Cryptocurrency has revolutionized the way we conduct financial transactions, making it more accessible and convenient for everyone. One of the key benefits of this digital currency is its ability to enable decentralized finance loans, also known as DeFi lending. Unlike traditional banking systems, DeFi lending does not rely on a third-party bank to host or grant loans. Instead, it operates on blockchain networks such as Solana, where lending and borrowing are done directly between users.

In simple words, DeFi lending is a lucrative business for investors who wish to earn profits through lending and borrowing using digital assets. Currently, the most widely-known and popular DeFi lending platform is Compound. It mainly works by holding cryptocurrencies as collateral and offering them to borrowers. The platform follows certain rules and ratios to ensure secure and transparent transactions between the community of users.

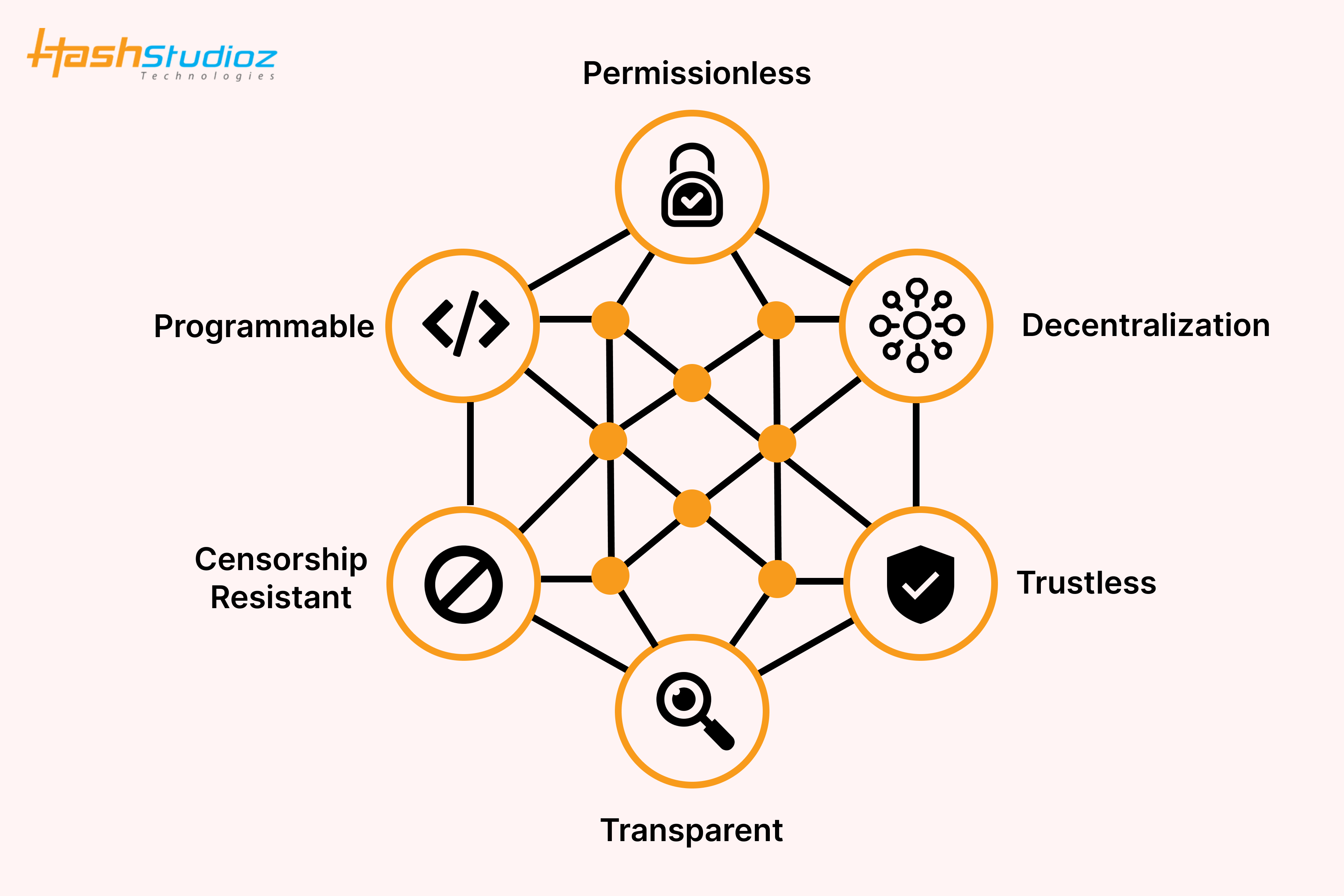

Various DeFi lending platforms offer different types of instruments for users to borrow or lend crypto assets. The main advantage of DeFi lending is that it removes the need for intermediaries and middlemen, providing users with direct access to funds and reducing transaction costs. Additionally, DeFi lending allows for greater scalability and flexibility, enabling users to create and interact with decentralized applications (dApps) for more personalized lending and borrowing experiences.

What is DeFi Lending?

DeFi Lending, also known as decentralized finance lending, refers to a system where individuals can borrow or lend funds using open-source protocols without the need for intermediaries such as banks. It is an important aspect of the decentralized finance ecosystem, which aims to revolutionize traditional financial systems.

When it comes to DeFi lending, users have the option of depositing their funds into a smart contract on a decentralized platform. This smart contract then allows lenders to provide loans to borrowers, with the amount and terms of the loan determined by the algorithmic rules of the platform.

One of the key advantages of DeFi lending is the speed at which it can work. Unlike traditional lending systems, which often require lengthy approval processes, DeFi lending uses blockchain technology to expedite transactions and provide instant access to funds. This makes it an attractive option for individuals and businesses in need of quick financing.

Another important feature of DeFi lending is its transparency. Since all transactions are recorded on the blockchain, users can easily view and verify the history of loans and repayments. This level of transparency helps to ensure trust and fair dealing between borrowers and lenders.

Furthermore, DeFi lending is permissionless, meaning that anyone can participate regardless of their location or financial status. This opens up lending opportunities to individuals who may not have access to traditional banking services. Additionally, DeFi lending often uses stablecoins as collateral, which are digital assets pegged to a stable asset like the U.S. dollar. This provides stability and reduces the risk for lenders.

In conclusion, DeFi lending has become increasingly popular due to its open and efficient nature. It offers individuals the opportunity to borrow or lend funds in a secure and transparent manner, without the need for intermediaries. While there are risks associated with DeFi lending, it has the potential to revolutionize the way people access and invest their money.

A Guide to Decentralized Finance Loans

Decentralized finance (DeFi) loans are becoming increasingly popular in the world of digital banking. With DeFi loans, transactions are processed using smart contracts on the blockchain, eliminating the need for intermediaries such as traditional banks. This allows for a more secure and transparent lending process.

Unlike traditional lending systems where a high credit score is often required, DeFi loans are permissionless, meaning anyone can borrow money without the need for extensive credit checks. Since DeFi loans are based on cryptocurrencies, users can also borrow and lend without having to convert their assets into fiat currency.

One of the key advantages of DeFi loans is the ability to earn higher interest rates compared to traditional banking systems. Lenders can earn higher yields by providing liquidity to decentralized finance platforms, which then distribute the interest earned among the lenders. This appeals to users who are looking to grow their capital in a more efficient and secure manner.

DeFi loans also allow for larger capital ratios, meaning users can borrow more money compared to their base capital. This provides users with more flexibility and enables them to take advantage of various investment opportunities such as arbitrage or flash loans.

Furthermore, the decentralized nature of these loans eliminates the need for intermediaries, making the lending process faster and more efficient. Transactions are processed directly between the lenders and borrowers using smart contracts, reducing the processing time and lowering transaction fees.

However, although DeFi loans offer many advantages, there are also risks associated with them. Because the lending and borrowing process is completely decentralized, there is no central authority or third-party oversight. This means there is a higher risk of encountering fraudulent contracts or hackers trying to exploit vulnerabilities in the system.

In conclusion, DeFi lending is a growing trend in the world of decentralized finance. It offers users the opportunity to borrow and lend money in a secure and efficient manner, without the need for intermediaries. However, users must also be cautious and ensure they are familiar with the risks and associated security measures when using DeFi lending platforms.

Savings

In the world of decentralized finance, savings is an important factor in the lending industry. By providing customers with the option to safely deposit their funds, lenders have the opportunity to use these savings to facilitate loans to borrowers. In other words, lenders act as intermediaries between savers and borrowers, allowing both parties to benefit from the transaction.

Technological advancements have made it easier for lenders to manage these savings accounts and provide transparency and accountability to their customers. With the use of analytics and advanced management systems, lenders can monitor and track the savings on their platforms, ensuring that borrowers have access to the funds they need.

The main aim of a savings account in the context of DeFi lending is to increase the lender’s pool of assets. This can be done through the purchase of tokenized assets that are pegged to real-world markets. By offering savings accounts that provide a higher interest rate than traditional banks, lenders can attract more customers and grow their lending capabilities.

In conclusion, the concept of savings in DeFi lending is an essential component of the overall ecosystem. It allows lenders to increase their pool of assets and provide borrowers with the funds they need. With the help of technological advancements and transparent management systems, savings accounts have become an important tool in the world of decentralized finance.

Understanding DeFi Lending

DeFi lending refers to the practice of borrowing and lending through decentralized networks. In this open and permissionless environment, individuals can borrow and lend digital assets without intermediaries or banks. DeFi lending takes advantage of smart contracts and blockchain technology to provide a transparent and secure system for loans.

Users who need funds can borrow from the DeFi lending platforms, utilizing their digital assets as collateral. These loans can be in the form of stablecoins or other cryptocurrencies. For example, platforms like MakerDAO and Venus allow users to borrow stablecoins by collateralizing their holdings of other cryptocurrencies like Ethereum.

One of the advantages of DeFi lending is that anyone can participate in the lending and borrowing process. This means that individuals who may not have access to traditional banking services can still have the opportunity to borrow and earn interest on their holdings. Additionally, the decentralized nature of DeFi lending ensures that there is no centralized authority managing the loans, giving users more control over their funds.

However, it’s important to note that there are risks associated with DeFi lending. Since it is a relatively new and rapidly developing field, there may be issues with security and transparency that need to be addressed. Additionally, the value of the collateralized assets may fluctuate, leading to potential losses for the borrower.

In the future, as DeFi lending continues to evolve, we may see the development of new platforms and networks that offer even more lucrative lending opportunities. For example, Solana, a high-performance blockchain, is known for its fast transactions and low fees, making it an attractive option for DeFi lending. Third-party platforms like Uniswap also play a role in the DeFi lending ecosystem by allowing users to trade and borrow assets.

In conclusion, DeFi lending is a decentralized and permissionless system that allows users to borrow and lend digital assets through open networks. By utilizing smart contracts and blockchain technology, individuals can take advantage of transparent and secure lending instruments, earning interest on their holdings while also having control over their funds. Despite the risks involved, DeFi lending has the potential to revolutionize the traditional banking system and provide financial opportunities for a wider range of individuals.

How Decentralized Finance Works

Decentralized finance, or DeFi, is a concept that allows individuals to manage their financial needs without relying on traditional banking institutions. This new system utilizes blockchain technology to provide lending and other financial services to anyone, regardless of their location or financial status.

One of the key features of DeFi lending is the use of smart contracts, which are self-executing contracts with the terms and conditions directly written into code. These smart contracts enable lenders to offer loans to customers based on predetermined policies, such as fixed interest rates or collateralization ratios.

Unlike traditional lending platforms, DeFi lending services usually do not require extensive KYC (Know Your Customer) procedures. This makes it easier for individuals to access financial services and allows them to securely borrow or lend funds using their own wallets.

One of the top DeFi lending platforms is MakerDAO, which is known for its algorithmic lending and stablecoin offering. The platform uses a proof-of-collateralization system, where users can deposit and lock their cryptocurrencies as collateral in order to borrow stablecoins.

Another popular DeFi lending platform is Aave, which allows borrowers to take flash loans without requiring any collateral. Aave also leverages the power of the community by enabling users to earn interest by lending out their tokens to the market.

The Benefits of Decentralized Finance

Decentralized finance offers several benefits over traditional banking systems. Firstly, it enables individuals to have full control over their funds, as there is no need to rely on third-party intermediaries like banks. Additionally, DeFi platforms often provide more efficient and transparent financial services, as transactions are recorded on a public blockchain.

Another advantage of DeFi lending is that it allows individuals to access financial services that were previously unavailable to them. For example, individuals with smaller savings or less creditworthiness can still participate and benefit from loans or other financial tools within the DeFi system.

In conclusion, decentralized finance is revolutionizing the traditional financial system by offering more efficient, accessible, and secure financial services. With its use of blockchain technology, smart contracts, and innovative lending solutions, DeFi is transforming the way individuals can manage their financial needs and participate in the global economy.

The Basics of DeFi Lending

DeFi lending, also known as decentralized finance lending, is a system that allows individuals to borrow and lend assets without the need for traditional banking institutions. In this system, loans are processed and assets are locked on a blockchain, making the entire process transparent and secure. Instead of relying on intermediaries like banks, individuals can borrow and lend directly from each other.

One of the first and most well-known DeFi lending platforms is MakerDAO. It operates on the Ethereum blockchain and allows users to borrow stablecoins like DAI by using their ETH as collateral. The borrowed stablecoins can then be used for various purposes, such as trading on exchanges like Binance or even for everyday expenses.

DeFi lending offers several benefits compared to traditional lending systems. Firstly, it is a trustless system, meaning that borrowers do not need to rely on the trustworthiness of a central authority. They can simply trust the smart contracts and the blockchain to handle their loans. Additionally, DeFi lending often offers more efficient interest rates and terms compared to traditional banks.

Another important aspect of DeFi lending is the use of liquidity pools. These pools are created by users who supply their own assets to be lent out to borrowers. In return, they earn interest on their supplied assets. This allows for a more decentralized and shared lending system, where the risk and benefits are distributed among the participants.

Decentralized finance loans are often used for various purposes, such as funding personal projects, investing in other cryptocurrencies, or even for business purposes. The nature of DeFi lending allows for more flexibility compared to traditional loans, as borrowers can access loans without going through lengthy approval processes or providing extensive documentation.

In conclusion, DeFi lending is an innovative and transparent system that provides individuals with the opportunity to borrow and lend assets in a secure and efficient manner. By utilizing blockchain technology and smart contracts, DeFi lending removes the need for intermediaries and offers a decentralized alternative to traditional banking systems.

The Benefits of DeFi Lending

DeFi lending provides a range of benefits for individuals and businesses alike. One of the key advantages is its decentralized nature, which allows for greater accessibility and inclusivity. Traditional lending often involves intermediaries and lengthy approval processes, but DeFi lending breaks down these barriers, allowing anyone to participate.

Another major benefit is the use of smart contracts, which provide automated and transparent processes. By utilizing blockchain technology, DeFi lending eliminates the need for trust in a centralized institution. Instead, users can rely on the immutability and transparency of the blockchain to ensure that their transactions are secure and verifiable.

DeFi lending also offers flexible interest rates and collateralization options. Borrowers have the freedom to choose from various interest rate mechanisms, such as fixed or algorithmic rates, based on their risk appetite and financial goals. Additionally, borrowers can collateralize their assets, mitigating the risk for lenders and potentially accessing lower interest rates.

Furthermore, DeFi lending allows individuals and businesses to put their idle assets to work. Instead of letting their savings sit idle, users can lend out their crypto assets and earn interest on them. This enables them to generate passive income and make their money work for them.

Moreover, DeFi lending offers faster transaction speeds and increased liquidity. Traditional banking systems can often be slow and inefficient, whereas DeFi lending leverages blockchain technology to facilitate quick and seamless transactions. Access to liquidity is also improved, as users can easily borrow against their assets without having to wait for approval from a centralized institution.

Overall, DeFi lending presents an innovative and different approach to lending. By incorporating decentralized protocols and blockchain technology, it provides a more accessible and transparent form of financing. Whether you are an individual looking to grow your savings or a business in need of capital, DeFi lending offers a range of benefits that traditional lending cannot match.

High Returns on Investment

DeFi lending offers the opportunity for investors to earn high returns on their investment. Unlike traditional lending systems, DeFi lending platforms use smart contracts to connect borrowers and lenders directly, cutting out intermediaries such as banks. These platforms provide attractive returns to lenders by offering higher interest rates compared to traditional banking options.

One of the reasons why DeFi lending platforms can offer such high returns is the efficient use of capital. The funds supplied by lenders are pooled together, and this liquidity is then used to provide loans to borrowers. Instead of having the funds sit idle in a bank account, DeFi lending enables these funds to be put to work, earning interest for the lenders.

Another factor that ensures higher returns on DeFi lending is the associated risks. While lending your funds through DeFi protocols may involve some level of risk, the returns often outweigh these risks. The decentralized nature of these platforms allows for transparency and the verification of loans through smart contracts, which increases security and reduces the chances of default.

It is important to note that not all lending platforms offer the same interest rates. Different platforms have different lending models, and the interest rates can vary depending on factors such as the demand for loans, the availability of lenders, and the types of collateral that borrowers provide. Therefore, it is crucial to research and identify the right platform that aligns with your investment goals and risk tolerance.

Furthermore, DeFi lending platforms offer various types of lending pools, allowing lenders to choose the one that best suits their preferences and risk appetite. Some platforms may focus on lending to individual borrowers, while others may focus on providing liquidity for trading or other purposes. Understanding the different types of lending pools and how they work can help lenders make informed decisions about where to invest their funds.

In conclusion, DeFi lending presents a lucrative opportunity for investors to earn high returns on their investment in a decentralized and efficient manner. With its transparent and secure system, it offers advantages over traditional banking and opens up new possibilities for the future of lending. However, it is essential to research, understand the risks, and choose the right platform to maximize returns and minimize potential losses.

Transparency and Security

One of the key advantages of DeFi lending platforms is the transparency and security they offer to borrowers and lenders. Unlike traditional lending institutions, where the inner workings and decision-making processes are often opaque, DeFi lending platforms provide a high level of transparency.

Here, all transactions are recorded on the blockchain, making it easier for anyone to research and verify the lending process. Additionally, the use of smart contracts provides proof of agreement and ensures that funds are secured and distributed according to the terms set by the protocol.

Moreover, platforms like MakerDAO utilize collateralization as a means to secure the money lent by borrowers. This means that borrowers need to provide collateral, usually in the form of stablecoins pegged directly to the dollar, which acts as a safety net for lenders in case of default.

In a decentralized lending market, the collateral is managed by an algorithmic system, which reduces the risks associated with lending and increases the overall security of the platform. This type of collateralization eliminates the need for intermediaries and allows for a more direct peer-to-peer lending experience.

By offering transparency and security, DeFi lending platforms make it easier for users to lend and borrow money, especially for those who are unable to access conventional lending institutions. The technological advancements in the DeFi space enable faster transaction speeds and more efficient lending processes, providing a viable alternative to traditional financial systems.

Accessibility and Global Reach

One of the key advantages of decentralized finance (DeFi) lending is its accessibility and global reach. Unlike traditional banking systems, which often have limitations and constraints in terms of who can access their services, DeFi lending platforms are open to anyone with an internet connection and a compatible wallet.

Decentralized lending platforms are built on blockchain technology, which brings immutability and transparency to the system. This means that all transactions and decisions made on the platform are shared and recorded on the blockchain, allowing participants to always know the rules and expectations when using these services.

One of the main features of DeFi lending is collateralization. Borrowers can deposit their cryptocurrency as collateral in order to borrow funds. This collateral is held in smart contracts and serves as proof of the borrower’s ability to repay the loan. Collateralization makes lending in the DeFi space less risky for lenders, as they can always liquidate the collateral in case of default.

Furthermore, DeFi lending platforms allow borrowers to access a wide range of lending markets and protocols. These platforms often integrate with various lending protocols, such as Aave, Compound, and benqi, allowing users to have access to different markets and lending opportunities. This opens up a world of possibilities for borrowers to find the best rates and terms for their loans.

Additionally, DeFi lending platforms often offer various ways to earn interest on deposited assets. This can be done by providing liquidity to lending markets or by participating in yield farming strategies. This helps users to make their money work for them and generate earnings on their idle assets.

Overall, the accessibility and global reach of DeFi lending platforms are what make them attractive to many users around the world. The open and transparent nature of these platforms, combined with the ability to access a wide range of markets and opportunities, allows individuals to participate in the global financial system in a way that was previously only available to banks and other financial institutions.

Flexible Loan Terms

In the world of decentralized finance lending, one of the key advantages is the flexibility of loan terms. Unlike traditional lending, where banks set strict rules and terms, decentralized finance lending offers borrowers the ability to tailor the loan terms to their specific needs.

One such flexible option is the use of stablecoins as collateral. Stablecoins are cryptocurrencies that are pegged to a stable asset, such as the US dollar. This allows borrowers to use their stablecoin holdings as collateral, providing stability to the loan and reducing the risk of price volatility.

Another feature of decentralized lending is the ability to often access funds quickly. Traditional lending methods can involve a lengthy approval process, but with decentralized lending, borrowers can receive their funds almost instantly. This is possible due to the open and permissionless nature of decentralized finance, as the lending protocols are automated and do not require human intervention.

Decentralized lending platforms typically utilize overcollateralization as a security measure. This means that borrowers must provide more collateral than the value of the loan. The excess collateral helps to protect lenders in case the borrower defaults on the loan. Overcollateralization also helps to ensure that borrowers have a vested interest in repaying the loan, as they have more to lose if they default.

Furthermore, decentralized lending platforms often use advanced analytics and risk management tools to assess borrowers’ creditworthiness. These tools can analyze borrowers’ cryptocurrency wallets and other factors to determine their ability to repay the loan. This data-driven approach can provide lenders with increased confidence in the borrowing process.

In conclusion, decentralized lending offers flexible loan terms that allow borrowers to tailor their loans to their specific needs. Stablecoins as collateral, quick access to funds, overcollateralization, and advanced analytics are just some of the factors that contribute to the flexibility and security of decentralized finance loans.

Getting Started with DeFi Lending

Decentralized Finance, or DeFi, lending is a new and innovative way to earn interest on your assets by lending them out to the decentralized finance network. If you wish to participate in DeFi lending, you can do so through a decentralized application, or dapp, where you can lend your assets to other users in the network.

One popular example of a DeFi lending platform is Venus, which has become a go-to choice for many users due to its high liquidity and transparent system. To start lending on Venus, you need to first identify the assets you wish to lend and deposit them into the platform. Once your assets are in the platform, you can start earning interest over time.

It is important to note that there is a difference between DeFi lending and traditional lending. In DeFi lending, the borrower does not need to provide any collateral or go through a credit check. Instead, the borrower’s reputation and track record within the DeFi community acts as their collateral.

Another advantage of DeFi lending is the ability to earn interest on your assets without relying on a centralized authority. This form of lending eliminates the need for intermediaries, which reduces the risk of issues such as scams or fraud. Additionally, DeFi lending platforms often offer higher interest rates compared to traditional banks, allowing you to maximize your earnings.

However, it is important to be aware of the risks associated with DeFi lending. Since the lending is decentralized, there may be risks of hacks or vulnerabilities in the system. It is also possible to lose your capital if the borrower defaults on their loan. To mitigate these risks, it is crucial to choose a reputable DeFi lending platform and conduct thorough research before lending your assets.

In conclusion, DeFi lending is a rapidly growing sector within the decentralized finance space that offers individuals the opportunity to earn interest on their assets without relying on traditional intermediaries. By participating in DeFi lending, you can contribute to the development of the decentralized finance network and meet the growing demand for liquidity in the market.

Choosing the Right Platform

When it comes to decentralized finance (DeFi) lending, there are a number of platforms to choose from. Each platform has its own set of rules and features that may be more suitable for different types of users.

One popular DeFi lending platform is MakerDAO, which operates on the Ethereum network. MakerDAO allows users to borrow and lend cryptocurrencies, with interest rates determined by supply and demand. The platform is known for its transparency and open-source nature.

Another platform worth considering is Venus, which is built on the Binance Smart Chain. Venus offers a range of assets that users can deposit and lend, including stablecoins and cryptocurrencies. The platform provides a secure and permissionless way for users to earn interest on their assets.

When choosing a platform, it’s important to consider factors such as the amount of assets available, interest rates, and security. Some platforms may offer higher interest rates, but may also have a higher risk associated with them. It’s important to do your own research and understand the risks before depositing your assets.

Additionally, it’s important to consider the future uses of the platform. Some platforms may offer additional features, such as the ability to invest in other DeFi protocols or participate in governance. These features can provide additional opportunities for users to grow their savings.

Overall, when choosing a DeFi lending platform, it’s important to consider the factors that are most important to you, such as security, transparency, and the types of assets available. By doing your research and considering these factors, you can ensure that you choose the right platform for your financial needs.

Frequently Asked Questions:

What are flash loans in DeFi lending?

Flash loans in DeFi lending are a type of loan that allows users to borrow and return funds within the same transaction, without the need for collateral. These loans are typically used for arbitrage opportunities and other complex financial strategies.

How do flash loans work?

Flash loans work by taking advantage of the composability of smart contracts in the blockchain. When a flash loan is executed, the user borrows funds from a pool, performs a series of operations with the borrowed funds, and then returns the funds plus any fees within the same transaction. If the borrowed funds are not returned, the entire transaction is automatically reverted.

What are the benefits of using flash loans?

One of the main benefits of using flash loans is the ability to execute complex financial strategies without the need for significant upfront capital. Flash loans also have the potential to create new opportunities for arbitrage and price manipulation in decentralized financial markets.

Are flash loans risky?

Flash loans can be risky due to their highly speculative nature. If the borrower fails to execute the intended operations and return the funds within the same transaction, the entire loan is automatically reverted. This means that the borrower must have a solid understanding of smart contracts and the underlying protocols to avoid losing funds.

Is it possible to earn money with flash loans?

Yes, it is possible to earn money with flash loans by taking advantage of arbitrage opportunities and other profitable strategies. However, it requires careful planning and execution to minimize risks and maximize profits. It is also important to note that flash loans are a relatively new and evolving concept in DeFi lending, so there may be potential risks and limitations that have not yet been fully explored.

Video:

DECENTRALIZED FINANCE | Aave Protocol | Full Tutorial on Lending & Borrowing w/ Defi

What is DeFi? A Guide to Decentralized Finance.

The Future Of DeFi Lending? Undercollateralized Loans Explained!

DeFi lending is a game-changer in the financial world. I love how it eliminates the need for banks and allows users to directly borrow and lend funds. The transparency and security offered by blockchain technology are unmatched. I can’t wait to explore more DeFi lending platforms and make profitable investments!

I am fascinated by the concept of DeFi lending. It’s amazing how technology is reshaping the traditional lending industry. By removing intermediaries, it not only provides direct access to funds but also reduces transaction costs. This is revolutionary for both borrowers and lenders!

DeFi lending is truly a game-changer. The traditional banking system has always been plagued with high fees and slow transaction times. With DeFi lending, we can now bypass all these inefficiencies and experience a more streamlined and cost-effective borrowing and lending process. It’s amazing how blockchain technology is reshaping the lending industry!

DeFi lending is a game-changer! I’ve been using Compound for a while now and it’s amazing how easy it is to earn passive income by lending my crypto assets. No need for banks or middlemen, just direct transactions between users. Love it!

DeFi lending is a game-changer! It’s amazing how this technology is disrupting the traditional lending industry. I’ve been using Compound for a while now, and the returns on my investments have been impressive. No need to rely on banks anymore, we can now lend and borrow directly between users. It’s decentralized, transparent, and efficient. Love it!

DeFi lending is truly groundbreaking! It empowers individuals to bypass banks and take control of their finances. I love how it allows us to earn profits through lending and borrowing using digital assets. This is the future of finance!