In the rapidly growing market of blockchain technology and cryptocurrencies, decentralized finance (DeFi) has emerged as a promising sector, revolutionizing traditional financial transactions. DeFi platforms offer a wide range of services on various blockchains, providing users with opportunities for lending, borrowing, and earning high yields on their investments.

However, the decentralized nature of the ecosystem has also attracted fraudsters and scammers who exploit the trust of users. Recently, an incident on the Solana blockchain has shed light on how a crypto developer managed to deceive the Defi ecosystem and its participants.

Using a Solana-based platform, the developer created an attractive investment opportunity, promising high returns on deposits. As news about the platform’s potential spread, it experienced a peak surge in total value locked (TVL), indicating the trust and interest of the Defi community.

Unfortunately, the developer had devised a complex scam, in which he double-counted the deposits and artificially inflated the TVL figures. By doing so, he aimed to create an illusion of financial success and gain further investments from unsuspecting individuals.

Another significant factor contributing to the scam’s success was the de-emphasizing of intermediaries. In the Defi ecosystem, the elimination of intermediaries is often celebrated as a way to protect users and provide liquidity. However, in this case, it played into the hands of the fraudulent developer who exploited the trust given to him by the community.

The impact of this scam on the Solana-based Defi ecosystem highlights the need for stronger regulation and security measures to protect users from such fraudulent activities. It also emphasizes the importance of conducting thorough due diligence and verifying the credibility of platforms and developers before making any investments in the crypto space.

Financial Inclusion and Disintermediation

Financial inclusion is a key focus of the decentralized finance (DeFi) ecosystem, as it aims to provide accessible financial services to individuals who have been traditionally underserved by the traditional financial system. DeFi projects enable individuals to participate in financial activities such as lending, borrowing, and investing by leveraging cryptocurrencies and blockchain technology.

The DeFi ecosystem emphasizes disintermediation, eliminating the need for intermediaries like banks to facilitate financial transactions. By using smart contracts on blockchain platforms, individuals can directly interact with the DeFi protocols, thereby reducing costs and increasing efficiency.

One notable example of this disintermediation is the platform called DefiLlama, which tracks the total value locked (TVL) in the DeFi market. It provides a comprehensive view of the funds secured in various DeFi protocols across different blockchains, including Solana-based platforms. This transparency helps investors and users assess the overall health of the ecosystem and make informed decisions.

Furthermore, the rise of DeFi has also led to innovative financial services and investment opportunities. Individuals can now participate in activities such as yield farming, staking, and providing liquidity to decentralized exchanges. These opportunities allow users to earn passive income and actively participate in shaping the future of the DeFi ecosystem.

However, it is crucial for individuals to exercise caution while engaging with DeFi platforms. The lack of regulatory oversight and the presence of potential scams underscore the need for investors to conduct thorough research and due diligence before committing their funds. Additionally, the use of proper security measures, such as hardware wallets, can protect users from potential hacking attempts.

In conclusion, the DeFi ecosystem has the potential to revolutionize the traditional financial system by promoting financial inclusion and disintermediation. The accessibility and transparency provided by blockchain technology enable individuals to take control of their finances and access innovative investment opportunities. However, users must also be vigilant and aware of the risks associated with the decentralized nature of the ecosystem.

DefiLlama De-Emphasises Double-Counted Crypto Deposits

The surge in the popularity of the Solana blockchain has led to a sharp increase in liquidity within the Defi ecosystem. As more individuals look to leverage the network’s innovative financial services, their crypto deposits have become a key factor in the growth of the market.

However, a recent discovery by the Defi tracking platform DefiLlama has revealed a potential issue with the way contracts handle these deposits. The platform has identified instances where deposits made on Solana-based platforms were being double-counted, inflating the total value locked (TVL) figures reported by these platforms.

DefiLlama, known for its efforts to provide accurate and reliable data on the Defi ecosystem, has decided to de-emphasise double-counted deposits in order to protect investors and maintain the integrity of the market. By eliminating these duplicate transactions from its calculations, DefiLlama aims to provide a more accurate representation of the TVL and the true impact of Solana-based platforms on the Defi ecosystem.

This move is a testament to DefiLlama’s commitment to transparency and its dedication to making informed investment decisions. By identifying and addressing issues like double-counted deposits, the platform helps investors make better decisions and seize opportunities in the rapidly evolving Defi space.

DefiLlama’s de-emphasis of double-counted crypto deposits also highlights the importance of disintermediation in the Defi ecosystem. The platform’s efforts to eliminate intermediaries and provide direct access to financial services align with the core principles of Defi, which emphasize financial inclusion and empowering individuals to take control of their funds.

With the continued growth of the blockchain industry and the increasing popularity of cryptocurrencies, platforms like DefiLlama play a crucial role in ensuring the integrity and security of the Defi ecosystem. By shining a light on potential scams and issues, these platforms contribute to the sustainable development of the industry and protect the interests of investors.

Solana Network’s TVL at Its Peak

The Solana network has reached its peak in terms of Total Value Locked (TVL) as its ecosystem continues to grow and attract more investments. Through its innovative financial services, Solana-based Defi platforms provide individuals with opportunities to participate in the crypto market and take advantage of the benefits offered by decentralized finance.

The surge in TVL on the Solana network can be attributed to several factors. Firstly, the platform’s high scalability allows for faster and more efficient transactions, attracting users who seek liquidity and seamless trading experiences. Additionally, the elimination of intermediaries in Solana-based Defi services de-emphasises the need for trust and reliance on traditional financial institutions.

Furthermore, the inclusion of Solana in popular Defi data aggregators like Defillama has also had a significant impact on the network’s TVL. These platforms provide comprehensive information and analysis on Solana-based projects, making it easier for investors to evaluate their potential profitability and make informed decisions. The increased visibility and exposure on these aggregators further attract funds and deposits to the Solana ecosystem.

Solana’s TVL surge also highlights the growing interest in the crypto market as a whole. As more individuals recognize the potential of cryptocurrencies and decentralized finance, they are turning to platforms like Solana to diversify their investment portfolios and explore new financial opportunities. This growing demand has further propelled the network’s TVL to new heights.

To protect investors and ensure the integrity of the Solana network, stringent smart contracts and security measures are in place. This provides users with confidence in the security and reliability of their deposits and transactions. Additionally, the Solana community actively collaborates and shares information to detect and prevent potential scams or fraudulent activities, further safeguarding the ecosystem.

In conclusion, the Solana network’s TVL has reached its peak due to the impact of its scalable and efficient infrastructure, the inclusion on popular Defi aggregators, and the increasing demand for innovative financial opportunities in the crypto market. As Solana continues to attract investments and provide users with a decentralized and secure platform, its TVL is expected to further grow in the future.

Opportunities for Innovative Investments

In the fast-paced world of crypto and decentralized finance (DeFi), there are numerous opportunities for individuals to make innovative investments. The emergence of blockchain technology has opened up a whole new world of possibilities, with the potential for high returns and a decentralized financial ecosystem.

One such opportunity lies in the network’s high-yield DeFi platforms, which allow individuals to earn passive income by providing liquidity or making deposits. These platforms, such as Solana-based DeFiLlama, eliminate the need for intermediaries and offer individuals direct access to the market. With a total value locked (TVL) of billions of dollars, these platforms have gained significant traction in the crypto community.

Investors can take advantage of these platforms by depositing their crypto assets and earning interest on their investments. This not only provides a steady stream of income but also eliminates the need for traditional financial institutions. Moreover, Solana’s fast and low-cost transactions ensure efficient and cost-effective investment opportunities.

Furthermore, DeFi platforms also offer opportunities for borrowing and lending. By utilizing smart contracts, individuals can borrow funds without the need for traditional lenders. This not only allows for greater financial inclusion but also reduces the impact of centralized financial institutions on the market.

Additionally, the surge in articles and news about DeFi projects and solana-based platforms highlights the growing interest in this sector. Investors can stay updated on the latest market trends, investment strategies, and potential risks, enabling them to make informed decisions.

Overall, the innovative nature of the crypto and DeFi ecosystem presents exciting opportunities for individuals to diversify their investment portfolios and participate in a decentralized financial landscape. By leveraging blockchain technology and eliminating intermediaries, individuals can protect their funds while taking advantage of the market’s potential for high returns.

The Surge of DeFi Platforms and Their Impact on the Crypto Market

In recent years, there has been a significant surge in the popularity of decentralized finance (DeFi) platforms. These platforms, built on various blockchain networks such as Solana, have revolutionized the financial industry by offering innovative services that eliminate the need for traditional intermediaries.

DeFi platforms allow individuals to securely and transparently invest and transact with cryptocurrencies, opening up new opportunities for financial inclusion. The surge in DeFi platforms has also had a profound impact on the overall crypto market, with a substantial increase in both the total value locked (TVL) and the liquidity available in these platforms.

The Solana-based DeFi platform, DeFiLlama, has seen tremendous growth in its TVL. This increase can be attributed to the platform’s ability to protect users’ deposits through smart contracts and its emphasis on providing a secure and efficient network for DeFi activities. As a result, more individuals are choosing to invest their funds in DeFi platforms like DeFiLlama, rather than relying on traditional financial institutions.

Another important impact of the surge in DeFi platforms is the disintermediation of financial services. With DeFi platforms, individuals can directly access a range of financial services, such as lending, borrowing, and trading, without relying on intermediaries. This not only reduces costs but also increases the efficiency and speed of transactions.

Furthermore, the surge in DeFi platforms has created a new market for smart contracts and blockchain-based investments. These platforms enable individuals to invest in a variety of crypto-assets, such as tokens and digital assets, through smart contracts. This opens up a new era of investment opportunities and financial innovation.

At the peak of the surge in DeFi platforms, there were articles highlighting the risks associated with these platforms. Some individuals double-counted their deposits, resulting in significant losses. However, platforms like Solana-based DeFiLlama have taken steps to address these risks and protect users’ investments.

In conclusion, the surge of DeFi platforms has had a profound impact on the crypto market, revolutionizing the way individuals invest and transact with cryptocurrencies. These platforms provide innovative financial services, eliminate the need for intermediaries, and create new opportunities for financial inclusion. However, it is important for individuals to exercise caution and conduct thorough research before engaging with DeFi platforms to avoid potential risks.

Understanding the Deceptive Tactics of a Crypto Developer

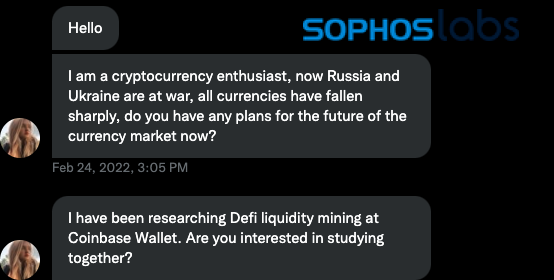

In recent years, the cryptocurrency market has experienced a surge in popularity, attracting individuals who seek financial opportunities in the decentralized finance (DeFi) ecosystem. However, this newfound interest has also led to the emergence of fraudulent actors who exploit the lack of regulation and transparency in the industry for their personal gain.

One such case involved a crypto developer who deceived the DeFi ecosystem, ultimately impacting the market and undermining the trust of investors and users. This developer, operating under the alias “DefiLLama,” capitalized on the innovative investment contracts and platforms that the Solana-based network offered.

At its peak, the “DefiLLama” platform claimed to have a total value locked (TVL) of millions of dollars, offering impressive opportunities for individuals to invest their funds and earn substantial returns. However, a closer look revealed that the TVL figures were double-counted for services such as deposits from friends and internal transactions within the platform.

The deceptive tactics employed by this crypto developer not only affected the Solana blockchain’s liquidity but also brought negative consequences to the wider DeFi ecosystem. By de-emphasizing the need for intermediaries and disintermediation, the “DefiLLama” platform misled users into thinking they could protect their investments and eliminate the risk of fraudulent activities.

Unfortunately, this incident highlights the importance of thorough due diligence and skepticism when engaging in the crypto market. Investors and users must be wary of promises that seem too good to be true and rely on credible sources and articles to protect their funds and make informed decisions.

In conclusion, the deceptive tactics of this crypto developer underscore the significance of regulation, transparency, and accountability within the DeFi ecosystem. As the crypto market continues to evolve, it is crucial for individuals to stay vigilant and educate themselves on the potential risks and rewards associated with their deposits and investments.

The Role of Cryptocurrency in Promoting Financial Inclusion

Financial inclusion is a crucial aspect of ensuring that individuals from all backgrounds have equal access to financial services. The emergence of cryptocurrencies and blockchain technology has opened up new opportunities for promoting financial inclusion and eliminating intermediaries in the ecosystem.

Cryptocurrencies, such as Solana, have created innovative platforms and networks that allow individuals to participate in the financial market directly, without the need for traditional banking systems. Solana-based platforms offer a range of services, from simple deposits to complex investment contracts, all within a decentralized network.

One of the key benefits of cryptocurrency in promoting financial inclusion is the disintermediation of transactions. By eliminating intermediaries, individuals can directly transact with others, without having to rely on traditional financial institutions and their associated fees. This allows for faster and more cost-effective transactions, especially for individuals in underserved areas.

Add to this the liquidity provided by cryptocurrency platforms, and individuals have access to a whole new range of investment opportunities. Crypto platforms like DeFiLlama provide users with a comprehensive overview of the total value locked (TVL) in different DeFi protocols, allowing them to make informed decisions on where to invest their funds.

Moreover, the impact of cryptocurrency in promoting financial inclusion is not limited to individuals. Blockchain technology has the potential to transform the way businesses operate, especially in developing economies. By leveraging the decentralized nature of cryptocurrencies, businesses can protect their finances and assets from inflation or economic instability, thus creating a more sustainable and secure environment.

In conclusion, cryptocurrency has played a significant role in promoting financial inclusion and creating a more accessible and inclusive ecosystem. With innovative platforms and decentralized networks, individuals can access financial services, transact, and invest with greater ease and efficiency. As the crypto market continues to surge, it is crucial to harness its potential to bridge the gap and empower individuals from all backgrounds.

DefiLlama’s Approach to Ensuring Accurate Crypto Deposit Data

DefiLlama, a prominent platform in the blockchain ecosystem, has implemented a robust approach to ensure the accuracy of crypto deposit data. With the rise of decentralized finance (defi), it has become crucial for investors and individuals to have access to reliable information regarding their investments and the liquidity of platforms.

DefiLlama’s innovative solution eliminates the need for intermediaries by relying on blockchain technology. By tracking transactions directly on the blockchain, DefiLlama can accurately calculate the Total Value Locked (TVL) in various defi platforms, such as Solana-based networks. This approach not only protects users from double-counted or false deposit data, but it also de-emphasizes the role of intermediaries in the ecosystem.

Accurate Data for Informed Investments

DefiLlama’s accurate deposit data is essential for investors looking to make informed decisions about their crypto investments. By providing real-time information on the TVL of defi platforms, individuals can assess the impact and opportunities associated with their investments. This transparency enables users to identify trends, assess risk, and capitalize on emerging market conditions.

Protecting the Defi Ecosystem

With the surge in defi platforms, the accurate reporting of deposit data is crucial for the overall stability of the ecosystem. DefiLlama’s approach ensures that the TVL is calculated accurately, protecting the integrity of the entire system. By eliminating the possibility of false or manipulated data, DefiLlama contributes to the security and trustworthiness of the defi ecosystem.

Promoting Financial Inclusion

DefiLlama’s commitment to accurate deposit data supports the broader goal of promoting financial inclusion. By providing transparent and reliable information about defi platforms, individuals from all backgrounds can make informed decisions and participate in the defi market. This disintermediation facilitates access to financial services and empowers individuals to take control of their financial futures.

In conclusion, DefiLlama’s approach to ensuring accurate crypto deposit data plays a vital role in the growth and stability of the defi ecosystem. By leveraging blockchain technology and eliminating intermediaries, DefiLlama provides individuals with the necessary information to make informed investment decisions, while also protecting the overall integrity and inclusivity of the defi market.

The Success Story of Solana Network in the Crypto Space

The Solana network has emerged as one of the most successful players in the crypto space, providing innovative solutions that have propelled its growth and popularity. With its emphasis on speed and scalability, Solana has managed to attract a significant surge of users and developers to its ecosystem.

Solana’s unique approach de-emphasises the need for intermediaries and puts a strong focus on the inclusion of individuals and their investments. This has resulted in a thriving ecosystem that offers diverse opportunities for financial growth and transactions.

One of the key factors contributing to Solana’s success is its ability to protect user funds and provide a secure platform for investment and borrowing. By eliminating the reliance on traditional intermediaries, Solana-based defi contracts offer users increased control over their funds and reduce the risk of double-counted deposits.

Articles and reports from platforms like Defillama have highlighted the significant impact Solana has had on the crypto market. The network’s total value locked (TVL) continues to reach new peaks, indicating the growing popularity and trust in Solana-based defi services.

The Solana network’s focus on disintermediation has also led to the creation of innovative liquidity solutions. Through the use of smart contracts, Solana enables users to access liquidity pools and lending protocols directly, without the need for middlemen. This not only enhances the efficiency of transactions but also opens doors to new investment strategies for crypto enthusiasts.

Financial Growth and Opportunities

The success of Solana can be attributed to its ability to provide a platform that offers a wide range of financial growth opportunities. By eliminating intermediaries and introducing innovative services, Solana has empowered individuals to make the most of their crypto investments.

Moreover, Solana’s surge in popularity has also resulted in increased market demand for its native cryptocurrency – SOL. Many investors and crypto enthusiasts have chosen to invest in SOL, recognizing the network’s potential to revolutionize the crypto space.

In conclusion, Solana’s success story in the crypto space can be attributed to its emphasis on disintermediation, speed, and scalability. By providing a secure and efficient platform for financial transactions, Solana has opened new doors for individuals to access innovative defi services and grow their investments.

Exploring New Avenues for Investment in the DeFi Sector

The decentralized finance (DeFi) sector has witnessed a surge in activity and interest, presenting individuals with new opportunities for innovative investments. With the growing popularity of cryptocurrencies like Solana, investors are now able to explore avenues for investment that were previously inaccessible.

One of the key advantages of the DeFi ecosystem is its ability to eliminate intermediaries, allowing individuals to directly interact with the blockchain and its various financial services. This disintermediation not only reduces fees but also protects funds from potential scams or fraudulent activities.

Investors can now participate in the DeFi ecosystem by making deposits on Solana-based platforms. These platforms provide liquidity by allowing users to borrow against their deposited assets. The inclusion of smart contracts ensures the security of transactions and guarantees the safety of the invested funds.

However, it is important to note that the total value locked (TVL) of a platform should be carefully considered before making any investment decisions. Some platforms may overstate their TVL by double-counting deposits or inflating their liquidity. Investors must take into account the reputation and transparency of a platform before depositing their funds.

The DeFi sector offers a wide range of investment opportunities, from yield farming and liquidity mining to staking and decentralized exchanges. These innovative investment strategies provide potential for significant returns, but they also come with their own set of risks. It is crucial for investors to thoroughly research and understand these strategies before diving in.

Articles and resources like Defillama can be valuable tools for investors looking to navigate the DeFi landscape. Defillama provides real-time data and analytics on various DeFi protocols, helping investors make informed decisions about their investments. By staying informed and leveraging the power of blockchain technology, individuals can make the most of the opportunities presented by the DeFi sector.

The Growth of DeFi Platforms and Their Influence on the Crypto Market

The rise and popularity of decentralized finance (DeFi) platforms have had a significant impact on the crypto market. These platforms offer individuals the opportunity to deposit their cryptocurrencies and take advantage of various financial services without the need for intermediaries. This disintermediation has led to a surge in the market, with the total value locked (TVL) reaching its peak.

DeFi platforms, such as solana-based contracts and networks like Solana, have provided innovative opportunities for individuals to protect and grow their investments. The inclusion of borrowing and lending services, along with the provision of liquidity, has attracted many crypto enthusiasts. This surge in interest can be seen through metrics like TVL, which tracks the total value held in decentralized finance protocols.

According to data from platforms like DefiLlama, the TVL of solana-based DeFi protocols has experienced a significant increase. This growth can be attributed to the rise of solana as a popular network for crypto developers and users. With its fast and scalable blockchain, solana has provided a conducive environment for the development of various DeFi applications.

The impact of DeFi platforms on the crypto market goes beyond just financial opportunities. It also eliminates the need for individuals to rely on traditional financial institutions for their transactions. By leveraging the power of blockchain technology, individuals can directly interact with smart contracts and execute transactions without the involvement of intermediaries.

The growth of DeFi platforms has also led to the emergence of various articles and educational resources aimed at providing insights into this innovative financial ecosystem. These resources help individuals understand the risks and benefits of participating in DeFi and empower them to make informed investment decisions. With the continued growth of DeFi platforms, it is expected that their influence on the crypto market will only continue to expand.

Frequently Asked Questions:

What is the article about?

The article is about a crypto developer who deceived the DeFi ecosystem by unveiling a scam. It also discusses financial inclusion and disintermediation, opportunities for innovative investments, the surge of DeFi platforms and their impact on the crypto market, and the decrease in double-counted crypto deposits.

Can you provide more information about the scam?

In the article, it is mentioned that a crypto developer deceived the DeFi ecosystem by carrying out a scam. However, the specific details of the scam are not provided.

What is financial inclusion and disintermediation?

Financial inclusion refers to the accessibility and availability of financial services to individuals and businesses. Disintermediation, on the other hand, is the reduction or elimination of intermediaries in financial transactions, allowing for a more direct and efficient relationship between the parties involved.

What opportunities for innovative investments are mentioned in the article?

The article mentions that the DeFi ecosystem provides opportunities for innovative investments. Specifically, it highlights the Solana Network’s TVL (Total Value Locked) being at its peak, indicating potential investment opportunities in the network. However, it doesn’t delve into the specific types of innovative investments available in the DeFi ecosystem.

How has the surge of DeFi platforms impacted the crypto market?

The surge of DeFi platforms has had a significant impact on the crypto market. It has brought increased attention and investment to the sector, leading to the growth of decentralized finance as an alternative to traditional financial processes. The rise of DeFi platforms has also led to the development of new investment opportunities and increased liquidity in the crypto market.

What is TVL and why is the Solana Network’s TVL mentioned?

TVL stands for Total Value Locked and refers to the total value of assets that are locked in the DeFi ecosystem. The Solana Network’s TVL is mentioned in the article because it is currently at its peak, indicating a high level of activity and potential investment opportunities in the network.

What is DefiLlama and why does it de-emphasize double-counted crypto deposits?

DefiLlama is a platform that tracks the total value locked in various DeFi protocols. It aims to provide accurate and transparent data to the DeFi ecosystem. It de-emphasizes double-counted crypto deposits to ensure that the reported TVL reflects the actual value and avoids misleading information.

Video:

CRYPTO SCAMMED. THE MONEY IS GONE, DISAPPEARED OVERNIGHT.

⚠️MASSIVE NEWS PREPARE NOW INSITITUTIONS ARE HERE

6 ways to spot a rug pull in crypto — How to avoid scams!

How did the scammer manage to deceive the Defi ecosystem? Can you provide more details about the complex scam?

Hi JohnSmith, thank you for your comment. The scammer employed a sophisticated tactic to deceive the Defi ecosystem. They created an enticing investment opportunity on a Solana-based platform, promising high returns on deposits. This attracted a lot of attention from the Defi community, resulting in a surge in total value locked (TVL) on the platform. However, behind the scenes, the scammer engaged in double-counting deposits, artificially inflating the TVL to make it seem more attractive. This manipulation allowed them to deceive users into investing more money than they should have, ultimately resulting in significant financial losses. The complexity of the scam made it difficult to detect, but now that it’s been uncovered, the Defi community and regulators are working together to prevent future incidents like this. I hope these additional details shed more light on the scam!

This is outrageous! It’s disheartening to see how fraudsters are taking advantage of the trust of users in the crypto industry. We need stricter regulations and better security measures to protect investors from such scams.

Wow, this is really shocking! Can you provide more details on how exactly the developer managed to deceive the Defi ecosystem?