If you’re a crypto investor or borrower, you may be wondering what the popular products in the market are for lending and borrowing. One such platform is Binance, which offers various lending and borrowing options. When it comes to lending, you can earn interest on your cryptocurrency holdings by lending them to others. On the other hand, if you’re looking to borrow, you can use your crypto as collateral to get a loan.

One of the advantages of crypto lending is that you have control over your assets. Unlike traditional lending methods where you relinquish control of your assets, in crypto lending, you can still hold onto your crypto while receiving a loan. This collateralized loan method ensures that you won’t permanently lose your crypto in case of a market loss or if the lender is hacked.

When it comes to crypto lending, there are two main types: crypto-backed lending and collateralized lending. In the crypto-backed lending model, borrowers use their crypto as collateral and can take out loans in fiat currency or stablecoins like Tether. On the other hand, the collateralized lending model requires borrowers to deposit crypto as collateral and they can borrow other cryptocurrencies in return.

Before deciding to lend or borrow, it’s important to understand the risks involved. Due diligence is crucial in the crypto world, as there have been countless events where investors and borrowers lost their assets. It’s essential to monitor the market, stay updated on news and events, and do thorough research on the lending platform you’re considering.

When it comes to lending, one of the key benefits is the potential for high-yield returns on your capital. Compared to traditional banks, crypto lending platforms often offer higher interest rates. However, it’s important to note that the risks are higher as well. To protect your capital, make sure to choose a reputable lending platform that has proper security measures in place and a track record of providing loans and protecting borrowers’ assets.

In conclusion, crypto lending can be a simple and lucrative way to grow your wealth. By lending your crypto, you can earn interest on your holdings, and by borrowing, you can access capital without requiring traditional credit checks. However, it’s crucial to do your due diligence, understand the risks involved, and choose a reputable lending platform to ensure the safety of your assets.

The Benefits of Crypto Lending for Investors

Investing in crypto lending offers several advantages for investors looking to maximize their earnings and diversify their portfolios:

- Diversification: Crypto lending allows investors to diversify their investments by adding a new asset class to their portfolio. By lending cryptocurrencies, investors can potentially earn interest on their holdings while diversifying away from traditional investments.

- Higher Earnings Potential: Unlike traditional savings accounts with low-interest rates, crypto lending platforms often offer higher interest rates, allowing investors to earn a significant return on their investment.

- Stability: Stablecoins like USDT (Tether) are often used as collateral in crypto lending. These stablecoins are pegged to a stable asset, such as the US dollar, providing investors with a more stable investment option compared to volatile cryptocurrencies.

- Reduced Risk: Crypto lending platforms typically have diligence and regulatory processes in place to minimize the risk of default. Additionally, some platforms have insurance funds in case of unexpected events, reducing the risk for investors.

- Liquidity: Investing in crypto lending allows investors to maintain liquidity. Unlike traditional investments in real estate or stocks, where funds are often locked in for a certain period, investors can typically withdraw their funds at any time from a crypto lending platform.

- Ease of Use: Crypto lending platforms make the lending process simple for investors. Once an investor deposits their crypto onto the platform, the platform takes care of lending it out, handling all the borrowing and lending transactions.

- Bonuses and Rewards: Some crypto lending platforms offer additional bonuses or rewards for their investors. These can include loyalty programs, referral bonuses, or additional interest rates for holding platform native tokens or participating in certain activities.

In conclusion, crypto lending offers a range of benefits for investors, including the potential for higher earnings, diversification, reduced risk, and ease of use. By investing in crypto lending platforms, investors can take advantage of the ever-changing and fast-growing world of cryptocurrencies while having the stability of stablecoins and regulatory oversight.

The Benefits of Crypto Lending for Borrowers

Earning Passive Income: One of the major benefits of crypto lending for borrowers is the opportunity to earn passive income. By using their crypto assets as collateral, borrowers can earn interest on their holdings while retaining ownership of their digital currencies.

Diversifying Investments: Crypto lending allows borrowers to leverage their crypto holdings to access additional funds for investment purposes. This enables them to diversify their portfolio and potentially maximize their returns.

Closing the Gap Between Traditional and Crypto Finance: Crypto lending provides an alternative finance option that bridges the gap between traditional banking systems and the digital economy. By entering the world of crypto lending, borrowers can access financial services that may not be easily available through traditional banks.

Flexible and Easy-to-Use Platforms: Many crypto lending platforms offer user-friendly interfaces and intuitive processes, making it simple for borrowers to enter the world of crypto lending. These platforms typically work based on smart contracts and are designed to be easily navigable, making the borrowing process more accessible for all users.

Higher Interest Rates: Compared to traditional banking systems, crypto lending often offers higher interest rates. As the crypto market is ever-changing and based on supply and demand, borrowers may have the opportunity to earn higher returns on their borrowed funds.

Increased Privacy and Security: When borrowers use crypto lending platforms, their transactions are typically conducted using blockchain technology. This technology ensures greater privacy and security as the details of the transactions are stored on a decentralized network and cannot be easily tampered with.

Access to Funding Opportunities: Borrowers can use crypto lending to fund various projects or ventures. Whether they need funds for personal expenses, business expansion, or even investing in other cryptocurrencies, crypto lending can provide the necessary funds to support these endeavors.

Lower Risk of Losses: In traditional lending, borrowers run the risk of losing their assets if they are unable to repay the loan. However, in crypto lending, borrowers can mitigate this risk by providing collateral in the form of their crypto assets. This reduces the chances of losses as the collateral can be used to cover the loan in case of default.

Option to Borrow Stablecoins: Some crypto lending platforms offer the option to borrow stablecoins like USDT (USD-Tether) instead of volatile cryptocurrencies. This helps borrowers avoid the risk associated with the price fluctuations of cryptocurrencies and provides a more stable borrowing experience.

Fast and Efficient Loan Processing: Unlike traditional lending, which can involve lengthy application processes and approvals, crypto lending platforms often offer quick and efficient loan processing. Borrowers can receive their funds in a matter of hours or even minutes, depending on the platform and loan terms.

Choice of Lending Platforms: With the growing popularity of crypto lending, there are now various platforms to choose from. Borrowers can compare interest rates, terms, and features offered by different platforms to find the one that best suits their needs and preferences.

Opportunity to Borrow Fiat: While crypto lending primarily involves borrowing digital assets, some platforms have started offering the option to borrow fiat currencies. This allows borrowers to access traditional currencies like dollars while still benefiting from the advantages of crypto lending.

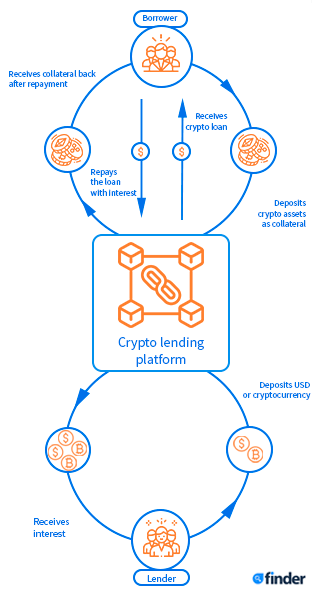

How Crypto Lending Works

One of the most popular use cases for cryptocurrencies is using them to earn interest through crypto lending platforms. These platforms act as an exchange where borrowers can borrow cryptocurrencies by using their own digital assets as collateral.

When a borrower wants to borrow funds, they deposit a certain amount of their own cryptocurrencies into a smart contract on the lending platform. The platform then lends them a specific amount of another cryptocurrency, such as Bitcoin or Ethereum, with interest. This allows the borrower to access funds without having to sell their existing holdings and potentially miss out on any gains.

For example, let’s say you’d like to borrow $10,000 worth of Bitcoin. To do this, you would deposit a certain amount of your own digital assets, such as Ethereum, as collateral. The lending platform would then lend you the Bitcoin, and you would need to repay the loan plus interest within a certain timeframe.

In return for depositing your cryptocurrency as collateral, you can earn interest on your holdings. This means that while you’re borrowing funds, you can also be making money by lending out your own assets. The interest rates offered for crypto lending platforms can vary and are often higher than traditional banking institutions.

One of the key benefits of crypto lending is the ability to maintain ownership over your digital assets while still accessing funds. This is especially attractive for long-term investors who do not want to sell their crypto holdings, but need liquidity for various reasons, such as making additional investments or covering expenses.

Although crypto lending platforms offer a safe and secure way to lend and borrow cryptocurrencies, it’s important to note that they are still subject to risks. The value of cryptocurrencies can be volatile, and there is always the potential for losses. Therefore, it’s crucial to carefully consider the loan-to-value ratio, or the amount of collateral required compared to the loan being given, to ensure the loan is secure.

In conclusion, crypto lending platforms provide an alternative way to access funds and earn interest on digital assets without having to sell your holdings. They offer opportunities for both borrowers and lenders to benefit from the changing value of cryptocurrencies, and can be a valuable tool for both individuals and institutions.

Types of Crypto Assets Accepted for Lending

When it comes to crypto lending, there are various types of crypto assets that can be accepted as collateral on lending platforms. The ability to accept different types of assets gives investors and borrowers the freedom to choose the cryptocurrency that best suits their needs. Below are some of the common types of crypto assets accepted for lending:

1. Seasoned cryptocurrencies:

Many lending platforms only accept well-established and widely recognized cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH). These cryptocurrencies have a track record of stability and relatively high market value, making them popular choices for borrowers seeking loans.

2. Stablecoins:

Stablecoins are another type of crypto asset that is commonly accepted for lending. These are cryptocurrencies that are pegged to a stable asset, such as a government fiat currency like the US Dollar (USD). Stablecoins offer borrowers the ability to take out loans while minimizing the potential for volatility in the cryptocurrency market.

3. Other cryptocurrencies:

Despite the popularity of Bitcoin and Ethereum, there are numerous other cryptocurrencies available that lending platforms may accept as collateral. This includes altcoins, which are alternative cryptocurrencies to Bitcoin, as well as newer and emerging cryptocurrencies that have the potential to generate high-yield returns.

4. Tokenized assets:

Some lending platforms also accept tokenized assets as collateral. Tokenized assets are digital representations or tokens of real-world assets, such as real estate or art. These digital tokens can be used as collateral to secure loans on lending platforms.

It’s important to understand the types of crypto assets accepted for lending on a particular platform before deciding to use it. Each platform may have its own list of accepted collateral, and investors and borrowers should consider the risks and potential returns associated with each type of asset.

Risks and Potential Losses in Crypto Lending

When it comes to crypto lending, there are several risks and potential losses that investors and borrowers should be aware of. While this form of lending may provide certain benefits, it also poses certain dangers and uncertainties.

Volatile Nature of Tokens

One of the main risks in crypto lending is the volatility of tokens. Unlike traditional lending where borrowers provide collateral in the form of stable assets, crypto lending often involves lending tokens with a fluctuating value. This means that borrowers may receive tokens that decrease in value over time, causing potential losses for both parties involved.

Lack of Regulation

Another risk is the lack of regulation in the crypto lending market. Unlike traditional lending institutions that are subject to various regulatory bodies, crypto lending platforms are less regulated. This lack of oversight can make it challenging to protect against potential scams or fraud, leaving investors and borrowers more vulnerable to losses.

Security Risks

Crypto lending also poses security risks. Since transactions occur through digital wallets and platforms, there is a higher risk of hacking and theft. If a borrower’s or investor’s wallet is compromised, they run the risk of losing their tokens or funds. This emphasizes the importance of using secure platforms and taking necessary precautions to protect one’s assets.

Interest Rate and Liquidity Risks

Interest rate and liquidity risks are also factors to consider in crypto lending. The interest rates on crypto loans can be higher than traditional loans, making it more expensive for borrowers. Additionally, the liquidity of crypto assets can vary, meaning that borrowers may face challenges in converting their tokens back into fiat currencies or other desired assets.

Counterparty Risks

Counterparty risks exist in crypto lending as well. Trusting a borrower or lender with your tokens or funds involves an element of risk. There is always the potential for default or fraud, where borrowers may fail to repay the loan or lenders may vanish with the provided collateral. It’s essential to thoroughly assess the reputation and credibility of the parties involved before engaging in crypto lending.

Overall, while crypto lending can offer opportunities for earning interest and providing credit to individuals and businesses, it’s crucial to understand and mitigate the various risks and potential losses associated with this form of lending.

How to Choose a Crypto Lending Platform

When it comes to choosing a crypto lending platform, there are several factors to consider. First, you need to determine what your needs are as an investor or borrower. Are you looking for a platform that offers securities lending or both? Do you want the ability to use your crypto as collateral for a loan? Understanding your specific requirements will help you narrow down your options.

Next, you’ll want to find a reputable platform that has a range of lending options. Look for platforms that have been in the market for a while and have a track record of successfully lending to borrowers. You can also check if the platform is regulated by government authorities or if they have partnered with traditional financial institutions.

Security is another important consideration when choosing a crypto lending platform. Look for platforms that offer collateralized loans, which means that your loan is backed by an asset such as Bitcoin or other cryptocurrencies. This provides an additional layer of protection against losses in case of default.

Furthermore, make sure the platform offers user-friendly features and a seamless lending process. Look for platforms that allow you to easily deposit and withdraw your funds, and that offer transparent and competitive interest rates.

Lastly, it’s essential to consider the platform’s reputation and track record. Look for user reviews and testimonials to get a sense of the platform’s reliability and customer service. Additionally, consider reaching out to the platform’s customer support team with any questions or concerns you may have.

In conclusion, when choosing a crypto lending platform, consider your specific needs, security measures, reputation, and user experience. By following these guidelines, you’ll be able to find a platform that meets your requirements and offers a safe and reliable lending service.

Managing Risks in Crypto Lending

When it comes to crypto lending, managing risks is crucial for both investors and borrowers. The crypto industry has been notorious for being hacked, and there are cyber risks associated with owning and trading cryptocurrencies. It is essential to have a clear risk management strategy in place.

One way to manage risks in crypto lending is by using collateralized loans. By requiring borrowers to provide collateral in the form of tokens, the lender can ensure that their investment is protected even if the borrower defaults. This approach reduces the risk of potential losses.

It is always important to make sure the source of your loans is trustworthy. If the lending platforms you are using are not transparent or well-established, there is a higher chance of funds being lost or stolen. It is advisable to choose platforms that have written financial regulations and offer insured loans.

Borrowers should consider the bottom line ratio when taking out loans. It is crucial to calculate whether the potential gains from trading or investing with borrowed funds will be enough to cover the loan and interest payments. Higher volatility in the crypto market increases the risk of losses, so borrowers should consider their risk tolerance before borrowing.

Monitoring the market and keeping a close eye on the value of the collateral is also essential. If the value of the collateral tokens drops significantly, there is a risk of the loan being liquidated. Borrowers should ensure they have a clear exit strategy in place to protect their wealth.

Last but not least, it is important to stay updated on the latest security measures and protect your assets against theft. Two-factor authentication, cold wallets, and other security measures can go a long way in safeguarding your cryptocurrencies.

Lending Options and Terms for Investors

When it comes to investing in cryptocurrencies, there are various lending options and terms that investors can consider. These options can help investors gain additional income by lending their funds to borrowers in the crypto market.

Investment Platforms

Investors can choose to lend their crypto assets through specialized lending platforms. These platforms help investors monitor their investments and provide tools to manage their lending options and terms effectively.

Lending Contracts

Investors can enter into lending contracts with borrowers, which specify the terms of the loan. These contracts usually involve locking up a certain amount of cryptocurrency for a set period of time, during which the borrower will pay interest to the investor.

Risk Considerations

Investors should always consider the risks involved in lending their cryptocurrencies. The crypto market is highly volatile, and there is always a possibility of losing value on their investments. However, some platforms offer decentralized borrowing and lending options, where assets are insured and borrowers are required to provide collateral to secure the loans.

Pegged Tokens

One option for investors is to lend pegged tokens, such as USDT, which are usually pegged to the value of the US dollar. This can provide a more stable lending option and reduces the risk of losing value due to cryptocurrency price fluctuations.

Diversify Investments

To mitigate risk, investors should consider diversifying their lending investments across multiple platforms or sources. This will help spread the risk and reduce the impact of losing value on a single lending platform.

Earn Higher Interest

Investors with a higher risk tolerance can lend their funds at higher interest rates, especially during periods of rising cryptocurrency prices. However, it’s important to be cautious and assess the credibility and reputation of the borrowing party before lending a significant amount.

Payment Options

Investors usually have the option to be paid in cryptocurrencies or traditional fiat currencies, like dollars. This gives them the freedom to choose how they want to use their earned interest, whether for reinvestment or withdrawing to their bank accounts.

Consolidate and Reinvest

Seasoned investors can consider consolidating their earnings from lending and reinvesting them into well-established cryptocurrencies. This strategy allows them to both gain additional income through lending and potentially benefit from the price appreciation of the cryptocurrencies they invest in.

Lending Options and Terms for Borrowers

When it comes to borrowing cryptocurrency, there are various lending options and terms to consider. One popular option is using a platform that offers crypto lending services. These platforms act as intermediaries between lenders and borrowers, providing a line of credit for borrowers to tap into.

Before choosing a platform, it’s important to consider the regulations they operate under. Well-established platforms will have clear regulations in place to avoid scams and protect borrowers’ funds. It’s also crucial to consider the loan-to-value ratio offered by the platform. This ratio determines how much cryptocurrency can be borrowed against the value of the collateral provided.

Collateral is a key aspect of crypto lending. Borrowers must provide collateral to secure the loan. The collateral can be in the form of cryptocurrency or other valuable assets. By using collateral, lenders can mitigate the risk of not getting their funds back.

One advantage of crypto lending is that it’s a relatively quick process. Borrowers can quickly access funds without going through lengthy approval processes like traditional banks. However, it’s important to understand that the loaned cryptocurrency can be liquidated if the borrower falls behind on payments or the value of the collateral decreases.

There are also risks associated with crypto lending. One major risk is the potential for theft or being hacked. Borrowers must ensure that they’re using platforms with secure systems in place to protect their cryptocurrency holdings. It’s also crucial to consider the volatility of the cryptocurrency market. Prices can fluctuate rapidly, which can impact the value of the collateral and the loan repayment.

Another consideration is the interest rates on crypto loans. Interest rates can vary depending on the platform and market conditions. Borrowers should compare rates from different platforms to find the best option for their needs. Margin trading is another option to consider, but it carries an additional risk as it involves trading with borrowed funds, which can lead to losses if the market goes against the borrower’s position.

In closing, crypto lending offers opportunities for borrowers to access funds quickly and efficiently. However, it’s important to carefully consider the terms and risks involved. Working with a well-established platform that offers clear regulations and adequate security measures is essential for protecting against scams and potential losses.

Disadvantages of Crypto Lending

While crypto lending offers several advantages to both borrowers and lenders, there are also some disadvantages that should be considered.

1. Volatility

One of the biggest disadvantages of crypto lending is the inherent volatility of cryptocurrencies. The value of cryptocurrencies can fluctuate rapidly, which can lead to potential flash crashes or spikes. It is important for lenders to be aware of this volatility and to consider the potential impact on their loan repayments. Borrowers may also face a challenge in repaying their loans if the value of the borrowed cryptocurrency drops significantly.

2. Lack of Regulation

Unlike traditional lending, crypto lending platforms and protocols are not subject to the same level of regulatory oversight. This lack of regulation can make the industry more susceptible to scams or fraudulent activities. It is important for borrowers and lenders to thoroughly research and choose well-established and reputable platforms before engaging in any lending activities.

3. Lack of Insurance

Unlike traditional banks or lending institutions, most crypto lending platforms do not offer insurance on deposited funds. This means that if a platform were to become insolvent or suffer a security breach, there is no guarantee that borrowers or lenders would be able to recover their funds. It is important for investors to carefully consider the level of risk they are willing to tolerate when participating in crypto lending.

4. Smart Contract Risks

Many crypto lending platforms use smart contracts to facilitate loan agreements. While smart contracts can provide efficiency and automation, they are not immune to bugs or vulnerabilities. If a smart contract were to contain a coding error or be subject to a cyberattack, borrowers and lenders could potentially lose their funds or face other financial risks.

5. Limited Collaterals

The range of accepted collateral types in crypto lending is relatively limited compared to traditional lending. Most platforms primarily accept cryptocurrencies as collateral, such as Bitcoin or Ethereum. This means that borrowers who do not hold these specific cryptocurrencies may be unable to secure a loan. Additionally, borrowers must have enough collateral to cover the value of the loan, which may present a challenge for those with limited cryptocurrency holdings.

In conclusion, while crypto lending offers numerous advantages, there are also several disadvantages that must be considered. The inherent volatility of cryptocurrencies, lack of regulation and insurance, smart contract risks, and limited collateral options are all factors that borrowers and lenders should carefully evaluate before participating in crypto lending activities.

Frequently Asked Questions:

What is crypto lending?

Crypto lending is a process in which individuals or institutions lend their cryptocurrency assets to borrowers in exchange for interest. It allows investors to earn passive income on their crypto holdings and borrowers to access funds without selling their cryptocurrency.

How does crypto lending work?

Crypto lending platforms connect lenders and borrowers in a peer-to-peer manner. Lenders deposit their cryptocurrency into the platform’s smart contracts, which are then available for borrowing. Borrowers can request loans and provide collateral. If the loan is approved, the borrower receives the funds, and they are required to repay the loan amount along with the agreed-upon interest.

What are the benefits of crypto lending for investors?

Crypto lending offers several benefits for investors. First, it provides an opportunity to earn passive income on their cryptocurrency holdings. Second, it allows diversification of investment portfolios by adding a lending component. Finally, crypto lending platforms often have high interest rates compared to traditional banks, increasing the potential earning potential for investors.

What are the risks involved in crypto lending for borrowers?

While crypto lending can provide access to funds without selling cryptocurrency, there are risks involved for borrowers. The value of the collateral can fluctuate, leading to potential liquidation if the collateral value falls below a certain threshold. Borrowers should also carefully consider the interest rates and repayment terms to ensure they can afford to repay the loan.

Videos:

Crypto Borrowing Strategy – Tactic #01 as a KEY to Maximizing your Earning Potential on DeFi Borrows

Learn the Basics of Cryptocurrency: A Guide for Beginners

I’ve been using Binance for crypto lending and borrowing, and it’s been a great experience so far. With the ability to earn interest on my crypto holdings, I can make the most of my assets while minimizing risk. Plus, the option to use my crypto as collateral for a loan gives me flexibility. Overall, crypto lending has given me more control over my assets compared to traditional lending methods. Highly recommend!