In the ever-evolving world of cryptocurrencies, stackwise platforms have emerged as a game-changer for individuals and institutions looking to earn interest on their crypto holdings. These platforms allow users to lend their cryptocurrencies to borrowers and earn passive income in return.

While there are several crypto lending platforms available, it’s important to choose the right one that suits your needs and offers the best returns. This article will provide an overview of the top 11 crypto lending platforms in 2023, making it easier for you to find the perfect crypto lender.

Crypto lending platforms are gaining attention as they provide an alternative way to earn money from your cryptocurrencies. Instead of simply holding your crypto and waiting for its price to increase, these platforms allow you to request loans using your crypto holdings as collateral.

One of the top platforms in this space is stackwise, which offers bitcoin-backed loans. With stackwise, you can borrow fiat currency while still earning interest on your bitcoin holdings. This innovative feature sets stackwise apart from others and makes it a popular choice among cryptocurrency holders.

Another platform worth considering is Fuji. Fuji is a decentralized crypto lending platform that aims to protect lenders’ capital. They achieve this by offering a unique risk pooling scheme, where lenders’ funds are collectively governed and monitored by the community. This ensures that even in the case of borrower defaults or platform failures, lenders are not left with the risk.

When looking for a crypto lending platform, it’s crucial to take into account factors such as interest rate, maximum loan amount, and the overall user experience. Some popular platforms like CoinRabbit and Tender offer competitive interest rates, while others like BlockFi and Celsius have a reputation for their reliable performance.

Whether you’re a newcomer to the crypto lending space or an experienced lender, knowing the top crypto lending platforms in 2023 is essential. These platforms offer a secure and lucrative way to earn passive income from your cryptocurrency holdings while having the flexibility to borrow funds if needed.

In conclusion, finding the best crypto lending platform that suits your requirements can be a challenging task. However, by considering factors such as interest rate, security features, governance options, and reputation, you can make an informed decision and choose the platform that aligns with your financial goals.

Top 11 Crypto Lending Platforms in 2023

Looking for the best crypto lending platforms in 2023? Check out these top 11 platforms that offer a variety of services to help you earn and manage your crypto assets.

Aave

Aave is a decentralized lending platform that allows you to borrow and lend a wide variety of crypto assets. With Aave, you can take out loans and earn interest on your deposits.

Celsius

Celsius is a centralized lending platform that provides a wide range of tools and services for managing your crypto assets. They offer a loyalty program, where you can earn rewards for taking out loans and holding their native CEL token.

SpectroCoin

SpectroCoin is an official crypto lending platform that allows you to borrow against the value of your crypto assets. They support a wide range of cryptocurrencies and offer competitive loan-to-value ratios.

Babel Finance

Babel Finance is a crypto lending platform that provides loans backed by a wide range of crypto assets. They offer a multi-coin lending platform, allowing you to manage different portfolios of crypto assets.

Lending

With Lending, you can lend out your crypto assets and earn interest on your deposits. They offer a variety of lending options, including crypto-backed loans and leveraged trading.

Bitcoin Credit

Bitcoin Credit is a crypto lending platform that offers a wide range of services to help you manage your crypto assets. They provide loans backed by bitcoin and offer a variety of tools and resources to help you make smart investment decisions.

4Finance

4Finance is a centralized lending platform that offers crypto-backed loans. They provide a wide range of loan options and have a user-friendly dashboard for managing your loans.

Record

Record is a crypto lending platform that allows you to earn interest on your crypto assets. They offer a wide variety of lending options, including fixed-term loans and flexible interest rates.

Earning

Earning is a crypto lending platform that allows you to earn interest on your crypto assets. They offer a variety of lending options, including fixed-term loans and flexible interest rates.

Providers

Providers is a crypto lending platform that offers a wide range of services for managing your crypto assets. They provide a variety of loan options, including crypto-backed loans and leveraged trading.

Recommendation

When looking for a crypto lending platform, it’s important to consider factors such as the platform’s reputation, supported cryptocurrencies, availability, and interest rates. It’s also important to carefully review the terms and conditions of the platform and consider seeking professional advice before making any decisions.

Best Platforms for Crypto Lenders

When it comes to lending your cryptocurrency, there are several platforms to choose from. Whatever your goals and preferences may be, there are pros and cons to consider for each platform. Here are a few of the best platforms for crypto lenders:

1. BlockFi

BlockFi is a financial company that offers crypto-backed loans and interest-earning accounts. One of the main advantages of BlockFi is its over-collateralization, which allows you to borrow against your crypto assets at a higher loan-to-value ratio. It also offers competitive interest rates and the possibility to earn interest on your deposits.

2. Maker

Maker is a decentralized finance (DeFi) platform that allows you to borrow against your crypto assets. It operates on the Ethereum blockchain and offers a transparent and open-source system. One of the main advantages of Maker is its over-collateralization and the ability to borrow without a credit check. The platform also offers a governance token called MKR, which allows users to participate in decision-making and earn rewards.

3. CoinList

If you’re looking for a platform to lend your crypto assets, CoinList is another good choice. CoinList offers a range of services for both entrepreneurs and investors, including the ability to lend and borrow crypto. It provides access to a wide range of tokens and has a transparent and secure platform. CoinList also offers the possibility to earn interest on your deposited assets and trade within its ecosystem.

To protect yourself as a lender, it’s important to consider the protections offered by each platform. Some platforms may offer insurance or other forms of protection to safeguard your funds. Additionally, make sure to do your own research and consider the reputation and track record of each platform before making a choice.

Secure Crypto Lending Services

When it comes to crypto lending services, security is of utmost importance. With the rise in popularity of cryptocurrencies, it has become more important than ever to choose a platform that offers highly secure services. This is because a single security breach can result in the loss of valuable digital assets.

One of the pretty secure crypto lending platforms is BlockFi. They are known for their robust security measures and have a track record of keeping customer funds safe. They have a team of experts who work tirelessly to ensure that the platform is secure against hackers and other malicious actors.

Another highly secure crypto lending platform is Celsius Network. They have taken multiple steps to ensure the safety of customer funds. They make use of multi-signature wallets to protect against unauthorized access and have implemented strict KYC/AML procedures to prevent any fraudulent activity.

Goldfinch is another platform that focuses on security. They have created a smart contract-based lending platform that is designed to be tamper-proof. This means that once a loan has been issued, it cannot be altered or manipulated. It provides a highly secure lending option for borrowers and lenders alike.

Choosing the Right Crypto Lending Platform

When buying a cryptocurrency, it is essential to consider the lending options available for that particular coin. Some lending platforms offer loans only for specific cryptocurrencies, while others provide a more extensive range of options. It is always important to do thorough research and find a platform that suits your needs and preferences.

One of the platforms that offer loans for a wide range of cryptocurrencies is Unchained Capital. They support popular cryptocurrencies like Bitcoin and Ethereum, as well as many other altcoins. This makes it easier for users to find a lending solution for their preferred digital assets.

BlockFi is another platform that offers a choice of cryptocurrencies to use as collateral for loans. They allow users to deposit their crypto into an interest-earning account and provide loans against those assets. This gives users the flexibility to choose the cryptocurrency they want to borrow against.

Earning Returns on Your Crypto

One of the main reasons people turn to crypto lending is to earn returns on their digital assets. By depositing their coins into a lending platform, users can earn interest on their holdings. This can be an attractive option, especially considering the low-interest rates offered in traditional savings accounts.

Crypto lending platforms like BlockFi and Celsius Network promise attractive returns on deposits. They offer competitive interest rates that are often higher than what traditional banks provide. This can be especially beneficial for long-term holders who want to earn passive income on their crypto.

It is important to note that the returns offered by lending platforms can vary. It is always recommended to compare different platforms and consider factors such as interest rates and loan terms before making a decision. Doing thorough research can help ensure that you find the best option for earning returns on your crypto.

Conclusion

In conclusion, crypto lending platforms offer secure and convenient options for borrowing and lending digital assets. Platforms like BlockFi, Celsius Network, and Goldfinch prioritize security and implement various measures to protect customer funds. With the right research and consideration, users can find a platform that offers attractive returns and suits their needs.

Leading Crypto Lenders of 2023

In 2023, the cryptocurrency lending industry continues to cover new ground with record growth and innovative platforms. Among the leading crypto lenders in the market are YouHodler, CoinLoan, BlockFi, and Goldfinch. These platforms offer a range of services that allow users to compare lending options, deposit their assets, and receive loans.

YouHodler

YouHodler is a highly regarded platform that prioritizes customer satisfaction and offers a variety of financial services. They have a customer loyalty program and when you deposit cryptocurrency, you can earn up to 12% annual payout.

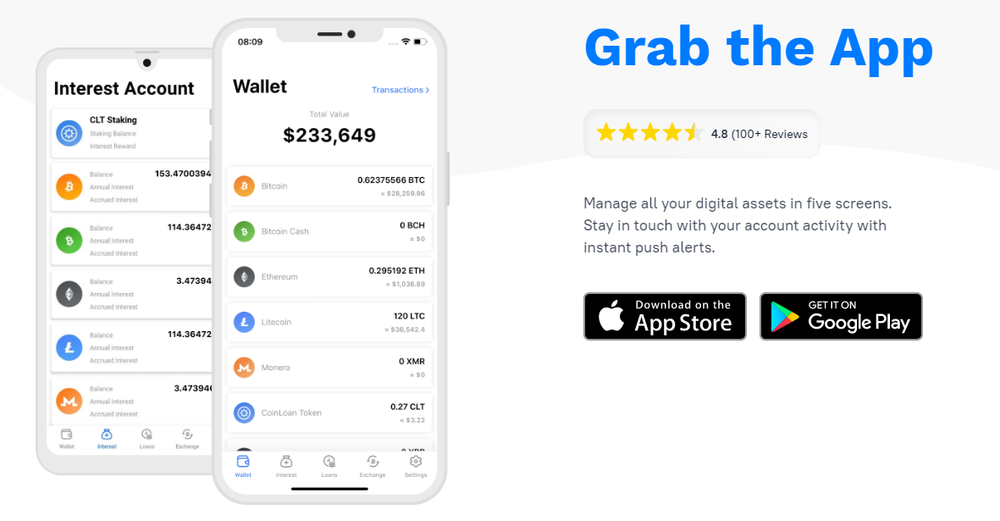

CoinLoan

CoinLoan is a crypto-backed loan provider that offers fast loan approvals within 24 hours. Instead of selling your assets, you can use them as collateral for a loan. They also provide a decentralized finance (DeFi) loan marketplace to compare loan offers from different lenders.

BlockFi

BlockFi is one of the best platforms for investors looking for higher returns on their digital assets. They offer loans with competitive interest rates and have a wide range of deposit options. BlockFi also provides a Bitcoin rewards credit card and a referral program.

Goldfinch

Goldfinch is an aggregator that connects lenders and borrowers in the crypto lending space. They have a unique vision of using borrowed funds to support emerging economies. Despite the risks involved in lending, Goldfinch aims to increase financial inclusion and make a positive social impact.

In conclusion, the leading crypto lenders in 2023 offer a variety of services and options to cater to different customer needs. Whether you are looking to earn interest on your deposits, compare loan offers, or support social impact initiatives, there are plenty of platforms to choose from.

Top-Rated Crypto Lending Providers

When it comes to earning passive income from your cryptocurrency holdings, there are several top-rated crypto lending providers that can help you maximize your returns. These platforms offer various lending and borrowing services, allowing you to leverage your crypto assets to earn interest or obtain funding for your investment activities.

One of the most popular crypto lending platforms is Compound. Compound provides a unique solution for depositors and borrowers, as it operates on a decentralized, non-custodial basis. This means that you have full control over your funds and can earn interest on your deposits without relying on a third-party custodian.

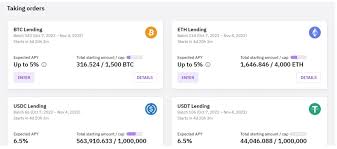

Another top-rated crypto lending provider is CoinLoan. This platform offers a tier-based interest rate structure, allowing users to choose the best option based on their desired percentage and duration. CoinLoan also provides customers with the ability to move their cryptocurrency positions anytime and offers high yields on crypto-backed loans.

Nexo is a well-established company in the crypto lending industry. They offer instant loans against your cryptocurrency holdings, with payout directly into your bank account. Nexo provides customers with a variety of funding options, including crypto-based borrowing and fiat loans. They also offer a rewards program, where customers can earn additional benefits based on the amount and duration of their loans.

If you’re looking for a comprehensive crypto lending platform, Cefi is a great option. They offer a wide range of financial products, including both lending and trading services. Cefi’s ecosystem allows users to easily switch between trading and lending, making it a versatile choice for those who are actively involved in the crypto market.

When choosing a crypto lending provider, it’s important to consider both the pros and cons of each platform. Some platforms may offer higher interest rates but have less user-friendly interfaces, while others may have lower yields but provide a more streamlined experience. Additionally, you should always ensure that the platform is legal and regulated in your jurisdiction, as this can help protect your funds and ensure a secure lending experience.

No matter which top-rated crypto lending provider you choose, it’s important to remember that lending your cryptocurrency involves risks. It’s always a good idea to do your own research and carefully consider the terms and conditions of each platform before depositing your funds. By taking these precautions, you can make informed decisions and maximize your earning potential in the crypto lending space.

Reliable Crypto Lending Platforms

If you are looking for reliable crypto lending platforms, it’s important to consider factors such as performance, support, limitations, and community when choosing the right platform for your needs. Here are a few platforms that have proven themselves to be reliable:

1. CoinRabbit

CoinRabbit is a crypto lending platform that provides a range of lending options for depositors. With a simple and user-friendly interface, CoinRabbit allows you to deposit your bitcoin and earn interest on your holdings. The platform also offers bitcoin-backed loans, allowing you to access liquidity without having to sell your holdings.

2. BlockFi

BlockFi is a well-established platform that provides lending and borrowing services for a range of digital assets. With a strong community and a wide range of supported cryptocurrencies, BlockFi offers competitive interest rates and a seamless user experience. They also provide a referral program that allows you to earn rewards for referring others to the platform.

3. Binance

Binance is a leading cryptocurrency exchange that has also entered the lending space. They offer a range of lending products, including the ability to earn interest on your crypto holdings and access loans using your digital assets as collateral. Binance provides a secure and reliable platform for both lending and trading, making it a popular choice among crypto enthusiasts.

4. Unchained Capital

Unchained Capital is a crypto lender that offers loans backed by bitcoin. They focus on providing lending options for long-term bitcoin holders who want to access liquidity without selling their holdings. Unchained Capital provides a cold storage solution to avoid the risks of bankruptcy or platform failures that can be associated with other lending platforms.

5. Blockworks

Blockworks is a lending platform that offers a unique approach to crypto lending. They provide loans against your digital assets, allowing you to grow your portfolio while still maintaining ownership of your crypto. With a focus on risk management and continuous monitoring, Blockworks ensures that your investments are protected and you can earn passive income.

When considering reliable crypto lending platforms, it’s important to review each platform’s offerings, fees, and security measures. Additionally, it is advised to diversify your lending portfolio to spread out any potential risks. By choosing a reliable platform and managing your investments wisely, you can enjoy the benefits of crypto lending while mitigating risks.

Trusted Crypto Lending Solutions

When it comes to maintaining and lending your crypto assets, finding a trusted crypto lending platform is crucial. These platforms offer crypto-backed loans, allowing you to leverage your digital assets to access funds without having to sell them. In this article, we will explore the top crypto lending platforms in 2023 that provide trusted solutions for borrowers and lenders alike.

Cake DeFi

Cake DeFi is a popular crypto lending platform that offers several lending options, including lending out your crypto assets to earn passive income. They support a wide range of cryptocurrencies, such as Bitcoin, Ethereum, and Tether, and provide competitive interest rates on loans.

Stackwise

Stackwise is a non-custodial crypto lending platform that enables users to earn interest on their crypto holdings. They offer a wide range of lending options, allowing users to choose the best rates and terms for their needs. With Stackwise, you can easily move your funds between different lending providers in order to maximize your yield.

CoinRabbit

CoinRabbit is a crypto lending platform that offers borrowers the option to choose between normal lending or staking their digital assets. This allows users to earn even more passive income from their crypto holdings. CoinRabbit provides competitive rates and a user-friendly interface, making it a popular choice among borrowers.

BitGo

BitGo is a well-known crypto custodian that also offers lending services. They provide institutional-grade lending solutions and have a wide range of borrowing options. With BitGo, users can choose between principal and interest swapping, ensuring flexibility in their lending strategy.

Binance

Binance, one of the largest cryptocurrency exchanges, also provides lending services to its users. They offer high yield lending products, allowing users to earn passive income on their crypto holdings. Binance’s lending solutions are reliable and trustworthy, making them a popular choice among borrowers.

In conclusion, when looking for trusted crypto lending solutions in 2023, it is important to choose platforms that have a solid reputation, offer competitive rates, and provide a wide range of lending options. By choosing a trusted platform, you can easily earn passive income and avoid having to sell your crypto assets, allowing you to stack your earnings and further grow your portfolio.

Most Popular Crypto Lending Companies

As we enter into 2023, the popularity of crypto lending platforms continues to grow. These companies offer a range of services to help individuals and businesses leverage their crypto assets for various purposes.

1. BlockFi

BlockFi is one of the most well-known and trusted crypto lending platforms. They provide users with the ability to take out loans against their crypto holdings, earning interest on their deposits, and even access an interest-earning account for their holdings.

2. Celsius Network

Celsius Network is a user-friendly platform that allows individuals to earn interest on their crypto assets. Users can request loans against their crypto holdings, and the platform provides competitive interest rates. Celsius Network also offers a mobile app with a simple and intuitive interface.

3. MakerDAO

MakerDAO is unique in that it is a decentralized lending platform built on the Ethereum blockchain. Users can deposit their Ethereum tokens as collateral and receive stablecoin loans in return. MakerDAO aims to provide a more efficient and transparent way to access funding without the need for a centralized authority.

4. SALT Lending

SALT Lending offers loans backed by crypto assets, allowing users to unlock the value of their holdings without selling them. Users can borrow against popular cryptocurrencies such as Bitcoin and Ethereum, and the platform provides competitive interest rates and flexible loan terms.

5. Unchained Capital

Unchained Capital is a platform that allows users to borrow against their Bitcoin holdings. They provide customized loan structures and focus on serving high-net-worth individuals and businesses. Unchained Capital also offers a multi-signature vault solution for secure storage of Bitcoin.

6. Finance

Finance is a leading decentralized finance (DeFi) platform that offers a range of lending and borrowing services. Users can provide liquidity to the platform and earn interest on their deposits, or borrow against their assets. Finance aims to provide a more efficient and open financial system.

7. Celsius Network

Celsius Network is known for its user-friendly interface and range of features. In addition to lending and borrowing services, Celsius Network offers the ability to earn interest on crypto assets, access a credit card that allows users to spend their crypto holdings, and even subscribe to a collective income pool.

8. BlockFi

BlockFi offers competitive interest rates on deposits, allowing users to earn passive income on their crypto assets. They also provide loans against crypto assets, with flexible terms and quick approval times. BlockFi has a strong track record and is widely trusted in the crypto lending space.

9. MakerDAO

MakerDAO is known for its decentralized nature and transparent approach to lending. Users can borrow stablecoins against their Ethereum holdings, with the appropriate collateral requirements. MakerDAO also allows users to participate in governance decisions through its native MKR token.

10. SALT Lending

SALT Lending is a well-established platform that offers competitive interest rates and flexible loan terms. Users can borrow against their crypto assets, with the ability to withdraw funds in fiat currency. SALT Lending provides a straightforward solution for individuals and businesses in need of capital.

11. Finance

Finance provides a range of features that set it apart from other lending platforms. They offer higher leverage options, a variety of on-ramp options for fiat deposits, and a user-friendly interface. Finance also has a strong track record of performance and has gained endorsement from industry experts.

In conclusion, there are several popular crypto lending platforms available in 2023, each offering unique features and benefits. Whether you’re looking to earn passive income on your crypto assets, borrow against them, or access funding for your business, there is a platform that can meet your needs.

Innovative Crypto Lending Platforms

As the crypto lending market continues to grow, innovative platforms are emerging to meet the increasing demand. These platforms offer a variety of features and services, making them stand out from the competition.

1. CoinLoan

CoinLoan is one of the top platforms in the market, offering a wide range of lending options. They support various cryptocurrencies and allow borrowers to pledge their coins as collateral. The platform also offers a unique feature where borrowers can lend their stablecoins to generate passive income.

2. CEFI

CEFI is an innovative lending platform that focuses on providing loans for crypto-related business applications. They offer a maximum loan amount of $10 million and have a wide range of resources to support their borrowers. CEFI also acts as an aggregator, connecting borrowers with the top lenders in the market.

3. Goldfinch

Goldfinch is a lending platform that aims to provide loans in a decentralized manner. They have a unique approach, where loans are originated on-chain and lenders can directly pair with borrowers. This enables borrowers to access liquidity without relying on a centralized authority.

In addition to these platforms, there are others in the market that offer unique features and benefits. It’s important to review each platform carefully and consider what you are looking for in a lending platform.

Despite the wide range of options available, borrowing and lending in the crypto market can still be a complex task. It’s important to do your research and understand the risks involved. Mistakes can be costly, so it’s crucial to subscribe to official news sources and stay informed about the latest developments in the industry.

Having a clear strategy and understanding the terms and conditions of each platform will help you navigate the crypto lending market and make the most of the opportunities available.

Cutting-Edge Crypto Lending Platforms

When it comes to borrowing and lending digital assets, there are several cutting-edge platforms that are making waves in the crypto industry. These platforms are revolutionizing the way individuals and businesses can access funds and earn passive income through their crypto assets. One such platform is Nexo.

Taking a user-friendly approach, Nexo provides an open and purpose-built ecosystem for crypto borrowing and lending. Users can deposit their crypto-assets, such as Bitcoin or Ethereum, and earn interest on them. What sets Nexo apart is that users can also borrow against their crypto-assets without needing to sell them.

Another innovative platform in this space is MakerDAO. They have created a decentralized lending system that offers specific loan-to-value ratios (LTVs) for different crypto-assets. This allows users to easily borrow against their holdings while minimizing the risk of losing a significant amount.

BlockFi, on the other hand, offers a solution that combines both borrowing and earning interest. Users can deposit their crypto-assets into BlockFi’s interest-bearing accounts and earn interest on them. At the same time, they can also borrow against their holdings and use the funds for various purposes.

Fuji is another platform that deserves mention. They provide a unique lending solution that checks the creditworthiness of borrowers by analyzing their on-chain activities. This enables them to offer loans to individuals who don’t have a traditional credit history.

These cutting-edge platforms have their pros and cons, and each caters to a specific type of user. Whether you are looking to earn passive income, borrow funds, or protect your investments, there is a crypto lending platform for you. It’s important to do your research and understand the terms and conditions of each platform before making any decisions.

In 2023, we can expect even more advancements in this space as the crypto lending industry continues to grow. Keep an eye out for new platforms and products that may offer innovative solutions and opportunities for users.

Top Crypto Lenders with Stablecoin Deposits

In the world of cryptocurrency, finding a reliable crypto lending platform can be a challenge. However, there are some top names in the industry that offer stablecoin deposits, providing a secure and stable way to lend and borrow crypto-backed loans.

While there are many platforms that offer crypto lending services, not all of them accept stablecoin deposits. Stablecoins are a type of cryptocurrency that is pegged to a stable asset, such as the US dollar, in order to maintain a steady value. This makes stablecoins a popular choice for lenders and borrowers who want to avoid the price volatility typically associated with other cryptocurrencies.

One of the top crypto lending platforms that accepts stablecoin deposits is BlockFi. BlockFi allows users to lend and borrow crypto assets, with stablecoins being one of the supported options. The platform also offers competitive interest rates and flexible terms for borrowers, making it a popular choice among the crypto lending community.

Another platform that accepts stablecoin deposits is Ledn. Ledn provides a range of crypto lending services, including the ability to borrow against your crypto holdings. They also offer a variety of stablecoins to choose from, giving users the flexibility to lend or borrow in their preferred currency.

Salt is another name in the crypto lending space that accepts stablecoin deposits. Salt provides a range of loan options, including the ability to lend stablecoins and earn interest on your holdings. They also offer a loan-to-value ratio of up to 70%, giving borrowers more flexibility in terms of the amount they can borrow.

Overall, if you’re looking for a crypto lending platform that accepts stablecoin deposits, there are several options to choose from. Whether you decide to go with BlockFi, Ledn, Salt, or another platform, it’s important to do your own research and find the platform that best suits your needs in terms of interest rates, terms, and supported stablecoins.

Frequently Asked Questions:

What are some of the top crypto lending platforms in 2023?

Some popular crypto lending platforms in 2023 are YouHodler, Nexo, Celsius Network, and BlockFi.

How do crypto lending platforms work?

Crypto lending platforms allow users to borrow or lend digital assets such as Bitcoin or Ethereum. Users can deposit their crypto assets into the platform and earn interest on their holdings or use them as collateral to borrow funds.

What are the advantages of using crypto lending platforms?

Some advantages of using crypto lending platforms include earning passive income through interest rates, gaining access to liquidity without selling crypto assets, and potentially lower interest rates compared to traditional lending institutions.

Are there any risks involved in using crypto lending platforms?

Yes, there are risks involved in using crypto lending platforms. Some potential risks include the volatility of cryptocurrency prices, the risk of hacking or security breaches, and the possibility of a platform shutting down or facing regulatory issues.

Video:

7 Passive Income Ideas – How I Make $67k per Week

BlackRock CEO Larry Fink SECRETLY INVESTING in Ethereum & 5 Crypto Coins

Top 5 BEST Crypto Exchanges in 2023: Are They SAFE?!

Wow, I never knew there were so many options for crypto lending platforms! Can you recommend the safest one with good returns?

Sure, crypto_lover_2023, I’m glad you found this article informative! When it comes to safety and good returns, one platform that stands out is SecureCrypto. They prioritize security, with multi-layer authentication and cold storage for your funds. Plus, they offer competitive interest rates and a user-friendly interface. I highly recommend checking them out!

Wow, these crypto lending platforms are really changing the game. It’s great to see how we can earn passive income just by lending our cryptocurrencies. I’m definitely going to check out stackwise and Fuji. Thanks for the recommendations!

I have been using stackwise for a few months now and I must say, it’s been a great experience. The platform is user-friendly and offers competitive interest rates. I feel secure lending my cryptocurrencies on stackwise knowing that they have a strong security infrastructure in place. Highly recommended!

Is stackwise the best crypto lending platform in terms of returns?

Stackwise is definitely one of the top crypto lending platforms in terms of returns. Their innovative bitcoin-backed loans allow you to borrow fiat currency while still earning interest on your bitcoin holdings. It’s a win-win situation!