Are you searching for a reliable and efficient crypto collateral loan service in Australia? Look no further as we walk you through the top 10 options available in the country. Whether you are looking to borrow funds or collateralize your assets, these platforms offer a range of services to suit your needs.

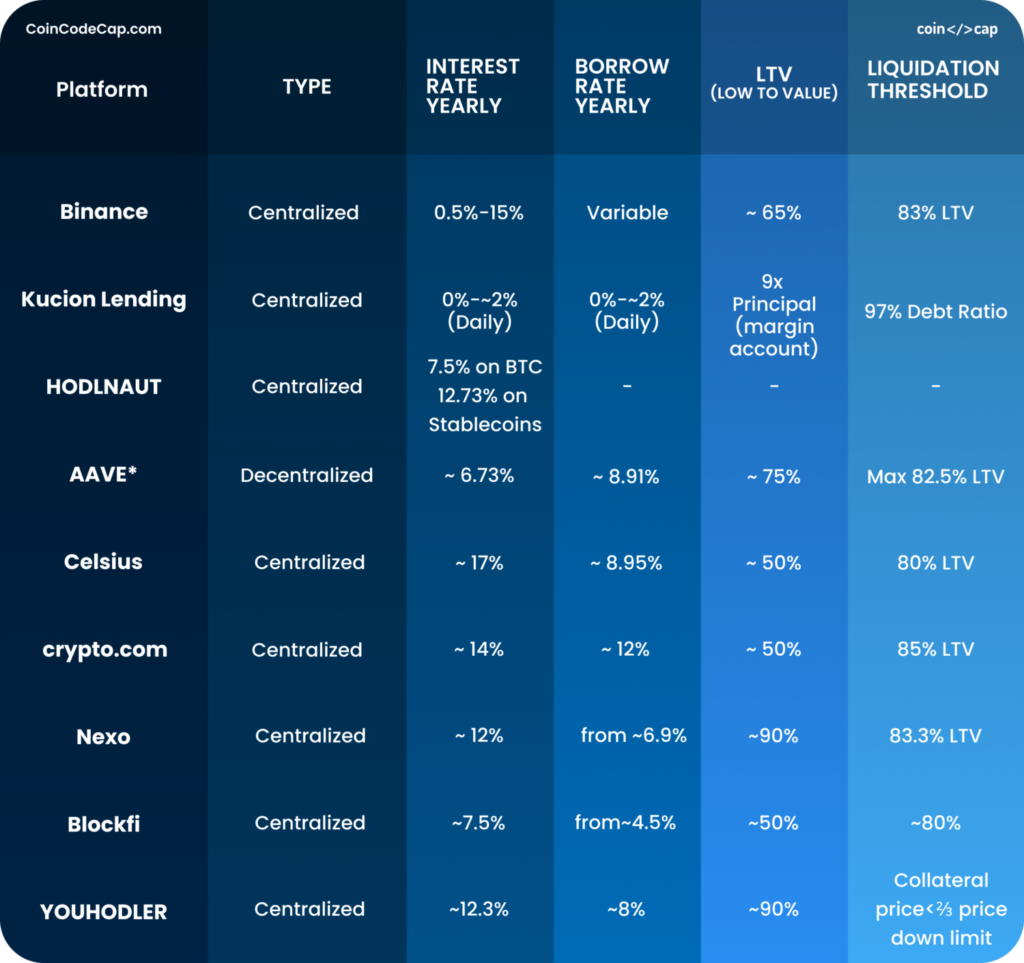

Interest rates may vary from one platform to another, so it’s important to compare and choose the one that best fits your requirements. From Nebeus to Zerion, there are established platforms that provide customer-friendly solutions for lending and borrowing.

One such platform is Nebeus, offering analytics and risk management tools to help you make informed decisions. With their collateral-based lending and borrowing system, you can easily access funds by backing them with your crypto assets. When it comes to collateral options, Avalanche and Loda offer a wide range of choices, making it easier for you to find the one that suits you best.

For those looking for instant services, Bitrue might be the true solution you need. They allow you to send, earn, and hold assets, giving you a higher level of control over your finances. Meanwhile, Alchemix provides a unique approach by allowing you to earn and borrow assets at the same time, making it a great option for earning passive income.

If you’re on the fringe of the crypto world and want to dip your toes into the market, Midas Investments and PointPay both offer user-friendly interfaces for beginners. These platforms operate on blockchain technology, ensuring transparency and security for your assets.

Whether you’re an experienced investor or just starting your crypto journey, these top 10 crypto collateral loan services in Australia offer a range of features and options to cater to your needs. Don’t limit yourself to traditional financing methods – explore the world of crypto and find the path to financial freedom.

How Crypto Collateral Loans Work

Crypto Collateral Loans: When it comes to borrowing money using your cryptocurrency assets, crypto collateral loans offer a convenient solution. These loans work by allowing borrowers to use their digital currencies as collateral in exchange for instant cash or stablecoin loans.

Instant Access: One of the main advantages of crypto collateral loans is the instant access they provide. With traditional loans, the process can take weeks or even months, but with crypto collateral loans, borrowers can receive funds quickly and efficiently.

Encryption and Security: Cryptocurrency assets are secured using advanced encryption techniques, offering an added layer of security for lenders and borrowers. Additionally, most crypto collateral loan platforms implement strict security measures to protect users’ assets and personal information.

DeFi Integration: Several crypto collateral loan providers also integrate with decentralized finance (DeFi) platforms, allowing borrowers to easily lend and borrow crypto assets through smart contracts and decentralized lending protocols like Compound or Aave.

Collateral Custody: Crypto collateral loans typically require borrowers to deposit their digital assets into a secure custodial wallet provided by the loan service. This ensures that the collateral is held in a safe and reliable location, minimizing the risk for both parties involved.

Loan Terms: The terms for crypto collateral loans vary depending on the platform and the borrower’s needs. Some platforms offer flexible loan durations, while others may require specific repayment terms and interest rates.

Loan Repayment: Borrowers must repay their loans within the agreed-upon time frame, typically with interest. Failure to do so may result in the liquidation of the collateral to cover the outstanding loan amount.

Currency Options: Crypto collateral loans allow borrowers to use a variety of cryptocurrencies as collateral, including Bitcoin, Ethereum, and other popular digital assets.

Portfolio Diversification: Crypto collateral loans can also serve as a strategic tool for portfolio diversification. By using their cryptocurrency holdings as collateral, borrowers can access cash or stablecoin loans while keeping their digital assets invested in the market.

Global Availability: Since cryptocurrency transactions occur on a worldwide scale, crypto collateral loan services are accessible to borrowers across different countries and regions.

Comparison and Selection: It is important for borrowers to compare different crypto collateral loan platforms and choose the one that best suits their needs. Factors to consider may include interest rates, loan terms, repayment options, and the level of security provided by the platform.

Benefits of Crypto Collateral Loans

Crypto collateral loans offer several advantages for borrowers who are looking to leverage their cryptocurrency assets. Here are a few key benefits:

Diversify Your Portfolio

By using a crypto collateral loan service like MidasInvestments, borrowers can unlock the value of their cryptocurrency holdings and diversify their investment portfolio. This allows them to access liquidity without selling their crypto assets, which can be especially beneficial if they believe the value of their crypto holdings will increase in the future.

Higher Loan Amounts

Crypto collateral loans typically offer higher loan amounts compared to traditional loans. This is because the loan amount is based on the value of the borrower’s cryptocurrency collateral, which can be significantly higher than the borrower’s creditworthiness or income.

Bank-Grade Security

Most crypto collateral loan services, such as MidasInvestments, offer bank-grade security measures to protect borrowers’ assets. Funds are stored in secure wallets with multi-layer encryption, and regular security checks are performed to ensure the safety of the assets.

Flexible Repayment Options

With crypto collateral loans, borrowers have the flexibility to choose their repayment terms. They can repay the loan in full or in installments, depending on their financial situation and preferences. This allows borrowers to manage their loans in a way that suits their needs and financial goals.

No Credit Checks

Unlike traditional loans, crypto collateral loans do not require borrowers to undergo credit checks. The loan amount is based solely on the value of the borrower’s crypto collateral, making it easier for individuals with limited credit history or poor credit scores to access financing.

Active and Passive Income Opportunities

By leveraging their crypto assets through a collateral loan, borrowers have the opportunity to generate both active and passive income. They can use the loan funds to invest in other cryptocurrencies or projects, potentially earning returns on their investments. Additionally, some platforms, like Celsius and Oasis, offer interest payments on the collateral held, allowing borrowers to earn passive income while their crypto assets are being utilized as collateral.

In conclusion, crypto collateral loans provide a variety of benefits, including portfolio diversification, higher loan amounts, bank-grade security, flexible repayment options, no credit checks, and active and passive income opportunities. By choosing the right loan service and understanding the terms and conditions, borrowers can make the most of their crypto assets and unlock the potential they hold.

What to Consider When Choosing a Crypto Collateral Loan Service

When choosing a crypto collateral loan service, there are several factors to consider to ensure you are making the best decision:

- Security: Security should be a top priority for every crypto collateral loan service. Look for platforms that offer bank-grade security measures to protect your digital assets and personal information from cyber threats.

- Fastest Loan Approval: If you need funds quickly, consider choosing a service that can provide the fastest loan approval process. Some platforms may offer instant approval, meaning you can access your loan amount instantly.

- Value for Your Cryptocurrency: Check the loan-to-value (LTV) ratio offered by different loan providers. Higher LTV ratios mean you can borrow a larger amount against the value of your cryptocurrencies.

- Custody and Security Protocol: Find out how the platform operates its custody and security protocols. Look for services that use advanced web3 technology or operate through established custody providers like BitGo to ensure the safe storage of your digital assets.

- Interest Rates and Policy: Compare the interest rates offered by different loan providers to ensure you are getting the best deal. Also, check if there are any hidden fees or penalties. It’s important to understand the loan repayment terms and policies.

- Audited and Reliable: Choose a crypto collateral loan service that has been audited and has a reliable reputation in the market. Look for platforms that have transparent processes and undergo regular audits to ensure the security of your assets.

- User-Friendly Platform: It’s important to choose a loan service that offers an easy-to-use platform. Look for features like portfolio tracking, lending calculator, and user-friendly interfaces to make the borrowing process simpler.

- Multiple Cryptocurrency Options: If you have a diverse cryptocurrency portfolio, consider choosing a service that accepts a wide range of digital assets as collateral. This will give you more flexibility in borrowing options.

- Reputation and Reviews: Before making a decision, check the reputation and reviews of the loan service. Look for feedback from other users to get a better understanding of their experience and the overall reliability of the platform.

- Customer Support: Lastly, consider the level of customer support provided by the loan service. Make sure they have a responsive customer service team that can assist you with any queries or issues that may arise during the loan process.

By considering these factors, you can make an informed decision and choose the best crypto collateral loan service that meets your specific needs and preferences.

Top 10 Crypto Collateral Loan Services in Australia

If you’re looking for crypto collateral loan services in Australia, you’re in luck. There are many options to choose from, each with their own unique features and benefits. Here is a list of the top 10 services available:

-

MidasInvestments: With MidasInvestments, you can borrow a significant amount of funds by staking your crypto as collateral. They offer various loan options and have a user-friendly platform.

-

Passive Orders: Passive Orders is a leader in the crypto collateral loan industry. They offer a wide variety of loan options and have a secure wallet for storing your assets.

-

Exchanges: Many exchanges, such as Nexo and BitGo, offer crypto collateral loan services. These services are a great option if you already have an account with the exchange and want to access funds quickly.

-

Blockchain-based loans: Services like Zengo and Cedefi offer blockchain-based loans, which provide more transparency and independence compared to traditional loans. These loans are secured by the blockchain and can be accessed instantly.

-

Compound: Compound is a trusted platform that allows you to borrow and lend cryptocurrency. They have a wide range of loan options and offer competitive interest rates.

-

Ecosystem Loans: Ecosystem loans, such as those offered by Oasis and Cedefi, are a great way to start building your crypto portfolio. These loans allow you to borrow funds using your existing crypto assets as collateral.

-

Cyber Finance: Cyber Finance offers instant loans in real-time. They have a user-friendly platform and provide competitive interest rates for borrowers.

-

Etoro: Etoro is a popular platform that allows you to trade and invest in cryptocurrencies. They also offer crypto collateral loans, which can be a convenient option if you already have an account with them.

-

Avalance: Avalanche is a trusted platform that allows you to borrow funds against your crypto assets. They offer a wide variety of loan options and have competitive interest rates.

-

Fringe: Fringe is a crypto collateral loan service that offers a variety of loan options. They have a user-friendly platform and provide quick and secure loan transfers.

In summary, there are many top-quality crypto collateral loan services available in Australia. Whether you’re starting out or looking to expand your crypto portfolio, these services can provide the financial support you need with the added benefits of security and flexibility.

Service A

Service A provides a unique and secure platform for crypto collateral loans in Australia. They offer a range of services and features that set them apart from other providers in the industry. Let’s take a closer look at what makes Service A stand out.

1. Flexible and Secure

Service A is powered by a multi-layer software infrastructure to ensure the security of users’ funds. With bank-grade security measures in place, customers can trust that their crypto assets are protected.

2. Competitive Interest Rates

When it comes to interest rates, Service A offers some of the most competitive rates in the market. Borrowers can benefit from low interest rates, making it easier and more affordable to generate profit from their crypto assets.

3. Wide Range of Supported Currencies

Service A supports a wide range of cryptocurrencies, including popular coins such as Bitcoin, Ethereum, and Litecoin. This allows users to use their preferred digital assets as collateral for loans.

4. Real-Time Portfolio Management

Using Service A’s user-friendly platform, borrowers can easily manage their collateral and loans in real-time. They have the ability to view their portfolio and make important decisions on the go.

5. Reliable Customer Support

Service A prides itself on providing top-notch customer support. Their team of experts is available to assist users with any queries or concerns they may have about the platform or their loans.

In conclusion, Service A is a leading crypto collateral loan service in Australia that offers flexible and secure loan options, competitive interest rates, a wide range of supported currencies, real-time portfolio management, and reliable customer support. Whether you are a crypto enthusiast looking to borrow against your assets or a seasoned investor seeking better borrowing and investment capabilities, Service A has got you covered.

Service B

Service B is a leading provider of crypto collateral loan services in Australia. With a focus on modern finance solutions, Service B aims to empower individuals and businesses to take control of their finances and gain financial independence.

Unlike traditional borrowing options, Service B offers collateral loans backed by crypto assets. This provides customers with a number of advantages, such as the ability to borrow against their investments without having to sell them. This allows customers to maintain their investment portfolios and potentially benefit from future growth in the crypto market.

One of the key features of Service B is their advanced finance system, which enables customers to receive loans in real-time. This means that customers can make use of their crypto assets and access the funds they need quickly and conveniently.

Service B takes the security of their customers’ assets seriously. They have built-in features to protect customers’ investments and ensure that their crypto assets are stored safely. This includes cyber security measures to safeguard against potential threats and risks.

Service B also offers a range of additional services, including a crypto wallet for easy management of crypto assets and analytics tools for monitoring and tracking investment performance. This helps customers stay informed and make informed decisions about their investments.

With Service B, customers have the opportunity to benefit from the growing crypto industry while also enjoying the convenience and flexibility of borrowing against their crypto assets. Whether you wish to finance a personal expense or use the funds for business purposes, Service B provides a reliable and secure solution for crypto collateral loans in Australia.

Service C

Hassle-Free Crypto Collateral Loan Services in Australia

Service C is an oasis for crypto holders in Australia who seek a convenient and reliable way to access funds without selling their digital assets. As one of the top 10 crypto collateral loan services, Service C provides independence and flexibility to users.

With Service C, users can unlock the value of their crypto assets and enjoy aave real-time loan services. The platform is fully decentralized, ensuring the highest level of security for users’ collateral and funds. Users can choose from a wide range of supported cryptocurrencies, including popular options such as Bitcoin, Ethereum, and Tether.

One of the main features that sets Service C apart is its built-in multi-coin wallets. Users can conveniently manage their crypto assets within the platform, making it easier to track their portfolio and monitor their collateral. The platform also offers advanced encryption services to ensure the safety of users’ data.

Service C offers competitive interest rates for crypto collateral loans, making it a better option compared to traditional financial platforms. Users can also earn interest by holding Service C’s native token, which plays a vital role in the platform’s ecosystem.

When it comes to withdrawal, Service C provides fast and efficient services. Users can easily convert their loaned assets back into their preferred cryptocurrencies or fiat currency. Service C supports multiple withdrawal options and ensures that users receive their funds in a timely manner, helping them solve their financial needs quickly.

Overall, Service C is a reliable and innovative platform that offers exceptional crypto collateral loan services to users in Australia. With its user-friendly interface, bank-grade security, and wide range of supported assets, Service C is a top choice for crypto holders looking to access funds while keeping their digital assets.

Service D

Introduction

Service D is a blockchain-based collateral loan service that operates in the Australian market. It is built on the Ethereum network and offers a range of services for individuals who want to earn passive income, lend their assets or invest in the crypto field.

Key Features

One of the key features of Service D is its built-in compounding strategy, which enables users to earn interest on their collateral loans. This means that users can earn interest on their loans while still being able to use their assets for other purposes.

Service D also offers a variety of cryptocurrencies and altcoins for lending or borrowing, including popular currencies like Bitcoin and Ethereum, as well as lesser-known coins. This allows users to diversify their holdings and take advantage of different investment opportunities.

Security and Encryption

Service D takes security seriously and uses advanced encryption techniques to protect user funds. All funds are stored in BitGo’s multi-signature wallets, providing an extra layer of security. This ensures that users’ assets are safe and protected against hack attempts.

Earn Interest on Crypto Collateral

With Service D, users can earn interest on their crypto collateral by lending it to other traders or borrowers. This can be a lucrative option for those looking to earn passive income in the crypto space, as interest rates can vary depending on market conditions and demand.

Additionally, Service D offers a range of features that enable users to make the most out of their collateral. This includes the ability to lend or borrow a variety of crypto pairs, invest in NFTs or futures, and take advantage of DeFi strategies and networks. Users have the freedom to choose their preferred investment path and make informed decisions about what suits their financial goals.

Avalanche and Web3 Integration

Service D is also ready for the future of the blockchain industry, with plans to integrate with the Avalanche network and Web3 technologies. This will further expand the services and opportunities available to users, allowing them to operate with even more cryptocurrencies and take advantage of new features and functionalities.

Conclusion

Service D is an Australian-based crypto collateral loan service that offers a wide range of features and benefits to its users. With its built-in compounding strategy, advanced security measures, and plans for future integration with Avalanche and Web3, Service D provides individuals with a trusted and convenient way to leverage their crypto assets.

Service E

Service E provides users with the ability to borrow funds against their crypto accounts. The platform offers fully insured accounts and allows users to collateralize their digital assets, such as Bitcoin, and borrow against their value. This means that users can continue to hold and benefit from the potential appreciation of their digital assets while still accessing the funds they need.

The platform is built-in with a suite of advanced features, including a web3 wallet that allows users to send and receive cryptocurrency. Additionally, Service E offers a stake-based rewards program, where users can earn additional tokens by staking their digital assets on the platform.

Service E also operates as a non-custodial platform, meaning that users maintain full control over their digital assets and can store them in a secure wallet of their choice. This provides an added layer of security, as users do not need to trust a third-party with their digital assets.

Furthermore, Service E has a number of lending partners, including Bitrue, Binance, Celsius, and more. This allows users to access a wide range of loan options and choose the terms that best suit their needs. Whether users are looking for short-term loans to fund purchases or long-term loans for investments, Service E has options available.

Overall, Service E offers a comprehensive and secure platform for users to borrow funds against their digital assets. With a number of lending partners and advanced features, users can easily access the funds they need while still maintaining control over their crypto accounts.

Service F

Service F is a non-custodial lending platform that allows users to borrow against their crypto assets. As a lender, Service F offers a range of altcoins that can be used as collateral, including Bitcoin, Ethereum, and many others. The platform prides itself on its financial services, providing a safe and secure environment for users to access instant liquidity.

One of the main advantages of Service F is its blockchain-based technology, which ensures that all transactions are secure and transparent. The platform uses smart contracts to facilitate borrowing and lending, eliminating the need for intermediaries and reducing the risk of fraud.

Service F also offers a user-friendly interface that makes it easy for borrowers and lenders to navigate the platform. With just a few clicks, users can start a deposit and borrow against their crypto assets. The platform also provides tools and resources to help users manage and track their loans.

Features:

- Secure and transparent blockchain-based platform

- Wide range of altcoins as collateral

- User-friendly interface for easy navigation

- Tools and resources for loan management

- Instant liquidity and fast transactions

Service F is a top choice for borrowers and lenders in the Australian fintech scene. With its focus on security and ease of use, the platform has quickly gained popularity since its launch in 2023. Whether users are looking to borrow or earn passive income, Service F provides a reliable and efficient solution for their crypto-backed loan needs.

Service G

Service G is a non-custodial platform that offers a number of safety features to help borrowers securely back their loans with crypto collateral. The platform’s simple and user-friendly interface makes it easy for borrowers to use, and they can get started in minutes with just a few clicks.

One of the key features of Service G is its wide variety of supported pairs, allowing borrowers to choose the collateral that best suits their needs. Whether they want to use BTC, ETH, or any other popular cryptocurrency, they can find it on Service G.

Service G also offers a unique lending service that allows borrowers to not only get cash for their crypto but also bring a variety of traditional assets into the crypto world. This means that borrowers can use their shares, accounts, or other assets as collateral to secure a loan.

By using blockchain technology, Service G ensures that all transactions are secure and transparent. The platform has partnered with trusted wallets and developers such as BitGo to ensure the safety of borrowers’ funds. With Service G, borrowers can always be confident that their collateral and loans are in safe hands.

In conclusion, Service G is a top crypto collateral loan service in Australia that offers a secure and simple platform for borrowers to back their loans with crypto collateral. With its wide variety of supported pairs, non-custodial nature, and safety features, Service G is a trusted choice for borrowers looking to access cash through their crypto assets.

Service H

Service H is a top-notch crypto collateral loan service that provides a variety of features to meet your financial needs. Whether you want to borrow against your Ethereum or Bitcoin holdings, Service H has got you covered.

With Service H, you can securely deposit your crypto holdings in their audited and professional system. Your assets are protected using top-of-the-line security measures, ensuring the safety of your investment. They work with trusted lenders to ensure that you get the best rates and terms for your loan.

Service H offers a user-friendly interface that makes it easy to navigate through the platform. You can quickly and easily withdraw funds or send them to other wallets or exchanges. With their efficient withdrawal execution, you can access your funds without any delays.

When it comes to customer support, Service H has a dedicated team of professionals who are ready to assist you with any inquiries or issues you may have. They have a variety of support channels, including email and live chat, to ensure that you receive timely and helpful assistance.

Service H understands the importance of staying up-to-date with the latest trends and innovations in the crypto world. They are constantly updating their platform to support new cryptocurrencies and chains, so you can easily access and manage your assets.

Whether you are a seasoned crypto investor or just starting out, Service H is a reliable and trustworthy option for your crypto collateral loan needs. With their secure infrastructure and user-friendly platform, you can have peace of mind knowing that your finances are in good hands.

Service I

Service I is a top crypto collateral loan service in Australia, providing a platform for users to grow their investments through loans and collateralized assets. With a variety of loan options and advanced features, Service I offers a marketplace where borrowers and lenders can connect and benefit from real-time asset values.

One of the key features of Service I is its custodial wallet, provided by Cryptocom. This secure wallet allows users to store their crypto assets with encryption, ensuring the safety of their funds. With Service I, you’ll have unlimited access to your wallet and can easily transfer funds in and out as needed.

Service I offers a range of loan options for users, allowing them to borrow against their crypto assets at competitive interest rates. Whether you’re looking for a short-term loan or want to borrow for a longer period, Service I has options to suit your needs. Best of all, the interest on your loan is compounding, enabling you to maximize your returns.

A standout feature of Service I is its partnership with Swissborg, a leading cryptocurrency platform. This collaboration allows Service I users to benefit from higher loan-to-value ratios, giving them access to more funds compared to other loan services. Starting since [year] , Service I has been providing borrowers with a reliable and user-friendly platform for their crypto collateral loan needs.

When using Service I, borrowers can compare different loan options and choose the one that best suits their needs. Its intuitive interface makes it easy to navigate and find the loan that fits your requirements.

Service I also offers a variety of other features for its users, including the ability to earn interest on your crypto assets, participate in the staking of certain coins, and even invest in a selection of curated portfolios. With Service I, you can grow your investments and make the most of your crypto assets.

Frequently Asked Questions:

What is Hodlnaut?

Hodlnaut is a crypto lending platform that provides collateralized loans in Australia.

How does Hodlnaut work?

Hodlnaut allows users to borrow against their cryptocurrency holdings. Users deposit their crypto assets as collateral and receive a loan in stablecoin.

What types of crypto can be used as collateral on Hodlnaut?

Hodlnaut accepts Bitcoin (BTC), Ethereum (ETH), and other popular cryptocurrencies as collateral.

What are the interest rates offered by Hodlnaut?

Hodlnaut offers competitive interest rates starting from 6% per annum.

Can I withdraw my collateral at any time?

Yes, Hodlnaut allows users to withdraw their collateral at any time, as long as the loan is fully paid off.

What is the minimum and maximum loan amount on Hodlnaut?

The minimum loan amount on Hodlnaut is $1,000, while the maximum loan amount depends on the value of the collateral.

Is Hodlnaut regulated in Australia?

Yes, Hodlnaut is registered with the Australian Securities and Investments Commission (ASIC) as a digital currency exchange and remittance service provider.

Video:

The ULTIMATE Credit Card Tier List | Best Credit Cards In Australia

Top 10 BEST Crypto Lending Platforms for Passive Income (2022)