When it comes to investing in the cryptocurrency industry, there are alternatives to simply buying and holding assets like Bitcoin or Ethereum. One popular method is arbitrage, where traders take advantage of price differences between different platforms or exchanges to make a profit.

Flash Loan arbitrage is a particularly profitable strategy, and Uniswap is one of the most popular decentralized exchanges for executing these trades. With this approach, traders can borrow a large amount of cryptocurrency for a short period of time, execute profitable trades, and repay the loan, all within the same transaction.

Building a Flash Loan Arbitrage Bot on Uniswap requires understanding the structure of smart contracts and utilizing tools like Metamask to interact with the Ethereum network. By deploying your own smart contract, you can program your bot to look for price discrepancies between different tokens and execute trades automatically.

Before diving into the world of Flash Loan arbitrage, it’s important to familiarize yourself with the basics of Uniswap and how it works. Uniswap is a decentralized exchange protocol that allows for the swapping of ERC20 tokens directly from your wallet, without the need for an order book or centralized exchange.

Flash Loan arbitrage bot can be a highly profitable venture, but it also comes with its own risks. Security is paramount, as any vulnerabilities in your smart contract could result in the loss of your funds. Therefore, it’s necessary to thoroughly test and audit the code before deploying it on the Ethereum network.

By understanding the principles behind Flash Loan arbitrage and being able to build your own bot, you can take advantage of the opportunities presented by Uniswap and other decentralized exchanges, and potentially earn significant profits.

Paxful & LocalBitcoins Alternatives – Crypto Exchanges Similar To LocalBitcoins

LocalBitcoins has long been a popular platform for peer-to-peer (P2P) trading of cryptocurrencies. However, if you’re looking for alternatives, there are several other exchanges that offer similar services and features. Here’s an introduction to some of the alternative exchanges that can be used as alternatives to LocalBitcoins.

1. Paxful

Paxful is a P2P cryptocurrency exchange that allows users to buy and sell Bitcoin using various payment methods. With Paxful, you can find offers from individuals willing to sell Bitcoin for cash, bank transfers, gift cards, and more. The platform also supports a wide range of currencies, making it easier for users from different countries to trade.

2. HodlHodl

HodlHodl is another P2P cryptocurrency exchange that allows users to trade Bitcoin. One of the key features of HodlHodl is its multisig escrow, which ensures that funds are held securely during transactions. The platform does not hold user funds, and all transactions are conducted directly between the counterparties involved.

3. BitQuick

BitQuick is a P2P Bitcoin marketplace that enables users to buy and sell Bitcoin quickly. The platform offers several payment methods, including cash deposits, wire transfers, and money orders. BitQuick has a simple and user-friendly interface, making it a great option for beginners in the crypto industry.

4. CoinRabbit

CoinRabbit is a P2P exchange that allows users to borrow and lend various cryptocurrencies. The platform offers a unique feature called Future Proof, which lets users lock in a certain amount of cryptocurrency at a specific price for a future date. This can be useful for traders who want to hedge against potential price fluctuations or for long-term holders who want to secure their profits.

5. LocalCoinSwap

LocalCoinSwap is a decentralized P2P cryptocurrency exchange that supports a wide range of cryptocurrencies. What’s unique about LocalCoinSwap is its community-driven governance model, where token holders have the right to participate in decision-making processes. This gives users an opportunity to be more involved in the development and direction of the platform.

When choosing an alternative to LocalBitcoins, consider factors such as the available payment methods, transaction fees, user reviews, and the security measures in place. Each exchange may have different limits, rates, and additional features, so it’s important to do your research and find the one that best suits your needs.

What does “x04 OP transfer” mean?

The term “x04 OP transfer” mainly implies a peer-to-peer (p2p) transfer of assets, particularly in the context of cryptocurrencies. It is worth noting that such transfers are done directly between buyers and sellers, without the involvement of intermediaries such as banks.

In the world of cryptocurrency trading, a “x04 OP transfer” does not refer to a wire transfer or any other traditional method of transferring funds. Instead, it implies the buying and selling of digital assets directly between parties involved in the transaction.

When engaging in a “x04 OP transfer” on platforms like localbitcoins, hodlhodl, or bitquick, it is important to consider factors such as price, transaction fees, and the overall trading conditions. These may vary based on the platform you choose and the terms agreed upon between the buyer and seller.

If you are looking to build a flash loan arbitrage bot on Uniswap for profit, learning about “x04 OP transfers” and their alternatives can be beneficial. Flash loans, which focus on executing and repaying a loan within a single transaction, can provide opportunities for arbitrage and faster trading. However, they also come with risks, so it’s important to thoroughly understand the process and potential risks involved before engaging in such activities.

Please note that the information provided here is for educational purposes only and does not constitute financial advice. It is best to do your own research and consult with experts before engaging in any form of cryptocurrency trading or flash-loan activities.

What is Crypto Arbitrage: The Beginner’s Guide

Crypto arbitrage is a trading strategy that takes advantage of price differences in cryptocurrencies across different platforms or exchanges. It involves buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another, profiting from the price discrepancy.

The process of crypto arbitrage involves three main steps:

- Finding price differences: Arbitrage opportunities can be identified by monitoring the prices of different cryptocurrencies on various exchanges.

- Executing trades: To perform arbitrage, traders need to simultaneously buy the cryptocurrency at the lower price and sell it at the higher price, taking advantage of the price difference.

- Profiting from the trade: By executing the trades successfully, traders can make a profit equal to the difference between the buy and sell prices, minus any transaction or transfer fees.

There are several types of crypto arbitrage, including:

- Exchange arbitrage: Taking advantage of price discrepancies between different crypto exchanges.

- Triangular arbitrage: Exploiting price differences between three cryptocurrencies to make a profit.

- Statistical arbitrage: Using quantitative analysis to identify and profit from market inefficiencies.

Crypto arbitrage can be a profitable investment strategy, but it’s important to consider the risks involved. The success of arbitrage opportunities depends on factors such as transaction costs, market liquidity, and timing. Additionally, arbitrage opportunities may be short-lived as markets quickly adjust to eliminate price discrepancies.

It’s worth noting that crypto arbitrage can be automated using trading bots. These bots are programmed to scan multiple exchanges for price differences and execute trades automatically. However, using bots introduces additional risks, such as technical issues or errors in trading strategies.

In conclusion, crypto arbitrage is a strategy that allows traders to profit from price differences in cryptocurrencies across different platforms or exchanges. It offers opportunities for profit, but also carries risks that should be carefully considered before engaging in arbitrage trading.

Bitquick ; Ethereum Transaction Structure

Bitquick is a platform that allows users to buy and sell Bitcoin for cash. This article will provide an introduction to Bitquick, its trading strategies, and the Ethereum transaction structure used on the platform.

Introduction to Bitquick

Bitquick is a popular platform that facilitates cash-to-Bitcoin transactions. Users can buy Bitcoin by visiting a local bank branch and depositing cash into the seller’s account. This method of acquiring Bitcoin allows for quick transactions and is popular among users who prefer anonymity.

Trading Strategies on Bitquick

On Bitquick, users can choose from various trading strategies depending on their preferences and market conditions. Some popular strategies include market orders, limit orders, and stop orders. These strategies allow users to optimize their trades and maximize their profits.

Ethereum Transaction Structure on Bitquick

When trading on Bitquick, users need to be familiar with the Ethereum transaction structure. Transactions on Bitquick are based on the Ethereum blockchain and are executed using smart contracts. The transaction structure includes the sender’s address, the recipient’s address, the amount of Bitcoin being traded, and the transaction fee.

Users can choose between different methods of transferring funds on Bitquick. These methods may vary depending on the platform and can include bank wire transfers, credit/debit card payments, or even flash loans.

Withdrawal and Loan Services on Bitquick

Bitquick also offers withdrawal and lending services to its users. Users can withdraw their Bitcoin to an external wallet or exchange if they wish to hold it long-term or trade on other platforms. Additionally, Bitquick provides loan services where users can borrow funds without selling their Bitcoin. These loans are based on collateral and can be an ideal option for users who want to keep their Bitcoin position while accessing extra funds.

Conclusion

In conclusion, Bitquick provides a platform for trading Bitcoin using cash. Users can execute transactions based on various strategies and take advantage of withdrawal and loan services. Understanding the Ethereum transaction structure is essential for successful trading on the platform. However, it’s important to note that trading and using loan services involve risks that users need to accept and consider before engaging in such activities.

Flash Loan vs Flash Swap

Flash loan and flash swap are two popular concepts in the world of decentralized finance (DeFi). While they share similarities, there are also some key differences between the two.

Flash Loan

A flash loan is a type of loan that allows users to borrow a certain amount of cryptocurrency for a very short period of time, usually within a single transaction. One of the main advantages of flash loans is that no collateral is required, making it an attractive option for those who don’t have a good credit/debit score or access to traditional banking services.

Flash loans are particularly useful for arbitrage strategies, as they allow users to quickly borrow assets, trade them on platforms like Uniswap, and then pay back the loan all within a single transaction. This can result in significant profit if the arbitrage opportunity is executed successfully.

Flash Swap

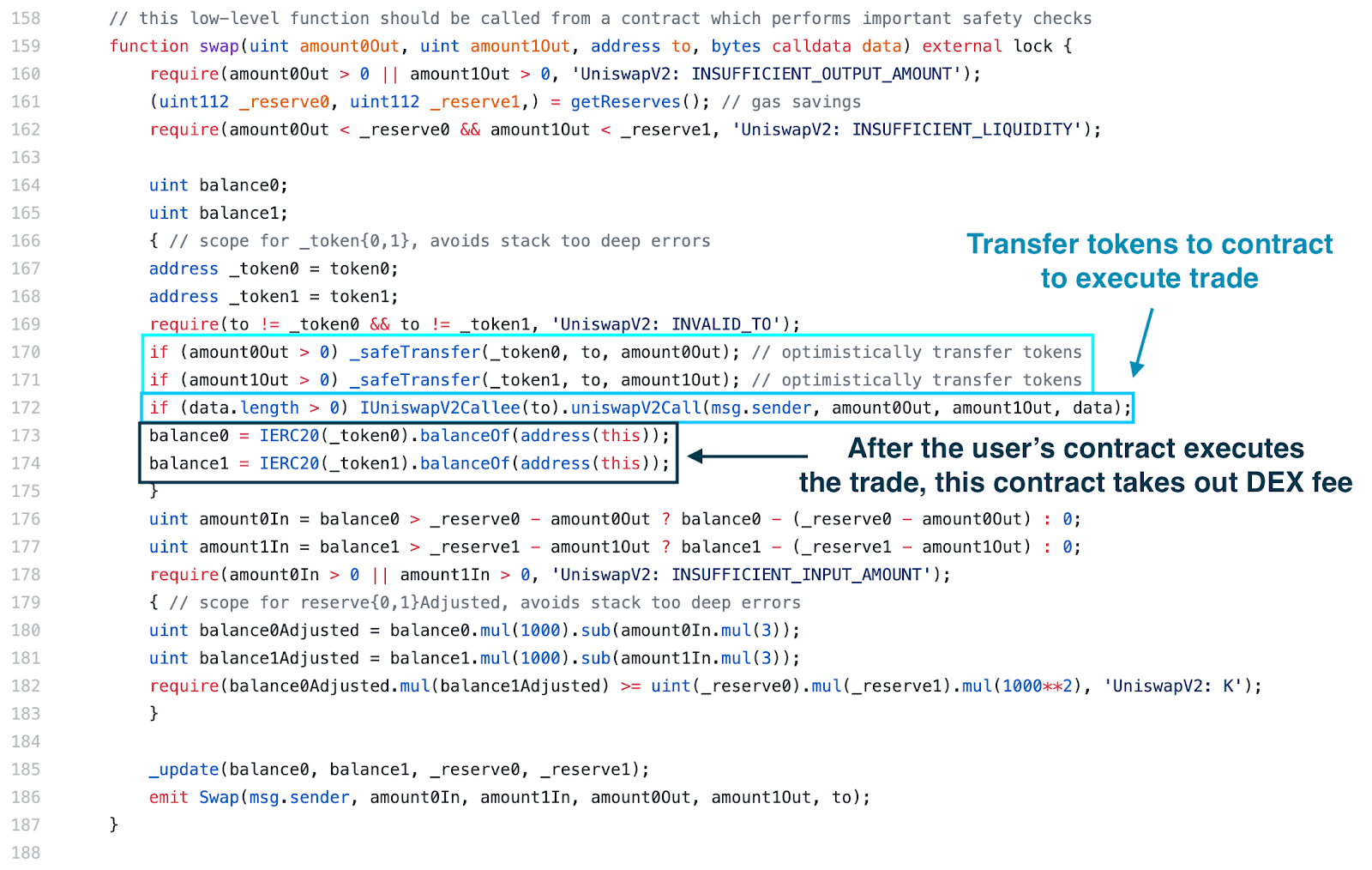

Flash swap, on the other hand, is a feature introduced by Uniswap that enables users to instantly borrow any available ERC-20 token from a pool and execute a swap in the same transaction. Unlike flash loans, flash swaps do not require the borrowing of funds. Instead, they enable users to swap tokens without having to actually own them. This can be useful for executing complex trading strategies or simply for obtaining a specific token.

The main advantage of flash swaps is that they are faster and more cost-effective compared to traditional token swaps on decentralized exchanges. They eliminate the need for multiple transactions, reducing gas fees and minimizing the time between borrowing and executing the swap.

Although flash loans and flash swaps are different in terms of their mechanisms and use cases, both have become quite popular in the DeFi world. Whether you prefer flash loans for arbitrage opportunities or flash swaps for instant token swaps, these tools have opened up new possibilities for users to maximize their profits and optimize their trading strategies on platforms like Uniswap.

BisQ

BisQ is a decentralized peer-to-peer cryptocurrency exchange that allows users to buy and sell cryptocurrencies directly with each other. It operates on a global scale and supports various cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more. BisQ positions itself as a privacy-focused platform, allowing users to trade without the need for personal information or identity verification.

LocalCoinSwap

LocalCoinSwap is another peer-to-peer cryptocurrency exchange that aims to provide a safe and secure trading environment for users. It supports a wide range of cryptocurrencies and fiat currencies, allowing traders from all over the world to participate. Unlike traditional exchanges, LocalCoinSwap does not hold user funds. Instead, it acts as an escrow service, which helps to prevent fraud and ensures a fair trading process.

Introduction to Flash Loan Arbitrage

Flash loan arbitrage is a trading strategy that takes advantage of price differences between different cryptocurrency exchanges. It involves borrowing a large amount of cryptocurrency using a flash loan contract and using that to exploit temporary price discrepancies. The idea is to buy low on one exchange and sell high on another exchange, making a profit in the process. Flash loan arbitrage has become popular in the cryptocurrency world because it allows traders to make significant profits with minimal capital investment.

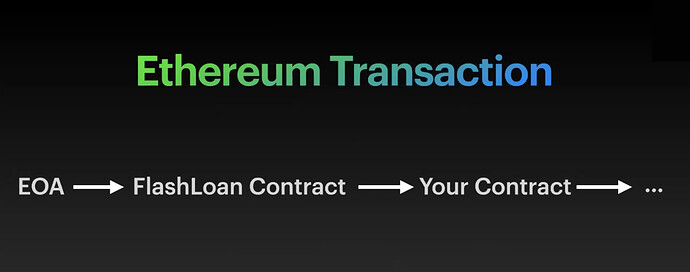

Flash loan arbitrage is made possible by smart contracts on platforms like Uniswap. These contracts enable users to borrow a large amount of cryptocurrency without the need for collateral. However, the loan must be repaid within the same transaction, or the transaction will fail. This makes flash loan arbitrage a high-risk strategy, as any losses incurred must be covered by the trader.

To participate in flash loan arbitrage, you will need to have a good understanding of how cryptocurrency exchanges operate and the ability to identify price discrepancies quickly. It is also important to have access to fast and reliable trading platforms to execute trades in real-time. While flash loan arbitrage can be lucrative, it is not without risks, and traders should be prepared to handle potential losses.

Build a Flash Loan Arbitrage bot on Uniswap

Flash loans have become an increasingly popular tool in the cryptocurrency industry, allowing users to borrow a large amount of funds for a short period of time without any collateral. In the context of Uniswap, a flash loan arbitrage bot can be created to take advantage of price differences between different liquidity pools.

The first step in building a flash loan arbitrage bot on Uniswap is to understand how the Uniswap protocol works. Uniswap is a decentralized exchange that allows users to trade cryptocurrencies directly from their wallets. Flash loans can be utilized to borrow funds from the Uniswap protocol and use them for arbitrage opportunities.

To build the bot, you will need to code a program that performs a series of actions. This includes calling the flash loan function in the Uniswap smart contracts, performing the desired arbitrage strategy, and repaying the loan with any profits made.

One popular arbitrage strategy involves taking advantage of price discrepancies between different liquidity pools. For example, if the price of a cryptocurrency is higher in one liquidity pool compared to another, you can buy the cryptocurrency from the lower-priced pool and sell it on the higher-priced pool, making a profit in the process.

The flash loan function in the Uniswap smart contracts allows you to borrow a large amount of funds for a single transaction. This means that you can use the borrowed funds to make trades and repay the loan, all within a single transaction. The funds are automatically transferred back to the flash loan provider at the end of the transaction.

Building a flash loan arbitrage bot on Uniswap can be a profitable opportunity for experienced traders. However, it is important to note that flash loans are a relatively new concept and come with their own risks. It is recommended to thoroughly understand the risks involved and test your bot with small amounts of funds before deploying it with larger amounts.

Why build a flash loan arbitrage bot on Uniswap?

There are several reasons why building a flash loan arbitrage bot on Uniswap can be an attractive opportunity. Firstly, flash loans allow you to access a large amount of funds without any collateral, providing you with significant trading power.

Secondly, Uniswap is one of the most popular decentralized exchanges in the cryptocurrency industry, with a high trading volume and liquidity. This means that there are often price discrepancies between different liquidity pools, creating arbitrage opportunities.

Lastly, building a flash loan arbitrage bot on Uniswap can be a way to automate and scale your trading strategies. By using a bot, you can execute trades more efficiently and take advantage of price discrepancies in real-time.

In conclusion, building a flash loan arbitrage bot on Uniswap can be a profitable venture for experienced traders. However, it is important to thoroughly understand the risks involved and test your bot with small amounts of funds before deploying it with larger amounts.

How does it work

Flash loan arbitrage bot on Uniswap is a trading bot that leverages flash loans to profit from price differences between different cryptocurrency tokens on the Uniswap exchange. Flash loans allow a trader to borrow a large sum of cryptocurrency without collateral, as long as the loan is repaid in the same transaction. This provides a unique opportunity for arbitrage trading.

The bot will first identify price differences between tokens on different exchanges. It will then execute a series of transactions to buy the token at a lower price on one exchange and sell it at a higher price on another exchange. By leveraging flash loans, the bot can instantly borrow the required funds and repay the loan once the arbitrage transaction is complete, ensuring a quick and profitable trade.

What’s unique about this bot is that it leverages flash loans to maximize profit in a short amount of time. Instead of using personal funds, the bot borrows the necessary funds to execute the arbitrage trade and then repays the loan in the same transaction. This allows the bot to make the most of price differences and take advantage of market inefficiencies.

In conclusion, the flash loan arbitrage bot on Uniswap allows traders to profit from price differences between tokens by executing quick and profitable trades. By leveraging flash loans, the bot can quickly borrow and repay funds, maximizing profit potential. However, it’s important to note that flash loans carry their own risks and should be approached with caution. Traders should also have a good understanding of the Uniswap platform and market dynamics before using the bot.

P2P TRADING LOCALBITCOINS

LocalBitcoins is a popular peer-to-peer trading platform that allows users to buy and sell Bitcoin directly with each other. Unlike traditional exchanges, LocalBitcoins does not hold user funds or act as a middleman. Instead, it provides a platform where traders can connect and negotiate the terms of their trades.

One advantage of using LocalBitcoins is that it offers more alternatives to traditional trading services. Users can choose from various payment methods, such as cash, bank transfers, or even gift cards. This flexibility allows traders to find the most convenient option for them.

When trading on LocalBitcoins, users can borrow and mine Bitcoin at a given interest rate to fund their trades. They must then repay the borrowed Bitcoin, along with any interest, once the trade is completed. This feature offers an extra layer of flexibility for traders who may not have sufficient funds to execute a trade.

LocalBitcoins also supports swap contracts, which enable traders to exchange their Bitcoin for another cryptocurrency. This allows for diversification of assets and can be useful for risk management purposes.

It’s important to note that using LocalBitcoins implies a higher level of responsibility and security measures compared to traditional exchanges. While LocalBitcoins provides an escrow service to protect traders, it’s still essential to exercise caution and only engage with trusted counterparties.

Another platform that works similar to LocalBitcoins is Paxful. Paxful also allows users to buy and sell Bitcoin directly with each other and provides a wide range of payment methods. Both LocalBitcoins and Paxful are popular choices for traders who are looking for a more decentralized and peer-to-peer trading experience.

In conclusion, LocalBitcoins and Paxful are excellent platforms for P2P trading and offer more flexibility compared to traditional exchanges. They allow users to avoid high fees and provide a wide range of trading services. However, it’s essential to understand the risks involved and take necessary security measures to protect your assets.

The x03 Flash-loan and contract

In the world of cryptocurrency trading, flash loans have become a popular method to quickly take advantage of price discrepancies and earn high profits. Flash loans are essentially loans that are taken and repaid within the same transaction, allowing users to borrow a large sum of cryptocurrency without the need for collateral.

Flash-loan contracts are smart contracts that facilitate the flash loan process. These contracts are mainly deployed on decentralized exchanges like Uniswap and enable traders to avoid the need for upfront capital by borrowing funds from liquidity pools.

The x03 flash loan and contract offer a unique opportunity for arbitrage trading on Uniswap. With this strategy, traders can take advantage of price differences between Uniswap and other exchanges to make a profit. The x03 flash loan contract handles the borrowing and repaying of funds, while the arbitrage bot executes trades to exploit the price discrepancies.

Using the x03 flash loan and contract, traders can easily transfer assets between different decentralized exchanges to take advantage of better prices. For example, a trader could borrow Ethereum from Uniswap, use it to purchase a token at a lower price on another exchange, and then repay the borrowed funds and pocket the difference once the transaction is complete.

This flash loan arbitrage strategy is highly profitable because it allows traders to take advantage of the high liquidity of Uniswap and the price differences between various exchanges. The x03 flash loan and contract make this process much easier, as it automates the loan and trade execution process, reducing the risk and effort involved.

What is crypto arbitrage about?

Crypto arbitrage is a trading strategy that involves taking advantage of price differences for digital assets across different exchanges. It involves borrowing funds to make trades and profiting from the price discrepancies. Traders can wire funds to exchanges and build algorithms to identify these opportunities and execute trades automatically.

When it comes to arbitrage opportunities, the differences in prices can vary depending on the liquidity and demand of a particular coin or token. Traders can transfer funds quickly between exchanges, taking advantage of the fast transaction times of cryptocurrencies. This allows them to capitalize on these price discrepancies before the market corrects itself.

One of the popular strategies is using flash loans and decentralized exchanges like Uniswap. Flash loans allow traders to borrow a large sum of money for a single transaction. They can then use this borrowed capital to exploit price differences in the market. Uniswap, a decentralized exchange running on Ethereum, enables users to trade ERC-20 tokens directly from their digital wallets without the need for intermediaries.

Arbitrage opportunities arise when the price of a token on one exchange is higher compared to another. Traders can deploy their arbitrage bots to buy tokens at a lower price on one exchange and sell them at a higher price on another. This process can be repeated multiple times to generate profits.

However, there are risks involved in crypto arbitrage. Market conditions can change rapidly, and the profitability of arbitrage opportunities can diminish over time. Additionally, fees and slippage can eat into profits and reduce the effectiveness of the strategy. Traders need to carefully analyze market conditions and execute trades swiftly to maximize their chances of success.

HodlHodl: Three Types of Transaction

HodlHodl is a decentralized peer-to-peer cryptocurrency exchange that supports three types of transactions. These transactions provide users with different opportunities for investing and trading in the digital asset industry.

The first type of transaction is a regular transfer, where users can transfer their digital assets directly to each other’s wallet addresses. This type of transaction is suitable for users who want to send or receive a fixed amount of coins without any additional conditions or requirements.

The second type of transaction is a collateral-based transaction, which is commonly used in lending platforms. In this type of transaction, users can lend their digital assets and receive collateral in return. The collateral acts as security for the loan and is released once the loan amount is repaid.

The third type of transaction is an escrow-based transaction, where users can trade their digital assets with each other with the help of a smart contract. The smart contract ensures that both parties fulfill their obligations, and the transfer of assets only occurs when all conditions are met. This type of transaction provides a safer and more secure way of trading, especially for larger transactions.

Overall, HodlHodl provides a variety of transaction types that cater to different needs in the crypto industry. Whether you’re looking for a simple transfer, a collateral-based loan, or a secure escrow-based trade, HodlHodl has options for all types of users.

Cryptocurrency lending arbitrage

Cryptocurrency lending arbitrage refers to the practice of taking advantage of price differences between different lending platforms in order to make a profit. Cryptocurrency lending involves providing loans in cryptocurrency, with the borrower using their cryptocurrency holdings as collateral.

Arbitrage opportunities arise when the interest rates offered by different lending platforms vary, allowing borrowers to obtain a loan at a lower interest rate and then lend it out at a higher interest rate on another platform. By buying low and selling high, cryptocurrency lending arbitrage allows investors to profit from the price differences between different lending platforms.

One of the types of arbitrage in this context is flash loans, which allow users to borrow large amounts of cryptocurrency without any collateral, as long as the loan is repaid in the same transaction. The sender of the flash loan can execute complex arbitrage strategies within a single transaction, taking advantage of price discrepancies between different exchanges or platforms.

Flash loans have become popular due to the security and efficiency they offer. They are typically based on smart contracts, with the most popular one being the 0x protocol’s flash loan implementation, which supports a variety of cryptocurrencies.

The best way to get started with cryptocurrency lending arbitrage is to familiarize yourself with various lending platforms and their interest rates. Some popular lending platforms include Aave, Compound, and MakerDAO. Depending on the structure of your arbitrage strategy, you may focus on earning extra interest or making profits from the price differences between platforms.

When doing cryptocurrency lending arbitrage, it is important to consider the risks involved. Flash loans, for example, can be risky as they require a deep understanding of smart contracts and the ability to execute complex transactions within a single block. Additionally, the market for cryptocurrency lending is highly volatile and subject to sudden price swings.

In conclusion, cryptocurrency lending arbitrage can be a profitable strategy for those who are willing to put in the time and effort to understand the market and execute trades effectively. By taking advantage of the price differences and interest rates between different lending platforms, investors can potentially earn significant profits. However, it is important to be aware of the risks involved and to carefully consider your strategy before getting started.

Frequently Asked Questions:

How can I build a Flash Loan Arbitrage Bot on Uniswap?

You can build a Flash Loan Arbitrage Bot on Uniswap by following a step-by-step tutorial that provides guidance on coding and deploying the bot. The tutorial will cover the necessary smart contract development, integration with Uniswap, and implementation of arbitrage strategies to make profits through flash loans.

What is the difference between Flash Loan and Flash Swap?

The main difference between Flash Loan and Flash Swap is the type of transaction involved. Flash Loans allow users to borrow a specific amount of assets without collateral as long as they are returned within the same transaction. On the other hand, Flash Swaps enable users to swap tokens without requiring upfront deposits, as long as the borrowed tokens are returned within the same transaction.

What is crypto arbitrage?

Crypto arbitrage is a trading strategy that involves exploiting price differences of cryptocurrencies across different exchanges. Traders take advantage of these price discrepancies by buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another, making a profit from the difference.

What are some alternatives to LocalBitcoins for peer-to-peer crypto trading?

Some alternatives to LocalBitcoins for peer-to-peer crypto trading include BisQ, Paxful, and Bitquick. These platforms provide similar features and allow users to trade cryptocurrencies directly with each other, without the need for intermediaries or centralized exchanges.

Why is crypto lending arbitrage popular?

Crypto lending arbitrage is popular because it offers an opportunity for traders to earn profits by borrowing cryptocurrencies at a low interest rate and lending them at a higher interest rate. This strategy takes advantage of the interest rate differentials between lending platforms and can be highly lucrative in the crypto market.

What is the risk arbitrage in lending?

The risk arbitrage in lending refers to the potential risks associated with borrowing and lending cryptocurrencies. These risks include the default risk of borrowers not repaying the loan, the volatility risk of the borrowed assets’ prices changing significantly, and the counterparty risk of the lending platform facing financial difficulties. Traders engaging in lending arbitrage need to carefully assess and manage these risks.

Video:

كيف استعمل الفلاش لون لتكوين ثروة ⚡️

Secret Formula for PASSIVE INCOME with Flash Loans

This article provides valuable insights into the world of Flash Loan Arbitrage on Uniswap. As a cryptocurrency enthusiast, I find arbitrage strategies intriguing and potentially profitable. The concept of borrowing a large amount of cryptocurrency for a short period of time and executing profitable trades sounds like a game-changer. I’m excited to explore building my own Flash Loan Arbitrage Bot and uncover price discrepancies in the market. Thanks for the informative read!

Is Flash Loan Arbitrage safe and legal? Can I use it without any risks?

Flash Loan Arbitrage can be a profitable strategy in the cryptocurrency industry. However, it’s important to note that it comes with its risks. While it is technically legal, there are potential risks involved that you should consider. This includes the possibility of price slippage, smart contract vulnerabilities, and potential market manipulation. It is crucial to thoroughly research and understand the risks before engaging in Flash Loan Arbitrage. As with any investment strategy, it is recommended to consult with a financial advisor and proceed with caution.