Crypto lending has become an increasingly popular subject in recent times, attracting the attention of both borrowers and lenders. With the rise of digital currencies, it is no surprise that individuals are exploring the possibilities of leveraging their crypto assets to access loans. But how does crypto lending actually work?

Unlike traditional lending, which typically involves contacting a bank or financial institution via email or in person, crypto lending takes place on a decentralized exchange. The subject of the loan is usually cryptocurrencies, such as Bitcoin or Ethereum, which are used as collateral by the borrowers. The degree of security offered by these cryptocurrencies varies depending on their types and market value.

When borrowers pledge their crypto assets as collateral, they enter into a smart contract with the lender, agreeing to the terms and conditions of the loan. These terms include the duration of the loan, interest rates, and any other relevant rules. The promise of smart contracts is to ensure that the terms of the loan are automatically executed, without the need for a third party to oversee the transaction.

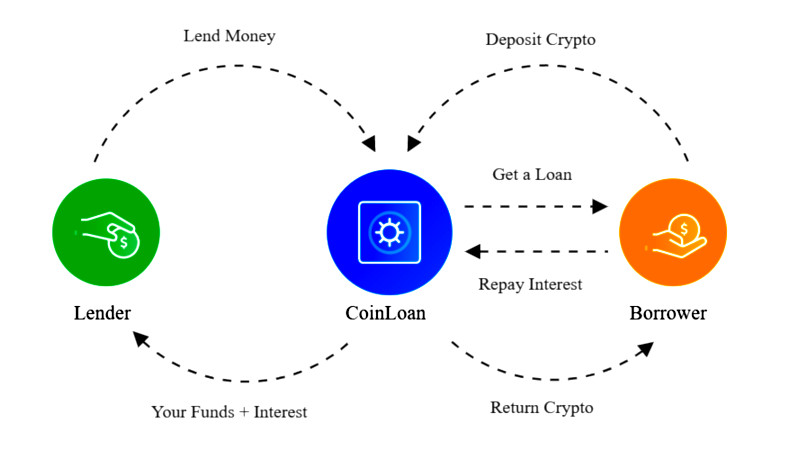

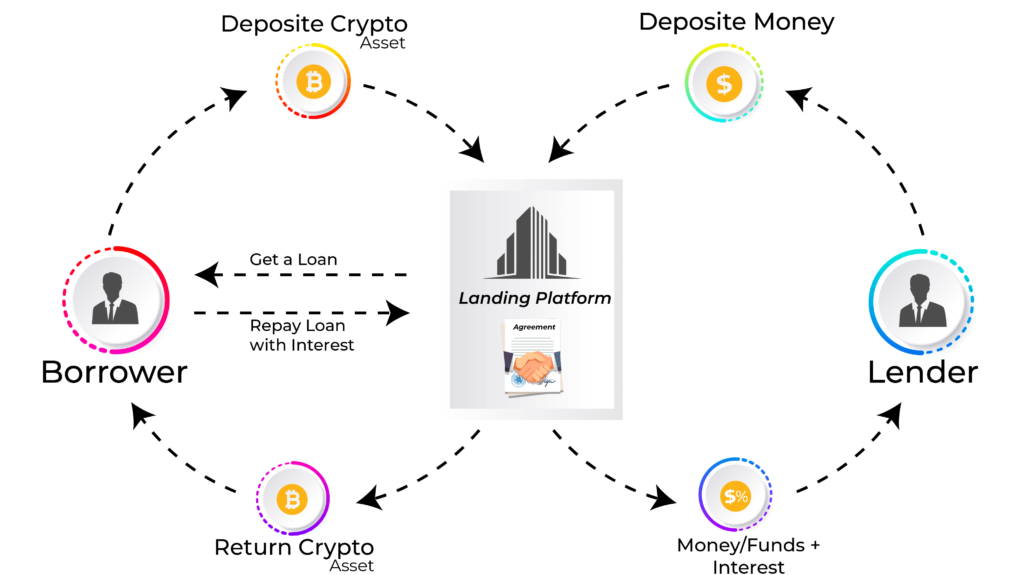

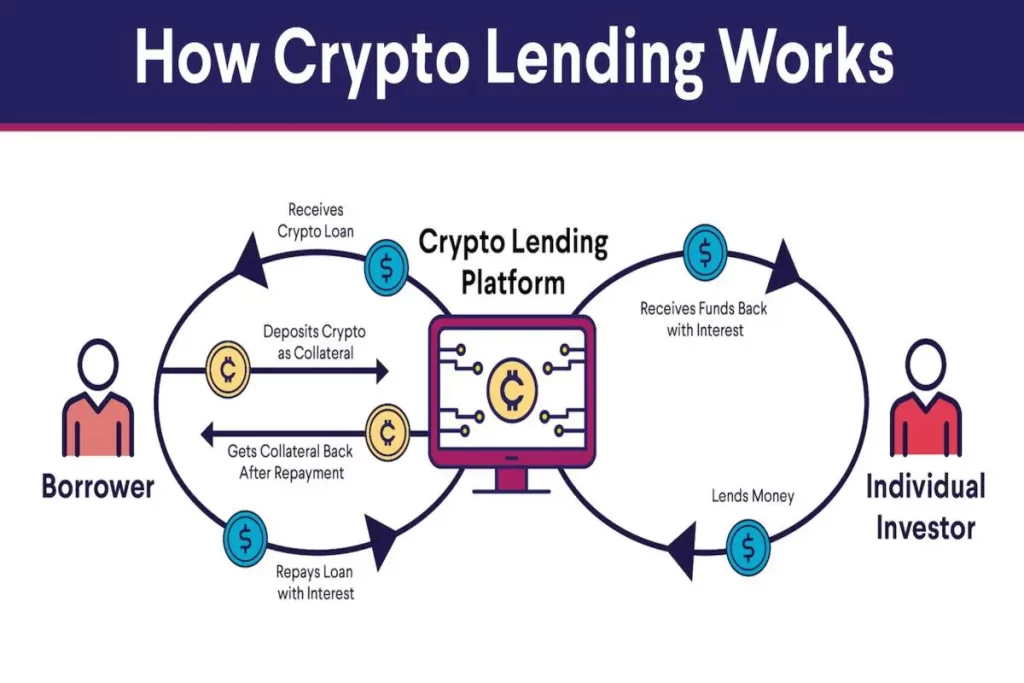

While crypto lending might sound complex, it is actually a rather straightforward process. Lenders deposit their digital currencies into a lending platform, which acts as a custodian of these assets. Borrowers, on the other hand, can apply for a loan directly through the platform, providing the necessary collateral and agreeing to the terms. Once the loan is approved, borrowers receive their loan in the form of digital currencies, which can be used for any purpose they see fit.

One key difference between traditional lending and crypto lending is the nature of the collateral. In traditional lending, borrowers typically offer tangible assets, such as real estate or vehicles, as collateral. In crypto lending, the collateral is in the form of digital currencies, which are subject to greater price volatility. This means that lenders may require a higher degree of collateral to offset the potential risks.

In conclusion, crypto lending is a relatively new concept that offers individuals the opportunity to leverage their digital assets for financial purposes. Whether you’re a lender looking to earn interest on your crypto holdings or a borrower in need of cash, crypto lending provides a flexible and accessible solution. However, as with any financial decision, it is important to do your research and understand the risks involved before participating in the crypto lending market.

Understanding Crypto Lending: A Comprehensive Guide

Before we dive into the world of crypto lending, it’s important to understand the basics of cryptocurrencies. Cryptocurrencies are digital currencies that use cryptography to secure and verify transactions. The most popular cryptocurrency is Bitcoin, but there are many other digital currencies available.

One of the key features of cryptocurrencies is their decentralization. Unlike traditional currencies that are controlled by central banks, cryptocurrencies operate on a decentralized network called the blockchain. This means that transactions are verified by a network of computers, rather than a single central authority.

So how does crypto lending work? In simple terms, crypto lending is the process of lending and borrowing cryptocurrencies. Similar to traditional lending, borrowers can use their cryptocurrencies as collateral to obtain a loan. This is known as crypto-backed lending.

There are also securities-based lending platforms that allow users to borrow against their investment portfolios. These platforms evaluate the value of the portfolio and offer loans based on a percentage of its value. This is similar to margin trading in the stock market, where investors can borrow against their securities holdings.

When you lend your cryptocurrencies, you can earn interest on your holdings. Many platforms offer fixed interest rates, which can be a way to generate passive income. However, it’s important to fully understand the risks associated with lending and borrowing cryptocurrencies, especially considering the volatility of the digital asset market.

Before you start lending or borrowing, it’s important to do your own research and assess the credibility and security of the lending platform. Look for platforms that have a proven track record, with positive reviews and a strong community of users. It’s also a good idea to read the platform’s terms and conditions, and understand how your assets will be stored and protected.

In summary, crypto lending is a way to generate passive income by lending your cryptocurrencies. It’s important to understand the risks and drawbacks associated with lending and borrowing, and to choose a reputable platform to ensure the safety of your assets.

What is Crypto Lending?

Crypto lending is a digital form of secure borrowing and lending that is done using cryptocurrencies like Bitcoin. It allows users to lend their digital assets to others in exchange for an agreed upon interest rate. This concept is gaining popularity among crypto holders and investors who want to put their assets to work and earn passive income.

Unlike traditional lending through banks, crypto lending platforms operate under different regulations and do not require the same degree of background checks and qualification process. Crypto lending platforms make it easy for users to lend and borrow cryptocurrencies without needing to share personal information or undergo extensive approval processes.

How does Crypto Lending work?

Crypto lending platforms act as intermediaries between lenders and borrowers, matching them based on their preferences and terms. Lenders deposit their crypto assets into a lending pool, and borrowers can request a loan by offering collateral, usually in the form of other cryptocurrencies. The platform then assesses the borrower’s creditworthiness and the amount of collateral provided before approving the loan.

Once a loan is approved, the borrower receives the crypto assets and is required to make regular interest payments as agreed upon. If the borrower fails to make payments, the lender has the ability to claim the collateral and sell it to recover their funds. Lenders are rewarded with interest payments for participating in the lending process.

The potential and drawbacks of Crypto Lending

Crypto lending offers several benefits, including the ability to earn passive income, diversify investment portfolios, and gain access to liquidity without needing to sell digital assets. However, there are also potential drawbacks to consider. The value of cryptocurrencies is highly volatile, and lenders and borrowers are exposed to the risk of market fluctuations. Additionally, there is limited regulation in place for crypto lending platforms, which means there may be less protection for participants in case of fraud or platform failure.

In order to assess the risks and potential rewards of crypto lending, it is important for users to carefully review the specific terms and conditions of each platform and conduct thorough research. It is recommended to start with a small amount and gradually increase exposure as users become familiar with the platform’s operations and track record. It is also advised to consult with financial professionals or seek expert advice in order to fully understand the implications and risks associated with crypto lending.

How Does Crypto Lending Work?

Crypto lending offers an alternative way for holders of digital assets to earn passive income. While there are still questions and risks associated with this emerging market, it provides an opportunity for individuals to engage in lending and borrowing activities using their cryptocurrencies.

When it comes to crypto lending, the process typically involves platforms that act as intermediaries between lenders and borrowers. These platforms help match lenders with borrowers and facilitate the contractual and legal details of the loans.

One of the key features of crypto lending is the ability to obtain loans without the need for credit checks or providing personal data. This self-executing nature of blockchain technology allows lenders to assess borrowers based on the collateral they provide, rather than traditional creditworthiness.

For borrowers, crypto lending offers access to funds without having to liquidate their digital assets. This can be an appealing option for those who want to hodl their crypto holdings while still having the ability to access liquidity.

However, it is important for users to thoroughly understand the risks and implications of crypto lending. The loan-to-value (LTV) ratio, which determines the amount a borrower can borrow relative to the value of their collateral, is one factor that needs to be carefully considered. Additionally, the volatility of the crypto market can impact the value of the collateral, potentially leading to the liquidation of the borrower’s assets.

Platforms that offer crypto lending services typically have their own set of compliance and regulatory requirements. Users must follow these guidelines to ensure legal compliance and protect their interests. It is crucial for borrowers and lenders to analyze the terms and conditions of these platforms and fully understand the risks involved before engaging in any lending or borrowing activities.

In conclusion, crypto lending provides an alternative avenue for individuals to earn passive income and access liquidity without selling their digital assets. While there are risks and uncertainties associated with this market, understanding the details and risks thoroughly can help users make informed decisions and engage in honest and satisfactory lending and borrowing experiences.

Benefits of Crypto Lending

With the rise of cryptocurrency, a new form of lending has emerged – crypto lending. This innovative lending method brings numerous benefits for both borrowers and lenders in the crypto space.

Access to Liquidity

One of the primary benefits of crypto lending is the increased access to liquidity. Crypto holders can easily borrow against their digital assets, allowing them to access much-needed funds without selling their crypto holdings.

Lower Interest Rates

Crypto lending platforms often offer lower interest rates compared to traditional financial institutions. This is due to the decentralized nature of blockchain networks and the absence of intermediaries, resulting in reduced borrowing costs and lower interest rates.

Diversification of Investment

Crypto lending provides an alternative investment opportunity for individuals looking to diversify their portfolio. By lending their crypto assets, investors can earn interest on their holdings and potentially generate additional income.

Increased Financial Inclusion

Crypto lending platforms enable individuals who may not have access to traditional banking services to participate in financial activities. This promotes financial inclusion by providing an avenue for people to borrow and lend money in a secure and efficient manner.

Transparent and Secure Transactions

Blockchain technology ensures transparent and secure transactions on crypto lending platforms. The use of smart contracts, self-executing agreements encoded on the blockchain, eliminates the need for intermediaries and reduces the risk of fraud or manipulation.

Opportunity for Staking Rewards

Some crypto lending platforms offer the opportunity for users to earn staking rewards. By lending their tokens to staking pools, users can contribute to the security and stability of the blockchain network while earning additional tokens as rewards.

Varied Loan Terms and Options

Crypto lending platforms provide borrowers with various loan terms and options to suit their needs. Whether it’s short-term loans for liquidity needs or long-term loans for investment purposes, borrowers can find flexible loan options to meet their specific requirements.

Confidence in Asset Safety

Crypto lending platforms often have robust security measures in place to protect users’ assets. With advanced encryption techniques and multi-signature wallets, these platforms ensure the safety of borrowers’ collateralized assets.

Healthy Market Competition

The growth of the crypto lending industry has led to healthy market competition, resulting in better loan terms and rates for borrowers. This benefits borrowers as they can choose from various platforms offering competitive rates and terms.

In conclusion, crypto lending offers numerous benefits to both borrowers and lenders in terms of access to liquidity, lower interest rates, diversification of investment, increased financial inclusion, transparent and secure transactions, staking rewards, varied loan terms and options, confidence in asset safety, and healthy market competition. As the crypto lending space continues to evolve, it provides an exciting alternative for individuals looking to leverage their digital assets.

Risks of Crypto Lending

When engaging in crypto lending, it’s important to understand the risks involved. While it may seem similar to traditional lending, there are unique aspects to crypto lending that make it a potentially more volatile and risky venture.

One of the key risks is the volatility of the cryptocurrency asset being used as collateral. Cryptocurrencies are generally known for their price fluctuations, and if the value of the collateral drops significantly during the lending period, the lender may not be able to sell it for the agreed-upon amount to recoup their investment.

Another important risk is the lack of regulation and oversight in the crypto lending market. Compared to traditional lending, which is subject to strict regulations and oversight from financial authorities, crypto lending is still a relatively new and unregulated sector. This means that borrowers and lenders must be well-informed and rely on their own diligence to ensure they are making informed decisions.

The nature of lending in the crypto space also presents risks related to security and fraud. While there are platforms and protocols in place to connect lenders and borrowers, there is always a risk of hacking and theft. Crypto lending platforms and protocols must focus on securing their systems and implementing robust security measures to protect user funds. Additionally, borrowers should be cautious when providing personal and financial information to ensure they are dealing with trustworthy platforms and lenders.

Default risk is also a concern in crypto lending. Because cryptocurrencies are highly volatile and the market is still relatively new, there is a higher risk of default compared to traditional lending. Borrowers may find it difficult to repay the loan as agreed due to significant price fluctuations, resulting in potential loss for both the lender and the borrower.

Lastly, there is limited recourse available in case of disputes or losses. Unlike traditional lending, where borrowers and lenders can seek legal recourse through established legal frameworks, crypto lending agreements often rely on smart contracts and may not have the same legal protections. This means that in case of default or dispute, it may be challenging to recover the funds or seek legal remedy.

In conclusion, while crypto lending can be a lucrative opportunity, it is essential to understand and evaluate the risks involved. Volatility, lack of regulation, security vulnerabilities, default risk, and limited recourse are all significant drawbacks to consider. By being adequately informed and taking appropriate precautions, borrowers and lenders can mitigate these risks and make informed decisions in the crypto lending space.

Choosing a Crypto Lending Platform

When it comes to choosing a crypto lending platform, there are several factors to consider. Firstly, it’s important to understand the terms and conditions of the platform, including the available loan terms and interest rates. You should also take the time to thoroughly research the platform and ensure that it is reputable and trustworthy.

Another important factor to consider is the available collateral options. Different platforms may accept different types of collateral, so it’s important to understand what is acceptable and what isn’t. For example, some platforms may only accept popular cryptocurrencies like Bitcoin or Ethereum, while others may allow for a wider range of options.

It’s also important to consider the level of security provided by the platform. Since you’ll be transferring and storing your crypto assets on the platform, you want to ensure that it has robust security measures in place to protect your funds. Look for platforms that use secure, encrypted wallets and have implemented multi-factor authentication.

Additionally, you should assess the platform’s reputation and track record. Look for reviews and testimonials from other users to get a sense of their experiences. You may also want to consider whether the platform has professional qualifications and certifications, as this can provide added confidence in their services.

Furthermore, consider the level of customer support provided by the platform. It’s important to have access to knowledgeable and responsive support staff who can assist you with any issues or inquiries that may arise. Check if the platform offers support 24 hours a day, 7 days a week.

Lastly, consider the platform’s compensation structure. Some lending platforms may charge a fee for their services, while others may have a revenue-sharing model. Understanding the compensation structure beforehand can help you make an informed decision.

In summary, choosing a crypto lending platform requires careful consideration of various factors. From understanding the terms and available collateral options to assessing the platform’s security and reputation, it’s important to thoroughly research and compare different platforms to find the one that best suits your needs.

Top Crypto Lending Platforms

When it comes to crypto lending platforms, there are several options available to users. These platforms offer a range of features and benefits that can give users confidence in their lending activities.

1. Celsius Network

Celsius Network is a popular crypto lending platform that has the goal of making digital currencies more accessible to users. With Celsius Network, users can earn interest on their crypto holdings and also borrow against their crypto assets. The platform clearly states its interest rates and offers a borrower-centric approach.

2. Nexo

Nexo is another well-known crypto lending platform that aims to make crypto financing more attainable. The platform acts as a trustee and offers instant crypto-backed loans, allowing users to borrow against their cryptocurrency holdings. One of the important features of Nexo is its high loan-to-value ratio, which can be as high as 90% in some cases.

3. BlockFi

BlockFi is a trusted company in the crypto lending space, offering competitive interest rates on crypto loans. The platform provides crypto-backed loans, allowing users to leverage their crypto assets to secure a loan. BlockFi also has a user-friendly interface and offers a variety of loan duration options to suit different needs.

4. Aave

Aave is a decentralized lending platform that allows users to lend and borrow various cryptocurrencies. One of the unique features of Aave is its “flash loans” that enable users to borrow large amounts of crypto without collateral, as long as the borrowed amount is returned within a single transaction. Aave also offers attractive interest rates for lenders.

5. Cred

Cred is a crypto lending platform that offers a wide range of lending and borrowing options. Users can earn interest on their crypto holdings or take out crypto-backed loans. Cred also provides a unique feature called “CredEarn” that allows users to earn interest in stablecoins, which can be beneficial during market drops or limited liquidity.

In conclusion, understanding the top crypto lending platforms and their implications can help users make smarter decisions when it comes to lending and borrowing digital currencies. With the benefits and flexibility offered by these platforms, more users are looking to educate themselves and create a steady income stream from their cryptocurrency holdings.

How to Get Started with Crypto Lending

Getting started with crypto lending is a relatively straightforward process. To begin, you will need to open a cryptocurrency wallet where you can store your crypto-assets. There are many different wallet options available, ranging from online wallets to hardware wallets. It’s important to choose a wallet that works well for your needs and offers the necessary security features.

Once you have a wallet, you can start by depositing your crypto-assets into the wallet. These assets will then be put into circulation, where they can be borrowed by other individuals or institutions. As a lender, you will receive interest payments on your crypto-assets, which can be an attractive source of passive income.

Before you can start lending, you’ll need to find a platform that offers crypto lending services. There are a variety of platforms available, each with its own set of features and benefits. It’s important to do your research and choose a platform that is reputable and reliable.

Once you’ve found a platform, you can create an account and deposit your crypto-assets. From there, you can start taking out loans or lend your crypto-assets to other users. The terms of the loans will be set by the platform and will vary depending on factors like the amount borrowed and the duration of the loan.

A key consideration when getting started with crypto lending is the risk involved. While crypto lending can be a lucrative investment opportunity, it also comes with risks. It’s important to carefully assess the terms of any loan agreement and understand the potential risks involved.

Overall, getting started with crypto lending can be a profitable and exciting venture for those looking to make the most of their cryptocurrency assets. With the right platform and careful decision-making, you can leverage your crypto-assets to generate income and participate in the growing crypto lending industry.

Factors to Consider Before Participating in Crypto Lending

Before engaging in crypto lending, there are several factors that borrowers and lenders should carefully consider:

1. History and Compliance:

It is essential to see the history and compliance record of potential borrowers and lenders. Understanding their track record, including any legal enforcement actions, can provide valuable insights into their credibility and reliability.

2. Accounts and Assets:

Both borrowers and lenders should consider the type and amount of crypto assets involved. Borrowers should strive to understand the details of their accounts and asset holdings, while lenders need to ensure that the collateral they are granting is of sufficient value.

3. Interest Rates and Options:

Borrowers should carefully review the interest rates and options offered by lenders. Different lending platforms may have varying terms and conditions. Comparing the available options can help borrowers find the best rates and repayment terms.

4. Qualification and Requirements:

Borrowers need to understand the qualification criteria and requirements set by lenders. Some platforms may have restrictions or limited availability, so it’s important to determine whether you qualify before applying.

5. Security and Protection:

Given the highly volatile nature of cryptocurrencies, ensuring the security and protection of your assets is crucial. Borrowers should see what measures the lending platform has in place to protect their funds and personal information.

6. Education and Research:

Both borrowers and lenders should strive to educate themselves about the intricacies of crypto lending. Staying updated with the ever-changing crypto landscape and understanding the risks involved can help make informed decisions.

Ultimately, engaging in crypto lending can offer exciting opportunities, but it is important to thoroughly consider these factors to ensure a safe and successful experience.

Cryptocurrency Collateral

When it comes to crypto lending, one of the fundamental concepts to understand is cryptocurrency collateral. Cryptocurrency collateral refers to the digital assets that borrowers are required to provide as security to the lender in exchange for a loan. This collateral acts as a guarantee for the lender, ensuring that they have an asset to hold onto in case the borrower fails to repay the loan.

There are several advantages to using cryptocurrency collateral in the lending process. First and foremost, it allows people who may not have a traditional credit history or those with lower credit scores to obtain loans. This is because the collateral acts as a form of protection for the lender, reducing the risk involved in lending to individuals who may not have a strong financial track record.

Crypto-backed loans also offer a higher degree of privacy compared to traditional loans. Since the collateral is held in digital form, borrowers can retain a certain level of anonymity, which may be desirable for some individuals. Additionally, cryptocurrency collateral can be easily transferred, allowing for faster and more efficient loan transactions.

However, it’s important to note that using cryptocurrency as collateral does come with its risks. One of the main risks is the volatility of the crypto market. The value of cryptocurrencies can fluctuate drastically, so borrowers need to be aware that if the value of their collateral decreases significantly, they may need to provide additional assets or face the risk of their collateral being liquidated.

To ensure the integrity of the collateral and protect the interests of both the lender and borrower, it is vital to have a well-defined contract in place before entering into a crypto-loan agreement. This contract should clearly outline the terms and conditions of the loan, including the duration, interest rates, and any additional fees or penalties.

In conclusion, cryptocurrency collateral plays a crucial role in the world of crypto lending. It offers unique advantages such as increased accessibility to loans, improved privacy, and faster transactions. However, borrowers should be aware of the risks associated with using cryptocurrency as collateral and ensure they thoroughly understand the terms of the loan before entering into any agreements.

Interest Rates in Crypto Lending

Crypto lending has become increasingly popular in recent years, as more individuals are exploring the potential to earn interest on their cryptocurrency holdings. One of the most popular cryptocurrencies used in lending is Tether (USDT), a stablecoin that is often used as collateral for secured loans.

When it comes to interest rates, crypto lending works differently compared to traditional lending. Instead of relying on banks or financial institutions to provide loans, users can lend their digital assets to others and earn interest in return. The interest rates on these loans are typically higher compared to traditional banking systems, with some lenders claiming rates as high as 20% or more.

The ability to transfer digital assets quickly and securely is one of the key advantages of crypto lending. Unlike traditional lending, where the process can take days or even weeks, crypto lending platforms allow lenders to earn interest on their assets within hours. This quick turnaround time is made possible by the blockchain technology that powers cryptocurrencies, allowing for near-instantaneous transactions and settlements.

However, it’s important for potential lenders to understand that crypto lending comes with its own set of risks. As with any investment, there is always the potential for loss. The value of cryptocurrencies can be volatile, and if the value of the collateral used in a loan were to decrease significantly, it could result in a default and the loss of the lender’s funds. Additionally, the lack of regulation in the crypto lending space means that there may be a higher degree of risk compared to traditional lending.

Before taking part in crypto lending, it is advisable for lenders to thoroughly research and understand the platform they are using. This includes reviewing the platform’s policies and security measures to ensure the safety of their assets. It is also important to establish the credibility and track record of the platform, as well as the history and reputation of the borrowers. By doing your due diligence and asking the right questions, you can better protect your investment and make informed decisions when it comes to crypto lending.

Repayment Terms in Crypto Lending

When it comes to repayment terms in crypto lending, there are several factors to consider. One of the main differences between traditional lending platforms and crypto lending is the type of collateral taken to secure the loan. Instead of using physical assets like real estate or vehicles, crypto lending platforms take digital assets such as Bitcoin, Ethereum, or other cryptocurrencies as collateral.

Another important aspect is the repayment tracking. In traditional lending, borrowers often make monthly payments in cash or through a mortgage, and the lender keeps track of these payments. In crypto lending, however, the process is done through smart contracts on the blockchain. These contracts automatically track the repayment of the loan, ensuring that both the lender and borrower can see the progress and verify the payments made.

The repayment terms in crypto lending can vary depending on the platform and the type of loan. Generally, loans in the crypto lending market have shorter terms compared to traditional loans. This is because the cryptocurrency market can be volatile, and lenders prefer to minimize their risks by keeping the loan terms short. However, some platforms offer longer-term loans to provide borrowers with more flexibility.

It’s also important to note that the repayment terms in crypto lending can be affected by the market conditions. For instance, if the value of the collateral drops significantly, the borrower may be required to provide additional collateral or repay the loan in full. This is to ensure that the lender is protected in case of a major market downturn.

Overall, understanding the repayment terms in crypto lending is crucial before taking out a loan. It’s important to consider the risks and implications of borrowing against crypto-assets, as well as the rules and regulations in your jurisdiction. Additionally, it’s always a good idea to do thorough research and seek professional advice before entering into any contractual agreements in the crypto lending space.

Connect With Us

When it comes to understanding crypto lending, we focus on providing comprehensive information to help you make informed decisions. We believe that knowledge is power, and we want to empower you with the tools and resources you need to navigate the world of crypto lending.

At the bottom of this page, you’ll find links to our social media channels and contact information. We encourage you to connect with us and join the conversation. Whether you have questions, feedback, or simply want to stay updated on the latest developments in crypto lending, we welcome your input.

We understand that the security of your personal information is a top priority. That’s why we take every precaution to ensure that your data is protected and secure. We use advanced encryption technology and follow best practices to safeguard your sensitive information. You can trust that your details are in safe hands.

Because crypto lending involves the use of crypto-assets and digital money, it can be an appealing option for those looking to borrow or lend. Unlike traditional banking services, crypto lending opens up a world of possibilities and flexibility. However, it’s important to understand how these loans work and the potential drawbacks that may come with them.

One of the main benefits of crypto lending is the ability to directly interact with a smart contract that uses crypto-backed collateral. This is often seen as a more efficient and transparent process compared to traditional lending methods. Additionally, the loan-to-value ratio can be more favorable, allowing borrowers to access a larger loan amount.

Founded by John Wilkins, an industry expert with years of experience in financial services, our platform provides a straightforward and secure sign-in process. We strive to offer user-friendly and advertising-supported services that cater to the modern borrower. Our limited registration process ensures that your experience is seamless and hassle-free.

With the rise in popularity of digital currencies and securities-based lending, we recognize the need for a secure and trustworthy platform. That’s why we go above and beyond to create a place where you can trust that your digital assets are in good hands. We understand the unique legal and regulatory implications associated with crypto lending, and we take our responsibility seriously.

Whether you’re a lender looking to put your crypto assets to work or a borrower in need of quick and convenient access to credit, our platform is here to help. We offer a range of tailored solutions that cater to your specific needs. With our transparent and user-friendly interface, you can easily navigate the world of crypto lending with confidence.

So, if you’re tired of traditional banking services and want to explore the benefits of crypto lending, look no further than our platform. Join the countless others who have already discovered the advantages of borrowing and lending within the crypto ecosystem. Sign up today and take the first step towards a more innovative and efficient financial future.

Frequently Asked Questions:

What is crypto lending?

Crypto lending is a process that allows individuals to borrow or lend cryptocurrencies, usually through online platforms or services. It involves the borrowing of digital assets in exchange for collateral, and the lenders earn interest on their crypto holdings.

How does crypto lending work?

Crypto lending works by connecting borrowers and lenders through online platforms. Borrowers provide collateral in the form of cryptocurrencies, and in return, they receive a loan in a different cryptocurrency. Lenders, on the other hand, lend their cryptocurrencies to the borrowers and earn interest on their holdings.

What are the benefits of crypto lending?

Crypto lending offers several benefits, such as the ability to earn passive income from lending cryptocurrencies, diversification of investment portfolio, and the opportunity to access liquidity without selling crypto assets. It also provides an alternative for borrowers who may not have access to traditional banking services.

Are there any risks involved in crypto lending?

Yes, there are risks involved in crypto lending. The value of cryptocurrencies can be volatile, which means there is a risk of losing money if the value decreases. Additionally, there is a risk of default by borrowers, although collateral is usually provided to mitigate this risk. It’s important to carefully assess the risks before participating in crypto lending.

How do interest rates work in crypto lending?

Interest rates in crypto lending are determined by supply and demand dynamics on the lending platforms. The rates can vary depending on factors such as the amount of collateral provided, the duration of the loan, and the type of cryptocurrency being borrowed or lent. Generally, higher interest rates are offered for riskier loans.

What are some popular crypto lending platforms?

There are several popular crypto lending platforms available, including BlockFi, Celsius Network, Nexo, and Bitfinex. These platforms allow individuals to lend and borrow a variety of cryptocurrencies, providing flexible options for users.

Is crypto lending regulated?

The regulation of crypto lending varies depending on the jurisdiction. Some countries have specific regulations in place for crypto lending platforms, while others may consider them under existing financial regulations. It’s important to research and understand the regulatory environment before participating in crypto lending.

Video:

Crypto Lending Explained For Beginners | How To Earn On Kucoin

Understanding the Bitcoin Blockchain: A Comprehensive Guide

What is AAVE? (Animated) Crypto Borrowing and Lending Explained

I think crypto lending is a great way to leverage your crypto assets and access loans. It’s convenient that it takes place on a decentralized exchange and uses smart contracts for secure transactions. However, I would like more information about the risks involved.

I find crypto lending to be a fascinating concept. It’s amazing how technology has enabled individuals to leverage their crypto assets for loans. The decentralized nature of crypto lending eliminates the need for intermediaries, making it a more efficient and secure option. I’m excited to see how this industry continues to evolve.

How can I be sure that my crypto assets are safe as collateral in crypto lending?

I have been using crypto lending for a few months now and I must say, it’s a game-changer! The process is so much easier and faster compared to traditional lending. Plus, the smart contracts give me peace of mind knowing that everything will be executed as agreed. Highly recommend!

Great article! Can you explain the risks associated with crypto lending?

Wow, this article explains crypto lending so well! I’ve always been curious about it, and now I feel like I understand the process much better. It’s amazing how smart contracts eliminate the need for a middleman. Can’t wait to try it out!

Crypto lending is a fascinating concept. It’s amazing to see how technology is reshaping the lending industry. I’m definitely curious to learn more about the benefits and risks involved in crypto lending.

How secure is crypto lending compared to traditional lending methods?