When it comes to investing, we all want to maximize our returns and take advantage of the highest yields available. Recently, there has been a lot of buzz around Anchor’s 20% APY, which sounds incredibly tempting at first glance. However, upon deeper examination and careful consideration, I have decided to pass on this opportunity. Here’s why:

Firstly, it’s important to understand how Anchor achieves such high APY. The company primarily lends out the deposited holdings to borrowers, using algorithmic models to ensure the loans are secure and minimize risks. While this might sound like a great way to generate returns, it also means that there is a possibility of losing your investment. Unlike stablecoin accounts where your funds are held at a fixed value, with Anchor, the value fluctuates based on the success of the loans.

Secondly, there is a liquidity concern. With Anchor, you can borrow against your native holdings, but this also means that your maximum liquidity is limited. If you have planned future investments or need quick access to your funds, Anchor may not be the best option for you. It’s essential to consider your financial goals and evaluate the liquidity requirements before deciding to invest.

Furthermore, while the 20% APY sounds enticing, it’s important to note that this is a projected figure based on the company’s model. There is no guarantee that Anchor will be able to achieve this high return consistently. As an investor, it’s crucial to have realistic expectations and not get swept away by the allure of high yields. It’s better to invest in assets with stable and proven track records, even if the returns may not be as attractive.

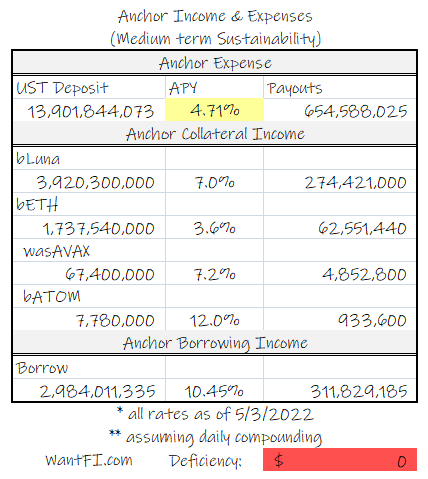

Lastly, there are concerns about the long-term sustainability of Anchor’s business model. The 20% APY seems too good to be true, and it’s essential to question how the company can maintain such high returns. There is always the risk that the demand for borrowed funds may not be sufficient, leading to a decline in the returns. It’s important to consider the viability of the project and assess the risks involved before making any investment decisions.

In conclusion, while the idea of earning a 20% APY may be tempting, passing on Anchor’s offering is the right decision for me. The risks and uncertainties associated with this investment outweigh the potential returns. It’s crucial to thoroughly research and evaluate any investment opportunity before committing your hard-earned money. Ultimately, it’s about finding a balance between risk and reward and choosing investments that align with your financial goals.

Understanding Anchor Protocol:

Anchor Protocol is a growth-oriented platform that is regarded as one of the top DeFi projects in the Terra ecosystem. It is designed to offer stability and high rewards for users who deposit their TerraUSD (UST) into the protocol.

TerraUSD (UST) is a stablecoin that is pegged to the value of the US dollar. It can be used for various purposes within the Terra ecosystem, such as payments, lending, and borrowing.

When you deposit UST into Anchor Protocol, you are essentially becoming a lender. Your deposited UST is used by borrowers who need to secure loans on Terra’s blockchain. In return for lending your UST, you earn a variable interest rate, which is currently set at 20% APY.

This high-interest rate is a result of the system’s design and the risks associated with it. Anchor Protocol uses a number of protocols and technologies to ensure the stability of the platform and protect the lender’s funds. However, there is always a risk involved when lending funds, and it’s important to understand the potential risks before participating.

One risk is the possibility of losing all of your deposited UST. If borrowers default on their loans or if the value of UST decreases significantly, there is a chance that lenders could lose their entire deposit. While measures are in place to mitigate these risks, they cannot guarantee the safety of your funds.

Another variable to consider is the circulating supply of UST. The more UST that is being used for borrowing, the higher the interest rates become. This is because there is less UST available for lenders to earn interest on, and the demand for borrowing increases as well.

So, why should you consider using Anchor Protocol if there are risks involved? Well, despite the potential risks, Anchor Protocol has been successful in maintaining stability and providing high returns for its lenders. The protocol has a planned liquidation mechanism in place to protect lenders’ funds and ensure the stability of the system.

In summary, Anchor Protocol is a high-interest lending platform within the Terra ecosystem. It offers stability and high returns for lenders who are willing to take on the associated risks. If you’re considering participating in the protocol, make sure to do your due diligence and understand the risks involved before depositing your UST.

High APY Dilemma: Decision Making Process

When it comes to deciding where to invest your money, the decision-making process can be quite challenging. In the world of decentralized finance (DeFi), there are many platforms offering high Annual Percentage Yields (APY) on staked cryptocurrencies, making it even more difficult to choose.

One platform that has garnered attention is Anchor, with its impressive 20% APY. However, before jumping in and staking all your funds on Anchor, it’s important to weigh the pros and cons.

One of the main considerations is the sustainability of the high APY. While earning a higher percentage can be enticing, it’s crucial to understand how the platform generates the returns and whether it is a dependable and sustainable source. Some platforms may offer high returns initially but fail to maintain them in the long term.

Additionally, it’s important to assess the risks associated with the platform. Are there any mechanisms in place to ensure the safety of lenders’ and depositors’ funds? What happens if the borrowed money is not paid back? Understanding the risks and safeguards in place will help you make an informed decision.

Moreover, it’s worth exploring other DeFi platforms that offer lower APYs but may have additional functionalities or benefits. Some platforms allow users to stake multiple cryptocurrencies, give users more control over their funds, or have a broader range of investment options.

Another factor to consider is the value of the cryptocurrency being staked. While a high APY may be attractive, it’s essential to evaluate the overall value and growth potential of the cryptocurrency you are staking. For example, if you stake Bitcoin, which has a higher market cap and more stability, it may be a safer bet compared to staking a relatively new project with unknown prospects.

In conclusion, when faced with the high APY dilemma, it’s crucial to do your research, weigh the risks and rewards, and choose a platform that fits your financial goals and risk tolerance. It’s also wise to diversify your investments and not put all your eggs in one basket. Remember, no investment is completely risk-free, so always proceed with caution.

Evaluating Risk and Safety Factors

When it comes to evaluating the risks and safety factors associated with Anchor’s 20% APY, there are several important considerations to take into account.

First and foremost, it’s crucial to understand the potential drop in interest-paying tokens. While the 20% APY may sound appealing, it’s important to recognize that the actual percentage could fluctuate over time. The company’s stakeable token, UST, which is used to earn rewards as a lender, has a circulating supply that can be added or reduced. This means that the APY may not always be a true representation of what lenders will receive in terms of rewards.

Additionally, the technology behind Anchor’s APY system can pose potential risks. The company relies on Terra’s technology, known as Terraform, to maintain stable borrowing and lending rates. However, there have been concerns raised about the lack of transparency and oversight in this technology, which could potentially impact the stability of the APY rates.

Furthermore, it’s important to consider the safety of your investments. While Anchor offers a high APY, there may be limited protections in place for investors. It’s crucial to conduct thorough research and understand the potential risks before committing significant funds to the platform.

Lastly, it’s worth considering that the APY offered by Anchor is not unique to the platform. There are other companies in the market that offer similar or even higher APY rates. Taking the time to explore and compare different options can allow you to make a more informed decision about where to invest your funds.

Anchor Protocol: A Deep Dive

Anchor Protocol is an algorithmic lending and borrowing platform built on the Terra blockchain. It has achieved significant attention and growth since its launch in March this year. Users are attracted to this platform due to its high Annual Percentage Yield (APY) of 20%, which is much higher than traditional savings accounts. However, before diving into Anchor’s APY, it is important to understand how this decentralized finance (DeFi) project works.

How does Anchor Protocol work?

Anchor Protocol generates a stable and sustainable APY by lending users’ TerraUSD (UST) assets to borrowers. Users who deposit UST into Anchor Protocol become lenders, while those who borrow UST become borrowers. The interest generated from these loans is distributed to lenders, which is how the 20% APY is achieved. Anchor Protocol keeps a maximum borrowing amount to ensure stability and to protect the value of UST.

The Risks and Governance

While the 20% APY may seem appealing, it’s important to understand the risks and governance associated with Anchor Protocol. The platform relies on algorithmic stability mechanisms to maintain its peg to the U.S. dollar. However, there is a risk of not being able to maintain this stability, especially if there is a sudden decrease in the demand for UST loans. Additionally, governance plays a crucial role in making decisions about interest rates, borrowing limits, and other key aspects of the protocol.

Why some investors choose to pass on Anchor’s 20% APY

Despite the high potential earnings, there are certain factors that make some investors skeptical about Anchor Protocol’s 20% APY. One concern is the sustainability of such high returns. The APY may vary according to market conditions and the growth of the Terra ecosystem. Additionally, some investors may prefer to keep their UST for other investments or use it on other DeFi projects. Another factor is the volatility and risks associated with cryptocurrencies, which could affect the stability of the platform.

Overall, Anchor Protocol fits into the Terra ecosystem by providing a way for users to earn passive income and borrow stablecoins. However, it is essential to understand the risks involved and to make an informed decision when it comes to participating in the platform. Whether you decide to borrow, lend, or exchange using Anchor Protocol, it is important to consider the maximum APY, the stability of the platform, and the circulating supply of UST.

The Reality of 20% APY

The idea of earning a 20% Annual Percentage Yield (APY) on your investments sounds enticing, but it’s important to understand the reality behind such high returns. While platforms like Anchor are offering this attractive rate, there are several factors to consider before jumping in.

First and foremost, it’s crucial to acknowledge the risks associated with high-interest accounts. The high returns may seem appealing, but they come with a higher level of risk. The 20% APY is not guaranteed, and there is always the possibility of losing your investment.

Furthermore, platforms like Anchor primarily achieve these returns by using algorithmic models and staking mechanisms. While this may seem like a sophisticated and secure system, it’s important to understand that all investments carry inherent risks. The volatility of cryptocurrencies, such as Bitcoin, can have a significant impact on returns. Additionally, the staking process itself carries its own set of risks.

Another important aspect to consider is the overall value and distribution of the returns. While some users may be able to benefit initially from the high APY, as more people join the platform, the returns may decrease. This is due to the distribution model, where returns are paid out to all users based on their stake in the system. As the system grows, the returns may not be as favorable.

Additionally, the offering of such high rates raises questions about the sustainability of the platform. Platforms like Anchor need to maintain a balanced ecosystem to ensure the stability and longevity of their service. If the returns are too high, it could lead to an imbalance in the ecosystem, resulting in potential issues down the line.

Lastly, it’s important to consider regulation and protections when investing in high-interest accounts like Anchor. While some platforms may claim to have certain protections in place, it’s essential to thoroughly research and understand the regulatory landscape before committing your funds. Lack of proper regulation could pose risks to your investments and may limit your legal recourse in case of any issues.

In conclusion, while the idea of earning a 20% APY on your investments may sound appealing, it’s important to approach it with caution. Understand the risks involved, the sustainability of the platform, and the regulatory landscape before making any investment decisions. High returns come with high risks, and careful consideration needs to be given to protect your hard-earned money.

Alternative Investment Options

When it comes to investing, there is no shortage of options available. While Anchor’s 20% APY might seem tempting, it’s important to consider alternative investment options that can offer a more balanced approach.

1. Stablecoin Investments:

One alternative is to invest in stablecoins, such as USDN, which are designed to maintain a steady value. Being bonded with real-world assets, stablecoins offer a more stable investment option with lower risks because their value is pegged to a fiat currency.

2. DeFi Platforms:

Another option is to explore decentralized finance (DeFi) platforms. These platforms work on blockchain technology and allow users to earn interest by lending their cryptocurrency to others. Unlike traditional banks, DeFi platforms offer higher interest rates because there is no intermediation or overhead costs involved.

3. Diverse Cryptocurrency Portfolio:

A diverse cryptocurrency portfolio can be a smart investment choice for those willing to take on more risks. By spreading your investments across various cryptocurrencies, you can potentially capitalize on the growth of different projects and have the opportunity to earn higher returns.

4. Investing in Terra:

Terra, a blockchain-based platform, is another investment option worth considering. Terra is primarily known for its stablecoin, UST, which is pegged to the US dollar. However, Terra’s ecosystem also includes various other projects and tokens that have shown promising growth.

In conclusion, while Anchor’s 20% APY may sound enticing, it is crucial to explore alternative investment options. Stablecoin investments, DeFi platforms, a diverse cryptocurrency portfolio, and investing in Terra are just a few examples of the many opportunities available. Remember to do thorough research and understand the risks involved before making any investment decision.

Investment Strategies for Long-term Profit

When it comes to investing, there are numerous strategies that individuals can employ in order to maximize their long-term profits. One popular investment model is utilizing a stablecoin-based system, like Anchor’s recent offering of a 20% APY. However, while the high interest rates may sound enticing, there are several factors to consider before jumping in.

One of the main concerns with anchor-based investments is the risk involved. While Anchor promises a 20% APY, the stability of their platform is not guaranteed. There have been instances in the past where stablecoin platforms have failed, causing users to lose their funds. This is a risk that investors must carefully assess and consider before committing their money.

Another issue with using Anchor’s stablecoin is the lack of regulatory protections. Unlike traditional financial systems, stablecoin platforms do not have the same level of oversight and consumer protections. This means that if something goes wrong, investors may not have the same recourse to recover their funds or seek legal action.

Additionally, there is the risk of volatility associated with stablecoins. While stablecoins are designed to maintain a stable value, they are still subject to market fluctuations. This means that if the value of the stablecoin drops, investors could still lose a significant amount of money.

Overall, while the high interest rates offered by Anchor’s stablecoin may sound appealing, it is important to carefully weigh the risks and rewards before making any investment decisions. Long-term profit should be the primary goal, and investors should research and analyze different investment options to find a strategy that aligns with their financial objectives and risk tolerance.

Factors Influencing Anchor Protocol’s Safety

1. Algorithmic stability: Anchor Protocol is built on the Terra blockchain, which utilizes an algorithmic stablecoin called TerraUSD (UST). This stablecoin is designed to maintain a peg to the value of the U.S. dollar. By using this algorithmic stability mechanism, Anchor Protocol ensures that its interest-paying accounts are backed by a stable and reliable asset.

2. Collateralization: Anchor Protocol requires borrowers to provide collateral in the form of TerraUSD (UST) or other blockchain assets. This collateral acts as a safeguard against default and ensures that the protocol can cover any losses in the event of a drop in the value of the borrowed assets.

3. Bonded assets: Anchor Protocol also uses bonded assets to provide additional security. Bonded assets are native tokens within the Terra ecosystem that are locked up as collateral and generate rewards for their holders. These bonded assets help to further secure the protocol and minimize potential risks.

4. Regulation: Anchor Protocol’s safety is also influenced by its compliance with regulations. The protocol operates under the guidance of the Terraform Labs team and is built in accordance with regulatory requirements. This ensures that the platform operates within a legal framework and minimizes the risk of regulatory intervention.

5. Sustainable growth: Anchor Protocol’s safety is also a result of its sustainable growth model. The protocol generates revenue through the interest paid by borrowers, and this revenue is used to reward users who hold TerraUSD in their accounts. The sustainable revenue model ensures the long-term viability of the protocol and fosters trust among users.

6. Associated projects: Anchor Protocol is part of a larger ecosystem within the Terra blockchain. This ecosystem includes other projects that enhance the safety of Anchor Protocol. For example, Terra’s stablecoin algorithm and the use of bonded assets are not only utilized by Anchor, but also by other projects within the ecosystem. This interconnectedness adds an extra layer of safety to Anchor Protocol.

7. Transparency and auditability: Anchor Protocol’s safety is further bolstered by its transparency and auditability. The protocol’s code is open-source and can be reviewed by anyone. Additionally, regular third-party audits are conducted to ensure the integrity of the protocol. This transparency and auditability foster trust among users and provide assurance that their funds are secure.

Addressing Concerns: Security Measures

When it comes to choosing a platform to invest your money in, security should be one of the top priorities. In this essay, I’ll address the security measures implemented by Terra, which played a crucial part in my decision to pass on Anchor’s 20% APY.

1. Multi-Signature Validation: Terra uses a multi-signature validation process to maintain the security of users’ funds. This means that multiple signatures are required to authorize transactions, reducing the risk of unauthorized access.

2. Stake in the Ecosystem: As an investor, it’s important to consider the value and stability of the project you’re investing in. Terra has a strong stake in the ecosystem, with its native stablecoin serving as the backbone of its platform. This provides added security and assurance that the project is built on a solid foundation.

3. Borrowing and Lending Protection: One of the risks associated with high interest-paying platforms is the potential for defaulting borrowers. Terra addresses this issue by creating a borrowing and lending model that allows borrowers to stake collateral in excess of the loan amount. This provides an added layer of protection for lenders.

4. Regulation Compliance: While the decentralized finance (DeFi) space is known for its innovative and fast-paced nature, it’s important to consider the regulatory implications. Terra takes a responsible approach by ensuring compliance with relevant regulations, which adds an extra level of security for investors.

5. Monitoring and Auditing: Terra is committed to ensuring the security of their platform by conducting regular security audits and monitoring for any potential vulnerabilities. This proactive approach helps to identify and address any issues before they can be exploited.

6. Partnership with Avalanche: As part of their commitment to security, Terra has partnered with Avalanche, a platform known for its robust security measures. This partnership provides an additional layer of security for Terra users, further mitigating risks associated with the platform.

7. Transparency and Community: One of the most dependable indicators of a platform’s security is transparency and community engagement. Terra has been consistently transparent about their security measures and takes an active approach in engaging with their community. This open dialogue helps to build trust and confidence in the platform.

In conclusion, the security measures implemented by Terra were a significant factor in my decision to pass on Anchor’s 20% APY. By addressing the risks associated with high-interest platforms, Terra has created a more secure and dependable ecosystem for investors. Their commitment to security, compliance, and transparency makes them a trusted choice in the DeFi space.

Market Volatility and Its Impact

Market volatility refers to the fluctuation in prices and the overall instability of the financial markets. It is characterized by rapid and significant price movements, both up and down, in a short period of time. The high level of volatility introduces various risks and challenges for investors and traders.

One major risk associated with market volatility is the potential for significant financial losses. When prices are constantly changing, it becomes more difficult to accurately predict market trends and make sound investment decisions. This can result in investors losing a good portion of their investment capital, especially if they buy assets at high prices and sell them at lower prices.

Another mechanism that can be impacted by market volatility is borrowing. Anchor, for instance, allows users to borrow tokens like Terrausd (UST) at a stable interest rate. However, during times of high market volatility, the stability of UST can be compromised, making it riskier for borrowers to take on debt. The same goes for lenders who may not feel confident in offering loans when the market is highly unpredictable.

The Lack of Consumer Confidence and Increased Risks

The lack of consumer confidence can also be a result of market volatility. When prices are constantly changing and there is increased uncertainty, consumers may be hesitant to invest or spend their money. This can have a negative impact on economic growth and stability.

Furthermore, market volatility can create a mismatch between technology and financial regulations. As technology enables faster and more efficient trading, regulations may struggle to keep up with the pace of change. This can lead to issues such as insider trading, market manipulation, and other fraudulent activities that can further erode consumer confidence and trust in the financial system.

The Impact on Anchor’s 20% APY

Anchor offers a 20% APY (Annual Percentage Yield) on deposited tokens, which is considerably higher than many other investment options available. However, this high APY comes with its own set of risks, particularly in times of market volatility.

During periods of market instability, the value of certain assets can decrease significantly, leading to potential losses for those invested in Anchor. If the interest rate is not adjusted to reflect this change, investors may find themselves earning less than expected or even losing money.

In conclusion, market volatility is a natural part of the financial landscape, and it can have a profound impact on various aspects of the economy. While Anchor’s 20% APY may seem attractive, it is important to keep in mind the potential risks and uncertainties that come with higher returns. Investors should carefully evaluate their risk tolerance and financial goals before deciding to invest in such a volatile market.

Diversification: The Key to Financial Stability

When it comes to managing your finances, diversification is the key to ensuring stability and mitigating risks. Anchor’s 20% APY may sound tempting, but relying solely on one investment can be too risky, especially in a volatile market.

The Workings of Anchor’s Ecosystem

Anchor, a decentralized finance protocol, is offering a 20% APY on their stablecoin, TerraUSD (UST). While this high percentage may seem attractive, it’s essential to consider the potential risks and possible consequences.

The Risks of High APY

One of the main risks of Anchor’s offering is the lack of diversification. If you put all your assets into Anchor’s ecosystem and the total value of Terra or other assets in the ecosystem decreases, you may lose a significant portion of your investment.

Ensuring Financial Stability

By diversifying your investments, you spread out your risk and protect yourself from potential losses. Instead of relying solely on Anchor’s APY, you can explore other investment options such as stocks, bonds, or real estate. This way, if one investment performs poorly, others can help balance out the losses.

The Solution: Diversify

To maintain financial stability, it’s crucial to diversify your portfolio. By spreading your investments across various assets, you can reduce the impact of market fluctuations and protect against potential losses. While Anchor’s 20% APY may sound enticing, it’s important to consider the risks and make informed decisions.

The Importance of Planning

When engaging in financial activities, planning is essential. Consider your goals, risk tolerance, and time horizon. Diversification should be a part of your overall financial strategy, ensuring that you have a steady stream of income and are prepared for any unexpected events.

The Value of Terra and Anchor’s Token

Terra’s native token, Luna, has been performing well, with an increase in value of over 100% in the past year. Anchor’s token, ANC, has also seen significant growth, but relying solely on these tokens exposes you to the risks associated with their performance.

The Potential Risks of Anchor’s Ecosystem

Anchor’s ecosystem, while innovative, is not without risks. For example, the stability of the TerraUSD (UST) stablecoin relies on the active use of loans and other financial activity. If there is a lack of activity or a significant number of loans default, it could put the stability of the system at risk.

The Benefits of Diversification

By diversifying your investments, you can protect yourself from such risks. Instead of relying on a single platform or token, consider spreading your investments across different sectors, asset classes, or even geographical regions. This approach helps mitigate the impact of any single investment’s poor performance.

Conclusion

While Anchor’s 20% APY may sound tempting, it’s crucial to understand the importance of diversification for financial stability. By spreading your investments across various assets and platforms, you can minimize the potential risks associated with a single investment. Diversification ensures that you have a solid foundation for your financial future.

Making an Informed Decision

When considering long-term financial decisions, it is crucial to gather all the necessary information before making a choice. This holds true in the case of Anchor’s 20% APY offering, where borrowers are tempted by the high-interest rate but need to carefully weigh the risks and rewards.

One important factor to consider is the amount of terrausd (UST) that is borrowed. The exchange rate for UST is pegged to the US dollar, ensuring its stability. However, borrowers need to evaluate their needs and assess how much UST they need to borrow, as the borrowed amount will need to be repaid eventually.

Another aspect to be aware of is the protection of the borrowed assets. While borrowers may read about the high APY and be enticed to participate, they should be cautious and fully understand the risks involved. A drop in the exchange rate of UST could significantly decrease the value of the borrowed assets, leading to potential losses.

Furthermore, consumers should be aware of the value of bitcoin in the financial system. While bitcoin is often regarded as a stablecoin and seen as a safe investment, it is important to consider the potential volatility that it can experience. Borrowing against bitcoin may generate high-interest rates, but it also exposes borrowers to further risks.

By thoroughly evaluating the pros and cons of borrowing and the stability of the assets, individuals can make an informed decision about whether to participate in Anchor’s 20% APY offering. It is essential to consider the long-term implications and potential consequences to ensure the best outcome for individual financial needs.

Frequently Asked Questions:

What is Anchor’s APY?

Anchor’s APY is 20%. It is the annual percentage yield that Anchor Protocol offers to its users.

Why are you choosing to pass on Anchor’s 20% APY?

I am choosing to pass on Anchor’s 20% APY because I have concerns about the sustainability and safety of such high returns. I prefer to invest in more stable and diversified assets.

How does Anchor Protocol work?

Anchor Protocol is a decentralized finance (DeFi) platform built on the Terra blockchain. It allows users to earn a stable 20% APY on their crypto deposits by staking UST, a stablecoin pegged to the US dollar. The platform uses a combination of algorithmic stability mechanisms and diversified investments to maintain this high APY.

What are the risks of investing in Anchor Protocol?

Investing in Anchor Protocol carries several risks. One of the main risks is the possibility of a smart contract exploit or a hack that could result in loss of funds. Additionally, there is the risk of a drop in the price of UST, which could affect the stability of the APY. It is also important to consider the potential regulatory risks and the overall volatility of the cryptocurrency market.

Video:

Anchor Protocol Offers 20% APY Savings!

Automation run for Youtube: 14 Jun 2023 07:56:20:116 GMT+05:30

Annual Percentage Rate vs Annual Percentage Yield