Looking for the best crypto loan sites in 2022? Look no further! We’ve gathered a list of the top platforms that offer crypto loans, so you can compare and find the one that suits your needs. Whether you’re a seasoned crypto investor or just getting started, these platforms have something for everyone.

One of the leading platforms in the space is Voltswap. With Voltswap, you can quickly and easily get a loan using your crypto assets as collateral. The platform offers a wide range of loan options and allows you to keep your assets safe and secure. With Voltswap, you can access funds in just minutes, making it a convenient solution for those in need of quick cash.

Another top player in the crypto loan sector is Cedefi. Cedefi provides a cloud-based platform that allows users to borrow and lend cryptocurrencies. With Cedefi, you can easily borrow funds using your digital assets as collateral and earn interest on your borrowed funds. The platform offers a wide range of borrowing and lending tools, making it a popular choice among crypto enthusiasts.

Zerion is also a leading platform in the crypto loan space. Zerion offers a wide range of services, including borrowing, lending, and managing your crypto assets. With Zerion, you can easily create a portfolio of interest-bearing assets and access a wide range of lending and borrowing options. The platform also provides tools to help you track and analyze your investments, helping you make better financial decisions.

Hodlnaut is another platform worth mentioning. Based in Singapore, Hodlnaut offers interest-earning accounts for Bitcoin and other cryptocurrencies. With Hodlnaut, you can earn interest on your crypto holdings and start growing your wealth. The platform serves millions of users around the world and has become a trusted name in the crypto lending space.

These are just a few of the top crypto loan sites to consider in 2022. Each platform offers its own unique set of features and benefits, so it’s important to take the time to compare and choose the best one for you. Whether you’re looking to borrow funds or earn interest on your crypto assets, these platforms provide the tools and solutions you need to succeed in the crypto lending space.

Binance – The Leading Crypto Loan Provider

Binance is one of the world’s leading crypto loan providers, offering a wide range of services and features for its users. With Binance, it’s easy to start operations and get a loan using your BTC or other cryptocurrencies as collateral.

As one of the most advanced lending platforms, Binance provides a secure and decentralized way to borrow funds. The platform uses advanced encryption and decentralized finance (DeFi) protocols to ensure the safety of users’ finances.

Binance accepts a variety of assets as collateral, including BTC, USDT, and other popular cryptocurrencies. This makes it convenient for users to choose the assets they want to use as collateral and get a loan in return.

Repaying the loan on Binance is also straightforward, with multiple options available. Users can choose to repay the loan in the same asset they borrowed or in another supported cryptocurrency. This flexibility gives users more control over their repayments.

One of the unique features that sets Binance apart from other loan providers is its high-yield lending pools. Users can save their idle assets in these pools and earn interest on them while participating in the lending market. This feature allows users to passively generate income from their cryptocurrencies.

With Binance’s efficient and secure loan service, users can access funds in minutes. Whether you need capital for trading, investing, or any other purpose, Binance provides a trustworthy and user-friendly platform to meet your needs.

In summary, Binance is among the best crypto loan providers in the space, offering a wide range of assets, advanced features, and efficient loan services. Its high-yield lending pools and flexible repayment options make it a top choice for users looking to access funds while securely managing their crypto assets.

Elon Musk’s Favorite Crypto Loan Platforms

When it comes to crypto loan platforms, there are a few that have caught the attention of Elon Musk. One such platform is Zerion, which allows you to borrow money using your cryptocurrency as collateral. With Zerion, you can start borrowing in less than three minutes, thanks to their streamlined and user-friendly interface. What makes Zerion stand out is their focus on user safety and security. They use trusted encryption methods to ensure that your digital assets are protected at all times.

Another platform that Elon Musk has shown interest in is Handshake. Handshake allows you to take out a loan by using your Bitcoin portfolio as collateral. One of the key features that make Handshake popular is their flexible loan periods. You can choose to borrow for as little as 30 days or as long as 180 days, giving you the freedom to manage your loan according to your needs. With Handshake, you can also choose to repay your loan using a variety of cryptocurrencies, including Ethereum and Binance Coin.

If you’re looking for a platform that offers a wide range of services, then Bitget might be the one for you. Bitget is a crypto loan platform that also offers futures trading, spot trading, and a variety of investment options. With Bitget, you can instantly borrow against your cryptocurrency holdings, whether it’s Bitcoin, Ethereum, or any other type of digital asset. Their team is dedicated to serving millions of users worldwide, providing them with top-notch service and support.

Voyager is another platform that Elon Musk has mentioned as one of his favorites. Voyager offers a range of services, including crypto loans, that are built on the back of their cloud-based brokerage platform. With Voyager, you can start borrowing in just a few simple steps. All you need is a Voyager account, and you can start using their loan services without any hassle. Plus, Voyager offers real-time portfolio management, so you can keep track of your investments and loans at all times.

For those who prefer more traditional banking services, Binance might be the platform to consider. Binance offers a crypto loan service that is issued directly through their checking account. This means that you can borrow money using your cryptocurrency as collateral and receive the funds in your Binance checking account instantly. Binance also offers flexible repayment options and low interest rates, making it a popular choice among crypto enthusiasts.

How to Choose the Right Crypto Loan Site for You

When it comes to choosing a crypto loan site, there are several factors to consider. First, you should determine what type of loan you are looking for. Some platforms offer loans in fiat currency, while others provide loans in cryptocurrency. Consider whether you need immediate access to cash or if you’re looking for a loan with lower interest rates.

Another important factor to consider is the interest rate charged by each platform. Since interest rates can vary greatly, it’s essential to compare rates from different platforms. Look for a platform that offers competitive rates and flexible terms.

Furthermore, you should consider the security measures employed by the platform. Look for a platform that uses leading security protocols, such as two-factor authentication and encryption, to protect your funds and personal information. A platform that has been audited by third-party security firms is also a better choice.

You’ll also want to consider the platform’s reputation and track record. Look for platforms that have been in operation for a while and have a solid history of successfully managing loans and payments. Read reviews and testimonials from other users to get a sense of their experiences with the platform.

Additionally, consider the platform’s supported cryptocurrencies. If you hold a specific cryptocurrency and want to use it as collateral for a loan, make sure the platform supports that particular coin. Some platforms may only support a limited number of cryptocurrencies, while others may support a wide range of options.

Finally, consider the platform’s additional features and services. Some platforms offer tools and analytics to help you better manage your loans and investments. Others may provide services such as a mobile wallet or a platform for trading and investing in cryptocurrencies. Consider which additional features are important to you and choose a platform that offers them.

Top Crypto Loan Sites to Consider

1. CoinLoan: This platform offers loans in fiat currency and accepts a variety of cryptocurrencies as collateral. It also supports masternode coins and charges competitive interest rates.

2. Zerion: Zerion is a smart wallet platform that allows you to manage your loans and investments in one place. It offers a simple and user-friendly interface.

3. CoinRabbit: CoinRabbit offers crypto loans based on the value of your cryptocurrency holdings. It also provides weekly interest payments and supports a wide range of cryptocurrencies.

Table

Here is a table comparing the key features of these platforms:

| Platform | Supported Cryptocurrencies | Loan Type | Interest Rates | Additional Features |

|---|---|---|---|---|

| CoinLoan | Bitcoin, Ethereum, Ripple, and more | Fiat currency loans | Competitive rates | – |

| Zerion | – | – | – | Smart wallet and analytics |

| CoinRabbit | Bitcoin, Ethereum, Litecoin, and more | Value-based loans | – | Weekly interest payments |

By considering these factors and comparing different platforms, you can find the right crypto loan site that meets your specific needs and preferences. Remember to research each platform thoroughly and choose wisely to ensure a successful crypto loan experience.

The Pros and Cons of Using Crypto as Collateral

Using crypto as collateral has become increasingly popular in the financial sector, offering traders and customers a unique way to leverage their digital assets. Before jumping into this type of loan, it’s important to understand the potential pros and cons involved.

Pros:

- High Liquidity: Crypto-backed loans enable you to unlock the value of your digital assets without having to sell them. This can be particularly beneficial if you believe the value of your crypto will increase in the future.

- Fast and convenient: Unlike traditional bank loans, crypto loans can be executed instantly, allowing you to access funds right when you need them. This is especially useful if you’re in a time-sensitive situation or have urgent financial needs.

- No credit checks: Many crypto lending platforms don’t require credit checks, making it easier for individuals with poor or no credit history to secure a loan. This opens up opportunities for borrowers who may have difficulty accessing traditional financial services.

- Flexible loan terms: Crypto lending platforms often offer more flexible loan terms compared to traditional providers. You can customize your loan duration, interest rates, and repayment terms to suit your specific needs.

Cons:

- Volatility: Cryptocurrencies are known for their volatile nature, and the value of your collateral can fluctuate dramatically. If the value of your crypto falls significantly, you may be required to provide additional collateral or risk having your assets liquidated by the lender.

- High-interest rates: While crypto loans may offer more flexibility, they often come with higher interest rates compared to traditional loans. It’s important to carefully compare rates and analyze the overall cost of the loan before making a decision.

- Security concerns: While most crypto lending platforms employ security measures, there is always a risk of hacks and theft. Make sure to choose a trustworthy platform with robust security protocols to protect your assets.

- Limited loan options: Not all cryptocurrencies are accepted as collateral by lending providers. Popular coins like Bitcoin (BTC) and Ethereum (ETH) are widely accepted, but if you hold less common coins, you may have limited options.

In conclusion, using crypto as collateral can be a good option if you want to access funds quickly or leverage the value of your digital assets. However, it’s important to carefully consider the pros and cons, and choose a reliable lending platform with transparent terms and good customer reviews.

Why More People are Opting for Crypto Loans

Over the past few years, the popularity of crypto loans has been on the rise. With the increasing adoption of cryptocurrencies and the emergence of decentralized finance (DeFi) platforms, more and more people are opting to use their digital assets as collateral to secure loans. In this article, we will explore some of the reasons why crypto loans are becoming increasingly popular.

1. Accessibility and Flexibility

Unlike traditional lending institutions, crypto loan platforms like MidasInvestments, ECOS, and Current create a more inclusive and accessible lending environment. These platforms allow users to borrow and lend funds across various cryptocurrencies without the need for a credit check or extensive paperwork. This makes it easier for individuals who may not have access to traditional banking services to secure loans using their crypto assets.

2. Higher Loan Amounts

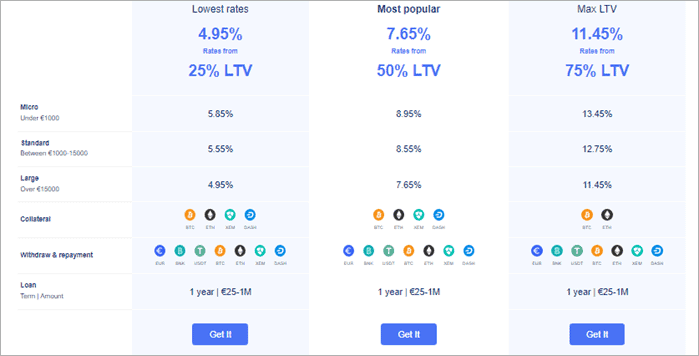

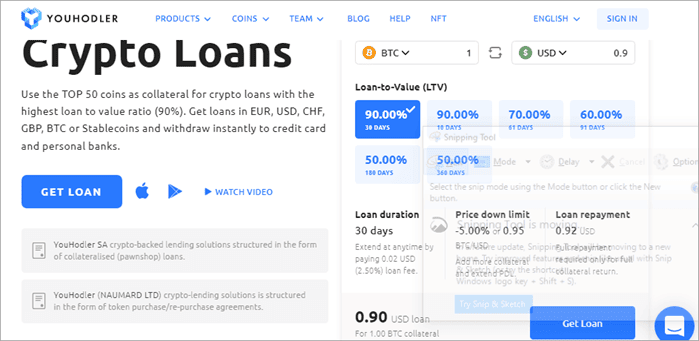

With the rise of non-fungible tokens (NFTs) and the increasing value of cryptocurrencies, borrowers can now leverage their digital assets to access higher loan amounts. Platforms like YouHodlr and 2023 Compare offer loan-to-value ratios that can go as high as 70-80% of the collateral’s value. This allows borrowers to unlock the value of their crypto holdings and access liquidity for various purposes, such as investments, purchases, or debt consolidation.

3. Lower Interest Rates

Compared to traditional lenders, crypto loan providers often offer lower interest rates. This is because they operate within the decentralized finance (DeFi) space, where interest rates are typically set algorithmically based on supply and demand. With the absence of intermediaries and the use of smart contracts, borrowers can benefit from competitive interest rates and potentially save on interest payments.

4. Fast and Efficient Process

Unlike traditional loan applications that can take days or weeks to process, crypto loans can be approved and disbursed within minutes. Platforms like Voyager, Wallet, Crypterium, and others use blockchain technology to streamline the loan application and approval process. There are no lengthy credit checks or time-consuming paperwork. This quick and efficient process appeals to individuals who need immediate access to funds without the hassle of a lengthy approval process.

5. Diverse Range of Loan Types

Crypto loan platforms offer a variety of loan types to cater to different needs and risk tolerances. Borrowers can choose from fixed-rate loans, adjustable-rate loans, and interest-only loans, among others. This flexibility allows borrowers to select the loan type that aligns with their financial goals and preferences. Additionally, some platforms also offer the option to customize loan terms, including repayment periods and loan-to-value ratios, providing borrowers with more control over their loan experience.

In conclusion, the increasing popularity of crypto loans can be attributed to their accessibility, higher loan amounts, lower interest rates, fast approval process, and diverse range of loan types. As more people recognize the benefits and advantages of borrowing against their digital assets, the demand for crypto loans is likely to continue growing in the future. It is important, however, for borrowers to carefully compare and choose trusted platforms that offer secure and reliable lending services.

Exploring the Different Interest Rates on Crypto Loans

Crypto loans have gained significant popularity in recent years, offering users the opportunity to borrow funds against their cryptocurrency holdings. One of the key factors to consider when exploring crypto loans is the interest rate charged by various platforms. Let’s take a closer look at the different interest rates offered by some of the top crypto loan sites in 2022.

1. Nexo:

Nexo, a well-known crypto lending platform, offers competitive interest rates starting at 5.9% APR. With Nexo, users can earn interest on their crypto holdings while also being able to borrow against them. This flexibility ensures that users can effectively manage their portfolios and profit from their investments.

2. SwissBorg:

SwissBorg is another platform that offers attractive interest rates on crypto loans. With rates as low as 4.5% APR, SwissBorg aims to provide users with a cost-effective solution for accessing funds while leveraging their cryptocurrency assets. The platform also offers a convenient mobile application, making it easier to manage funds on the go.

3. VoltSwap:

VoltSwap is an efficient decentralized exchange that allows users to earn passive income by providing liquidity to the market. Through their staking and farming features, users can enjoy impressive interest rates, sometimes reaching up to 100% or more on an annual basis. This allows users to maximize their earnings while actively participating in the crypto market.

4. MidasInvestments:

MidasInvestments is a platform that focuses on the DeFi sector and offers a wide range of interest rates for different types of collateral. Users can earn varying interest rates on their digital assets, depending on the risk and demand of the market. This flexibility ensures that users can stay up-to-date with the latest offerings and maximize their returns.

5. Bitrue:

Bitrue is a popular exchange that not only allows users to trade a wide variety of cryptocurrencies but also offers crypto loans. The platform charges competitive interest rates and ensures that users’ funds are securely stored with encryption and other safety measures. Additionally, Bitrue provides weekly interest payments, allowing users to see their earnings grow over time.

In conclusion, when exploring crypto loans, it’s important to consider the different interest rates offered by various platforms. Each platform has its own highlights, whether it’s the low rates offered by SwissBorg or the versatility of MidasInvestments. By comparing and choosing the best option, users can make the most of their crypto assets and grow their portfolios effectively.

How Crypto Loans are Revolutionizing the Lending Industry

The advent of cryptocurrency has brought about a new wave of innovation in the lending industry. Crypto loans provide borrowers with the ability to instantly access funds in real-time, without having to rely on traditional banking systems. This has been made possible by the emergence of trustworthy and unique platforms like Celsius that have launched their audited lending and borrowing services.

Unlike traditional banks, crypto loan platforms allow users to borrow against their cryptocurrency holdings, regardless of whether it’s Bitcoin (BTC), Ethereum (ETH), or other popular coins. They can use their digital assets as collateral, enabling them to access loans and maintain their positions in the volatile market prices. As a result, users are able to reach their financial goals without having to sell their crypto holdings, which can be a wise strategy in the long run.

These platforms offer a variety of loan options, including fixed-rate and variable-rate loans, and they provide flexible terms to suit borrowers’ needs. In addition to borrowing, users can also save their digital assets on these platforms, earning interest on their deposits. With the majority stake in the crypto lending market, platforms like CoinRabbit, Bitrue, and PointPay offer a secure and trustworthy environment for users to trade, borrow, and save.

The rise of decentralized finance (DeFi) and blockchain technology has also contributed to the revolution in the lending industry. Platforms like Cedefi leverage the power of smart contracts and the transparency of the blockchain to provide secure and efficient lending services. By utilizing DeFi protocols, borrowers and lenders alike can benefit from a decentralized system that ensures fair execution and no third-party interference.

In addition to traditional cryptocurrencies, some platforms like Bitget also offer loans in the form of NFTs (non-fungible tokens), which have gained significant popularity in recent years. This allows borrowers to access cash using their current NFT holdings, providing them with an open and flexible financing option.

As the crypto lending industry continues to evolve, it is important for borrowers and lenders to stay informed about the latest trends and platforms. Conducting thorough research and reading trustworthy reviews can help individuals make informed decisions about which platforms to use. With the right knowledge and a trustworthy crypto loan platform, borrowers can revolutionize their finances and unlock new opportunities within the crypto ecosystem.

Security Measures Taken by Top Crypto Loan Sites

When it comes to cryptocurrency, security is of utmost importance. The top crypto loan sites have implemented robust security measures to ensure the safety of user funds and personal information. Here are some of the security measures taken by the most popular crypto loan sites:

Voyager:

- Voyager has partnered with insurance providers to offer coverage for digital assets held on the platform, providing an extra layer of protection for users.

- The platform utilizes enterprise-grade encryption and multi-factor authentication to safeguard user accounts and transactions.

- The Voyager team regularly conducts security audits and penetration testing to identify and fix any vulnerabilities.

Voltswap:

- Voltswap has designed its platform with security in mind, implementing advanced security protocols to protect user funds.

- They use secure cold storage to store the majority of user assets offline, minimizing the risk of hacking or theft.

- Voltswap employs a team of experienced professionals who continuously monitor the platform for any suspicious activity or potential security threats.

MyConstant:

- MyConstant offers a secure platform with features like two-factor authentication and withdrawal white-listing to protect user accounts.

- User funds are held in separate custodial accounts, ensuring that they are safe even in the event of a breach.

- Constant employs industry-standard security measures and regularly updates its security protocols to stay ahead of potential threats.

Kucoin:

- Kucoin provides a secure platform for investors to buy, sell, and earn interest on their cryptocurrencies.

- They have implemented various security measures, including industry-leading multi-layer encryption, to ensure the safety of user funds.

- Kucoin also offers a robust risk control system that monitors user accounts and transactions for any suspicious activity.

Nexo:

- Nexo takes security seriously and has implemented a wide range of measures to protect user funds and personal information.

- User funds are stored in multi-signature wallets and insured up to $375 million, providing users with peace of mind.

- The platform follows strict anti-money laundering (AML) and know your customer (KYC) procedures to prevent fraud and identity theft.

By implementing these security measures, the top crypto loan sites ensure the safety of user assets and create a trustworthy environment for investors and borrowers alike. Whether you are looking to borrow against your crypto holdings or earn interest on your assets, these platforms provide a secure way to participate in the crypto market.

Case Studies: Successful Crypto Loan Stories

Interested in hearing success stories of individuals who have benefited from crypto loans? Look no further! Here are a few case studies highlighting the successful experiences of borrowers who have used crypto lending platforms.

Hodlnaut: Unlocking the Potential of Crypto Assets

One successful borrower, Hodlnaut, turned to a crypto lending platform to unlock the potential of their crypto assets. By using a trusted provider, Hodlnaut was able to borrow against their Bitcoin (BTC) holdings without selling them, allowing them to retain ownership and benefit from potential future price increases. This not only provided them with the capital they needed, but also allowed them to effectively manage their digital asset portfolio.

VoltSwap: Maximizing Returns with Instant Loans

VoltSwap, a decentralized finance (DeFi) platform, launched their lending service to provide borrowers with instant loans. By leveraging the Ethereum network, VoltSwap enables users to instantly borrow funds against their crypto assets. This innovative service also supports multiple chains, including Binance Smart Chain (BSC) and Avalanche, providing added flexibility and protection for borrowers.

CoinLoan: Flexible and Efficient Borrowing

CoinLoan is a trusted platform that offers flexible borrowing options for individuals looking to utilize their crypto assets. With CoinLoan, borrowers can choose from a range of available loan options, including traditional fiat currencies or stablecoins. Additionally, CoinLoan provides an efficient loan process, allowing borrowers to easily create an account, deposit their collateral, and receive their loan instantly.

SwissBorg: A Comprehensive Crypto Banking Solution

SwissBorg goes beyond just crypto loans, offering a comprehensive suite of banking services. Borrowers looking for a trustworthy provider can access a range of services, including investment options, fee management, and secure wallet solutions. With SwissBorg, borrowers can find a one-stop solution for all their crypto financial needs.

Zerion: Simplifying Crypto Portfolio Management

Zerion is a decentralized finance platform that focuses on simplifying crypto portfolio management. Borrowers using Zerion can access a user-friendly interface that provides real-time data and analytics on their holdings. This enables borrowers to make informed decisions about their portfolio, ensuring that they can efficiently manage their assets while meeting their lending requirements.

These case studies showcase the diverse range of options available in the crypto lending space and highlight how borrowers can benefit from these services. Whether you are looking to unlock the potential of your crypto assets, access instant loans, or find a comprehensive banking solution, there are trustworthy providers out there that can help you achieve your financial goals.

What the Future Holds for Crypto Loans

In the real of cryptocurrencies, where innovation is taking place at a lightning-fast pace, the future of crypto loans looks promising. As more people become familiar with the potential of digital assets, the demand for crypto loans is expected to rise.

Crypto loans bring together the best of both worlds by combining the flexibility of cryptocurrencies with the stability of traditional banking. With crypto loans, users can either borrow against their existing holdings or use their assets as collateral for trading or other financial activities. This opens up new avenues for generating income and maximizing returns.

As the crypto market continues to mature, we can expect to see multiple new features and functionalities being introduced. For example, cloud wallets could become more common, making it even easier to manage and trade various digital currencies. Additionally, new platforms may emerge that offer specialized lending and banking services tailored specifically to the needs of cryptocurrency holders.

One key trend that is expected to dominate the crypto loan market in 2023 is the rise of decentralized finance (DeFi). DeFi platforms eliminate the need for intermediaries and allow users to lend, borrow, and earn interest on their digital assets without relying on traditional banking institutions. This shift towards DeFi is driven by the desire for greater privacy, security, and control over one’s finances.

Another exciting development on the horizon is the integration of fiat currencies into the crypto loan ecosystem. This would enable users to easily convert their digital assets into traditional currencies like dollars or euros, making it easier to spend or reinvest their holdings. Such integration could also pave the way for new trading and investment opportunities in the crypto market.

In summary, the future of crypto loans looks bright. With the rapid advancement of blockchain technology and the increasing number of platforms offering crypto lending services, millions of users around the world will have access to flexible and convenient financial solutions. Whether it’s for managing investments, earning interest, or simply accessing cash when needed, crypto loans are set to revolutionize the way we think about borrowing and lending in the digital age.

Frequently Asked Questions:

How can I compare different crypto loan sites?

To compare different crypto loan sites, you can consider factors such as interest rates, loan-to-value ratio, repayment terms, fees, customer reviews, and the range of supported cryptocurrencies. It is also important to check if the platform is licensed and regulated.

What are the advantages of taking a crypto loan?

There are several advantages of taking a crypto loan. Firstly, you can access funds without selling your cryptocurrencies, allowing you to hold onto your assets and potentially benefit from future price appreciation. Additionally, crypto loans often have lower interest rates compared to traditional loans, and the approval process is usually quicker and less stringent.

Is it safe to take a loan from crypto loan sites?

When taking a loan from crypto loan sites, it is important to choose a reputable and secure platform. Look for platforms that have transparent security measures and are licensed and regulated. Additionally, make sure to do thorough research and read customer reviews before committing to a loan.

Can I get a crypto loan if I have bad credit?

Unlike traditional loans, crypto loans do not typically require a credit check. This means that even if you have bad credit or no credit history, you may still be eligible for a crypto loan. However, the loan terms and interest rates may be influenced by factors such as collateral and the loan-to-value ratio.

Which crypto loan sites support a wide range of cryptocurrencies?

There are several crypto loan sites that support a wide range of cryptocurrencies. Some popular platforms include Nexo, Celsius Network, and BlockFi. These platforms offer loans against various cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and many others, providing users with more flexibility in accessing funds.

Video:

Top 5 BEST Crypto Exchanges in 2023: Are They SAFE?!

Top 10 BEST Crypto Lending Platforms for Passive Income (2022)

Wow, Voltswap sounds like a great platform for getting a crypto loan! I love how they prioritize the safety and security of your assets. Definitely going to give it a try!

I have been using Voltswap for a few months now, and I must say it’s an excellent platform for crypto loans. The process is simple and the interest rates are reasonable. I highly recommend it!

I’ve been using Voltswap for my crypto loans and I must say, it’s been a great experience. The platform is user-friendly and the interest rates are reasonable. I feel confident knowing that my assets are secure while I have access to quick cash.

I think Voltswap is a great platform for getting crypto loans. It’s very user-friendly and I like how they prioritize security. The process is quick and easy, and I feel confident knowing my assets are safe.