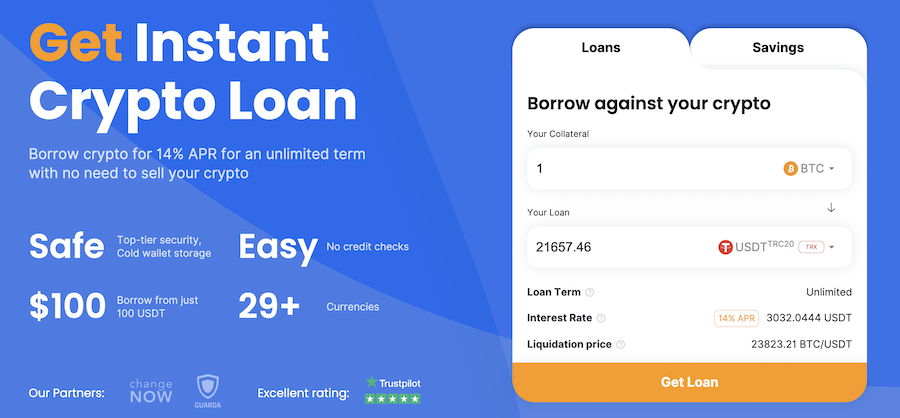

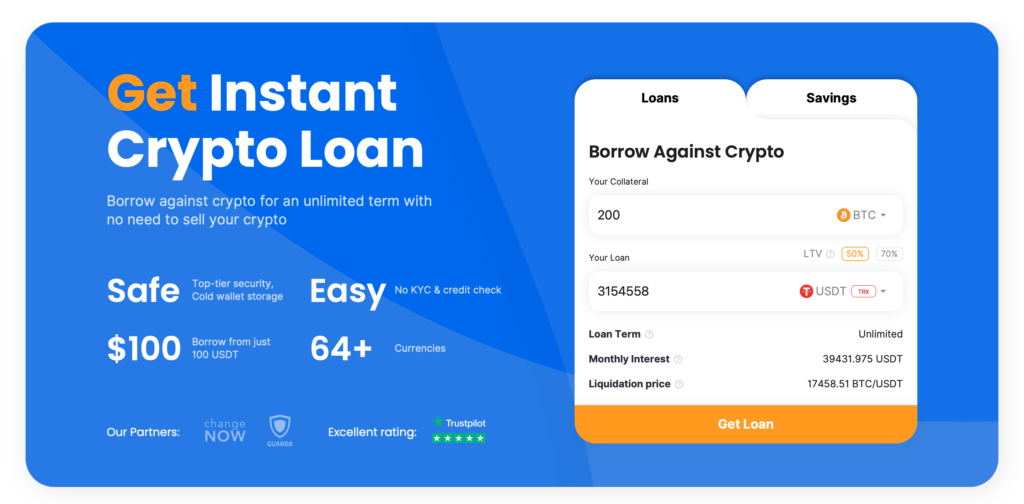

When it comes to borrowing, there are a plethora of options available in the financial market. However, not all of them offer the same level of convenience and flexibility. That’s where our service comes in. We are able to provide loans in USDT and a wide variety of other cryptocurrencies, making it easier for individuals to access the funds they need.

Our platform is designed to make the borrowing process as smooth as possible. With a simple application process and quick approval rates, you can get the funds you need in no time. Whether you are looking to consolidate debt, invest in stocks, or simply need some extra cash, our platform can cater to your needs.

With our service, borrowers are able to choose from a wide range of cryptocurrencies to hold as collateral. This gives borrowers the flexibility to select the assets that best suit their financial goals. What’s more, all collateral is securely stored and protected, ensuring the safety of your holdings.

Repayment happens automatically through our platform, and borrowers can choose to repay their loans in either the same cryptocurrency they borrowed or in USDT. The repayment rate is locked in at the time of borrowing, so you don’t have to worry about sudden changes in exchange rates.

Our platform is accessible through both mobile and desktop devices, making it convenient for people on the go. Furthermore, our team of financial experts is always available to provide assistance and answer any questions you may have. We strive to provide a top-notch user experience, and your feedback is greatly appreciated.

Whether you need a small loan for a quick financial fix or a large sum for a significant investment, our service can meet your needs. With a high loan-to-value ratio (LTV) and the ability to borrow against over 100 different assets, our platform offers unparalleled flexibility for borrowers.

So why wait? Open an account with us today and take advantage of our crypto loan service. With our partners in the crypto industry, we can offer competitive interest rates and ensure that you get the best borrowing experience possible. Your financial future is in your hands, and we are here to help you make the most of it.

Crypto Loans in USDT and 100 Other Assets

When it comes to crypto loans, there are many options available depending on your needs and preferences. One of the advantages of crypto loans is that you can borrow USDT and other cryptocurrencies as collateral, giving you much flexibility in how you use your funds.

With crypto loans, the process is usually instant, and you can have access to your funds quickly. The amount you can borrow will depend on the value of the collateral you offer and the interest rate that is set.

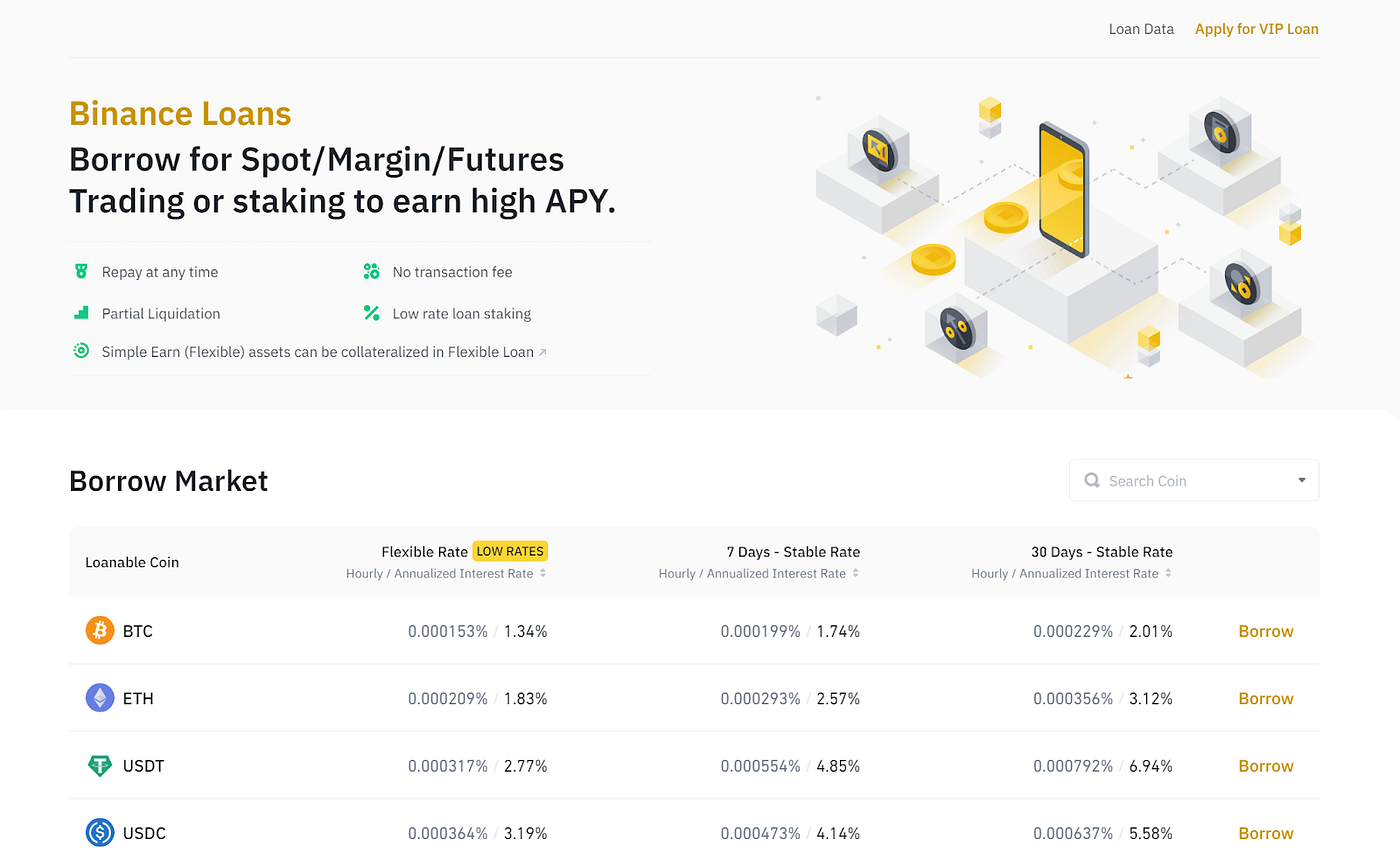

There are different types of crypto loans available, ranging from personal loans to business loans. The interest rates can vary, and it’s important to carefully consider the terms and conditions before taking a loan. However, compared to traditional loans, crypto loans generally offer lower interest rates and fewer fees.

With crypto loans, your collateral is usually kept secure in a private wallet, ensuring that you have control over your assets. This means that even if the loan defaults, your collateral won’t be affected. Your personal information will also remain private and won’t be shared with any third parties.

If you’re interested in crypto loans, you can easily apply for one online. The application process is simple and can be completed in just a few minutes. Once your loan application is approved, the funds will be sent to your designated wallet address, and you can use them as you like.

The Advantages of Crypto Loans

There are several advantages to opting for a crypto loan. Firstly, by using your crypto assets as collateral, you can access funds without needing to sell your assets, allowing you to continue benefiting from any potential price appreciation. Additionally, the process is much quicker compared to traditional loans, making it an ideal option for emergency services.

Furthermore, as crypto loans are decentralized and don’t involve intermediaries like banks, there are fewer fees involved. You can also borrow a variety of assets, with over 100 options available, including popular cryptocurrencies like Bitcoin and Ethereum. The flexibility and freedom provided by crypto loans make them a popular choice among borrowers.

If you need financial advice, there are usually resources available to help you make informed decisions. You can reach out to customer support via email or phone to understand the terms and conditions better. Before taking a crypto loan, it’s important to assess your current financial situation and consider the risks involved.

In conclusion, crypto loans offer a secure and efficient way to access funds using your crypto assets as collateral. With a wide range of assets available and lower interest rates compared to traditional loans, crypto loans provide borrowers with greater control over their finances. Whether you need funds for personal or business purposes, crypto loans can be a valuable tool in achieving your goals.

Borrow USDT and Various Cryptocurrencies

Looking to borrow USDT or various other cryptocurrencies? With our lending service, you can quickly borrow USDT and a wide range of other cryptocurrencies. Whether you need funds for personal use or business purposes, our platform offers a convenient way to access the crypto loans you need.

When you borrow USDT or other cryptocurrencies with our partners, you can enjoy competitive interest rates and a straightforward application process. With just a few simple steps, you can open an account and start borrowing within minutes.

One of the advantages of borrowing USDT and other cryptocurrencies is the flexibility it offers. Unlike traditional loans, you don’t need to worry about credit checks or collateral. You can use your crypto assets as collateral for the loan, which means that even if you don’t have a good credit score or a valuable asset, you can still borrow the funds you need.

It’s important to note that borrowing USDT or other cryptocurrencies comes with its own set of risks. As the value of cryptocurrencies can change quickly and dramatically, it’s important to be aware of the potential for fluctuations in value. Additionally, if you’re not familiar with how cryptocurrencies work, it’s recommended that you do your own research and seek professional advice.

Our lending service provides a safe and secure platform for borrowing USDT and various other cryptocurrencies. We work with trusted partners who are experts in the field of crypto lending. This means that you can borrow with confidence, knowing that your assets are in good hands.

So, whether you need funds for an emergency or you’re looking to make a strategic investment, our platform offers a convenient and flexible way to borrow USDT and various other cryptocurrencies. Start your application today and find out what options are available for you.

Crypto Loan Use Coins As Collateral

When it comes to cryptocurrency, there are various currencies available for use as collateral in a crypto loan. With this type of loan, individuals can borrow USDT and other cryptocurrencies by using their existing coins as collateral.

One of the main advantages of a crypto loan is the ability to start borrowing against your coins without having to sell them. Unlike centralized financial systems, crypto loans are decentralized and can be accessed through various partners.

How Does It Work?

When you take out a crypto loan, you choose the amount and term of the loan. The loan is then provided to you in USDT or other supported tokens. You can choose to receive the payout in one single transaction or in multiple installments.

Interest rates on crypto loans vary and are based on market conditions. As a borrower, you need to understand the terms and the interest rate associated with the loan. It’s important to note that interest rates can change during the term of the loan.

Benefits and Alternatives

With a crypto loan, you have the ability to use your existing cryptocurrencies as collateral, which allows you to access funds without selling your assets. This can be particularly useful for long-term holders who do not want to miss out on potential price appreciation.

Another benefit of crypto loans is the quick and convenient process. It only takes minutes to apply for a loan, and the funds can be deposited directly into your account. There are no credit checks required, and the loan is not based on your credit score.

However, it’s important to weigh the pros and cons of crypto loans. While they offer quick access to funds, there may be higher fees associated with these loans compared to traditional loans. Additionally, if the value of your collateral drops significantly, you may be required to provide additional collateral or face liquidation of your assets.

In conclusion, crypto loans provide an alternative way for people to access funds without selling their cryptocurrencies. With the ability to use coins as collateral, individuals can start borrowing against their assets with quick and convenient services. However, it’s important to understand the terms and fees associated with these loans before taking them out.

Secure Your Loan With Crypto Assets

If you’re looking to take out a loan, but don’t want to go through the hassle of a traditional credit check, you can now secure your loan with crypto assets. By using your cryptocurrency as collateral, you can borrow funds against the value of your assets without affecting your credit score.

One of the main advantages of using crypto assets as collateral is that it allows you to take advantage of any potential price increases in the market. If the value of your crypto assets increases during the loan period, you can profit from these gains. Additionally, the process is quick and convenient, with most lenders offering instant loan approval and funding within minutes.

When using your crypto assets as collateral, it’s important to note that your personal information is kept private. Your crypto assets are securely stored in a wallet address that only you have access to. This means that even if there were any changes or security breaches outside of your control, your assets would remain safe.

If you’re unsure about the process or have any questions, you can review the FAQ section or reach out to the lending team for advice and assistance. They will be able to guide you through the application and review process, compare the offers from different lenders, and ensure that you get the best loan terms. The team is also available to help with any emergencies or issues that may happen during your loan period.

By using your crypto assets as collateral, you can access lending partners that offer loans in USDT and over 100 other assets. This gives you the flexibility to use the loan for any purpose, whether it’s for personal or business needs. Additionally, the system is free to use, and there are no commissions or spammed emails to worry about.

So, if you’re in need of a loan, consider securing it with your crypto assets. With the launch of crypto loans in USDT and 100+ other assets, you can now borrow funds quickly and conveniently, with much higher privacy and security compared to traditional fiat loans.

Access Funds Without Selling Your Crypto

Are you in need of immediate funds but don’t want to sell your precious cryptocurrency assets? With our crypto lending service, you can access funds without the need for selling your crypto. This allows you to continue benefiting from potential long-term gains while conveniently accessing the money you need.

Unlike traditional lending alternatives, our service allows you to use your cryptocurrency as collateral, which provides a more secured and instant borrowing option. This means that you can quickly access funds without having to go through the lengthy application process of traditional loans.

By using your crypto assets as collateral, you don’t have to worry about credit checks or other paperwork that comes with traditional borrowing. You can simply stake your crypto and obtain a loan instantly.

It’s important to understand that while you’re using your cryptocurrency as collateral, you still retain ownership of your assets. This means that once you repay the loan, your crypto is returned to you in the same condition as it was before.

Our service supports a wide range of cryptocurrencies, including Bitcoin, allowing you to access funds using the most popular digital asset in the market. We have a network of top lenders and exchanges, ensuring that you have access to the best rates and options for borrowing.

Whether you’re looking for consolidation or simply need money for personal reasons, our crypto lending service is here to help. You can compare different lending options to find the one that suits your needs the most and start the borrowing process without any hassle.

Don’t let the current market conditions stop you from accessing the funds you need. With our crypto lending service, you can access funds quickly and conveniently without selling your cryptocurrency. Start today and take advantage of the many benefits our service has to offer.

Get A Loan With Flexible Repayment Options

When it comes to borrowing money, having flexible repayment options can provide peace of mind. At [ИМЯ КОМПАНИИ], we understand the importance of tailoring loan terms to meet the individual needs of our borrowers. Whether you’re looking to borrow in USDT, cryptocurrency, or fiat currency, we offer a range of repayment options.

One option is to choose an interest-only repayment plan. This allows borrowers to make monthly payments that only cover the interest accrued on the loan. By using this flexible repayment plan, borrowers have the freedom to pay off the loan principal at their own pace while keeping their monthly payments lower.

Another option is a fixed repayment plan, which involves paying both the interest and principal over a set period of time. This option provides borrowers with the certainty of knowing exactly when their loan will be fully repaid, making budgeting and financial planning easier.

Advantages:

- Flexible repayment options tailored to individual needs.

- Ability to borrow in a range of cryptocurrencies or fiat currencies.

- Access to a wide variety of loan alternatives.

- Protection of collateral’s value against market fluctuations.

- Low interest rates compared to traditional lending alternatives.

- Faster approval process compared to traditional lenders.

How It Works

Applying for a loan with flexible repayment options is simple and straightforward. First, borrowers must provide their personal information and details about the loan amount, collateral, and desired repayment plan. Once the loan application is submitted, it will be reviewed by our lending team.

After the loan is approved, borrowers will receive their loan in the requested currency, whether it’s USDT, cryptocurrency, or fiat. It’s important to note that borrowers are responsible for paying any applicable fees, such as an origination fee, which is a fee charged to cover the cost of processing the loan.

Borrowers can use the loan funds for any purpose they choose, whether it’s to finance a personal project, invest in cryptocurrency, or pay off existing debts. Throughout the loan term, borrowers have the option to make additional payments or pay off the loan early without any penalty.

FAQs:

- What happens if I can’t make the monthly payments?

- How long does the approval process take?

- What happens if the loan term expires?

If a borrower is unable to make the monthly payments, the collateral’s value may be at risk. In such cases, our team will work with the borrower to find a solution that best suits their financial situation.

The approval process typically takes less than 24 hours. Once the loan is approved, borrowers can expect to receive their funds within 1 or 2 business days.

If the loan term expires and the borrower has not fully repaid the loan, we may repossess the collateral to cover the remaining balance.

Low Interest Rates And No Credit Checks

When it comes to crypto loans, one of the main advantages is the low interest rates offered. Unlike traditional loans, which can have high interest rates, crypto loans are often associated with lower rates, making them an attractive option for borrowers.

Another advantage of crypto loans is that they typically do not require credit checks. This means that even if you have a poor credit history or no credit at all, you may still be eligible for a loan. Instead of relying on your credit score, crypto loans are usually secured by the value of your cryptocurrency holdings.

These loans can be taken out in various currencies, such as USDT, BUSD, and other stablecoins. The specific currency options available may vary depending on the lender and their product offerings. However, it is important to note that the interest rates and fees may vary depending on the currency you choose.

One of the key advantages of crypto loans is the ability to receive funds almost instantly. Unlike traditional loans, which can take days or even weeks to be approved, crypto loans can often be processed within minutes. This means that if you’re in need of funds quickly, a crypto loan could be the best option for you.

However, it’s important to consider the cons of crypto loans as well. One of the main drawbacks is the volatility of cryptocurrencies. As the value of cryptocurrencies can fluctuate significantly, there is a risk that the value of your collateral could decrease during the loan term. This could result in a higher loan-to-value ratio and potentially require additional collateral or lead to a default on the loan.

Furthermore, as crypto loans are often decentralized, there is less control and regulation compared to traditional loans. This means that if you encounter any issues or disputes during the loan term, resolving them may be more challenging compared to traditional loan options.

In conclusion, crypto loans offer low interest rates and no credit checks, making them an attractive option for many people. However, the risks associated with cryptocurrencies and the lack of centralized control should also be considered before taking out a loan. It is important to carefully weigh the pros and cons and seek professional advice if needed before opening a crypto loan.

Take Advantage of Stablecoin Loans

Unlock the Potential of Your Cryptocurrency Holdings

If you have been accumulating various cryptocurrencies and are looking for an opportunity to put them to work, stablecoin loans offer a lucrative solution. By using your crypto as collateral, you can borrow stablecoins like USDT and many other assets. This allows you to hold onto your digital assets while still accessing the value they represent.

Benefit from Favorable Interest Rates

One of the key advantages of stablecoin loans is the almost guaranteed lower interest rates compared to traditional loans. By leveraging your crypto holdings, you can access funds at rates that are often much lower than those offered by fiat lenders. This makes stablecoin loans a cost-effective option for those who want to leverage their capital while keeping their crypto assets.

Flexible Loans for Various Purposes

Stablecoin loans offer flexibility for borrowers, as they can be used for a wide range of purposes. Whether you need to cover personal expenses, invest in new opportunities, or make necessary purchases, stablecoin loans give you the freedom to use the funds as you see fit. This means you can take advantage of market opportunities or cover unexpected expenses without having to sell your crypto assets.

Quick and Secure Application Process

Applying for stablecoin loans is a straightforward and secure process. As a decentralized consumer, you have the freedom to choose from various lending platforms based on your specific needs and preferences. Applications can often be completed online within a matter of minutes, and once approved, you will have access to your funds. This ensures a quick and efficient funding process.

Why Choose Stablecoin Loans?

- Low interest rates compared to fiat lenders

- Ability to hold onto your crypto assets

- Flexibility in using loan funds

- Quick and secure application process

- Opportunity to leverage your capital

- Access to a wide range of stablecoins

- Potential for profit as the value of your holdings rise

- Various repayment options to fit your needs

Start Maximizing Your Crypto Holdings Today

If you’re ready to unlock the potential of your cryptocurrency holdings, stablecoin loans offer a convenient and profitable solution. Whether you want to grow your wealth or simply meet your financial needs, stablecoin loans provide the flexibility and security you’re looking for. Explore the various lending platforms and start taking advantage of stablecoin loans to make your crypto work for you.

Borrow USDT And Maintain Your Crypto Exposure

When it comes to managing your crypto assets, it’s essential to have the flexibility to borrow USDT and maintain your crypto exposure. With various crypto lending platforms available, you can easily borrow USDT or other supported cryptocurrencies against your existing tokens.

By borrowing USDT, you can avoid the need for selling your tokens, which allows you to keep your current exposure to the crypto market. This means you can still benefit from any potential price increases in the future.

Many lending platforms offer USDT loans with competitive terms and conditions. You can choose from different partners and compare the terms and interest rates they offer. It’s important to note that the availability of borrowing options, terms, and interest rates may vary depending on the lending platform you choose.

With crypto loans, your borrowed USDT or other cryptocurrencies are securely held and can be used for whatever purpose you need, whether it’s for personal or business use. The repayment terms will depend on the platform you borrow from, but most platforms offer flexible repayment options.

One of the pros of borrowing USDT is that you can potentially profit from a higher rate of return on your borrowed USDT compared to the interest rate you pay. If the rate of return on your investments is higher than the interest rate on your loan, you can make a profit.

Another benefit is that borrowing USDT provides a quick and convenient solution for emergency expenses. Instead of liquidating your crypto assets, which may result in losses due to market volatility, you can simply borrow USDT and access the funds you need without disrupting your crypto portfolio.

When considering borrowing USDT, it’s important to understand the terms and conditions associated with the loan. Make sure to read and evaluate the terms, interest rates, and any fees or commissions involved before making a decision. By understanding these factors, you can make an informed choice and choose the best lending platform for your needs.

In summary, borrowing USDT allows you to maintain your crypto exposure while accessing the funds you need. With a wide range of lending platforms and partners available, you can compare and choose the most suitable option for your borrowing needs. Whether it’s for personal expenses or business investments, borrowing USDT can be a convenient and flexible solution.

Fast and Easy Loan Process

Borrowing money is an essential part of personal finance. Whether you are in need of extra capital for a business venture or simply want to cover unexpected expenses, getting a loan can provide the financial assistance you need. However, traditional loan processes can be time-consuming and complex, often requiring extensive paperwork and credit checks.

Fortunately, with crypto lending, the loan process has become faster and easier. Instead of using traditional currencies, you can borrow in popular cryptocurrencies like USDT and many more. This allows you to take advantage of the rise in crypto values and borrow against the crypto assets you already have in your stock.

When you choose our service for your crypto loan, you no longer have to wait for a lengthy approval process. Our instant loan system quickly assesses your borrowing requirements and provides you with a payout almost instantly. You can conveniently access your borrowed funds as soon as your collateral reaches a certain value, and there are no longer any lengthy waiting periods.

With our crypto lending service, you have control over your loan terms and interest rates. Unlike centralized financial institutions where rates are set by the bank, you get to choose the rate that works best for you. Additionally, your collateral can be used as your balance during the borrowing period, ensuring that you have access to your assets.

Repayment is also hassle-free with our crypto loan service. Theres no need to worry about your collateral being liquidated in case of default. The loan can be repaid using crypto or fiat currencies, and you have the flexibility to pay back the loan in installments or in full, depending on what suits your financial situation.

Use Crypto Loans for Various Purposes

If you have a number of cryptocurrencies and are in need of money, consider utilizing crypto loans as an option. With crypto loans, you can borrow USDT and various other cryptocurrencies to fulfill your financial needs. Whether you want to cover unexpected expenses, fund a project, or make investments, crypto loans offer a flexible solution.

One of the advantages of crypto loans is the ability to borrow against your existing cryptocurrencies without selling them. Instead of selling your coins, you can use them as collateral to secure a loan. This way, you can still benefit from any potential increase in value while accessing the funds you need.

When taking out a crypto loan, the loan-to-value (LTV) ratio is an important factor to consider. The LTV ratio determines how much you can borrow in relation to the value of your collateral. Different lenders offer varying LTV ratios, so it’s crucial to compare options and find the best one for your needs.

With crypto lending services, you have control over your borrowed funds. You can choose how to spend the borrowed money, whether it’s for personal or business purposes. The flexibility offered by crypto loans allows you to diversify your financial placements and potentially earn more with your borrowed funds.

Furthermore, crypto loans often offer competitive interest rates. Unlike traditional lending institutions, crypto lending platforms can provide lower APRs due to the absence of intermediaries and the use of blockchain technology. This can help you save money in the long run while getting the funds you need quickly.

It’s important to note that if you fail to repay your crypto loan, the lender may repossess the collateral. However, with proper financial planning and advice, you can avoid this situation and use crypto loans as a tool for financial growth.

Crypto loans are not limited to just USDT; various stablecoins and other cryptocurrencies are available for borrowing. By leveraging your accumulated coins, you can gain access to a wider range of borrowing options.

In today’s crypto market, there are numerous lending platforms and partners that offer crypto loan services. Some of the top platforms, such as Crypto.com, offer over 100 cryptocurrencies as collateral options. This provides you with more opportunities to borrow the funds you need.

To access crypto loans, you usually need to deposit your collateral on the lending platform. The collateral is held securely while you have access to the borrowed funds. Once you repay the loan, you can retrieve your collateral. Alternatively, if you change your mind, you can sell your collateral to pay off the loan.

So, if you have accumulated a substantial number of cryptocurrencies and are in need of money, consider crypto loans as an alternative to traditional borrowing options. Explore the various lending platforms and compare the rates and terms available to find the best solution for your specific needs.

Unlock the Value of Your Crypto Assets

With our platform, you can unlock the value of your crypto assets and utilize them for various purposes. Whether you need funds for personal expenses, investment opportunities, or to cover unforeseen expenses, we offer a convenient solution.

Secure Collateralized Loans

Our platform allows you to deposit your personal cryptocurrency holdings as collateral for loans. By using your crypto assets as collateral, you can access much higher loan amounts and lower interest rates compared to traditional lenders. Your collateral is securely held by our trusted lenders, ensuring the safety of your assets.

Flexible Repayment Options

We offer flexible repayment options for your crypto loans. You can choose the loan term that suits your needs, ranging from 4 to 12 months. Repayment can be made in USDT or other supported cryptocurrencies. Additionally, you have the option to make early repayments without any penalties.

Opportunity to benefit from potential cryptocurrency price changes

By using your cryptocurrency as collateral for a loan, you have the opportunity to benefit from potential price changes. If the value of your collateral increases during the loan term, you can choose to change your collateral’s value and borrow more funds against the increased value.

Convenient Application Process

Getting started with our platform is simple. Just create an account, deposit your cryptocurrency assets, and complete a few checks for verification purposes. Once your account is approved, you can easily access and manage your loans through our user-friendly app or website.

Available for a Variety of Cryptocurrencies

Our platform supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Dogecoin, and 100+ other assets. This allows you to leverage the value of various cryptocurrencies and choose the best collateral for your financial needs.

Transparent and Centralized Exchange

Our platform operates as a transparent and centralized exchange for crypto loans. All loan terms, interest rates, and repayment details are clearly presented to you before accepting the loan. This ensures transparency and enables you to make informed decisions regarding your borrowing needs.

Start Unlocking the Value of Your Crypto Assets Today

Don’t let your crypto assets sit idle. Start utilizing them for your financial needs and make them work for you. Whether you need immediate funds or want to seize new investment opportunities, our platform offers a practical and secure solution.

Frequently Asked Questions:

What cryptocurrencies can I borrow with crypto loans?

You can borrow USDT and over 100 other cryptocurrencies.

Can I sell my cryptocurrency after borrowing?

Yes, you can sell your cryptocurrency after borrowing.

What is the process of borrowing USDT?

The process of borrowing USDT involves providing collateral in the form of cryptocurrency and receiving USDT in return.

Are there any requirements to be eligible for crypto loans?

Yes, you need to meet certain requirements such as having sufficient collateral and passing any necessary KYC/AML verifications.

How long can I borrow the cryptocurrency for?

The length of time you can borrow the cryptocurrency for depends on the terms and conditions set by the lending platform.

Videos:

How to Borrow $16,000,000 in Cryptocurrency for FREE

As an investor, I find this platform really convenient. Being able to borrow USDT and other cryptocurrencies with ease and convert them to fiat currencies is a game-changer. It offers a wide range of options and the borrowing process is smooth. Highly recommended!

Wow, this sounds like a great opportunity! I’ve been looking for a platform that offers flexible loans in USDT and other cryptocurrencies. It’s reassuring to know that my collateral will be securely stored and protected. The quick approval rates and automatic repayment also make the process so convenient. I can’t wait to explore the possibilities and start borrowing and converting my assets!

This service sounds great! It’s refreshing to see a platform that offers loans in a wide variety of cryptocurrencies. The quick approval rates and smooth application process make it even better. I can definitely see myself using this platform to access the funds I need.

Is there a minimum loan amount required for borrowing in USDT and other cryptocurrencies?

Hi Mike1995! There is a minimum loan amount required for borrowing in USDT and other cryptocurrencies. The minimum loan amount may vary depending on the specific cryptocurrency and lending platform you choose. It is recommended to check the terms and conditions of the platform you are interested in to find out the exact minimum loan amount.

I have been using this platform for a while now and I must say, it has been a great experience. The borrowing process is smooth and the approval rates are quick. I love how I can choose from a wide range of cryptocurrencies as collateral, it gives me the flexibility I need. Highly recommend!

Are the interest rates competitive compared to traditional loans?

Yes, our interest rates are highly competitive compared to traditional loans. We understand the importance of offering affordable borrowing options for our users. With our service, you can benefit from low interest rates, making it easier for you to repay your loan. Whether you’re consolidating debt or investing in a new venture, our platform provides a cost-effective solution for your financial needs.