and security become key concerns. Ethereum, the leading blockchain for DeFi applications, must address these issues to support the increasing demand. Additionally, regulatory frameworks need to adapt to this new digital way of conducting financial transactions to ensure consumer protection and prevent fraudulent activities.

In conclusion, the future of Bitcoin DeFi is promising. It has the potential to disrupt the current financial system and provide individuals with more control over their finances. As the market continues to grow and evolve, it is crucial for developers, regulators, and users to collaborate and build a sustainable and secure DeFi ecosystem.

Frequently asked questions:

What is DeFi?

DeFi stands for Decentralized Finance, which refers to a movement in the cryptocurrency space that aims to create an open-source, permissionless, and transparent financial system using blockchain technology. It offers decentralized alternatives to traditional financial intermediaries such as banks and brokers, allowing users to have control and custody over their funds.

What are some examples of popular DeFi protocols?

Some popular DeFi protocols include MakerDAO, Compound, Uniswap, Aave, and Synthetix. These protocols offer various services such as decentralized lending, borrowing, trading, and synthetic assets creation. They operate on the Ethereum blockchain and rely on smart contracts to automate financial transactions.

How does Bitcoin fit into the DeFi ecosystem?

Bitcoin is the largest and most well-known cryptocurrency, but it is not inherently designed for DeFi applications. While there have been some efforts to bring Bitcoin into the DeFi ecosystem through projects like Wrapped Bitcoin (WBTC), it currently has limited functionality compared to Ethereum, which has become the primary blockchain for DeFi.

What is the future of Bitcoin DeFi?

The future of Bitcoin DeFi remains uncertain. While there is potential for Bitcoin to become more integrated with DeFi through interoperability solutions and sidechains, it may face challenges due to its limited scripting language and slower transaction confirmation times compared to Ethereum. However, as the DeFi space evolves, there could be innovations that enable greater integration between Bitcoin and decentralized finance.

How is Ethereum leading the way in the rise of DeFi?

Ethereum has emerged as the leading blockchain for DeFi due to its smart contract functionality, robust developer community, and existing infrastructure. It provides a platform for developers to build and deploy DeFi applications, and has seen significant growth in terms of both user adoption and the value locked in DeFi protocols. Ethereum’s success has paved the way for the rise of DeFi and continues to drive innovation in the space.

What are the risks associated with participating in DeFi?

Participating in DeFi carries various risks, including smart contract vulnerabilities, loss of funds due to hacks or scams, impermanent loss in liquidity pools, and regulatory uncertainty. Users should exercise caution and do thorough research before engaging with DeFi protocols. It’s also important to understand the potential risks and have a clear understanding of how these protocols work before investing or interacting with them.

Video:

The Comprehensive Guide to Linear Coin (LINA): Exploring Its Value, Technology, Use Cases

Making Money with Decentralized Finance: Exploring the Potential of DeFi

I find the rise of the DeFi ecosystem absolutely fascinating. It’s incredible to see how Ethereum is leading the way in revolutionizing the financial industry. With protocols like WBTC, DeFi is providing the perfect opportunity for Bitcoin holders to dive into decentralized finance without any hassle.

This article provides a great overview of the Crypto DeFi ecosystem. It’s amazing how Ethereum is paving the way for decentralized finance. I can’t wait to see what the future holds for Bitcoin DeFi!

As a crypto enthusiast, I find the DeFi ecosystem fascinating. It’s incredible to see how Ethereum is revolutionizing traditional finance systems. The ability to bring Bitcoin into the Ethereum ecosystem through platforms like WBTC is a game-changer. Exciting times ahead for DeFi!

I’ve been exploring the Crypto DeFi ecosystem for a while now, and it’s truly fascinating. Ethereum’s contribution to the DeFi revolution is unmatched. I love how it enables the seamless integration of Bitcoin through platforms like WBTC. The future of decentralized finance looks promising!

I have been exploring the Crypto DeFi ecosystem for some time now and it’s truly fascinating. It’s amazing to see how Ethereum is leading the way and opening up new possibilities for financial freedom. The future of Bitcoin DeFi looks promising as well. Exciting times ahead!

I really enjoyed this guide! It explained the concepts of the Crypto DeFi ecosystem in a clear and concise way. It’s fascinating to see how Ethereum is leading the way and allowing for the integration of Bitcoin into the decentralized financial markets. The future of DeFi looks promising!

I find the rise of the DeFi ecosystem extremely fascinating. It’s amazing to see how Ethereum is leading the way and allowing Bitcoin holders to participate in decentralized financial markets. This is definitely the future of finance!

As a crypto enthusiast, I must say that the DeFi ecosystem is an absolute game-changer. It’s amazing to see how Ethereum is leading the way in creating decentralized financial solutions. I believe that the future of Bitcoin DeFi is bright, and I’m excited to see the innovative protocols and platforms that will continue to revolutionize the industry. Keep up the great work!