The cryptocurrency market experienced a major setback during a recent series of events, resulting in significant losses for investors and traders. One of the most notable incidents involved a hack on a decentralized finance (DeFi) platform, which led to the theft of millions of dollars worth of digital assets.

The hack occurred in July and targeted a popular DeFi platform called Mango. Hackers managed to exploit a vulnerability in the platform’s smart contract code, allowing them to gain unauthorized access to user funds. As a result, approximately $5.4 million worth of cryptocurrency, including Bitcoin (BTC), Ethereum (ETH), and XRP, was stolen.

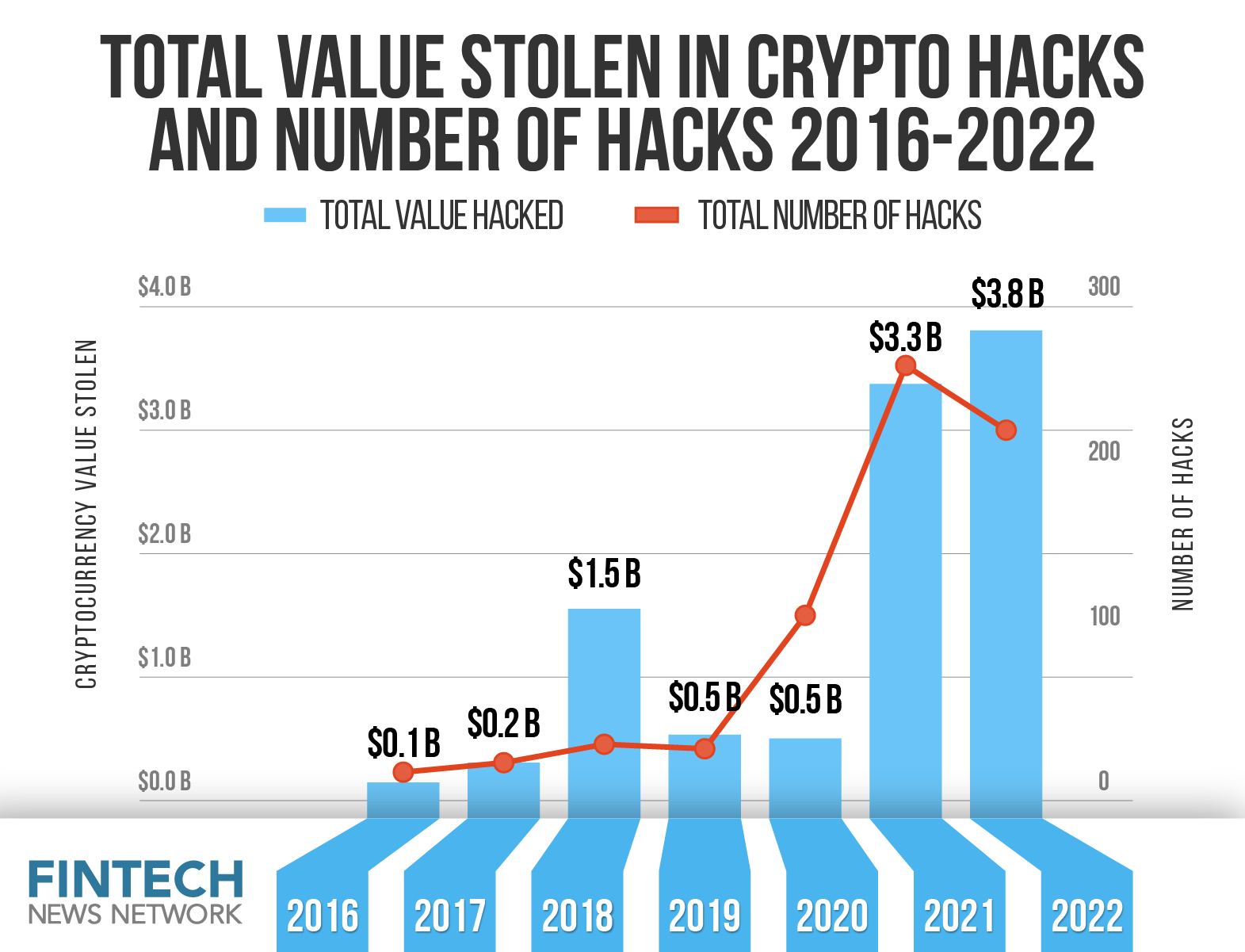

This incident serves as a cautionary tale for the cryptocurrency community, highlighting the importance of security measures and the need for constant vigilance when investing in DeFi platforms. In recent years, the popularity of DeFi has surged, with the total value locked in these platforms reaching an all-time high of $94 billion in May 2021. However, the rise in popularity has also attracted the attention of hackers, who have been able to exploit vulnerabilities in these platforms and make off with millions of dollars.

One of the main reasons DeFi platforms have become targets for hackers is due to their use of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. While smart contracts offer numerous benefits, such as increased efficiency and transparency, they also come with their own set of risks. If a smart contract is not properly constructed or audited, hackers can easily exploit vulnerabilities and gain unauthorized access to user funds.

In the case of the Mango hack, hackers were able to exploit a vulnerability in a smart contract that interacted with an oracle, a crucial component of DeFi platforms that provides external data to the blockchain. By manipulating the oracle, the hackers were able to trick the platform into transferring user funds into their own address, effectively stealing millions of dollars.

This series of hacks serves as a wake-up call for the cryptocurrency community, highlighting the need for improved security measures and better auditing practices. As the popularity of DeFi continues to grow, it is crucial that platform developers and users take the necessary precautions to protect their assets and ensure the accuracy and integrity of their operations. Only by doing so can the crypto community hope to combat these ever-evolving threats and prevent further losses.

A cautionary tale for smart contract developers

Recent events in the crypto market have highlighted the significant risks that come with DeFi (decentralized finance) projects and smart contract development. The hack of a multi-million dollar DeFi platform serves as a cautionary tale for developers in the industry, as it exposed vulnerabilities that could result in massive losses for both investors and the broader crypto community.

In July, a hacker managed to exploit a vulnerability in the smart contracts of a popular DeFi lending platform, resulting in the theft of millions of dollars worth of cryptocurrency. This incident, along with other recent hacks in the crypto space, has underscored the need for better security measures and thorough auditing of smart contracts before they are deployed.

Smart contract developers must be aware of the potentially devastating consequences of a breach. The hack of the DeFi platform not only resulted in financial losses but also eroded trust in the wider blockchain ecosystem. The losses incurred by individuals and organizations serve as a reminder that even the most secure platforms can be vulnerable to attacks.

The hacker’s target: DeFi platforms

DeFi platforms have become the most attractive targets for hackers due to the large sums of money involved. The growing popularity of lending and trading platforms like Aave and Mango Markets has drawn the attention of hackers, who seek to exploit vulnerabilities in their smart contracts in an attempt to steal millions of dollars in cryptocurrency.

These successful attacks highlight the importance of secure coding practices and regular security audits. Developers must be cautious when designing and implementing smart contracts, as a single vulnerability can result in substantial financial losses and damage to the reputation of the entire DeFi community.

Enhancing the security of smart contracts

As the crypto market continues to grow, it is crucial for smart contract developers to prioritize security. Implementing best practices, such as thorough code reviews, rigorous testing, and utilizing third-party security audits, can help identify and mitigate vulnerabilities in smart contracts.

Furthermore, the use of decentralized oracles can provide an additional layer of security by ensuring that external data used by smart contracts is accurate and reliable. By improving the accuracy of external data, smart contracts can better safeguard user funds from potential attacks.

The cautionary tale of the recent DeFi hack serves as a reminder to the crypto community that security should always be a top priority. The continuous improvement of security measures and the implementation of best practices will help protect the integrity of the blockchain ecosystem and prevent unprofitable losses that can occur from hacks and breaches.

Crypto community with 94% historical accuracy sets Ethereum price for July 31

A reliable source from the crypto community, known for its 94% historical accuracy, has set the Ethereum price for July 31. This accuracy is achieved by using an oracle, a system that retrieves and verifies data from various sources to ensure the most precise prediction. The community has proven its ability to accurately forecast price movements in the past, making this information highly valuable to investors.

Accurate Predictions and Occurring Events

The crypto community’s accuracy in predicting Ethereum price movements has been crucial for many developers and investors. With such high accuracy, they can anticipate and make informed decisions on whether it is worth investing more or less in Ethereum. This scheme has been successful even during times of market losses and unprofitable schemes, providing a valuable resource for those in the crypto space.

For July 31, the community predicts that Ethereum will be valued higher than $100,000, which is a significant increase compared to its current worth. This forecast takes into account several factors, including recent market trends, platform developments, and historical data. It is important to note, however, that the crypto market is highly volatile and subject to unpredictable changes, so it is always advised to exercise caution when making investment decisions.

High Stakes: Hackers Targeting DeFi Platforms

Despite the accuracy of the crypto community’s predictions, the security of the crypto market remains a concern. DeFi platforms, in particular, have been targeted by hackers, leading to millions of dollars in losses. These hackers utilize various techniques to exploit vulnerabilities in the platforms, highlighting the need for enhanced security measures.

One recent incident involved the breach of the Mango Markets platform, where hackers were able to steal more than $50 million worth of cryptocurrency. This attack demonstrates the importance of implementing robust security measures to protect users’ funds and maintain trust within the crypto community. Platforms that fail to prioritize security may face significant losses and damage their reputation.

Looking Ahead: The Future of Crypto Market Security

As the crypto market continues to evolve, ensuring the security of platforms and protecting users’ funds will be a crucial focus. Developers, investors, and regulators must work together to address vulnerabilities, implement robust security measures, and increase overall awareness of potential risks. Without proper security measures in place, the industry risks losing the trust and confidence of investors, hindering its growth and adoption.

Efforts are already underway to strengthen security measures, such as the implementation of multi-factor authentication, enhanced encryption technologies, and ongoing security audits. However, it is important to remain vigilant and adaptable to the evolving tactics of hackers. Only through continued collaboration and proactive measures can the crypto community ensure a secure and thriving market for years to come.

Crypto community with 84 historical accuracy sets Bitcoin price for July 31 2023

A tale of hackers and lost money unfolded in the crypto market during the week of July 31, 2023. Two major DeFi hacks took place, resulting in millions of dollars being stolen. These smart contract attacks have become a major concern for developers and traders alike, as even the most secure blockchain platforms are facing security breaches.

The first hack hit the Solana platform, where hackers managed to exploit a vulnerability and stole over $100,000 in XRP. The security breach occurred due to a failed attempt by the developers to address a crucial security flaw in the platform’s code. This hack served as a cautionary tale for the crypto community, emphasizing the importance of thorough security measures.

Following this event, another major DeFi hack took place, this time on the Atlas platform. Hackers were able to breach the smart contract and steal a total of $2 million. This incident highlighted the need for increased security and vigilance in the crypto market.

Amidst these losses, the crypto community with an 84% historical accuracy set the Bitcoin price for July 31, 2023. Predicting the price of cryptocurrencies is a complex task, but these experts have shown remarkable accuracy in the past. Their prediction serves as a beacon of hope for traders and investors, guiding their decisions in a market filled with uncertainty.

The crypto market has always been a target for hackers, and these recent events emphasize the need for robust security measures. As the market grows, hackers become more sophisticated in their attacks, making it essential for platforms and traders to stay ahead and prioritize security. The crypto community is hopeful that the lessons learned from these hacks will strengthen the overall security of the ecosystem, making it more resilient to future attacks.

In conclusion, the crypto market faced significant setbacks during the week of July 31, 2023, with millions of dollars being stolen through smart contract hacks. However, the accuracy of the Bitcoin price prediction by the crypto community provides some solace to traders and investors, showing that even in the face of adversity, there is still hope for profitable outcomes.

Buckle up: XRP price eyes NFTs targeted more than most by hackers

The cryptocurrency market continues to be plagued by hacking attempts, with XRP being one of the platforms that has been hit the hardest. In July alone, a total of $84 million worth of XRP was stolen in various hacks, making it one of the most targeted cryptocurrencies.

One particular attack that caught the eyes of many was the July hack where a hacker stole over $100,000 worth of XRP from a trader’s account. This cautionary tale serves as a reminder that no platform is safe from hackers and that users should exercise caution when engaging with DeFi platforms.

DeFi platforms, such as Aave and Atlas, have been a major target for hackers due to their historical vulnerability to hacks. In the first half of 2023, these platforms lost a total of $31 million to hacks, further emphasizing the need for improved security measures.

While the accuracy of these numbers may vary, the fact remains that XRP has become a prime target for hackers. The underlying blockchain technology has made it difficult for law enforcement agencies to trace and retrieve stolen funds, giving hackers more incentive to target XRP.

With the rising popularity of NFTs, XRP has become a valuable asset for hackers. The XRP price is expected to continue to rise, making it an attractive target for those seeking to profit from stolen funds. As such, users should remain vigilant and take necessary precautions to protect their XRP holdings from potential attacks.

In conclusion, the recent surge in hacking attempts targeting XRP serves as a cautionary tale for the cryptocurrency market. Users must be aware of the risks and take steps to ensure the security of their funds. As the market continues to evolve, developers and platform operators must prioritize security to prevent further losses and make the ecosystem unprofitable for hackers.

Mango Market Hacker Loses Millions in Failed Aave Scheme

In July, the crypto market was once again rocked by a series of hacking events that resulted in significant losses. One of the notable attacks targeted Mango Market, a decentralized platform built on the Solana blockchain. The hacker attempted to exploit a vulnerability in the Aave protocol, a crucial smart contract for decentralized lending on Ethereum, but their plan ultimately backfired.

The hacker’s scheme involved manipulating the oracle’s data feed to deceive the Aave protocol into liquidating a large number of user accounts. However, the high security measures implemented by the Aave developers and the early detection of suspicious activities prevented the scheme from succeeding. As a result, the hacker lost millions in potential profits.

This failed Aave scheme is a cautionary tale for hackers looking to make a quick buck in the DeFi market. While the potential for high returns may be tempting, the risks are equally high. The security measures implemented by blockchain platforms and the vigilance of the community make it increasingly difficult for hackers to exploit vulnerabilities and get away with stolen funds.

The Mango Market hack serves as a reminder of the historical losses incurred by the crypto market due to malicious attacks. In 2021 alone, over $3.1 trillion worth of cryptocurrencies have been stolen through various hacking techniques. This alarming figure highlights the importance of implementing strong security measures and conducting frequent audits to ensure the safety of users’ funds.

Although the hacker in this case lost millions, it is important to note that these attacks can still result in significant losses for users. The hack on Mango Market compromised the balances of 84 traders, resulting in a total loss of even over 100,000 Solana and 94 Ethereum. Such events underscore the need for caution and thorough due diligence when participating in decentralized finance platforms.

In the aftermath of the hack, the Mango Market team has taken steps to improve security and restore confidence in the platform. They have pledged to compensate affected users and have implemented additional security measures to prevent similar incidents from occurring in the future.

Bitcoin to hit 100000 if these two events occur

The cryptocurrency market has been facing a series of attacks and hacks lately, with millions of dollars being stolen from various platforms. The most recent cautionary tale comes from the DeFi sector, where a smart contract vulnerability in the Aave platform resulted in the loss of $31 million. These incidents highlight the need for the community to exercise more caution and for developers to make accuracy and security a crucial part of their blockchain projects.

If these events continue to occur, it is highly likely that Bitcoin will reach a price of $100,000. In the early quarter of July, Bitcoin was targeted by hackers who attempted to steal millions of dollars from exchanges. While the cryptocurrency market loses billions of dollars during these hacks, Bitcoin, with its strong security and decentralized nature, remains relatively unscathed.

The second event that could propel Bitcoin to the $100,000 mark is the continued growth and adoption of the cryptocurrency. Bitcoin has become a household name, and more and more people are putting their trust and money into this digital asset. With a market capitalization of over $1 trillion, Bitcoin has proven itself to be a reliable and high-value investment. The ongoing interest in Bitcoin from institutional investors, such as Mango Markets and Solana, sets the stage for even more growth and potential for a high market price.

However, it is important to note that the cryptocurrency market is highly volatile and can be subject to drastic price swings. While the events mentioned above may increase the chances of Bitcoin hitting $100,000, there are no guarantees. Investors should always do their own research, exercise caution, and only invest what they can afford to lose in this unpredictable market.

Crypto market hangs in the balance facing a crucial ‘make or break’ week

The crypto market is currently in a state of cautionary as it faces a crucial ‘make or break’ week ahead. Following the recent million-dollar DeFi hack, investors and traders are on high alert, closely watching the events unfold.

One of the platforms affected by the hack is Aave, a popular decentralized lending platform. Gauntlet, a DeFi risk simulation platform, warned that such attacks could occur during events where the historical total value locked in DeFi platforms reached $100,000 million.

The hack not only resulted in significant financial losses for the cryptocurrency community, but it also raised concerns over the security and accuracy of DeFi platforms. Millions of dollars were lost, and the hacker managed to steal millions worth of Ethereum by exploiting a vulnerability in the Mango Markets contract.

While the crypto market has been experiencing loses, with the price of Ethereum and even XRP taking a hit, all eyes are now on the trillion-dollar market’s response to these events. The next week is crucial in determining the future of the market and its resilience against hackers.

The recent hack serves as a reminder for developers and platforms to prioritize security and implement smart contract audits. Aave, Mango, and other affected platforms must buckle down and reassess their security measures to prevent further attacks.

As the crypto market hangs in the balance, traders and investors must exercise caution and be wary of unprofitable lending platforms. With millions of dollars lost in a single quarter, it is crucial to research and choose platforms with a proven track record and community trust.

In conclusion, the crypto market is currently facing a critical juncture, and the coming week will determine its fate. The recent hacking incidents have highlighted the importance of security in the crypto space, and platforms must take proactive measures to ensure the safety of user funds and regain the trust of the community.

Frequent questions:

What happened to the crypto market after the million-dollar DeFi hack?

The crypto market suffered massive losses following the million-dollar DeFi hack. The hack caused a significant drop in prices and a loss of confidence among investors.

What is the Bitcoin price set for July 31, 2023, by the crypto community with 84 historical accuracy?

The crypto community with 84 historical accuracy has set the Bitcoin price for July 31, 2023, but the specific price was not mentioned in the article.

What events need to occur for Bitcoin to hit $100,000?

To reach a price of $100,000, two specific events need to occur, which were not mentioned in the article.

What happened to the Mango Market hacker in the failed Aave scheme?

The Mango Market hacker lost millions in the failed Aave scheme. This serves as a cautionary tale for smart contract developers and highlights the risks involved in the crypto market.

What is the Ethereum price set for July 31 by the crypto community with 94 historical accuracy?

The crypto community with 94 historical accuracy has set the Ethereum price for July 31, but the specific price was not mentioned in the article.

What happened to the crypto market after the million-dollar DeFi hack?

The crypto market suffered significant losses following the million-dollar DeFi hack. The hack had a major impact on prices and raised concerns about security in the industry.

Why is the XRP price eyeing NFTs more than most in the crypto market?

The XRP price is targeting NFTs more than most in the crypto market because hackers have found them to be lucrative targets. This raises concerns about the security and vulnerability of NFT platforms.

What is the current state of the crypto market?

The crypto market is hanging in the balance and facing a crucial “make or break” week. The article does not provide detailed information on the specific factors contributing to this state or the potential outcome.

Video:

MASSIVE DeFi Hack Just Happened | What you Must Know!

Is Your DeFi Investment Safe? Euler Finance’s Loss of $197 Million

What are the potential price predictions for Bitcoin and Ethereum after this DeFi hack? Will they recover?