Wonderland is a decentralized finance (DeFi) project that operates on the basis of a decentralized autonomous organization (DAO) and relies on community voting for decision-making processes. TIME, the native token of Wonderland, is unique in its design and mechanics, featuring regular rebases and staking/unstaking functionalities that create a dynamic and interactive ecosystem. With an attractive APY and rewards, it has gathered attention from crypto enthusiasts worldwide.

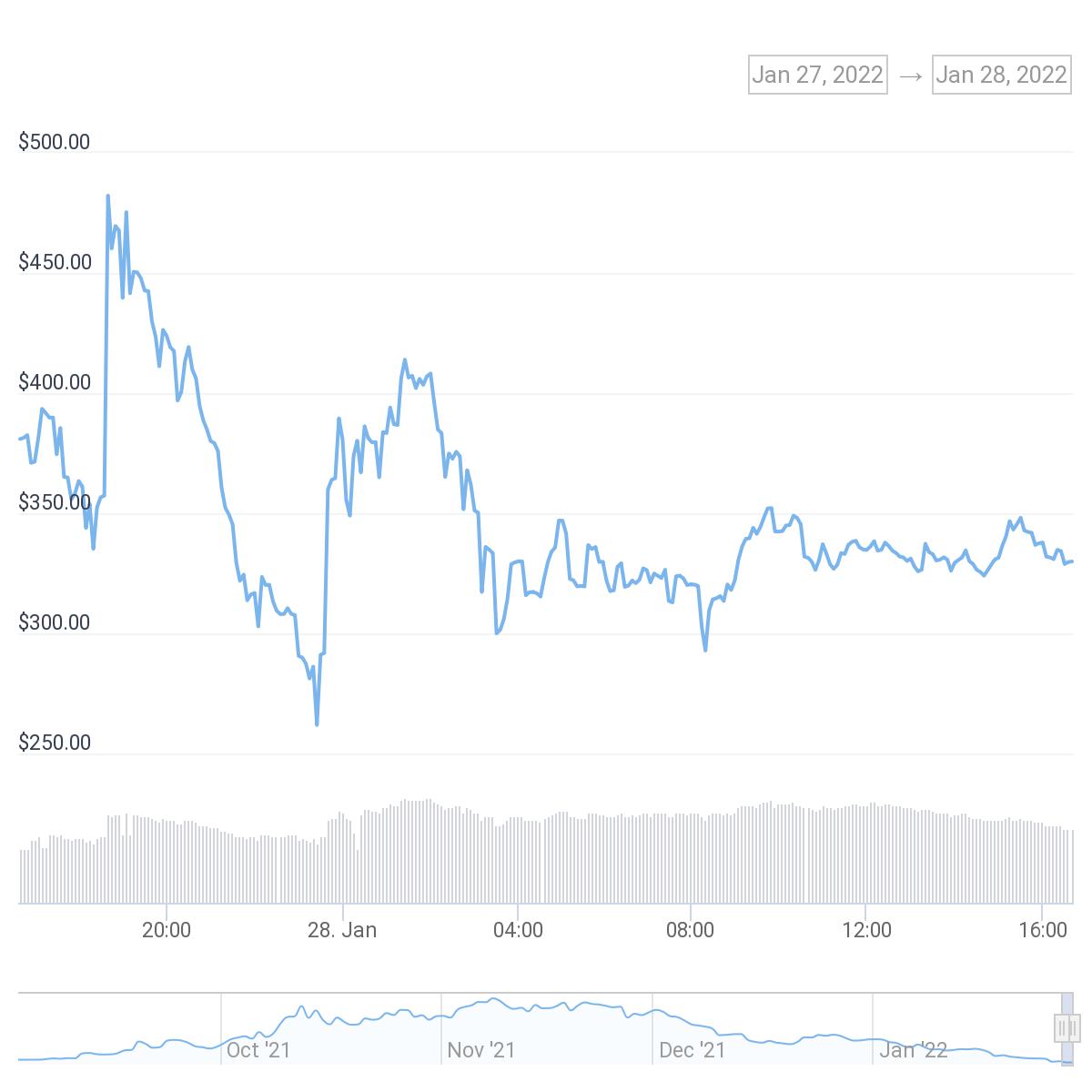

After its revelation in November, Wonderland’s token price experienced significant volatility in the market. Weekly price retreats accompanied unusual fluctuations, leaving holders and traders wondering about the future of TIME. Cryptocurrency transfers showed that the price could dramatically change, losing or gaining a significant amount within days. With such turbulent markets, it is essential to approach Wonderland’s price prediction with caution and a realistic understanding of the factors at play.

To predict the future price of TIME, investors and analysts often refer to various estimates and indicators. However, it is important to keep in mind that these predictions are not foolproof and should not serve as the sole basis for decision-making. While wallets like WalletInvestor and WMEMO can provide some insight, their predictions should be taken with a grain of salt. Short-term predictions may have a higher level of accuracy compared to long-term ones, as the cryptocurrency market is known for its volatility.

One analysis worth considering is the impact of other protocols on Wonderland’s price. The Avalanche ecosystem, which TIME is a part of, has gained significant attention, with major exchanges like Binance showing interest. This suggests that there is belief in Avalanche’s future potential, which could indirectly benefit Wonderland as well. Additionally, the yield farming event and the overall performance of DeFi protocols in the coming year could have an effect on TIME’s value.

In conclusion, a thorough inquiry into the fundamentals of Wonderland, its governance structure, and price history is needed to make an informed prediction about TIME’s future performance. While the project has faced challenges, it has also demonstrated resilience and potential for growth. Ultimately, it is important to balance short-term market trends with a long-term perspective and tolerance for risk. With careful analysis and an understanding of the broader cryptocurrency landscape, investors can make more educated decisions regarding their investment in TIME and the future of Wonderland finance.

Disclaimer: This article should not be considered financial advice and is for informational purposes only. Before making any investment decisions, please consult with a professional financial advisor.

Recent Performance of Wonderland (TIME)

Wonderland (TIME) is a unique cryptocurrency that allows users to stake their tokens and earn rewards. The project launched in November and has a successful history on the Avalanche network. With the launch of its products, such as the TIME token and the Wonderland treasury, investors have been able to lock in their cryptos and earn yield on a daily basis.

One of the key features of Wonderland is its stability. The project has never experienced any retreats or loss of liquidity, ensuring that investors can confidently stake and unstake their tokens without worrying about any issues with their investments.

When it comes to staking, users can invest any amount of TIME tokens into the network and earn yield based on the current rates. This can be easily calculated using the Wonderland Calculator, which provides users with information on how much they can earn based on their staked position.

In December, Wonderland announced an important revelation regarding their treasury. The project said that it would be wrapping all of its TIME tokens to create a new token called WRAP. This move was seen as a great opportunity for investors to diversify their holdings and potentially earn more yield.

According to Michael from WalletInvestor, the prediction for Wonderland’s future is positive. He stated that the project has a strong community and a solid roadmap, making it a promising investment for the upcoming year. Many investors have followed the news closely and are considering adding TIME to their portfolios.

The team behind Wonderland has also been actively working on partnerships and collaborations with other projects in the crypto space. This has allowed them to expand their liquidity and bring more attention to their platform, ultimately increasing the value of the TIME token.

In conclusion, the recent performance of Wonderland (TIME) has been impressive. With its unique staking and yield-generating features, as well as its partnerships and collaborations, the project has positioned itself as a promising investment in the cryptocurrency market. Investors looking to diversify their holdings and earn yield on a daily basis should consider adding TIME to their portfolios.

Historical Price Analysis of TIME

When it comes to the financial market, conducting a historical price analysis is an essential process for investors and traders. This analysis helps them understand the past performance of a particular asset and make informed decisions about its future value. In the case of the TIME token, which is associated with the Wonderland finance ecosystem, conducting a historical price analysis is also crucial.

Finance and Investing: TIME is a utility token designed to be used within the Wonderland finance ecosystem. Investors and traders who are interested in this token need to understand its price history to assess potential risks and rewards associated with investing in it.

Michael’s Advisor: Michael, a finance manager, wants to invest in TIME tokens but wants to evaluate its past performance. He can select a specific time period and wrap the token’s historical price data into an easy-to-understand format.

Short-term Decline: In September 2021, TIME experienced a significant decline in its price. Michael wants to examine this event closely and assess the future stability of the token.

Staking and Risk Calculation: Staking is an important feature of TIME, and investors must understand the risks associated with it. By calculating the potential rewards and risks, Michael can make an informed decision about whether or not to stake his TIME tokens.

Tokens Recovery: Despite its short-term decline, many experts and analysts believe that TIME has the potential to recover. Coincodex, for example, points out that the token has a good chance of recovering its value and recommends it for investors looking for liquidity and stability.

Holders and Staking/Unstaking Controversies: There have been controversies regarding TIME token’s staking and unstaking process. Investors and holders need to research these controversies to fully understand their impact on the token’s performance and make informed decisions.

Weekly Crypto Performance: Michael also needs to analyze the weekly performance of TIME in comparison to other cryptocurrencies. This analysis can help him assess the token’s strength and weakness as well as determine its potential value in the future.

Overall, a comprehensive historical price analysis of TIME is crucial for understanding its past performance, evaluating its potential future value, and making informed investment decisions.

Factors Influencing Wonderland’s Price

When it comes to understanding the factors that influence Wonderland’s price, several key elements come into play. These elements include the treasury, voting power, community members, and the formal voting process.

The treasury is a crucial aspect of the Wonderland ecosystem. It holds the platform’s assets and is influenced by community members through voting. The value of the treasury affects the price of Wonderland’s native token, TIME, as it reflects the overall health of the platform.

The formal voting process allows community members to make decisions that impact the platform’s future. This process ensures that important changes and upgrades are implemented with the consensus of the community, which in turn can influence the price of TIME.

The protocols and mechanisms put in place for rebases also play a significant role in determining the price of Wonderland. Rebases, which occur based on predefined criteria, can affect the supply and demand of TIME, thus influencing its price. Understanding these protocols and expected rebases is essential for predicting the price changes.

It is also important to consider the performance of other cryptocurrencies and platforms in the market. Cryptos like AVAX and TIME tend to move in relation to each other and the overall market sentiment. Additionally, the rewards and APY offered by staking TIME can affect the demand for the token and its price.

To calculate potential returns and predict price movements in the short-term, investors must consider factors such as the number of TIME tokens staked and the amount of AVAX-TIME LP tokens. These inputs can provide insights into the overall demand for and supply of TIME, influencing its price.

In history, we have seen instances where the price of TIME has plunged due to market conditions. However, it has also shown a great recovery and the ability to bounce back. Patryna Coincodex reports a 200% increase in the price of TIME in the past year, which indicates the potential for positive returns.

In conclusion, the price of Wonderland’s native token, TIME, is influenced by various factors, including the treasury, voting power, community members, formal voting process, rebases, protocols, and market sentiment. Analyzing these factors can help investors make informed predictions about the future price of TIME and make decisions accordingly.

Analysis of Wonderland’s Market Capitalization

Wonderland is a decentralized finance (DeFi) project built on the Avalanche network. It aims to create a stablecoin, called TIME, that is backed by a reserve of stable assets. This reserve is spread across various assets to ensure stability and mitigate risk.

One of the key features of Wonderland is its staking/unstaking mechanism. Users can stake their TIME tokens in the Wonderland bank to earn rewards. The longer the tokens are staked, the higher the rewards. Staking also provides a mechanism for maintaining the stability of the TIME token.

In the past, Wonderland faced controversies regarding its reserve and rebasing mechanism. Some users had concerns about the transparency and the effectiveness of the rebasing process. However, the team behind Wonderland has been working to address these concerns and provide more information and clarity to the community.

Market capitalization is an important metric to consider when analyzing the performance of a cryptocurrency. It is calculated by multiplying the price of the token by the total supply. In the case of TIME, the market capitalization can be influenced by factors such as its price, the total supply, and the demand for the token in the market.

Wonderland’s market capitalization has seen some fluctuations in the past. However, it is important to note that past performance does not guarantee future returns. Investing in cryptocurrency markets can be highly volatile and unpredictable. Therefore, it is advised to do thorough research and analysis before making any investment decisions.

Recently, there has been speculation and predictions about the future price of TIME and whether it can recover from its previous market downturns. It is important to take these predictions with caution and to consider various factors such as market trends, network activity, and the overall sentiment towards the project before making any investment decisions.

In conclusion, the market capitalization of Wonderland’s TIME token is influenced by various factors such as the reserve, staking/unstaking mechanism, market demand, and overall market sentiment. It is important for investors to stay informed and conduct their own research before making any investment decisions.

Current Trends in the Cryptocurrency Market

The cryptocurrency market is constantly evolving, with new trends emerging and shaping the industry. One of the most talked-about trends is the rise of wonderlandmoney, a decentralized finance protocol that aims to revolutionize the way people interact with cryptocurrencies.

One of the key features of wonderlandmoney is its locking and staking/unstaking mechanisms. Users can lock their tokens in smart contracts, which allows them to earn rewards. This incentivizes long-term holding and reduces the selling pressure on the market.

Another trend in the cryptocurrency market is the concept of rebasing. Rebase mechanisms adjust the supply of a token based on predefined rules. This can help stabilize the price and prevent extreme volatility. Investors need to stay up to date with the latest news and announcements to understand the impact of rebase events on the market.

Moreover, the history of the cryptocurrency market has shown that some tokens experience significant price declines due to various factors. It is essential for investors to carefully consider their tolerance for risk and thoroughly research the tokens they are interested in.

Several platforms and services are available to help investors navigate the cryptocurrency market. These platforms provide tools such as calculators, prediction charts, and portfolio management solutions. However, it is important to note that these tools are not foolproof and should be used in conjunction with other research and analysis.

Some forecasters believe that wonderlandmoney will offer exciting opportunities for investors in the future. With its unique features and innovative protocols, wonderlandmoney has the potential to reshape the cryptocurrency landscape.

In conclusion, the cryptocurrency market is subject to constant change and evolution. Investors should stay informed about the latest trends and news to make informed decisions. It is important to diversify investments and carefully assess the risks associated with each token or protocol. By staying informed and conducting thorough research, investors can navigate the cryptocurrency market with confidence.

Market Sentiments towards Wonderland

In recent months, Wonderland’s popular DeFi platform has successfully attracted a significant number of investors seeking high returns. Wonderland’s unique staking mechanism allows users to stake their tokens and earn monthly yield through a rebase process. With the promise of substantial returns, many investors have eagerly staked their tokens, making use of Wonderland’s innovative staking system.

However, the recent news of a fall in the value of Wonderland’s native token, TIME, has raised concerns among investors. The retreats in the token’s price have led some holders to question the long-term stability of the platform. This revelation has prompted many to reconsider their investment decision and evaluate the risks involved.

While the rally in the market should not be cause for alarm, it is important for investors to take into account the history of similar events in the DeFi space. In December, many platforms saw a similar dip in token prices, only to recover significantly in the following months. This should serve as a reminder that short-term market fluctuations do not necessarily reflect the long-term prospects of a project.

The recent fall in the price of Wonderlands can be attributed to a variety of factors, including market sentiment and external events. However, it is worth noting that the fundamentals of the project remain strong, and the team behind Wonderland continues to develop innovative products to attract users. Moreover, the introduction of new features, such as the ability to unstake tokens without penalties, has further increased the utility and attractiveness of the platform.

In January, the network will undergo a rebase, which is expected to bring more stability to the token price. Additionally, the approval and recommendation by prominent figures in the DeFi space can help restore investor confidence. While the current situation may be cause for concern, it is important not to lose sight of the long-term potential and the opportunities that Wonderland offers.

In conclusion, the market sentiments towards Wonderland may fluctuate, but the underlying value of the project and its innovative approach to DeFi remain strong. As with any investment, investors should exercise caution and do their own research before making any decisions. The future developments and news surrounding Wonderland will undoubtedly influence the market and determine the trajectory of the project.

Expert Opinions on the Future of TIME

The future of W wonderlandmoney, cryptos, and the TIME token has been a topic of speculation and discussion among crypto enthusiasts. Many experts have shared their opinions on what the future holds for TIME and how investors can maximize their returns.

Staking and the Fall of TIME

One opinion that has emerged is that staking could play a significant role in the future of TIME. Staking allows token holders to lock their funds into a specific protocol and earn passive income in return. The fall in the price of TIME has led some experts to suggest that staking could help stabilize the token’s value and attract more investors.

The Monthly Rebase and Price Volatility

Another aspect of TIME‘s future that experts have considered is the monthly rebase process. The rebasing mechanism adjusts the supply of TIME tokens to maintain their equilibrium value. However, some experts argue that this process can lead to price volatility, making it challenging to predict the long-term value of TIME.

Selecting Protocols and Investment Strategies

When it comes to investing in TIME and other tokens, experts suggest careful consideration and research of the underlying protocols. Different protocols offer various features, such as liquidity mining, staking rewards, and governance rights. Investors should analyze these factors to select protocols that align with their investment goals and risk appetite.

Expert Forecasts and Price Charts

Forecasting the future price of TIME is a complex task, but experts rely on various tools and indicators to make predictions. Price charts, historical data, and market trends are all factors that analysts consider. Additionally, staying updated with the latest news and developments in the crypto market can provide valuable insights into the potential growth or decline of the TIME token.

In conclusion, the future of TIME remains uncertain, but there are strategies and expert opinions that investors can consider. Staking, selecting protocols, analyzing price charts, and staying informed about market trends can all play a role in optimizing investments in TIME and other cryptocurrencies.

Price Predictions for Wonderland (TIME)

Wonderland (TIME) is a cryptocurrency project that has gained significant attention in the DeFi market. With its unique algorithm-based rebases and high returns, many investors are keen to know the future price predictions for this token.

Despite recent controversies surrounding some of its members, Wonderland (TIME) continues to make headlines in the crypto space. The Avax-TIME weekly predictions suggest that the token has the potential to climb to new heights, making it a good investment opportunity for both short-term and long-term gains.

To start investing in Wonderland (TIME), it is important to perform a thorough analysis of the market and consider the predictions provided by experts. The weekly analysis by WMemo predicts a rally in January, with a possibility of the token losing some value before experiencing a significant rally.

One of the key features that make Wonderland (TIME) an attractive investment is its unique rewards system. By staking their tokens, investors can earn rewards on a monthly basis, providing a steady source of income. Additionally, the manager on the platform offers a user-friendly interface for importing and swapping tokens, making it easy for users to navigate the market.

Before deciding to invest in Wonderland (TIME), it is important to understand that the cryptocurrency market is highly volatile. It is always recommended to do your own research and consider the advice of experts before making any investment decisions.

Wonderland (TIME) also offers a unique opportunity to earn while you decide. By participating in their rebate program, users can earn rebates on their purchases, helping to offset any potential losses. This makes it a great option for traders who want to mitigate risks while still profiting from their investments.

Potential Risks and Challenges for TIME

Investing in TIME tokens comes with its fair share of risks and challenges. One of the major risks is the volatility of the cryptocurrency market itself. The price of TIME can experience rapid fluctuations, causing investors to lose their positions and potential returns.

Another risk is the controversy surrounding the Wonderland ecosystem and its tokens. There have been controversies in the past, which can affect the stability and trust in the platform. It is important to stay updated with the latest news and information before making any investment decisions.

Furthermore, the locking of TIME tokens in the ecosystem may limit liquidity and make it difficult for investors to exit their positions when needed. This lack of liquidity can be a challenge, especially during times of market uncertainty.

Additionally, the platform’s performance and stability are also important factors to consider. As more users flock to Wonderland and use the platform, there is an increased risk of network congestion and slower transaction speeds. This can impact the overall user experience and potentially deter new members from joining.

Moreover, it is crucial to carefully calculate and consider the rewards and interest rates offered by platforms like Nexo and Binance before deciding to invest in TIME tokens. Sometimes the promised returns may not live up to expectations, and the actual returns may be lower than anticipated.

Overall, investing in TIME tokens can be rewarding, but it is essential to be aware of the potential risks and challenges associated with it. Conduct thorough research, seek advice from financial advisors, and carefully evaluate the current market conditions before making any investment decisions.

Strategies for Investing in Wonderland

Investing in Wonderland’s native cryptocurrency, TIME, can be a volatile yet potentially rewarding venture. The price of TIME has experienced significant swings, with moments of rally and revelation. Therefore, understanding the strategies for investing in Wonderland is crucial to address the risks and maximize potential returns.

Long-term Investment:

One strategy is to read the market and price trends carefully, understanding the project’s fundamentals and long-term prospects. If you believe in Wonderland’s potential, you can stake your TIME tokens and hold them for an extended period, allowing you to make the most of the project’s growth over time.

Short-term Trading:

For those with a higher appetite for risk and expertise in trading, short-term investments can yield numerous opportunities. Timing the market can be a challenging task, but successfully using strategies like swing trading or catching the market’s momentum can help generate profits in volatile price movements.

Staking and Avalanche Rebasing:

Another way to make the most of your TIME tokens is through staking. By staking your tokens, you contribute to the network’s security and receive rewards in return. Additionally, Wonderland offers the Avalanche rebasing mechanism, allowing users to unstake their TIME tokens at any time, potentially taking advantage of short-term price changes.

Metamask and Other Wallets:

To invest in Wonderland, you will need a good wallet like Metamask, which is compatible with the Avalanche network. Setting up your wallet is an essential step before diving into the cryptocurrency market. Ensure you secure your wallet properly and keep your account information safe to protect your investment.

Before investing, make sure to research the project thoroughly, understand its goals and progress. Analyze the market trends, evaluate your risk tolerance, and set realistic expectations for your investment returns. It is essential to keep track of daily market updates to stay informed about any significant developments that might impact the price of TIME.

Finally, it’s worth noting that the cryptocurrency market, including Wonderland, can be highly volatile. Prices can plunge or surge dramatically, making it crucial to stay vigilant and adapt your investment strategy accordingly. Conducting thorough research and regularly reviewing your investment moves will help you make informed decisions and potentially recover any losses or maximize your gains.

Frequently Asked Questions:

What is the current price of TIME tokens?

The current price of TIME tokens is $0.05.

Will the price of TIME tokens recover?

It is difficult to predict the future price of TIME tokens. However, there is always a possibility of recovery in the cryptocurrency market.

How can I unstake my TIME tokens?

To unstake your TIME tokens, you need to go to the Wonderland website and navigate to the staking section. Look for the unstake option and follow the provided instructions.

Are there any fees for unstaking TIME tokens?

There might be certain fees associated with unstaking TIME tokens, such as gas fees on the Ethereum network. These fees can vary depending on the current network congestion.

Is Wonderland a reliable platform for staking TIME tokens?

Wonderland has gained popularity in the crypto community for its staking features. However, it’s always important to do your own research and assess the risks before engaging with any platform.

Videos:

When I said Tesla Will 100x They Laughed At Me – Now My New Forecast Says This Will 100x In 7 Years

How I Lost $20,000 with $TIME Wonderland, Can It Recover?

Why $TIME Wonderland’s price is crashing. Good Buying Opportunity? Discussion with Bludex.

It seems like Wonderland’s price is in a constant rollercoaster ride. As an investor, I’m both fascinated and cautious about the potential for recovery. The unpredictable nature of cryptocurrency markets makes it challenging to rely solely on predictions. I believe it’s crucial to thoroughly analyze the project’s fundamentals and assess the risks before making any investment decisions.

Can anyone provide any insights or predictions on the future price of TIME? I want to make an informed investment decision.

I think Wonderland’s price prediction is highly speculative and uncertain. The market volatility and fluctuations make it risky to invest in TIME. Investors should approach it with caution and consider other factors before making a decision.

Is there any consensus among experts on the potential recovery of the TIME token? I’m curious to know if the recent volatility is just a temporary setback or a long-term concern.

I’ve been following Wonderland for a while now, and I must say, the volatility in the market has me a bit nervous. I think it’s important to approach any price prediction with caution and not solely rely on it for decision-making. However, the unique design and mechanics of TIME make it an intriguing investment opportunity worth considering.

It’s always exciting to see new DeFi projects like Wonderland emerge in the market. However, the volatility in the price of TIME has me a bit concerned. I think it’s crucial for investors to do thorough research and analysis before making any investment decisions. The potential for recovery is there, but it’s important to approach it with caution.