DeFi, or decentralized finance, has exploded in popularity in recent years, offering innovative financial services and investment opportunities to crypto enthusiasts. However, with the increasing complexity of DeFi platforms and transactions, it can be a daunting task to keep track of your crypto taxes.

That’s where crypto tax software can help. By automating the tax reporting process, these platforms simplify tax calculations and ensure compliance with the tax regulations of your country or state. With the right platform, you can save time and effort, and avoid potential penalties from inaccurate or incomplete tax reporting.

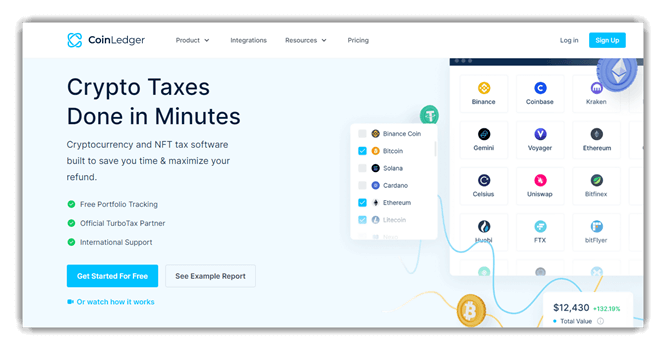

One such platform is CoinLedger. It supports the import of transactions from popular exchanges like Binance and Coinbase, as well as DeFi platforms such as Uniswap and Compound. With CoinLedger, you can easily track your income and calculate your tax liability for each coin or token. It provides comprehensive reports and calculates your capital gains, losses, and income from staking or liquidity mining.

For professional tax preparation, you can download the reports generated by CoinLedger and provide them to your tax advisor or accountant. This ensures that your crypto taxes are accurately reported and reduces the risk of audits or fines. CoinLedger also integrates with popular tax software like TurboTax, making it even easier to file your taxes.

If you have any questions or frequently asked for support, CoinLedger offers excellent customer service. Their team is knowledgeable and responsive, ready to assist you with any tax-related queries. They understand the unique challenges of crypto taxation and can provide guidance specific to your situation.

As crypto gains more mainstream adoption, it’s important to stay on top of your tax obligations. Don’t let the complex nature of DeFi transactions overwhelm you. Utilize the best crypto tax software like CoinLedger to simplify your tax reporting and ensure compliance with the ever-changing tax laws.

Understanding DeFi Taxes

If you are involved in the world of decentralized finance (DeFi) and own crypto assets, it is important to understand the tax implications that come with it. DeFi refers to a range of financial applications built on blockchain technologies that aim to provide decentralized alternatives to traditional finance. As such, taxes on DeFi transactions and holdings can be complex and require careful attention.

One popular tool that can help simplify your tax reporting is CoinLedger, a professional crypto tax software platform. With CoinLedger, you can easily track and import your DeFi transactions from various platforms, such as Coinbase, and generate accurate tax reports. This software supports major cryptocurrencies and integrates with popular tax calculators, making it easier for you to calculate your tax liability.

When it comes to reporting your crypto income, it is essential to accurately report any earnings from DeFi activities. DeFi platforms often generate income in the form of interest, fees, or rewards, which may be subject to tax. It is important to keep track of these earnings and report them correctly to avoid any issues with tax authorities.

One frequently asked question is whether popular tax software platforms like TurboTax support DeFi-related tax reporting. While TurboTax is one of the best-known tax software providers, it may not have built-in support for DeFi transactions. In such cases, using dedicated crypto tax software like CoinLedger can be a more suitable option.

Transitioning to decentralized finance platforms may bring significant tax implications, especially as tax authorities around the world continue to develop new regulations for crypto assets. To stay compliant and ensure accurate reporting, it is crucial to utilize the right tax software platform. CoinLedger and other similar tools can help simplify the process and provide the necessary tools to meet your tax obligations.

In conclusion, understanding the tax implications of your DeFi activities is crucial as the crypto industry continues to evolve. Utilizing dedicated tax software platforms like CoinLedger can simplify the process of tracking and reporting your DeFi transactions. Stay up to date with the latest regulations and guidelines provided by tax authorities, and consult a professional if you have more complex tax questions.

Benefits of Using Crypto Tax Software

Using crypto tax software can provide numerous benefits for individuals and businesses involved in the world of decentralized finance (DeFi). Here are some of the key advantages:

Accurate and Efficient Tax Calculations

One of the most important benefits of using crypto tax software is accurate and efficient tax calculations. These platforms have built-in calculators that can automatically generate your tax liability or refund based on your transaction history. The software keeps track of all your crypto activities, including buys, sells, trades, and transfers, making it easier to calculate your taxable income.

Simplified Tax Reporting

DeFi can involve complex transactions and multiple platforms. Using crypto tax software simplifies the tax reporting process by automatically generating necessary forms, such as IRS Form 8949. This saves you time and effort, as the software organizes your transactions and provides a clear picture of your tax obligations.

Support for Various Platforms

Crypto tax software supports a wide range of platforms that individuals use for their DeFi activities. Popular platforms like Coinbase, CoinLedger, and more are supported, ensuring that you can import your transaction history from these platforms into the tax software. This makes it convenient and efficient to consolidate your cryptocurrency records for tax purposes.

Compliance with Tax Laws

Keeping up with ever-changing tax regulations can be challenging, especially in the crypto space. Crypto tax software stays up-to-date with the latest tax laws, ensuring that you remain compliant. It helps you correctly report your crypto income and ensures that you do not miss out on any important deductions or credits.

Access to Professional Support

If you have any tax-related questions or concerns, crypto tax software often provides access to professional support. This can be invaluable, especially when dealing with complicated DeFi activities or specific tax situations. Having access to tax experts can help ensure that your tax reporting is accurate and that you are maximizing your deductions.

Using crypto tax software in 2023 and beyond is the right choice for individuals and businesses involved in DeFi. With the frequently asked questions and the ability to import transactions from popular platforms, such as Coinbase and CoinLedger, these software platforms are designed to simplify the tax reporting process and help you navigate the complexities of crypto taxes.

Key Features to Look for in Crypto Tax Software

When searching for crypto tax software, there are a few key features to look for to ensure you choose the best platform for your needs.

1. Import support for various exchanges and platforms

A good crypto tax software should have the ability to import data from popular exchanges and platforms such as Coinbase, allowing you to easily track your crypto transactions and income.

2. Defi support

With the rise of decentralized finance (DeFi), it’s important to find a crypto tax software that supports this new form of crypto investment. Look for software that can accurately handle the tax implications of activities like yield farming and liquidity mining.

3. Calculators for different tax scenarios

A comprehensive crypto tax software should have built-in calculators that can handle different tax scenarios, such as capital gains, income from staking, and more. This will help you accurately calculate your tax liability and make the tax reporting process easier.

4. Frequently asked questions and professional guidance

The best crypto tax software should provide frequently asked questions and professional guidance to help you navigate through the complexities of crypto tax reporting. It’s important to have access to resources that can answer your specific questions.

5. Right level of automation

While automation can help simplify the tax reporting process, it’s also important to have the option of manual editing and customization. Look for a crypto tax software that strikes the right balance between automation and the ability to make manual adjustments when needed.

6. Tax forms and reports

Make sure your chosen crypto tax software can generate the necessary tax forms and reports required by your tax jurisdiction. A professional-looking report can help you ensure compliance and provide a clear overview of your crypto tax situation.

In summary, when choosing crypto tax software, look for a platform that supports import from popular exchanges and platforms, has defi support, offers calculators for different tax scenarios, provides frequently asked questions and professional guidance, offers the right level of automation, and can generate necessary tax forms and reports. By considering these key features, you can simplify your tax reporting process and ensure compliance with crypto tax regulations.

Best Crypto Tax Software and Calculators for 2023

When it comes to managing your crypto taxes for the year 2023, having the right software and calculators in place is essential. With so many crypto transactions and investments happening during that time, it’s important to have a reliable tool that can help you calculate and report your taxes accurately. Here are some of the best options available:

CoinLedger

CoinLedger is a popular crypto tax software that supports all major platforms and exchanges, including Coinbase. With its easy-to-use interface, you can import your transaction history from Coinbase and other platforms, track your income for tax purposes, and generate detailed tax reports. CoinLedger also offers professional help for more complex tax situations, making it a great choice for individuals and businesses.

TurboTax

TurboTax is a well-known tax preparation software that has added support for crypto transactions. You can download the TurboTax Crypto software, which integrates with popular exchanges and platforms, helping you import your transaction history and calculate your tax liability accurately. TurboTax also provides answers to frequently asked questions about crypto taxes and offers guidance for individuals in all states.

Import Your Data from Coinbase and More

One of the most important features of these tax software options is the ability to import your data from popular crypto platforms, including Coinbase. This saves you time and effort in manually entering all your transactions, ensuring that you have accurate tax reports.

Professional Help for Complex Situations

If you have a more complex tax situation due to your involvement with DeFi platforms or other crypto activities, it’s important to choose a tax software that offers professional help. CoinLedger, for example, has a team of experts who can assist you in navigating the complexities of crypto taxes and ensure that you are meeting all relevant tax obligations.

In summary, when it comes to managing your crypto taxes in 2023, having the right software and calculators is crucial. Look for a software that supports popular platforms like Coinbase, offers professional assistance if needed, and provides easy data import features. With the right tool, you can simplify your tax reporting and ensure compliance with the tax laws of your state.

CoinLedger

CoinLedger is a professional crypto tax software platform that helps you simplify your tax reporting for crypto and DeFi transactions. Whether you are an individual investor or a professional trader, CoinLedger provides the right tools and calculators to help you accurately track and report your income from crypto.

Key Features

- Supports import of data from popular platforms like Coinbase and more

- Automatically calculates your taxable income

- Provides a detailed breakdown of your crypto transactions

- Generates tax forms and reports for easy filing

- Offers tax guidance and answers to commonly asked questions

With CoinLedger, you can download transaction data from your crypto platforms and import it directly into the software. This saves you time and ensures that all relevant information is included during tax season. The platform supports different tax regulations for various states, so you can be confident that your tax reporting is accurate and up to date.

An important feature of CoinLedger is its ability to handle DeFi transactions. DeFi, or decentralized finance, has gained popularity in recent years, and it involves various crypto activities like lending, borrowing, yield farming, and more. CoinLedger simplifies the tax reporting process for these complex transactions, ensuring that you comply with the tax regulations in your jurisdiction.

When it comes to tax software for crypto, CoinLedger is considered one of the best platforms available. It offers a user-friendly interface, robust calculators, and comprehensive tax support. Whether you are a beginner or an experienced trader, CoinLedger can help you navigate the complexities of crypto taxes and ensure you report everything correctly.

How CoinLedger Can Simplify Your DeFi Tax Reporting

Maintaining accurate and up-to-date tax records for your cryptocurrency investments can be a daunting task. With the complexity of decentralized finance (DeFi) and the continuous changes in tax regulations, it’s crucial to have reliable software that can simplify the process. CoinLedger is a powerful crypto tax software that can efficiently handle your DeFi tax reporting.

Similar to popular tax platforms like TurboTax, CoinLedger offers intuitive and user-friendly software specifically designed for cryptocurrency investors. It provides a comprehensive range of tools and features that automate the process of calculating your tax liabilities, making it easier for you to comply with tax regulations.

One of the most important features of CoinLedger is its ability to import data from multiple crypto platforms. Whether you’ve traded on Coinbase, invested through DeFi platforms, or earned income through staking or lending, CoinLedger can import your transactions and help you accurately calculate your taxable income.

Unlike some other tax software, CoinLedger is built specifically for crypto and DeFi tax reporting. This means it understands the unique intricacies of these types of investments, ensuring that you stay compliant with tax regulations while minimizing your liability.

CoinLedger supports a wide range of functionalities that include advanced tax calculators, automatic record keeping, and real-time data updates. It also has a knowledgeable support team to help you with any questions or issues that may arise during the tax reporting process.

To make tax reporting even more convenient, CoinLedger also offers a mobile app that you can download straight to your phone. This allows you to track your crypto transactions and income on the go, ensuring that you stay organized and have all the necessary information at your fingertips.

Frequently Asked Questions (FAQ) section on the CoinLedger platform can provide further assistance and clarify any doubts you may have. Additionally, CoinLedger keeps up with the latest tax regulation changes and updates the software accordingly, ensuring that you’re always in compliance with the most current requirements.

In summary, if you’re looking for the best software to simplify your DeFi tax reporting, CoinLedger is the right platform for you. With its comprehensive functionality, easy data import, and expert support, it can help you track and report your crypto income accurately, saving you time and ensuring compliance with tax regulations.

Why CoinLedger is the Best Choice for Crypto Tax Software

CoinLedger is the best choice for crypto tax software for several reasons. First and foremost, it is one of the most frequently recommended platforms by professionals in the crypto space. Many experts and tax professionals have praised CoinLedger for its accuracy and user-friendly interface.

Unlike other tax software such as TurboTax, CoinLedger is specifically designed for crypto users. It understands the complexities of crypto taxation, including the income generated from DeFi platforms. By using CoinLedger, you can easily track your crypto transactions and generate accurate tax reports.

One of the key features of CoinLedger is its ability to import data from popular crypto platforms like Coinbase. This means that you don’t have to manually enter all your crypto transactions and income. CoinLedger automates the process, saving you time and reducing the risk of errors.

In addition to its import feature, CoinLedger also provides a variety of helpful calculators and tools to assist you in your tax reporting. These tools can help you calculate your capital gains, identify any taxable events during your DeFi activities, and more. With CoinLedger, you have all the resources you need to accurately report your crypto income.

Furthermore, CoinLedger keeps up to date with the latest tax laws and regulations in the United States. Tax laws regarding crypto are constantly evolving, making it difficult for individuals to stay compliant. CoinLedger takes away the burden of keeping track of these changes by providing accurate and updated tax reporting features.

If you ever have any questions or need assistance with your tax reporting, CoinLedger offers professional support. Their team is knowledgeable about crypto taxation and can help answer any questions you may have. This level of support is especially important for those who are new to crypto and may be unsure about the tax implications of their activities.

In summary, CoinLedger is the best choice for crypto tax software due to its user-friendly interface, ability to import data from popular platforms, comprehensive calculators and tools, compliance with tax laws, and professional support. If you want to simplify your tax reporting and ensure accuracy, download CoinLedger today.

Frequently Asked Questions about Crypto Tax Software

1. What is crypto tax software?

Crypto tax software is a specialized platform or tool that helps individuals and businesses keep track of their cryptocurrency transactions and calculate their tax liabilities. It automates the process of importing data from various crypto platforms and wallets, making it easier to report crypto taxes accurately.

2. Why is it important to use crypto tax software?

Using crypto tax software is important because it simplifies the tax reporting process for individuals and businesses involved in crypto trading. It helps you stay compliant with tax regulations while reducing the risk of errors and penalties. With the increasing complexity of crypto transactions, having the right software can save you time and effort.

3. What are some popular crypto tax software platforms?

Some of the popular crypto tax software platforms include CoinLedger, TurboTax, and Coinbase, among others. These platforms support a wide range of crypto exchanges and wallets, making it convenient to import data and calculate taxes accurately.

4. Can I use crypto tax software for DeFi platforms?

Yes, most crypto tax software supports DeFi platforms. These platforms allow you to import transactions from popular DeFi platforms such as Uniswap, Aave, and Compound, among others. By using crypto tax software, you can ensure that your tax reporting for DeFi transactions is accurate and compliant.

5. Do I need professional help in addition to using crypto tax software?

While using crypto tax software can simplify the process, it is always advisable to seek professional help, especially if you have complex transactions or are unsure about certain tax regulations. A tax professional can review your crypto tax forms and provide guidance to ensure accuracy and compliance.

6. Can I track my crypto income using crypto tax software?

Yes, crypto tax software allows you to track your crypto income. It automatically imports transaction data and categorizes them as income, capital gains, or losses. This feature helps you monitor your crypto earnings throughout the year and simplifies the reporting process during tax season.

7. Are there any calculators available on crypto tax software platforms?

Yes, most crypto tax software platforms offer calculators that can help you estimate your tax liabilities. These calculators allow you to input your transaction details and generate an estimate of your tax obligations. However, it is important to note that these estimations should not be considered as tax advice, and consulting a tax professional is recommended.

8. Can I download my tax forms from crypto tax software platforms?

Yes, most crypto tax software platforms allow you to download your tax forms once you have calculated your tax liabilities. These forms can be easily printed or filed electronically, depending on the requirements of your tax jurisdiction.

9. Are there any specific tax regulations for crypto in the United States?

Yes, there are specific tax regulations for crypto in the United States. The IRS treats crypto as property and requires taxpayers to report any crypto transactions, including buying, selling, mining, and receiving crypto as income. Failure to comply with these regulations can result in penalties and interest.

10. Does crypto tax software support multiple crypto currencies?

Yes, crypto tax software supports multiple cryptocurrencies. You can import transaction data from various crypto platforms and wallets, including Bitcoin, Ethereum, Ripple, Litecoin, and many more. This enables accurate tax reporting for a wide range of crypto assets.

11. What is the best crypto tax software platform?

The best crypto tax software platform depends on your specific needs and preferences. Some popular options include CoinLedger, TurboTax, and Coinbase. It is recommended to research and compare different platforms to find the one that suits your requirements.

Get Started with CoinLedger Today

Are you looking for a reliable and user-friendly crypto tax software for your DeFi transactions? Look no further – CoinLedger is here to help! As one of the best platforms in the market, CoinLedger offers a range of features to simplify your tax reporting process and ensure compliance with tax laws.

With CoinLedger, importing your transactions from various sources is a breeze. Whether you have used popular exchanges like Coinbase or decentralized exchanges within the DeFi ecosystem, CoinLedger supports the import of data from these platforms. You can easily track your crypto income and expenses, making it an important tool for tax planning and reporting.

Not sure about the tax implications of your DeFi activities? CoinLedger has got you covered. The software provides a variety of calculators to help you understand the tax implications of different transactions. From capital gains to staking rewards, CoinLedger can calculate your tax liabilities and ensure accurate reporting.

If you have any questions or need assistance during the tax reporting process, CoinLedger has a dedicated support team to address your concerns. Frequently asked questions are also available on the platform, providing quick answers to common queries.

Getting started with CoinLedger is easy. Simply visit their website and download the software onto your device. Once set up, you can start importing your crypto transactions and let CoinLedger do the rest. The platform also offers professional services for more complex tax situations, ensuring you have the right expertise to navigate the crypto tax landscape effectively.

So, why wait? Start using CoinLedger today and simplify your tax reporting for DeFi transactions. With its user-friendly interface and comprehensive features, CoinLedger is the source you need to streamline your tax obligations. Don’t let the complexities of crypto taxation overwhelm you – let CoinLedger take care of it for you!

Frequently asked questions:

What is Crypto Tax Software for DeFi?

Crypto Tax Software for DeFi is a type of software that helps individuals and businesses simplify their tax reporting and calculations for cryptocurrency transactions and activities in the decentralized finance (DeFi) space.

Why is Crypto Tax Software for DeFi important?

Crypto Tax Software for DeFi is important because it helps users accurately calculate their tax liabilities on DeFi transactions, which can be complex and time-consuming to do manually. It also helps ensure compliance with tax laws and regulations related to cryptocurrencies.

What are the best Crypto Tax Software and Calculators for 2023?

Some of the best Crypto Tax Software and Calculators for 2023 include CoinTracker, ZenLedger, TaxBit, and CryptoTrader.Tax. These platforms provide comprehensive tax reporting and calculations for various types of cryptocurrency transactions and activities.

How does CoinLedger help with crypto tax reporting?

CoinLedger is a Crypto Tax Software that helps users simplify their tax reporting by automatically importing transaction data from various cryptocurrency exchanges and wallets. It categorizes transactions, calculates gains and losses, and generates tax reports that can be easily exported and used for filing taxes.

What are some frequently asked questions about Crypto Tax Software?

Some frequently asked questions about Crypto Tax Software include: How accurate are the calculations? Will the software work with my specific cryptocurrency transactions? Is the software secure and trustworthy? How much does the software cost? Can the software generate tax forms that are accepted by tax authorities?

Videos:

How to Pay Zero Tax on Crypto (Legally)

Watch This BEFORE You Do Your Crypto Taxes

Are there any free alternatives to CoinLedger? I’m looking for a solution that doesn’t require me to spend more on tax reporting software.

Hi JohnSmith79, if you’re looking for a free alternative to CoinLedger, you can try out TaxBit. It’s a great option that offers free tax reporting software for crypto. With TaxBit, you can import your transactions, calculate your tax liability, and generate detailed reports, all without spending extra money. Give it a try and simplify your tax reporting for DeFi investments. Happy accounting!

This crypto tax software seems to be a game changer! I’ve been struggling to keep track of my DeFi investments and calculate my taxes accurately. With CoinLedger, it looks like I can finally simplify the process and avoid potential penalties. Can’t wait to try it out!

Can CoinLedger also calculate the tax liability for staking rewards?

Yes, CoinLedger can calculate the tax liability for staking rewards. It automatically tracks your staking income and includes it in your tax calculations. This feature makes it easy to accurately report your earnings and stay compliant with tax regulations. Give it a try!

As a crypto enthusiast, I have been overwhelmed with the complexity of DeFi transactions and tax reporting. CoinLedger seems like a game-changer. It’s great to see a platform that can import transactions from various exchanges and DeFi platforms. This will definitely save me time and effort in calculating my tax liability. I’m excited to try it out and maximize my tax savings!

Is CoinLedger compatible with other tax software programs for seamless integration?

Yes, CoinLedger is compatible with other tax software programs for seamless integration. It allows you to import and export data in various formats such as CSV and Excel, making it easy to integrate with other software used for tax preparation. This ensures a smooth and efficient tax reporting process, saving you time and ensuring accuracy in your crypto tax calculations.