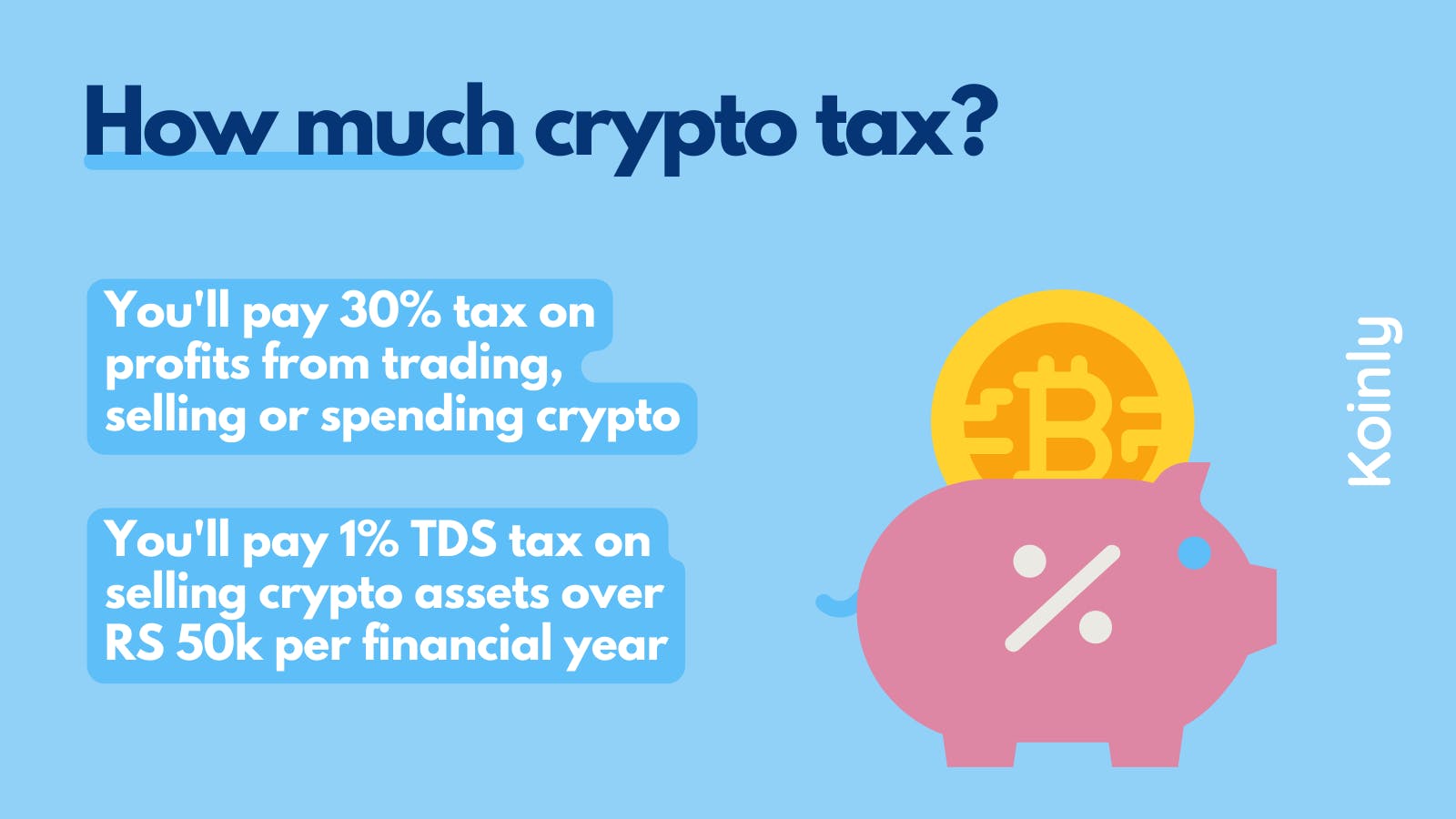

When it comes to buying and selling cryptoassets, it’s important to understand the tax implications that come along with it. Depending on the country you live in, the treatment of cryptoassets for tax purposes may vary. In November 2019, the national tax agency clarified the tax treatment of cryptoassets, differentiating between holding them as an investment and using them for utility purposes.

One important aspect to consider when it comes to tax implications is the pooling of cryptoassets. If you pool your cryptoassets with others, such as on lending platforms, you can potentially receive interest or other forms of income from the pool. The tax treatment of pooling can vary depending on the country and specific circumstances.

Another key consideration is how cryptoassets are treated when they are used to make purchases of goods or services. In some jurisdictions, using cryptoassets to pay for goods or services may trigger a taxable event, as the value of the cryptoassets used may be considered a gain. It’s important to keep track of all such transactions and understand the tax implications in your jurisdiction.

Borrowing against your cryptoassets is another area where tax implications may arise. If you pledge your cryptoassets as collateral for a loan, the tax treatment will depend on whether the borrowing is considered a taxable event. In some cases, the tax consequences may be negligible, while in others, they may be more significant. It’s essential to seek professional advice to understand the tax implications of borrowing against your cryptoassets.

Additionally, the tax treatment of cryptoassets held as part of a corporate entity may differ from that of personal holdings. The tax implications for corporate cryptoassets can be complex and require careful consideration. Again, professional advice is recommended in these scenarios.

In conclusion, understanding the tax implications of cryptoassets is crucial. It’s important to keep accurate records of all transactions and to seek professional advice when necessary. Depending on your jurisdiction, the tax treatment of cryptoassets can vary greatly, and failure to comply with tax obligations can result in penalties or legal consequences. Educating yourself about the tax implications of cryptoassets can help you make informed decisions and avoid potential pitfalls.

Overview of Cryptoassets

Cryptoassets, such as Bitcoin, Ethereum, and Zebu, are digital or virtual currencies that use cryptography for security. They are typically decentralized and operate on a technology called blockchain, which is a distributed ledger that records all transactions made with the currency. Unlike traditional currencies, cryptoassets are not issued by a central authority, making them immune to government interference or manipulation.

The main attraction of cryptoassets is their potential for significant financial gains. Investors are drawn to the potentially high returns that come with the volatile nature of these assets. However, with the high rewards also come high risks, as the value of a cryptoasset can fluctuate dramatically in a short period of time.

One of the key questions individuals have when it comes to cryptoassets is the tax implications. Cryptoassets are treated as property for tax purposes, which means that any gains made from their sale or exchange are subject to capital gains tax. Similarly, any losses can be deducted from capital gains, resulting in a potential tax benefit.

When it comes to trading cryptoassets, the tax consequences can be quite complex. The IRS requires individuals to report their cryptocurrency transactions, including the date and value of each transaction. Failure to do so can result in penalties or even an audit. It is important for individuals to keep accurate records of their cryptoasset transactions and consult with a tax professional to ensure compliance with tax laws.

In addition to trading, individuals may also receive cryptoassets as payment for goods or services, or hold them as investments. In these cases, the fair market value of the cryptoasset at the time of receipt or disposal needs to be determined for tax purposes. This can be challenging due to the volatility of the cryptoasset market and the lack of clear guidelines from tax authorities.

Overall, the tax implications of cryptoassets are still evolving, and there is a great deal of uncertainty in this area. It is important for individuals to stay informed about any changes in tax laws and seek professional advice to ensure compliance.

Tax Regulations on Cryptoassets

Cryptocurrency has gained unprecedented popularity in recent years, with individuals like Mr. Anderson and Ms. Kate investing in digital currencies as an alternative asset class. However, many people do not have a clear idea about the tax implications of these investments. Cryptocurrency is treated as property in the UK for tax purposes, which means that when an individual receives cryptocurrency, it is subject to capital gains tax.

Airdrops, which are free distributions of cryptocurrency tokens to holders of a particular blockchain, also have tax consequences. The value of the airdropped tokens should be added to the recipient’s taxable income. Similarly, if a person receives cryptocurrency as payment for goods or services, the value of the received cryptocurrency should be included in their taxable income.

When it comes to trading cryptocurrency, the tax implications can become extremely complex. The UK tax regulations are strict regarding the treatment of cryptocurrency trading. If a person is involved in the buying and selling of cryptocurrency with the intention of making a profit, they are considered a trader. This means that any gains or losses made from cryptocurrency trading are subject to income tax rather than capital gains tax.

On the other hand, if an individual buys cryptocurrency as an investment and holds it for a certain period (typically more than 9 months), any gains made when selling the cryptocurrency will be subject to capital gains tax. It is important to note that losses on cryptocurrency investments can also be used to offset capital gains on other assets.

Calculating taxes on cryptoassets can be challenging, as the value of cryptocurrencies can fluctuate significantly. Therefore, it is advisable to seek professional advice when it comes to reporting and calculating taxes. Keeping track of the original purchase price, fees, and any other expenses related to cryptocurrency transactions is crucial for accurate tax reporting.

In conclusion, the tax regulations on cryptoassets in the UK have strict implications for both traders and investors. Understanding the tax consequences of holding, trading, or receiving cryptocurrencies is essential to avoid any potential legal issues. Seeking professional advice and staying informed about the latest tax guidelines is highly recommended to ensure compliance with the UK tax laws.

Classification of Cryptocurrencies for Tax Purposes

When it comes to taxes, it is important to understand how cryptocurrencies are classified. Let’s take a look at the different classifications for tax purposes.

1. Currency

Some cryptocurrencies are treated as a form of currency. This means that you can use them to pay for goods and services, and they are subject to normal income tax regulations. For example, if you use Bitcoin to buy something, you would need to report the value of the Bitcoin as income.

2. Assets

Other cryptocurrencies are treated as assets. This means that if you buy and sell these cryptocurrencies, you may be subject to capital gains tax. For example, if you buy Ethereum and sell it at a higher value, you would need to report the gains and pay taxes on them. This also applies to tokens received through airdrops.

3. Miscellaneous Income

There are also cases where cryptocurrencies are classified as miscellaneous income. If you are a trader and engage in frequent cryptocurrency transactions, the profits or losses from these transactions are considered miscellaneous income. It is important to keep accurate records and report this income accordingly.

4. Gifts

If you receive cryptocurrencies as a gift, the value of the gift is still subject to taxation. The giver may be required to report the gift and pay any applicable taxes, while the recipient may need to declare the value of the gift as miscellaneous income.

5. Utility Tokens

Utility tokens, which are used to access a specific product or service, are not typically considered taxable assets. However, if you earn tokens through mining or other activities, the value of these tokens may be subject to taxation. It is important to consult with a tax professional to understand the specific tax implications of utility tokens.

In conclusion, the classification of cryptocurrencies for tax purposes depends on their specific use and function. Whether they are treated as currency, assets, miscellaneous income, or gifts, it is important to understand the tax implications and consult with a tax professional to ensure compliance with tax regulations and make accurate tax calculations.

Tax Relief for Capital Losses on Cryptoasset Sales

When it comes to cryptoassets, tax implications are a significant concern for individuals involved in activities such as mining, trading, or investing in cryptocurrencies. One aspect that individuals need to be aware of is the tax relief that is available for capital losses on cryptoasset sales.

Capital losses can occur when you sell your cryptoassets at a lower price than what you initially paid for them. These losses can be offset against any capital gains you may have made from other investments, thereby reducing your overall tax liability.

If you have made a capital loss on the sale of your cryptoassets, it is essential to understand the tax guidelines provided by your national revenue service. By following these guidelines, you can calculate your capital gains and losses accurately and report them correctly on your tax return.

Keep in mind that the treatment of capital losses on cryptoassets may differ from other financial products. It is crucial to maintain proper records of all your cryptoasset transactions, including the cost of acquisition and the disposal proceeds.

One key benefit of capital losses is that they can help you recover some of the costs associated with your cryptoasset investments. By offsetting these losses against any capital gains, you can lower your overall tax liability.

However, it is important to note that tax relief for capital losses on cryptoasset sales is not available for all individuals. It usually applies only to individuals who engage in cryptoasset activities as a self-employed or professional trader. Individuals who hold cryptoassets as a personal investment or use them for personal purposes, such as sending gifts or making payments, may not be able to claim this tax relief.

Before taking any tax deductions or claiming tax relief for capital losses on cryptoasset sales, it is advisable to consult a qualified tax professional who can provide guidance based on your specific circumstances. They can help you understand the tax implications and ensure that you comply with all the necessary reporting requirements.

In summary, capital losses on cryptoasset sales can provide tax relief by offsetting them against capital gains. However, this tax relief is subject to guidelines and may not be available for all individuals. Proper record-keeping and accurate calculations are essential to properly report your capital gains and losses on your tax return.

Requirements for Claiming Tax Relief on Cryptoasset Losses

When it comes to cryptoassets, it’s important to understand the requirements for claiming tax relief on any losses you may have. Unlike fiat currency or stocks, cryptocurrencies are highly volatile and can be subject to significant price fluctuations. This means that you may have earned a substantial amount on your investments, but also risk losing a considerable portion of your investment.

If you find yourself in a situation where you have lost money on your cryptoassets, you may be able to claim tax relief. However, there are certain conditions that must be met in order to qualify for this relief. First and foremost, you need to be earning income in the UK and be subject to UK tax laws. This means that if you’re not a UK resident or you don’t have any UK earnings, you won’t be eligible for tax relief on your losses.

Furthermore, you can only claim tax relief on losses that have been realized. This means that if you’re still holding onto your cryptoassets and their value has decreased, you won’t be able to claim relief until you dispose of them. Additionally, you need to keep detailed records of your transactions, including the date and price at which you acquired and disposed of your cryptoassets.

It’s also important to be aware that tax relief on cryptoasset losses is not means-tested. This means that no matter how much you earned or lost, you can still claim relief if you meet the above requirements. However, it’s always a good idea to consult with a tax professional or HMRC for advice specific to your situation, as the rules and regulations surrounding cryptoassets can be complex.

Another thing to keep in mind is that tax relief on cryptoasset losses is separate from the annual tax-free allowance provided to individuals. This means that even if you’ve used up your allowance for other types of earnings or gains, you can still claim relief on your cryptoasset losses without it affecting your overall tax liability.

Overall, understanding the requirements for claiming tax relief on cryptoasset losses is crucial for anyone working with cryptocurrencies. By doing the necessary research and staying up to date with HMRC guidelines, you can ensure that you’re aware of the tax implications of your cryptoasset activity and take the necessary steps to avoid any potential tax liabilities.

Valuing Cryptoassets for Tax Purposes

When it comes to tax purposes, valuing cryptoassets can be a challenging task. This is because cryptoassets are not typically tied to a specific physical entity or backed by any central authority. In the eyes of HMRC, cryptoassets are considered to be a form of property, rather than a currency.

Receiving cryptoassets in exchange for anything other than cash can have tax implications. Each transaction is considered separate and may trigger a taxable event. For example, if you receive cryptoassets as payment for goods or services, you will need to calculate their value in order to report the appropriate amount on your tax return.

Valuing cryptoassets can be particularly difficult due to their volatile nature. The value of cryptocurrencies can fluctuate widely, sometimes on a daily basis. This means that the amount you receive in cryptoassets may not necessarily reflect their current market value.

One way to value cryptoassets is to look at the amount for which they can be sold on a crypto exchange. However, this might not be a reliable basis if there is limited market activity or if the cryptoassets in question are relatively unknown or illiquid.

Another option is to rely on the value of the cryptoassets at the time they were acquired. For example, if you purchased 1 Bitcoin in November 2020 for $10,000, you could use this as the basis for valuing any subsequent transactions involving that Bitcoin.

It’s important to be aware of the tax consequences of certain crypto events, such as airdrops or hard forks. When you receive free cryptoassets through an airdrop or as a result of a hard fork, it is generally considered as income and you will need to calculate the value for reporting purposes.

In conclusion, valuing cryptoassets for tax purposes can be a complex task. It requires a careful understanding of the rules and regulations set forth by national tax authorities. It’s important to keep detailed records of your transactions and to consult with a tax professional who is familiar with the intricacies of crypto tax. By accurately valuing your cryptoassets, you can ensure that you are meeting your tax obligations and avoiding any potential penalties.

Reporting Cryptoasset Transactions in Tax Returns

When it comes to reporting cryptoasset transactions in tax returns, there are a few important considerations to keep in mind. Whether you are trading, working, or simply using cryptoassets for personal purposes, it is crucial to understand the tax implications and fulfill your reporting obligations.

First and foremost, it’s essential to report any taxable gains or losses resulting from cryptoasset transactions. Instead of reporting the actual costs of each transaction, you can opt for a simplified approach and use the fair market value of the cryptoassets at the time of the transaction. This can be particularly useful if you have a high volume of trades and it’s challenging to keep track of the costs for each individual transaction.

For individuals who wish to report losses on their tax returns, it’s important to note that losses on cryptoassets that are considered completely worthless or stolen can be treated as a capital loss. The losses can be deducted against other taxable gains, thus potentially reducing your overall tax liability.

It’s also worth mentioning that if you receive cryptoassets as gifts or as part of a mining activity, the fair market value of these assets at the time you received them may be taxable. It’s advisable to keep records of these transactions and consult with a tax specialist to ensure accurate reporting.

Depending on the country in which you are domiciled, there may be specific guidelines and regulations regarding the taxation of cryptoassets. It’s important to stay updated on any changes to tax laws and consult with a tax professional to ensure compliance.

In summary, reporting cryptoasset transactions in tax returns can be complex but necessary to avoid potential penalties and ensure compliance. Whether you are a regular trader, a cryptoasset holder, or a miner, understanding the tax implications of these transactions is crucial. By following the relevant guidelines, keeping accurate records, and seeking expert advice when needed, you can navigate the ever-changing landscape of cryptoasset taxation with confidence.

Tax Treatment of Worthless Cryptoassets

When it comes to the tax treatment of worthless cryptoassets, the rules can vary depending on the jurisdiction. However, there are some general guidelines to consider.

In most cases, if you own cryptoassets that have become worthless, you can claim a capital loss for tax purposes. This means that you can use the loss to offset any capital gains you have made in the same tax year or in future years.

However, it is important to look at the specific guidelines provided by the tax authority in your jurisdiction. For example, HMRC in the UK provides guidance on the tax treatment of different types of cryptoassets. The treatment can vary depending on the original nature of the asset and how it was acquired.

If you are unsure about the tax treatment of your worthless cryptoassets, it is always best to consult a tax professional. They will be able to provide you with specific advice based on your individual circumstances.

It is worth noting that the tax treatment of worthless cryptoassets can be different from other types of investments. For example, while stocks or other securities that become worthless are usually treated as a capital loss, the tax treatment of cryptoassets can vary.

In April 2021, HMRC in the UK published updated guidance on the tax treatment of cryptoassets. The new guidelines provide further clarity on how to treat different types of cryptoassets for tax purposes.

When it comes to investing in cryptoassets, it is important to keep track of your transactions and understand the tax implications. By doing so, you can ensure that you are compliant with tax laws and take advantage of any tax benefits or deductions that may be available to you.

In summary, if you have lost money from worthless cryptoassets, you may be able to deduct the loss from your taxable income. However, it is important to understand the specific rules and guidelines provided by your tax authority and consult a professional if necessary.

Implications of Cryptoasset Mining for Taxes

Cryptoasset mining involves the process of using computer power to solve complex mathematical problems and validate cryptocurrency transactions. This activity has important tax implications that individuals need to be aware of.

1. Taxable income from mining

When cryptoassets are mined, they are typically considered taxable income. The value of the cryptoassets at the time of mining is included as part of the individual’s income and should be reported accordingly.

2. Determining the value of mined cryptoassets

It can be challenging to determine the exact value of mined cryptoassets at the time of mining due to their volatile nature. Individuals may need to use the fair market value at the time of acquisition or a reliable exchange rate to calculate the taxable income.

3. Reporting mining activities

It is important to report mining activities to the appropriate tax authorities. Failure to do so may result in penalties or fines. Additionally, individuals should keep track of their mining activities and the associated costs to ensure accurate reporting.

4. Deducting mining expenses

Individuals engaging in mining activities may be able to deduct certain expenses associated with mining, such as equipment and electricity costs. However, it is essential to consult with a tax professional or advisor to understand the specific guidelines and requirements.

5. Potential risks and side effects

Mining cryptoassets comes with inherent risks, such as hardware malfunctions, power outages, or theft of mining equipment. These risks can lead to financial losses, which may need to be reported for tax purposes.

6. Other tax implications

In addition to mining activities, individuals should be aware of other tax implications related to cryptoassets, such as buying, selling, or trading them. Each transaction may have tax consequences, and individuals should seek professional advice to understand their obligations.

In summary, mining cryptoassets can have significant tax implications. It is important for individuals to accurately report their mining activities, determine the taxable income, and understand the potential risks and other associated tax obligations. Consulting with a tax professional can provide valuable guidance and ensure compliance with tax regulations.

Tax Obligations for Cryptoasset Exchanges

When it comes to tax obligations for cryptoasset exchanges, there are several key factors to consider. Firstly, drops in cryptoasset value can have tax implications if you sell or exchange them. In order to avoid triggering taxable events, it is important to have a clear understanding of the rules and regulations surrounding cryptoasset taxation.

If you receive gifts of cryptoassets, you may need to unlock and potentially pay taxes on them. In some cases, even decentralized finance (DeFi) scenarios can create taxable events. Given the evolving nature of the cryptoasset landscape, it is crucial to stay informed about the latest tax regulations and obligations.

When it comes to content and service-based cryptoassets, such as those used for trade or airdrops, it is important to review the tax implications. If you make a profit from these activities, you may be subject to tax obligations. On the other hand, if you are using cryptoassets for employment or other purposes, there is typically no tax obligation unless you sell them.

Loans and selling cryptoassets also come with their own tax implications. Generally, loans are not taxable events, but selling cryptoassets is. If you have any questions or concerns regarding the tax implications of these transactions, it is recommended to consult with an accounting professional or tax advisor.

In the case of stolen or lost cryptoassets, there may still be tax obligations. If you are looking to claim theft or loss as a deduction, there are certain criteria that need to be met. It is essential to review the specific guidelines and rules in order to navigate these situations properly.

Overall, tax obligations for cryptoasset exchanges can be complex and vary based on individual circumstances. It is important to stay informed and constantly review the latest tax regulations and guidelines. If you are unsure about your specific tax obligations, it is advisable to seek professional advice and guidance.

Penalties for Non-Compliance with Cryptoasset Tax Regulations

When it comes to taxation of cryptoassets, non-compliance with the regulations can have serious consequences. The penalties for failing to comply with tax requirements can vary depending on the jurisdiction and the severity of the non-compliance.

One common penalty for non-compliance with cryptoasset tax regulations is the imposition of fines. These fines can be substantial, especially if the non-compliance is deemed to be intentional or fraudulent. In addition to fines, individuals and businesses may also face additional penalties such as interest and back taxes.

Another potential penalty for non-compliance with cryptoasset tax regulations is the loss of certain tax benefits or deductions. For example, if a taxpayer fails to report their cryptoasset transactions, they may not be able to claim any allowable losses or expenses incurred in relation to those transactions.

In some cases, non-compliance can even lead to criminal charges. If a taxpayer is found to have intentionally evaded taxes on their cryptoasset activities, they may be subject to criminal prosecution. This can result in steep fines, imprisonment, or both. Furthermore, non-compliant individuals and businesses may also face reputational damage and loss of business opportunities.

To avoid these penalties, it is crucial for individuals and businesses to understand and comply with the tax regulations surrounding cryptoassets. This includes keeping accurate records of all cryptoasset transactions and reporting them correctly on tax returns. Seeking professional advice from tax experts who specialize in cryptoassets can help ensure compliance and minimize the risk of penalties.

Consultation with Tax Professionals for Cryptoasset Tax Planning

When it comes to navigating the complexities of cryptoasset tax planning, consulting with tax professionals is essential. Tax professionals have the expertise and knowledge to provide guidance and advice tailored to your specific situation. They can help you understand the tax implications of your cryptoasset investments and make informed decisions.

Consulting with tax professionals can be particularly useful when it comes to understanding the tax treatment of different types of cryptoassets. From payments and trading to NFTs and token lending, the tax implications can vary greatly depending on the nature of the transaction. Tax professionals can help you navigate these intricacies and ensure you are in compliance with tax regulations.

One area where tax professionals can provide valuable advice is in calculating and managing your tax liabilities. They can help you identify deductible expenses, such as transaction fees and trading expenses, that can help reduce your taxable income. They can also advise on tax relief and allowances that you may be eligible for, depending on your jurisdiction.

Another important aspect that tax professionals can assist with is keeping track of your cryptoasset transactions. They can help you maintain accurate records of acquisitions, disposals, and earnings, which is crucial for tax reporting purposes. Keeping thorough records and being able to provide proof of your transactions can help protect you in case of a tax audit.

Consulting with tax professionals can also be beneficial when it comes to tax planning for the future. They can help you understand the potential tax implications of certain investments or activities, allowing you to make well-informed decisions. They can also help you consider tax-efficient strategies for managing your cryptoassets, such as utilizing tax-advantaged accounts or structuring your investments in a way that minimizes tax liabilities.

In conclusion, consulting with tax professionals is vital for effective cryptoasset tax planning. Their expertise and guidance can help you navigate the complexities of cryptoasset taxation, ensure compliance with tax regulations, and optimize your tax position. By working with tax professionals, you can gain peace of mind and confidence in your tax planning strategies.

Frequently Asked Questions:

What are the tax implications of cryptoassets?

The tax implications of cryptoassets depend on various factors such as the country’s tax laws and regulations, the type of crypto asset, and the purpose of holding or using the crypto asset. In general, cryptoassets are treated as property for tax purposes, and any profit or gain from activities involving cryptoassets is subject to taxation.

Do I have to pay taxes on mining cryptoassets?

Yes, you generally have to pay taxes on mining cryptoassets. When you mine cryptoassets, you are essentially creating new tokens, and the value of these tokens will be subject to taxation. The specific tax treatment may vary depending on your country’s tax laws and regulations, so it’s important to consult with a tax professional or accountant.

What are the tax implications of receiving airdrops?

The tax implications of receiving airdrops depend on the particular circumstances and your country’s tax laws. In general, airdrops are considered taxable events, and the value of the airdropped tokens at the time of receipt will be subject to taxation. It’s important to keep track of the value of the airdropped tokens and report it accurately on your tax return.

Are crypto payments subject to taxation?

Yes, crypto payments are generally subject to taxation. When you receive crypto as payment for goods or services, it is considered a taxable event, and the value of the crypto at the time of receipt will be subject to taxation. The specific tax treatment may vary depending on your country’s tax laws, so it’s recommended to seek guidance from a tax professional.

What are the tax requirements for cryptoassets in the United States?

In the United States, the tax requirements for cryptoassets are governed by the Internal Revenue Service (IRS). Cryptoassets are treated as property for tax purposes, and any income or gains from activities involving cryptoassets, such as mining, airdrops, or crypto payments, are subject to taxation. It’s important to report your crypto transactions accurately on your tax return and comply with the IRS guidelines.

Are there any tax exemptions or deductions for cryptoassets?

The availability of tax exemptions or deductions for cryptoassets will depend on your country’s tax laws and regulations. In some jurisdictions, there may be specific exemptions for certain types of cryptoassets or deductions for related expenses such as mining equipment or electricity costs. It’s advisable to consult with a tax professional or accountant to determine if any exemptions or deductions apply to your situation.

Video:

A Comprehensive Guide To Taxes On Cryptoassets In The UK

Cryptoassets and their taxation (UK)

Can you give more information on the specific tax implications of pooling cryptoassets? How does it differ between countries?

Pooling cryptoassets can have different tax implications depending on the country and specific circumstances. In some countries, when you pool your cryptoassets on lending platforms and receive interest or other forms of income from the pool, it may be considered as taxable income. It’s important to check the tax laws and guidelines of your jurisdiction to understand the specific implications. Keep in mind that tax regulations can vary greatly between countries, so consulting with a professional tax advisor is recommended.

I have been using cryptoassets for a while now, and I must say that the tax implications can be quite complicated. It’s crucial to stay updated on the regulations and guidelines in your country. However, the potential gains from investing in cryptoassets definitely make it worth the effort.

I totally agree with the importance of understanding the tax implications of cryptoassets. It’s crucial to know how your country treats cryptoassets for tax purposes, especially when it comes to pooling them with others or using them for purchases. Keeping track of all transactions and understanding the tax obligations is essential. Great article!

Understanding the tax implications of cryptoassets is crucial for any crypto investor. It’s essential to know how the tax authorities treat these assets, whether they are held for investment or used for utility purposes. Different countries may have different tax laws regarding cryptoassets, so stay updated to avoid any potential tax burdens.

Understanding the tax implications of cryptoassets is crucial for anyone involved in the crypto market. As a trader, I’ve learned that different countries have different tax regulations for cryptoassets. It’s important to stay informed about the tax treatment for both investment and utility purposes. Pooling cryptoassets and using them for purchases can also have tax consequences. And let’s not forget about borrowing against cryptoassets, which can lead to additional tax obligations. Stay updated and compliant to avoid any unwanted surprises!