If you are a cryptocurrency holder, you may be looking for ways to earn passive income on your holdings. One of the ways to achieve this is by lending your cryptocurrencies, such as Bitcoin, on various platforms available in the market. However, it is crucial to select the right lending platform to ensure the safety of your funds.

When looking for a crypto lending platform, the first thing you need to do is conduct an overview of the platforms available. There are many platforms out there, each offering different features and benefits. You want to choose a platform that is secure, reliable, and trustworthy.

One of the key criteria for selecting a crypto lending platform is its reputation. You want to choose a platform that has a strong track record and has been operating for a significant period of time. This will ensure that the platform is well-established and has a proven track record of serving its members.

Another important aspect to consider is the types of cryptocurrencies and stablecoins that the platform supports. Some platforms may only offer loans in Bitcoin, while others may have a variety of cryptocurrencies available. It is important to choose a platform that supports the cryptocurrencies you hold.

Additionally, you should consider the risk associated with lending your cryptocurrencies. While lending can be a profitable venture, it is not without risk. You need to understand the platform’s risk management strategies and the potential risks involved in lending your cryptocurrencies. This will help you make an informed decision and minimize any potential losses.

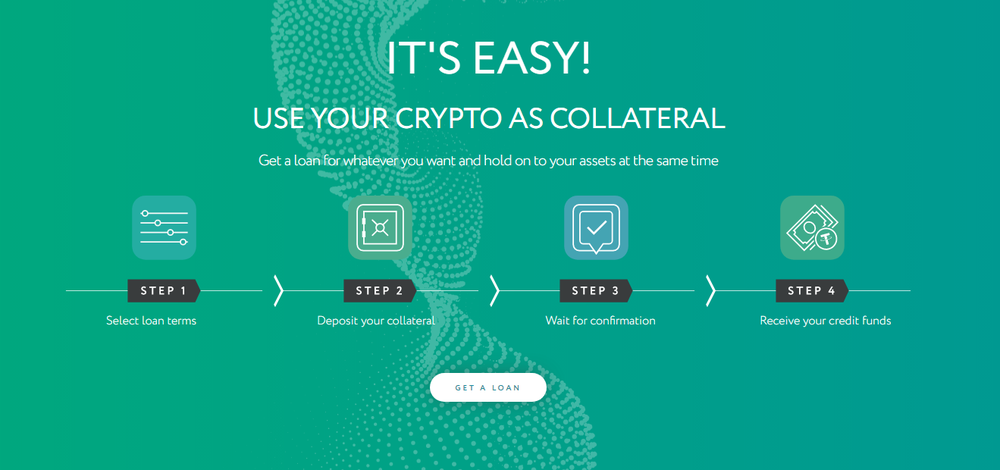

Moreover, it is important to consider the terms and conditions of the lending platform. Some platforms may require collateral, while others may not. Some platforms may offer fixed interest rates, while others may have variable rates. Understanding these terms will help you assess whether the platform is suitable for your lending needs.

Furthermore, you should consider the platform’s user interface and the ease of use. A user-friendly interface will make it easier for you to navigate and use the platform effectively. Additionally, you should consider the platform’s customer support and the level of assistance they offer to their users.

In conclusion, finding a safe and reliable crypto lending platform requires careful research and consideration. By following the criteria mentioned above and conducting a thorough search, you can find a platform that suits your needs. For a complete overview of the safest crypto lending platforms and the best Bitcoin loan sites, visit our website to learn more.

Top 10 Safest Crypto Lending Platforms for Bitcoin Loans

When it comes to lending platforms for Bitcoin loans, users prioritize safety and security. Therefore, it is crucial to find the best and most secure platforms. Here are the top 10 safest crypto lending platforms:

- Crypto.com: This platform provides a high level of security and offers monthly interest payments, making it a great choice for users who want a steady income from their Bitcoin.

- SmartFi: With features like smart contracts and a crypto-to-fiat lending platform, SmartFi is one of the best options for users who want to borrow Bitcoin without the risk of liquidation.

- Polygon: Offering a wide range of lending solutions, Polygon ensures that users can choose the terms that best suit their needs. The platform also provides high LTVs and low interest rates.

- Bitcoin.com: As a major player in the crypto industry, Bitcoin.com provides users with a secure platform for lending and borrowing Bitcoin. The platform also offers a bonus for new users.

- BlockFi: BlockFi is known for its high level of security and the ability for users to receive their Bitcoin as collateral. The platform also offers competitive interest rates and flexible loan terms.

- Celsius Network: This platform is the go-to choice for many users due to its high-security standards. Users can earn interest on their Bitcoin and enjoy a low minimum borrowing limit.

- Gemini: Gemini is a reputable platform that provides a secure lending environment. Users can collateralize their Bitcoin and access their loans directly without the need for a third party.

- Crypto-Fiat Loans: Some lending platforms offer the option to borrow Bitcoin while providing fiat currency as collateral. This way, users can benefit from the value appreciation of the borrowed Bitcoins without being exposed to the risk.

- Manual Approval Process: Some lending platforms have a manual approval process, which adds an extra layer of security. Users can rest assured that their loans are provided after careful review and consideration.

- Withdrawal to a separate address: Safety can be further ensured by withdrawing the borrowed Bitcoins to a separate address, reducing the risk of loss or theft.

Choosing one of these top 10 safest crypto lending platforms for Bitcoin loans offers users a secure and reliable way to borrow or lend their Bitcoins. Make sure to carefully consider the features, terms, and risks associated with each platform to find the one that best suits your needs.

Trusted Bitcoin Loan Sites Will Help You Get Cash Quickly

If you are in need of quick cash, trusted Bitcoin loan sites can offer you a solution. Unlike traditional banking methods, these platforms provide instant access to loans without the need for extensive verification processes or collateral. By taking advantage of the high adoption rate of cryptocurrencies, these sites have revolutionized the lending industry and made it easier for individuals and businesses to get the funds they need.

Fast and Convenient Process

Bitcoin loan sites operate on peer-to-peer (P2P) lending platforms, which allow borrowers and lenders to connect directly. This eliminates the need for intermediaries and their associated costs, making the borrowing process more efficient. With just a few clicks, borrowers can apply for a loan and receive the funds in their crypto wallet within minutes.

No Credit Check or Collateral Required

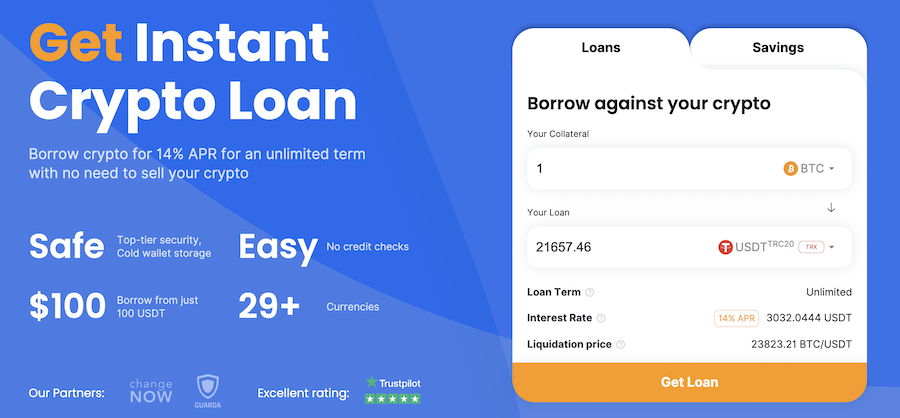

One of the key advantages of trusted Bitcoin loan sites is that they offer loans without the need for a credit check or collateral. Instead, borrowers can secure their loans by providing their cryptocurrency as collateral, which is held securely by the platform until the loan is repaid. This eliminates the risk of being liquidated due to fluctuations in the market and allows individuals with limited or no credit history to access funding.

Competitive Interest Rates

Bitcoin loan sites provide borrowers with access to a variety of loan options, including fixed and variable interest rates. This allows borrowers to choose a repayment plan that best suits their financial situation. Additionally, the platforms ensure fair interest rates by leveraging smart contracts and blockchain technology to automatically adjust rates based on supply and demand.

Flexible Loan Terms

Trusted Bitcoin loan sites offer borrowers flexibility in terms of loan durations. Whether you need funds for a few months or a longer period, these platforms can accommodate your needs. Additionally, some sites offer the option to extend loan terms, allowing borrowers to avoid penalties and maintain their financial stability.

In conclusion, trusted Bitcoin loan sites provide a fast, secure, and convenient way to access cash. With competitive interest rates, flexible loan terms, and the absence of credit checks or collateral requirements, these platforms have become the go-to place for individuals and businesses in need of quick funding. By leveraging the power of cryptocurrencies, these sites are paving the way for a more inclusive and efficient lending industry.

How to Keep Your Crypto Assets Safe with Crypto Lending Platforms

Do thorough research on the best crypto lending platforms

When it comes to keeping your crypto assets safe with crypto lending platforms, it is essential to do diligent research on the platforms available in the market. Look for platforms that have a solid reputation and provide transparent and secure lending services.

Choose platforms that offer the highest level of security

Opt for platforms that offer the highest level of security for your crypto assets. This includes features such as multi-signature wallets, cold storage, and two-factor authentication to ensure that your assets are protected from hackers and unauthorized access.

Consider platforms that offer collateralized loans

One of the safest options for crypto lending is to choose platforms that offer collateralized loans. These platforms require borrowers to provide collateral, such as Bitcoin or other cryptocurrencies, which acts as a guarantee for the loan. In case of default, the lender can seize the collateral to recover their funds.

Invite platforms that provide stablecoin loans

Stablecoins, which are cryptocurrencies pegged to a stable asset such as the US dollar, are becoming increasingly popular in the crypto lending space. Some platforms offer loans in stablecoins, which can provide a more stable borrowing experience and protect borrowers from the volatility of other cryptocurrencies.

Keep a wide variety of crypto assets in your lending portfolio

Diversification is key to maintaining the safety of your crypto assets. Instead of relying solely on Bitcoin, consider lending a wide range of crypto assets. This way, if there is a downturn in one particular market, you won’t suffer a significant loss as there will be other assets in your portfolio.

Monitor your loan performance and address any issues promptly

Regularly monitor the performance of your loans on different platforms. Keep track of the interest rates, loan terms, and repayment schedules to ensure that everything is in order. If you notice any issues or discrepancies, address them promptly with the lending platform to resolve them effectively.

Sign up for platforms that offer flexible loan terms

Flexibility is crucial when it comes to crypto lending. Look for platforms that offer flexible loan terms, allowing you to adjust the loan amount, interest rate, and repayment period according to your needs. This will enable you to tailor the lending experience to your specific requirements.

Stay informed about the latest developments in the crypto lending industry

The crypto lending industry is constantly evolving and new platforms and solutions are being introduced regularly. Stay informed about the latest news and developments in the industry to ensure that you are aware of any changes or improvements that can benefit your lending activities.

Follow best practices for maintaining the security of your crypto assets

Finally, it is essential to follow best practices for maintaining the security of your crypto assets. This includes using strong and unique passwords, enabling two-factor authentication, regularly updating your software and hardware wallets, and being cautious of phishing attempts and suspicious websites.

Conclusion

Keeping your crypto assets safe with crypto lending platforms requires thorough research, choosing secure platforms, diversifying your lending portfolio, and staying informed about the latest industry developments. By following these steps and best practices, individuals can confidently engage in crypto lending while minimizing the risks associated with this type of investment.

The Benefits of Using Reliable Bitcoin Loan Sites

When it comes to borrowing and lending in the crypto industry, using reliable Bitcoin loan sites can provide several benefits. These platforms have been approved and trusted by the community, offering a safe and secure environment for borrowing and lending transactions.

One of the main benefits of using these Bitcoin loan sites is the ability to earn interest on your Bitcoin holdings. Instead of keeping your Bitcoin in a wallet and not making any profit, you can lend it out and earn interest over time. This can be particularly attractive for long-term investors who are looking to earn passive income on their digital assets.

Another advantage is the simplicity and convenience of the borrowing process. Unlike traditional lending institutions, Bitcoin loan sites typically have a quicker approval process, allowing borrowers to access funds within minutes or hours. This makes it easier for those in need of instant capital to get the required funds without going through lengthy verification procedures.

Moreover, using Bitcoin loan sites is a suitable option for borrowers with limited credit history or poor credit scores. These platforms often have alternative ways to evaluate creditworthiness, such as analyzing the borrower’s transaction history or collateral provided. This opens up borrowing opportunities for those who may not qualify for loans from traditional lenders.

Additionally, some Bitcoin loan platforms offer a hybrid ecosystem that combines traditional lending methods with blockchain technology. For example, platforms like BlockFi provide loans backed by Bitcoin and other cryptocurrencies, allowing users to borrow funds while using their digital assets as collateral. This provides borrowers with more flexibility and options when it comes to accessing the needed funds.

In conclusion, using reliable Bitcoin loan sites can offer various benefits for both borrowers and investors. These platforms provide a simple and convenient borrowing process, attractive interest rates, and alternative ways of evaluating creditworthiness. Whether you’re looking to borrow or invest, utilizing these platforms can help you make the most out of your Bitcoin holdings.

Smart Crypto Loans: The Future of Crypto Lending

As the cryptocurrency market continues to grow, more and more people are looking for ways to leverage their digital assets. One of the most popular options is crypto lending, which allows users to borrow against their crypto holdings. However, with such a wide variety of providers and platforms available, it can be difficult to know where to start. That’s where smart crypto loans come in.

Smart crypto loans are the future of crypto lending because they offer a range of benefits that traditional lending platforms cannot match. For example, many smart crypto loan providers, such as Wintermute, offer margin loans, which allow users to borrow more than the value of their collateral. This means that hodlers can access more funds without needing to sell their tokens.

Unlike traditional lending platforms that often require a credit card or other form of forced savings as collateral, smart crypto loans are backed by the value of the borrower’s digital assets themselves. This collateralized lending means that borrowers can get access to the funds they need without the high cost and hassle of traditional loans.

Furthermore, smart crypto loans often come with more flexible repayment terms. Users can choose to repay their loan in either fiat or cryptocurrency, depending on their preference. This flexibility is a major bonus for those who want to maximize their potential gains while using their digital assets.

When it comes to choosing the right smart crypto loan provider, reputation and transparency are key. Look for providers with a track record of excellent service, such as BTCPop. It’s also important to consider factors such as loan-to-value ratios (LTVs) and loan terms.

Smart Crypto Loan FAQs:

- What are smart crypto loans?

- How do smart crypto loans work?

- What are the benefits of smart crypto loans?

- How can I choose the right smart crypto loan provider?

- Are smart crypto loans safe?

In summary, smart crypto loans are the future of crypto lending because they offer more flexibility, lower cost, and higher potential gains for borrowers. With a wide range of providers available, it’s important to do your research and choose the safest and most reputable platform for your financial needs.

Boost Your Financial Freedom with Bitcoin Loans

If you are looking for ways to enhance your financial freedom, Bitcoin loans can be a great option. Many platforms offer Bitcoin loans, allowing you to borrow funds using your Bitcoin holdings as collateral. This enables you to use your Bitcoin investments as a source of liquidity, without having to sell them.

One of the safest and most reliable ways to get a Bitcoin loan is through a crypto lending platform. These platforms connect borrowers with lenders that are willing to provide loans in exchange for Bitcoin and other cryptocurrencies as collateral. The lenders usually have strict approval processes and provide the highest loan-to-value ratios, ensuring that borrowers can access a significant amount of funds based on their collateral.

How Bitcoin loans work

When you take out a Bitcoin loan, the lender will hold your Bitcoin as collateral. The loan amount is usually calculated based on the value of your Bitcoin holdings, ensuring that you can get a loan that aligns with your needs. As a borrower, you can benefit from the flexibility and convenience of accessing funds without selling your Bitcoin holdings.

The benefits of Bitcoin loans

Bitcoin loans offer several advantages. Firstly, you can invest in other projects or opportunities without using your fiat currency. Secondly, by using your Bitcoin as collateral, you can access liquidity without having to sell your holdings, which can be particularly beneficial if you believe that the value of Bitcoin will increase in the future. Additionally, Bitcoin loans often come with low monthly interest rates, making them an affordable option for borrowers.

Furthermore, some platforms offer referral programs, allowing borrowers to earn rewards for referring new users to the platform. This can be a great way to earn passive income and boost your financial freedom.

Choosing the right platform

When selecting a platform for Bitcoin loans, there are several factors to consider. Look for platforms that have a strong track record and positive user reviews to ensure that your Bitcoin holdings are safe. Additionally, consider the loan-to-value ratios offered by different platforms, as this will determine how much you can borrow based on your collateral. It’s also important to review the terms and conditions, interest rates, and fees of each platform to ensure that they align with your financial goals.

Overall, Bitcoin loans offer individuals the opportunity to leverage their Bitcoin holdings to access funds for various purposes. By selecting a reputable and reliable platform, you can enjoy the benefits of Bitcoin loans while maintaining control over your investments.

Safeguarding Your Investments: Secure Crypto Lending Platforms

When it comes to investing in cryptocurrencies, security is of utmost importance. Therefore, it’s crucial to choose a crypto lending platform that offers verified and secure services to ensure the safety of your investments.

One way to ensure the security of a crypto lending platform is to check if it is still in operation and has a good track record. You can also check the platform’s security measures, such as two-factor authentication and cold storage for storing user funds.

Before using a crypto lending service, it is important to review its terms and conditions, including its fee structure and loan-to-value ratio. This will help you understand how the platform operates and the costs involved in borrowing or lending crypto.

Several crypto lending platforms are approved and regulated by relevant authorities, providing an additional layer of security for investors. These platforms typically have strict guidelines in place to ensure compliance with regulations and protect user funds.

One type of crypto lending platform is peer-to-peer (P2P), where borrowers and lenders interact directly. P2P platforms rely on smart contracts and blockchain technology to secure transactions and ensure fair lending practices.

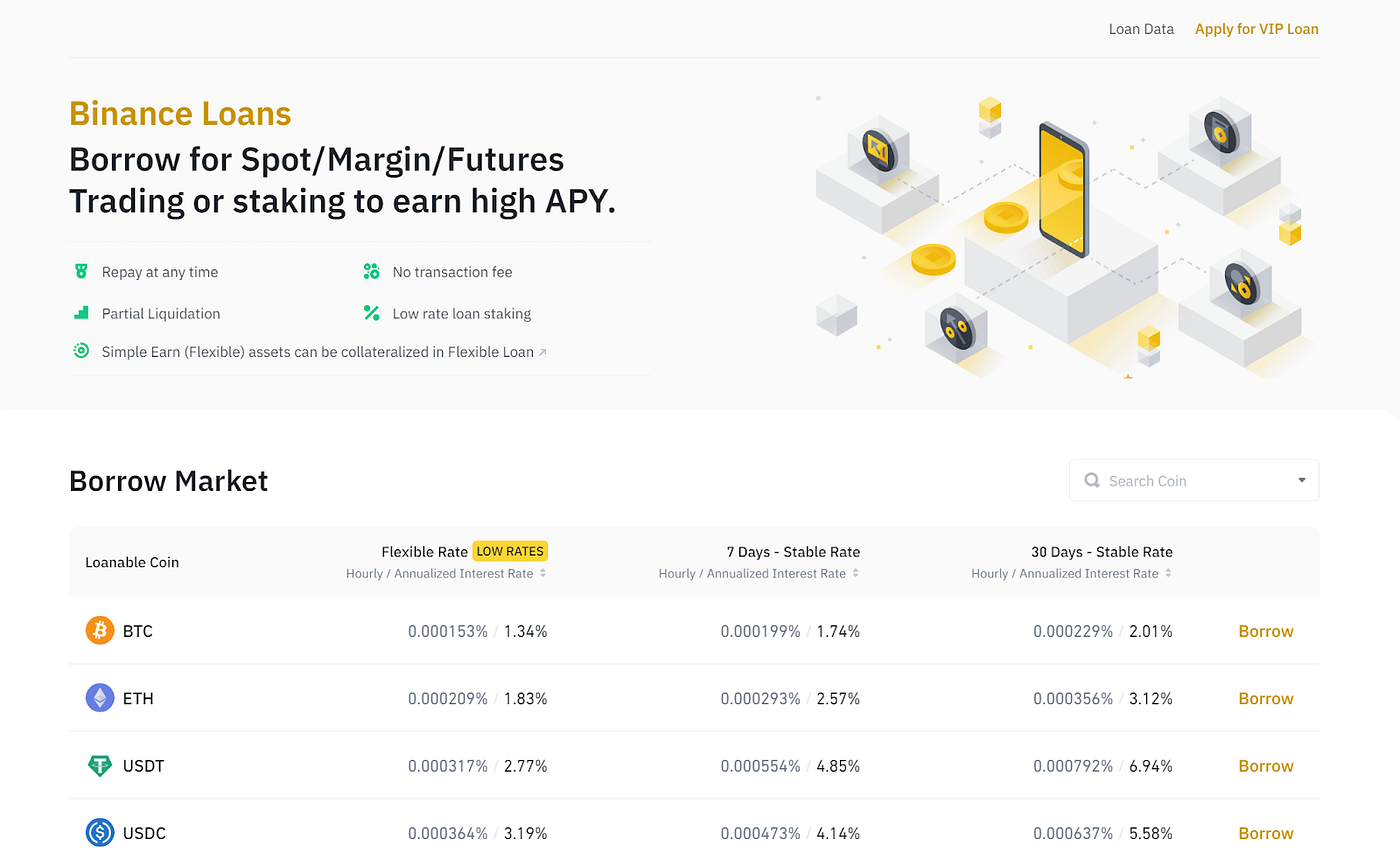

Another type of platform is an exchange-based lending platform, where users can lend their cryptocurrencies to other traders on the exchange. These platforms usually offer short-term loans and provide a fast and convenient way to earn interest on your crypto holdings.

Many crypto lending platforms require borrowers to provide collateral in the form of another cryptocurrency. This helps protect lenders from potential default and provides a guarantee for the loan. It’s important to understand the collateral requirements and the potential risks involved before participating in such lending programs.

Platforms like YouHodler and Nexo have gained popularity in the industry due to their high level of security and professionalism. These platforms are trusted by many crypto investors and offer a wide range of lending options and services.

If you’re considering using a crypto lending platform, it’s essential to do your research and choose the safest option available. Read reviews, check the platform’s reputation, and learn from other hodlers’ experiences before making a decision.

Remember, safeguarding your investments is the priority, so make sure to choose a secure crypto lending platform to protect your assets.

Top Crypto Lending Platforms for High Returns and Low Risks

When it comes to crypto lending platforms, there are several key factors to consider: high returns and low risks. In this article, we will explore some of the top platforms that offer attractive rates of return while ensuring the safety of your investments.

YouHodler

YouHodler is a popular choice for crypto lending due to its high borrowing limits and available loan terms. With just a click of a button, you can apply for a loan and receive it in no time. They have a strong reputation in the industry and offer a variety of features such as crypto-fiat conversions and instant loan withdrawals.

Nexo

Nexo is another recommended platform for crypto lending. They offer high loan-to-value ratios and have a strong user base. With Nexo, you can easily borrow against your crypto assets and benefit from their instant loan approval process. They also provide complete transparency and security, ensuring the safety of your assets.

BlockFi

BlockFi is a major player in the crypto lending industry, offering competitive interest rates and flexible loan terms. They have taken security measures seriously and offer strong collateralized loan options. You can also benefit from their quick and easy loan application process, making it a good choice for borrowers.

BTCPop

BTCPop is a P2P lending platform that allows borrowers to get loans without any credit checks. They have a strong reputation in the industry and offer a wide range of financial solutions. With BTCPop, you can borrow against your crypto assets and enjoy high returns on your investments.

How to Choose the Best Cryptocurrency Lending Platform

When searching for the best crypto lending platform, it is important to consider factors such as security, interest rates, and reputation. Look for platforms that offer strong collateralized loan options and have a high rating in the industry. Additionally, check if they have instant loan approval processes and transparent loan terms.

With the increasing adoption of cryptocurrency, more and more platforms are entering the market. However, it is still important to do your own research and choose a platform that suits your individual needs. By considering these factors, you can ensure that your crypto assets are safe and that you get the best possible returns.

FAQs

- What cryptocurrencies are available for lending?

- Do I need to provide collateral?

- How long is the loan period?

- Can I borrow fiat or only crypto?

- Are there any fees involved?

The Rising Popularity of Crypto Loans and Why You Should Consider Them

The popularity of crypto loans has been on the rise in recent years as more and more people are turning to cryptocurrencies for financial solutions. If you’re looking for a way to make your crypto holdings work for you, then crypto loans provide an excellent opportunity.

One of the main reasons why crypto loans are gaining traction is because they offer a way for individuals to access much-needed funds without having to sell their crypto holdings. By collateralizing their crypto assets, borrowers can borrow against their holdings while still maintaining ownership.

Addition to this, crypto loans also come with the benefit of instant and hassle-free transactions. Unlike traditional loans, where the approval process can take several days or even weeks, crypto loans can be processed and funded within minutes. This quick turnaround time allows borrowers to access the funds they need when they need them.

Another advantage of crypto loans is the ability to borrow stablecoins. Stablecoins are cryptocurrencies that are pegged to a stable asset, such as the US dollar, and are designed to minimize volatility. By borrowing stablecoins, borrowers can avoid the risks associated with market fluctuations and ensure a more stable loan balance.

Crypto loans are also becoming popular because they provide borrowers with more privacy and security compared to traditional lending platforms. Since most crypto loans are collateralized, lenders do not typically require extensive credit checks or income verification. This means that borrowers with lower credit scores or irregular sources of income can still access the funds they need.

When it comes to choosing a crypto lending platform, there are several popular sites to consider. Platforms like YouHodler, Celsius Network, and Nexo have established themselves as trusted providers of crypto loans with millions of dollars in loans issued to date. These platforms offer competitive interest rates, flexible loan durations, and various loan-to-value ratios (LTVs) to accommodate different borrowing needs.

In conclusion, the rising popularity of crypto loans can be attributed to the many benefits they offer, such as access to funds without selling crypto holdings, instant transactions, and borrowing stablecoins. If you’re looking to make your crypto work for you or in need of quick and secure financing, exploring the world of crypto lending platforms is highly recommended.

Discover the Reach of Crypto Lending Platforms Around the World

With the rise in popularity of cryptocurrencies, peer-to-peer lending platforms have emerged as a convenient way to borrow and lend digital assets. These platforms provide instant access to loans, enabling individuals to borrow funds without going through traditional financial institutions.

One highly recognized platform in this space is Nexo. Nexo is a lender that accepts cryptocurrency as collateral for loans. They have a user-friendly interface and offer competitive interest rates. Through their platform, borrowers can easily monitor their loan status and make payments using their preferred cryptocurrency.

Another popular platform is Crypto.com. Crypto.com offers a wide range of lending services, including instant crypto loans, crypto-backed loans, and margin trading. They accept a variety of cryptocurrencies as collateral, such as Bitcoin, Ethereum, and many others. They also provide updates on market trends and offer a built-in calculator to help customers estimate loan terms and interest rates.

For those who prefer a peer-to-peer lending platform, Celsius Network is worth considering. Celsius allows users to borrow and lend various cryptocurrencies, including Bitcoin. They also offer competitive interest rates and don’t require borrowers to undergo a credit bureau check. Additionally, they allow borrowers to choose between receiving their loan in USD or cryptocurrency.

SmartLoan is another player in the crypto lending market. They provide loans in USDC, a USD-pegged cryptocurrency. The platform offers a low minimum loan amount and doesn’t require borrowers to undergo a credit check. SmartLoan also offers a customer referral program, allowing users to earn rewards for bringing in new customers.

In conclusion, crypto lending platforms have become an efficient and accessible way for individuals to borrow funds using their digital assets as collateral. Whether you are looking for instant loans, peer-to-peer lending, or cryptocurrency-backed loans, there are platforms available to cater to your needs. It is important, however, to research and compare different platforms to find the one that best suits your borrowing requirements.

Explore the Best Bitcoin Loan Sites for Quick and Secure Transactions

When it comes to borrowing cryptocurrency, Bitcoin loan sites offer a quick and secure way to access the funds you need. These platforms provide an overview of how the loan works and the types of projects or activities that can be made possible with the borrowed cash.

One of the popular Bitcoin loan sites is YouHodler. This platform allows you to borrow Bitcoin or other cryptocurrencies and choose how to repay it. They offer quick ways to make smart investments with your loaned funds. Another popular platform is SmartFi, which has similar features and offers bonuses for using their service.

These Bitcoin loan sites typically have a range of available loan options, allowing you to choose the one that best suits your needs. Some even offer a research network where you can find articles and details related to borrowing and the benefits of having a crypto-fiat loan.

When using these platforms, your loan accounts are usually deposited directly into your crypto wallet, and repayment is made in cryptocurrency as well. This allows for a more secure and efficient way of conducting transactions compared to traditional banking methods.

Furthermore, these Bitcoin loan sites often have certain features like multi-institution network access, which allows you to connect various accounts and perform transactions from different exchanges or platforms. This feature enhances the convenience and flexibility of using these platforms.

Overall, exploring the best Bitcoin loan sites can provide you with quick and secure access to cash, allowing you to fund your projects or activities without the need for traditional banking methods. These platforms offer a range of loan options, bonus incentives, and secure transaction features that make borrowing cryptocurrency a suitable and efficient means of accessing funds.

Frequently Asked Questions:

Which are some of the safest crypto lending platforms?

Some of the safest crypto lending platforms are BlockFi, Celsius Network, and Nexo.

What are the best bitcoin loan sites?

The best bitcoin loan sites include BlockFi, Celsius Network, and Nexo.

What kind of updates can I sign up for?

By signing up for updates, you can receive information about new features, promotions, and important news from the crypto lending platforms.

How can I discover the safest crypto lending platforms?

You can discover the safest crypto lending platforms by conducting research, reading reviews, and comparing the features and security measures of different platforms.

Video:

6 Crypto Charts To Trade Before The Potential Bitcoin ETF!!

Borrow Against Crypto – How to Get Instant Cash with 0% Interest! (Crypto Loan Strategy)

✅ GET A CRYPTO LOAN WITH BYBIT (SUPER CHEAP & EASY!!!) BORROW BITCOIN, CRYPTO & ALTCOINS!!

I have been lending my Bitcoin on various platforms for a while now, and it has been a great way to earn passive income. It’s important to do thorough research and choose a platform with a strong reputation to ensure the safety of your funds. Happy lending!

I have been lending my Bitcoin on various platforms for a while now and it has been a great way to earn passive income. It’s important to do thorough research and choose a secure platform with a good reputation. Don’t forget to diversify your lending and consider the types of cryptocurrencies supported.

As a cryptocurrency investor, I have found that lending my Bitcoin on trusted platforms is a great way to earn passive income. It’s important to do your research and select a reliable platform with a strong track record to ensure the safety of your funds. The variety of supported cryptocurrencies is also a crucial factor to consider. Happy lending!

I have been lending my Bitcoin on various platforms for a while now, and it’s been a great way to earn passive income. It’s important to do thorough research and choose a reputable platform to ensure the safety of your funds. Overall, it’s a solid investment strategy!

As a long-time Bitcoin holder, I have been looking for ways to earn passive income on my cryptocurrency. Lending my Bitcoin on secure platforms seems like a great option. I agree that selecting the right lending platform is crucial, as it ensures the safety of my funds. Reputation, track record, and supported cryptocurrencies are all important factors to consider. Thanks for the insightful article!

Is there any platform that offers loans in stablecoins other than Bitcoin?

Yes, there are platforms that offer loans in stablecoins other than Bitcoin. You can find platforms that support various stablecoins like Tether (USDT), USD Coin (USDC), and Dai (DAI) for lending. Make sure to do thorough research and choose a platform that suits your needs.

As a long-time cryptocurrency holder, I highly recommend exploring crypto lending platforms to earn passive income. I have been using one for a while now and it has been a great experience. The key is to choose a platform with a solid reputation and a wide range of supported cryptocurrencies. Happy lending!