If you’re interested in earning passive income from your cryptocurrency holdings, staking can be a lucrative strategy. Staking allows you to participate in the validation of transactions on a blockchain network and earn rewards for your contribution. In the UK, there are several crypto staking platforms that offer this service, but not all of them are created equal. In this article, we will introduce you to the best crypto staking platform in the UK for 2023 and teach you how to stake your crypto.

When choosing a crypto staking platform, it’s important to look for a platform that offers high staking rewards and a user-friendly interface. Our research has shown that the best platform for staking in the UK is Platinum Staking. Platinum Staking is a proven platform that has a built-in staking calculator, which allows you to estimate your earnings based on the amount of crypto you stake and the staking period.

One of the biggest advantages of Platinum Staking is that it offers multiple staking periods, ranging from a few days to several months. This allows you to choose the staking period that suits your investment strategy best. Additionally, Platinum Staking supports a wide range of popular cryptocurrencies, including Bitcoin, Dogecoin, and Tezos. This means that you can stake your favorite crypto assets and earn rewards in their native tokens.

Platinum Staking also provides a secure and efficient staking process. When you stake your crypto, the platform automatically distributes rewards to your account on a daily basis. This means that you don’t have to worry about manually claiming your rewards or missing out on potential earnings. Furthermore, Platinum Staking has implemented advanced security measures to protect your funds, so you can stake with peace of mind.

If you’re new to staking and unsure about how to get started, Platinum Staking offers a comprehensive educational section where you can learn everything there is to know about staking. They provide step-by-step guides, tips, and advice on how to maximize your staking earnings and minimize risk. Whether you’re a beginner or an experienced investor, Platinum Staking offers a user-friendly platform that caters to all levels of proficiency.

In conclusion, if you’re looking for the best crypto staking platform in the UK for 2023, look no further than Platinum Staking. With their high staking rewards, proven track record, and user-friendly interface, Platinum Staking is the ideal platform for staking your crypto assets. Start earning passive income today by staking with Platinum Staking!

Discover the Best Crypto Staking Platform in the UK for 2023

If you’re a crypto-hungry investor in the UK, one of the best ways to earn passive income with your digital assets is through staking. Staking allows you to lock up your tokens and support the operations of a blockchain network, earning potential rewards in return. In 2023, one of the best crypto staking platforms in the UK is Pancake.

Pancake is an excellent choice for staking because it offers high staking returns and a user-friendly interface. Regardless of your personal knowledge or experience in the crypto space, Pancake makes it easy to create and manage your staking account. The platform also provides regular updates and support, ensuring that you have the information and assistance you need for successful staking.

Unlike proof-of-work networks like Bitcoin, where miners consume massive amounts of computational power, Pancake operates on a proof-of-stake network. This means that instead of mining, validators are selected based on the number of tokens they hold and “stake” to support the network. By staking your tokens on Pancake, you become a validator and help secure the network, earning rewards in the process.

One of the benefits of staking on Pancake is that it eliminates the need for expensive mining equipment. All you need is a wallet that supports staking and a certain number of tokens to stake. Regardless of the size of your holdings, you can participate and earn rewards. This makes staking on Pancake accessible to both individual holders and institutional investors.

Another advantage of choosing Pancake as your staking platform is the potential for higher returns compared to other staking options. The platform offers competitive staking rates and allows users to choose between different staking periods, ranging from a few days to several months. This flexibility allows you to tailor your staking strategy to your investment goals and risk tolerance.

In conclusion, if you’re looking for the best crypto staking platform in the UK for 2023, Pancake is an excellent choice. With its proven track record, user-friendly interface, and competitive staking returns, Pancake offers a great opportunity for crypto investors to generate passive income while contributing to the security and decentralization of blockchain networks.

Learn How to Stake Crypto

Staking crypto has become an enormous trend in the digital currency world. It enables investors to earn passive income by holding and staking their cryptocurrencies. By staking their coins, individuals can participate in the consensus mechanism of the blockchain network and support the network’s security and functionality.

To learn how to stake crypto, it is essential to choose a reliable and secure staking platform. Reading reviews from other users is a great way to ensure that the platform offers the desired features and has a good reputation. Moreover, one must consider factors such as withdrawal options, long-term profitability, staking rewards, and the platform’s built-in security measures to protect against theft and other fraudulent activities.

When it comes to staking, there are two types of rewards offered: on-chain and off-chain. On-chain rewards involve earning native tokens of the staked cryptocurrency, while off-chain rewards can come in the form of additional tokens or interest payments. Additionally, staking platforms may offer different staking options, such as proportional staking or fixed-term staking, each with their own advantages and considerations.

One popular staking platform is Crypto.com, which offers a complete list of staking options for various cryptocurrencies. The platform has an official mobile app that allows users to stake their crypto easily and conveniently. Moreover, Crypto.com offers a simplified staking process, making it accessible even to beginners in the crypto space.

Staking crypto can be a long-term investment strategy, as it allows individuals to earn a yield on their holdings over time. By staking their coins, investors can potentially earn a significant amount of income and enjoy the benefits of compounding interest. However, it’s important to keep in mind that staking involves the locking up of funds, and one may not have immediate access to their staked assets.

Staking is a concept that differs from traditional investing. Unlike purchasing cryptocurrencies with the hope that their value will increase, stakers earn payouts for supporting the network’s operations. This means that staking is more closely related to the maintenance of the blockchain network rather than speculative trading.

Mining vs Staking

When it comes to earning cryptocurrencies, there are two popular methods: mining and staking. Both have their own advantages and considerations, so it’s important to understand the differences between them.

Mining

Mining is the process of validating transactions and recording them on the blockchain. Miners use powerful computers to solve complex mathematical problems, which requires a significant amount of computational power and energy. In return for their efforts, miners are rewarded with newly minted coins.

Mining can be a profitable venture, especially if you have access to cheap electricity and the latest mining hardware. However, it also comes with certain drawbacks. First, it requires a high initial investment in equipment and infrastructure. Second, mining can be highly competitive, as miners race to solve the mathematical problems and claim the rewards. Additionally, mining carries the risk of volatility in cryptocurrency prices, which can affect the profitability of mining operations.

Staking

Staking, on the other hand, involves participating in the Proof of Stake (PoS) consensus mechanism. In PoS, instead of miners, validators are responsible for processing transactions and creating new blocks. Validators are chosen based on the number of coins they hold and are willing to “stake” as collateral.

By staking their coins, validators help secure the network and maintain its integrity. In return, they receive staking rewards, which are proportional to the number of coins they stake. Staking is considered a more energy-efficient and environmentally friendly alternative to mining.

Staking has its own set of considerations. Validators need to ensure their systems are always online and properly maintained. They also need to have a good understanding of the chosen cryptocurrency and its underlying technology. Additionally, staking requires a certain level of commitment, as staked coins are typically locked for a set period of time.

In conclusion, both mining and staking offer opportunities to earn cryptocurrencies. Mining requires significant investments and carries certain risks, while staking requires a commitment and understanding of the chosen cryptocurrency. The best option for you depends on your individual circumstances and preferences.

Understanding Crypto Staking

Crypto staking is a process where individuals can participate in the verification and validation of transactions on a blockchain network. It allows users to acquire and hold certain crypto assets, which they can then stake on a platform to earn rewards. When users stake their tokens, they are essentially backing the network and helping to ensure its security and integrity.

What is staking? Staking involves locking a certain amount of tokens in a wallet and allowing them to be used by the network for the purpose of validating transactions. In return for their contribution, stakers are rewarded with additional tokens or benefits.

How does it work? When a user stakes their tokens, they are essentially adding them to a pool of funds that are used for various staking activities. The platform then distributes the rewards earned by the pool among the stakers based on their share of the total stake.

Why stake crypto? The enormous popularity of crypto staking is due to its high potential for returns. By staking their tokens, individuals can earn passive income without the need for active trading or investing. Additionally, staking helps to maintain network security and decentralization.

Benefits of staking: Staking offers several benefits to investors. It provides a low-risk and predictable source of income through rewards and fees. It also reduces the volatility associated with cryptocurrency investments, as rewards are denominated in the same crypto asset being staked.

Trusted staking platforms: When choosing a staking platform, it is important to select a trusted and regulated provider that offers secure services and has a good reputation in the industry. Some popular staking platforms include Nexo, Aqru, and Solana.

Withdrawing your stake: If you wish to withdraw your stake, you can usually do so by following the instructions provided by the staking platform. However, it is always advisable to seek professional advice or consult the platform’s documentation to ensure a smooth and secure withdrawal process.

Common questions about staking: Some common questions regarding staking include: “How much can I stake?”, “Are there any fees associated with staking?”, and “What happens if the network undergoes a major upgrade?” These questions vary depending on the platform and the cryptocurrency being staked.

The Benefits of Crypto Staking

Crypto staking offers numerous advantages for individuals looking to start earning passive income from their cryptocurrency investments. Here are some of the key benefits:

- Regular Rewards: When you stake crypto, you have the opportunity to earn regular rewards for participating in the network’s consensus mechanism. This means that you can earn a steady income from your staked coins without actively trading or selling them.

- Stable Returns: Unlike other forms of investment, staking crypto typically offers stable and predictable returns. This makes it an attractive option for individuals who prefer a more secure and consistent income stream.

- Flexible Holding Period: Crypto staking allows you to choose the duration of your staking period, giving you the flexibility to decide how long you want to lock up your funds. Some platforms offer daily, weekly, or monthly withdrawal options, allowing you to access your staked funds when needed.

- Lower Fees: Staking often involves lower fees compared to trading or mining. This can result in significant cost savings, especially for individuals who frequently engage in cryptocurrency transactions.

- Participate in Network Consensus: By staking your coins, you actively contribute to the security and stability of the network. This can be a rewarding experience for individuals who want to play a more active role in the cryptocurrency ecosystem.

In conclusion, crypto staking offers an excellent opportunity for individuals looking to earn passive income with their cryptocurrency holdings. With the growing popularity of staking platforms like Coinbase, Nexo, and Binance, it’s now easier than ever to get involved in crypto staking and start enjoying the benefits it brings. Whether you’re holding Bitcoin, Ethereum, Dogecoin, or any other staking-enabled coin, staking can be a trusted and regulated way to generate regular rewards while contributing to the network’s consensus mechanism.

Choosing the Right Staking Platform

When it comes to staking cryptocurrency, choosing the right platform can be a crucial decision. This guide will help you understand the key factors to consider when selecting a staking platform that aligns with your investment goals and preferences.

1. Platform Reputation and Security

The reputation and security of a staking platform should be at the top of your list when making a choice. Look for platforms that have a proven track record and positive reviews from other users. Additionally, ensure that the platform has robust security measures in place to protect your assets.

2. Variety of Supported Coins

Another important factor to consider is the variety of coins offered for staking. Different platforms may support different cryptocurrencies, so make sure that the platform you choose supports the coins you want to stake. Popular platforms like Coinbase, Kraken, and KuCoin often offer a wide range of staking options.

3. Staking Rewards and APY

The staking rewards and Annual Percentage Yield (APY) offered by the platform are significant factors to examine. Higher rewards and APY mean you can potentially earn more on your staked assets. Compare the rates offered by different platforms to find the one with the best earnings potential.

4. Platform Fees

Consider the fees associated with staking on a platform. Some platforms may charge management fees, transaction fees, or deposit/withdrawal fees. It’s important to understand the fee structure and how it may impact your earnings.

5. User-Friendly Interface

The platform’s interface and usability should be user-friendly and accessible. Look for platforms that offer an intuitive design, making it easy for you to navigate and manage your staking activities.

6. Platform Stability and Reliability

A stable and reliable staking platform is crucial to ensure uninterrupted staking and earning potential. Look for platforms with a solid infrastructure and a history of uptime to minimize any potential disruptions.

By considering these factors, you’ll be able to choose the right staking platform that aligns with your goals, maximizes your earning potential, and provides a secure environment for your staked assets.

Factors to Consider when Staking Crypto

When it comes to staking crypto, there are several important factors to consider. These factors can play a crucial role in determining the success and profitability of your staking efforts. Here are some key considerations:

1. Choosing the Right Platform

First and foremost, you need to select the best crypto staking platform for your needs. Look for a platform that offers a user-friendly interface, competitive interest rates, and a reliable track record. Some popular options in the UK for 2023 include Coinbase, BlockFi, and Tezos.

2. Interest Rates and Rewards

One of the main reasons to stake crypto is to earn interest or rewards. Different platforms offer varying interest rates, so it’s essential to compare and find the best rates for your chosen coin. The interest rate may also vary based on the length of the staking period.

3. Security and Trustworthiness

Security is paramount when it comes to staking crypto. Make sure the platform you choose is trusted and has a secure infrastructure to protect your funds. Look for platforms that offer insurance coverage for digital assets and prioritize safeguarding user funds.

4. Liquidity and Withdrawals

Consider how easily you can access your staked funds. Some staking platforms offer more flexibility than others when it comes to withdrawals. Look for platforms that allow for quick and easy withdrawal of your staked coins without extensive lock-up periods or penalties.

5. Coin Selection

Each staking platform supports different cryptocurrencies. Before diving in, ensure that the platform supports the coin you want to stake. Additionally, consider the potential future value of the coin and its long-term prospects for growth, as this can impact your staking returns.

6. Network Participation

Staking involves participating in the network of a particular cryptocurrency. Evaluate the network’s overall health, including its stability, security, and decentralization. Staking on a network with a strong and secure foundation is generally more reliable and likely to provide consistent returns.

7. Staking Strategy

Developing a staking strategy can help maximize your returns. Consider factors such as the length of staking periods, the number of coins required for staking, and potential economic gains. Diversifying your staked coins across multiple platforms can also help mitigate risks and optimize rewards.

By taking these factors into account, you can make an informed decision when it comes to staking crypto and enhance your chances of earning passive income from your digital assets.

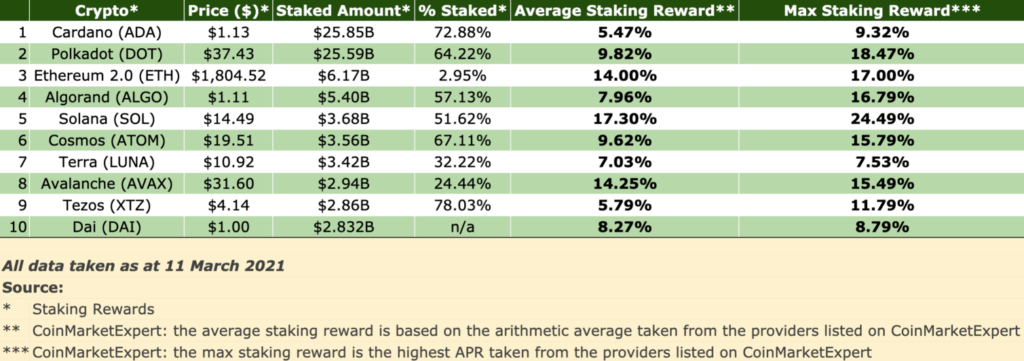

Top Cryptocurrencies for Staking

When it comes to staking cryptocurrencies, there are several top-rated options available. Staking on exchanges is an excellent way to be rewarded for holding digital assets. Stablecoins, such as Tether (USDT) and USD Coin (USDC), have become popular choices for staking due to their stable value and low fees. These stablecoins also offer a user-friendly intro to staking for beginners.

For those looking for a more decentralized approach, Ethereum (ETH) and Cardano (ADA) are excellent choices. Both blockchains offer excellent staking protocols, with Ethereum’s upcoming Eth2 upgrade set to bring even more rewards for users. Cardano’s staking system is already in place and has been highly praised for its ease of use and high level of security.

Another popular option for staking is Dogecoin (DOGE). Despite being initially considered a joke currency, DOGE has gained significant market value and is now ready to be staked. Staking DOGE can be a great way to earn passive income while supporting the network at the same time.

Lithuania-based exchange, Kraken, is a trusted platform that offers staking services for a wide range of cryptocurrencies. With a minimum staking amount and a user-friendly interface, Kraken makes it easy for users to enter the staking market. The exchange also offers competitive fees and a high level of security.

Overall, the best cryptocurrency for staking will depend on individual preferences and goals. It’s important to do thorough research and choose a platform that aligns with specific needs and preferences. Staking can be an excellent way to earn passive income, but it’s crucial to have a complete understanding of the chosen cryptocurrency and the staking process before getting started.

Calculating Staking Rewards

When it comes to staking crypto on platforms like Poloniex or KuCoin, calculating your staking rewards can be an important step in understanding the potential returns on your investment.

There are several methods for calculating staking rewards, especially when it comes to popular cryptocurrencies like Ethereum or BNB. Most staking platforms provide an annual percentage yield (APY) or yearly staking reward percentage, which can be used to estimate potential earnings.

To calculate your staking rewards, you can use the following steps:

- Intro step: Gather the necessary information.

- Step 1: Determine the amount of funds you plan to stake or invest.

- Step 2: Find the annual staking reward percentage provided by the platform.

- Step 3: Calculate the potential yearly earnings by multiplying the amount staked by the annual reward percentage.

- Step 4: Consider any additional factors that may affect your earnings, such as fees or taxes.

- Step 5: Review the calculated rewards and consider the potential risks and benefits before making a decision.

It’s important to note that staking rewards may vary depending on the platform and the specific cryptocurrency being staked. Some platforms, like Poloniex or KuCoin, also offer different staking levels or tiers, which can affect the overall potential earnings.

Additionally, the UK government’s tax authority, HMRC, introduced a system for taxing staking rewards as income. This means that any staking rewards received may be subject to taxation, especially for retail investors. It’s important to consult with a tax professional or refer to the HMRC guidelines for further information on how staking rewards may be taxed.

In conclusion, calculating staking rewards is an important part of the staking process. By understanding the potential earnings and considering any additional factors, investors can make informed decisions on how to best utilize their crypto assets.

Risks and Security in Crypto Staking

When it comes to crypto staking, there are certain risks and security considerations that retail investors should be aware of. While staking can be a profitable way to earn passive income, it is important to understand the potential risks involved.

Minimum Staking Requirements

One risk is the minimum staking requirements imposed by staking platforms. Some platforms require a minimum amount of digital tokens to participate in staking. This means that retail investors with smaller stakes may not be able to participate in certain staking opportunities.

Volatile APYs

Another risk is the volatility of annual percentage yields (APYs). The APYs for staking can vary greatly depending on market conditions and the specific cryptocurrency being staked. Retail investors should be aware that the APYs they see at the time of investing may not always be the same and can fluctuate over time.

Security of Platforms

Ensuring the security of the staking platform is also important. Retail investors should conduct thorough research on the platform they are considering and look for platforms that have a strong track record of security and reliability. It is also advisable to use platforms that have insurance coverage in case of any security breaches or hacks.

Dependency on Exchanges

Many staking platforms are integrated with cryptocurrency exchanges. While this can be convenient, it also means that investors are relying on the security and reliability of these exchanges. If an exchange experiences a security breach or ceases operation, it could potentially impact the staked assets and the investor’s ability to earn staking rewards.

Unbonding Periods and Liquidity

Some staking platforms have unbonding periods, which is the timeframe that must pass before an investor can withdraw their staked assets. This lack of liquidity can be a disadvantage, especially for retail investors who may need quick access to their funds. Additionally, the process of unbonding and withdrawing staked assets may involve transaction fees, which can consume a portion of the staking rewards.

While staking can offer great opportunities for retail investors to grow their digital asset holdings, it is important to be aware of the potential risks and take necessary precautions. Conducting thorough research, choosing reliable platforms, and staying informed about market conditions are key factors in ensuring a successful and secure staking experience.

Staking Strategies and Tips

Staking has become an attractive option for cryptocurrency investors looking to earn passive income. By staking their coins, investors can participate in the network’s consensus mechanism and earn rewards. Here are some staking strategies and tips to consider when choosing a crypto staking platform:

- Choose an eligible cryptocurrency: Not all cryptocurrencies are stakable. Make sure that the cryptocurrency you want to stake is supported by the platform you choose.

- Look for a proven platform: To maximize your staking gains, consider platforms that have a track record of successful staking activities. Platforms like BlockFi and KuCoin have a solid reputation in the crypto world.

- Diversify your staking holdings: Instead of putting all your eggs in one basket, consider staking multiple cryptocurrencies. This way, you can spread out your risk and potentially earn more rewards.

- Stay updated with project news: The success of a staking project heavily relies on the development and progress of the underlying network. Stay informed about the project’s updates and other news to make informed staking decisions.

- Consider the staking rewards: Different platforms offer different staking rewards. Compare the potential rewards of various platforms to choose the one that offers the best returns.

- Understand the staking mechanism: Each cryptocurrency has its own staking mechanism. Make sure you understand how the staking process works and what you need to do to participate.

In conclusion, staking cryptocurrency can be a great way to earn passive income. By following these staking strategies and tips, you can maximize your staking gains and make the most out of your staked tokens. Remember to do thorough research and choose a reliable platform that offers the staking services you’re looking for. Happy staking!

Staking vs Other Crypto Investment Options

When it comes to investing in cryptocurrencies, there are various options available, each with their respective advantages and risks. Staking is one such option that has gained popularity in recent years.

Staking involves holding and locking a certain amount of cryptocurrency in a staking wallet to support the network’s operations. In return, stakers earn rewards in the form of additional tokens. This method is similar to traditional ways of earning interest on savings accounts or investing in dividends.

Compared to other investment options, staking requires a much lower initial investment. While some investments may require large amounts of capital, staking allows individuals to participate with as little as a single token.

One of the main benefits of staking is that it provides a passive income stream. Unlike trading or investing in altcoins, staking allows individuals to earn ongoing rewards without constantly monitoring the market and making trading decisions. This makes staking an attractive option for beginners or those who are not comfortable with the technical aspects of trading.

Another advantage of staking is the compounding feature. When stakers earn rewards, these rewards are automatically added to their staking balance. Over time, this can significantly increase the staked amount and the potential rewards.

One of the key risks associated with staking is the possibility of losing the staked funds due to network issues or security breaches. However, reputable staking platforms typically have measures in place to mitigate these risks, such as frequent blockchain snapshots and off-chain storage of funds.

For those who wish to invest in cryptocurrencies but are not interested in staking, there are other options available. Some popular alternatives include trading on centralized exchanges, investing in decentralized finance (DeFi) platforms, or purchasing stablecoins like USDC or Tether.

Trading on exchanges allows individuals to buy and sell cryptocurrencies in real-time, based on market fluctuations. DeFi platforms offer various investment opportunities, such as yield farming or liquidity provision, which often provide higher returns but also come with higher risks. Purchasing stablecoins allows individuals to benefit from cryptocurrency market movements while still having the stability of a fiat currency.

In conclusion, staking is a relatively low-risk investment option that provides a passive income stream for crypto holders. It is a suitable choice for beginners or those who prefer a more hands-off approach to investing. However, it’s important to consider the risks and rewards of staking alongside other investment options that may better align with individual financial goals and risk tolerance.

Future Trends in Crypto Staking

The world of cryptocurrency continues to evolve, and one area that is gaining increasing attention is crypto staking. By staking your coins, you can passively earn rewards and contribute to the security of the network. Looking ahead to 2023, there are several future trends that crypto stakers should keep an eye on.

Increase in Earning Potential

As more people recognize the benefits of crypto staking, the potential for earning rewards is expected to increase. Leading staking platforms may introduce new features that allow users to earn additional income, such as by participating in network governance or voting on protocol upgrades.

Diversification of Staking Options

Currently, the most common coins available for staking are Ethereum and Tezos. However, in the coming years, more projects are likely to offer staking options to their token holders. This will allow stakers to diversify their portfolios and find new opportunities for passive income.

Regulatory Changes and Compliance

As the crypto industry matures, regulators may introduce new licensing requirements for staking platforms. Stakers should be prepared to provide identification and comply with regulations to ensure the platform they choose is trusted and compliant.

Rise of Proof-of-Stake Coins

Proof-of-stake (PoS) coins offer an alternative to traditional proof-of-work (PoW) mining. As awareness of the environmental impact of PoW mining grows, more investors may look to PoS coins as a greener option for earning passive income. Staking platforms should be ready to accommodate this influx of new investors.

Increase in Accessibility

Staking platforms are becoming more user-friendly and accessible to beginners. Features like easy coin transfer, lock-up periods, and built-in staking calculators make it easier for anyone to stake their coins and earn rewards. Stakers can also benefit from educational resources, such as guides and tutorials, to learn the ins and outs of staking.

In conclusion, the future of crypto staking looks bright with the potential for higher earning, an increase in staking options, and the rise of PoS coins. However, stakers should stay informed about regulatory changes and choose top-rated and trusted platforms that offer a user-friendly experience. With the right approach, crypto staking can be a great way to earn passive income and contribute to the growth of the cryptocurrency markets.

Frequently asked questions:

What is crypto staking?

Crypto staking refers to the process of holding and maintaining a cryptocurrency in a wallet to support the network’s operations. In return for staking, users earn interest or rewards on their staked crypto assets.

How can I stake crypto in the UK?

In the UK, you can stake crypto by using various staking platforms that offer staking services. These platforms allow you to choose the cryptocurrency you want to stake, and they handle the technical aspects of the staking process on your behalf.

What are the benefits of staking crypto?

Staking crypto has several benefits. Firstly, it allows you to earn passive income in the form of interest or rewards. Secondly, it helps secure the blockchain network by participating in the consensus mechanism. Lastly, staking often offers a higher return compared to traditional investment options.

Which is the best crypto staking platform in the UK?

There are several top crypto staking platforms in the UK, but the best one depends on your specific needs and preferences. Some popular options include Coinbase, Binance, and Kraken. It’s important to research each platform’s staking terms, fees, and supported cryptocurrencies before choosing one.

Can I stake any cryptocurrency?

No, not all cryptocurrencies can be staked. Staking is typically available for cryptocurrencies that use a proof-of-stake (PoS) consensus mechanism. Some popular stakable coins include Ethereum, Cardano, and Polkadot.

What are the risks of staking crypto?

While staking crypto can be a profitable venture, it also carries some risks. The value of the staked cryptocurrency can fluctuate, potentially resulting in financial loss. Additionally, there may be technical risks such as bugs or vulnerabilities in the staking platform, which could lead to loss of funds. It’s important to assess and manage these risks before staking your crypto.

Videos:

5 Best Crypto to Stake for Maximum Returns 2023 (BIG PASSIVE REWARDS)

Binance ETH Staking Tutorial (Stake Ethereum on Binance)

How To Make Money From STAKING CRYPTO in 2023 As A Beginner (Without Skills)