DeFi flash loans have been making headlines in the cryptocurrency ecosystem, and for good reason. These unique financial instruments allow users to borrow large amounts of funds without the need for collateral. In this article, we will explore what flash loans are, how they work, and why they are gaining popularity in the DeFi space.

Flash loans are a concept that exist thanks to the decentralized nature of blockchain systems. In traditional borrowing platforms, users must provide collateral to secure a loan. However, in the case of flash loans, users can borrow funds without the need for collateral, under the condition that the borrowed funds are repaid in the same transaction. This is made possible by the use of smart contracts, which automatically execute the loan and repayment logic.

One of the key benefits of flash loans is their wide range of applications. Users can use flash loans to execute complex trading strategies, arbitrage opportunities, or even to protect themselves against price changes on exchanges. Flash loans have also been used to provide instant liquidity to projects, especially in situations where funds need to be accessed quickly.

However, flash loans do come with their fair share of risks. Since flash loans are undercollateralized, there is a risk of the loan not being repaid, which can have a significant impact on the overall stability of the DeFi ecosystem. To mitigate this risk, some platforms have implemented safeguards such as transaction fees and on-chain price oracles like Chainlink, which provide accurate data for executing flash loan transactions.

In conclusion, flash loans are a revolutionary concept in the DeFi space, offering users unprecedented access to large amounts of funds without the need for collateral. However, it is important for users to understand the risks and to carefully assess the potential impact of executing a flash loan before diving into this exciting new financial tool.

What are DeFi Flash Loans?

DeFi flash loans have become a very popular tool in the decentralized finance (DeFi) ecosystem. They are a type of loan that allows users to borrow a large amount of cryptocurrency without any upfront collateral. This means that you don’t need to provide any assets as collateral in order to take out the loan. Instead, the loan is secured by the smart contract itself.

The unique feature of flash loans is that they must be repaid in the same transaction they are borrowed. This means that if you fail to repay the loan in the same transaction, the whole transaction is reversed and the loan is cancelled. This allows users to take advantage of arbitrage opportunities and execute multiple actions in one transaction, all without the need to have sufficient collateral or funds available.

Flash loans are most commonly used for market manipulation and profit-making strategies, where traders can borrow large amounts of cryptocurrency to perform actions such as swapping tokens, manipulating prices, and creating wash trading. These actions can potentially increase profits by taking advantage of price discrepancies in different markets or selling assets at artificially inflated prices.

However, it is important to note that flash loans also come with limitations and risks. Since there is no collateral required, flash loans are considered to be undercollateralized and carry a high level of risk for lenders. If the value of the borrowed assets declines significantly during the transaction, the borrower might not be able to repay the loan, resulting in a loss for the lender.

In conclusion, DeFi flash loans are a powerful tool that allows users to take advantage of arbitrage opportunities and execute multiple actions in one transaction. They have become popular in the DeFi ecosystem for their ability to provide quick access to funds without the need for collateral. However, it’s important to be aware of the risks and limitations associated with flash loans before engaging in any activities.

How do DeFi Flash Loans work?

A DeFi flash loan is a type of loan that allows users to borrow funds without providing collateral. It is a unique feature of the decentralized finance (DeFi) ecosystem, providing users with the ability to execute complex financial operations in a single transaction. Flash loans are gaining popularity among DeFi enthusiasts due to their wide range of uses and the potential for high returns.

Flash loans work by using smart contracts on the blockchain to enable users to borrow tokens for a very short period of time, typically within a single transaction. The loan is only valid within the same transaction and must be repaid before the transaction completes. If the loan is not repaid, the transaction is reversed, and any changes made during the loan period are reverted.

The process of taking out a flash loan involves several steps. First, the borrower specifies the amount of tokens they want to borrow and the type of loan they are looking for. The smart contract then checks if the borrower has sufficient funds to repay the loan, and if so, proceeds with the loan. Once the loan is approved, the borrower can use the funds to execute their desired operations, such as trading, swapping tokens, or even exploiting price differences between different decentralized exchanges.

One of the key features of flash loans is that they offer unsecured borrowing, meaning there is no need to provide collateral. This makes them accessible to a wide range of users and eliminates the need for a centralized finance provider. However, it also introduces risks, as flash loans can be used maliciously to manipulate markets or perform other illicit activities.

To address this, some protocols have introduced additional safeguards, such as requiring borrowers to pay fees or imposing restrictions on the types of operations that can be performed during the loan period. Additionally, flash loan activity can be monitored and audited using blockchain explorers like Etherscan, allowing users to track and verify the transactions.

In conclusion, DeFi flash loans offer a unique and powerful tool within the decentralized finance ecosystem. They provide users with the ability to borrow funds without collateral and execute complex financial operations all within a single transaction. However, users should be aware of the risks associated with flash loans and take appropriate precautions when engaging in these types of transactions.

Why are DeFi Flash Loans gaining popularity?

The popularity of DeFi Flash Loans has been on the rise due to several factors. One of the main reasons is the potential for quick and significant profits. Flash loans allow users to borrow large amounts of assets or tokens without having to provide collateral, enabling them to execute complex trading strategies and take advantage of price discrepancies in decentralized finance (DeFi) platforms. These loans enable users to manipulate the system and make profits within a single transaction.

Flash loans are a new and innovative primitive in DeFi, especially appealing to enthusiasts who are interested in exploring the possibilities of decentralized finance. Unlike traditional lending systems, flash loans are open to anyone and don’t require any sort of credit check or background verification. This accessibility makes them particularly attractive to those who may not have access to traditional lending systems.

One of the main reasons that DeFi Flash Loans are gaining popularity is the lower risk involved compared to conventional lending. Traditional lending often entails the risk of defaulting, where the borrower is unable to pay back the loan. However, in flash loans, the loan gets automatically reverted if the borrower fails to execute all the required actions within a single transaction. This reduces the risk for both the borrower and the lending platform.

Moreover, flash loans provide a way for users to effectively take on larger amounts of debt than they would be able to in a traditional lending system. This can be particularly useful for users who want to leverage their assets to make larger trades or investments. Flash loans allow users to borrow funds, execute their desired trades, and then pay back the loan immediately – all within a single transaction.

Although flash loans have their advantages, they are not without risks. One potential vulnerability is the reliance on oracles, which are systems that provide external data to smart contracts. If a malicious actor is able to manipulate the price data provided by oracles, they may be able to profit at the expense of others. This vulnerability has been reported in the Ethereum ecosystem, and it highlights the need for secure and decentralized oracles.

In conclusion, DeFi Flash Loans are gaining popularity due to their potential for significant profits, accessibility, lower risk compared to traditional lending, and the ability to take on larger amounts of debt. However, it is important to be aware of the risks involved, especially when it comes to vulnerabilities in decentralized oracles.

The benefits and risks of DeFi Flash Loans

DeFi flash loans, which generate a lot of buzz in the Ethereum community, offer many benefits for cryptocurrency traders and enthusiasts. Flash loans allow traders to borrow a significant amount of funds from the existing liquidity pool without the need for collateral. This enables users to take advantage of market opportunities and execute complex trading strategies.

However, there are certain risks and limitations associated with flash loans. Since flash loans don’t require collateral, they are subject to the risk of liquidations if the borrowed funds are not paid back within the same transaction. This can result in significant losses for the borrower.

Flash loans are commonly used for arbitrage operations, where traders take advantage of the price differences between different exchanges or trading platforms. This can be especially profitable when manipulating decentralized exchanges (DEXs) and their liquidity pools. However, it is important to note that flash loans are not without risks. Malicious traders can exploit these loans by manipulating the market to their advantage, resulting in losses for other participants.

One of the limitations of flash loans is that they are only available on certain blockchains, such as Ethereum. Flash loan functionality is not yet widely available on other chains such as Bitcoin or Binance Smart Chain. Additionally, not all tokens or cryptocurrencies are compatible with flash loan protocols, so users need to check whether the asset they want to borrow is supported.

When using flash loans, it is important to understand how the process works and the potential risks involved. It is recommended to do thorough research and due diligence before engaging in flash loan borrowing. It is also important to have a clear understanding of the terms and conditions of the flash loan protocol, including any fees or penalties that may apply.

In conclusion, flash loans offer significant benefits for traders in the cryptocurrency market, but they also come with risks. It is crucial to have a deep understanding of how flash loans work and to be aware of the potential risks and limitations. By taking precautions and thoroughly researching the flash loan protocol, users can maximize the benefits and minimize the risks associated with flash loans.

How to execute a DeFi Flash Loan transaction

To execute a DeFi flash loan transaction, you need to take the following steps:

- Choose a lending platform: Select a DeFi lending platform that offers flash loans. There are several options available in the market, such as Aave, dYdX, and MakerDAO.

- Write the transaction logic: Use smart contract programming to write the logic for your flash loan transaction. This logic will determine how you make use of the borrowed funds to generate profits. For example, you can implement an arbitrage strategy where you borrow funds on one exchange and use them to make a profitable trade on another exchange.

- Access the flash loan: Connect your smart contract to the lending platform and call the flash loan function. This function allows you to borrow funds without any collateral, as long as you return the borrowed amount plus interest within the same transaction.

- Execute your operations: Once you have the borrowed funds, you can perform various operations, such as trading assets, leveraging arbitrage opportunities, or providing liquidity to decentralized exchanges. These operations should be designed to generate a profit within the same transaction.

- Repay the loan: After executing your operations and making a profit, you need to repay the flash loan by transferring the borrowed amount plus interest back to the lending platform. This repayment should happen within the same transaction to avoid any penalties or liquidations.

- Access the profit: If your flash loan transaction was successful and you made a profit, you can access the profit and transfer it to your wallet. This profit can be in the form of cryptocurrencies or stablecoins, depending on the assets involved in your transaction.

It’s important to note that executing a DeFi flash loan transaction involves certain risks. Since flash loans are uncollateralized, if you fail to repay the loan within the same transaction, the entire transaction can be reversed, and you may lose any profit you made. Additionally, flash loans rely on oracles for obtaining real-time price data, and if these oracles are manipulated or provide inaccurate pricing information, it can impact the profitability of your transaction. Therefore, it is crucial to thoroughly understand the risks involved and carefully plan your flash loan strategy.

In conclusion, DeFi flash loans have become increasingly popular in decentralized lending systems, allowing traders and lenders to access large amounts of capital without the need for collateral. By leveraging flash loans, participants can execute complex financial operations within a single transaction, opening up new possibilities for arbitrage, trading, and liquidity provision. However, it’s important to be aware of the risks and ensure proper execution of the flash loan transaction to maximize the potential benefits.

Popular platforms that offer DeFi Flash Loans

There are several popular platforms that offer DeFi flash loans, providing users with the opportunity to execute complex transactions without the need for upfront capital or collateral. These platforms act as intermediaries between lenders and borrowers, facilitating the borrowing and lending process in the decentralized finance ecosystem.

One popular flash loan platform is MoonPay, which allows users to instantly borrow funds and repay them within a single block. MoonPay offers a wide range of tokens across multiple blockchains, making it easy for users to access liquidity in various markets. Thanks to MoonPay’s user-friendly interface and efficient loan processing, millions of dollars worth of flash loans have been executed on the platform.

Another well-known flash loan provider is CubeS, which enables users to borrow funds without posting collateral. The platform utilizes advanced oracles to ensure accurate pricing and to minimize the risks associated with flash loans. CubeS also offers a wide range of tokens and supports various blockchains, allowing users to freely transfer their borrowed funds to different DeFi protocols and trading platforms.

It is important to note that participating in DeFi flash loans carries certain risks. Since these loans are unsecured, borrowers must ensure that they have a solid repayment plan in place before initiating a flash loan. Additionally, flash loans are subject to the risks associated with smart contract vulnerabilities and pricing manipulation. However, with a thorough understanding of how flash loans work and a careful assessment of the associated risks, users can take advantage of the benefits offered by these innovative financial tools.

Real-life use cases of DeFi Flash Loans

DeFi flash loans have gained significant popularity in the world of decentralized finance due to their unique attributes and potential benefits. In this section, we will explore some real-life use cases where flash loans can be of great help in executing complex financial transactions.

Arbitrage opportunities

Flash loans enable traders to take advantage of arbitrage opportunities across various decentralized exchanges. By utilizing flash loans, traders can borrow large amounts of a certain currency, execute profitable trades on different platforms, and repay the loan within the same transaction. This helps them to effectively manipulate the market to their advantage and make a profit.

Preventing liquidations

Flash loans can be used to prevent liquidations in lending platforms. If a borrower is at risk of defaulting on their loan due to insufficient collateral, they can utilize a flash loan to quickly access funds and address the deficiency. By injecting additional collateral into their loan, borrowers can avoid being liquidated and maintain their financial positions.

Reverting transaction state

In the event of a failed transaction or a contract exploit, flash loans can be used to revert the state of the transaction. By executing a flash loan and manipulating specific variables, developers can create a situation where the transaction is automatically reversed. This helps to mitigate the impact of potential vulnerabilities and protect the funds within the decentralized system.

Mortgage refinancing

Flash loans can also be utilized in the real estate market for mortgage refinancing. By borrowing a flash loan, homeowners can immediately pay off their existing mortgage and secure a new loan with better terms. This process helps them save on interest payments and potentially improve their financial situation.

These are just a few examples of how DeFi flash loans can be implemented in real-life scenarios. The flexibility and accessibility provided by flash loans make them a valuable tool for various financial transactions, especially in the decentralized finance space. However, it’s crucial to understand the risks associated with flash loans and exercise caution when utilizing them.

The future of DeFi Flash Loans

The rise of DeFi flash loans has paved the way for a new era in decentralized finance. While they are still relatively new, their immense potential and benefits are starting to become apparent. As more users and developers understand their functionality and advantages, the future of DeFi flash loans looks certain to continue growing.

Millions of dollars are being borrowed and utilized from flash loans, allowing users to access large amounts of capital without the need for collateral. This opens up opportunities for both individuals and businesses, enabling them to take advantage of lucrative investment opportunities or address financial needs.

Preventing malicious attacks and manipulation is crucial in DeFi, and flash loans are no exception. Developers are constantly working to enhance the security of flash loan contracts to protect users’ funds and ensure the ecosystem remains robust. Platforms like Furucombo provide a reliable and user-friendly interface for executing flash loan transactions, making the process more accessible and secure.

One common concern surrounding flash loans is the reliance on oracles to provide accurate price feeds. In case of market manipulation or incorrect price data, it can lead to losses for borrowers. To address this, developers are exploring ways to improve oracle systems and ensure the accuracy and reliability of price information used in flash loan operations.

The decentralization aspect of DeFi flash loans is another key factor in their future. By leveraging blockchains like Ethereum, flash loans provide a decentralized and censorship-resistant method for capital transfer. This not only increases accessibility but also reduces the risk of intermediaries manipulating transactions for their own profit.

While flash loans are currently unsecured, there are ways to mitigate the risk of defaults and address potential losses. For example, protocols can implement mechanisms that allow liquidators to intervene in case of borrowers defaulting on their loans. Additionally, platforms like Furucombo have cancellation mechanisms in place to prevent losses in case of flash loan cancellations.

As the DeFi ecosystem continues to evolve, the future of flash loans holds great potential. With ongoing advancements in security, oracle systems, and risk mitigation strategies, flash loans are poised to play a significant role in the DeFi landscape. Whether you’re a user looking to profit from arbitrage opportunities or a developer exploring new ways to leverage flash loans, understanding how they work and their implications is key to staying ahead in this rapidly evolving space.

Flash loan attacks: the risks and consequences

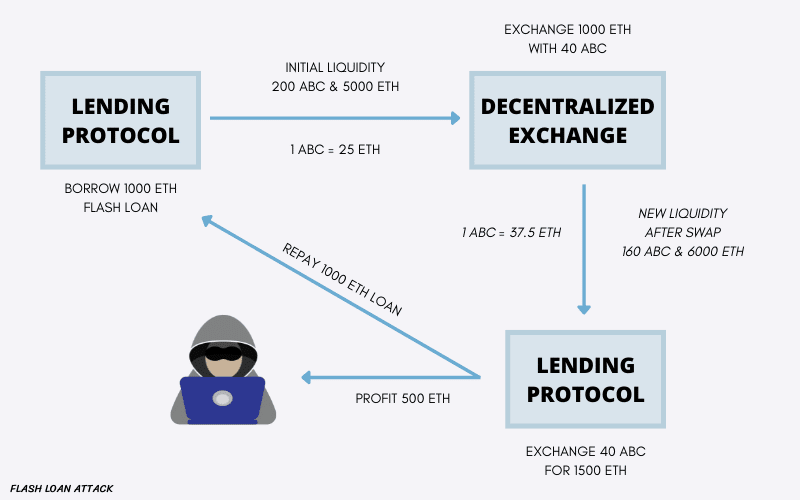

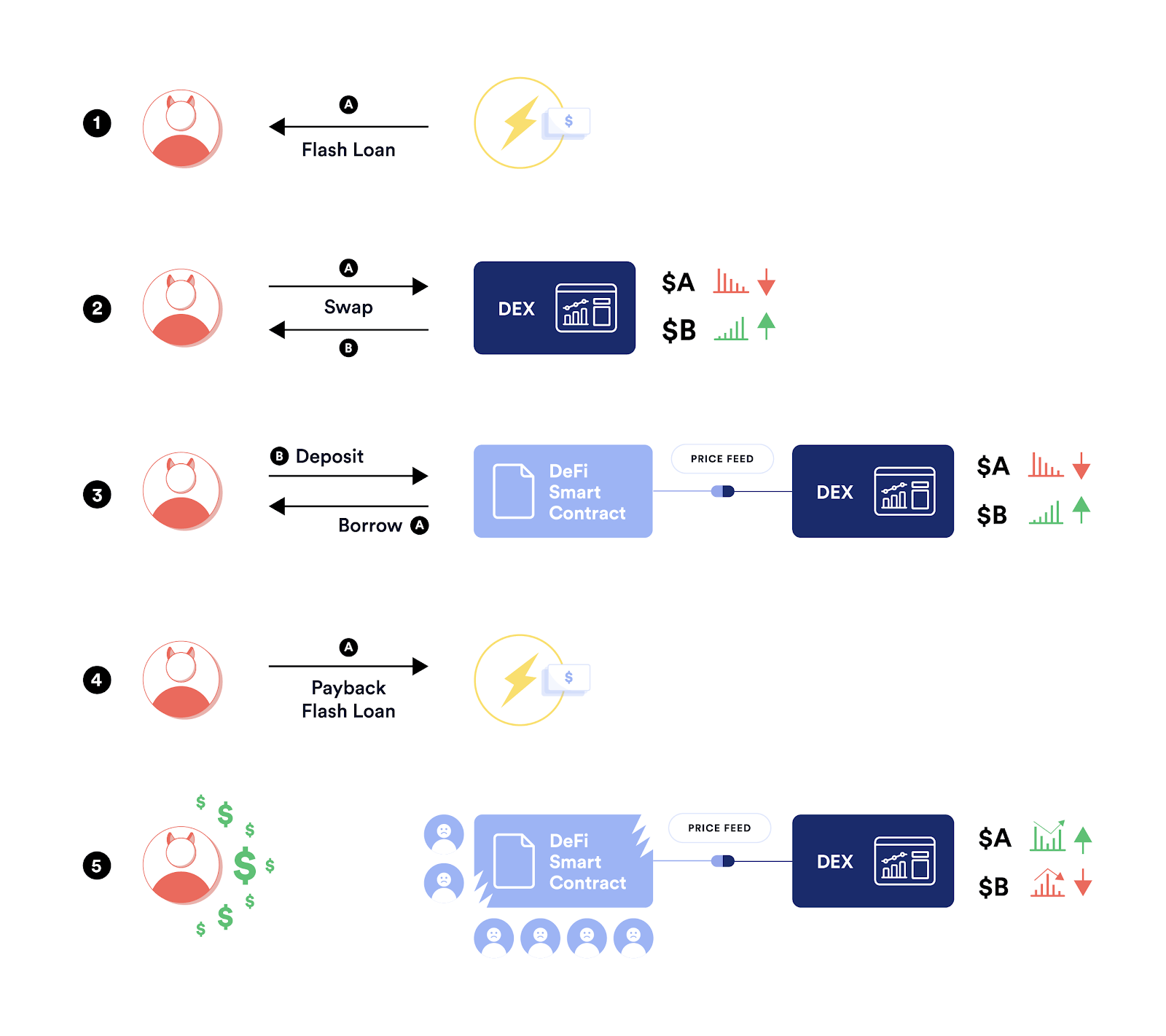

Flash loan attacks have emerged as a major risk in the decentralized finance (DeFi) ecosystem. These attacks target vulnerabilities in the execution of flash loan transactions, where borrowers can take out a loan without any collateral. However, these loans are subject to certain conditions, such as being fully repaid within the same transaction.

In flash loan attacks, malicious actors exploit these conditions to their advantage. They take out a flash loan from a lending platform and use the funds to manipulate the market. This can involve activities like manipulating prices or executing multiple transactions to take advantage of price discrepancies. By the time the transaction is completed, the attacker has made a profit and can repay the loan, leaving no trace of their activity.

Flash loan attacks are particularly concerning because they can address a larger market-wide issue rather than just targeting specific individuals or platforms. They can be used to exploit vulnerabilities in decentralized exchanges (DEX) and other DeFi platforms, potentially causing significant financial losses for users.

One of the main risks associated with flash loan attacks is the lack of coverage. Since flash loans are undercollateralized, there is no guarantee that the lender will be fully repaid if the attack is successful. This creates a burden on the lenders and can lead to losses for them.

To mitigate the risk of flash loan attacks, platforms and users need to implement strong security measures. This can include implementing stricter loan conditions, conducting thorough audits of smart contracts, and utilizing flash loan monitoring tools. Additionally, it’s important for users to exercise caution when using flash loans and to conduct due diligence on the platforms they are interacting with.

How have flash loan attacks impacted the DeFi ecosystem?

Flash loan attacks have had a significant impact on the DeFi ecosystem, raising concerns about the security and stability of decentralized finance platforms. These attacks exploit the unique nature of flash loans, which allow users to borrow funds without collateral as long as they are repaid in the same transaction.

Typically, flash loan attacks involve taking advantage of price manipulation and arbitrage opportunities on-chain. A user borrows a large sum of money through a flash loan and uses it to execute multiple transactions, such as buying an undercollateralized asset, manipulating its price, and then selling it at a higher price. The borrowed funds are then repaid within the same transaction, ensuring that no collateral is required.

During these attacks, the most commonly targeted platforms are decentralized exchanges (DEXs) and lending protocols. Since flash loans enable users to access significant amounts of funds quickly and easily, they have become a popular tool for malicious actors looking to exploit vulnerabilities in DeFi protocols.

Flash loan attacks highlight the importance of decentralized finance protocols having robust security measures in place. It is crucial for developers and users to understand the potential risks associated with flash loans and take necessary precautions to mitigate them. Additionally, increased transparency and auditing of DeFi platforms can also help identify and address vulnerabilities before they are exploited.

Measures to mitigate flash loan attacks

Understanding the potential risks associated with flash loan attacks is crucial for participants in the decentralized finance (DeFi) ecosystem. Flash loans allow users to borrow large amounts of funds without the need for collateral, making them susceptible to various exploitative tactics.

On-chain monitoring: Implementing real-time monitoring and analysis of on-chain transactions helps detect suspicious activities and mitigate potential flash loan attacks. This includes monitoring the movement of funds, identifying abnormal behavior, and analyzing transaction patterns.

Slippage protection: Flash loan attackers often manipulate asset prices to their advantage. Implementing mechanisms to prevent slippage between borrowed and returned assets can help mitigate such attacks. Using decentralized exchanges with slippage protection features can help minimize the impact of price manipulation.

Limited borrowing capacity: By restricting the maximum amount that can be borrowed in a flash loan, platforms can limit the potential profits for attackers. This measure reduces the impact of large-scale attacks and helps protect the platform from significant financial losses.

Improved oracle systems: Oracle manipulation is a common technique used in flash loan attacks. Enhancing the security and reliability of oracle systems helps prevent attackers from accessing inaccurate and manipulated price data. Using multiple sources of price information and implementing robust verification mechanisms can strengthen the integrity of the oracle systems.

Transparent pricing and risk disclosures: Providing clear and upfront information about the pricing and risks associated with flash loans is essential. This helps users make informed decisions and understand the potential consequences of engaging in flash loan activities.

Enhanced smart contract audits: Thoroughly auditing the smart contracts used in flash loan platforms can identify potential vulnerabilities and ensure that they are secure. Regular security assessments and code reviews help identify and fix any exploitable weaknesses in the underlying code.

Collateral requirements: Requiring borrowers to provide collateral for flash loans can help mitigate risks and ensure that borrowers have a stake in repaying the loan. This reduces the potential for malicious attacks and increases the accountability of borrowers.

Active community engagement: Building a strong and active community within the DeFi ecosystem helps in identifying and addressing potential risks associated with flash loan attacks. Encouraging users to report suspicious activities and providing channels for communication and feedback can foster a collaborative and vigilant environment.

Frequently Asked Questions:

What are flash loans in DeFi?

Flash loans in DeFi refer to a type of loan that allows users to borrow funds instantly and without the need for collateral. These loans are executed on decentralized platforms and are typically settled within a single transaction block.

Why are flash loans popular in DeFi?

Flash loans are popular in DeFi because they allow users to access a large amount of capital without the need for collateral. This opens up various trading and arbitrage opportunities, as users can exploit price discrepancies and execute complex trading strategies within a single transaction.

Are flash loans risky?

Flash loans carry some level of risk due to their instant and uncollateralized nature. If a user fails to execute all transactions successfully within a single block, the loan is not repaid, and the transaction is reverted. However, as long as the transactions are properly planned and executed, flash loans can be a powerful tool for efficient capital allocation.

What are some use cases for flash loans?

Flash loans can be used for various purposes in DeFi, including arbitrage trading, collateral swapping, refinancing, and liquidation. Traders can exploit price discrepancies between different decentralized exchanges, while borrowers can optimize their loan positions by swapping collateral or refinancing their existing loans.

Do centralized lending platforms offer flash loans?

No, flash loans are specific to decentralized finance (DeFi) platforms. Centralized lending platforms, also known as CeFi, typically require collateral and have longer processing times. Flash loans are only possible in the decentralized and instantly settling environment of DeFi.

Will flash loans replace traditional loans?

Flash loans are unlikely to replace traditional loans entirely. While they offer unique advantages in terms of instant access to capital and flexibility, they also carry higher risks and require a certain level of technical knowledge. Traditional loans, on the other hand, are more regulated and offer more predictable terms and processes for borrowers.

Video:

Trade Crypto with Flash Loans (DEFI Explained)

All You Need to Know about DeFi and Flash Loans (Explained) [CH 4 | All About Smart Contract Audits]

Flash loans are a game-changer in the crypto space. I love how they allow us to access large amounts of funds without collateral. The use of smart contracts for loan execution is brilliant. However, we must also acknowledge the risks associated with undercollateralized loans. It’s important to proceed with caution and have a backup plan in case things go wrong.

Flash loans are an exciting development in the world of decentralized finance. They have opened up new opportunities for users to access funds without collateral, allowing them to execute complex strategies and protect against price changes. However, it’s important to remember the risks involved, as undercollateralization can lead to potential loan losses. Overall, flash loans have definitely revolutionized the lending space in DeFi.

I have been following the development of DeFi flash loans and I must say, they have revolutionized the lending industry. The ability to borrow funds without the need for collateral opens up so many possibilities for users. It’s amazing how smart contracts make it all possible. However, it is important to be aware of the risks involved. Great article!

This is a fascinating article! I had no idea about the concept of flash loans in DeFi. It’s amazing how blockchain technology enables borrowing without collateral. I can definitely see the potential for executing complex trading strategies and taking advantage of arbitrage opportunities. However, I do wonder about the risks involved, especially with the loans being undercollateralized. Overall, a very informative read!

Flash loans are a game-changer in the cryptocurrency world! It’s amazing how users can borrow funds without needing collateral. The flexibility and versatility of flash loans is truly impressive. However, it’s important to be aware of the risks involved. Proper risk management is crucial when utilizing these loans. Great article, by the way!

Flash loans are a game-changer in the world of decentralized finance. It’s remarkable how they allow users to access large amounts of funds without requiring collateral. This opens up a wide range of possibilities, from executing trading strategies to providing liquidity to projects. However, it is important to acknowledge the risks associated with flash loans, given their undercollateralized nature.

Flash loans are a game-changer in the cryptocurrency industry. Being able to borrow funds without collateral opens up endless possibilities for traders and investors. However, it’s crucial to understand the risks involved and use flash loans responsibly.

Flash loans are a game-changer in the DeFi space! They have opened up a world of opportunities for traders like myself. With flash loans, I can execute complex trading strategies and take advantage of arbitrage opportunities without having to worry about collateral. It’s truly amazing how these loans have revolutionized the cryptocurrency industry.