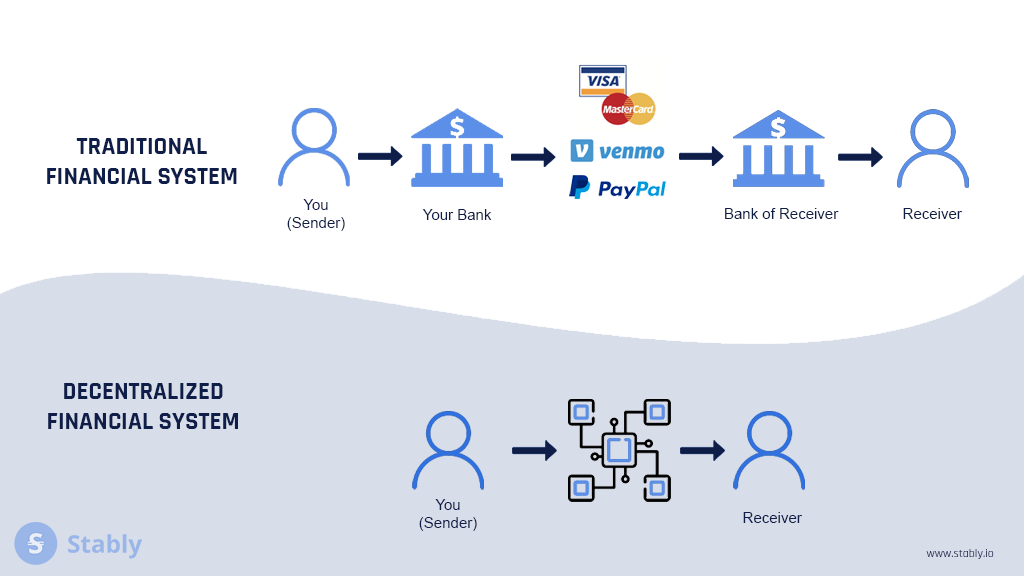

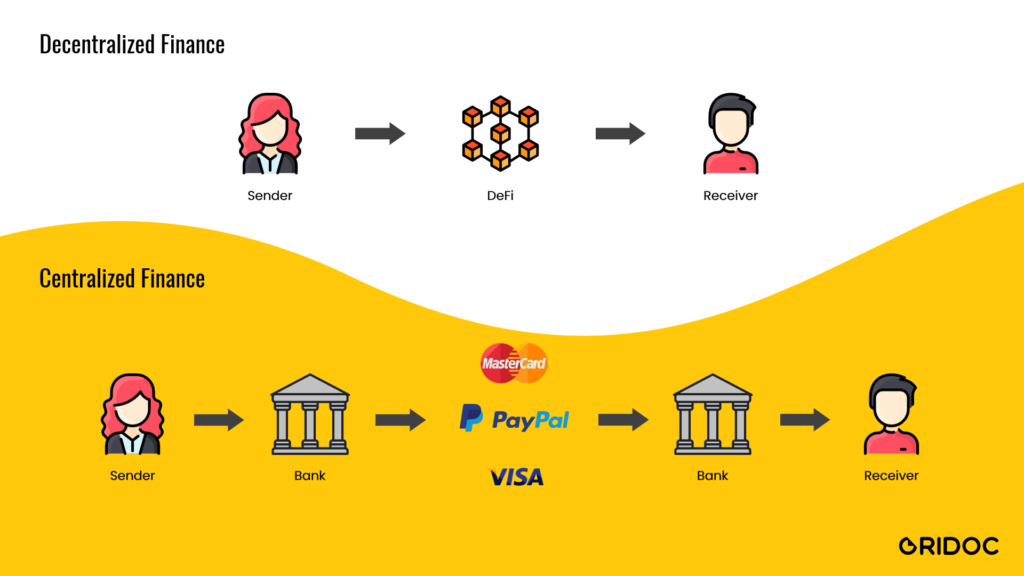

Decentralized Finance (DeFi) and Centralized Finance (CeFi) are two different approaches to the world of digital currencies and blockchain technology. DeFi is a financial system that is built on blockchain technology and allows users to invest, trade, and lend without the need for a central authority. On the other hand, CeFi refers to the traditional financial system that operates with centralized control and authority.

DeFi offers a decentralized alternative to the conventional financial system by using smart contracts and protocols that are built on blockchains like Ethereum. The main advantage of DeFi is that it gives users full control over their assets and eliminates the need for intermediaries. Users can start investing and trading in DeFi using their own wallets and interact directly with the protocols.

On the other hand, CeFi offers a more familiar and regulated experience for users who prefer the traditional financial system. CeFi platforms are usually owned and operated by a central authority, such as a bank or an exchange. They provide services like lending, trading, and investing in cryptocurrencies, but with the added benefit of regulatory oversight and customer support.

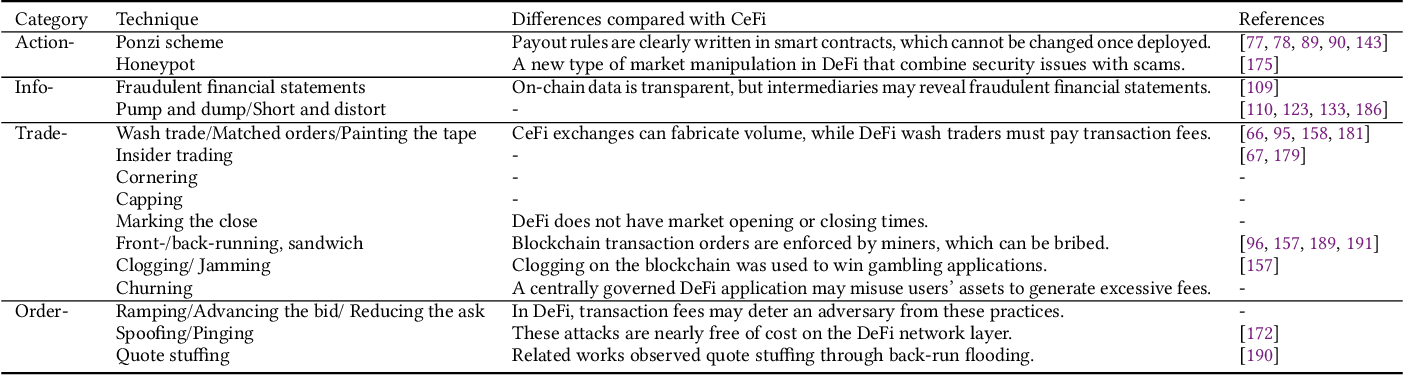

While DeFi provides users with maximum control and autonomy, CeFi offers more security and regulatory compliance. DeFi platforms are known for their open and permissionless nature, which enables innovation and quick changes in the ecosystem. However, this also means that there is a higher risk of scams and hacks since there is no central authority to regulate and protect users.

In summary, DeFi and CeFi are two different approaches to the world of crypto and finance. DeFi offers a decentralized and open financial system, while CeFi provides a more regulated and secure experience. The choice depends on what you prioritize – the flexibility and control that DeFi offers, or the security and regulatory oversight that CeFi provides.

Understanding DeFi and CeFi

DeFi, or decentralized finance, refers to a new form of financial system that is built on blockchain technology. It provides users with the ability to access financial products and services without the need for a central authority. In DeFi, all transactions and protocols are transparent and verifiable on the blockchain, giving users more control over their assets.

CeFi, or centralized finance, on the other hand, is the traditional financial system that we are familiar with. It is controlled by centralized authorities like banks and governments, and relies on intermediaries to facilitate transactions and manage assets. While CeFi offers convenience and regulatory oversight, it lacks the transparency and decentralization that DeFi provides.

DeFi: Smart Contracts and Decentralized Control

What sets DeFi apart from CeFi is the use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These smart contracts enable users to interact with financial protocols without the need for intermediaries. In DeFi, you have full control over your assets and can make transactions and investments without relying on a centralized authority.

CeFi: Regulatory Oversight and Convenience

CeFi, on the other hand, offers the advantage of regulatory oversight. Centralized financial institutions are subject to regulations and can provide a higher level of security and protection for users’ assets. Additionally, CeFi platforms often offer user-friendly interfaces and customer support, making it easier for users to navigate the financial system.

When it comes to making a choice between DeFi and CeFi, it ultimately depends on your individual needs and preferences. If you value decentralization, transparency, and control over your assets, DeFi may be the better option. On the other hand, if you prefer the convenience and regulatory oversight provided by centralized authorities, CeFi may be more suitable.

It is important to note that both DeFi and CeFi have their own unique risks and benefits. In DeFi, you need to be cautious of smart contract vulnerabilities and hacks, while in CeFi, you are subject to the regulations and policies set by centralized authorities. Understanding these differences and doing thorough research before you start using any financial products is crucial to protect yourself and make informed decisions.

In conclusion, DeFi and CeFi offer different approaches to finance, with DeFi providing decentralization and control over assets, while CeFi offers regulatory oversight and convenience. Both have their own advantages and risks, and the choice between the two depends on the individual user’s preferences and priorities.

What is Decentralized Finance (DeFi)?

Decentralized Finance (DeFi) is an emerging trend in the financial industry that is built upon smart contracts and blockchain technology. Unlike centralized finance (CeFi), DeFi aims to give users control over their assets and financial transactions without the need for intermediaries or regulatory authorities.

DeFi protocols allow users to access a wide range of financial products and services, such as lending, borrowing, and investing, using cryptocurrencies. These protocols are designed to be transparent, secure, and open to anyone who wants to participate. With DeFi, there is no central authority that controls your funds or dictates how you can use them.

One of the key advantages of DeFi is that it allows users to make transactions without relying on traditional financial institutions. This means that people all around the world can access financial services and products, regardless of their location or economic status. Furthermore, DeFi protocols often offer better interest rates than traditional lending platforms, making it an attractive option for those looking to invest or borrow.

However, it is important to note that DeFi is not without its risks. Since these protocols are built on blockchain technology, they are susceptible to vulnerabilities and smart contract bugs. Additionally, the lack of regulatory oversight means that users need to do their own research and due diligence when using DeFi platforms.

In conclusion, DeFi is a disruptive force in the financial industry that gives users more control over their assets and financial transactions. By using decentralized protocols and smart contracts, individuals can access a wide range of financial products and services without relying on centralized intermediaries. While there are risks involved, the benefits of DeFi, such as increased accessibility and better interest rates, make it an appealing option for many crypto users.

What is Centralized Finance CeFi?

Centralized Finance (CeFi) refers to the traditional financial system where intermediaries, such as banks and financial institutions, play a crucial role in controlling and regulating the financial transactions. In CeFi, users typically entrust their assets, such as money and investments, to these centralized entities, which have the authority to control and monitor these funds.

CeFi is characterized by its regulatory framework, which is enforced by governmental and financial authorities. Each financial product and transaction is subject to these regulations, ensuring a certain level of security and protection for investors and users. The centralized nature of CeFi allows for easier compliance with these regulations and provides a sense of stability and familiarity.

In contrast, decentralized finance (DeFi) is built on blockchain technology and operates without the need for intermediaries. With DeFi, individuals have more control over their financial activities and can interact directly with smart contracts and decentralized protocols. DeFi provides users with the ability to make investments, trade cryptocurrencies, and engage in lending and borrowing activities without relying on traditional financial institutions.

One of the main advantages of CeFi is its established infrastructure and extensive network. Centralized platforms have been around for years and have built-in mechanisms for handling high transaction volumes and ensuring liquidity. This allows users to start investing or trading without the need for technical knowledge or the hassle of navigating decentralized platforms.

Another benefit of CeFi is the ability to access a wide range of financial products and services. Centralized platforms offer a variety of investment options, such as stocks, bonds, and mutual funds, that may not be available on decentralized platforms. Additionally, CeFi platforms typically offer user-friendly interfaces and customer support, making it easier for users to navigate and understand the financial products they are engaging with.

However, CeFi also has its downsides. The centralized nature of these platforms means that users have to rely on the authority and integrity of the centralized entity. This creates a single point of failure, as any issues or vulnerabilities with the centralized system can potentially compromise user funds.

CeFi also requires users to trust the centralized entity with their personal and financial information. This can be a concern for individuals who prioritize privacy and anonymity in their financial transactions. Additionally, CeFi platforms may have restrictions or limitations imposed by the regulatory authorities, which can restrict the accessibility and freedom of users.

In conclusion, CeFi provides users with a familiar and regulated environment for their financial activities, with the advantages of established infrastructure and a wide range of financial products. However, it also limits user control and introduces potential risks associated with centralized control and trust. Decentralized finance (DeFi) offers an alternative solution, allowing individuals to have more control over their financial activities and interact directly with blockchain-based protocols.

DeFi vs CeFi: Key Differences

In the world of crypto finance, there are two main types of systems: decentralized finance (DeFi) and centralized finance (CeFi). While both systems aim to provide financial services, there are key differences that set them apart.

Authority and Control

One of the biggest differences between DeFi and CeFi is the level of authority and control. In DeFi, the authority is decentralized and distributed among the users themselves. This means that no single entity has control over the system, and decisions are made collectively through smart contracts on blockchain protocols. On the other hand, in CeFi, there is a central authority or institution that has control over the financial operations and decisions.

Transaction Speed and Change

Another difference between DeFi and CeFi is the transaction speed and ability to change. DeFi transactions are typically faster because they are executed directly on the blockchain without the need for intermediaries. In contrast, CeFi transactions may require a longer processing time due to the involvement of centralized intermediaries. Additionally, DeFi systems can easily adapt and change as they are built on smart contracts, whereas CeFi systems often require a more complex and time-consuming process to implement changes.

Regulatory Compliance and Privacy

One important aspect to consider when choosing between DeFi and CeFi is regulatory compliance and privacy. DeFi protocols operate in a more decentralized and open manner, making it difficult for regulatory authorities to enforce compliance. CeFi platforms, on the other hand, are subject to regulatory oversight and must adhere to specific rules and regulations. This can provide users with a higher level of security and protection, but also means less privacy compared to DeFi.

Financial Products and Accessibility

The range of financial products available is also different between DeFi and CeFi. DeFi platforms offer a wide variety of products, including decentralized lending, borrowing, and trading, that can be accessed by anyone with an internet connection. CeFi platforms, on the other hand, often offer more traditional financial products like bank accounts, loans, and investment instruments. These centralized platforms may require users to go through a KYC (Know Your Customer) process and can have geographical restrictions.

Ultimately, the choice between DeFi and CeFi depends on what you prioritize as a user. DeFi offers more decentralization, privacy, and accessibility, while CeFi provides regulatory compliance, security, and traditional financial services. Both systems have their pros and cons, and it’s important to evaluate your needs and preferences to make an informed decision.

Advantages and Disadvantages of DeFi

Advantages of DeFi:

- Greater Financial Inclusion: DeFi allows anyone with an internet connection to access financial services and products, regardless of their location or socioeconomic status.

- Decentralization: DeFi operates on decentralized blockchains, which means there is no central authority controlling or governing transactions. This reduces the need for intermediaries and removes the risk of censorship or manipulation by a single entity.

- Transparency: DeFi transactions are recorded on public blockchains, making them transparent and verifiable by anyone. This ensures trust and eliminates the need for manual audits.

- Flexibility: DeFi offers a wide range of financial products, including lending, borrowing, trading, staking, and yield farming. Users can easily switch between different protocols and customize their investment strategies.

- Smart Contracts: DeFi protocols are powered by smart contracts, which are self-executing agreements with the terms of the transaction directly written into the code. This eliminates the need for intermediaries and ensures that transactions are executed exactly as intended.

Disadvantages of DeFi:

- Lack of Regulation: DeFi operates in an unregulated environment, which exposes users to potential risks such as hacking, scams, and fraudulent activities. There is currently no overarching regulatory framework to protect users or address disputes.

- Complexity and User Experience: DeFi platforms can be complex and difficult to navigate, especially for users who are not familiar with blockchain technology. The user experience is often less polished compared to centralized finance (CeFi) platforms, which could deter mainstream adoption.

- Security Risks: While blockchain technology is generally considered secure, DeFi platforms are not immune to vulnerabilities. Smart contract bugs or exploits can lead to significant financial losses for users.

- High Volatility: The cryptocurrency market is highly volatile, and many DeFi projects are built on top of existing crypto assets. This means that users are exposed to price fluctuations and could potentially lose a significant portion of their investments.

- Limited Customer Support: Unlike traditional financial institutions, DeFi platforms often lack robust customer support. If users encounter issues or have questions, they may have limited avenues for assistance.

Advantages and Disadvantages of CeFi

Advantages:

- CeFi platforms offer a familiar and user-friendly experience to crypto users, which can be more accessible for those who are new to the crypto space.

- They provide a wide range of financial products and services, allowing users to invest in various cryptocurrencies and assets.

- CeFi platforms often have better customer service and support, with dedicated FAQs and assistance available to help users navigate the platform.

- Centralized finance platforms have regulatory frameworks in place, ensuring compliance and offering protection to users’ funds.

- CeFi platforms can handle a higher transaction volume, allowing for faster processing times compared to decentralized finance platforms.

Disadvantages:

- CeFi platforms are built on centralized infrastructure, meaning that users have to trust a single authority to control their funds and transactions.

- Users need to create an account and go through KYC (Know Your Customer) procedures to start using CeFi platforms.

- Unlike decentralized finance (DeFi) platforms, which are built on smart contract protocols, CeFi platforms can be affected by security breaches and hacks.

- CeFi platforms may have limited flexibility in terms of making changes or introducing new features, as they typically require approval from the centralized authority.

- CeFi platforms may have higher fees and lending rates compared to DeFi platforms, as they operate as intermediaries and need to cover operational costs.

Источник: https://www.bitira.com/

FAQs around DeFi vs CeFi

What is DeFi?

DeFi, short for decentralized finance, is a type of financial system that operates on blockchain technology. It allows users to engage in various financial transactions, such as lending, borrowing, and trading, without the need for intermediaries or central authorities.

What is CeFi?

CeFi, short for centralized finance, refers to traditional financial systems where intermediaries, such as banks and financial institutions, play a central role in facilitating transactions and managing user assets.

What are the main differences between DeFi and CeFi?

One of the main differences between DeFi and CeFi is the level of control and authority. In DeFi, users have full control over their funds and can interact with smart contracts built around decentralized protocols. On the other hand, in CeFi, users have to rely on intermediaries to manage their funds, which can introduce potential risks and delays.

How do DeFi and CeFi differ in terms of regulatory compliance?

DeFi operates outside the traditional regulatory framework, while CeFi is subject to regulatory compliance. This means that CeFi platforms are required to follow certain rules and guidelines set by regulatory authorities, which can provide users with a certain level of protection, but may also limit the freedom and flexibility compared to DeFi.

What are the benefits of using DeFi?

DeFi offers several benefits, including greater financial inclusivity, as it allows anyone with an internet connection to access financial services. It also enables users to have full control over their assets and eliminates the need for intermediaries, reducing fees and potential risks associated with centralized financial systems.

Why might someone choose CeFi over DeFi?

Some individuals may prefer CeFi over DeFi because they are more familiar with traditional financial systems and feel more comfortable with the regulations and oversight provided by centralized authorities. Additionally, CeFi platforms may provide a more user-friendly interface and offer a wider range of financial products and services.

Can I start using DeFi if I already have crypto?

Yes, if you already have cryptocurrencies, you can start using DeFi. DeFi platforms usually support popular cryptocurrencies like Bitcoin and Ethereum, making it easy for users to invest, trade, or lend their existing crypto assets.

Are DeFi protocols safer than centralized platforms?

DeFi protocols are built on smart contracts that are designed to execute transactions automatically without the need for intermediaries. While this eliminates the risk of human error or manipulation, it does not guarantee complete safety. It’s important for users to conduct thorough research, understand the risks, and use reputable platforms when engaging in DeFi activities.

Is DeFi or CeFi more secure?

When it comes to security, there is an ongoing debate about whether DeFi or CeFi provides better protection for users’ assets.

DeFi, or decentralized finance, offers a high level of security because it eliminates the need for a central authority to control financial transactions. Instead, DeFi protocols are built on smart contracts, which are self-executing agreements on blockchains like Ethereum. These smart contracts ensure that transactions are executed without the need for intermediaries, making it harder for malicious actors to manipulate or access user funds. Additionally, DeFi platforms are open-source, allowing for audits and transparency that can help identify vulnerabilities and potential risks.

On the other hand, CeFi, or centralized finance, relies on traditional financial institutions and regulatory authorities to oversee financial activities. While CeFi platforms may have robust security measures in place, they are also more susceptible to hacks, fraud, and regulatory interference. Centralized platforms hold user funds and personal information, making them attractive targets for hackers. Furthermore, regulatory authorities can impose restrictions or freeze assets, which can limit users’ control over their funds.

In summary, both DeFi and CeFi have their own security considerations. DeFi offers decentralized control and transparency through smart contracts on blockchains, reducing the likelihood of hacks and fraud. However, it also requires users to take responsibility for their own security and be cautious of potential risks. CeFi, on the other hand, provides a more familiar and regulated environment, but users have to trust the centralized authority to protect their assets. Ultimately, the choice between DeFi and CeFi depends on individual preferences and risk tolerance.

Which platform is better for investment: DeFi or CeFi?

When it comes to choosing a platform for investment, whether it’s in decentralized finance (DeFi) or centralized finance (CeFi), there are several factors to consider. Both DeFi and CeFi offer unique advantages and disadvantages, catering to different needs of users in the crypto space.

DeFi: Decentralized Finance

DeFi platforms are built on blockchains, like Ethereum, and they operate without the need for intermediaries or central authorities. These platforms use smart contracts to facilitate transactions and provide various financial products and protocols. Users have full control of their assets and can participate in lending, borrowing, and trading activities.

- Pros of DeFi:

- Decentralized nature: DeFi platforms offer a higher level of financial autonomy and control, allowing users to manage their assets without relying on intermediaries.

- Accessibility: DeFi platforms are open to anyone with an internet connection, enabling greater inclusivity and global accessibility for financial services.

- Transparency: DeFi transactions and protocols are recorded on the blockchain, providing transparent and immutable records for auditing.

- Cons of DeFi:

- Regulatory uncertainties: DeFi operates in a relatively unregulated space, which can potentially expose users to higher financial risks.

- Smart contract vulnerabilities: While smart contracts eliminate the need for intermediaries, they can still be prone to coding errors and security vulnerabilities.

- Limited support: Unlike CeFi platforms, DeFi platforms may have fewer customer support options and resources available.

CeFi: Centralized Finance

CeFi platforms, on the other hand, are operated by centralized entities and authorities, handling user funds and transactions on their behalf. These platforms often require KYC (Know Your Customer) procedures and adhere to regulatory frameworks. Users entrust their assets to these platforms, and in return, they benefit from various financial services and products.

- Pros of CeFi:

- Regulatory compliance: CeFi platforms operate within established regulatory frameworks, providing users with a sense of security and protection.

- Crypto-investing expertise: CeFi platforms often offer expert advice, market analysis, and specialized financial products to help users make informed investment decisions.

- Customer support: CeFi platforms typically provide dedicated customer support services, assisting users with any issues or inquiries they may have.

- Cons of CeFi:

- Centralized control: Users need to trust the centralized authority and rely on them to handle their funds and execute transactions.

- Limited accessibility: CeFi platforms may have restrictions on certain jurisdictions or require additional documentation, limiting accessibility for some users.

- Dependency on intermediaries: CeFi platforms require users to rely on intermediaries for financial services, which can introduce counterparty risks.

Ultimately, the choice between DeFi and CeFi depends on individual preferences, risk tolerance, and investment objectives. DeFi offers a decentralized ecosystem with greater control and openness, while CeFi provides regulatory compliance and specialized services. It is important to evaluate the features and risks associated with each platform before deciding where to invest your crypto assets.

How does DeFi affect the cryptocurrency market?

DeFi has brought significant changes to the cryptocurrency market by introducing decentralized financial systems that operate on blockchains and smart contracts. Unlike traditional CeFi (centralized finance), DeFi allows users to have full control over their assets and conduct various financial transactions without the need for intermediaries or centralized authority.

With DeFi, users can participate in lending and borrowing programs, earning passive income from their cryptocurrency holdings. They can also invest in decentralized exchanges, where they can trade various cryptocurrencies without the need for a central authority overseeing the transactions.

One of the key benefits of DeFi is its ability to provide financial services to people around the world who may not have access to traditional banking systems. Additionally, DeFi products often offer better returns on investments and lower transaction fees compared to centralized counterparts.

DeFi has also led to the emergence of new innovative financial products and protocols, such as decentralized stablecoins and yield farming. These products allow users to generate returns on their crypto assets by providing liquidity to various DeFi protocols and earning rewards in return.

However, it’s important to note that DeFi also poses certain risks. Since it operates in a decentralized environment, there is a lack of regulatory oversight, which can expose users to potential scams and hacks. Additionally, the smart contracts used in DeFi protocols are not foolproof, and vulnerabilities can be exploited by malicious actors.

Overall, DeFi has significantly changed the cryptocurrency market by providing users with more control over their financial assets and introducing innovative financial products. While there are risks associated with using DeFi, it offers an alternative to the traditional centralized financial system and has the potential to revolutionize the way people interact with crypto.

Frequently Asked Questions:

What is DeFi and CeFi?

DeFi refers to Decentralized Finance, which is a blockchain-based financial system that operates without any central authority or intermediaries. CeFi, on the other hand, stands for Centralized Finance and refers to traditional financial systems that are controlled and regulated by centralized entities such as banks or financial institutions.

What are the advantages of DeFi over CeFi?

DeFi offers several advantages over CeFi. It enables users to have full control over their funds, eliminates the need for intermediaries, provides transparency through the use of blockchain technology, and allows for global accessibility. Additionally, DeFi platforms often offer higher yield opportunities compared to traditional banking systems.

Is DeFi more secure than CeFi?

Both DeFi and CeFi have their own security risks. In DeFi, smart contract vulnerabilities, hacks, and scams can pose risks to users’ funds. CeFi, on the other hand, may be susceptible to centralized points of failure and hacking attempts. It’s important for users in both DeFi and CeFi to exercise caution and proper security measures when engaging in financial activities.

Which one is better for me, DeFi or CeFi?

The choice between DeFi and CeFi depends on your personal preferences and goals. If you value decentralization, privacy, and direct control over your funds, then DeFi might be a better choice for you. However, if you prefer established regulations, customer support, and possibly lower risks, then CeFi may be more suitable. It’s important to consider the benefits and risks associated with both options before making a decision.

Videos:

DeFi vs CeFi? Explained by a Finance Nerd (FOR BEGINNERS)

Defi Vs CeFi | The Differences Between DeFi and CeFi

What is a Decentralized Exchange and Why Should You Care?

seems to be a safer option for those who value regulatory oversight and customer support.

I believe DeFi is the future of finance. With DeFi, users have the power to control and manage their own assets without relying on intermediaries. It’s a game-changer in the crypto industry.

What are the risks associated with decentralized finance (DeFi)?

Decentralized finance (DeFi) certainly offers many advantages, but it is important to be aware of the risks involved. One of the main risks is the potential for smart contract vulnerabilities, as these contracts are coded by developers and can contain bugs or security loopholes. In addition, DeFi platforms are not regulated like traditional financial institutions, so there is a higher risk of scams or fraudulent activities. It is crucial for users to do thorough research, understand the risks, and exercise caution when participating in DeFi activities. Stay informed and always be mindful of security measures to protect your investments.

provides a safer and more reliable environment for financial transactions. With CeFi, I feel more secure knowing that there are regulations in place and customer support available in case of any issues. Although DeFi offers more control, I prefer the peace of mind that comes with using a centralized platform.