If you’re looking for a way to earn passive income in the complicated world of cryptocurrencies, Ohm crypto staking might be your best bet. When you stake your Ohm tokens, you can earn rewards while also helping to secure the network.

Staking is best done when you want to make your crypto holdings work for you. By staking your Ohm tokens, you can participate in the network’s governance and increase your rewards. You can also stake other tokens, such as WETH, to earn even more.

One attractive feature of Ohm staking is the vesting period. Unlike other tokens, Ohm has a vesting period of 48 hours. This means that once you start staking, your tokens are locked in for a certain period of time, which can help make the price more stable.

Ohm staking can be done on various platforms and organizations, such as Sushiswap. This allows users to store and exchange their Ohm tokens with ease. The staking rewards offering makes it an attractive alternative for holders who want to earn passive income without the need for complicated trading strategies.

When you stake your Ohm tokens, there are a few factors to consider. One is the bonding curve, which determines the price of staking and unstaking over time. Another is the supply curve, which shows how many Ohm tokens will be minted throughout the staking period.

Overall, Ohm crypto staking offers a unique opportunity for users to earn passive income in a stable and secure manner. By staking their tokens, users can participate in the governance of the network and earn rewards while minimizing the risks associated with trading. Whether you’re a seasoned crypto investor or just starting out, Ohm staking is definitely something to consider.

What is Ohm Crypto Staking?

Ohm Crypto Staking is a feature that allows users to lend their Ohm tokens and earn passive income in return. When you lend your Ohm tokens, you commit a certain amount for a specified period, and in return, you receive rewards in the form of interest. This can be a great way to generate additional income by putting your idle tokens to work.

The Ohm protocol is based on an algorithmic stablecoin called Ohm, which is designed to maintain its price stability through a bonding curve. When the demand for Ohm tokens increases, the price goes up, and when the demand decreases, the price goes down. Staking your Ohm tokens can help maintain the stability of the protocol, as it incentivizes users to hold onto their tokens instead of selling them.

One of the key benefits of Ohm Crypto Staking is that it allows users to earn passive income without the need to actively trade or engage in complex financial transactions. You can simply lend your Ohm tokens and watch your balance grow over time. This makes it an attractive option for individuals who want to earn passive income but don’t have the time or expertise to actively manage their investments.

Additionally, Ohm Crypto Staking is also a relatively low-risk investment strategy. The Ohm protocol is backed by a reserve fund which helps mitigate the risk of losses. This fund is used to cover any potential losses in case the protocol’s stability is compromised. This provides a level of assurance for stakers that their investments are protected.

Ohm Crypto Staking is currently widely supported by various exchanges and wallets, including Trezor and CryptoWallet.com. This makes it easy for users to buy, stake, and manage their Ohm tokens securely. Whether you’re a long-term holder or a short-term trader, Ohm Crypto Staking can be a smart strategy to maximize the utility of your Ohm tokens and earn passive income.

Understanding Passive Income

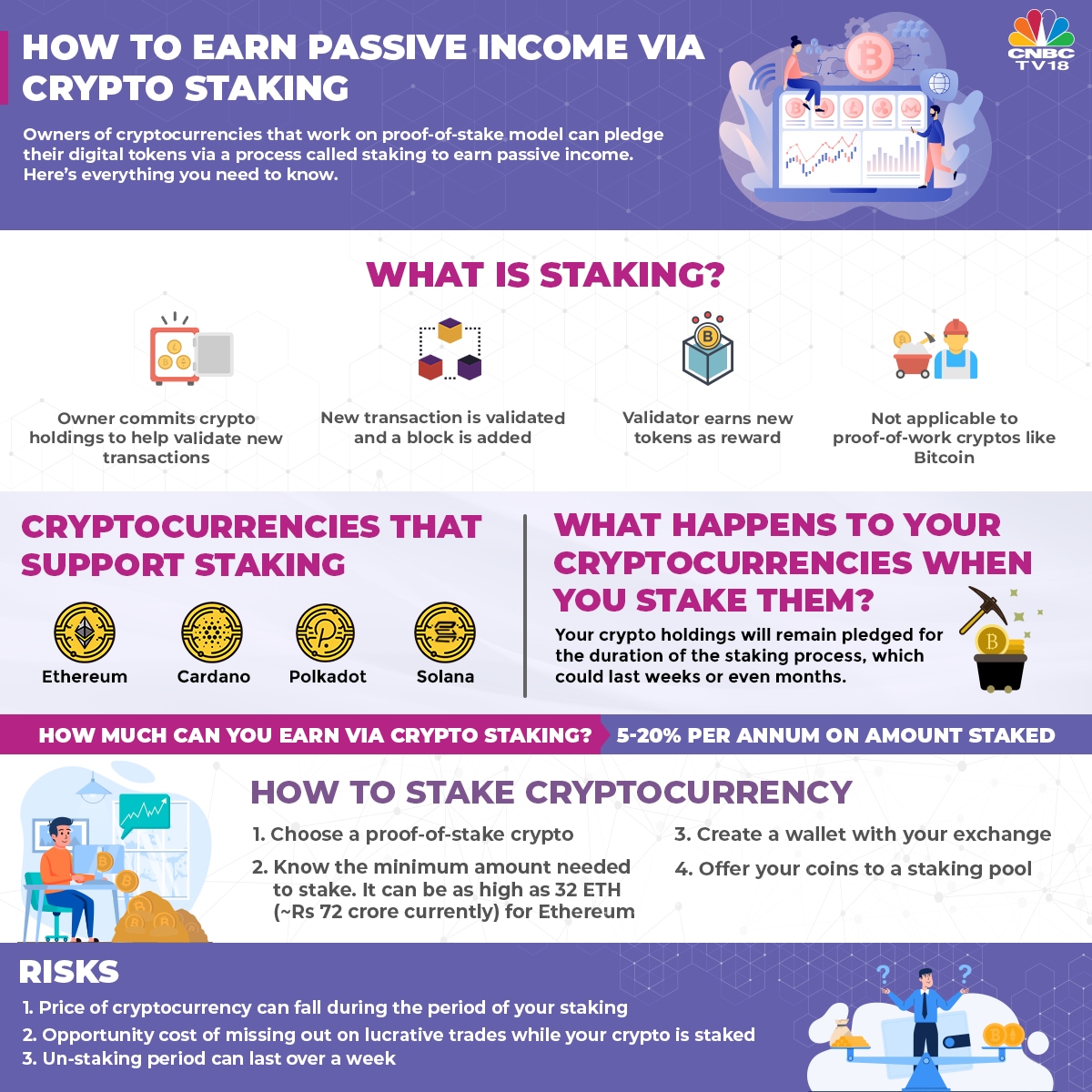

Passive income refers to the income generated with little to no effort from the individual. It is a type of income that allows individuals to earn money without actively working for it. In the world of cryptocurrency, passive income can be achieved through staking.

Staking introduces a new way for crypto holders to earn passive income by simply holding their coins in a specific place, such as a wallet or a reserve. It is similar to lending, where individuals lend their coins to others and earn interest on the lent amount. However, in staking, individuals lend their coins to the protocol rather than to other users.

Martin, the creator of Ohm cryptocurrency, currently operates one such protocol which allows holders of Ohm coins to stake their holdings and earn passive income. Stakers can choose to stake their Ohm coins on various exchanges or in their personal wallets to earn rewards.

While the staking returns may vary, Ohm offers a higher rate of return compared to other cryptocurrencies. In certain cases, stakers can earn a stable 30% annualized return or even higher in a few hours. This attractive and stable return makes Ohm staking a profitable source of passive income for holders.

One of the best features of Ohm staking is its low risk factor. The staking rewards are protocol-owned, meaning they are not owned by any individual or centralized authority. This feature ensures that holders have better documentation, transparency, and control over their investment.

How Ohm Staking Works

Ohm staking operates on a native demand curve, which adjusts the unit return based on the amount of coins staked. This unique mechanism ensures that the rewards are distributed fairly and that the staking process remains stable.

To become a staker, individuals must first acquire Ohm coins from exchanges or other users. Once they have obtained the coins, they can choose to stake them using the Ohm wallet or other compatible wallets.

The Ohm network uses a bonding mechanism, where stakers bond their coins to the protocol and earn rewards in return. The protocol-owned vault acts as a reserve, receiving the staked coins and distributing the earned rewards to the stakers. This bonding feature improves the stability and security of the Ohm network.

The Ohm protocol also allows stakers to lend their bonded coins to others. This lending feature further increases the potential earning opportunities for stakers, as they can earn additional interest on their holdings.

In conclusion, staking Ohm coins is a great way to earn passive income in the cryptocurrency world. With its high returns, low risk, and innovative features, Ohm staking provides individuals with a stable and profitable source of income.

Benefits of Ohm Crypto Staking

Ohm Crypto Staking offers several benefits for cryptocurrency holders looking to earn passive income in a secure and stable way. Here are some key advantages of Ohm Crypto Staking:

- Higher Potential Returns: By staking your Ohm tokens, you have the opportunity to earn higher rewards compared to traditional investments. This allows you to grow your wealth at a faster rate.

- Stability and Security: Ohm is designed to be a stable store of value, backed by a treasury of crypto assets. This provides stability and security, reducing the risk of losing your investment.

- Easy to Get Started: Staking Ohm tokens is a simple process that can be done through popular wallets like Metamask. You don’t need a high level of technical expertise to participate.

- Passive Income: Once you stake your Ohm tokens, you can sit back and earn passive income without actively trading or making complex investment decisions.

- Native Utility: Ohm tokens have native utility within the Ohm ecosystem. By staking, you contribute to the stability and growth of the network, making it more valuable over time.

- Risk Mitigation: Ohm Staking is a low-risk investment option compared to other volatile cryptocurrency investments. It offers a safe and secure way to earn consistent returns.

- Multiple Rewards: In addition to earning passive income from staking, Ohm Stakers also benefit from various reward mechanisms, such as rebases and dividends, enhancing their overall investment returns.

- Community Support: Ohm has an active and supportive community offering forums and social platforms where you can connect with like-minded individuals and learn from their experiences.

- Access to Exchanges: With the growing popularity of Ohm, more exchanges are listing the token, making it easier for you to buy and sell as needed.

By participating in Ohm Crypto Staking, you can achieve profitable and sustainable passive income, backed by a stable and secure ecosystem. It’s a great way to grow your wealth over time and enjoy the benefits of the Ohm network.

How Ohm Crypto Staking Works

Ohm staking is a unique opportunity for investors to earn passive income by participating in the Ohm ecosystem. When you stake your Ohm tokens, you can earn a return on your investment in the form of newly minted Ohm tokens. This process is known as crypto staking.

When you stake your Ohm tokens, you lock them up for a certain period of time, usually 7 days. During this period, your Ohm tokens will be used to back the Ohm stablecoin and contribute to the stability of the Ohm ecosystem.

The improvements in the Ohm protocol will also benefit those who stake their tokens. As the price of Ohm rises, the return offered to stakers will increase, making it even more attractive to store and stake your tokens.

During the staking period, you cannot withdraw your tokens or use them for other purposes. However, there are ways to deal with this limitation. For example, you can use Sushiswap or another decentralized exchange to trade your staked Ohm tokens for another asset, such as WETH.

One organization offering staking opportunities is the newly formed Ohm DAO, which aims to provide a higher level of governance and control over the protocol. Stakers can participate in the decision-making process and contribute to the future direction of Ohm.

Staking your Ohm tokens is also beneficial from an economic standpoint. By staking your tokens, you are helping to stabilize the Ohm ecosystem and ensure the sustainability of the protocol. This not only benefits you as a staker but also benefits the entire Ohm community.

The Ohm protocol is designed to be decentralized and secure. Your tokens are stored in your own wallet, such as Trezor, and the staking process happens on-chain. This means that your tokens are always under your control and cannot be accessed by anyone else.

In summary, Ohm crypto staking allows you to earn passive income by backing the Ohm stablecoin and contributing to the stability of the Ohm ecosystem. It offers attractive returns and the opportunity to participate in the governance of the protocol. Staking your Ohm tokens is a step towards becoming an active participant in the crypto market and earning a return on your investment.

Diversifying Your Investment with Ohm

Investing in Ohm allows you to diversify your portfolio and take advantage of the benefits it offers. Ohm is a widely owned and decentralized cryptocurrency that is backed by a basket of assets, including the dollar and other stablecoins. This diversification strategy helps to reduce risk and increase potential returns.

When you stake your Ohm tokens, you not only earn rewards for helping to secure the network but also have a say in the decision-making process. Ohm holders have voting power within the decentralized autonomous organization (DAO), allowing them to participate in governance and influence the future of the platform.

Unlike traditional staking methods, Ohm staking does not have a lock-up period. This means you can withdraw your tokens at any time, providing you with liquidity and flexibility. Additionally, staking Ohm can help to stabilize the price and increase the overall value of the token, benefiting all holders.

Benefits of Ohm Staking

- Earn passive income: By staking your Ohm tokens, you can earn a passive income in the form of rewards.

- Participate in governance: As an Ohm holder, you have a voice in the decision-making process of the DAO.

- Increase token value: Staking Ohm helps to stabilize the price and increase the value of the token.

- Flexibility: Ohm staking allows you to withdraw your tokens at any time, giving you liquidity and flexibility.

- Reduce risk: Diversifying your investment with Ohm can help reduce risk by backing the token with a basket of assets.

Whether you’re a seasoned investor or new to the world of cryptocurrency, staking Ohm is a great way to earn passive income and participate in a decentralized community. Explore the benefits of Ohm staking and start diversifying your investment today.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before making any investment decisions.

The Importance of Olympus in Ohm Crypto Staking

When it comes to Ohm crypto staking, Olympus is a significant feature that plays a crucial role in the process. In Ohm, Olympus serves as a basket of different tokens, where newly staked tokens are locked to provide a higher return for the holders.

Olympus operates unlike other networks or cryptocurrencies, as it uses a rebase feature to stabilize its price. This means that when the price of Ohm falls below the target, the protocol mints new tokens and distributes them to stakers. On the other hand, when the price is higher than the target, it reverts some of the tokens owned by the protocol.

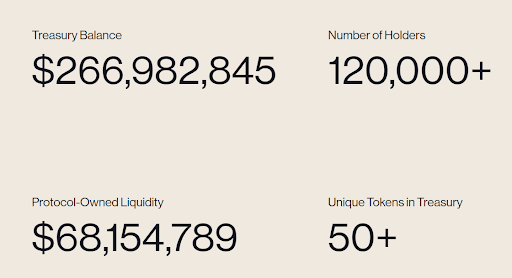

This unique mechanism ensures that the value of Ohm remains stable and provides a reliable passive income for those who stake their tokens. The OlympusDAO treasury also plays a vital role in this process by managing the funds and implementing decisions for the benefit of the network and its stakeholders.

One of the biggest advantages of Ohm crypto staking with Olympus is the ability to earn a passive income without the complexity and risks associated with trading or lending on exchanges. Staking allows users to earn a return on their tokens simply by holding them in their wallets, making it a straightforward and hassle-free investment option.

In addition to that, Ohm stakers can also participate in the bonding program, which allows them to earn even higher returns by locking their tokens for a specific period. This incentivizes long-term commitment and helps strengthen the network by increasing the amount of staked tokens.

For those interested in getting started with Ohm crypto staking, there are several exchanges where you can buy Ohm tokens, including Bitrue and SushiSwap. Once you have acquired Ohm, you can simply stake it in your wallet and start earning passive income. Just keep in mind that staking involves locking your tokens for a certain period, so make sure you are comfortable with this commitment before proceeding.

In conclusion, Olympus is a crucial component of Ohm crypto staking, providing stability and passive income opportunities for holders. With its unique rebase feature and treasury management, OlympusDAO ensures that the value of Ohm remains steady and offers an attractive investment option for those looking to earn passive income.

Case Study: Earning Passive Income with Ohm Crypto Staking

Ohm is a decentralized digital currency that operates on the Ethereum blockchain. It is based on an algorithmic stablecoin design and has a fixed supply of 333,333 OHM tokens.

Staking Ohm tokens is a great way to earn passive income. Stakers can lock their tokens in the protocol’s Treasury Bonding system for a certain period of time and earn rewards in return. The amount of rewards one can get depends on how much Ohm they stake and for how long.

When staking Ohm, one can choose to become a Treasury Bond staker or an Ohm LP staker on SushiSwap. As a Treasury Bond staker, one lends their Ohm tokens to the protocol to earn interest. The economic value of these lent tokens is used to help stabilize the Ohm price and expand the protocol.

In the case of Ohm LP staking, stakers provide liquidity to the Ohm/wETH pair on SushiSwap. They receive LP tokens in return, which can be staked to earn more Ohm. This is a more complex strategy that requires a dedicated understanding of liquidity pools and bonding curves.

By staking their Ohm tokens in either of these options, users can earn passive income while helping the Ohm ecosystem grow. The staked tokens are held securely and can be redeemed after a certain period of time, which can range from a few days to several months.

Currently, the Ohm protocol offers an APY of 265,518,791% for Treasury Bond staking and 669% for Ohm LP staking. These rates can vary over time depending on the market conditions and the demand for Ohm tokens.

Stakers are incentivized with higher rewards during the bootstrap phase of the protocol to attract more participants and create a strong foundation for the ecosystem. This is done by distributing newly minted Ohm tokens to the stakers.

In case of social or economic emergencies, the protocol has a Treasury that can be used to provide stability and support. This Treasury is filled with Ohm tokens that are minted by the protocol and can be used to buy back Ohm from the market or provide incentives to stakers.

In conclusion, Ohm crypto staking offers a lucrative opportunity to earn passive income while contributing to the growth of a decentralized ecosystem. Whether you choose to stake your Ohm tokens in the Treasury Bonding system or become an Ohm LP staker on SushiSwap, the potential for earning rewards is significant. However, it’s important to carefully evaluate the risks and rewards associated with each staking option before making a decision.

Risks and Considerations in Ohm Crypto Staking

When it comes to Ohm crypto staking, there are several risks and considerations that potential investors need to be aware of. One of the main risks is the backing of the Ohm tokens, as they are not currently backed by any physical or tangible assets. Instead, their value is determined by the market and the demand for them.

Another consideration is the period of time for which you are staking your Ohm tokens. Staking can be a long-term commitment, and you may not have access to your tokens for an extended period of time. It’s important to consider this before deciding to stake your cryptocurrency.

One attractive feature of Ohm crypto staking is the ability to earn passive income while holding your tokens. However, it’s important to note that this income is not guaranteed and can fluctuate depending on various factors, such as changes in the price of Ohm tokens or the performance of the protocol.

Unlike some other forms of staking, Ohm crypto staking does not require you to lock up a specific amount of tokens. Instead, you can stake any amount you choose, making it a more flexible option for investors. However, this also means that the potential rewards may be lower compared to protocols that require a higher minimum amount of staked tokens.

One consideration is the centralized nature of Ohm crypto staking. The protocol is currently controlled by a centralized treasury, which holds a basket of assets. This centralized control raises concerns about the security and stability of the protocol.

In addition, the protocol uses a rebasing mechanism, which can lead to complicated economic dynamics. The rebase adjusts the supply of Ohm tokens every day based on the market price, which can result in significant changes in the token’s value. This can make it difficult to predict the future profitability of staking Ohm tokens.

Furthermore, staking Ohm tokens involves a certain level of speculation, as their value is driven by market demand and the performance of the protocol. This means that there is a risk of losing money if the price of Ohm tokens decreases.

In summary, Ohm crypto staking offers the opportunity for passive income, but it also comes with risks and considerations. It is important to carefully assess these factors and consider your own investment goals and risk tolerance before participating in Ohm crypto staking.

Tips for Maximizing Your Ohm Crypto Staking Rewards

If you are a cryptocurrency enthusiast looking to earn passive income, Ohm Crypto Staking is a protocol that offers a great opportunity. By staking your Ohm tokens, you can generate rewards and contribute to the governance and growth of the OlympusDAO network. Follow these tips to maximize your staking rewards:

1. Set up a Metamask Wallet

To start staking Ohm tokens, you will need a Metamask wallet. Metamask is a popular cryptocurrency wallet that allows you to securely store and manage your Ohm tokens.

2. Calculate Your Total Staking Rewards

Before staking, use the Ohm Crypto Staking rewards calculator on the OlympusDAO website. This calculator will help you estimate your potential earnings based on factors such as the amount of Ohm tokens you plan to stake and the duration of your stake.

3. Stay Updated on Protocol Changes

The OlympusDAO protocol is continuously evolving. Stay informed about any updates or changes by following official OlympusDAO channels and the community. By staying up to date, you can ensure that you are making the most of your staking rewards.

4. Diversify Your Staking Portfolio

Consider diversifying your staking portfolio by staking your Ohm tokens on multiple networks. Many cryptocurrencies offer staking utilities, and by spreading your stake, you can potentially earn more rewards.

5. Take Advantage of Ohm’s Price Rebase

Ohm tokens harness the power of an algorithmic stablecoin reserve. During periods of high demand, Ohm’s price can increase, leading to increased staking rewards. Keep an eye on Ohm’s price and consider adjusting your stake accordingly to maximize your earnings.

6. Contribute to the OlympusDAO Treasury

If you want to earn even more rewards, consider becoming a dedicated OlympusDAO community member. You can contribute to the OlympusDAO treasury by providing services or proposing improvements. By actively participating, you can earn additional rewards beyond regular staking.

By following these tips, you can maximize your Ohm Crypto Staking rewards and make the most out of your investment. Explore the OlympusDAO website and community to learn more and get started today!

Frequently Asked Questions:

What is Ohm crypto staking?

Ohm crypto staking refers to the process of holding and locking Ohm tokens in a wallet to participate in the OlympusDAO ecosystem. By staking Ohm, holders are able to earn rewards in the form of additional Ohm tokens.

How can I earn passive income through Ohm crypto staking?

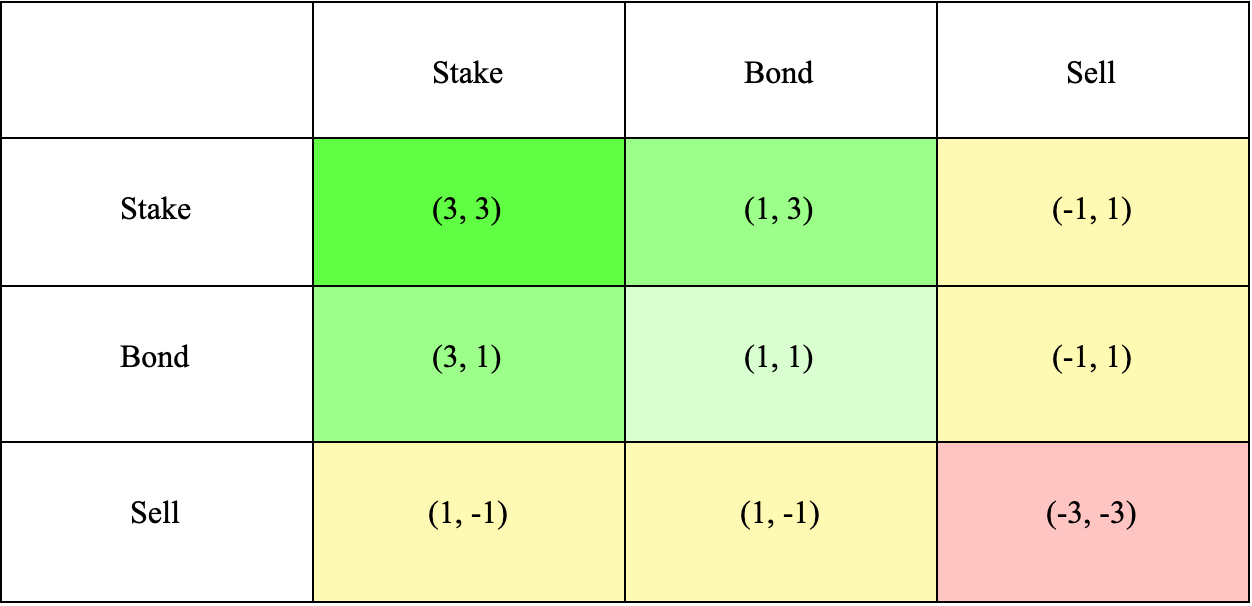

By staking Ohm tokens, you can earn passive income through two main mechanisms: bonding and seigniorage. Bonding involves locking your Ohm tokens to mint a synthetic asset called OHM-D, which earns you OHM-D rewards. Seigniorage involves minting new Ohm tokens when the protocol is above its target price, generating income for stakers.

What is the use case of the governance token for OlympusDAO?

The governance token for OlympusDAO, called OHM, allows holders to participate in the decision-making process for the protocol. OHM holders can vote on proposals, contribute to shaping the future of OlympusDAO, and play a role in system upgrades, feature implementations, and other governance-related decisions.

Can I stake other cryptocurrencies besides Ohm?

No, currently only Ohm tokens can be staked in the OlympusDAO ecosystem. The staking mechanism is specifically designed for Ohm as it is the native token of the protocol.

Are there any risks involved in Ohm crypto staking?

While Ohm crypto staking can be a lucrative opportunity, it’s important to be aware of the risks involved. The value of Ohm tokens can fluctuate, potentially resulting in a loss of investment. Additionally, there may be risks associated with the underlying smart contracts and protocol vulnerabilities. It is crucial to do thorough research and understand the risks before engaging in Ohm staking.

What is the minimum amount of Ohm tokens required for staking?

There is no specific minimum amount of Ohm tokens required for staking. You can stake any amount of Ohm, regardless of its quantity. However, it’s worth noting that the amount you stake will determine the rewards you earn proportionally.

How can I stake Ohm tokens?

To stake Ohm tokens, you will need to connect your wallet to the OlympusDAO platform and navigate to the staking section. From there, you can select the amount of Ohm tokens you want to stake and initiate the staking process. Make sure you follow the instructions provided by the platform and confirm the transaction through your wallet.

Video:

Olympus DAO: 4,000%+ APY Real? | Staking $OHM Explained| Become a Passive Income Icon

Ω OHM Conversation with @TacticalInvesting – What is 4,4 and 9,9? How Olympus DAO Game Theory Works

OHM Staking and Bonding: When and Why

I’ve been staking my Ohm tokens for a while now, and it’s been a great way to earn passive income. The vesting period of 48 hours adds a level of stability to the price, which is definitely a plus. Plus, I love that I can participate in the network’s governance and earn rewards at the same time. Ohm crypto staking is definitely worth considering!

Does Ohm crypto staking have any minimum requirements or can anyone participate?

Yes, anyone can participate in Ohm crypto staking! There are no minimum requirements to get started. You can stake any amount of Ohm tokens that you have and start earning rewards. It’s a great opportunity to generate passive income in the world of cryptocurrencies.

I recently started staking my Ohm tokens and I have to say, it’s been a great way to earn passive income. The vesting period of 48 hours provides stability to the price and the rewards are quite attractive. I highly recommend Ohm crypto staking!

Can you explain more about the bonding curve and how it affects the price of staking and unstaking over time?

Ohm crypto staking is an excellent opportunity for investors to earn passive income. By staking my Ohm tokens, I can secure the network while also enjoying rewards. The vesting period of 48 hours adds stability to the price, making it a reliable investment option. I highly recommend Ohm staking for anyone looking to make their crypto holdings work for them.