When it comes to crypto staking, there are often misconceptions about what it entails and how to maximize profits. Many people think that trading is the only way to make money in the crypto market, but staking offers an alternative option.

Before you choose a staking platform, it’s important to know some key facts. Staking is a frequently used term in the blockchain world, but what exactly does it mean? Staking allows users to lock up their cryptocurrency in a wallet to participate in the proof-of-stake consensus algorithm and receive rewards for securing the network. Different blockchains have their own staking platforms and methods, so it’s essential to do your research and find a reputable platform.

One of the advantages of staking is that you don’t always need a high trading volume to earn rewards. Let’s take the example of Haru, a staking service for Tezos, Cosmos, and other cryptocurrencies. Haru takes care of all the technical aspects and allows users to automate their staking process. Their rewards calculator helps users estimate their potential earnings based on their deposits and the current network targets.

Another popular staking option is Komodo, which requires users to run full nodes to earn rewards. While this may sound like a complicated process, it’s actually quite simple when you have the right tools and resources. For example, ChangeNOW, a crypto investment platform, offers a staking calculator that lets users calculate their estimated income from staking Komodo. This feature provides users with a clear idea of how much they can earn from their investment.

Understanding Crypto Staking

When it comes to crypto staking, it is important to understand how it works and what it entails. Staking is a crucial part of many cryptocurrencies and allows users to earn passive income by participating in the network’s consensus mechanism. By staking or delegating tokens, users can contribute to the security and operation of the network and earn rewards in return.

To stake cryptocurrencies, users need to choose the right platform or network that supports staking. Popular choices include Ethereum, Cardano, and Tron, among others. Once users have chosen their preferred network, they can stake or delegate their tokens to a validator or masternode, depending on the chosen cryptocurrency.

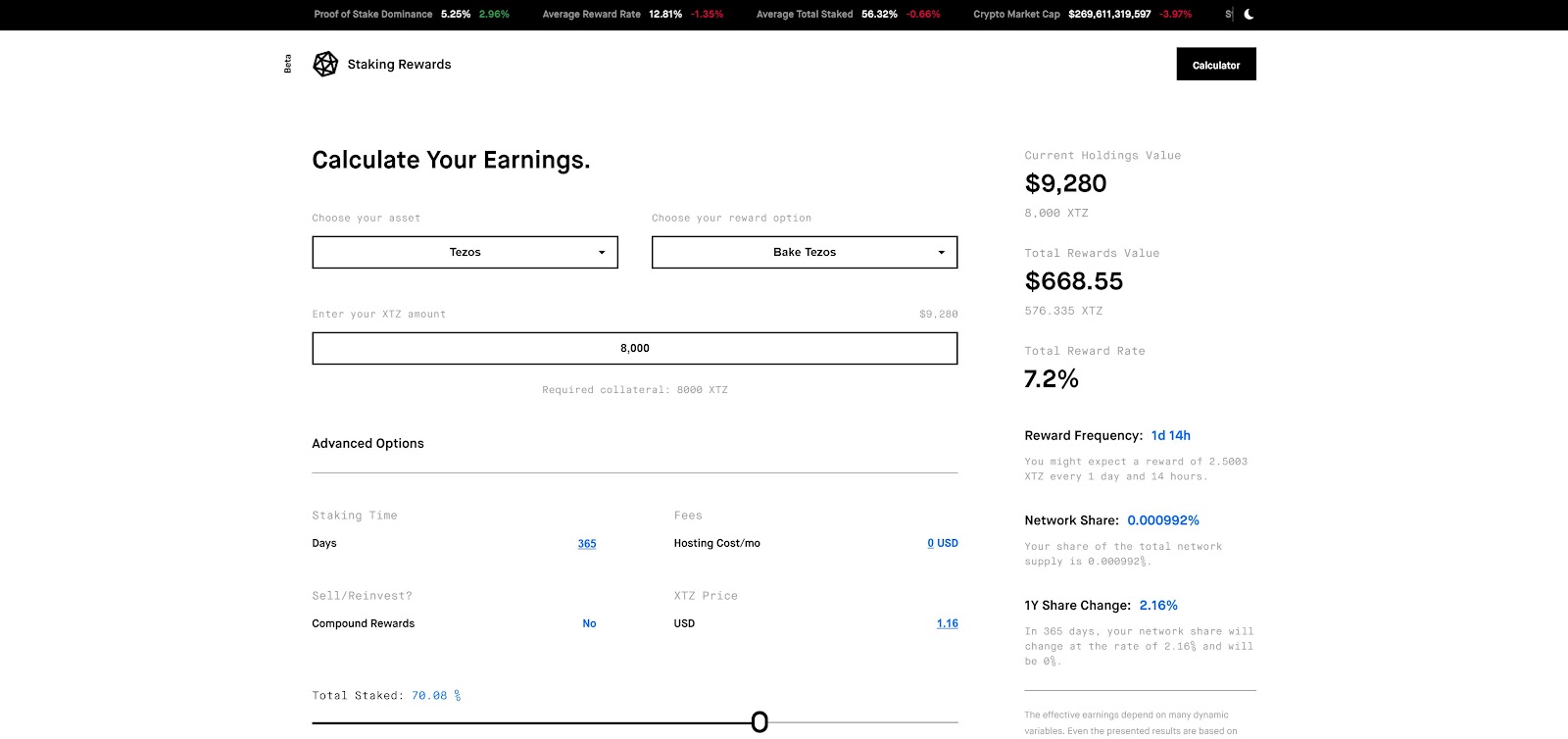

Staking rewards are based on various factors such as the total amount of tokens staked, the duration of the lockup period, and the performance of the network. Different networks offer different staking plans and rates, so it is essential to do thorough research before making a decision. Users can use staking rewards calculators to estimate their potential earnings based on their chosen staking model.

By staking their chosen cryptocurrency, users can expect to earn a certain percentage of annualized rewards, which are typically higher than traditional savings or deposit accounts. Staking provides a passive income stream, allowing users to earn while holding their tokens, unlike active trading or mining. However, it is important to note that staking involves locking up tokens for a certain period, so users need to consider their liquidity needs and long-term plans.

In recent years, staking has become increasingly popular among crypto enthusiasts due to its potential for earning passive income. With the emergence of new staking models such as proof-of-stake (PoS) and delegated proof-of-stake (DPoS), more users are drawn to the concept of staking as a way to earn rewards and support the network.

In conclusion, understanding the basics of crypto staking is crucial for anyone looking to earn passive income with their cryptocurrencies. By staking or delegating tokens to a validator or masternode, users can expect to receive staking rewards based on the chosen network’s performance and staking model. It is important to consider factors such as lockup period, staking plans, and potential earnings before deciding to stake their tokens.

The Benefits of Staking

Staking is a popular method of earning passive income in the world of cryptocurrency. While many users are familiar with mining, staking offers a more energy-efficient and low-cost alternative.

One of the main benefits of staking is the ability to participate in the consensus protocol of a blockchain network, such as Ethereum or Harmony. By staking your funds, you can help secure the network and earn rewards in return.

Staking also allows you to earn a higher annualized percentage yield (APY) compared to traditional saving methods. By using a staking rewards calculator, you can easily calculate your potential profits based on your staked tokens and the network’s current APY.

Additionally, staking provides a more predictable income stream compared to mining. Instead of relying on luck and mining power, staking rewards are determined by a mathematical formula and targets specific blocks or transactions.

Furthermore, staking is a more eco-friendly option compared to proof-of-work (PoW) mining. PoW mining, as seen in Bitcoin, requires significant computational power, which consumes a large amount of electricity. In contrast, staking is more energy-efficient and sustainable.

In some cases, staking may also offer additional benefits, such as the ability to vote on network proposals or participate in governance decisions. Platforms like Tezos, Cardano, and Cosmos allow stakers to have a say in the development and direction of the network.

Overall, staking provides users with a simple and accessible way to earn passive income from their cryptocurrency holdings. With the potential for higher earnings and a more sustainable approach to blockchain validation, staking has become increasingly popular in countries around the world.

How Staking Rewards Work

Staking rewards are a way for users to earn passive income by participating in the validation and consolidation of transactions on a blockchain network. When users invest their tokens in a staking platform, they can earn rewards for contributing to the security and efficiency of the network.

Staking rewards are usually calculated over a specific period known as an epoch or a cycle. During this time, stakers lock up their tokens and participate in the network by validating transactions and creating new blocks. The rewards they earn are then distributed among the stakers in proportion to their staked tokens.

Staking rewards can vary depending on the network and its staking model. Some networks, like Cardano and Stargate, use a delegated proof-of-stake (DPoS) method where users can delegate their staking power to a reputable user or validator. This allows users to participate in staking even if they do not have the technical knowledge or resources to operate their own nodes.

Other networks, like NEO and Ontology, use a Byzantine fault tolerance-based consensus algorithm where stakers use their staked tokens as collateral to validate transactions and create new blocks. In exchange for their efforts, they are rewarded with staking rewards.

It’s important for users to calculate the potential rewards and risks before deciding to stake their tokens. This can be done by using a staking rewards calculator that takes into account factors such as the staking rate, lock-up period, network volume, and staking options. By understanding the potential rewards and risks, users can make informed decisions and maximize their staking profits.

Staking rewards are a legitimate way to earn passive income in the crypto space. However, it’s important to always do thorough research before investing and to choose a reputable staking platform. By diversifying staking options and considering different networks, users can find the highest possible APY (Annual Percentage Yield) and earn consistent profits over the long term.

Choosing the Right Staking Platform

When it comes to staking your crypto assets, choosing the right staking platform is crucial. Each blockchain network has its own staking opportunities and rewards structure that you need to consider before making a decision.

Proof-of-Stake (PoS) Networks: Popular PoS networks like Tezos, Cardano, and Kusama offer higher rewards compared to traditional proof-of-work networks. With PoS, you can earn a certain percentage of your principal as staking rewards, providing a steady income stream.

Reputable Staking Pools: Many users prefer to stake their assets in staking pools as opposed to staking individually. Staking pools combine the assets of multiple users, increasing their chances of earning rewards. However, it’s important to choose a reputable staking pool to ensure the security and integrity of your assets.

Automated Staking Plans: Some platforms offer automated staking plans, allowing you to automate the staking process and earn rewards without needing to actively manage your staked assets. These plans can be a convenient option for users who want to maximize their staking rewards with ease.

Calculating Your Estimated Rewards: Before you invest in a staking platform, it’s important to know how much you can potentially earn. By using a staking rewards calculator, you can input various parameters, such as the amount of crypto you want to stake and the lockup period, to get an estimated annual return on your investment.

Know the Risks: While staking can be a lucrative opportunity, it’s important to understand the risks involved. Staked assets are locked for a specific period, and there is always a chance of losing a percentage of your investment if the network faces any issues.

Choosing the Right Staking Platform: When selecting a staking platform, consider factors such as platform reputation, security measures, user experience, and the variety of supported cryptocurrencies. Make sure to do thorough research and choose a platform that aligns with your staking goals and investment strategy.

Factors to Consider for Maximum Profits

Proof-of-Stake (PoS) vs Proof-of-Work (PoW)

In recent years, staking has gained popularity as an alternative to traditional mining with proof-of-work (PoW) consensus. Proof-of-stake (PoS) allows for easier participation, as it does not require expensive hardware or high electricity costs. Staking rewards vary depending on the network and the amount of tokens you hold, making it a more accessible and potentially profitable method for earning crypto rewards.

Calculating Staking Rewards

To maximize your profits through staking, it’s important to understand how rewards are calculated. Different networks have their own staking mechanisms, but the basic idea is to lock up your tokens and contribute to the network’s security and consensus. In exchange, you receive a percentage of the network’s block rewards. It’s essential to consider factors like the staking platform’s fees, lock-up period, and your chosen validator’s performance when calculating your potential returns.

Biweekly vs Daily Rewards

When choosing a staking plan, you’ll often have the option to receive rewards on a biweekly or daily basis. Biweekly payout plans make it easier to budget and manage your stake’s income, while daily payouts offer more frequent access to your earnings. Consider your financial goals and liquidity needs when deciding which payout frequency is best for you.

Misconceptions about Staking

There are some common misconceptions surrounding staking rewards. Some may assume that staking guarantees consistent and high returns, similar to interest earned on a savings account. However, staking rewards are subject to market conditions and network dynamics, and they can fluctuate over time. It’s important to set realistic expectations and consider staking as a long-term investment strategy rather than a quick way to generate income.

Choosing the Right Staking Assets

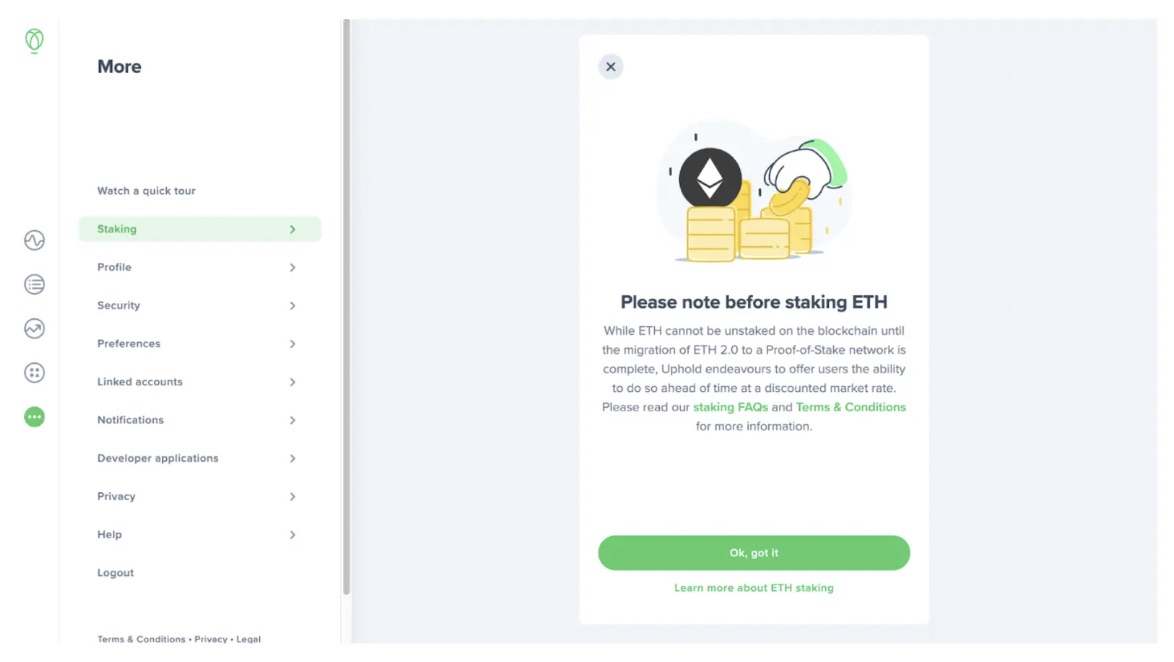

When selecting which assets to stake, it’s crucial to research and evaluate the networks and tokens available. Different networks offer varying staking rates and opportunities. For example, Ethereum’s upcoming shift to a proof-of-stake (PoS) model with Ethereum 2.0 has attracted attention, while other networks like TRON or Tezos offer their own staking opportunities. Carefully consider the potential rewards, lock-up periods, and the overall stability and reputation of the network before investing your tokens.

The Role of Proof-of-Stake (PoS)

Proof-of-Stake (PoS) is an important concept in the world of cryptocurrency and blockchain. Unlike the Proof-of-Work (PoW) model used by cryptocurrencies like Bitcoin and Ethereum, PoS eliminates the need for miners to solve complex mathematical problems. Instead, PoS allocates mining power to those who hold a certain amount of coins or tokens in a wallet, known as staking.

With PoS, users can stake their balance of a particular cryptocurrency, such as Tezos, NEO, or Callisto, and earn rewards. The rewards are calculated based on the amount staked and the annualized staking rate. This automated process eliminates the risk and cost associated with traditional mining, making it a more accessible option for crypto enthusiasts.

Staking rewards are an incentive for users to invest and contribute to the security of the blockchain network. By staking their coins, users become full nodes and participate in validating transactions. Their role is to confirm and add new blocks to the blockchain, in exchange for receiving rewards in the form of additional coins or tokens.

The rewards received through PoS can vary depending on the algorithm used by the blockchain platform. Some platforms like Ethereum and Tron use a modified version of PoS called Proof-of-Stake (PoS), which combines elements of both PoW and PoS. This hybrid model aims to leverage the benefits of PoS while maintaining some of the security features of PoW.

When considering staking as an investment strategy, it is important to use a reliable calculator, like the one provided by ChangeNOW.net, to estimate potential earnings. These calculators take into account factors such as the amount staked, the rewards rate, and the length of time the coins are staked. By entering these variables, users can easily find out how much they could earn and when they can withdraw their rewards.

Staking vs. Mining: A Comparison

Staking and mining are two popular methods of earning cryptocurrency, but they differ in several key aspects. Staking involves delegating your coins to a network and earning rewards for supporting its operations. On the other hand, mining requires using computational power to solve complex mathematical problems, securing the network, and earning rewards in the form of newly created coins.

Staking: A Justification for Higher Rewards

Staking has gained popularity in recent years as platforms like Tezos, Ontology, and Callisto have introduced staking options. One advantage of staking is the higher potential rewards compared to mining. With proof-of-stake (PoS) algorithms, staking makes it possible to earn a higher annualized percentage rate (APR) on your investment, based on the number of coins you have.

Mining: The Principal Choice for Network Security

While staking offers higher returns, mining is still the principal option for network security in many cryptocurrencies. With proof-of-work (PoW) algorithms, miners compete to solve complex puzzles and validate transactions, making the network more secure. Miners also receive newly minted coins as a reward for their efforts.

When it comes to staking, users can choose between different staking options without the hassle of lock-up periods or hardware costs. Staking also automates the process, allowing users to receive rewards without actively participating in mining operations.

Comparing Gas Fees and Flexibility

One key difference between staking and mining is the gas fees involved. Mining often requires substantial energy costs, while staking usually involves much lower costs. Additionally, staking offers flexibility, allowing users to withdraw their funds at any time and access their earnings without waiting for a specific period.

Both staking and mining have their advantages and drawbacks. It is important for crypto investors to carefully consider their goals, risk tolerance, and preferences before deciding to stake or mine. Ultimately, the choice between staking and mining depends on factors such as network security preferences, desired flexibility, and the ability to invest in hardware and electricity costs.

Managing Your Staking Portfolio

When it comes to managing your staking portfolio, there are a few important factors to consider. First, you need to choose which cryptocurrencies you want to stake. There are many options to choose from, including popular ones like Ethereum and Tezos, as well as lesser-known ones like Zilliqa and Qtum.

Once you’ve chosen your cryptocurrencies, you need to decide how much you want to stake. The higher the amount you stake, the higher your potential rewards. But it’s important to find a balance that works for you, considering factors like lock-up periods and potential risks.

Next, you need to understand how staking rewards are calculated. Each cryptocurrency has its own formula for determining rewards, usually based on factors like the network’s transaction volume, the amount of staking tokens you hold, and the length of time you stake for.

When managing your staking portfolio, it’s a good idea to automate the process as much as possible. Many reputable staking platforms offer options to automate staking, so you can earn rewards without constantly monitoring your accounts.

If you’re new to staking, it’s important to understand the basics of proof-of-stake (PoS) algorithms. Unlike proof-of-work (PoW) used by cryptocurrencies like Bitcoin, PoS relies on validators who “stake” their tokens as collateral to validate transactions and secure the network.

Another important aspect of managing your staking portfolio is diversification. By spreading your stake across different cryptocurrencies and networks, you can reduce the risk associated with any one investment. This can help protect your principal and ensure you continue to earn rewards even if one network experiences issues.

Lastly, stay informed about the latest developments in the staking world. New staking opportunities and platforms are constantly emerging, and staying up to date can help you make informed decisions about where to stake your tokens. Consider joining online communities and forums where members share experiences and insights.

In summary:

- Choose your cryptocurrencies wisely

- Find the right balance between stake amount and potential rewards

- Understand how rewards are calculated

- Automate staking to simplify the process

- Learn about proof-of-stake algorithms

- Diversify your staking portfolio

- Stay informed about new staking opportunities

Calculating Staking Rewards

Staking rewards are a great way to increase your profits and earn passive income from your cryptocurrency investments. If you plan to stake your tokens, it is important to consider how much you can potentially earn and calculate the rewards.

When staking cryptocurrencies like QTUM, Tezos, NEO, or Tron, you can earn consistent rewards by participating in the network’s proof-of-stake (PoS) consensus mechanism. Unlike proof-of-work (PoW) cryptocurrencies that require miners to validate transactions, proof-of-stake allows users to stake their tokens and become full nodes to confirm transactions and secure the network.

To calculate your staking rewards, you first need to know the annual percentage rate (APR) or reward rate offered by the cryptocurrency network. The APR can vary depending on the network and can be high or low based on the demand for the cryptocurrency and the overall performance of the network.

There are various online calculators available that automate the process of calculating staking rewards. These calculators take into account factors like the APR, your staked balance, and the length of time you plan to stake your tokens. By inputting this information, you can get an estimate of how much you can potentially earn over a certain period of time.

- For example, if you are staking Callisto with an APR of 8%, and you have 1000 CLO tokens staked for a year, the calculator can tell you how much CLO you will earn in that time.

- Another option is to stake Ethereum on the Harmony platform, which offers an APR of 12%. By staking your ETH on Harmony for a certain period, you can earn rewards in the form of ONE tokens.

- If you’d like to stake your coins on a platform with a higher APR, consider Komodo, which offers an APR of up to 6%. By staking your KMD tokens, you can earn rewards and participate in the security and governance of the Komodo network.

- Ontology is another popular platform for staking, with an APR ranging from 2% to 5%. By staking ONT tokens on Ontology, you can earn staking rewards and contribute to the network’s security and governance.

It’s important to note that staking rewards are not guaranteed and can vary based on the network’s performance, the number of tokens bonded to the network, and other factors. Additionally, some countries may have restrictions or specific requirements for staking cryptocurrencies.

To ensure you get the highest possible staking rewards, it’s important to carefully choose the cryptocurrency network and platform you want to stake with. Research the network’s performance, security measures, and staking plans before making a decision. Consider your own experience with staking and choose a platform that offers a user-friendly interface and provides full transparency in tracking your staking rewards.

By staking your tokens, you can earn passive income and maximize your profits with ease. Staking rewards can be a lucrative investment option for those who want to generate income from their cryptocurrency holdings without actively trading or engaging in other forms of speculation. So, if you’re looking to earn more from your cryptocurrencies, staking may be the best choice for you.

Tips and Strategies for Maximizing Profitability

Educate Yourself: To maximize your staking profitability, it is crucial to understand the definition, types, and basics of staking. Familiarize yourself with the concept of proof-of-stake and how it works in different blockchains like Tron, Komodo, and Zilliqa. Knowing the fundamentals will help you make informed decisions.

Choose the Right Cryptocurrency: Not all cryptocurrencies offer staking as an option. Research and find reputable projects that offer staking rewards. Consider factors like the project’s credibility, market demand, and potential for growth. Popular staking options include Tezos, Haru, and Earn.

Calculate and Monitor Staking Rewards: Use a staking rewards calculator to estimate your potential earnings. These calculators take into account factors like your staked amount, the duration of staking, and the staking rate. By keeping track of the estimated rewards, you can plan and strategize effectively to maximize your profits.

Consider Staking Plans: Some staking platforms offer different options or plans for staking. These plans may have varying staking rates or lock-up periods. Carefully analyze the available plans and choose the one that aligns with your investment goals and risk tolerance. Automated staking plans can also help you automate your staking process for convenience and efficiency.

Divide and Conquer: If you have a significant amount to stake, consider dividing it among multiple staking accounts or platforms. This diversification can help spread the risk and potentially increase your overall rewards. However, make sure to verify the credibility and security of the platforms before staking your tokens.

Withdraw or Reinvest: Once you start earning staking rewards, you have the option to withdraw or reinvest them. Assess your financial goals and decide whether you want to accumulate the rewards or use them for other purposes. Reinvesting the rewards can help you compound your earnings and generate a passive income stream.

Stay Informed: Stay updated with the recent developments and news in the staking space. Keep an eye on staking platforms, new projects offering staking, and any misconceptions that may arise. Being well-informed will enable you to adapt your staking strategy and make the most of potential opportunities.

Consider Other Staking Mechanisms: In addition to traditional staking, consider exploring other staking mechanisms such as masternodes or Delegated Proof-of-Stake (DPoS). These mechanisms may offer different rewards structures or additional benefits that can further increase your profitability. However, always do thorough research before investing in these options.

By following these tips and implementing effective staking strategies, you can maximize your staking profitability and make the most out of your crypto staking endeavors.

Frequently asked questions:

What is a crypto staking rewards calculator?

A crypto staking rewards calculator is a tool that helps crypto investors estimate their potential earnings from staking their coins. It takes into account factors such as the amount of coins to be staked, the staking period, and the annual staking rewards rate to provide an estimate of the profits.

How can I maximize my profits with crypto staking?

You can maximize your profits with crypto staking by considering various factors such as the staking rewards rate, the length of the staking period, and the amount of coins staked. By using a crypto staking rewards calculator, you can experiment with different scenarios to find the most profitable staking strategy.

What should I know before staking my crypto?

Before staking your crypto, it’s important to consider the staking rewards rate, the lock-up period, and any potential risks associated with staking. Make sure to research the project you are staking with, understand the terms and conditions, and evaluate the overall potential returns and risks involved.

Are there any risks involved in crypto staking?

Yes, there are risks involved in crypto staking. These may include the potential loss of staked coins due to technical vulnerabilities, hacking, or unforeseen circumstances within the blockchain network. Additionally, the staking rewards rate may not always be guaranteed, and fluctuations in the cryptocurrency market can affect the overall value of staked coins.

Video:

How to maximize your profits from Zilliqa staking? How often should you claim staking rewards?

How to Calculate Your Staking Rewards On the Staking Rewards Website

EARN $1000 PER DAY PASSIVE INCOME | CRYPTO VALIDATOR NODE!