Decentralized Finance, or DeFi, is a rapidly growing sector in the cryptocurrency industry. It offers users the ability to take control of their financial transactions and investments without relying on traditional financial institutions. However, with so many platforms and exchanges available, it can be overwhelming to know where to buy DeFi crypto.

If you’re looking to buy DeFi coins or tokens, there are several platforms and exchanges that you should consider. One popular option is PancakeSwap, which is built on the Binance Smart Chain and allows users to trade, invest, and provide liquidity for various DeFi projects. Another top choice is Solana, a high-throughput, low-latency blockchain network that has gained popularity for its fast transactions and low fees.

When choosing a platform or exchange, it’s important to consider factors such as fees, security, and user interface. Some platforms may charge higher fees than others, so it’s essential to compare prices and choose the one that suits your needs. Additionally, you should ensure that the platform you choose has a secure and user-friendly interface, making it easier for you to navigate and invest in DeFi coins.

In terms of fees and transfer times, DeFi platforms generally offer lower costs and faster transactions compared to traditional banking methods. This means that you can transfer funds and invest in DeFi coins within minutes, rather than waiting for hours or days for the transaction to be processed. Furthermore, DeFi platforms typically enable users to have complete control over their assets, as they are non-custodial. This means that you have full ownership and access to your coins, without the need to rely on a third party.

In conclusion, if you’re looking to buy DeFi crypto, there are several platforms and exchanges that you can choose from. It’s important to do your research and compare the features and offerings of different platforms before making a decision. With the right platform, you can take control of your financial future and invest in the rapidly growing world of DeFi.

Why Was DeFi Developed

The development of DeFi, or decentralized finance, was driven by several key factors in the cryptocurrency world. One of the main reasons for its development was the need for more control and autonomy over financial transactions. Traditional banking systems often involve intermediaries and third parties that can take time and charge fees to process transactions. DeFi aims to bypass these intermediaries and provide users with a more direct and efficient way to transfer funds.

Another reason for the development of DeFi was to address the limitations of traditional financial systems when it comes to accessing financial services. Many individuals, especially in developing countries, do not have access to traditional banking services. DeFi allows anyone with a smartphone and internet connection to participate in financial activities, such as lending and borrowing, without the need for a bank account or credit history.

Furthermore, DeFi was developed to provide users with more control over their own assets. In traditional financial systems, individuals often have to trust banks or other intermediaries to hold and manage their funds. With DeFi, users can hold their own private keys and have full control over their cryptocurrency assets. This means that they can make transactions, invest, and manage their funds as they wish, without relying on a centralized authority.

The development of DeFi also aims to make financial transactions more efficient and less costly. In traditional financial systems, transactions can take days to process, especially for international transfers, and fees can be high. DeFi platforms, on the other hand, leverage the speed and efficiency of blockchain technology to enable near-instantaneous transaction settlements and significantly lower fees. This makes it more accessible for individuals to send and receive funds, regardless of their geographical location.

In conclusion, DeFi was developed to provide individuals with more control, autonomy, and access to financial services. By leveraging blockchain technology, DeFi platforms aim to revolutionize the way financial transactions are conducted, making them faster, cheaper, and more inclusive. Whether you’re looking to buy, sell, lend, or invest in cryptocurrencies, exploring the world of DeFi can offer exciting opportunities and possibilities.

Cryptocurrency Price Movements

Understanding the price movements of cryptocurrencies, including decentralized finance (DeFi) tokens, is essential for any investor or trader in the crypto space. Price movements can be influenced by a variety of factors, such as market demand, news events, technological advancements, and overall market sentiment.

When it comes to DeFi tokens, these are coins that are typically developed on decentralized networks, such as Ethereum or Solana, and are designed to work within non-custodial financial platforms. This means that users have more control over their funds and can interact with these platforms without the need for a traditional, centralized intermediary.

Price movements in the DeFi space can be volatile, with rapid changes occurring in short periods of time. This can be seen in the quickfire price fluctuations experienced by tokens like DEFC and through various decentralized exchanges, such as PancakeSwap. Investors and traders should be prepared for these rapid price movements and have a solid understanding of how the DeFi ecosystem works.

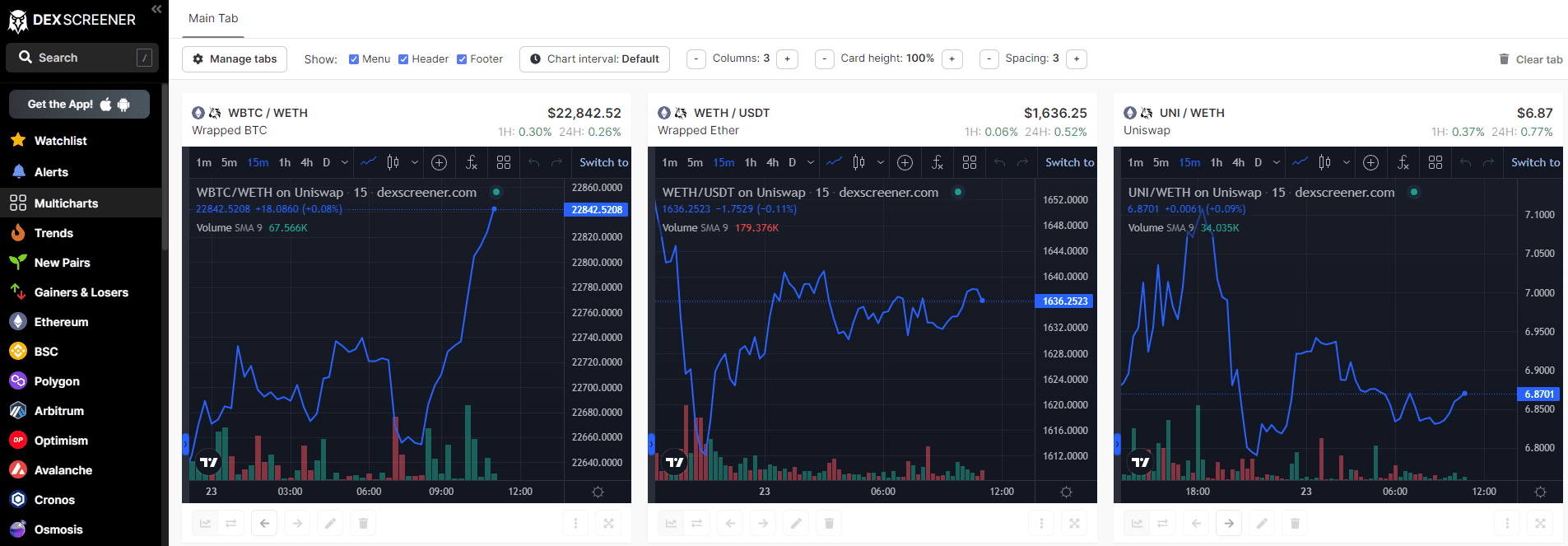

One way to track and analyze price movements is through cryptocurrency price charts. These charts provide visual representations of historical price data, allowing users to identify trends, patterns, and potential support or resistance levels. There are several popular charting platforms available, such as TradingView, CoinGecko, and CoinMarketCap, where users can view and analyze cryptocurrency price movements.

In addition to price charts, investors can also stay informed about the latest price movements by following reputable news sources and market analysis websites. These sources provide insights into market trends, news events, and other factors that may impact cryptocurrency prices.

To actually buy or sell cryptocurrencies, investors can use various platforms and exchanges. Some popular options include centralized exchanges like Binance, Coinbase, and Kraken, as well as decentralized exchanges like Uniswap and SushiSwap. Each platform has its own unique features, fees, and user experience, so investors should do their research before choosing a platform to use.

In summary, understanding cryptocurrency price movements is essential for any investor or trader in the crypto space, especially when it comes to DeFi tokens. By staying informed, using price charts, and utilizing reliable sources of information, investors can make more informed decisions and navigate the volatile world of cryptocurrency trading.

How to Buy DeFi Coin – Quickfire Walkthrough to Buy DEFC Tokens in Less Than 10 Minutes

If you want to buy DEFC tokens, you can do so in just a few steps. In this quickfire walkthrough, we will guide you through the process of buying DEFC tokens in less than 10 minutes.

Step 1: Choose a cryptocurrency exchange or platform

Before you can buy DEFC tokens, you need to find a cryptocurrency exchange or platform that supports DEFC. Some popular options include PancakeSwap, Solana, and Bitcoin.com.

Step 2: Create an account and verify your identity

Once you have chosen a platform, you will need to create an account and verify your identity. This is usually a straightforward process that involves providing some personal information and uploading documentation such as a passport or driver’s license.

Step 3: Transfer funds to your account

After your account is verified, you will need to transfer funds to your account. This can be done by clicking on the “Deposit” or “Funds” section of the platform and following the instructions for transferring your chosen cryptocurrency to your account.

Step 4: Find the DEFC token

Once your funds have been transferred and confirmed, you will need to find the DEFC token on the platform. This can usually be done by searching for “DEFC” or by navigating to the token’s page directly.

Step 5: Buy DEFC tokens

Now that you have found the DEFC token, you can proceed to buy it. To do this, enter the amount of DEFC tokens you wish to purchase and click on the “Buy” or “Trade” button.

Step 6: Review and confirm your purchase

Before finalizing your purchase, take a moment to review the details of your transaction. Make sure you are comfortable with the price and quantity of DEFC tokens you are buying. Once you are satisfied, click on the “Confirm” or “Buy” button to complete your purchase.

Step 7: Store your DEFC tokens

After your purchase is complete, it is important to store your DEFC tokens in a safe and secure wallet. Many platforms offer non-custodial wallets where you can store your tokens. Alternatively, you can download a traditional cryptocurrency wallet that supports DEFC tokens.

That’s it! In just a few simple steps, you can buy DEFC tokens and become part of the growing decentralized finance (DeFi) network. Now you can take control of your investments and participate in the exciting world of DeFi.

How Does DeFi Work

Decentralized Finance (DeFi) is a term used to describe financial applications and platforms that are built on blockchain networks like Ethereum, Solana, and others. Unlike traditional financial systems that rely on intermediaries like banks or brokers, DeFi operates on a peer-to-peer basis, allowing users to interact directly with each other without the need for intermediaries.

One popular DeFi platform is PancakeSwap, which is built on the Binance Smart Chain (BSC). It allows users to trade and exchange cryptocurrencies directly from their wallets. The platform utilizes automated market makers (AMMs) and liquidity pools to facilitate these transactions, offering users the ability to earn fees by providing liquidity to these pools.

So how does DeFi work? Let’s take a quickfire walkthrough:

- First, you need to download a cryptocurrency wallet that supports DeFi tokens.

- Transfer funds from your traditional bank account to your wallet.

- Find a reputable decentralized exchange (DEX) like PancakeSwap.

- Connect your wallet to the DEX by clicking the appropriate button.

- In the DEX, you can trade, buy, or sell various DeFi tokens.

- You can also participate in decentralized lending and borrowing platforms to earn interest or borrow funds.

- Keep in mind that DeFi platforms are non-custodial, meaning you have full control of your funds.

- Be aware of the fees associated with DeFi transactions. These fees can vary depending on network congestion and transaction complexity.

Why should you consider using DeFi? Well, DeFi platforms offer several advantages over traditional financial systems. Firstly, transactions on DeFi platforms are typically faster than traditional banking systems, with some transactions settling in a matter of minutes. Additionally, the decentralized nature of these platforms means that there is no single point of failure or control, making them more resilient and less susceptible to censorship or hacking attempts.

In conclusion, DeFi is revolutionizing the financial industry by providing individuals with greater financial freedom and control. By utilizing decentralized networks and protocols, users can access a wide range of financial services and products without relying on intermediaries. However, it is important to do thorough research and understand the risks involved before diving into the world of DeFi.

DeFi Coins and Tokens: What Every Investor Should Know

DeFi, short for decentralized finance, is a rapidly growing sector in the cryptocurrency industry that offers a range of financial services without the need for traditional intermediaries. In the world of DeFi, users have more control over their funds and can participate in various financial activities such as lending, borrowing, and trading.

One of the key characteristics of DeFi coins and tokens is their decentralized nature. Unlike traditional financial systems that rely on centralized authorities, DeFi platforms are built on blockchain networks, which means that transactions and movements of funds occur directly between users, without the need for intermediaries.

How do DeFi coins and tokens work? When you buy DeFi coins or tokens, you gain access to the underlying decentralized finance platform. These coins or tokens can be used to pay fees, participate in governance, or simply hold as an investment. For example, if you have a certain amount of the Ethereum-based DeFi coin, you can use it to lend or borrow funds on the Ethereum network.

When it comes to buying DeFi coins and tokens, there are several options available. You can use a centralized exchange, where you’ll need to create an account, deposit funds, and then trade for the desired DeFi coin or token. Alternatively, you can use a non-custodial wallet, such as MetaMask, which allows you to directly interact with the DeFi platform without going through a centralized exchange.

Before you buy DeFi coins and tokens, it’s important to do your research and understand the risks involved. DeFi projects are still relatively new and can be highly volatile, with prices sometimes experiencing drastic movements. Make sure to read whitepapers, check the team behind the project, and stay updated with the latest news from reliable sources.

In conclusion, DeFi coins and tokens provide investors with an opportunity to take control of their financial assets and participate in a decentralized financial network. By understanding how these coins and tokens work and conducting thorough research, you can make informed investment decisions in the exciting world of decentralized finance.

Top DeFi Platforms and Exchanges for Buying Crypto

Decentralized Finance (DeFi) has revolutionized the financial industry by bringing transparency, security, and efficiency to the world of cryptocurrency. If you wish to invest in DeFi coins, there are several platforms and exchanges where you can buy them. In this article, we will walk you through some of the top DeFi platforms and exchanges where you can buy your favorite crypto tokens.

PancakeSwap

PancakeSwap is a decentralized exchange (DEX) developed on the Binance Smart Chain (BSC). It allows users to trade, invest, and swap various DeFi tokens with ease. By using PancakeSwap, you can avoid the high transaction fees and slow transaction speed associated with traditional exchanges like Bitcoin. The platform is user-friendly and offers a quickfire option for transferring funds, which means you can buy your favorite coins in just a matter of minutes.

Solana

Solana is another decentralized exchange that offers a wide range of DeFi coins. It is known for its fast transaction speeds and low fees, making it an attractive choice for investors. Solana’s network handles hundreds of thousands of transactions per second, ensuring quick order executions. If you want to buy DeFi coins on Solana, all you need to do is connect your wallet, choose the token you wish to purchase, and click on the “Buy” button.

Quickfire

![]()

Quickfire is a popular DeFi platform that allows investors to buy and sell a variety of cryptocurrencies. It provides a user-friendly interface where you can easily navigate through different tokens and execute trades. Quickfire is a non-custodial platform, meaning you have full control over your funds. With Quickfire, you can take advantage of the price movements in the DeFi market and make quick trades to maximize your profits.

Why Choose DeFi Platforms and Exchanges?

There are several reasons why investors choose DeFi platforms and exchanges for buying crypto. Firstly, DeFi platforms offer a decentralized and transparent environment, ensuring that your funds are secure. Secondly, they usually have lower fees compared to traditional exchanges, allowing you to save more money. Lastly, DeFi platforms give you access to a wide range of DeFi coins, allowing you to diversify your portfolio and explore new investment opportunities.

If you are looking to buy DeFi coins, it’s important to choose a reliable platform or exchange that meets your needs. Take your time to research and compare different options to find the one that suits you best. Whether you choose PancakeSwap, Solana, Quickfire, or any other DeFi platform, make sure to follow the proper walkthrough and understand how they work before investing your hard-earned funds.

Understanding the Purpose and Development of DeFi

DeFi, short for decentralized finance, is a rapidly developing sector within the cryptocurrency industry. Unlike traditional finance, which is centralized and controlled by intermediaries, DeFi aims to create a financial system that is open, transparent, and accessible to everyone.

DeFi protocols are built on blockchain networks, such as Ethereum, Solana, and Binance Smart Chain, and allow users to perform various financial activities without relying on intermediaries. These activities include lending and borrowing funds, trading coins, earning interest, providing liquidity, and more.

One of the main benefits of DeFi is that it eliminates the need for traditional financial institutions, such as banks, and gives individuals full control over their assets. By using smart contracts and decentralized applications (dApps), users can directly interact with the DeFi network, without needing an intermediary to facilitate transactions.

Investors and users in the DeFi space can take advantage of the unique features it offers. For example, they can earn higher interest rates on their crypto assets by participating in decentralized lending platforms like Aave or Compound. The fees associated with using DeFi protocols are often significantly less compared to traditional financial services.

To get started with DeFi, users need to have some cryptocurrency that they can transfer to a non-custodial wallet. There are various non-custodial wallets available, such as MetaMask or Trust Wallet, that allow users to securely store their tokens and interact with DeFi protocols.

If you’re new to DeFi, it’s important to understand how these protocols work and do your own research before getting involved. There are many resources available, such as tutorials, walkthroughs, and expert opinions, that can help you navigate through the DeFi landscape and make informed investment decisions.

Overall, DeFi has gained significant attention and popularity due to its potential to revolutionize the financial industry. It offers individuals the opportunity to participate in a global, decentralized network that is open to anyone, regardless of their location or financial background. The development of DeFi is still ongoing, with new projects and innovations constantly being introduced to the market. Whether you’re an experienced investor or just starting out, understanding the purpose and development of DeFi can empower you to make the most of this exciting new financial paradigm.

Analyzing Cryptocurrency Price Movements in the Market

Understanding and analyzing cryptocurrency price movements in the market is crucial for any investor or trader. The volatility of the cryptocurrency market provides both opportunities and risks, making it necessary to stay informed and make informed decisions.

One important aspect to consider when analyzing cryptocurrency price movements is the need for reliable and up-to-date information. There are various sources available, such as financial news websites, social media platforms, and dedicated cryptocurrency news outlets. It’s important to use trusted sources that provide accurate and timely information.

Another factor to consider is how different cryptocurrencies perform in comparison to others. For example, Solana (SOL) has gained popularity due to its fast and low-cost transactions. Understanding the characteristics and market trends of each coin can help investors make better decisions.

One way to analyze price movements is through technical analysis. This involves analyzing historical price data and using different indicators and patterns to predict future price movements. Technical analysis tools such as charts, moving averages, and Fibonacci retracement levels can provide valuable insights.

In addition to technical analysis, fundamental analysis is also important. This involves analyzing the underlying factors that affect a cryptocurrency’s value, such as its technology, team, partnerships, and market adoption. Understanding these fundamentals can help investors identify potentially undervalued coins.

When analyzing price movements, it’s important to consider the impact of decentralized finance (DeFi) on the market. DeFi platforms have gained popularity in recent years, providing non-custodial lending and borrowing services. This means that investors can earn interest on their crypto holdings or borrow funds without relying on traditional financial intermediaries.

Furthermore, the rise of decentralized exchanges (DEXs) such as PancakeSwap has made it easier to buy and trade cryptocurrencies. These platforms allow users to directly swap tokens without the need for a centralized intermediary. Understanding how DEXs work and the fees involved can help investors navigate these platforms successfully.

In conclusion, analyzing cryptocurrency price movements requires a combination of technical and fundamental analysis. It’s important to stay informed with up-to-date and reliable information, understand the characteristics of different coins, and consider the impact of DeFi on the market. By doing so, investors can make more informed decisions and potentially capitalize on the opportunities presented by the volatile cryptocurrency market.

A Step-by-Step Guide on Buying DEFC Tokens in Less Than 10 Minutes

If you’re an investor looking to explore the world of decentralized finance (DeFi), you might be interested in buying DEFC tokens. DEFC is a cryptocurrency developed for lending, borrowing, and other financial movements on the DeFi network. In this walkthrough, we’ll show you how to buy DEFC tokens in less than 10 minutes.

Step 1: Set up your wallet

The first step is to set up a non-custodial wallet that supports DEFC, such as Solana. This will give you full control over your funds and means your investments remain decentralized. If you already have a wallet, make sure it supports Solana and DEFC.

Step 2: Transfer funds to your wallet

Once your wallet is set up, transfer the desired amount of cryptocurrency, such as Bitcoin, to your Solana wallet. This will serve as the initial capital for buying DEFC tokens. Make sure to account for any fees that may be incurred during the transfer.

Step 3: Connect your wallet to PancakeSwap

Next, go to PancakeSwap, a decentralized exchange running on the Binance Smart Chain. Connect your wallet to PancakeSwap, allowing it to access your funds for trading. Follow the instructions provided by PancakeSwap to connect your wallet.

Step 4: Buy DEFC tokens

On PancakeSwap, select the DEFC token from the dropdown menu. Set the amount of cryptocurrency you wish to exchange for DEFC tokens. Check the current price of DEFC and make sure you’re satisfied with the exchange rate. Click “Swap” to initiate the transaction.

Step 5: Confirm and wait

Confirm the transaction on your wallet and wait for the transaction to be processed. The time it takes for the transaction to complete may vary depending on the network activity and congestion. Once the transaction is confirmed, you will have successfully purchased DEFC tokens.

Step 6: Manage your DEFC tokens

Congratulations! You now own DEFC tokens. You can view and manage your DEFC tokens through your wallet. Monitor the price movements of DEFC and consider participating in the DeFi network using your newly acquired tokens. Remember to do your own research and exercise caution when investing in cryptocurrencies.

Now that you know how to buy DEFC tokens in less than 10 minutes, you can explore the exciting world of decentralized finance and take advantage of the opportunities it offers.

Exploring the Mechanics of DeFi and Its Decentralized Nature

Decentralized Finance, or DeFi, is a rapidly growing sector in the cryptocurrency industry that allows investors to bypass traditional financial intermediaries. In this walkthrough, we will explore the mechanics of DeFi and its decentralized nature.

What is DeFi?

DeFi refers to a set of financial applications and protocols built on blockchain networks, such as Ethereum or Solana. These applications aim to recreate traditional financial systems and services, such as lending, borrowing, trading, and investing, in a decentralized manner.

How does DeFi work?

DeFi protocols operate through smart contracts, which are self-executing contracts with the terms of the agreement directly written into the code. This means that transactions on DeFi platforms are automated and do not require intermediaries.

By leveraging blockchain technology, DeFi platforms provide transparent and secure financial services to users worldwide. Users can interact directly with these platforms, giving them more control over their funds and reducing the need for intermediaries.

Why should investors consider DeFi?

Investors interested in decentralized finance can benefit from lower fees, faster transaction times, and access to a wider range of financial products and services. By eliminating third-party intermediaries, DeFi platforms offer users more control over their investments and reduce the risk of censorship or manipulation.

Additionally, DeFi has the potential to provide financial services to the unbanked and underbanked populations worldwide, empowering individuals who may not have had access to traditional financial systems.

How to get started with DeFi?

To get started with DeFi, you will need a cryptocurrency wallet that supports the tokens you wish to invest in. Wallets like MetaMask or Trust Wallet are popular choices for interacting with DeFi protocols.

Once you have set up your wallet, you can explore various DeFi platforms and protocols, such as PancakeSwap or Aave. These platforms allow users to trade, lend, borrow, and earn interest on their cryptocurrencies.

Before investing in DeFi, it is important to do your own research and understand the risks involved. DeFi markets can be volatile, and it is crucial to assess the security measures and reputation of the platforms you choose to interact with.

In conclusion

DeFi has emerged as a disruptive force in the financial industry, providing users with greater financial autonomy and access to a wide range of services. Its decentralized nature, coupled with blockchain technology, offers a transparent and secure financial ecosystem for investors around the world.

As the DeFi space continues to evolve, it is essential for investors to stay informed and cautious while navigating this rapidly growing sector.

Frequently Asked Questions:

What is DeFi and how does it work?

DeFi stands for Decentralized Finance, and it refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems without the need for intermediaries like banks or financial institutions. It works by utilizing smart contracts on the blockchain to automate financial transactions, such as lending, borrowing, trading, and investing.

Where can I buy DeFi crypto?

There are several platforms and exchanges where you can buy DeFi crypto. Some popular options include Binance, Coinbase, Uniswap, and Sushiswap. It is important to do your own research and ensure that the platform you choose is reputable and trustworthy.

Why was DeFi developed?

DeFi was developed as a way to provide a more inclusive and accessible financial system. Traditional finance often excludes individuals who do not have access to traditional banking services or who live in regions with unstable economies. DeFi aims to bridge this gap by enabling anyone with an internet connection to access and participate in financial services.

Video:

How I Made $245,875 With Crypto: Enter The Top 1%

I Uncovered What Crypto Billionaires Are Buying (Find 1000x Altcoins)

These 3 DEFI PROJECTS Earn Me $540 / MONTH!!! (The BEST Defi Passive Income Projects RIGHT NOW!!)

I believe that DeFi is the future of finance. The ability to take control of my investments without relying on traditional financial institutions is empowering. I’ve had a great experience using PancakeSwap to trade and invest in various DeFi projects. The low fees and fast transactions on the Solana blockchain also make it a top choice for me. Overall, I highly recommend exploring the world of DeFi crypto.

I have been using PancakeSwap to buy DeFi crypto and I love it! The platform is user-friendly and the fees are reasonable. It’s a great option for anyone looking to get into DeFi. Highly recommend!

As a cryptocurrency enthusiast, I have been exploring the world of DeFi and I must say it’s amazing how it allows for decentralized financial transactions. I recently bought some DeFi tokens on PancakeSwap and the experience was smooth. The platform has a user-friendly interface and the fees were reasonable. Highly recommended!

I’ve been using PancakeSwap to buy DeFi crypto and it’s been a great experience. The user interface is very intuitive and the fees are reasonable. Highly recommend!

Where can I find more information about the price movements of DeFi crypto?

It’s great to see the growth of DeFi in the cryptocurrency industry. I have been using PancakeSwap for a while now and it offers a wide range of DeFi projects to trade and invest in. The low fees and fast transactions on Solana also make it a top choice. However, it’s important to compare fees and choose a platform with a user-friendly interface.