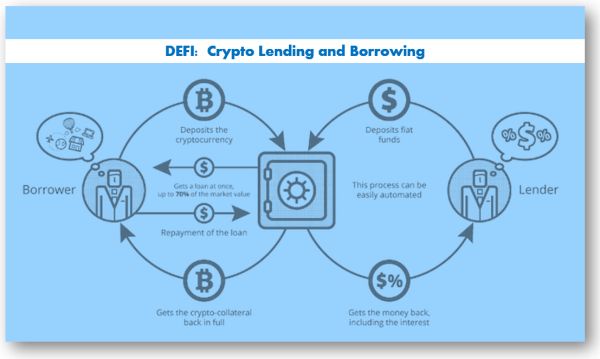

In the world of finance, lending has always been an essential part of the economy. People borrow money for various purposes, be it for personal or business use. However, traditional lending methods are no longer the only option available. With the rise of cryptocurrencies, a new form of lending has emerged – crypto lending.

Crypto lending allows individuals to lend or borrow digital assets instead of traditional fiat currency. Unlike traditional lending, where collateral is usually required, these cryptocurrency loans often involve using the cryptocurrencies themselves as collateral. This opens up a unique opportunity for cryptocurrency holders to borrow against their holdings, while still retaining ownership of their coins.

There are currently several companies that offer crypto lending services. Binance, one of the largest cryptocurrency exchanges, has its lending platform where users can lend out their cryptocurrencies in exchange for interest. The platform also allows borrowers to borrow cryptocurrencies by putting up collateral.

So, how does crypto lending work? Before lending, borrowers need to meet certain conditions set by the lending platform. These conditions vary from platform to platform, but generally include having a certain amount of cryptocurrency as collateral and maintaining a specific loan-to-value ratio. This ratio determines the amount of cryptocurrency that can be borrowed based on the value of the collateral.

Once the conditions are met, borrowers can give permission to the lending platform to calculate the loan amount and interest rate. The interest rate is usually fixed and charged monthly. The lending platform will then notify its clients of the approved loan and the interest rates generated.

One such lending platform is SpectroCoin, which offers a comprehensive range of crypto lending services. Users can upload their cryptocurrencies as collateral and receive a loan in the form of fiat currency, stablecoins, or other cryptocurrencies. If the loan is not repaid by the agreed-upon date, the borrower risks losing their collateral.

For lenders, crypto lending offers an opportunity to leverage their holdings and earn interest. While the risk of default is present, lenders can calculate their potential earnings before lending, giving them more control over their financial decisions.

In conclusion, crypto lending is a new and innovative way to access liquidity using cryptocurrencies as collateral. It provides an alternative to traditional lending methods and offers an opportunity for crypto holders to grow their assets. However, it is important to carefully consider the risks and conditions involved before engaging in any lending or borrowing activities.

How to Borrow Cryptocurrency

Borrowing cryptocurrency can be a safe and convenient way to access funds whenever you need them. Crypto lending platforms, such as Binance, provide services that let you borrow various types of digital assets using your own cryptocurrency holdings as collateral.

When you want to borrow cryptocurrency, you first need to look for a lending platform that meets your specific requirements. Consider factors such as loan-to-value ratio, interest rates, and loan terms to find the right platform for you.

Once you’ve found a suitable lending platform, the borrowing process typically begins with a deposit. You will need to specify the amount of cryptocurrency you want to borrow and the type of collateral you will provide. This collateral acts as security for the loan, ensuring that lenders can recover their capital in case of default.

After your collateral is uploaded and its value is calculated, the platform will notify lenders about your borrowing request. If lenders are interested in lending to you, they will back your loan. The payout will be made in the form of the requested cryptocurrency or another agreed-upon asset.

It’s important to note that when borrowing cryptocurrency, you are taking on debt that needs to be paid back. The terms and conditions of the loan will determine when and how you need to repay the borrowed funds. Failure to meet these conditions may result in the loss of your collateral.

Overall, borrowing cryptocurrency can be a valuable tool for individuals and businesses alike. It provides access to funds without the need for traditional financial institutions, and it allows for greater flexibility in managing your assets. However, it’s essential to carefully consider the risks and responsibilities associated with cryptocurrency loans, and only borrow what you can comfortably repay.

Get crypto loan within minutes

If you’re looking to get a crypto loan quickly and easily, there are several platforms that can help you achieve this. One of the most popular options is BlockFi, which offers loans within minutes using their software. They watch the market and conditions closely to ensure they give you the best borrowing rates possible.

Another platform that you can consider is Unchained Capital. They use a similar software system to BlockFi, which allows you to get a crypto loan quickly. However, the amount you can borrow depends on the digital assets you currently hold in your account.

If you’re in need of borrowing small amounts, SpectroCoin is a good option to consider. They offer loans starting from as little as $100 and have a simple application process. Unlike other platforms, there’s no waiting period or credit checks required.

Nexo is yet another platform that allows you to get a crypto loan within minutes. They offer flexible terms and competitive interest rates. Additionally, they provide an option for earning interest on your digital assets, which can help offset the cost of borrowing.

When it comes to getting a crypto loan, it’s essential to consider the conditions and terms offered by different platforms. Each platform has its own set of rules and regulations that you need to comply with. For example, some platforms may require you to hold a certain amount of digital assets as collateral for the loan.

The process of getting a crypto loan is relatively straightforward. You start by choosing a platform that suits your needs, creating an account, and depositing your digital assets. Once your account is verified, you can request a loan, and the funds will be deposited into your account. You can then use these funds for any purpose you see fit.

Unchained Capital

Unchained Capital is a crypto lending platform that allows users to either borrow or lend cryptocurrencies. It provides a step-by-step process for borrowers and lenders to participate in the lending marketplace.

For Lenders

Unchained Capital offers an opportunity for lenders to earn interest on their cryptocurrencies by providing them as collateral for loans. Lenders can watch the loan process unfold and have the option to step back at any point if they feel the conditions are not favorable.

For Borrowers

For borrowers, Unchained Capital offers loans with crypto as collateral. They can borrow various cryptocurrencies against their existing holdings, providing flexibility in terms of collateral options. The platform always checks the borrower’s creditworthiness and provides guarantees for safe lending.

Unchained Capital is different from other lending platforms in that it lets borrowers have direct custody of their collateral, unlike platforms like Coinbase, where the collateral is held in a separate account. This provides borrowers with more control over their assets.

The loans on Unchained Capital are based on a loan-to-value (LTV) ratio, which means the amount a borrower can borrow is limited to a certain percentage of the value of their collateral. This ensures that lenders are adequately protected.

The technology behind Unchained Capital’s lending platform is secure and transparent. It uses multisignature wallets and smart contracts to ensure the safety of funds and enforce the terms and conditions of the loan.

Overall, Unchained Capital provides a community-based lending platform where both lenders and borrowers can benefit from the opportunities provided by cryptocurrency loans. The platform works only with reputable borrowers and offers competitive rates to lenders.

How to Lend Your Cryptocurrency

If you have some extra cryptocurrency and you’re looking to put it to work, lending it out could be a great option. The crypto lending market offers the opportunity to earn passive income on your digital assets, while also helping others gain access to much-needed funds.

Marketplaces and Platforms

There are several marketplaces and platforms that facilitate crypto lending, such as Binance, Nexo, and BlockFi. These companies provide a safe and secure environment for borrowers and lenders to connect and transact.

Choosing the Right Platform

Before you start lending your cryptocurrency, it’s important to choose the right platform. Look for a platform that has a strong reputation, transparent fee structure, and offers a wide range of supported cryptos.

Lending Process

The lending process is usually straightforward. You deposit your cryptos into the platform, and they will automatically match you with borrowers who want to borrow those specific coins or tokens. The borrower will provide collateral, and you will earn interest on the loan.

Collateral and Loan Terms

The collateral provided by the borrower ensures that you are protected in case of a loan default. Different platforms have different collateral requirements and loan terms, so make sure to read and understand the terms before lending your crypto.

Risks and Rewards

While lending your cryptocurrency can be a lucrative way to earn passive income, it’s important to be aware of the risks involved. The crypto market is highly volatile, and the value of your collateral could decrease significantly. However, reputable platforms have measures in place to mitigate these risks and ensure the safety of your funds.

Withdrawal and Reinvestment

If you decide to lend your cryptocurrency, keep in mind that your coins or tokens will be locked up for a specific period of time. Once the loan reaches its maturity, you can withdraw your funds and reinvest them or use them towards your own financial goals or dreams.

Overall, lending your cryptocurrency can be a great way to earn passive income and contribute to the growth of the crypto ecosystem. Just make sure to do your due diligence, choose a reputable platform, and understand the risks involved before getting started.

Crypto Tax Software

When participating in the crypto lending market, borrowers and lenders alike need to stay compliant with tax regulations. Crypto tax software can help with this process by automating the calculation and reporting of taxable events related to crypto-backed loans.

One key benefit of using crypto tax software is that it can provide liquidity to borrowers who need to access their digital assets for spending or other expenses. The software should also perform necessary checks and notify borrowers when they need to send additional collateral or take other actions.

For lenders, crypto tax software can help specify how much they should hold in collaterals to ensure the value of the loan remains safe. It can also assist in the process of converting loan repayments from digital cryptos to fiat currency.

There are many ways to access crypto tax software. Some popular services include Coinbase, Binance, and Nexo. These platforms not only offer crypto lending services, but they also provide tools and software to help users calculate their taxes and stay compliant.

By using crypto tax software, borrowers and lenders can have peace of mind knowing that they are following the tax regulations and reporting their digital asset transactions accurately. This can be especially helpful for borrowers who may have multiple loans and investments in different cryptocurrencies, as the software can help calculate their tax liability for each type of digital asset.

In summary, crypto tax software is a valuable tool for those involved in crypto-backed lending. Whether you are a borrower or a lender, using this software can help you stay compliant with tax regulations, calculate your tax liability accurately, and ensure the smooth operation of your crypto lending activities.

What you should know about crypto loans

Crypto loans have become increasingly popular in recent years as a way for individuals to access funds using their digital assets. Instead of selling your coins, you can borrow against them and continue to benefit from potential price appreciation.

There are different ways to borrow cryptocurrency, with some companies offering loans with fiat as the collateral, while others require you to deposit crypto as collateral. One of the best services currently available is BlockFi, which offers loans using your digital coins as collateral.

Borrowing and repayment

When you take out a crypto loan, you’ll need to specify the amount of money you want to borrow and the type of cryptocurrency you’ll be using as collateral. You’ll also need to set the loan term, which can range from a few months to several years.

Once your loan is approved, the funds will be deposited into your account, and you can withdraw them as needed. The interest rate on crypto loans is usually lower than traditional loans, which makes them an attractive option for borrowers.

Collateral and risk

When using cryptocurrency as collateral, it’s important to understand the risks involved. If the price of your collateral coin drops significantly, you might be required to provide additional collateral or risk losing your coins. Some companies, like BlockFi, have a loan-to-value ratio (LTV) limit to help protect both parties.

Additionally, it’s essential to choose a reliable platform for your crypto loan. Look for a company that has a good reputation and can provide guarantees and transparency in their lending and funding services. SpectroCoin is another reputable platform that offers crypto loans with a wide range of supported coins.

Advantages of crypto loans

One of the main advantages of crypto loans is that you can access funds without having to sell your coins. This allows you to continue benefiting from potential price appreciation and gives you the flexibility to spend your loan amount in any way you choose.

Crypto loans also provide liquidity to cryptocurrency holders, enabling them to invest in new ventures or pursue their dreams without having to wait for their crypto investments to mature. This type of borrowing is becoming more popular among the crypto community as it offers a way to leverage their existing holdings and generate additional income.

Salt Lending

Salt Lending is a prominent player in the crypto lending industry, offering a unique platform that allows users to unlock the potential of their digital assets. With Salt Lending, borrowers have the opportunity to access the value of their cryptocurrency holdings without having to sell them. Instead, they can use their digital assets as collateral to secure loans in fiat money.

How it Works

When you sign up with Salt Lending, the first step is to open an account and upload your digital assets. The platform uses advanced software to calculate the value of your assets and determine how much capital you can borrow. Once your account is set up, you can start the funding process and receive your loan quickly, whenever you want.

The Benefits

One of the best things about Salt Lending is the flexibility it offers. Unlike traditional lenders, Salt Lending does not require credit checks or income verification. Instead, the loan is solely based on the value of your collateral. This means that even if you have a poor credit history or limited income, you can still access the funds you need. The interest rates are also fixed, so you can calculate exactly how much your monthly payments will be.

Another benefit of Salt Lending is that your digital assets are held in multi-signature wallets, ensuring maximum security. The platform also provides regular reports on the value of your collateral and offers stablecoins as a borrowing option. This means that you can borrow against stablecoins like USD Coin (USDC) or Tether (USDT), which have a fixed value and are less volatile than other cryptocurrencies.

In Conclusion

Salt Lending is a trusted platform that allows borrowers to unlock the value of their digital assets. With flexible loan options and fixed interest rates, it provides a convenient and secure way to access funds while keeping your cryptocurrencies invested for potential future gains. Whether you need funds for personal expenses, business ventures, or investment opportunities, Salt Lending is here to help you reach your financial goals.

Crypto collateral loans

When it comes to borrowing money, traditional loans usually require a lengthy application process, extensive documentation, and may have a waiting time of weeks or even months before approval. However, with crypto collateral loans, the process is much quicker and easier.

Crypto collateral loans are a type of lending where borrowers can use their cryptocurrency holdings as collateral to secure a loan. These loans are becoming increasingly popular as they provide a way for crypto investors to access funds without having to sell off their digital assets.

With crypto collateral loans, the same principle applies – borrowers provide collateral in the form of their cryptocurrency holdings, and in exchange, they receive a loan in a different cryptocurrency or in a traditional fiat currency such as USD or EUR.

There are several platforms that provide crypto collateral loans, such as Nexo, Coinledger, Coinrabbit, and others. The process usually involves sending the collateral to a secure wallet provided by the lending company, which then automatically evaluates its value and determines the loan amount that can be provided.

One of the significant advantages of crypto collateral loans is that they do not require a credit check, making them accessible to borrowers who may not qualify for traditional loans. Additionally, the loaned amount is not limited to a specific purpose, allowing borrowers to use the funds however they see fit.

How crypto collateral loans work

When a borrower wants to take out a crypto collateral loan, the first step is to determine the loan amount and the collateral required. This is usually done by the lending company, which evaluates the current market value of the borrower’s cryptocurrency holdings.

Once the loan terms are agreed upon, the borrower sends their cryptocurrency to the lending company’s secure wallet. The loan is then disbursed to the borrower’s account, usually within a short period of time.

The borrower is typically required to make monthly interest payments to the lending company until the loan is fully repaid. If the borrower fails to make the payments or the value of the collateral drops significantly, the lending company has the right to sell the collateral to recover the loan amount.

It’s important to note that the interest rates and loan terms may vary among different lending companies, so borrowers should carefully consider their options before choosing a provider.

In conclusion, crypto collateral loans offer a convenient and flexible way for cryptocurrency investors to access funds without having to sell off their digital assets. These loans are provided by various lending companies and can be used for different purposes. However, borrowers should be aware of the risks involved and carefully consider the terms and conditions before opting for a crypto collateral loan.

Crypto community trusts us

When it comes to crypto lending, trust is everything. That’s why the crypto community trusts us. We have established ourselves as a reliable and trustworthy platform that offers lending services to those in need. Whether you are looking to borrow or lend, you can count on us.

One of the reasons why the crypto community trusts us is because of our competitive rates. We offer monthly interest rates that are fixed and easy to understand. When you borrow or lend with us, you know exactly how much interest you will be paying or earning each month.

Another reason why the crypto community trusts us is because of our transparent lending process. We specify all the terms and conditions upfront, so you know exactly how the lending period works and what you can expect. There are no hidden fees or surprises when you borrow or lend with us.

Our lending platform works in multiple ways to accommodate different needs. Whether you want to borrow or lend, we have options that can suit your preferences. If you are looking to borrow, you can specify the amount you need and the interest rate you are willing to pay. If you are looking to lend, you can specify the amount you want to lend and the interest rate you want to earn.

One of the reasons why the crypto community trusts us is because of our focus on security. We take every precaution to ensure that your funds are safe and secure. Our lending platform utilizes state-of-the-art security measures to protect your account and ensure that your funds are not at risk.

In addition to security, we also offer immediate liquidity. When you borrow or lend with us, you can access your funds immediately. There is no waiting period or unnecessary delays. This is especially important in the crypto market where prices can fluctuate rapidly.

Overall, the crypto community trusts us because we prioritize the needs and interests of our users. Whether you are a borrower or a lender, you can count on us to provide you with the best possible experience. So if you are looking for a trustworthy and reliable lending platform, look no further. Trust the platform that the crypto community trusts. Trust us.

BlockFi

BlockFi is a platform that offers cryptocurrency loans to borrowers looking for extra liquidity. With BlockFi, you can borrow against your crypto holdings and use the funds for various expenses or investment opportunities.

The loan process with BlockFi is simple and straightforward. You can apply for a loan online or through their mobile app, and the application is usually reviewed and approved within minutes. Once approved, you can choose to receive the loan payout in either a stablecoin or the original cryptocurrency.

BlockFi offers competitive interest rates for its loans, and they have flexible repayment options. You can choose to repay the loan in monthly installments or pay it back in a single lump sum. The interest rates vary based on the loan-to-value ratio and the length of the loan term.

Before taking out a loan with BlockFi, it’s essential to understand the terms and conditions. They will specify the interest rate, repayment schedule, loan-to-value ratio, and any collateral requirements. It’s also important to calculate your borrowing capacity and ensure that you can afford the monthly loan payments.

One of the benefits of using BlockFi is that they accept a wide range of cryptocurrencies as collateral, including Bitcoin, Ethereum, and Litecoin. This allows you to access funds without selling your crypto assets, potentially avoiding a taxable event.

In addition to crypto loans, BlockFi also offers other financial services such as crypto interest accounts, where you can earn interest on your cryptocurrency holdings. They provide a secure platform backed by industry-leading software to ensure the safety of your funds.

If you’re looking to borrow against your cryptocurrency holdings or earn interest on your crypto assets, BlockFi is a platform that is worth considering. Their user-friendly interface and competitive interest rates make it easy to start generating more from your investments.

Nexo

Nexo is one of the many platforms that offer crypto lending services. It is a step ahead of many other similar platforms as it provides a unique feature known as “Instant Crypto Credit Lines”. This allows users to access different types of loans by using their crypto assets as collaterals. Moreover, Nexo provides the opportunity to earn interest on idle funds deposited in their accounts.

With Nexo, users can borrow against a variety of cryptocurrencies including Bitcoin, Ethereum, and many others. The amount that can be borrowed is based on the current value of the collateralized coins and is calculated in real-time through advanced technology. Repaying the loan is equally convenient, as it can be done using the same coins that were used as collateral.

Crypto Lending and Nexo

Nexo operates on the principle of a fixed term loan. The borrowers are given a specific period of time to repay the loan, during which interest is accrued. However, users have the flexibility to repay the loan at any time within the term without incurring any extra fees or penalties.

One interesting feature of Nexo is that it automatically calculates the loan-to-value ratio based on the current market value of the collateral. This ensures that borrowers are not over-leveraged and provides a good risk management system.

Nexo Accounts

Nexo offers two types of accounts for its users: the base Nexo Account and the Nexo Interest Account. The base account allows users to borrow, repay, and manage their loans, while the interest account provides an opportunity to earn interest on idle crypto assets.

By using Nexo, users have the advantage of earning interest on their deposited assets, either in the same crypto currency or in a different currency of their choice. This creates an opportunity for crypto holders to generate passive income while maintaining the liquidity of their assets.

In conclusion, Nexo is a financial platform that provides a comprehensive solution for crypto lending. With its unique features, it offers users the chance to borrow against their crypto assets, earn interest on their idle funds, and have the flexibility to repay their loans within a fixed term. Nexo is here to help users achieve their financial goals and make their dreams a reality.

Read More

If you are interested in exploring opportunities in the crypto lending market, there are several ventures that offer crypto loans. SpectroCoin is a popular option, providing a platform where investors can come and take advantage of the opportunity to lend their crypto assets in exchange for a return. This unchained ratio depends on factors such as the type of crypto and the loan duration.

If you are new to crypto lending, there are a few key things you should know. Currently, the most common type of crypto lending is through platforms that offer loans backed by Bitcoin as collateral. Nexo is one such platform that allows users to borrow against their Bitcoin holdings and make loan repayments in Bitcoin as well.

One of the advantages of crypto lending is that it provides a way for investors to earn interest on their crypto assets without having to sell them. This can be particularly appealing in times of low interest rates in the traditional financial market. CoinRabbit is a platform that offers crypto lending services with competitive interest rates, allowing users to earn passive income on their digital assets.

If you are looking to borrow against your crypto assets, there are also options available. Firo is a platform that allows users to borrow against their crypto holdings and spend the loan amount using a trusted debit card. This can be a convenient way to access funds without having to liquidate your crypto holdings.

Another important factor to consider when engaging in crypto lending is the risk involved. While some platforms offer ways to mitigate risk through collateral and other measures, there is still a level of risk associated with lending and borrowing in the crypto market. It is important to do your due diligence and thoroughly research any platform before engaging in lending or borrowing.

In conclusion, crypto lending is an emerging market with opportunities for both lenders and borrowers. Whether you are looking to earn passive income on your crypto assets or access funds without liquidating your holdings, there are platforms available that can meet your needs. Just be sure to understand the risks involved and choose a reputable platform to work with.

The Best Companies for Bitcoin and Crypto Loans

When it comes to borrowing against your cryptocurrency assets, there are several reliable companies that you can turn to. These companies provide a platform where you can lend your crypto and receive cash in return, allowing you to access the value of your digital assets without having to sell them off.

One such company that offers crypto lending services is SpectroCoin. SpectroCoin allows you to borrow against your cryptocurrency holdings with competitive interest rates. They provide a seamless lending process, where you can apply for a loan online and receive the funds quickly.

Another reputable company in the crypto lending space is Coinledger. Coinledger offers collateral-based loans, allowing you to borrow against your cryptocurrency holdings. They have a streamlined process where you can provide collateral in the form of your digital assets and borrow funds against it.

If you’re looking for a flexible lending platform, then SALT may be the right choice for you. SALT allows you to borrow against your crypto assets for a fixed period of time, giving you the flexibility to choose when you want to repay the loan. They also offer competitive interest rates and allow you to leverage stablecoins as collateral.

Regardless of the company you choose, it’s important to consider factors such as interest rates, loan terms, and collateral requirements. Make sure to do your research and choose a company that aligns with your borrowing needs and financial goals.

Frequently Asked Questions:

What is crypto lending?

Crypto lending is a process in which individuals or companies loan their cryptocurrency to others in exchange for interest payments. It allows crypto holders to earn passive income by lending their digital assets to borrowers.

How does crypto lending work?

Crypto lending works by connecting lenders with borrowers through an online platform. Lenders deposit their cryptocurrency into the platform and set their desired interest rates and loan terms. Borrowers then request loans by providing collateral. Once a loan is approved, borrowers receive the funds, and lenders earn interest on their deposited cryptocurrency.

Which companies offer cryptocurrency loans?

There are several companies that offer cryptocurrency loans, including Salt Lending, Unchained Capital, BlockFi, Nexo, and SpectroCoin. These companies provide borrowers with access to capital, while allowing lenders to earn interest on their crypto assets.

What should I know about crypto loans?

Before getting a crypto loan, it’s important to understand the terms and conditions, interest rates, repayment options, and collateral requirements. You should also research the reputation and security measures of the lending platform to ensure the safety of your funds.

How can I calculate my crypto loan?

You can use the online calculators provided by lending platforms like BlockFi to calculate the estimated interest payments and repayment schedule for your crypto loan. These calculators take into account variables such as loan amount, interest rate, and loan term.

Is crypto lending safe?

While crypto lending can be a lucrative option for earning passive income, it’s essential to choose a reputable and secure lending platform. Look for platforms that employ strong security measures, such as cold storage of funds and transparent lending practices. Additionally, diversifying your lending portfolio and doing thorough research can minimize the associated risks.

What happens if I default on a crypto loan?

If you default on a crypto loan, the lending platform may liquidate the collateral provided by the borrower to recover the loan amount. This is usually done through an automated process to ensure the lender receives their funds. Defaulting on a loan can also damage your credit score within the crypto lending community, making it harder to borrow in the future.

As a crypto enthusiast, I find crypto lending to be an innovative solution for accessing funds without selling my precious cryptocurrencies. It’s great to see platforms like Binance offering lending services and I appreciate the option to use my crypto holdings as collateral. This opens up a whole new world of possibilities for me. Keep up the good work!

Crypto lending is a game-changer in the world of finance. It offers a great alternative to traditional lending methods, allowing us to borrow against our cryptocurrency holdings. With the rise of cryptocurrencies, this is the future! Thanks for the comprehensive guide!

I have been using crypto lending platforms for a while now, and I must say it’s a game-changer. With traditional loans, I always had to provide collateral in the form of fiat currency or property. But with crypto lending, I can use my crypto holdings as collateral, and still keep ownership of my coins. It’s convenient and opens up a whole new world of possibilities for borrowers like me. Plus, platforms like Binance offer competitive interest rates, making it even more attractive. Definitely recommend trying it out!

How does crypto lending work? Does the interest rate fluctuate based on the value of the cryptocurrency used as collateral?

Hi JohnDoe1987! Crypto lending works by allowing individuals to lend or borrow digital assets instead of traditional fiat currency. When borrowing, the interest rate may fluctuate based on the value of the cryptocurrency used as collateral. This means that if the value of the collateral increases, the interest rate may decrease, and vice versa. It’s important to closely monitor the market to understand the potential impact on your loan.

How does crypto lending work? Can anyone borrow and lend or are there requirements?

Crypto lending works by allowing individuals to borrow and lend digital assets instead of traditional fiat currency. Unlike traditional lending methods, where collateral is usually required, crypto loans often involve using the cryptocurrencies themselves as collateral. This means that individuals can borrow against their cryptocurrency holdings while still retaining ownership of their coins. As for the requirements, different companies may have different criteria for both lenders and borrowers. It’s recommended to check with the specific lending platform for more information on their requirements and eligibility.

I think crypto lending is a game-changer in the financial industry. It provides an alternative option for borrowing and lending money using digital assets. With the rise of cryptocurrencies, it’s great to see companies like Binance offering competitive lending rates and the option to borrow against your own holdings. It’s a win-win situation for both lenders and borrowers.