Staking cryptocurrency has become a popular way for investors to earn passive income in the digital asset market. One of the platforms where users can enjoy the benefits of staking is Coinbase. However, it’s important to understand what staking is and how it works, as there are certain risks and considerations to keep in mind.

Staking is the process of holding a certain amount of a particular cryptocurrency in a digital wallet in order to support the operations of a blockchain network. By doing so, stakers can earn rewards in the form of additional tokens. Coinbase offers a staking program for several cryptocurrencies, including Ethereum, Tezos, and Algorand, among others.

When you stake your tokens on Coinbase, you are essentially contributing to the security and functionality of the blockchain network. This commitment entitles you to earn staking rewards over time. However, it’s important to note that staked assets are typically locked for a certain period of time, which means they cannot be easily sold or traded.

While staking can be a lucrative way to earn passive income, investors should be aware of the potential risks involved. There have been instances where issues with staked assets have arisen, such as technical glitches or security vulnerabilities. Additionally, regulatory concerns are an important consideration, as staking tokens may be classified as securities, subject to rules and regulations enforced by the SEC.

Despite these potential issues, Coinbase has taken steps to ensure the safety of its staking program. The company has filed a qualification application with the SEC’s Division of Financial and Market Integrity (DFMI), which will enable it to offer staking as part of its services. This action demonstrates Coinbase’s commitment to following regulatory guidelines and protecting the interests of its customers.

In conclusion, staking cryptocurrency on Coinbase can be a great opportunity to earn passive income, but it’s important to understand the risks and regulations associated with this practice. By taking the time to learn about staking and familiarize yourself with the specific rules and requirements of each asset, you can make informed decisions and maximize your earning potential.

What is Staking and How Does it Work?

Staking is a process that allows investors to earn passive income by holding and “staking” their cryptocurrency. It is a way for individuals to participate in blockchain networks and support their operations, while also receiving rewards in return. Staking involves locking up a certain amount of cryptocurrency, which helps to secure the network and maintain its integrity.

Staking works by individuals holding their cryptocurrency in a compatible wallet or on a platform that offers staking services, such as Coinbase. These platforms act as staking-as-a-service providers, allowing individuals to stake their tokens without needing to set up their own infrastructure. The platform then uses the staked tokens to participate in the network’s consensus mechanism and validate transactions.

When individuals stake their tokens, they earn rewards in the form of additional tokens or coins. These rewards are typically distributed periodically based on factors such as the amount of tokens staked, the duration of the stake, and the overall performance of the network. The rewards can vary depending on the specific cryptocurrency and the staking protocol in place.

Staking can be an attractive option for investors looking to generate passive income from their cryptocurrency holdings. However, it is important to understand the risks involved. Staking comes with the risk of loss of the staked tokens, as well as potential issues related to network security and governance. It is crucial for investors to thoroughly research and evaluate the staking process before participating.

Furthermore, investors should be aware of the regulatory framework surrounding staking. In the United States, for example, the SEC’s Howey Test is often used to determine whether a staking arrangement qualifies as a security. This could subject staking platforms and participants to additional rules and regulations, as well as investor protections.

In summary, staking offers a way for individuals to earn passive income with their cryptocurrency holdings. However, it is important to understand the risks and qualification requirements associated with staking, as well as the potential regulatory issues. Investors should conduct thorough research and exercise caution before engaging in staking activities.

Benefits of Staking Cryptocurrency

Staking cryptocurrency offers several benefits for investors and traders, providing an opportunity to earn passive income and maximize returns on their assets. Here are some key advantages of staking cryptocurrency:

- Higher potential returns: Staking allows individuals to earn additional rewards by actively participating in the blockchain network. By holding and staking their tokens, investors can earn a certain percentage of the total value of the staked assets in the form of rewards or interest.

- Enhanced security and protection: Staking involves holding and locking the cryptocurrency in a secure wallet, thus providing an extra layer of protection against potential threats and hacking attempts. This gives investors peace of mind knowing that their assets are held securely.

- Long-term investment strategy: Staking is typically a long-term investment approach, where individuals are incentivized for holding their tokens rather than selling them. This encourages investors to have a long-term perspective and not engage in short-term speculative trading.

- Access to exclusive features: Some staking platforms, like Coinbase, offer additional features and benefits to their clients who participate in staking. This may include access to new tokens, early access to information, or priority participation in token sales.

- Alignment with the blockchain ecosystem: Staking actively contributes to the security and stability of the blockchain network by incentivizing individuals to hold and stake their tokens. This helps ensure the overall health and functioning of the blockchain ecosystem.

- Regulatory compliance: Staking cryptocurrencies on platforms like Coinbase ensures compliance with relevant rules and regulations. Coinbase operates as a registered and regulated company, providing individuals with the confidence that their staking activities are conducted within the framework of applicable laws.

In contrast to other forms of passive income, staking cryptocurrency allows investors to actively participate in the blockchain network while earning rewards. By staking their tokens, individuals can align their interests with the success of the blockchain and contribute to its overall growth and development.

Staking on Coinbase: A Reliable and Secure Platform

When it comes to staking cryptocurrency, many investors are looking for a reliable and secure platform. Coinbase is a leading cryptocurrency exchange that offers staking services to its users. With staking on Coinbase, you can earn passive income by holding your tokens in a secure wallet and participating in the proof-of-stake consensus mechanism.

Unlike other platforms, Coinbase provides a trustworthy environment for staking. The company has a strong reputation in the cryptocurrency industry and is known for its strict regulatory compliance. This means that you can trust Coinbase to handle your assets securely and provide you with the necessary protections.

One of the main advantages of staking on Coinbase is the simplicity and convenience it offers. You don’t have to worry about setting up and maintaining your own staking infrastructure, as Coinbase takes care of all the technical aspects for you. This makes it a great option for those who want to earn passive income without the need for extensive technical knowledge or efforts.

Additionally, staking on Coinbase allows you to enjoy a steady and predictable return on your investment. By staking your tokens, you can earn a percentage of rewards generated by the network. This can be particularly beneficial for long-term investors who are looking for a stable source of income.

Another advantage of staking on Coinbase is the liquidity it provides. Unlike other staking platforms, where your tokens are locked up for a certain period of time, Coinbase allows you to trade your staked tokens at any time. This means that you can still have access to your assets and take advantage of market opportunities while earning staking rewards.

In conclusion, staking on Coinbase is a reliable and secure means of earning passive income from your cryptocurrency holdings. By taking advantage of the platform’s simplicity, reliability, and liquidity, you can earn staking rewards without the need for extensive technical knowledge or efforts. So if you’re looking to maximize your return on investment and enjoy the benefits of staking, Coinbase is definitely worth considering.

Supported Cryptocurrencies for Staking on Coinbase

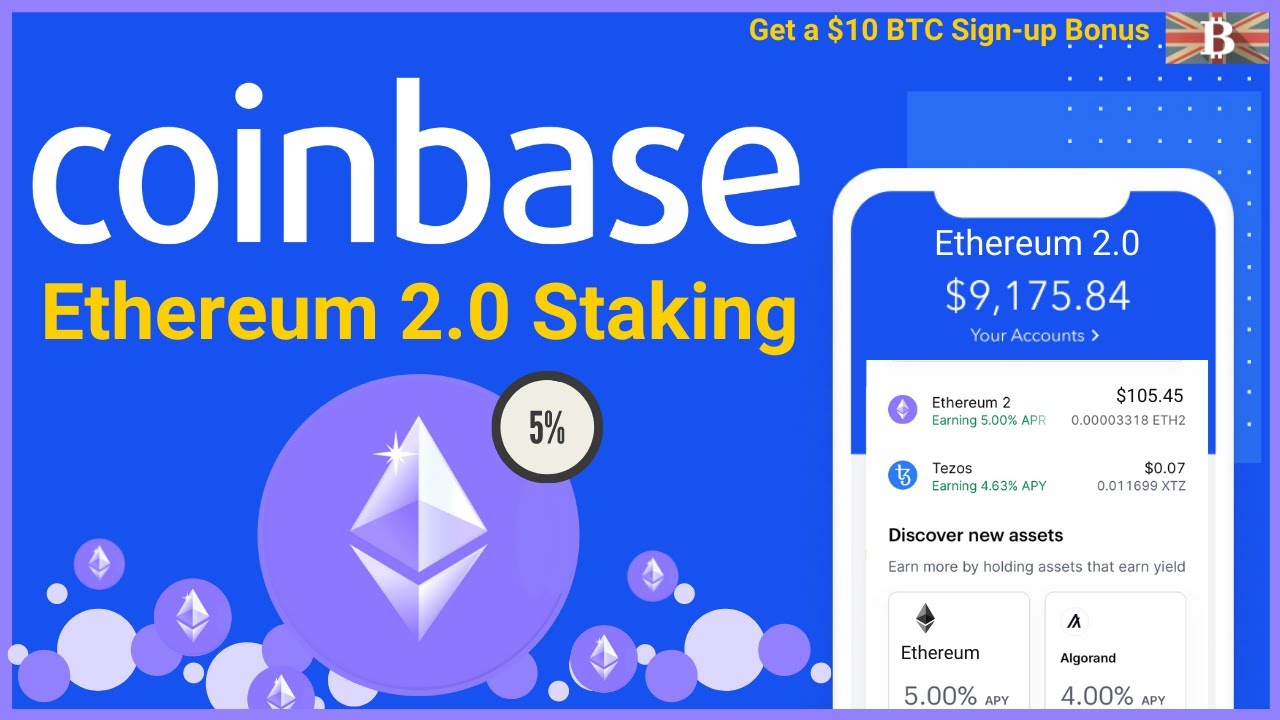

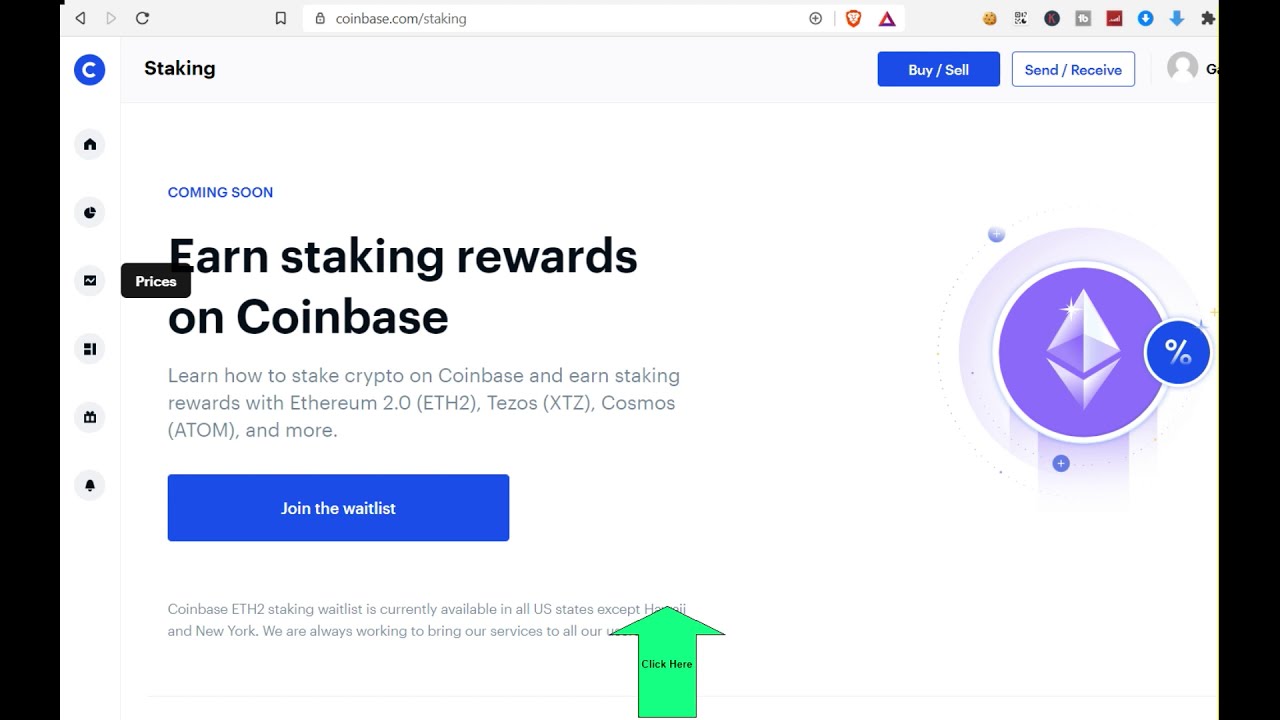

When it comes to staking cryptocurrency on Coinbase, you may wonder which coins are supported and how much passive income you can earn. Coinbase currently supports staking for a few different cryptocurrencies, including Ethereum 2.0, Tezos (XTZ), and Cosmos (ATOM).

If you’re wondering what the qualification process is like, you’ll be pleased to know that it’s quite simple. All you need to do is hold the supported cryptocurrency in your Coinbase account, and you’ll automatically start earning staking rewards. You don’t need to take any further action to receive your rewards, making it a hassle-free way to earn passive income.

However, it’s important to note that staking involves certain risks. Since Coinbase is a centralized exchange, it holds custody of your staked assets, which violates the “not your keys, not your crypto” principle. Unlike decentralized exchanges like Binance or Binance US, where you can stake your crypto without giving up custody, using Coinbase means trusting the exchange to maintain control over your assets.

Coinbase has made efforts to address these concerns, highlighting their commitment to maintaining the security of customers’ funds. They have a strong compliance center and employ strict controls to safeguard against any issues. However, it’s essential to remain aware of the risks and exercise caution when participating in staking on Coinbase or any other centralized exchange.

One key benefit of staking on Coinbase is the accessibility of the platform. Coinbase is one of the most widely used cryptocurrency exchanges, making it easy for users to participate in staking without having to navigate new platforms. If you’re already familiar with Coinbase and have an account there, you can easily access staking rewards without the need to register or explore other exchanges.

In terms of the rewards you can earn, the percentage varies depending on the cryptocurrency and the protocol. For example, Ethereum 2.0 staking currently offers an annual percentage yield (APY) of around 5-7%, while Tezos staking offers an APY of around 4-6%. These percentages are subject to change based on market conditions, so it’s always important to stay updated.

While staking on Coinbase can provide a passive income stream, it’s crucial to weigh the potential risks and rewards. Remember that staking is different from traditional investments, and there are unique risks associated with this type of action. It’s always a good idea to do your own research and fully understand the risks before committing any funds to staking.

How to Stake Cryptocurrency on Coinbase

Staking Basics

If you’re looking to earn passive income with your cryptocurrency holdings, staking is a popular method. Coinbase, one of the leading cryptocurrency exchanges, offers staking services for certain cryptocurrencies.

When you stake your cryptocurrency, you are essentially locking it up in a wallet, and in return, you earn rewards. Staked cryptocurrencies are used to support the operation and security of the blockchain network. Staking can be a way to potentially earn additional income while also contributing to the overall health of the network.

Staking on Coinbase

Coinbase makes staking cryptocurrency easy. To stake your coins on Coinbase, simply navigate to the “Staking” section on the platform. Under this section, you’ll find a list of supported cryptocurrencies that you can stake.

By staking on Coinbase, you benefit from the company’s security protections. Coinbase is regulated and has implemented various measures to protect user funds. This includes compliance with laws and regulations, as well as industry-standard security practices.

The Benefits of Staking on Coinbase

Staking on Coinbase offers several advantages. First, Coinbase is a well-known and reputable cryptocurrency exchange. This provides a level of trust and assurance for users. Additionally, Coinbase provides staking rewards directly into your account, simplifying the process and ensuring a seamless experience.

Coinbase also actively participates in regulatory efforts and provides information to the Securities and Exchange Commission (SEC). This means that Coinbase takes the necessary steps to operate within the confines of applicable laws and regulations, giving users peace of mind.

Getting Started with Staking

If you’re ready to start staking cryptocurrency on Coinbase, all you need to do is have a Coinbase account. Simply navigate to the “Staking” section as mentioned earlier and select the cryptocurrency you want to stake. Follow the prompts to initiate the staking process and you’ll start earning passive income in no time.

It’s important to note that staking may have certain requirements, such as minimum staking amounts or holding periods. Make sure to review the specific details for each cryptocurrency before staking to ensure you meet the criteria.

Conclusion

Staking cryptocurrency on Coinbase can be a lucrative way to earn passive income. With its established reputation, regulatory compliance, and user-friendly interface, Coinbase provides a reliable platform for staking your digital assets. By taking advantage of staking opportunities, you can potentially increase your earning potential while contributing to the growth and security of blockchain networks.

Minimum Requirements for Staking on Coinbase

Staking cryptocurrency on Coinbase can be an excellent way to earn passive income. However, there are some minimum requirements that you need to fulfill in order to participate in staking on the platform.

1. Account on Coinbase

To engage in staking on Coinbase, you must have an account with the platform. This means you need to register with Coinbase and complete all the necessary verification processes. Once you have a verified account, you can access the staking services.

2. Supported Cryptocurrencies

Not all cryptocurrencies are supported for staking on Coinbase. Currently, the platform offers staking for cryptocurrencies like Near, Ethereum 2.0 (ETH2), Algorand (ALGO), Tezos (XTZ), and EOS. You need to own these specific cryptocurrencies in order to participate in the staking program.

3. Minimum Staking Amount

Each supported cryptocurrency on Coinbase has its own minimum staking amount. For example, Near requires a minimum stake of 2 Near tokens, while Ethereum 2.0 requires a minimum stake of 0.0001 ETH. Make sure you have the required minimum amount of the specific cryptocurrency you wish to stake.

4. Staking Rewards

When you participate in staking on Coinbase, you can earn rewards in the form of additional cryptocurrency. The amount of rewards you will receive depends on various factors such as the network participation rate and the amount of cryptocurrency you stake. The specific details about the rewards structure can be found in the staking materials provided by Coinbase.

5. Risks and Considerations

Staking cryptocurrency is not risk-free. There are several risks and considerations you should be aware of before engaging in staking on Coinbase. These include the possibility of losing your staked cryptocurrency due to network issues or vulnerabilities, the potential volatility of the cryptocurrency market, and the lack of oversight and protection provided by securities regulations. Take the time to understand and evaluate these risks before staking your funds.

Overall, staking on Coinbase can be a profitable way to earn passive income from your cryptocurrency investments. However, it’s important to consider these minimum requirements and the associated risks before getting started. By taking these steps, you can ensure a smoother and more informed staking experience on the Coinbase exchange.

Understanding the Rewards and Returns of Staking

Staking is a process where cryptocurrency investors can earn passive income by holding and “staking” their coins in a program offered by exchanges such as Coinbase. By doing so, they contribute to the security and operation of the blockchain network and receive rewards in return.

When you stake your cryptocurrency on Coinbase, you are essentially lending it to the platform so that they can use it for staking and validating transactions on the blockchain. In exchange for your contribution, Coinbase shares a portion of the staking rewards with you.

The rewards you receive for staking can vary depending on the protocol being used and the specific coin you are staking. Typically, the rewards are a certain percentage of the staked amount, and they are awarded at regular intervals. Some coins may offer higher rewards than others, so it’s important to carefully consider the potential returns before staking.

It’s worth noting that staking on Coinbase is not without its risks. While Coinbase is a reputable and well-established corporation, there are always risks associated with staking. One of the main risks is the possibility of security breaches or mishandled funds, which can result in the loss of your staked assets.

Risks and Considerations of Staking Cryptocurrency

When it comes to staking cryptocurrency, there are several risks and considerations that you need to be aware of. These risks and considerations can have a significant impact on your investment and potential returns. It’s important to understand these risks before diving into staking.

The Risks of Staking Cryptocurrency

One of the main risks of staking cryptocurrency is the potential for loss. Unlike traditional investments, staking involves locking up your cryptocurrency for a certain period of time. During this time, the value of the cryptocurrency can fluctuate, and if the price drops significantly, you could end up losing a portion of your investment.

Another risk to consider is the security of the staking protocol. While blockchain technology is generally considered secure, there have been instances where staking protocols have been compromised. This could result in your cryptocurrency being stolen or manipulated.

There are also regulatory risks associated with staking cryptocurrency. Regulations regarding staking vary from country to country, and there is still a lack of clarity in many jurisdictions. This means that you could potentially face legal issues or penalties if you are not compliant with the regulations in your country.

Considerations for Staking Cryptocurrency

Before you start staking cryptocurrency, you should consider the following:

- Do you fully understand the staking protocol and how it works?

- What controls does the staking protocol have in place to protect your investment?

- Is the exchange or platform where you are staking registered and compliant with regulations?

- What fees or charges are associated with staking?

- What are the potential risks and rewards of staking on this particular platform?

It’s also important to note that staking cryptocurrency is not the same as staking a traditional investment like stocks or bonds. Cryptocurrency is highly volatile and can be subject to rapid price fluctuations. This means that the potential for gain is high, but so is the potential for loss.

In conclusion, staking cryptocurrency can be a way to earn passive income, but it’s not without its risks and considerations. Make sure to do your own research and understand the potential risks before deciding to stake your cryptocurrency.

Strategies for Maximizing Staking Rewards

When it comes to staking cryptocurrency on Coinbase, there are several strategies you can use to maximize your staking rewards. Here are some things to consider:

1. Choose the Right Coin

Selecting the right coin to stake is crucial. Not all coins available on Coinbase support staking, so make sure you choose a coin that offers staking-as-a-service. Additionally, consider the potential rewards and risks associated with staking a particular coin.

2. Understand the Risks

Staking cryptocurrency involves certain risks. While staking can earn you passive income, there are potential risks such as loss of funds or reduced liquidity. Make sure you understand the risks and assess your risk tolerance before staking your cryptocurrency.

3. Stay Informed

Keeping up-to-date with the latest information and news about staking and the specific assets you are staking is essential. Regularly check Coinbase’s news center and other reliable sources to stay informed about any updates or changes that may affect your staking rewards.

4. Diversify Your Staked Assets

By diversifying your staked assets, you can minimize the risk of loss. Consider staking multiple coins with different staking rewards and risks to create a more balanced staking portfolio.

5. Consider Staking Platforms

While Coinbase offers staking services, there are also other platforms like Binance.US that provide staking opportunities. Research different staking platforms to find one that offers better rewards or additional benefits for stakers.

6. Understand Tax Implications

Staking cryptocurrency may have tax implications. Make sure you are aware of the tax regulations in your country or region and the reporting requirements for staking rewards. Consult with a tax professional if needed to ensure you are compliant with the applicable tax laws.

Remember, staking cryptocurrency isn’t without its risks, but with careful planning and well-informed strategies, you can maximize your staking rewards and earn passive income.

Alternatives to Staking on Coinbase

While staking cryptocurrency on Coinbase is a popular way to earn passive income, there are other alternatives available for investors looking to diversify their holdings or explore different opportunities:

Trading on other exchanges

If you simply want to trade or invest in different cryptocurrencies, you can consider using other exchanges. By trading cryptocurrencies on different platforms, you can take advantage of market fluctuations and potentially earn profits without actively staking your assets.

Investing in securities or other financial instruments

If your goal isn’t just to earn passive income through staking, you can explore other investment opportunities such as stocks, bonds, or mutual funds. These traditional financial instruments offer different means of generating returns and can provide access to a wider range of assets.

Exploring decentralized finance (DeFi) protocols

Decentralized finance protocols, built on blockchain technology, offer alternative ways to earn rewards without relying on a centralized exchange like Coinbase. By participating in DeFi projects, you can provide liquidity, lend your assets, or participate in yield farming to earn returns.

Managing your own staking endeavors

If you’re knowledgeable about blockchain networks and have the technical expertise, you can choose to manage your own staking endeavors. This means running your own staking node and participating directly in the network’s consensus mechanism to earn rewards.

In conclusion, while staking cryptocurrency on Coinbase is a popular option, there are numerous alternatives available for investors looking to explore different investment opportunities. Whether it’s trading on other exchanges, investing in securities, exploring DeFi protocols, or managing your own staking endeavors, the market offers various ways to earn passive income and diversify your holdings.

Frequently Asked Questions about Staking on Coinbase

Q: When can I start staking on Coinbase?

A: Coinbase allows clients to start staking as soon as the staking program for a specific cryptocurrency is available. The availability of staking may vary depending on the cryptocurrency and the platform’s staking-as-a-service protocol.

Q: What are the regulations against staking?

A: The regulations surrounding staking can vary depending on the jurisdiction. It is important for investors to understand the legal framework and regulations in their region before engaging in staking activities. Failure to comply with the necessary regulations may result in legal consequences.

Q: Why do I need to stake my cryptocurrency?

A: Staking allows investors to earn passive income by participating in the validation and security of a blockchain network. By staking their cryptocurrency, investors contribute to the network’s operations and are rewarded with additional tokens as a form of compensation.

Q: Can I access my staked tokens at any time?

A: The accessibility of staked tokens depends on the staking protocol and the platform being used. Some platforms may have lock-up periods during which the staked tokens cannot be withdrawn. It is important for investors to familiarize themselves with the terms and conditions of the staking program before participating.

Q: How does staking on Coinbase compare to staking on another platform?

A: Coinbase offers a user-friendly interface and a well-established reputation as a cryptocurrency exchange and custodial service. This gives investors confidence in the security and reliability of the staking program. However, each platform has its own features and benefits, so it is advisable to research and compare different options before deciding where to stake your cryptocurrency.

Q: What protections does Coinbase provide for staking investments?

A: Coinbase takes various measures to protect the staking investments of its clients. These may include insurance coverage, multi-signature wallets, and strict security protocols. However, it is important to note that staking comes with its own risks and there is no guarantee of profit or protection against losses.

Q: What happens if my staked tokens are mishandled or lost?

A: In the event that staked tokens are mishandled or lost due to a security breach or other unforeseen circumstances, Coinbase will generally take appropriate actions to restore or compensate clients. However, the extent of such protection may vary and it is advisable to review the terms and conditions provided by Coinbase for specific details.

Q: Are there any charges or fees for participating in the staking program?

A: Coinbase may charge a fee for participating in the staking program. The specific fee structure and details can be found on the Coinbase platform or in the informational materials provided. It is important for investors to be aware of any charges or fees associated with staking before participating.

Q: What if staking violates the rules of a specific cryptocurrency or blockchain protocol?

A: If staking violates the rules or guidelines of a specific cryptocurrency or blockchain protocol, Coinbase may suspend or restrict the staking program for that particular asset. It is important for investors to stay informed about any updates or changes to the staking program and to ensure compliance with the rules set by the issuing entity or organization.

Frequently Asked Questions:

How does staking cryptocurrency on Coinbase work?

When you stake cryptocurrency on Coinbase, you are essentially locking your funds in a wallet to support the network’s operations. In return for staking, you earn rewards in the form of additional cryptocurrency.

What cryptocurrencies can be staked on Coinbase?

Currently, you can stake several cryptocurrencies on Coinbase, including Ethereum 2.0, Algorand, Tezos, and Cosmos. Coinbase frequently adds support for new cryptocurrencies, so the available options may change over time.

How much can I earn from staking cryptocurrency on Coinbase?

The amount you can earn from staking cryptocurrency on Coinbase varies depending on the cryptocurrency and the network’s staking rewards. The annual percentage yield (APY) can range from a few percent to double-digit numbers. It’s important to note that staking rewards are not guaranteed and can fluctuate.

What are the minimum staking requirements on Coinbase?

The minimum staking requirements on Coinbase vary depending on the cryptocurrency. For example, to stake Ethereum 2.0, you need to have a minimum of 0.025 ETH. The exact requirements for each cryptocurrency can be found on the Coinbase website or app.

Can I unstake my cryptocurrency at any time?

Yes, you can unstake your cryptocurrency at any time on Coinbase. However, there may be a certain unstaking period before your funds are available for withdrawal. The unstaking period varies depending on the cryptocurrency and network.

Does staking cryptocurrency on Coinbase have any risks?

While staking cryptocurrency on Coinbase can be a way to earn passive income, it also comes with certain risks. These risks include the potential loss of funds if the network experiences a security breach or a decrease in the value of the staked cryptocurrency.

How many NEAR Protocol tokens are currently in staking?

As of now, the exact number of NEAR Protocol tokens in staking on Coinbase is not publicly available. Coinbase does not disclose the specific amount of tokens being staked. However, you can check the staking participation rate on the NEAR Protocol blockchain to get an idea of the overall staking activity.

Video:

Earn Crypto Passive Income: TOP METHODS Revealed!!

How To Make Money With Coinbase in 2023 (Beginners Guide)

Cryptocurrency Staking Explained: How It ACTUALLY Works