When it comes to earning passive income from cryptocurrencies, staking has become an increasingly popular method. Unlike mining, which requires expensive equipment and technical expertise, staking simply means holding and locking a certain percentage of your crypto assets in a wallet, typically on a blockchain network. However, like any investment, staking crypto comes with its own set of risks that investors need to understand before jumping in.

One of the main advantages of staking crypto is the potential to earn regular rewards on your investment. This can be particularly attractive in a world of low interest rates, where traditional savings accounts offer minimal returns. Staking allows you to earn a set percentage of your holdings over time, which can add up to significant profits in the long term.

However, staking crypto also carries its fair share of risks. To start with, choosing the right crypto to stake can be a challenge. While some cryptocurrencies are well-known and have a long track record of success, others may be new and unproven. It’s important to do thorough research and only stake in projects that you believe have a long-term potential for growth.

In addition, staking crypto also means locking your funds for a specific period of time. While this can be an advantage if you have a low risk tolerance and prefer to hold your investments for the long term, it can be a disadvantage if you need quick access to your funds. If the value of the staked cryptocurrency decreases significantly, you may not be able to sell or transfer it until the staking period is over.

Furthermore, staking crypto on a decentralized blockchain network does not guarantee immunity from hacks or scams. While blockchain technology is known for its security, it is not foolproof, and hackers can still find ways to access and influence blockchain networks. It’s important to be aware of the potential risks and take necessary precautions to protect your staked assets.

Overall, staking crypto can be a lucrative way to earn passive income, but it’s essential to understand the risks involved. By doing thorough research, choosing the right cryptocurrencies to stake, and taking necessary security measures, investors can minimize the potential risks and maximize their earning potential.

The Basics of Crypto Staking

Staking has become a popular method of earning passive income in the crypto industry, allowing investors to earn rewards by holding and “staking” their cryptocurrencies. But what exactly does staking mean? And how does it work?

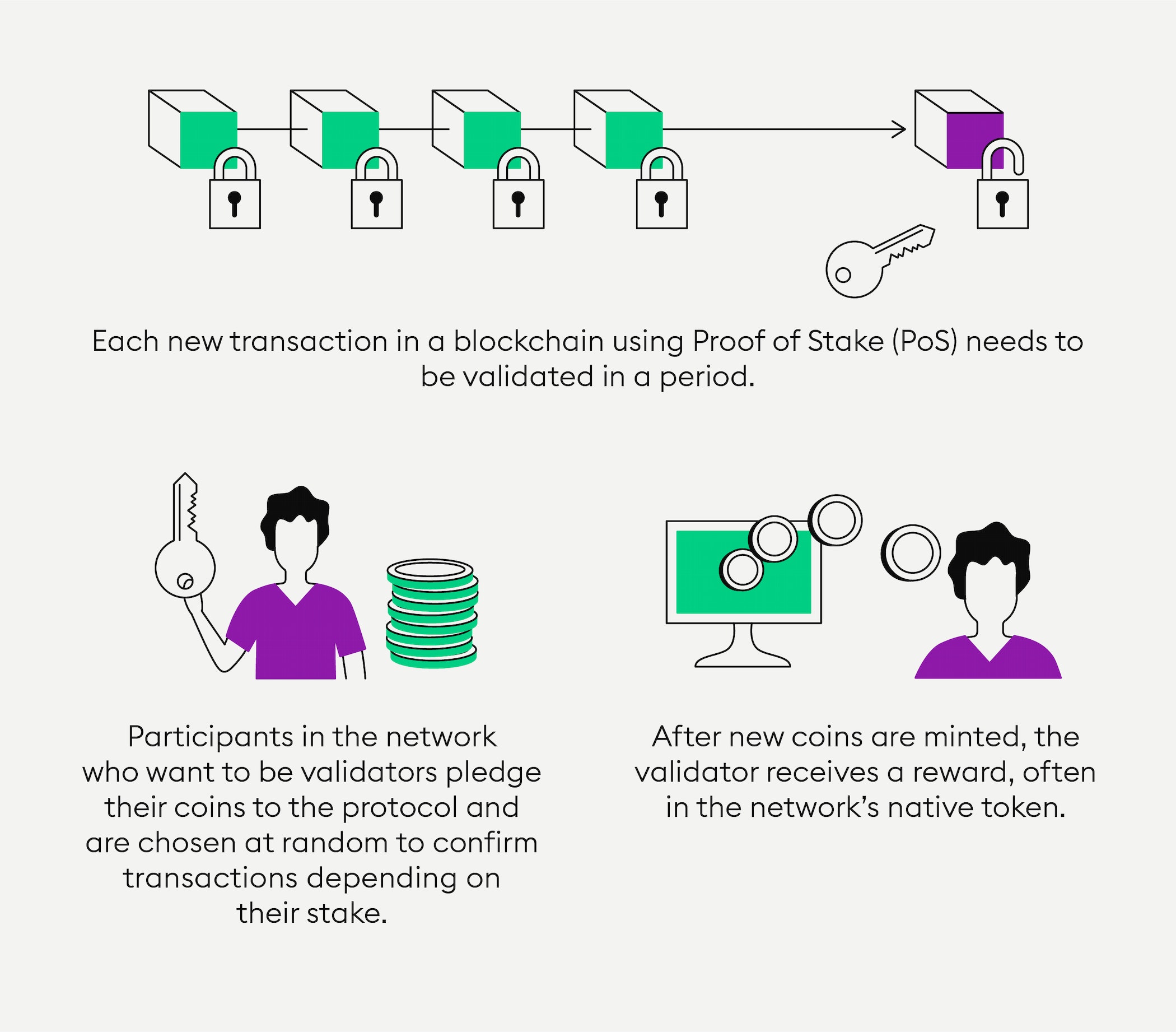

Staking is the process of participating in the Proof of Stake (PoS) consensus algorithm, which is an alternative to the more commonly known Proof of Work (PoW) algorithm used in Bitcoin mining. PoS allows holders of a particular cryptocurrency to “stake” their coins by locking them up in a wallet and supporting the network’s operations through validating transactions. In return, stakers earn rewards in the form of additional native tokens.

One of the key advantages of staking is that it doesn’t require expensive mining rigs or high computational power like PoW. Instead, it allows average investors to participate in the blockchain network’s operations and be rewarded for their contribution. However, it’s essential to note that staked cryptocurrencies are not completely risk-free, and there are several factors to consider to ensure a safe staking experience.

Choosing the right crypto for staking

When deciding which cryptocurrency to stake, it’s crucial to conduct thorough research and understand the project’s history, team, and overall vision. Some well-established projects, like Ethereum, Cardano, and Polkadot, already have staking mechanisms in place. These projects have a proven track record and are less likely to face security issues or decrease in value. On the other hand, staking newer or less-established cryptocurrencies comes with higher risks, as there may be a lack of liquidity or potential flaws in the staking process.

Centralized vs. decentralized staking

There are two main types of staking: centralized and decentralized. Centralized staking involves staking your cryptocurrencies through a trusted third-party platform or exchange. While this may be more convenient for some users, it also introduces an additional risk, as you have to trust the platform to handle your holdings securely. Decentralized staking, on the other hand, allows you to stake directly through your own wallet, giving you complete control over your funds and eliminating the risk of a third-party platform being compromised.

Understanding the risks

Staking comes with certain risks that investors should be aware of. One risk is the potential for slashing, where stakers can lose a portion of their staked coins for various reasons, such as validator misbehavior or network instability. Another risk is the volatility of the cryptocurrency market, which can cause the value of staked tokens to decrease. Additionally, there is always the possibility of encountering technical issues or security vulnerabilities.

To mitigate these risks, it’s essential to diversify your staking portfolio by investing in multiple cryptocurrencies and projects. This way, even if one project faces difficulties, your overall staking profits won’t be affected significantly. Furthermore, it’s recommended to use a hardware wallet to store your staked coins securely and regularly update your wallet’s software to stay protected against potential vulnerabilities.

Earning rewards and potential returns

One of the primary motivations for staking is the potential to earn rewards. The rewards are typically paid out in the form of additional native tokens, making it a way to increase your cryptocurrency holdings over time. The exact rewards and the Annual Percentage Yield (APY) can vary depending on the project and the number of coins staked. It’s important to research and compare different staking options to maximize your potential returns.

In conclusion, crypto staking can be a rewarding investment strategy, but it’s crucial to understand the risks involved and make informed decisions. By choosing the right cryptocurrencies, considering the staking method, and implementing proper security measures, investors can take advantage of the potential rewards while minimizing the associated risks.

Security Risks in Staking Ethereum

Staking Ethereum involves actively participating in the network by locking up a certain amount of ETH to support its operations and validate transactions. While staking can be a lucrative way to earn passive income, there are several security risks to be aware of before getting started.

1. Third-Party Risks

When staking Ethereum, users often rely on third-party platforms or services to facilitate the staking process. This introduces an additional layer of risk, as these platforms may be susceptible to hacks, scams, or other security breaches. It is crucial to thoroughly research and choose a reliable and reputable platform before entrusting them with your tokens.

2. Hacking and Loss of Funds

As with any cryptocurrency-related activity, staking Ethereum carries the risk of hacking and loss of funds. Malicious actors can exploit vulnerabilities in smart contracts, wallets, or other components of the staking process, potentially leading to the theft of your staked funds. It is essential to use secure wallets and keep your software up to date to minimize this risk.

3. Volatile Market Conditions

Ethereum’s price can fluctuate greatly, and this can have an impact on the value of your staked ETH. If the price of Ethereum drops significantly, the value of your staked funds will also decrease. It is important to consider market conditions and be prepared for potential losses before staking.

4. Smart Contract Risks

The staking process often involves interacting with smart contracts, which are vulnerable to bugs and coding errors. These vulnerabilities can be exploited by attackers, potentially resulting in the loss of staked funds. Users should be cautious and review the code of any smart contracts they use for staking.

5. Regulatory and Compliance Risks

Regulatory frameworks governing staking activities can vary by jurisdiction, and it is crucial to understand and comply with the applicable laws and regulations. Failure to do so can lead to legal consequences, fines, or loss of funds.

In conclusion, while staking Ethereum can be a potentially rewarding endeavor, it is not without its risks. It is essential to conduct thorough research, maintain proper security measures, and stay informed about the evolving regulatory landscape. By doing so, users can mitigate these risks and safely participate in the staking ecosystem.

Understanding Smart Contract Vulnerabilities

Smart contracts are an integral part of the blockchain technology that powers cryptocurrencies. These contracts are self-executing agreements written in code that automatically execute the terms of the agreement when certain conditions are met. However, smart contracts are not immune to vulnerabilities.

One of the main vulnerabilities is the potential for bugs or flaws in the code. Since smart contracts are essentially computer programs, they can have programming errors that could be exploited by malicious actors. These vulnerabilities can allow attackers to steal or manipulate the funds or assets held in the smart contract.

Another vulnerability is the risk of a successful attack on the underlying blockchain network. If the blockchain network that the smart contract is built on is compromised, it could potentially affect the smart contract and the funds or assets held within it. Understanding the security of the underlying blockchain network is crucial when using smart contracts.

Additionally, there is a risk of decentralized autonomous organizations (DAO) attacks. DAOs are organizations that are run by smart contracts and operate without any centralized control. In 2016, a high-profile DAO attack resulted in the theft of millions of dollars worth of cryptocurrency. This incident highlighted the importance of auditing and reviewing smart contracts to identify and mitigate potential vulnerabilities.

To mitigate these risks, it is important to follow best practices when using smart contracts. This includes conducting thorough code audits to identify vulnerabilities, using security tools and frameworks to enhance the security of the smart contract code, and staying updated with the latest security trends and developments in the blockchain industry.

Furthermore, diversifying your cryptocurrency holdings can also help reduce the impact of smart contract vulnerabilities. By spreading your investments across different cryptocurrencies and projects, you can minimize the risk of losing all your funds if one particular smart contract is compromised.

In conclusion, understanding smart contract vulnerabilities is crucial for investors who wish to participate in staking or other activities that involve interacting with smart contracts. By following best practices, diversifying investments, and staying informed about the latest security developments, investors can minimize their exposure to vulnerabilities and make more informed decisions about their cryptocurrency holdings.

Potential Consequences of Staking Mistakes

Staking crypto has become a popular way for investors to earn passive income in the crypto market. However, there are potential consequences and risks associated with staking that investors need to understand before participating.

One potential consequence of staking mistakes is the possibility of losing a significant portion of your investment. Staking involves locking up your crypto holdings for a certain period of time, and during this time, the value of the staked coins can fluctuate. If the price of the staked coins drops, you could end up losing a substantial amount of your initial investment.

Furthermore, staking often comes with a certain level of complexity, and there is an advanced understanding of how it works needed in order to maximize your profits and minimize losses. For instance, there are different staking models, with each model having its own set of risks and rewards. In some instances, investors may not have a clear guide on how to stake their crypto and may end up making mistakes that lead to financial losses.

Another potential consequence of staking mistakes is the risk of falling victim to malicious actors in the crypto space. Staking often requires users to transfer their coins to a staking wallet or platform, and if the wallet or platform is not secure, there is a risk of losing your funds to hackers or scammers. It is important to carefully choose a secure and reliable staking platform to mitigate this risk.

Additionally, staking involves participating in the validation process of a blockchain network, which is often centralized. This centralized nature can lead to potential risks, such as censorship or manipulation of transactions. Therefore, investors need to be aware of the potential risks associated with staking and should consider diversifying their investment portfolios to minimize the impact of any single staking mistake.

In summary, while staking can be a profitable venture in the crypto market, it is not without risks and potential consequences. Investors need to carefully assess the risks, choose secure platforms, and ensure they have a thorough understanding of how staking works to minimize the potential for financial losses.

Is Staking Crypto Worth the Risk?

Staking crypto has become increasingly popular in recent years, as more and more people look to make passive income from their digital assets. However, like any investment, staking crypto comes with its fair share of risks that investors should be aware of before jumping in.

One of the biggest risks associated with staking crypto is the potential for loss of funds. While staking can be a profitable endeavor, there is always the chance that the value of the staked tokens could decrease, resulting in a loss of investment. It is important for investors to carefully consider the potential risks and rewards of staking before deciding to participate.

Another risk to be aware of is the security of the staking platform. Not all staking platforms are created equal, and there have been instances in the past where platforms have been hacked or compromised, leading to the loss of funds. It is crucial for investors to thoroughly research and choose a reputable platform with a proven track record of security and transparency.

Additionally, investors should be aware of the risks associated with the overall volatility of the cryptocurrency market. Cryptos can be extremely volatile, with their prices fluctuating wildly in short periods of time. This can lead to significant gains, but it can also result in substantial losses. Investors should be prepared for these fluctuations and should only stake amounts they can afford to lose.

One final risk to consider is the regulatory environment. While cryptocurrencies operate in a decentralized manner, governments can still impose regulations and restrictions that can impact the staking ecosystem. It is important for investors to stay up to date on the latest regulations and to understand the potential implications for their staking activities.

Despite these risks, there are also advantages to staking crypto. Staking allows investors to earn passive income in the form of staking rewards or dividends. By participating in the network validation process, investors can contribute to the security and stability of the blockchain. Additionally, staking can be seen as a long-term investment strategy, as it incentivizes investors to hold onto their tokens instead of selling them.

Overall, staking crypto can be a rewarding endeavor if approached with caution and careful consideration. Investors should do their due diligence, choose a reputable staking platform, and diversify their portfolios to decrease the potential risks. By following these tips, enthusiasts can take advantage of the beauty of staking crypto without exposing themselves to unnecessary risks.

Minimizing Risks through Due Diligence

When it comes to staking crypto, there are ways to reduce the risks involved and protect your investments. By conducting due diligence, you can make informed decisions and minimize the chances of encountering specific risks.

One important aspect to consider is the decentralized nature of staking. Unlike centralized platforms, decentralized staking protocols offer more security and control over your funds. Therefore, it is essential to research and choose reliable decentralized platforms which support the crypto currencies you want to stake.

Another way to minimize risks is to diversify your staking portfolio. Instead of investing all your funds in a single crypto currency, you can spread them across multiple currencies. This strategy gives you the advantage of not relying on a single currency, and if one performs poorly, the others can compensate for the loss.

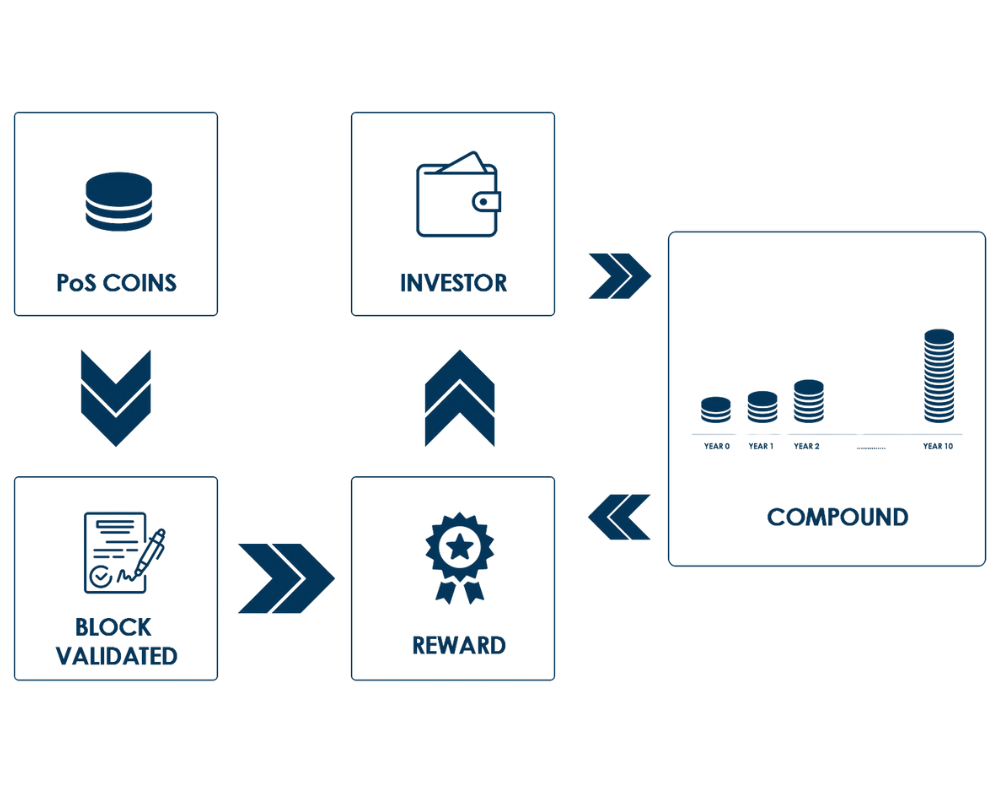

Staking also offers long-term benefits in terms of passive income and compound growth. However, it’s crucial to understand the terms and conditions of the staking process and the payout rates. Different staking options have varying lock-up periods and rewards, so it’s essential to choose the ones that align with your investment goals and risk tolerance.

Before jumping onto a staking platform, it’s important to be aware of the potential risks. Some platforms may not be as secure as others, and there have been instances of hacking and funds being stolen. Therefore, it’s necessary to research and choose platforms that have a good track record and offer robust security measures to protect your investments.

Additionally, it is essential to stay informed about the crypto market and the specific currencies you are staking. By keeping up with the latest trends and news, you can make more informed decisions about when to sell or hold your staked assets. Understanding the crypto market will also help you avoid potential scams or fraudulent projects.

Lastly, be smart about investing your staked earnings. Instead of immediately accessing and spending your rewards, consider reinvesting them back into staking or other secure investment opportunities. By reinvesting your earnings, you can potentially increase your returns and take advantage of compounding growth.

In conclusion, while staking crypto can offer significant rewards, it’s important to minimize risks through due diligence. By understanding the specific platforms and currencies you are staking, diversifying your portfolio, and staying informed, you can decrease the chances of encountering potential risks and maximize your staking experience.

How to Choose a Reliable Staking Service Provider

Staking has become a popular way for cryptocurrency holders to earn passive income by supporting and securing blockchain networks. However, choosing a reliable staking service provider is crucial to minimize risks and maximize potential profits. Here are some factors to consider when selecting a staking service provider:

1. Reputation and Support

Look for a staking service provider with a good reputation in the crypto community. Check online forums, social media, and reviews to gauge the experiences of other users. Additionally, ensure that the provider offers responsive customer support to address any concerns or issues that may arise.

2. Staking Periods and Payouts

Consider the staking periods offered by the service provider. Some providers may lock up your funds for longer periods, while others offer more flexible options. Similarly, understand the payout structure and frequency. Some providers may distribute rewards daily, while others do it monthly or quarterly. Choose a provider that aligns with your preferences and investment goals.

3. Validator Selection and Security

Examine the service provider’s process for selecting validators. Validators play a crucial role in maintaining network security and earning staking rewards. Ensure that the provider has a rigorous vetting process and offers a diverse selection of validators to mitigate the risks associated with centralization. Additionally, inquire about the security measures in place to protect your staked assets.

4. Fees and Token Support

Understand the fees charged by the staking service provider. This may include a percentage of your staked assets or other transaction fees. Compare the fees among different providers to find the most cost-effective option. Additionally, check if the provider supports the specific cryptocurrency you want to stake. Some providers may offer a limited selection, while others support a wide range of cryptocurrencies.

5. Track Record and Transparency

Look for a service provider that has a proven track record in successfully staking cryptocurrencies. Check if they publicly disclose information such as their staking infrastructure, historical performance, and team expertise. Transparency is key in building trust with the provider and ensuring that they have a solid foundation for staking operations.

By considering these factors, you can enhance your chances of selecting a reliable staking service provider and minimize the risks associated with staking crypto. Keep in mind that staking still carries certain risks, including potential losses due to market fluctuations, so it’s important to carefully assess and diversify your staking strategy. Conduct thorough research, stay updated with the latest developments, and consider seeking advice from experienced investors to make informed decisions.

Recognizing Red Flags in Staking Platforms

When considering staking platforms, it is important to be aware of certain red flags that may indicate potential risks or fraudulent activities. By recognizing these red flags, investors can protect their holdings and make informed decisions about where to stake their crypto.

1. Unrealistic Returns

If a staking platform promises extremely high returns or guarantees fixed rates, it is a major red flag. Staking returns are typically variable and depend on factors such as market conditions, the chosen cryptocurrency, and the platform’s staking model. Be cautious of platforms that promote excessively high returns as it could be a sign of a scam.

2. Lack of Transparency

If a staking platform does not provide comprehensive information about their team, their security measures, or their staking process, proceed with caution. Transparency is crucial when it comes to entrusting a platform with your crypto holdings. Look for platforms that are open about their operations and provide clear documentation of their staking protocols.

3. Unregulated Platforms

Staking platforms that are not regulated by recognized authorities pose a higher risk to investors. Regulatory oversight ensures that platforms adhere to certain standards and protocols, offering a layer of protection to users. Research the regulatory status of a staking platform before investing your crypto.

4. Poor Security Measures

Check if the staking platform has robust security measures in place to protect your funds. Look for platforms that utilize industry-standard encryption, multi-factor authentication, and cold storage for storing crypto assets. Neglecting security protocols puts your holdings at risk of theft or hacking.

5. Lack of Reputable Partnerships

Reputable staking platforms often have partnerships with well-established and respected entities in the cryptocurrency industry. Look for collaborations with reputable exchanges, wallets, or major projects, as these partnerships indicate a level of trustworthiness and legitimacy.

6. Limited or No Withdrawal Options

If a staking platform does not allow for easy withdrawal of your staked tokens or imposes excessive withdrawal fees, it may be a red flag. Ensure that the platform provides a clear withdrawal process and that you have control over your staked funds and can access them whenever needed.

In summary, when exploring staking platforms, it is important to thoroughly research and consider these red flags. Understanding the risks associated with staking crypto and being able to recognize potential warning signs will help protect your investments and ensure a safer staking experience.

Protecting Your Staked Ethereum from Hacks

In reality, staking can be a great way to earn passive income on your Ethereum holdings. However, it’s important to take precautions to protect your staked ETH from potential hacks.

Choose a Secure Wallet

When it comes to staking, choosing a secure wallet is crucial. Look for a wallet that has been well-established and has a good reputation in the crypto community. Avoid using newly launched or unknown wallets, as they may have vulnerabilities that could put your staked Ethereum at risk.

Be Aware of Long-term Risks

While staking can offer greater rewards than simply holding your Ethereum in a wallet, it’s important to be aware of the long-term risks. Staking involves locking up your ETH for a certain period of time, which means you won’t be able to access or sell it if the market takes a downturn. Consider the potential risks and make sure you’re comfortable with the idea of locking up your funds for a significant amount of time.

Diversify Your Staking

One way to decrease the risk of having your staked Ethereum hacked is by diversifying your staking across different platforms. Instead of putting all your eggs in one basket, consider spreading out your staked holdings among multiple platforms and protocols. This way, if one platform is compromised, you won’t lose all your staked ETH.

Stay Informed and Vigilant

Stay informed about the latest security practices and updates in the crypto space. Keep track of any news or reports of hacks or vulnerabilities in staking platforms. This information can help you make more informed decisions and take appropriate measures to protect your staked Ethereum.

Consider Cold Storage

Cold storage, such as using a hardware wallet, can be a secure way to store your staked Ethereum. Cold storage keeps your private keys offline, away from potential online threats. While it may be less convenient than using a hot wallet, the added security can be worth the extra effort.

Implement Multi-Factor Authentication

Adding an extra layer of security to your staking platform accounts can help protect your staked Ethereum from unauthorized access. Consider implementing multi-factor authentication, such as using a unique PIN or biometric verification, to add an extra level of security to your staking accounts.

Protecting your staked Ethereum from hacks requires diligence and a proactive approach. By following these tips and staying informed, you can decrease the likelihood of your staked ETH being stolen and ensure the safety of your investments.

Considerations for Long-Term Staking Strategies

When looking to participate in long-term staking strategies, it is important to consider a few key factors to ensure the safety and success of your investments. Here are some important considerations:

1. Understanding the Risks:

Before diving into staking cryptocurrencies, it is crucial to have a clear understanding of the risks involved. Staking is not risk-free and there is always a possibility of losing your investment. Therefore, it is important to carefully assess your risk tolerance and only allocate a portion of your portfolio that you can afford to lose.

2. Research and Due Diligence:

Before selecting a staking strategy, conduct thorough research on the blockchain platform you are interested in staking on. Consider factors such as the platform’s security, decentralized nature, and the team behind its development. Additionally, pay attention to the history and track record of the cryptocurrency you are considering staking.

3. Diversify Your Staking Portfolio:

To minimize risk and maximize potential rewards, it is advisable to hold a diversified staking portfolio. By allocating your funds across different cryptocurrencies and blockchains, you spread out the risks and decrease the impact of any one investment going south. This way, even if one project fails or underperforms, your overall portfolio can still thrive.

4. Staking Rewards and Dividends:

When staking, it’s important to understand the rewards and dividends you can expect to earn. Different cryptocurrencies and blockchain platforms may offer varying staking yields. Research the potential returns of each staking project and consider whether those rewards align with your long-term investment goals.

5. Keep Up with Market Trends:

Staying up to date with market trends and technological advancements is essential for successful long-term staking. Follow industry news, explore new staking opportunities, and keep an eye on emerging blockchain projects. This will allow you to adapt your staking strategy to capitalize on new opportunities and stay ahead of the curve.

By following these considerations, you can better navigate the world of staking and ensure a safer and more profitable long-term investment strategy.

Alternative Investment Options to Staking Ethereum

While staking Ethereum has gained popularity due to its potential for passive income, there are alternative investment options worth considering. These options offer different ways to generate profits and carry their own set of risks and benefits.

1. Trading Cryptocurrency

If you’re well-versed in the industry and have a good understanding of market trends, trading cryptocurrencies can be a potentially lucrative option. By buying low and selling high, you can make real profits, although it’s important to track the market closely to mitigate risks.

2. Investing in Proof-of-Stake (PoS) Coins

Another option is to invest in other cryptocurrencies that utilize the proof-of-stake consensus mechanism. By staking these coins, you can potentially earn rewards while maintaining a level of liquidity. However, it’s crucial to thoroughly research the project and its team to ensure its legitimacy and viability for investment.

3. Lending Crypto Assets

One more alternative is to lend your cryptocurrency assets to others in exchange for interest. This can be done through decentralized lending platforms or even peer-to-peer lending. By lending your assets, you can earn a passive income on your holdings, but be aware of the risks associated with lending, such as default risk and counterparty risk.

4. Investing in Other Cryptocurrencies

Alternatively, you can explore investing in other cryptocurrencies that have the potential for growth. This can include well-established coins like Bitcoin or lesser-known ones with promising technologies. However, keep in mind that investing in any cryptocurrency carries inherent risks, including market volatility and the possibility of losing your investment.

5. Mining Cryptocurrencies

If you have the technical knowledge and resources, mining cryptocurrencies can be an option. By dedicating your computational power, you can contribute to the blockchain network and potentially earn rewards in the form of newly minted coins. However, mining can be capital-intensive and requires regular maintenance, so be prepared for upfront costs and ongoing expenses.

6. Investing in Stablecoins

For a more stable investment option, you can consider investing in stablecoins like Tether (USDT). These cryptocurrencies are typically pegged to a fiat currency, such as the US dollar, and are designed to minimize price volatility. Investing in stablecoins can provide a relatively safe haven for your funds, although it may offer limited growth potential compared to other cryptocurrencies.

Remember, before diving into any alternative investment option, it’s important to thoroughly research and understand the associated risks and benefits. Consider factors such as the project’s team, potential market demand, and the overall credibility of the investment opportunity. By taking a holistic approach to investment, you can diversify your portfolio and potentially increase your chances of success.

Frequently Asked Questions:

What is staking crypto?

Staking crypto refers to the process of participating in the proof-of-stake consensus mechanism of a blockchain network by holding and “staking” a certain amount of the native cryptocurrency. By staking, users can earn rewards for validating transactions and securing the network.

What are the risks of staking crypto?

While staking crypto can be profitable, it also carries certain risks. One of the main risks is slashing, which occurs when a validator behaves maliciously or fails to perform its duties, resulting in a penalty or loss of funds. Other risks include network attacks, technical vulnerabilities, and market volatility.

Is staking on Binance safe?

Yes, staking on Binance is generally considered safe. Binance is one of the largest and most reputable cryptocurrency exchanges, and has implemented various security measures to protect user funds. However, it is important to note that no platform is completely immune to risks, so users should still exercise caution and conduct their own research before staking on Binance or any other platform.

How can I mitigate the risks of staking crypto?

There are several steps you can take to mitigate the risks of staking crypto. Firstly, make sure to choose a reputable and secure staking platform or exchange. It is also important to diversify your stake and not put all your eggs in one basket. Additionally, keeping your software and hardware up to date, using strong passwords, and enabling two-factor authentication can help enhance the security of your staked funds.

Can I lose money by staking crypto?

Yes, there is a possibility of losing money when staking crypto. As mentioned earlier, staking carries certain risks such as slashing, network attacks, and market volatility. If any of these risks materialize, it can result in a loss of funds. However, by being aware of the risks and taking necessary precautions, you can minimize the likelihood of financial losses.

What kind of rewards can I expect from staking crypto?

The rewards from staking crypto vary depending on the specific blockchain network and the amount of cryptocurrency being staked. In general, stakers can earn a portion of transaction fees, newly minted coins, or both. The exact rewards can differ from network to network, and it is essential to understand the staking mechanism and reward structure before participating in staking.

Is staking crypto a good investment strategy?

Whether staking crypto is a good investment strategy depends on various factors, including your financial goals, risk tolerance, and understanding of the underlying blockchain network. Staking can provide a steady income stream in the form of rewards, but it also comes with risks and uncertainties. It is important to do thorough research and consider your own circumstances before deciding whether staking crypto aligns with your investment strategy.

Video:

Cryptocurrency Staking Explained: How It ACTUALLY Works

Staking crypto is definitely a risky business. It’s crucial to choose wisely and do your research before diving in. But if you find the right project, the potential rewards can be worth it in the long run.

Personally, I believe staking crypto is a safe way to earn passive income. It allows for steady rewards without the need for expensive equipment or technical expertise. However, it’s crucial to carefully research and choose the right crypto projects to stake in, as not all of them may have long-term potential for growth.

I personally believe that staking crypto can be a safe way to earn passive income. However, it is crucial to carefully research and choose the right cryptocurrency to stake. Investing in well-established projects with a solid track record is a safer option, but it’s always a good idea to diversify and not put all your eggs in one basket. With proper precautions, the potential rewards of staking crypto outweigh the risks.

Staking crypto is a smart investment strategy. The potential rewards outweigh the risks if you choose wisely and stay informed. I have been staking for a year now and the passive income has been worth it!