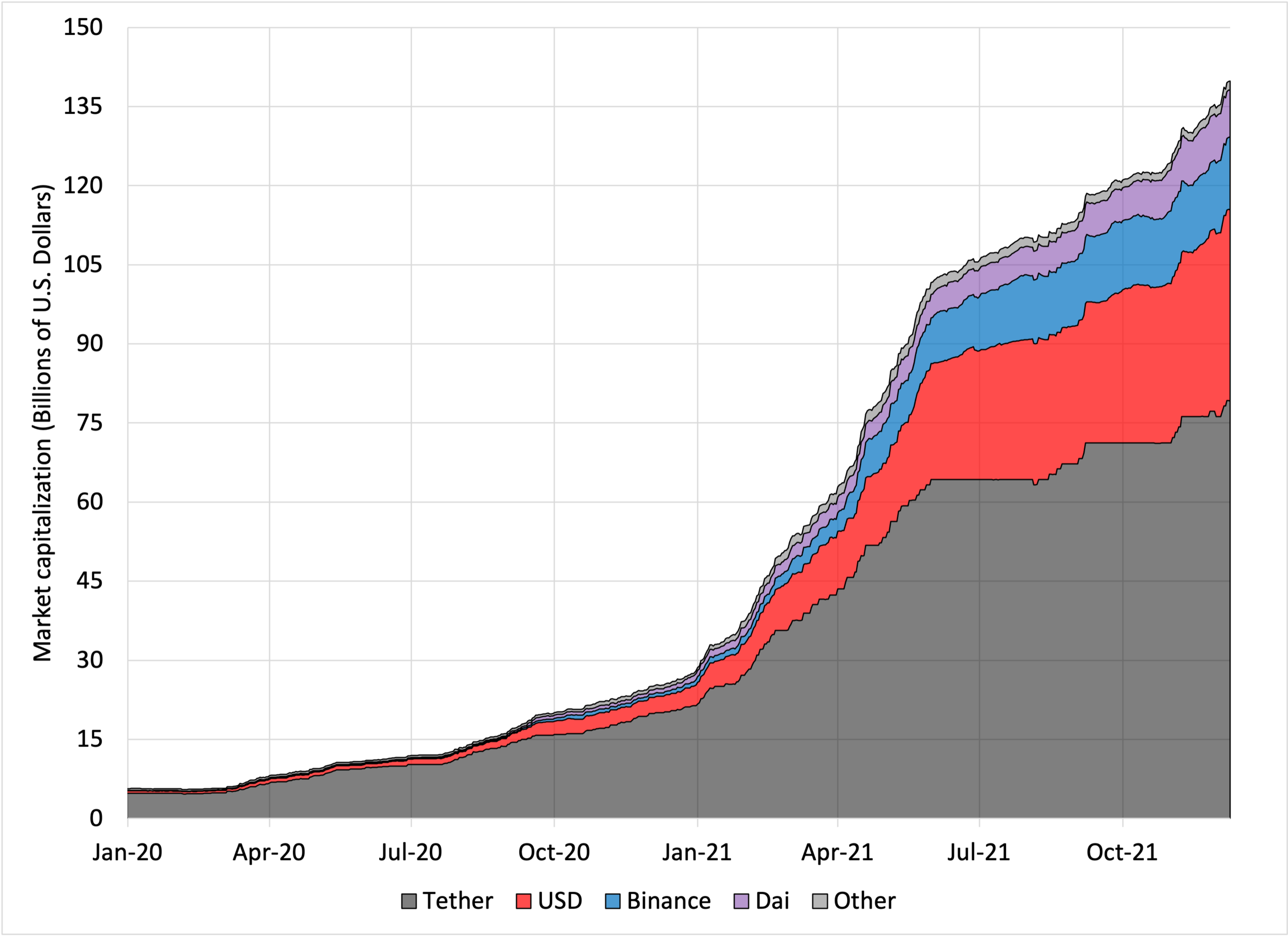

When it comes to stablecoins, Tether (USDT) is a dominant player in the cryptocurrency market. Many users turn to Tether loans to access liquidity for their investments or other financial needs. While these loans can offer attractive interest rates, it is important for users to understand the risks involved.

One of the risks of Tether loans is the potential for the stablecoin itself to face scrutiny or even collapse. Tether has faced controversy in the past, with concerns about whether the company has enough reserves to back up all of the Tether tokens in circulation. If Tether were to lose its value or face regulatory action, borrowers may find themselves in a difficult situation.

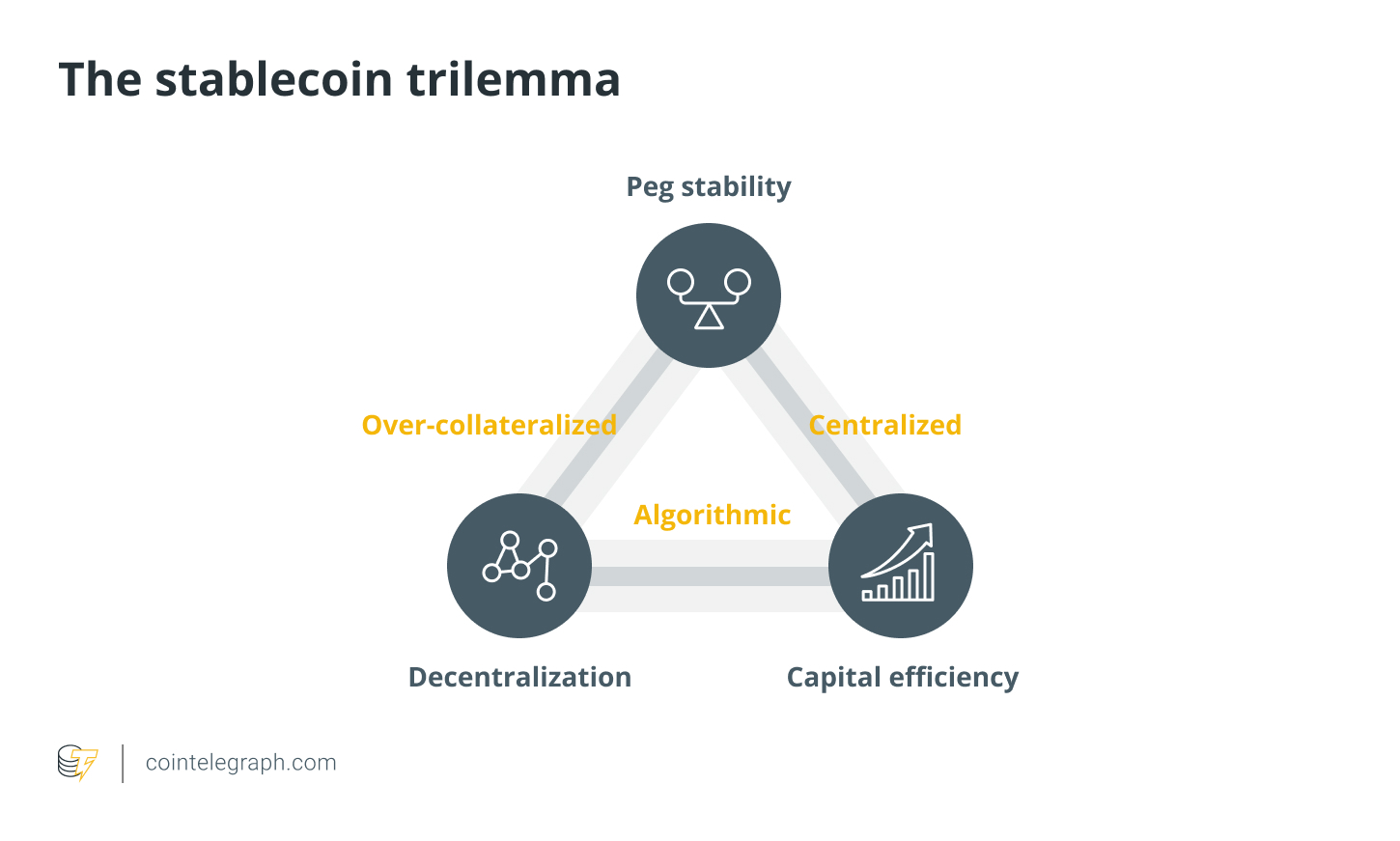

Another risk to consider is the speculative nature of stablecoins. While stablecoins are designed to maintain a stable value, they are still susceptible to market fluctuations. If the value of the stablecoin decreases significantly, borrowers may end up owing more than what they initially borrowed.

Additionally, Tether loans often involve using collateral or assets as security. If the borrower is unable to repay the loan, their collateral may be seized and sold off. This can result in a loss of assets and financial stability for the borrower.

Furthermore, Tether loans rely on platforms that facilitate borrowing and lending. These platforms may have their own risks and vulnerabilities. Hacks, scams, or other issues could compromise the security of the borrowed funds and put the borrower at risk.

In conclusion, Tether loans can offer attractive interest rates and liquidity, but they also come with significant risks. It is important for users to thoroughly understand these risks and carefully assess whether taking a Tether loan is the right decision for them. Additionally, diversifying investments and seeking expert advice can help mitigate some of the potential downsides.

Pros

Speculative: Tether loans offer an opportunity for users to engage in speculative trading, taking advantage of market fluctuations to potentially make a profit. With the ability to borrow Tether against their collateral, borrowers can increase their trading positions and potentially earn higher returns.

Collateralized: Tether loans require borrowers to provide collateral in the form of other cryptocurrencies, such as Bitcoin or Ethereum. This collateral acts as security for the loan, reducing the risk for the lender. Borrowers can choose from a wide variety of collateral options, allowing them to maintain their exposure to different assets while accessing liquidity.

Liquidity: Tether is one of the leading stablecoins in the crypto market, with a high level of liquidity. This means that borrowers can easily convert their Tether loans into other cryptocurrencies or traditional fiat currencies, providing flexibility in their trading strategies.

Flexibility: Tether loans can be used for various purposes, including leveraging existing positions, starting new trading strategies, or simply accessing short-term funds. This makes them suitable for both experienced traders and newcomers to the cryptocurrency market.

Low Risk of Default: Tether loans are backed by the reserves of the company behind Tether, meaning that borrowers are unlikely to face any issues with loan repayments. This provides a level of security and reduces the risk for borrowers.

Diverse Loan Marketplace: Tether loans are available on various lending platforms and decentralized finance (DeFi) protocols, allowing users to choose the most suitable option for their needs. This competitive marketplace ensures that borrowers can find favorable terms and interest rates for their loans.

Best USDT Lending Platforms For July 2023

USDT, or Tether, is one of the most popular stablecoins in the cryptocurrency market. It is pegged to the value of the US dollar and provides users with a way to hold a cryptocurrency that is less volatile than others. However, holding USDT in a wallet may not generate any returns, which is why USDT lending platforms have become increasingly popular. These platforms allow users to lend their USDT to other traders or investors and earn interest on their holdings.

For July 2023, the best USDT lending platforms are those that offer high returns while ensuring the security of user funds. FTX’s lending platform is highly recommended, as it has been around for years and has proven its resilience in times of market crisis. Users can earn interest on their USDT holdings by lending them out through FTX’s lending platform, and the platform provides the option to choose the time period for the loan.

TerraUSD (UST) is another stablecoin that is gaining popularity in the lending market. Unlike USDT, UST is backed by a reserve of collateral, which is known as the Terra protocol. This makes UST a more stable option than USDT, especially during market downturns. Users can lend their UST on various lending platforms and earn interest on their holdings.

A key question for lenders is: How do USDT lending platforms work? When a user lends their USDT on a platform, the platform will match them with borrowers who need USDT for trading or holding purposes. The borrower will put up collateral, usually in the form of other cryptocurrencies, and the lender will earn interest on their loan. If the borrower defaults on their loan, the lender may incur losses, which is why it’s important to choose a platform with a strong risk management system.

Decentralized lending platforms are also gaining traction in the USDT lending market. These platforms eliminate the middleman and allow users to lend and borrow USDT directly without the need for intermediaries. While decentralized lending platforms may offer higher returns, they also come with higher risks. Users should conduct thorough research and due diligence before participating in decentralized lending.

In conclusion, the best USDT lending platforms for July 2023 are those that offer high returns, have a strong risk management system, and prioritize the security of user funds. FTX’s lending platform and TerraUSD are leading options, with each offering unique features and benefits. Whether using a centralized or decentralized platform, users should be cautious and understand the risks associated with lending their USDT, especially in the volatile and speculative crypto market.

Pros And Cons Of CeFi USDT Lending

USDT lending in the centralized finance (CeFi) space has its pros and cons. One advantage is that it provides liquidity to customers who want to hold USDT while earning interest. This can be beneficial for those who do not want to sell their USDT holdings, as it allows them to earn a passive income on their stablecoin without taking on the risk of holding other volatile cryptocurrencies.

On the other hand, there are risks associated with USDT lending in CeFi. One major concern is the issue of centralization and the potential risk of the company itself. While USDT is known to be backed by Tether’s reserves, the fact that it is operated by a centralized entity can lead to uncertainties and potential risks for customers.

Another risk is the borrower’s ability to repay the loan. In the case of USDT, if the borrower is unable to repay the loan, the lender may face potential losses. This is particularly true in cases where the borrower is using the loan for speculative purposes or if the value of USDT drops significantly.

Furthermore, CeFi lending platforms may require borrowers to provide collateral to secure the loan. This adds an extra layer of protection for lenders and reduces the risk of default. However, it also means that borrowers need to have enough collateral to cover the loan amount, which can be a potential barrier for some individuals.

Despite the risks, USDT lending in CeFi can also provide certain advantages. By working with centralized platforms, borrowers can access loans more easily and quickly compared to decentralized alternatives. Additionally, some CeFi platforms offer higher interest rates on USDT loans compared to traditional banking options, which can be appealing to individuals looking for better returns.

In conclusion, USDT lending in the CeFi space comes with its own set of pros and cons. While it offers liquidity and the potential for earning interest on stablecoin holdings, it also carries risks such as centralization and potential borrower default. Individuals should carefully weigh these factors and their risk appetite before engaging in USDT lending in the CeFi market.

What Is USDT Lending

USDT lending, also known as Tether lending, is a type of lending service provided by the stablecoin USDT in the crypto market. Stablecoins like USDT are cryptocurrencies backed by traditional currency reserves, such as the US dollar, to maintain stability in their value and reduce the volatility often seen in other cryptocurrencies.

According to a post on FTX, stablecoin lending allows users to earn interest on their stablecoin holdings by providing those funds to lending platforms. This is similar to traditional lending, where individuals can lend money and earn interest on their loans. However, in the case of USDT lending, the lenders are providing their USDT to the lending platforms, which then lend it out to other users who need it.

One of the main reasons why users are interested in USDT lending is because they can earn interest on their stablecoin holdings, which can be much more beneficial than keeping their funds idle. This is particularly attractive since the crypto market is known to be highly volatile. By participating in USDT lending, users can potentially earn a stable return on their investments, regardless of the overall market conditions.

However, there are also some risks associated with USDT lending. The stability of stablecoins like USDT relies on the reserves they hold. If there are any concerns about the solvency of the reserves or if the reserves are not enough to cover the entire value of the stablecoin in circulation, it can lead to the value of the stablecoin dropping and potentially causing losses for users involved in USDT lending.

The Pros and Cons of USDT Lending

One of the pros of USDT lending is the potential to earn interest on idle stablecoin holdings. This can be an attractive option for investors who are looking for a relatively stable and low-risk way to earn returns on their funds. Additionally, USDT lending provides more liquidity to the stablecoin market, helping to facilitate trading and other crypto-related activities.

On the other hand, there are also cons to USDT lending. The risks include potential losses if the stablecoin’s reserves are not sufficient to cover its value or if there are concerns about the stability of the stablecoin itself. Additionally, there may be risks associated with the lending platforms themselves, including security breaches or insolvency.

In conclusion, USDT lending can be a useful tool for individuals looking to earn interest on their stablecoin holdings. However, it is important to be aware of the risks involved and to carefully consider the stability and solvency of the stablecoin and the lending platform before participating in USDT lending.

Tether Loans Risk to Stablecoin Crypto

In the world of cryptocurrency, stablecoin crypto like Tether loans can be a risky endeavor. While these loans may seem like a convenient way to access funds without having to sell your digital assets, there are several potential pitfalls that borrowers should be aware of.

Wrong Collateral: One major risk associated with Tether loans is the possibility of using the wrong collateral. Tether, like many other stablecoins, is supposed to be backed by assets held in reserves. However, there have been concerns raised about the level of transparency and assurance around Tether’s reserves. If the collateral used for the loan is not truly backed by stable assets, borrowers may find themselves in a precarious position.

Process and Platforms: Another risk factor is the process and platforms involved in Tether loans. Some platforms may not have robust security measures in place, making them vulnerable to hacking and theft. Additionally, the process of obtaining a Tether loan may not always be clear or straightforward, leading borrowers to make mistakes or unintentionally expose themselves to risk.

Resilience of Tether: Tether has faced criticism and scrutiny in the past, particularly due to concerns over its true value and stability. If Tether were to experience a significant loss in value or suffer from a loss of trust, borrowers who have taken out Tether loans could find themselves in a precarious financial position.

Post-FTX Acquisition: Tether’s acquisition by the cryptocurrency exchange FTX has raised additional concerns among some industry experts. This move has prompted questions about the potential conflicts of interest and lack of independence, which could further impact the stability and trustworthiness of Tether loans.

No Middleman: Tether loans are meant to provide a direct borrowing option without the need for a middleman. While this can be convenient, it also means that borrowers may not have the same level of protection or recourse if something were to go wrong compared to traditional financial transactions.

How Tethers Work: Tether loans typically involve borrowing Tether tokens and using a crypto asset as collateral. The borrowed funds are then used as desired, while the borrower is responsible for repaying the loan amount plus interest. The collateral is held as security until the loan is repaid.

Pros and Cons: Like any financial transaction, Tether loans come with their own set of pros and cons. On the one hand, borrowers can access funds without selling their digital assets and potentially miss out on future gains. On the other hand, the risks associated with Tether loans, such as collateral issues and Tether’s stability, cannot be ignored.

In conclusion, Tether loans in the stablecoin crypto market can be a risky endeavor due to factors like wrong collateral, platform vulnerabilities, the resilience of Tether, and lack of a middleman. Borrowers should carefully consider the potential risks and weigh them against the benefits before engaging in such loans.

How Does USDT Lending Work

Tether (USDT) lending is a process in which individuals or institutions can borrow or lend USDT, a popular stablecoin, through various platforms. The lending process usually involves a middleman who facilitates the borrowing and lending of USDT between borrowers and lenders.

When borrowers want to access liquidity without selling their USDT holdings, they can borrow USDT from lenders on these platforms. Lenders, on the other hand, can earn interest by lending their USDT to borrowers. This allows borrowers to access the funds they need without liquidating their assets and lenders to generate income on their USDT holdings.

The process typically involves borrowers providing collateral in the form of other cryptocurrencies or stablecoins. This collateral acts as security for lenders, reducing the risk of default on the loan. In return, borrowers receive USDT loans, which they can use as they see fit.

There are a few risks associated with USDT lending. One risk is the volatility of the collateral provided by borrowers. If the value of the collateral decreases significantly, there is a risk of liquidation, where the collateral is sold to repay the loan. This can result in borrowers losing their assets if the value of the collateral falls below a certain threshold.

Another risk is the counterparty risk of borrowing or lending from platforms that are not decentralized or audited. There is always a risk of the platform being hacked or mismanaged, leading to the loss of funds for borrowers and lenders.

Despite the risks, USDT lending can be a profitable venture for lenders, especially in a high-interest rate environment. However, it is important for participants to thoroughly research and understand the risks involved before engaging in USDT lending.

In conclusion, USDT lending is a way for individuals and institutions to borrow or lend USDT through various platforms. Borrowers can access liquidity without liquidating their assets, while lenders can earn interest on their USDT holdings. However, there are risks involved, such as volatility of collateral and counterparty risk, so thorough research is necessary before participating in USDT lending.

CeFi USDT lending

CeFi (Centralized Finance) platforms have become a popular option for cryptocurrency users to earn passive income through loans. One of the leading stablecoins in the cryptocurrency market is USDT (Tether), which has a 1:1 peg to the US dollar. Many CeFi platforms offer USDT lending options to their customers, allowing them to earn interest on their holdings without the need to trade or risk the fluctuation in value.

Stablecoins like USDT are designed to maintain a stable value, meaning their price does not fluctuate like other cryptocurrencies. This stability makes them an attractive option for investors who want to earn interest on their holdings without taking on the risk associated with other cryptocurrencies.

However, there are risks involved in lending USDT on CeFi platforms. One risk is the scrutiny that Tether has faced in the past. Tether has been criticized for not providing enough transparency about its reserves, leading to concerns that it may not have enough US dollars to back all the USDT in circulation. This lack of transparency has raised questions about the stability and value of USDT.

Another risk is the liquidity of USDT loans. While CeFi platforms may offer attractive interest rates, there is no guarantee that there will be enough demand for borrowers looking to take out USDT loans. This lack of liquidity can result in difficulties when trying to earn interest on USDT loans.

In addition, there is always the risk of default from borrowers. If a borrower is unable to repay their USDT loan, the lender may not be able to recover the full amount. This can result in financial losses for those lending USDT.

Overall, while CeFi USDT lending can be a way to earn passive income, it is important to carefully consider the risks involved. It is advisable to conduct thorough research on the platform, its security measures, and its track record before engaging in USDT lending or any other form of cryptocurrency lending.

Tether Stablecoins Face Renewed Scrutiny Post-FTX

Since the FTX’s acquisition of the Tether parent, questions have been raised about the risks associated with Tether stablecoins. Tethers, which are stablecoins tied to the value of the US dollar, have long been used in the cryptocurrency market as a way to avoid the volatility of other coins. However, the recent scrutiny over Tether’s stability has brought these risks back into focus.

One of the main concerns is whether Tether stablecoins are actually backed by enough reserve currency. Tether claims that each USDT is backed one-to-one by US dollars held in reserve. However, there have been reports that suggest Tether does not have enough financial reserves to cover all of its issued coins. This raises questions about the stability and value of Tether stablecoins.

Another risk associated with Tether stablecoins is the use of these coins in loan pools. Tether loans allow customers to borrow stablecoins by using their cryptocurrency holdings as collateral. However, if the value of the collateral drops significantly, borrowers may not have enough Tether stablecoins to cover their loans. This could lead to a crisis in the loan pool, as borrowers may not be able to repay their loans.

One of the cons of Tether stablecoins is that they still rely on a centralized authority, which goes against the decentralized nature of cryptocurrencies. Tether stablecoins are issued and backed by Tether Limited, meaning that users are essentially trusting a middleman to hold and manage their funds. This introduces counterparty risk and puts the stability of Tether stablecoins at risk.

Furthermore, Tether stablecoins have been known to be used in the cryptocurrency trading process as a way to avoid using actual US dollars. This introduces a risk of inflation and may lead to manipulation in the marketplace. If Tether stablecoins are not actually backed by enough US dollars, it could lead to a devaluation of the cryptocurrency market as a whole.

In conclusion, Tether stablecoins face renewed scrutiny and questions about their stability post-FTX. The risks associated with the stability and backing of Tether stablecoins, as well as their use in loan pools and cryptocurrency trading, are of concern. It remains to be seen how Tether will address these concerns and whether they will regain the trust of the cryptocurrency community.

Frequently Asked Questions:

What are the risks of Tether loans in the stablecoin crypto market?

Tether loans in the stablecoin crypto market carry several risks. One risk is the potential for the value of Tether (USDT) to decrease due to factors such as price volatility or market manipulations. Another risk is the counterparty risk, where the borrower may default on their loan and fail to repay the borrowed USDT. Additionally, there is a risk of regulatory intervention, as stablecoins like Tether have faced increased scrutiny from regulators. It’s important for individuals to carefully assess these risks before engaging in Tether lending.

How does USDT lending work?

USDT lending involves individuals or institutions lending their Tether (USDT) to borrowers in exchange for an agreed-upon interest rate. Borrowers can use the borrowed USDT for various purposes, such as trading or investing, while lenders earn interest on their loaned USDT. The lending process typically occurs through centralized finance (CeFi) platforms that facilitate the matching of lenders and borrowers and ensure the repayment of loans.

What are the pros of CeFi USDT lending?

There are several advantages of engaging in CeFi USDT lending. First, it allows individuals to earn passive income through interest earned on their loaned USDT. This can be an attractive option for those looking to grow their cryptocurrency holdings. Second, CeFi platforms provide a convenient and user-friendly interface for borrowers and lenders to participate in the lending process. Lastly, CeFi lending platforms often provide additional security measures, such as insurance or reputation systems, to mitigate risks for lenders.

What are the risks of Tether loans to stablecoin crypto?

Tether loans in the stablecoin crypto market carry inherent risks. One major risk is the potential for Tether (USDT) to lose its peg to the US dollar, which could result in significant losses for lenders. Additionally, Tether’s centralized nature raises concerns about counterparty risk, as borrowers may default on their loans. The stablecoin market as a whole also faces regulatory risks, which could impact the availability and value of Tether. These risks should be carefully considered before engaging in Tether lending.

What is the current scrutiny facing Tether stablecoins post-FTX?

Tether stablecoins, including USDT, have faced renewed scrutiny post-FTX. The regulatory focus has primarily been on the transparency and backing of Tether tokens. There have been concerns regarding Tether’s claims of having sufficient reserves to back the issued USDT tokens. The scrutiny has led to increased demands for audits and transparency from Tether, as regulators aim to ensure the stability and legitimacy of stablecoins in the crypto market.

What is USDT lending?

USDT lending refers to the practice of lending Tether (USDT) to borrowers in exchange for interest. Lenders provide their USDT to borrowers, who can then use the borrowed funds for various purposes within the cryptocurrency market. The borrowers agree to repay the borrowed USDT within a specified timeframe, along with the accrued interest. USDT lending is typically facilitated through centralized finance (CeFi) platforms that connect lenders and borrowers.

What are the best USDT lending platforms for July 2023?

As the cryptocurrency market is highly dynamic, the best USDT lending platforms can vary over time. However, some popular platforms for USDT lending as of July 2023 include Aave, Compound Finance, and Celsius Network. These platforms offer competitive interest rates, user-friendly interfaces, and robust security measures. It’s important to conduct thorough research and consider factors such as platform reputation, fees, and user reviews before choosing a USDT lending platform.

What are the pros and cons of CeFi USDT lending?

CeFi USDT lending has various pros and cons to consider. On the pros side, it allows individuals to earn interest on their loaned USDT, providing a passive income opportunity. CeFi platforms also offer convenience and ease of use, making it accessible for borrowers and lenders. However, there are also cons to consider. CeFi lending involves counterparty risk, as borrowers may default on their loans. Additionally, regulatory risks can impact the stability and availability of USDT. It’s crucial to weigh these pros and cons before participating in CeFi USDT lending.

Video:

Consolidating at Top of Range! That’s Great!

Stablecoins: Why This Hot Cryptocurrency Faces Challenges | WSJ