Peer-to-peer lending, also known as P2P lending, has gained significant popularity in the world of decentralized finance. With traditional lending methods becoming outdated and cumbersome, P2P lending offers a client-centric approach that eliminates the overhead and intermediaries typically involved in the lending process.

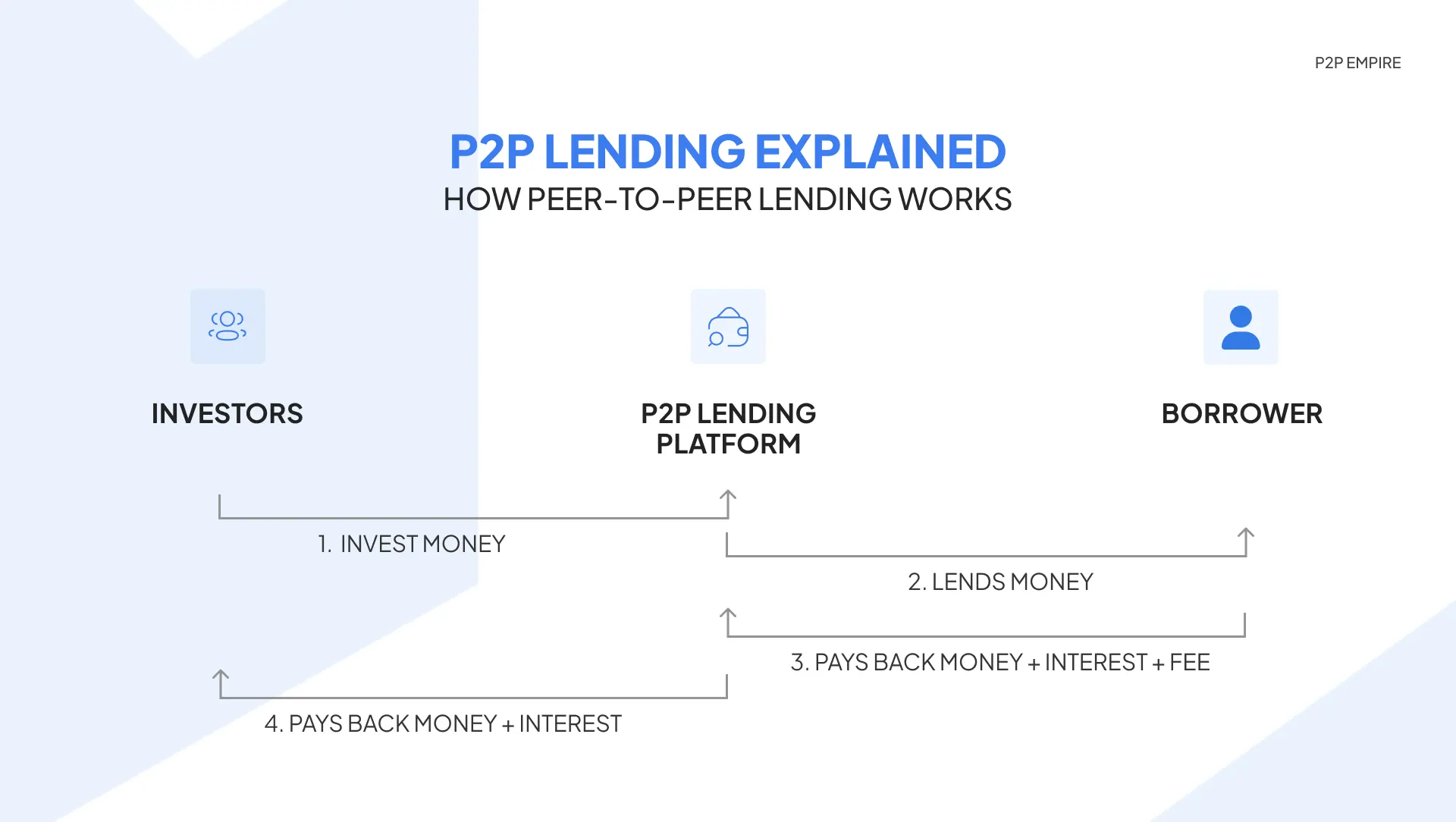

Unlike traditional lending institutions, peer-to-peer lending platforms connect borrowers directly with lenders, leveraging technology to facilitate secure and efficient transactions. This decentralized approach allows for more customizable terms and conditions, making P2P lending a more attractive option for borrowers seeking flexibility.

One key feature of P2P lending is the use of stablecoins as a medium of exchange. By using a stablecoin, such as a cryptocurrency pegged to a fiat currency like the US dollar, borrowers and lenders can transact without the volatility associated with other cryptocurrencies. This ensures that loan disbursement and repayments remain stable and reliable, even in a highly volatile market.

Another notable aspect of P2P lending is the use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts serve as an autonomous and secure way to design and enforce loan agreements, eliminating the need for a custodial or third-party intermediary.

Overall, peer-to-peer lending offers a more efficient and cost-effective way for individuals and businesses to access loans or invest their funds. By removing the barriers and inefficiencies of traditional lending, P2P lending platforms provide a seamless and secure environment for borrowing and lending, enabling access to capital and financial services to a wider global audience.

What is crypto P2P lending

Crypto peer-to-peer (P2P) lending is a trustless and decentralized alternative to traditional lending systems that enables individuals to lend and borrow funds directly from one another using cryptocurrencies. Unlike centralized lending platforms that act as intermediaries, crypto P2P lending eliminates the need for a third-party authority, thereby reducing costs and making the process more efficient.

Lenders and borrowers can interact directly on crypto P2P lending platforms. Lenders can earn returns on their investments by providing funds to borrowers, and borrowers can access capital without going through traditional creditworthiness checks. The transparency of blockchain technology ensures that every transaction and agreement is recorded and updated, providing a secure environment for both parties.

When it comes to crypto P2P lending, there are no geographical limitations. Individuals from all over the world can participate, making the lending space much wider and with more opportunities for both lenders and borrowers. This global accessibility also enables borrowers with limited access to traditional banking systems to obtain the funds they need.

Crypto P2P lending offers greater customization and flexibility compared to traditional lending systems. Borrowers can define their own loan terms, interest rates, and collateral options, while lenders can choose the projects and individuals they want to support. This level of control allows both parties to make informed decisions and tailor the lending experience according to their preferences.

One of the key advantages of crypto P2P lending is the elimination of the need for traditional KYC (Know Your Customer) procedures. Instead of requiring extensive documentation, crypto P2P lending platforms use smart contracts and blockchain technology to verify and secure transactions, reducing the overhead and time required for loan disbursement.

In the future, crypto P2P lending has the potential to become a great alternative to traditional lending systems. With its secure and efficient nature, it offers individuals the opportunity to earn returns on their crypto holdings while helping others access the capital they need. By cutting out intermediaries and creating a trustless environment, crypto P2P lending has the potential to revolutionize the way we think about lending and borrowing.

Traditional Peer-to-Peer Lending

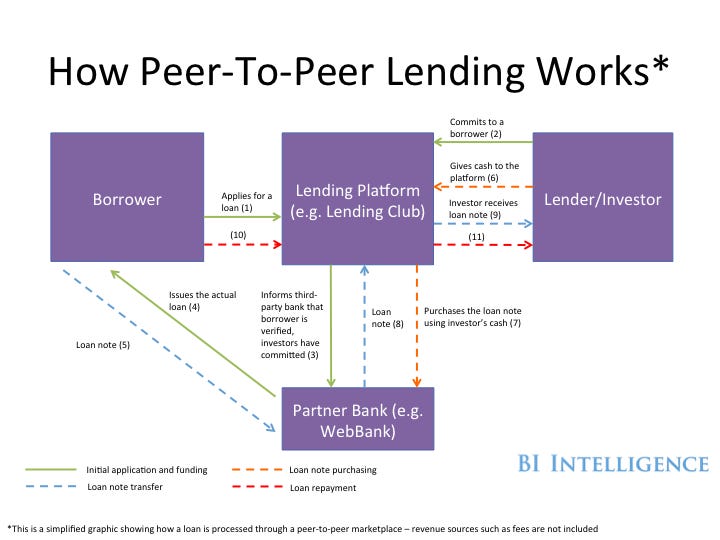

P2P lending has emerged as a popular alternative to traditional borrowing methods, such as obtaining loans from banks or other financial institutions. In a majority of cases, borrowing money from these sources always requires some form of authority or third-party entity to act as an intermediary, which could potentially compromise the borrower’s privacy and trust between the parties involved.

One of the key features of peer-to-peer lending is that it enables individuals to lend and borrow money directly from one another without the need for a traditional financial institution or authority. This trustless alternative promotes greater transparency and integrity in the lending process, including the tracking and management of the loans.

Traditional peer-to-peer lending platforms often have customizable features that allow borrowers and lenders to tailor their loan terms, interest rates, and collateral. This flexibility provides more control and options for both parties involved in the transaction.

Furthermore, since peer-to-peer lending operates outside the jurisdiction of traditional financial institutions, borrowers and lenders can access loans and investment opportunities that may not be available through conventional channels. This “outside-the-box” approach opens up new avenues for individuals who may not have a strong credit history or who are looking for alternative financing options.

In terms of security, peer-to-peer lending platforms employ advanced encryption techniques and secure protocols to safeguard the personal and financial information of its users. Additionally, due to its decentralized nature, these platforms are less susceptible to hacking or other cyber threats, making them a more secure option for borrowers and lenders alike.

Centralized vs Decentralized Crypto Lending

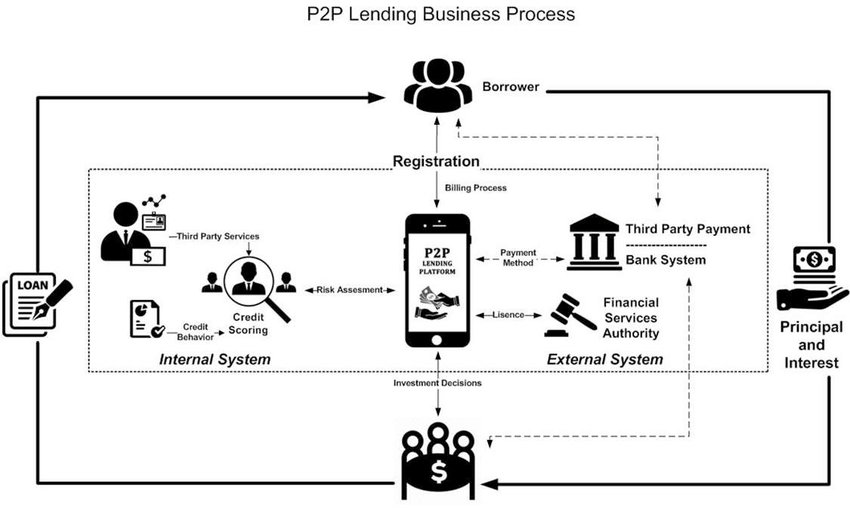

Centralized crypto lending refers to the traditional model of lending where a central authority, usually a financial institution, acts as an intermediary between lenders and borrowers. In this model, the central authority takes care of all the processes and decision-making involved in lending, including loan origination, underwriting, and collection.

In contrast, decentralized crypto lending operates on a peer-to-peer basis, utilizing blockchain technology to eliminate the need for intermediaries. Instead of relying on a single authority, decentralized lending platforms enable lenders and borrowers to interact directly with each other using smart contracts, which are self-executing agreements written on a blockchain.

Decentralized crypto lending offers several advantages over centralized lending. Firstly, it eliminates the need for a central authority, reducing the risk of fraud, manipulation, or other unethical behavior. Secondly, it provides lenders and borrowers with greater control and autonomy over their financial activities, as they can make decisions based on their own preferences and risk appetite.

Furthermore, decentralized lending platforms often offer more customizable and flexible loan terms compared to traditional lending institutions. They can provide a wider range of loan options, such as collateralized or uncollateralized loans, and offer competitive interest rates based on market conditions. Additionally, decentralized lending platforms are typically open to anyone with an internet connection, allowing individuals from all around the world to participate in lending and borrowing activities.

One of the main challenges of decentralized crypto lending is the lack of regulatory oversight compared to centralized lending. However, this can also be seen as an opportunity for innovation and experimentation, as decentralized lending platforms can often integrate new technologies and protocols more quickly than their centralized counterparts.

In summary, while centralized crypto lending offers the convenience and familiarity of traditional financial institutions, decentralized lending presents a more autonomous and potentially innovative alternative. Both models have their own strengths and weaknesses, and the choice between them ultimately depends on the preferences and priorities of the clients involved.

Crypto-Based Peer-to-Peer Lending

Crypto-based peer-to-peer lending is a brand new form of financial lending that meets the needs of the modern digital age. With the flash-like speed of transactions seen in the cryptocurrency market, peer-to-peer lending in the crypto space offers a decentralized and user-centric approach.

Features and Benefits

One key feature of crypto-based peer-to-peer lending is the implementation of smart contracts, which enable transparent and automated lending projects. The use of blockchain technology also provides a secure and immutable ledger of all transactions, ensuring data integrity.

In addition, transactions in crypto-based peer-to-peer lending can be made across borders, bypassing traditional banking gateways. This gives users greater flexibility and access to a wider range of investment opportunities. Furthermore, the social nature of the crypto community allows for peer-to-peer endorsements and collaborative research, enhancing the overall lending experience.

Security and Risk Management

Crypto-based peer-to-peer lending platforms have built-in security features to protect users’ funds. Multisignature storage, where multiple parties must provide their approval for a transaction to occur, adds an extra layer of security in case of potential losses.

Unlike centralized exchanges, where users’ data can be at risk of breaches, in crypto-based peer-to-peer lending, individuals have full control over their own data and can choose to remain anonymous. This eliminates the need to trust a centralized organization with sensitive personal information.

The Future of Crypto-Based Peer-to-Peer Lending

As the popularity of cryptocurrencies and blockchain technology continues to grow, so does the potential for crypto-based peer-to-peer lending to become a mainstream financial activity. The faster and more efficient nature of peer-to-peer lending, combined with the benefits of decentralized finance, are attracting more individuals and institutions alike.

In the future, with further advancements in software and the adoption of new cryptographic technologies, crypto-based peer-to-peer lending could potentially disrupt traditional banking systems and become the go-to method for earning passive income and providing loans.

P2P Crypto Lending Software Development — The Future of Borrowing and Lending

In today’s digital world, where trading and investing in cryptocurrencies is gaining momentum, peer-to-peer (P2P) crypto lending has emerged as a promising option for borrowing and lending. This new approach to lending allows individuals to access funds by using their crypto assets as collateral. Unlike traditional banks, P2P crypto lending platforms provide a decentralized framework, enabling borrowers and lenders to connect directly without the need for intermediaries.

One of the key advantages of P2P crypto lending is the ability to access loans quickly and easily, including for those who may not have a traditional banking relationship. In addition, there’s the potential to earn higher returns as a lender, as the interest rates offered on P2P lending platforms can be more attractive than those provided by traditional financial institutions.

The future of borrowing and lending

In the future, P2P crypto lending could see even more growth, with the introduction of stablecoins, which are cryptocurrencies pegged to a stable asset, such as the US dollar. By offering loans in stablecoins, P2P lending platforms can provide borrowers with a more stable investment environment, reducing the potential risks associated with the volatility of other cryptocurrencies.

Moreover, the use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, could further enhance the security and transparency of P2P crypto lending. By automating the borrowing and lending process through smart contracts, borrowers and lenders can have peace of mind, knowing that their transactions are carried out based on predetermined conditions, without the need for a third-party provider.

Additionally, P2P crypto lending platforms could become more liquidated as more businesses and individuals embrace this alternative form of borrowing and lending. With a wide range of cryptocurrencies available for use as collateral, including popular ones such as Bitcoin and Ethereum, borrowers have more flexibility in terms of the amount they can borrow and lenders have a greater opportunity to diversify their investment portfolios.

The challenges and changes ahead

However, P2P crypto lending is not without its challenges. As with any investment, there is always an inherent risk, and borrowers need to be aware of the potential for their collateral to be liquidated if they fail to repay the loan. Moreover, the ever-changing nature of the cryptocurrency market means that borrowers and lenders need to stay updated and monitor their investments closely to ensure compliance with any jurisdictional or regulatory changes.

Despite these challenges, the future of P2P crypto lending looks promising. With more and more individuals and businesses looking for alternative banking options, P2P lending platforms offer a unique and flexible approach to borrowing and lending. With the potential for higher returns, greater transparency, and reduced fees, it’s no wonder that the P2P crypto lending market is projected to reach billions of dollars in the coming years.

Popular Projects in the Decentralized Lending Space

Peer-to-peer lending means that borrowers can obtain loans directly from lenders without the need for traditional financial intermediaries. In the world of decentralized lending, popular projects are emerging that take advantage of the trustless and scalable nature of cryptocurrencies.

One such project is known as Compound, which operates on a peer-to-peer basis and works with a wide range of crypto assets as collateral. The platform allows users to earn interest on their holdings by supplying liquidity to borrowers, making it a popular choice for crypto investors looking to earn passive income.

An advanced approach to decentralized lending is implemented by MakerDAO, a project that uses a stablecoin called DAI to provide loans. DAI is a cryptocurrency that operates on the Ethereum blockchain and is backed by a collateral pool of other cryptocurrencies. This approach allows users to lock up their assets as collateral and borrow against them, earning interest in the process.

Another popular project in the decentralized lending space is Aave, which offers a wide range of lending and borrowing options. Aave operates on a peer-to-peer basis and provides users with the ability to lend or borrow a variety of cryptocurrencies, earning interest on their deposits or paying interest on their loans.

Decentralized lending platforms not only provide opportunities for earning interest on crypto assets, but they also offer a more inclusive and efficient way to access capital. With the growth of the decentralized finance (DeFi) space, these projects are likely to become even more popular in the future as they continue to improve and expand their offerings.

Happy HODLdays Earning Interest With Peer-to-Peer Crypto Lending

Peer-to-peer crypto lending is becoming an increasingly popular alternative for individuals looking to earn interest on their cryptocurrencies in a secure manner. This lending environment allows users to lend their crypto assets to borrowers directly, without the need for intermediaries or traditional financial institutions. By utilizing blockchain technology, peer-to-peer crypto lending ensures a secure and transparent lending process.

One significant advantage of peer-to-peer crypto lending is the ability to earn interest on your assets. Instead of leaving your cryptocurrencies idle in a wallet, you can earn passive income by lending them out to borrowers in need. This can be a great way to put your idle assets to work and generate additional revenue.

When it comes to peer-to-peer crypto lending, there are several ways to get involved. Platforms like BitBond, SALT, and Celsius Network provide gateways for lenders and borrowers to connect and facilitate lending transactions. These platforms offer various loan products, allowing lenders to customize their lending terms and choose their preferred interest rates.

Managing your crypto assets during the lending process is made easier through the use of secured blockchain technology. Blockchain networks provide a decentralized and immutable storage of data, ensuring that your assets are safe from hacking and other security breaches.

One key aspect of peer-to-peer crypto lending is compliance with anti-money laundering laws. Platforms typically have strict client monitoring and data verification processes in place to comply with these regulations. By following these guidelines, lenders can be assured that their lending activities are in line with legal requirements.

When making a decision to lend, it’s important to assess the borrower’s creditworthiness and evaluate their ability to repay the loan. This can be done through a detailed analysis of the borrower’s financials, credit history, and any collateral they may offer. By conducting thorough due diligence, lenders can minimize the risk of non-repayment and potential losses.

In the future, as regulatory frameworks continue to develop in the crypto space, peer-to-peer lending may become even more secure and standardized. The publication of laws and guidelines surrounding crypto lending will provide a clearer framework for lenders and borrowers to operate within, further enhancing the credibility and stability of the industry.

In conclusion, peer-to-peer crypto lending offers individuals a unique opportunity to earn interest on their cryptocurrencies in a secure and transparent manner. By leveraging blockchain technology and adhering to regulatory requirements, lenders can confidently participate in this growing industry.

Overcollateralized stablecoins

Overcollateralized stablecoins are a type of cryptocurrency that is designed to be backed by more than 100% of its value in collateral. This ensures the stability of the coin and mitigates the risk of default. These stablecoins are created on blockchain networks and can be obtained through various peer-to-peer lending platforms or decentralized finance protocols.

In contrast to traditional stablecoins, which are often issued by centralized entities like banks or financial institutions, overcollateralized stablecoins are decentralized and do not require a central authority for their issuance or management. This makes them more inclusive and accessible to a wider range of users.

One of the main benefits of overcollateralized stablecoins is their scalability. Since they are based on blockchain technology, they can be easily transferred and stored on the internet. This makes them a secure and efficient option for peer-to-peer lending and other financial transactions.

Another key feature of overcollateralized stablecoins is their ability to provide interest on deposited funds. This means that users can earn a passive income by holding these stablecoins in their wallets. This approach is in contrast to traditional banking systems, where interest rates may be variable and subject to the authority of a central bank.

In conclusion, overcollateralized stablecoins offer an innovative and decentralized solution for creating stable and secure digital currencies. Their development and use are becoming increasingly popular in the emerging field of peer-to-peer lending and decentralized finance. Through the use of blockchain technology, these stablecoins provide a more inclusive and accessible option for users to store and transact value securely.

How collateralized crypto lending works

Cryptocurrency collateralized lending is based on the concept of using digital assets as collateral for obtaining loans. This innovative approach allows borrowers to leverage their cryptocurrency holdings to access capital without having to liquidate their assets.

The origination of collateralized crypto loans does not involve traditional financial intermediaries such as banks. Instead, it is conducted through digital platforms or brands that operate in the cryptocurrency lending industry. These authorized platforms connect borrowers and lenders directly, creating a peer-to-peer lending framework.

Collateralized crypto lending services often provide a secure and transparent environment for borrowers and lenders to interact. They use advanced authentication and verification processes to ensure the identity and credibility of both parties. These platforms have a track record in the industry and have seen the history of lending activity, reducing the risk of theft or fraud.

When utilizing collateralized crypto lending, borrowers can obtain loans with lower overhead costs compared to traditional lending methods. These platforms operate in a decentralized space, which allows for more efficient and customizable loan terms and interest rates. The returns earned by lenders are usually higher as well, making it an attractive investment option.

One of the most popular forms of collateral used in crypto lending is Bitcoin. Its secure and widely accepted nature makes it an ideal asset for securing loans. However, other cryptocurrencies can also be used as collateral, depending on the platform’s policies and the borrower’s preferences.

In summary, collateralized crypto lending is an emerging alternative to traditional lending methods. Its decentralized and peer-to-peer approach provides borrowers with access to capital while allowing them to retain ownership of their digital assets. This new form of lending is built on secure and transparent frameworks, offering a viable option for individuals and businesses in need of funding.

Frequently Asked Questions:

What is peer-to-peer lending?

Peer-to-peer lending is a financial practice where individuals or businesses can borrow money directly from other individuals or investors, without the involvement of traditional financial institutions. It is often facilitated through online platforms that connect borrowers and lenders.

How does collateralized crypto lending work?

Collateralized crypto lending is a form of lending where borrowers provide cryptocurrency as collateral to secure a loan. The value of the collateral is typically higher than the loan amount, reducing the risk of default for the lenders. If the borrower fails to repay the loan, the lender can liquidate the collateral to recover their funds.

What are overcollateralized stablecoins?

Overcollateralized stablecoins are cryptocurrencies that are backed by more assets than the value of the stablecoin itself. This extra collateral is used to maintain the stability and value of the stablecoin. It provides a higher level of security to holders and lenders, as there is always sufficient collateral to cover the value of the stablecoin.

What are some popular projects in the decentralized lending space?

Some popular projects in the decentralized lending space include Compound, Aave, MakerDAO, and dYdX. These platforms allow users to lend and borrow cryptocurrencies in a decentralized manner, without the need for intermediaries or traditional financial institutions. They often offer competitive interest rates and a wide range of supported assets.

What is the difference between centralized and decentralized crypto lending?

Centralized crypto lending involves borrowing and lending through a centralized platform or company, where there is a central authority that manages and facilitates the lending process. Decentralized crypto lending, on the other hand, operates on blockchain technology and smart contracts, eliminating the need for intermediaries. It allows for peer-to-peer lending and offers increased transparency, security, and control over funds.

Video:

Peer-to-Peer Lending (AKA P2P Loans or Crowdlending) Explained in One Minute

As a cryptocurrency investor, I have been actively involved in peer-to-peer lending platforms for the past year. I must say, the decentralized approach is a game-changer. Unlike traditional lending institutions, P2P lending allows me to directly connect with borrowers and negotiate terms that work for both parties. The use of stablecoins as a medium of exchange also adds an extra layer of security and stability to the transactions. I highly recommend exploring the world of P2P lending if you want to maximize your crypto earnings.

How does P2P lending ensure secure and efficient transactions without intermediaries?

P2P lending ensures secure and efficient transactions without intermediaries through the use of smart contracts. Smart contracts are self-executing agreements written in code that automatically execute the terms of the loan once certain conditions are met. These contracts are stored on the blockchain, a decentralized and tamper-proof ledger, ensuring transparency and immutability. By eliminating the need for intermediaries, P2P lending reduces costs, speeds up the lending process, and enhances security.

Great article! I’m curious, could you provide some examples of popular projects in the decentralized lending space?

Sure, VeronicaJones! Here are a few popular projects in the decentralized lending space: Compound, Aave, and MakerDAO. These projects have gained traction in the crypto lending world due to their innovative features and robust security. Feel free to explore them further!

Can you provide examples of popular peer-to-peer lending platforms in the decentralized space?

P2P lending is a game-changer in the financial industry. It provides borrowers with greater flexibility and eliminates unnecessary intermediaries. With the use of stablecoins, it offers a secure and efficient lending experience. Exciting times ahead!

Peer-to-peer lending is revolutionizing the lending industry. With the elimination of intermediaries and customizable terms, borrowers have more flexibility and control over their loans. The use of stablecoins also adds an extra layer of security and stability to the process. Exciting times ahead for P2P lending!