Decentralized Finance, or DeFi, has emerged as an alternative to traditional financial systems. In the world of crypto, a DeFi crypto exchange provides users with the ability to trade tokens in a decentralized manner. One popular DeFi exchange is Uniswap, which is built on the Ethereum blockchain.

Unlike traditional exchanges, DeFi crypto exchanges do not have a central authority. Instead, they operate using smart contracts, which are lines of code that dictate how the exchange should function. When users want to swap tokens, they interact directly with the blockchain and execute the trade without the need for a middleman.

One of the key features of DeFi crypto exchanges is that they allow users to earn passive income through various investment options. Users can provide liquidity to the platform by locking up their tokens, and in return, they are rewarded with fees generated by trades on the exchange.

So, how does a DeFi crypto exchange work? In a traditional exchange, the exchange acts as an intermediary between buyers and sellers, matching orders and facilitating transactions. With a DeFi exchange, the process is entirely automated and trustless. Users can trade directly with each other, leveraging the power of smart contracts to ensure that transactions are executed fairly and securely.

When using a DeFi crypto exchange, users have complete control over their funds. They are the only ones who can access and manage their tokens, as the exchange does not hold any user funds. This level of control and transparency is a key advantage of DeFi platforms.

In conclusion, a DeFi crypto exchange is a decentralized alternative to traditional financial systems. It operates using smart contracts and allows users to trade tokens directly with each other. Unlike traditional exchanges, DeFi exchanges do not hold user funds and offer users complete control over their investments. With the growing popularity of DeFi and the many innovative features they offer, it is no wonder that more and more people are choosing to use these platforms for their crypto trading needs.

What Is DeFi in Crypto

DeFi, short for decentralized finance, is a term used to describe a new and innovative way of conducting financial transactions using blockchain technology. Unlike traditional financial systems, DeFi platforms do not rely on intermediaries such as banks or other financial institutions. Instead, they leverage the power of blockchain technology to enable direct peer-to-peer transactions.

DeFi platforms operate on a decentralized network, which means that there is no centralized authority controlling the transactions. Instead, all transactions are recorded on a public ledger called the blockchain. This makes DeFi platforms highly transparent and resistant to censorship or manipulation.

One of the main features of DeFi platforms is the use of smart contracts. These are self-executing contracts that are coded into the blockchain and automatically execute transactions once certain conditions are met. This eliminates the need for intermediaries, reduces the risk of fraud, and ensures that transactions are carried out in a secure and efficient manner.

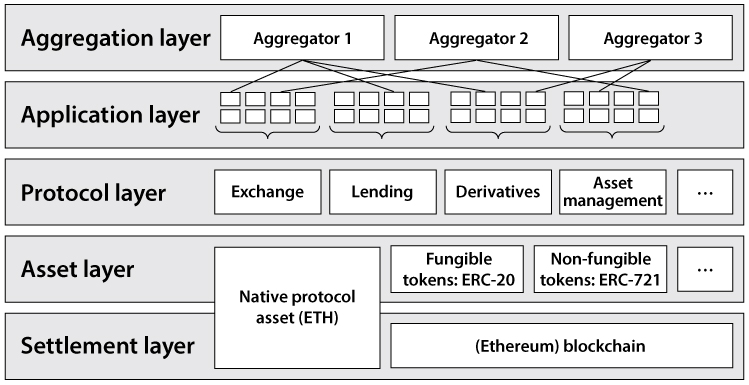

DeFi platforms support a wide range of financial activities, including lending, borrowing, trading, and investing. Users can interact with these platforms using a native cryptocurrency token, which is commonly an ERC-20 token. These tokens are used to pay for transaction fees, earn rewards, and participate in the governance of the platform.

DeFi has gained popularity in recent years due to its potential to disrupt the traditional financial industry. Many people see it as a more inclusive and accessible alternative to the existing financial system. However, it’s important to note that DeFi platforms are still in their early stages of development and come with their own risks and challenges.

Benefits of DeFi in Crypto:

- Decentralization: DeFi platforms are not controlled by a single entity, making them resistant to censorship or manipulation.

- Transparency: All transactions on DeFi platforms are recorded on a public ledger, ensuring transparency and accountability.

- Efficiency: Smart contracts automate transactions and eliminate the need for intermediaries, making transactions faster and more efficient.

- Inclusivity: DeFi platforms are accessible to anyone with an internet connection, allowing individuals from all over the world to participate in financial activities.

- Security: The use of blockchain technology and cryptography ensures the security and integrity of transactions and user funds.

Overall, DeFi in crypto is a highly innovative and revolutionary concept that has the potential to reshape the financial industry. It offers unique features and benefits that are not available in traditional financial systems, making it an attractive option for many investors and users.

How Does DeFi Work

DeFi, or Decentralized Finance, is a new technology in the crypto world that aims to transform traditional financial systems by leveraging blockchain and smart contracts. Unlike traditional financial institutions, DeFi eliminates the need for intermediaries and allows individuals to directly control their funds.

One of the key features of DeFi is the use of ERC20 tokens, which are programmable tokens that can represent various assets or utilities on the blockchain. These tokens can be created, transferred, and managed using smart contracts, making them a versatile tool for financial transactions.

DeFi platforms, such as Uniswap and other decentralized exchanges (DEXes), enable users to trade their ERC20 tokens directly with others, without the involvement of centralized intermediaries. This means that users have full control over their assets, and can swap tokens on-chain in a quick and secure manner.

Unlike traditional exchanges, DeFi platforms rely on open-source protocols and smart contract code, which is auditable and transparent. This means that users can verify the code behind the platform and ensure the security of their assets.

Furthermore, DeFi platforms also provide users with various financial services, such as lending and borrowing, yield farming, and staking. These services allow users to earn passive income on their crypto holdings and participate in the DeFi ecosystem.

Overall, DeFi is a revolutionary technology that empowers individuals by giving them full control over their financial assets. It provides an alternative to traditional financial institutions and allows people to make their own investment decisions. However, it’s important to note that DeFi is still a relatively new and rapidly evolving field, and users should only use DeFi platforms that they trust and understand.

Top decentralized exchanges in DeFi

Decentralized exchanges (DEXes) have gained significant popularity in the DeFi space, offering users a new way to trade cryptocurrencies and tokens. These DEXes work on blockchain technology and operate without the need for intermediaries or centralized authorities. They allow users to trade directly with one another, making transactions faster and more secure.

One of the most popular DEXes in the DeFi space is Uniswap. It operates on the Ethereum blockchain and is powered by a decentralized protocol. Uniswap enables users to swap ERC20 tokens without the need for an order book or centralized exchange. Instead, users can simply connect their wallets and execute trades directly on the platform. This unique approach to trading has attracted a large number of users and has made Uniswap one of the top decentralized exchanges in DeFi.

Another notable decentralized exchange is SushiSwap, which was actually forked from Uniswap’s code. SushiSwap offers additional features compared to its predecessor, such as yield farming and staking. These features allow users to earn rewards by providing liquidity to the platform and holding SUSHI tokens. SushiSwap has quickly gained popularity and has become a top choice for many DeFi enthusiasts.

Balancer is another decentralized exchange that offers a unique approach to trading. It is an automated portfolio manager and liquidity protocol, which allows users to create and manage weighted token portfolios. This enables users to balance their assets and optimize their trading strategies. Balancer has gained traction among DeFi users who are looking for a more customizable and flexible trading platform.

Overall, decentralized exchanges in DeFi are revolutionizing the way people trade and interact with digital assets. These exchanges offer a more secure and transparent alternative to traditional financial systems and have quickly become a top choice for many crypto enthusiasts. If you’re interested in exploring decentralized exchanges, it’s important to understand how they work and what features each platform offers. By doing so, you can make informed decisions and find the best DEX that suits your needs.

What is a DeFi protocol

A DeFi protocol, short for decentralized finance protocol, is a financial platform that operates on a decentralized network, such as a blockchain. Unlike traditional financial institutions, a DeFi protocol does not rely on intermediaries or centralized authorities to facilitate financial transactions and services. Instead, it is powered by smart contracts – self-executing contracts with the terms of the agreement written directly into the code.

One of the most popular and widely used DeFi protocols is Uniswap. Uniswap is a decentralized exchange (DEX) that allows users to trade ERC20 tokens directly from their wallets, without the need for an intermediary. It operates based on an automated market-making (AMM) model, where liquidity is provided by users rather than a centralized order book.

DeFi protocols are unique in their ability to enable financial services without the need for intermediaries. This means that anyone with an internet connection can participate in the DeFi ecosystem and access services such as lending, borrowing, yield farming, and asset management.

One of the key features of DeFi protocols is their open and permissionless nature. This means that anyone can create a DeFi protocol without needing permission from any centralized authority. Additionally, anyone can use and interact with these protocols without any restrictions or limitations.

The underlying technology that powers DeFi protocols is blockchain. Blockchain technology ensures transparency, immutability, and security, making it an ideal choice for decentralized financial applications. By leveraging blockchain, DeFi protocols eliminate the need for trust in intermediaries and create a more efficient and inclusive financial ecosystem.

As the popularity of cryptocurrencies and decentralized finance continues to grow, more and more people are turning to DeFi protocols as an alternative investment and financial solution. DeFi protocols offer a wide range of opportunities for users to earn passive income, access financial services, and trade various crypto assets.

Тэги: decentralized finance, DeFi, protocols, blockchain, smart contracts, Uniswap, DEX, ERC20 tokens, financial services, lending, borrowing, yield farming, asset management, blockchain technology, trust, cryptocurrencies, alternative investment, passive income, crypto assets

Understanding the Concept of Defi Crypto Exchange

A Defi crypto exchange, also known as a decentralized exchange, is a platform that allows people to trade tokens and cryptocurrencies directly with each other, without the need for intermediaries. Unlike traditional exchanges, which are centralized and controlled by a single entity, Defi exchanges are built on blockchain technology and operate in a decentralized manner.

One popular example of a Defi crypto exchange is Uniswap, which operates on the Ethereum blockchain. It is a top choice among many crypto enthusiasts due to its unique features. This platform enables users to swap ERC20 tokens directly, without the need for an order book or any centralized authority.

The main advantage of a Defi crypto exchange is that it allows for peer-to-peer trading, where users have full control over their funds. Instead of relying on a centralized exchange to hold their assets, users can securely trade directly with other individuals using smart contract technology.

This decentralized nature also means that Defi crypto exchanges are not subject to the same regulations and restrictions as traditional exchanges. They operate autonomously and cannot be shut down by any single entity. This provides users with more freedom and privacy in their financial transactions.

However, it should be noted that Defi crypto exchanges also come with their own set of risks and challenges. The code behind these platforms is open-source, which means that anyone can view and potentially exploit any vulnerabilities. Additionally, since transactions are directly between users, there is a higher risk of scams and fraudulent activities.

In summary, a Defi crypto exchange is a decentralized alternative to traditional exchanges, where users can trade tokens directly with each other. It offers increased privacy, security, and freedom, but also comes with unique risks. Understanding how this technology works and being cautious when using Defi exchanges is crucial for a successful and safe investment experience.

Exploring the Benefits of DeFi in Crypto

Decentralized Finance (DeFi) has gained popularity in the crypto industry due to its unique features and benefits. Unlike traditional centralized exchanges, DeFi platforms are built on blockchain technology, allowing for a trustless and transparent financial system.

One of the key benefits of DeFi is the ability to swap tokens directly on the platform, without the need for intermediaries. This is made possible through the use of decentralized exchanges (DEXes) like Uniswap, which operate on smart contract code.

Unlike centralized exchanges, where users have to trust a third party with their funds, DeFi platforms allow users to have complete control over their crypto assets. They can connect their wallets directly to the platform and execute transactions in a secure and private manner.

DeFi also offers a wider range of investment opportunities compared to traditional financial systems. Through decentralized lending and borrowing protocols, users can earn yields on their crypto holdings by providing liquidity to the platform.

Another benefit of DeFi is the ability to access these platforms from anywhere in the world. Unlike traditional financial systems that may have restrictions based on geography or legal frameworks, DeFi protocols are open to anyone with an internet connection.

Furthermore, DeFi platforms support the use of ERC-20 tokens, which is the standard for most cryptocurrencies. This means that users can easily trade and swap their tokens across different platforms without any hassle.

In conclusion, DeFi offers a decentralized and alternative way of managing financial assets in the crypto space. With its transparent and trustless nature, people can have full control over their funds and explore a wide range of investment opportunities. As this technology continues to evolve, more and more people are turning to DeFi as the top choice for their crypto transactions.

The Risks Involved in DeFi Crypto Exchanges

Decentralized Finance (DeFi) crypto exchanges have gained popularity in recent years due to their innovative features and alternative investment opportunities. Unlike traditional centralized exchanges, DeFi exchanges operate on a blockchain protocol, allowing users to trade and swap tokens directly from their wallets without the need for a middleman.

However, there are many risks involved in using DeFi crypto exchanges. Firstly, since these exchanges are decentralized, there is no central authority or regulatory body overseeing the platform. This lack of regulation can expose users to potential scams, hacks, and fraudulent activities.

Another risk is the smart contract technology that powers DeFi exchanges. While smart contracts are designed to automate and enforce transactions, they can be vulnerable to bugs or loopholes in the code. Exploiting these vulnerabilities can result in token theft or financial losses for users.

Additionally, the high number of tokens available on DeFi platforms can be overwhelming for many people. Unlike top centralized exchanges, which typically list only a limited number of popular cryptocurrencies, DeFi exchanges can host a wide variety of ERC20 tokens. This abundance of tokens can make it difficult to distinguish between legitimate projects and scams.

Moreover, the decentralized nature of DeFi exchanges means that users have to perform their own due diligence when choosing which tokens to invest in. Unlike centralized exchanges that conduct thorough vetting processes, DeFi platforms do not have such measures in place. This places the responsibility on the individual user to research and evaluate the tokens they wish to trade or invest in.

In conclusion, while DeFi crypto exchanges offer a decentralized and innovative alternative to traditional financial platforms, investors should be aware of the risks involved. The lack of regulation, potential vulnerabilities in smart contracts, and the vast array of available tokens all contribute to the inherent risks of using DeFi exchanges. Therefore, individuals should exercise caution and thoroughly assess the risks before making any investment decisions in the DeFi space.

How to Choose a Reliable DeFi Crypto Exchange

When it comes to investing in cryptocurrencies, having a reliable and secure crypto exchange is crucial. With the rise of decentralized finance (DeFi) and the advent of decentralized exchanges (DEXes), it is important to understand how they work and what features to look for in a reliable DeFi crypto exchange.

Decentralized Exchanges (DEXes)

Unlike traditional centralized exchanges, DEXes work on a decentralized protocol, which means that they operate without the need for intermediaries or third parties. This technology allows users to have full control over their funds and eliminates the risks associated with centralized exchanges, such as hacking and theft. One popular example of a DEX is Uniswap, which is built on the Ethereum blockchain and allows users to swap ERC20 tokens.

Security and Trust

Security should be a top priority when choosing a DeFi crypto exchange. You should look for exchanges that implement strong security measures, such as two-factor authentication and cold storage for user funds. Additionally, it is important to do thorough research on the exchange’s reputation and history of security breaches. Reading reviews and checking for regulatory compliance can also help ensure the trustworthiness of the platform.

Liquidity and Trading Volume

Another important factor to consider is the liquidity and trading volume of the DeFi crypto exchange. A high level of liquidity ensures that you will be able to buy or sell your tokens at the desired price without significant slippage. You should look for exchanges that have a large number of active users and a high trading volume, as this indicates a healthy market and better opportunities for trading.

Supported Tokens and User Interface

Before choosing a DeFi crypto exchange, it is important to check which tokens are supported on the platform. Some exchanges only support a limited number of cryptocurrencies, while others have a wide range of tokens available for trading. Additionally, the user interface should be intuitive and easy to navigate, especially for beginners. A well-designed and user-friendly interface can greatly enhance the trading experience and make it easier to monitor your investments.

In conclusion, choosing a reliable DeFi crypto exchange is a crucial decision for any investor in the cryptocurrency market. By considering factors such as security, liquidity, supported tokens, and user interface, you can ensure that you are making the best decision for your investment needs. Remember to always do thorough research and consider your own risk tolerance before committing to any platform.

Investing in DeFi: Tips and Strategies

Investing in DeFi, or decentralized finance, can be a lucrative opportunity for those willing to explore this emerging market. DeFi refers to a wide range of financial applications built on blockchain technology, which aims to provide decentralized alternatives to traditional financial intermediaries.

One of the key features of DeFi is the ability to invest in various decentralized exchanges (DEXes), which are platforms that allow users to trade cryptocurrencies directly with one another, without the need for a centralized intermediary. These DEXes operate using smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

When considering investing in DeFi, it is essential to understand how these exchanges work and what makes them unique. Many DeFi exchanges, such as Uniswap, are based on the Ethereum blockchain and utilize ERC20 tokens. These exchanges offer an alternative to centralized exchanges, allowing users to maintain control over their cryptocurrencies and eliminating the need to trust a centralized entity with their funds.

However, investing in DeFi comes with its own set of risks. The code underlying these decentralized protocols is public and accessible to anyone, making them susceptible to potential vulnerabilities and exploits. It is important to thoroughly research and understand the risks associated with investing in DeFi, especially when it comes to providing liquidity or staking your tokens.

One strategy to consider when investing in DeFi is to diversify your holdings across different protocols and tokens. This helps to spread out the risk and minimize the potential impact of any single investment going wrong. Additionally, staying informed about the latest developments and trends in the DeFi space can help identify potential investment opportunities and stay ahead of the curve.

Another tip is to pay attention to the popularity and adoption of different DeFi protocols and exchanges. The top DeFi platforms, often reflected in the total value locked (TVL), have more users and are considered more secure due to the larger amount of assets they manage. It is also important to carefully evaluate the team behind the project, their experience, and the level of community support.

In conclusion, investing in DeFi can offer unique opportunities to participate in the growing decentralized finance ecosystem. However, it is essential to do thorough research, understand the risks involved, and develop a diversified investment strategy that aligns with your financial goals and risk tolerance.

Regulatory Challenges in the DeFi Industry

The decentralized nature of DeFi platforms like Uniswap poses unique regulatory challenges for the industry. Unlike traditional centralized exchanges, DeFi platforms operate on automated smart contracts that execute transactions directly between users, without the need for intermediaries.

While this decentralized nature offers many benefits, such as removing the need for KYC (Know Your Customer) procedures and allowing anyone to participate, it also raises concerns for regulators. Without a central authority governing transactions, it becomes difficult to enforce regulations and mitigate risks.

One of the main challenges is the difficulty in regulating the tokens listed on DeFi platforms. These platforms allow users to swap various tokens, including those that may be considered securities or subject to regulatory oversight. Regulators are concerned about the potential for fraud and market manipulation on these platforms.

Another challenge is the anonymity and lack of transparency in DeFi transactions. Unlike traditional exchanges, where records of transactions can be traced back to specific individuals, DeFi platforms operate on pseudonymous addresses and immutable smart contracts. This anonymity makes it difficult for regulators to identify and enforce compliance measures.

Furthermore, the decentralized nature of DeFi platforms also makes it challenging for regulators to hold individuals or entities accountable for illegal activities. Since there is no central authority, it becomes difficult to enforce penalties or sanctions on those who violate regulations.

To address these challenges, regulators are exploring various approaches, such as extending existing regulations to cover DeFi platforms or developing new regulations specifically for the DeFi industry. Additionally, collaborations between regulators and industry participants are being initiated to create standards and best practices for DeFi platforms.

In conclusion, while DeFi platforms offer innovative features and advantages, the regulatory challenges they present cannot be ignored. The industry must find a balance between maintaining the decentralized and open nature of DeFi while also ensuring compliance with regulatory requirements to protect investors and prevent illegal activities.

The Future of DeFi Crypto Exchanges

The rise of decentralized finance (DeFi) has brought about a new wave of innovation in the cryptocurrency industry. DeFi crypto exchanges, unlike traditional centralized exchanges, have gained popularity due to their unique features and the technology they employ. One of the top DeFi exchanges in the market is Uniswap, which operates on the Ethereum blockchain and allows users to swap ERC-20 tokens without the need for an intermediating party.

What sets DeFi crypto exchanges apart from their centralized counterparts is the decentralized nature of their platforms. Instead of relying on a central authority, these exchanges operate on a protocol that is governed by smart contracts. This means that the code, which governs the exchange, is open-source and can be reviewed by anyone. Unlike centralized exchanges, where users have to trust the platform to handle their assets securely, DeFi exchanges provide an alternative where people have more control over their investments.

One of the key advantages of DeFi exchanges is their ability to enable peer-to-peer trading without relying on a trusted third party. By leveraging smart contracts, these platforms facilitate trading directly between users, eliminating the need for an intermediary. This not only reduces trading fees but also increases the security and transparency of the transactions. In addition, DeFi crypto exchanges offer a wide range of financial services, such as lending, borrowing, and staking, which further enhance the usability and utility of these platforms.

As the DeFi ecosystem continues to grow, we can expect to see more advancements in the technology and features of DeFi crypto exchanges. New protocols and platforms are constantly being developed, offering even more options for users to interact with the decentralized finance space. The future of DeFi crypto exchanges looks very promising, as they provide a viable alternative to traditional financial systems and empower individuals to take control of their financial future.

Frequently Asked Questions:

What is a Defi Crypto Exchange?

A DeFi (Decentralized Finance) crypto exchange is a type of exchange that operates on a decentralized network, utilizing smart contracts and blockchain technology. Unlike traditional centralized exchanges, where users have to trust a centralized authority with their funds, DeFi exchanges allow users to trade directly with each other, removing the need for intermediaries.

What is a DeFi protocol?

A DeFi protocol is a set of rules and smart contracts that define how a decentralized application (DApp) or platform operates in the DeFi ecosystem. These protocols are built on blockchain technology and enable decentralized finance functionalities such as lending, borrowing, trading, and more.

What are some top decentralized exchanges in DeFi?

Some of the top decentralized exchanges in DeFi include Uniswap, SushiSwap, and PancakeSwap. These exchanges allow users to trade cryptocurrencies directly from their wallets without the need for intermediaries or centralized authorities.

What is DeFi in Crypto?

DeFi (Decentralized Finance) in crypto refers to the use of blockchain technology and smart contracts to recreate traditional financial systems in a decentralized manner. It aims to provide individuals with more control over their financial assets and eliminate the need for intermediaries such as banks or brokers.

How does DeFi work?

DeFi works by utilizing smart contracts on blockchain platforms to automate and execute financial transactions. This allows for decentralized lending, borrowing, trading, and other financial activities. Users interact directly with these protocols using digital wallets, enabling them to have more control and transparency over their financial activities.

Video:

How to Make Money with Crypto – DeFi For Beginners

What is Uniswap – A Beginner’s Guide (2023 Updated)

DEFI INFINITE MONEY TRICK. Crypto INSANE GAINS +300% ALL IN.

Decentralized finance exchanges provide a much-needed alternative to the traditional financial systems. I believe that they have great potential in revolutionizing the crypto market. With decentralized exchanges, users have complete control over their tokens and can earn passive income, which is amazing. The use of smart contracts ensures transparency and eliminates the need for intermediaries. Overall, DeFi crypto exchanges are the future of cryptocurrency trading.