In the world of decentralized finance (Defi), users now have the opportunity to earn passive income through a concept called crypto staking. Crypto staking is a financial protocol that allows users to lock up their cryptocurrency funds for a certain period of time in order to earn high-interest yield.

The concept of staking is not new, but in the emerging world of Defi, it has taken on a new level of sophistication. Defi platforms, such as Binance, provide intuitive interfaces and calculators that allow users to easily stake their crypto and calculate their potential yield. These platforms also include features to calculate the yield on multiple staking periods, giving users the flexibility to choose the best option for their investment.

One of the key benefits of staking in the Defi space is the high-interest rates that can be earned. Unlike traditional finance, where interest rates are often low, staking in Defi can provide users with significantly higher yields. This is because Defi protocols are designed to be more efficient and secure, with on-chain contract calculations and military-grade wallet security.

When staking crypto, users can also benefit from additional features such as compound interest and the ability to participate in governance within the protocol. This means that not only can users earn a high-interest yield, but they also have the potential to shape the future of the project they are staking with.

It is important for users to do their own research and carefully consider the risks involved in staking crypto. While staking can be a profitable venture, there are also potential losses to be aware of. Some platforms may deduct fees from staked funds or users may be subject to loss of principal during the staking period.

In conclusion, Defi crypto staking is a concept that allows users to earn passive income by locking up their cryptocurrency funds for a certain period of time. With features such as high-interest rates, compound interest, and the ability to participate in governance, staking in Defi offers users a unique opportunity to grow their wealth in the crypto world.

High-Interest Rates

One of the key benefits of Defi crypto staking is the opportunity to earn high-interest rates on your deposited funds. Unlike traditional banking institutions that offer relatively low-interest rates, Defi staking allows users to earn significantly higher yields on their crypto investments.

Defi projects typically provide staking services that offer interest rates that are several times higher than what traditional finance can offer. This is because these projects operate on decentralized protocols, which eliminates intermediaries and associated fees, allowing them to provide higher returns to users.

When you stake your crypto assets, you essentially lock them up in a smart contract for a specific period of time. During this period, the protocol uses your funds for its activities, such as lending and borrowing. In return, you earn interest on your staked assets.

The interest rates for staking are usually calculated on an annual basis and are often referred to as Annual Percentage Yield (APY). The APY is calculated based on the amount of assets staked, the duration of the staking period, and the interest rate offered by the protocol.

It’s important to note that high-interest rates come with certain risks. While earning higher returns is enticing, it’s crucial to assess the risks associated with the protocol you choose to stake with. Factors such as the protocol’s security measures, its track record, and the overall risk profile of the crypto market should be taken into consideration to make informed investment decisions.

Defi Crypto Staking

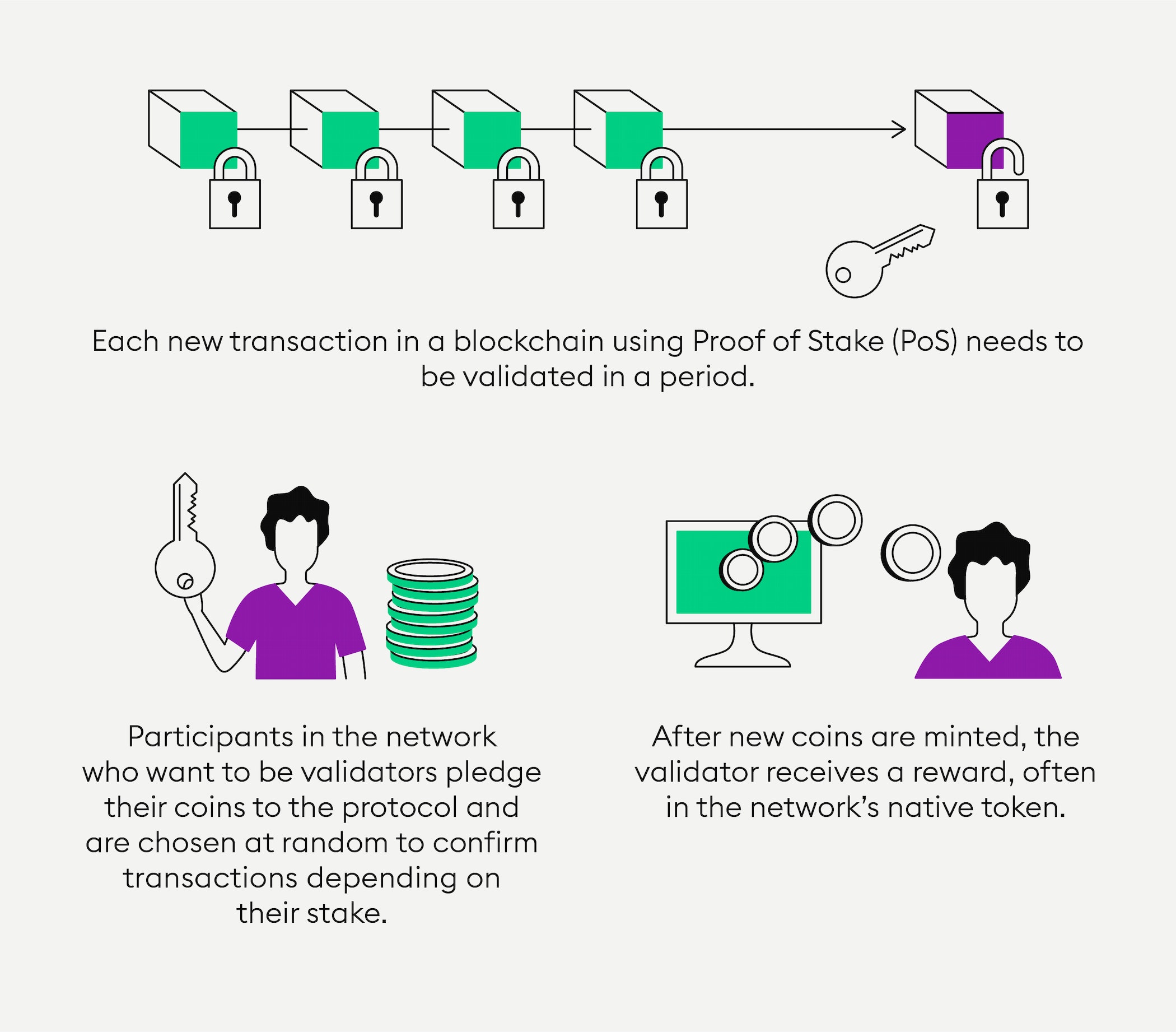

Defi Crypto Staking refers to the process of locking up and holding cryptocurrencies in a protocol to earn rewards. It is a popular concept within the decentralized finance (DeFi) world, offering users the opportunity to earn interest on their crypto holdings. Staking allows users to contribute their funds to a network in exchange for the chance to validate transactions, secure the network, and earn additional tokens as a reward.

One of the main benefits of Defi Crypto Staking is the potential to earn high-interest rates on staked funds. This can be especially attractive for users seeking to grow their wealth in the crypto market. However, it’s important to note that staking also involves risks, such as the possibility of losses due to market volatility or vulnerabilities in the underlying protocol.

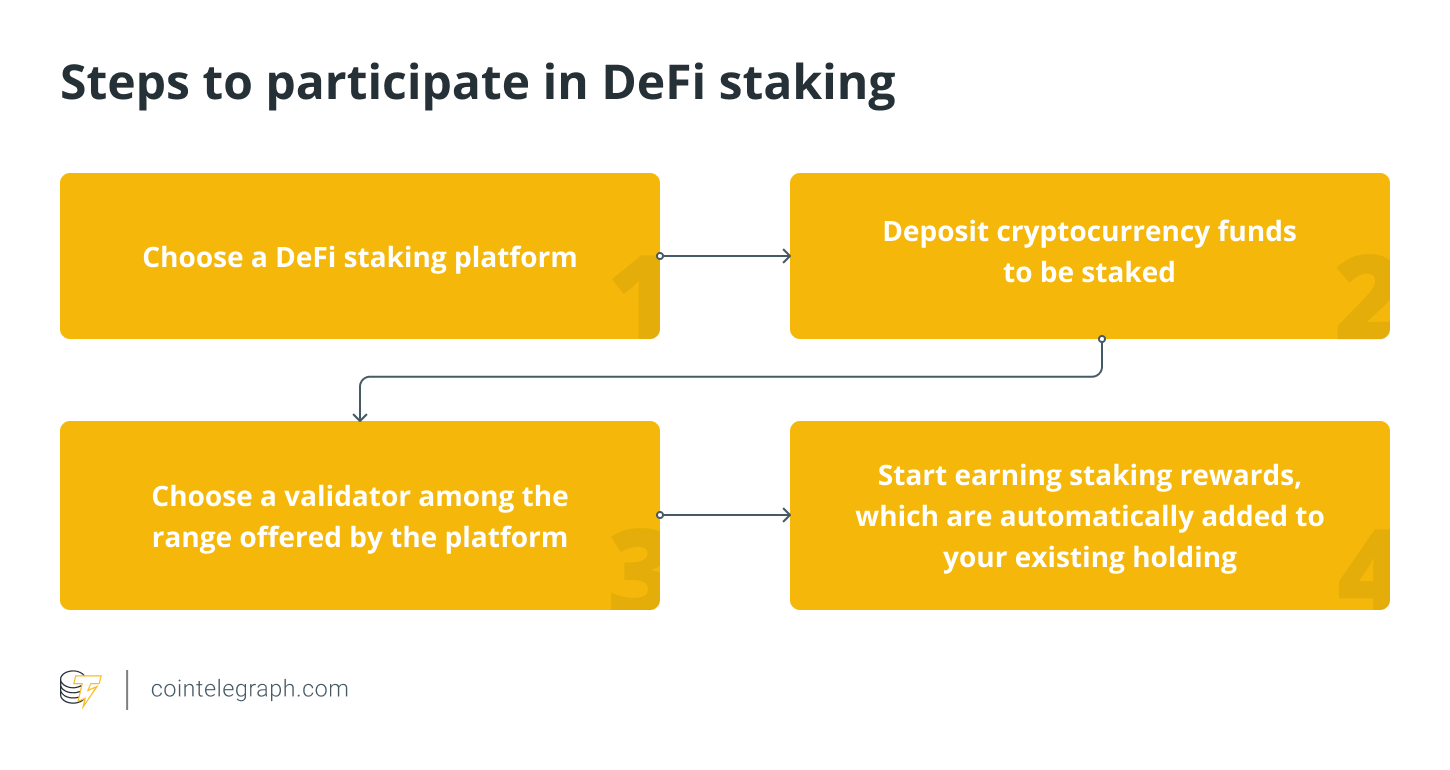

To engage in Defi Crypto Staking, users typically need a compatible wallet and platform that supports staking. The platform provides an interface for users to stake their tokens, monitor their earnings, and withdraw their rewards. The staking rewards are often calculated based on factors such as the amount of tokens staked, the length of the staking period, and the overall network activity.

Many Defi protocols offer staking services, including popular platforms like Binance and CoinStats. These platforms usually charge fees for staking and may deduct a portion of the rewards earned to cover the cost of operation. Users should carefully consider the fees and terms associated with staking before committing their funds to a particular protocol.

Overall, Defi Crypto Staking provides a way for users to earn passive income on their cryptocurrency holdings. It offers an emerging financial service that combines the concepts of decentralized finance and staking. With the right platform and proper research, users can make the best of staking to earn a yield on their crypto assets.

Yield Calculator

The Yield Calculator is a tool that allows users to calculate the potential yield on their crypto assets in a decentralized finance (DeFi) staking protocol. By inputting various parameters such as the amount of funds to stake, the contract period, and the current interest rates, users can get an estimate of the yield they can earn.

The calculator takes into account the low fees associated with DeFi staking and deducts them from the final yield calculation. It also provides an intuitive interface, making it easy for users to input their data and receive an accurate yield estimate.

One of the key benefits of using a yield calculator is the ability to evaluate different staking options and find the protocol that offers the best rates. Users can compare multiple projects and choose the one that aligns with their financial goals and risk tolerance.

Moreover, the calculator is designed to provide high-level security by utilizing military-grade encryption and keeping users’ data private. It acts as a reliable source of information on the potential yield rates, ensuring users make informed decisions.

In the emerging world of DeFi, where financial security and wealth management are paramount, yield calculators play a significant role. They enable users to transform their crypto assets into a yield-generating instrument, earning passive income through staking on-chain protocols.

How does the Yield Calculator work on Binance?

Binance, one of the leading crypto exchanges, offers a yield calculator feature on its platform. The calculator on Binance allows users to enter the amount of funds they want to stake, choose the staking period, and view the estimated yield they can earn.

The calculator takes into account the current interest rates offered by the staking projects listed on Binance, including the duration of the staking period. It also factors in any potential fees associated with staking or unstaking, providing a more accurate estimation of the potential yield.

Users can compare different staking options available on Binance and choose the one that best fits their investment strategy. They can also input different scenarios and see how the yield changes based on varying staking periods and amounts.

By using the yield calculator on Binance, users can make informed decisions about staking their crypto assets, maximizing their earnings, and taking advantage of the decentralized finance ecosystem.

Security

When it comes to decentralized finance (DeFi) protocols and crypto staking, security is of utmost importance. These protocols are designed to provide a secure and trustless environment for users to participate in various financial activities, such as earning interest on their crypto funds.

Decentralized finance protocols, also known as DeFi, utilize smart contracts to automate transactions and eliminate the need for intermediaries. This reduces the risk of losses or fraud that can occur in traditional financial systems.

One of the concepts that provides security in crypto staking is the use of military-grade encryption algorithms. These algorithms ensure that users’ funds are protected and cannot be easily accessed or stolen.

Additionally, many DeFi protocols have implemented security measures such as multi-signature wallets, which require multiple parties to approve transactions, further enhancing the security of users’ funds.

Furthermore, some DeFi platforms offer insurance services to provide an extra layer of protection against potential losses. These insurance services may include coverage against smart contract vulnerabilities or hacks.

Overall, the security of crypto staking and DeFi protocols is paramount to ensure the safety of users’ funds in this emerging field of finance. By implementing robust security measures and utilizing advanced encryption techniques, DeFi platforms aim to provide a secure and reliable environment for users to earn yield on their crypto assets.

DeFi Staking on CoinStats

DeFi staking on CoinStats allows users to earn interest on their crypto assets by participating in decentralized finance (DeFi) protocols. CoinStats, a popular cryptocurrency portfolio tracking app, offers a wide range of services and tools for managing crypto investments, including a staking feature.

By staking their crypto assets on CoinStats, users can earn passive income in the form of interest or rewards. This is made possible through the integration of multiple DeFi protocols into the CoinStats platform, which include lending and borrowing protocols, liquidity mining, and yield farming projects.

One of the main advantages of DeFi staking on CoinStats is the ease and convenience it provides for users. Instead of having to navigate through multiple wallets and protocols, users can stake their crypto assets directly from their CoinStats wallet. This saves time and simplifies the staking process.

The staking calculator on CoinStats allows users to quickly calculate their potential earnings and returns. By inputting the amount of crypto they wish to stake and the staking period, users can see an estimate of the interest they will earn. This helps users make informed decisions and plan their staking strategies.

Another benefit of DeFi staking on CoinStats is the security it offers. CoinStats utilizes military-grade encryption to protect users’ private keys and funds, ensuring that their assets are safe from hacks or theft. Additionally, since staking is done on-chain, users have full control over their funds and can withdraw them at any time.

In conclusion, DeFi staking on CoinStats is a powerful tool for investors looking to earn passive income and grow their wealth in the world of decentralized finance. With its intuitive interface, secure platform, and competitive interest rates, CoinStats provides users with one of the best options for DeFi staking.

Intuitive Interface

The concept of Defi Crypto Staking may seem complex, but with an intuitive interface, users can easily navigate through the various services and acts involved. The interface provides a user-friendly way to deduct and earn high-interest rates on crypto funds, making it accessible to both experienced and novice users.

The interface also offers features that include on-chain wallet transactions, allowing users to manage their wealth and track their earnings in real-time. Additionally, the interface provides a calculator that can help users calculate their potential earnings over a specified period.

Security is a top priority in the decentralized finance (Defi) world, and the interface provides military-grade security measures to ensure the safety of users’ funds. With private keys and encrypted wallets, users can have peace of mind knowing that their assets are protected from any potential losses or hacks.

Moreover, the intuitive interface is designed to provide a seamless user experience. With easy-to-use navigation and clear instructions, users can quickly understand how the staking protocol works and start earning yield on their staked crypto.

Some projects, such as Binance, offer multiple staking options. Therefore, the interface will display different staking periods and interest rates for users to choose from, depending on their investment preferences. This flexibility allows users to tailor their staking strategy to maximize their earnings.

In summary, an intuitive interface is the key to unlocking the potential of Defi Crypto Staking. It simplifies complex financial concepts and offers users a seamless experience, allowing them to earn high-interest rates on their crypto assets securely.

Low Fees

When it comes to DeFi crypto staking, low fees are one of the key advantages. Unlike traditional financial institutions that often charge high fees for their services, DeFi staking platforms provide users with a cost-effective way to earn passive income on their crypto assets. This is made possible through the use of smart contracts, which eliminate the need for intermediaries and reduce overhead costs.

By removing the middlemen, DeFi staking protocols can offer users higher yields on their investments. Users can earn interest on their staked funds without having to pay exorbitant fees, maximizing their potential earnings. In addition, these low fees make DeFi staking accessible to a wider range of users, democratizing access to financial services and creating opportunities for wealth accumulation.

Moreover, the low fees associated with DeFi staking do not compromise on security. The decentralized nature of DeFi ensures that users retain full control over their funds and can avoid the risks and potential losses associated with centralized platforms. By leveraging blockchain technology, DeFi staking platforms provide military-grade security for users’ assets, offering peace of mind and protection against hacks or unauthorized access.

To further enhance the user experience, DeFi staking platforms often provide intuitive interfaces and calculators that allow users to easily track their earnings and estimate potential rewards. These tools make it easier for users to make informed decisions and optimize their staking strategies. With the ability to monitor their earnings in real-time and deduct fees from their earnings, users can maximize their staking profits and stay up-to-date on their financial progress.

In conclusion, low fees are a distinguishing feature of DeFi crypto staking. By reducing costs and increasing accessibility, DeFi staking platforms offer users an attractive alternative to traditional finance. With the potential for high-interest yields and the security of decentralized networks, DeFi staking presents an exciting opportunity for individuals to grow their wealth and participate in the emerging world of decentralized finance.

Frequent questions:

What is DeFi crypto staking?

DeFi crypto staking is a process where users lock up their cryptocurrency in a smart contract to support the operations of a decentralized finance (DeFi) platform. In return for staking their coins, users earn a reward, typically in the form of additional tokens.

How does DeFi crypto staking work?

DeFi crypto staking works by users locking up their cryptocurrency in a smart contract associated with a specific DeFi platform. These smart contracts typically have predefined rules and conditions, determining the duration of the stake and the reward structure. The staked coins are then utilized by the DeFi platform for various purposes such as lending, liquidity provisioning, or other activities.

What are the benefits of DeFi crypto staking?

Some of the benefits of DeFi crypto staking include high-interest rates, security, an intuitive interface, a yield calculator, and low fees. These features make DeFi staking an attractive option for cryptocurrency holders looking to earn passive income on their crypto assets.

What are the high-interest rates offered by DeFi crypto staking?

The high-interest rates offered by DeFi crypto staking vary depending on the platform and the cryptocurrency being staked. However, it is not uncommon to see interest rates ranging from 5% to 15% or even higher. These rates can sometimes be significantly higher than traditional banking or savings accounts.

How does the security of DeFi crypto staking work?

The security of DeFi crypto staking is ensured through the use of smart contracts and blockchain technology. Smart contracts are programmable agreements that automatically execute predefined actions once certain conditions are met. This eliminates the need for intermediaries and reduces the risk of fraud or manipulation. Additionally, the decentralized nature of blockchain provides transparency and immutability, making it difficult for hackers to tamper with the staking process.

What is an intuitive interface in DeFi crypto staking?

An intuitive interface in DeFi crypto staking refers to a user-friendly and easy-to-navigate platform that simplifies the staking process. It typically includes features such as clear instructions, visual representations of data, and a seamless user experience. This makes it easier for users, even those without technical expertise, to participate in staking and earn rewards.

How does the yield calculator in DeFi crypto staking help?

The yield calculator in DeFi crypto staking helps users estimate the potential earnings from their staked tokens. By inputting the amount of tokens to be staked, the duration of the stake, and the current interest rate, users can get an idea of the rewards they can expect to earn. This allows users to make informed decisions and choose the most profitable staking options.

What are the fees associated with DeFi crypto staking?

DeFi crypto staking usually involves lower fees compared to traditional financial services. However, the specific fees can vary depending on the platform and the blockchain network being used. Some platforms may charge a small fee for staking and unstaking, while others may have gas fees associated with the blockchain transactions. It is important for users to research and compare the fees of different platforms before staking their tokens.

Videos:

Staking Rewards – Intro | DeFi

Wow, this article really helped me understand the concept of crypto staking! It’s amazing how Defi platforms like Binance offer such intuitive interfaces and calculators. I’m definitely excited to start staking and earning high-interest yields. Thanks for the informative article!

I have been staking my crypto on CoinStats for a while now and I must say, the high-interest rates and intuitive interface make it a great platform. Plus, the added security measures give me peace of mind. Definitely recommend it!

Staking in Defi is a game-changer! I love how it allows me to earn passive income with high-interest rates. The intuitive interface and calculators on platforms like Binance make it super easy to stake and calculate my potential yield.

Staking crypto in the world of Defi is a game-changer! I love how it allows me to earn passive income with the high-interest rates and enhanced security. The intuitive interfaces and calculators on platforms like Binance make it easy to stake and calculate potential yields. Plus, the ability to participate in governance and compound interest is a bonus!

Wow, I didn’t realize crypto staking could provide such high-interest rates! I’m definitely going to give it a try on CoinStats. The intuitive interface and yield calculator they offer make it easy to stake and calculate my potential yield. Plus, the enhanced security features make me feel confident in my investment. Can’t wait to earn some passive income!

I’ve been staking my crypto on CoinStats for a while now and I must say it’s been a game-changer for me. The intuitive interface and the yield calculator make it so easy to stake and calculate potential earnings. Plus, the high-interest rates and enhanced security give me peace of mind. Staking in Defi definitely beats traditional finance!