When it comes to the world of cryptocurrency, the term “staking” has been making waves in recent years. Staking allows users to earn rewards by depositing their digital assets into a wallet and supporting the blockchain network. In this comprehensive guide, we will explore the ins and outs of staking crypto, with a particular focus on DBX Crypto Staking.

DBX Crypto is a leading provider of staking services, allowing users to earn rewards by supporting the blockchain network. Staking involves holding a certain amount of crypto assets in a wallet, which helps maintain and secure the network. The process requires users to delegate their assets to validators or staking pools, who are responsible for validating transactions and maintaining the blockchain.

One of the main advantages of staking crypto is the opportunity to earn passive income. Validators, as well as users who delegate their assets to validators, are rewarded with new coins or tokens for their participation in the network. This incentivizes participants to actively support the network and maintain its efficiency and security. The rewards earned through staking can be seen as a form of interest or dividend on the staked assets.

In addition to the potential financial rewards, staking also allows users to engage in the governance of the blockchain network. Validators and delegated stakers have the power to participate in decision-making processes, such as voting on protocol upgrades or changes in the network’s rules. This gives participants a say in the direction and development of the blockchain, making staking a more active and involved form of participation compared to simply holding crypto assets.

However, staking crypto also comes with its own set of risks and considerations. One such risk is the potential for slashing penalties, which occur when validators or stakers engage in malicious behavior or fail to perform their duties properly. Slashing penalties can result in a reduction or loss of staked assets, so it is important to choose reliable and trustworthy validators or staking pools when participating in staking activities.

In conclusion, staking crypto through DBX Crypto is a convenient and potentially lucrative way to earn passive income and actively contribute to the blockchain ecosystem. It allows users to support the network, participate in governance, and earn rewards based on their staked assets. However, it is important to carefully consider the risks and choose reputable providers to ensure the security and success of your staking activities.

Staking Cryptocurrency – An Overview

Staking cryptocurrency is a process that allows users to participate in the validation and consensus mechanisms of a blockchain network. Through staking, users can lock up a certain amount of their cryptocurrency tokens in order to support the network’s operations, secure transactions, and earn rewards in return.

One of the key advantages of staking is that it helps promote decentralization within blockchains. By empowering individual users to become validators, staking reduces the reliance on centralized entities, such as exchanges, to perform validation tasks. This distributed network of validators ensures the integrity of the blockchain, making it more resistant to attacks and enhancing its overall security.

When users stake their cryptocurrency, they contribute to the consensus process of the blockchain network. Validators, who are responsible for validating and verifying transactions, are elected based on the number of tokens they have staked. The more tokens a user has staked, the higher their chances of being chosen as a validator. Validators who fulfill their duties diligently and comply with the network’s rules are rewarded with additional tokens.

Staking periods can vary depending on the blockchain network and the specific cryptocurrency being staked. Some networks may require users to lock their tokens for a fixed period of time, while others offer more flexibility, allowing users to unstake their tokens whenever they want. It is important to consider the staking duration and any associated risks before deciding to stake your cryptocurrency.

Importantly, staking also helps to create a stable and reliable ecosystem for cryptocurrencies. By incentivizing users to hold and lock their tokens, staking reduces the likelihood of short-term price fluctuations and encourages long-term investment strategies. This stability benefits both investors and the overall health of the blockchain network.

Understanding Staking in the Cryptocurrency Market

Staking has become a popular method for investors to earn passive income in the cryptocurrency market. It offers convenience, security, and the potential for significant rewards.

Staking involves locking up a certain amount of cryptocurrency in a staking wallet to support the network and validate transactions. In return, stakers are rewarded with additional tokens. This process helps to maintain the security and efficiency of the network while also incentivizing participation from the community.

Unlike traditional investment vehicles like stocks, where you can’t use your assets while they are invested, staking allows you to keep full control over your funds. You can still transfer and sell your staked tokens, but doing so may result in a loss of potential rewards.

Before you begin staking, it is important to research and understand the risks involved. Staking can be a profitable venture, but it is not without risks. There is the possibility of a price downturn, resulting in a loss of value for your staked tokens. Additionally, there is always the risk of technical issues or vulnerabilities in the staking network that could compromise the security of your assets.

One important factor to consider when selecting a staking service or platform is the level of compensation and rewards offered. Different staking pools or networks may have different minimum staking requirements and rewards structures, so it is crucial to know what you can expect in terms of potential earnings.

Staking is also a way to combat inflation and contribute to the stability of the cryptocurrency market. By staking your tokens, you are essentially taking them out of circulation, reducing the overall supply and potentially helping to maintain or increase the value of the cryptocurrency. This is especially relevant in a market like the cryptocurrency market, which is known for its volatility and price fluctuations.

In conclusion, staking is an attractive option for cryptocurrency investors who want to earn passive income and contribute to the security and stability of the network. It provides convenience, potential rewards, and the ability to still use your assets while staked. However, it is important to carefully consider the risks associated with staking and conduct thorough research before getting involved.

Benefits of Staking Crypto

Staking cryptos has become a popular method for investors to earn passive income and support the blockchain ecosystem. By staking their tokens, investors contribute to the overall security and decentralization of the network.

One of the main benefits of staking crypto is the ability to earn rewards. Staking allows you to earn a share of the total staking rewards based on the number of tokens you hold and the duration of your stake. These rewards can be quite lucrative, with many projects offering annual yields of over 10%.

Another benefit of staking crypto is the convenience it offers. Unlike other forms of generating passive income, such as mining, staking does not require any technical expertise. You simply hold your tokens in a staking wallet and let the network perform the necessary operations on your behalf.

In addition to earning rewards and convenience, staking crypto helps to maintain the security and decentralization of the blockchain. By staking tokens, you are locking them up and preventing them from being used for malicious purposes. This incentivizes investors to hold and support the network, resulting in a higher level of security.

Furthermore, staking crypto can also have positive effects on the price of a token. When investors stake their tokens, it reduces the circulating supply, leading to a decrease in selling pressure. This, combined with the increased demand for staking, can result in upward price movement for the token.

In summary, staking crypto offers several benefits including the ability to earn rewards, convenience, and support for the security and decentralization of the blockchain ecosystem. It is a powerful tool for investors looking to earn passive income and participate in the growing crypto industry.

How Does Staking Work?

Staking is a process that allows cryptocurrency holders to actively participate in the validation and maintenance of a blockchain network. Instead of just passively holding the cryptocurrency in a wallet, stakers get the opportunity to contribute to the security and functionality of the network while earning rewards in the form of additional tokens.

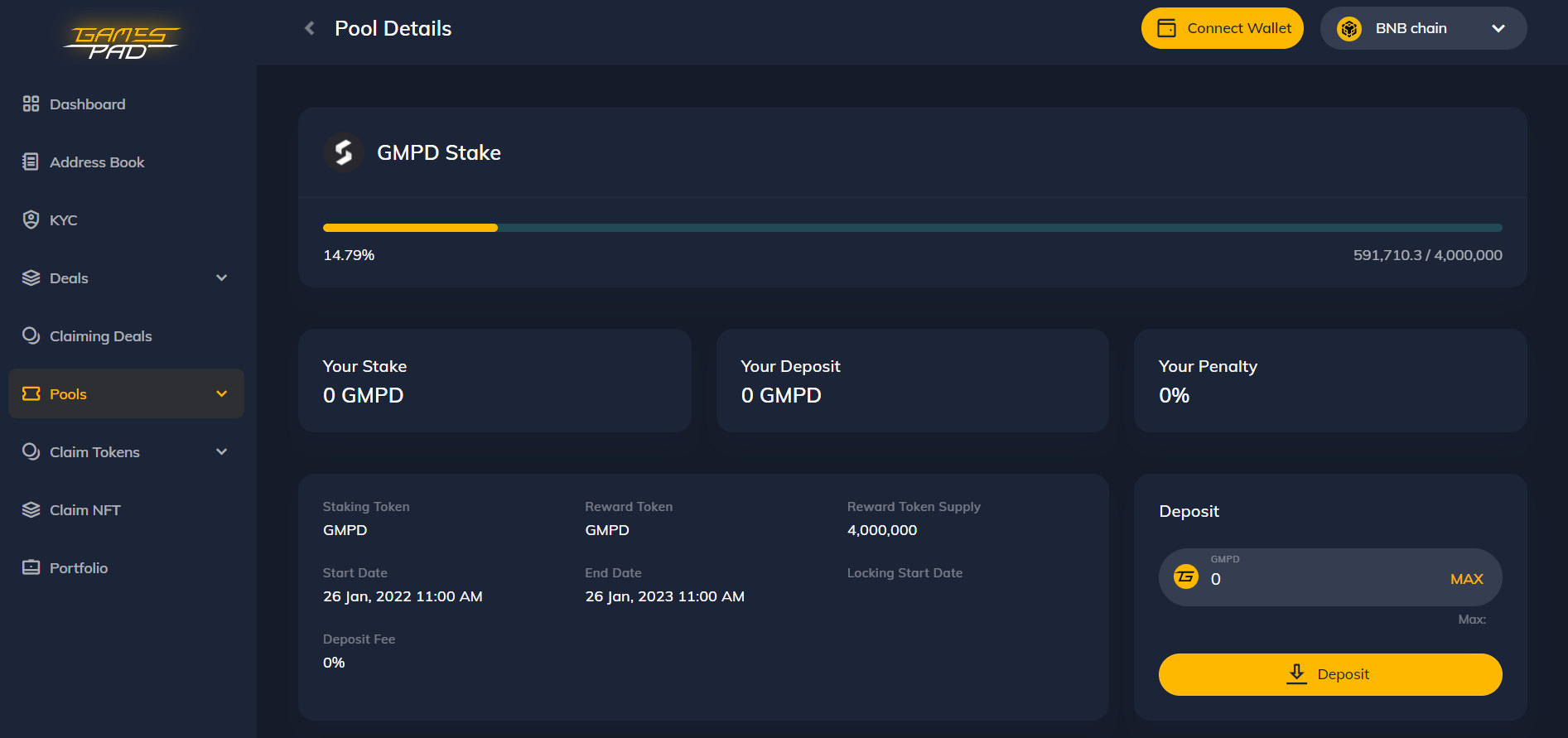

Start Staking: To start staking, users need to hold a certain amount of the specific cryptocurrency designated for staking. This amount is often referred to as the minimum staking requirement.

Delegate Staking: If you don’t have the minimum staking requirement, you can delegate your stake to a trusted third party staking provider. This allows you to pool your resources with others and collectively meet the minimum requirement.

Staking Rewards: By staking your cryptocurrency, you can earn rewards or staking interest, which is typically paid out at regular intervals. These rewards incentivize users to hold and stake their assets rather than sell them, thus contributing to the network’s stability and security.

Validation and Maintenance: When staking, users perform various tasks like validating transactions, storing network information, and maintaining the blockchain. These tasks help ensure the integrity and efficiency of the network.

Long-Term Commitment: Staking usually involves a lock-up period, during which your cryptocurrency cannot be moved. This commitment helps create a more stable and secure environment for the network.

Risks and Volatility: While staking provides the opportunity for significant rewards, it is not without risks. Cryptocurrencies are known for their volatility, and staking them can expose holders to potential downward price movements.

Additional Benefits: Aside from rewards, staking also offers additional benefits such as voting rights, access to certain services, and the ability to participate in project governance decisions.

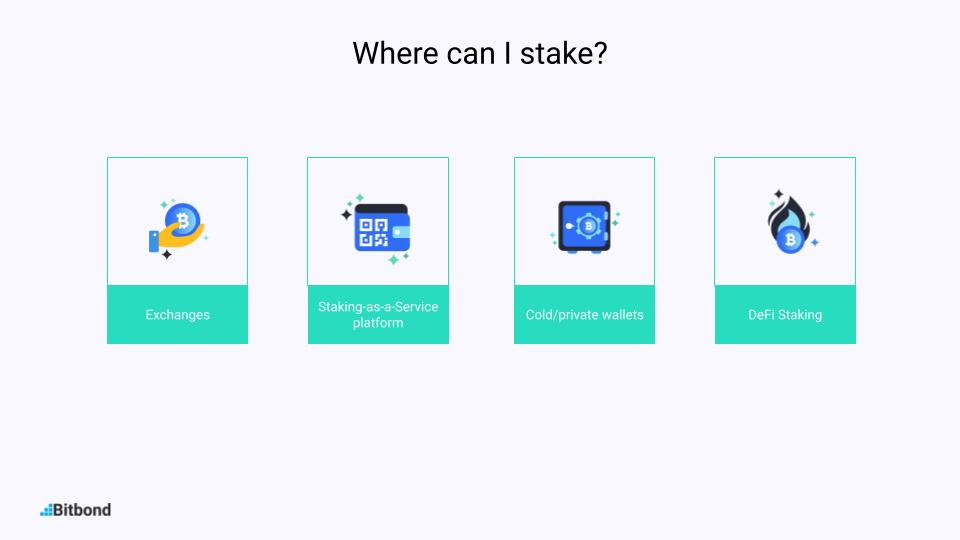

How to Stake: To stake your cryptocurrency, you’ll need a compatible wallet that supports staking. You can delegate your stake to a trusted staking pool or validate and maintain the network yourself.

Choosing the Right Cryptocurrency for Staking

When it comes to staking cryptocurrencies, it’s important to choose the right cryptocurrency that fits your investment goals and preferences. Different cryptocurrencies offer different rewards and benefits for staking, so it’s crucial to do your research before making a decision.

To start, you’ll want to visit the cryptocurrency’s official website to get all the necessary information. Check if they have a dedicated staking section or page that explains how their staking mechanism works. Look for details on the staking process, rewards, lock-up periods, and any other requirements or conditions.

It’s also important to determine if the cryptocurrency has a secure and reliable wallet for staking. Check if the wallet supports staking and if it offers features like delegation, where you can delegate your staking power to another trusted entity to earn rewards on your behalf. Additionally, make sure the wallet has a user-friendly interface and provides adequate support and resources for staking-related queries or issues.

When choosing a cryptocurrency for staking, it’s crucial to consider the underlying network and the technology it utilizes. Look for cryptocurrencies that have a strong and active community, a robust blockchain with a high number of transactions and blocks, and a secure and efficient consensus mechanism, such as proof of stake (PoS) or delegated proof of stake (DPoS).

Furthermore, take note of a cryptocurrency’s market performance and stability. Look at its historical price movements, 52-week high and low, and any recent announcements or developments that may have impacted its value. Understanding the risks associated with staking a particular cryptocurrency is essential in making an informed decision.

In summary, the process of choosing the right cryptocurrency for staking involves extensive research and analysis. Look for a cryptocurrency that aligns with your investment goals, has a secure and user-friendly wallet, supports a strong network and consensus mechanism, and offers potential rewards that make it worth the risk. By considering all these factors, you can make an informed decision and maximize your staking returns.

DBX Crypto Staking: A Comprehensive Guide

DBX Crypto Staking offers individuals the opportunity to earn passive income through a cryptocurrency staking mechanism. However, it is important to note that investing in cryptocurrencies involves risks. Before diving into staking DBX, it is crucial to research and understand the fundamentals of cryptocurrency investments, as the market can be volatile.

Disclaimer: The information provided here should not be considered as financial advice. It is always recommended to consult with a professional financial advisor before making any investment decisions.

DBX Crypto Staking falls into one of the categories of cryptocurrency staking, which is known as proof-of-stake (PoS). This method allows users who already hold DBX tokens to participate in the validation process of new transactions and secure the network.

Staking DBX involves locking up a certain number of tokens for a specific period of time. During this period, the stakers contribute to the decentralization and security of the DBX network. In return, they receive rewards in the form of additional DBX tokens.

To stake DBX, one can either choose to stake individually or join a staking pool. While individual staking allows complete control over the staked tokens, joining a staking pool enables users to pool their resources together with other stakers, increasing their chances of earning consistent rewards.

DBX Crypto Staking services come with risks, including the potential loss of the staked tokens. Stakers should carefully analyze the risks and consider factors such as market volatility, lock-up periods, and the reputation of the staking provider before staking their DBX tokens.

It is important to note that staking DBX is not a get-rich-quick scheme. It requires patience and a long-term perspective. Stakers need to be aware that they may not have immediate access to their staked tokens and should consider this before committing to the staking process.

In conclusion, DBX Crypto Staking offers individuals the opportunity to earn passive income by participating in the network validation and security process. However, it is crucial to understand the risks involved and conduct thorough research before running into staking DBX or any other cryptocurrencies.

Benefits of DBX Crypto Staking

DBX crypto staking offers several advantages for investors and participants in the cryptocurrency industry. Understanding these benefits is essential for anyone looking to make the most of their investment. By staking their DBX coins, individuals can earn a passive income while supporting the network’s security and efficiency.

1. A stable and secure investment: Staking DBX coins is a secure way to hold and grow your crypto investment. The consensus mechanism used in staking ensures the security and stability of the blockchain network. This makes DBX crypto staking an attractive option for those looking for a long-term investment.

2. Passive income: One of the most significant advantages of DBX crypto staking is the opportunity to earn passive income. By holding and staking your DBX coins, you can earn additional tokens as a reward for supporting the network. These rewards can add up over time and provide a steady stream of income.

3. Lower risks: Staking your DBX coins allows you to minimize the risks associated with other investment options in the crypto industry. Unlike trading on exchanges, staking provides a more stable and predictable return on investment. It also eliminates the need to constantly monitor and react to market fluctuations.

4. Network participation: By staking DBX coins, you become an active participant in the DBX network. This grants you the ability to contribute to network security and governance through voting and decision-making processes. Staking provides an opportunity to have a say and influence the direction of the project.

5. Rewards for participation: DBX crypto staking rewards participants for helping to secure and maintain the network. These rewards are calculated based on the amount of DBX coins staked and the duration of the stake. The longer you hold and stake your coins, the higher the rewards you can earn.

In conclusion, DBX crypto staking offers a range of benefits, including a stable and secure investment, passive income opportunities, lower risks compared to trading, network participation, and rewards for participation. It’s important to understand how staking works and the potential advantages it can provide before making any investment decisions in the crypto industry.

DBX DBX Profile

The DBX DBX Profile is an educational and informative platform that guides users through the staking process of DBX tokens. With a minimum requirement and convenience in mind, DBX DBX Profile offers an average user the opportunity to participate in staking without the need for complicated exchanges or industry knowledge.

The original contents of the DBX DBX Profile provide insights and information on where to stake your tokens, the risks and rewards involved, and the total staking statistics. Created by Ivan Zakharov, a renowned expert in the field of cryptocurrencies, DBX DBX Profile offers another layer of exploration into the world of staking.

One of the advantages of using DBX DBX Profile is that it eliminates the need for third-party validators, as the staking process is directly tied to the DBX chain itself. This helps to ensure the security and integrity of the staking process, as there are no additional parties involved that could pose a risk to your funds.

The DBX DBX Profile also provides various educational resources and guides, such as a step-by-step walkthrough of the staking process, explanations of the different staking pools and their associated benefits, and information on the governance of the DBX chain. This level of detail and transparency makes it easier for users to understand how staking works and what they can expect from participating.

Before you can start staking with DBX DBX Profile, it is important to read the content carefully and familiarize yourself with the specific requirements and processes involved. Staking DBX tokens requires a lock-up period, during which your tokens are held and cannot be accessed until the staking period is complete.

In conclusion, the DBX DBX Profile offers an educational and convenient way for users to participate in staking DBX tokens. With its informative content and streamlined process, users can explore the benefits of staking without the need for extensive industry knowledge or reliance on third-party validators.

DBX Crypto Staking Statistics

When it comes to DBX crypto staking, understanding the statistics is crucial for informed decision-making. Let’s take a closer look at some of the key figures and facts.

Inflation and Validation

DBX crypto staking involves participating in the network’s consensus mechanism and validating transactions. As a result, validators are rewarded with a certain amount of DBX tokens for their contribution to the network’s decentralization and security. This mechanism helps maintain network integrity and protects against potential attacks.

Lock-up Periods and Rewards

DBX staking requires a lock-up period, during which the staked assets cannot be accessed or transferred. This ensures the stability and security of the network. In return for this lock-up, participants are eligible to earn staking rewards. These rewards are typically distributed on a regular basis, such as every hour or every day, providing a consistent incentive for validators.

Benefits of DBX Crypto Staking

DBX crypto staking offers several benefits for participants. Firstly, it allows them to earn additional income by staking their DBX tokens, making it a lucrative investment opportunity. Secondly, staking contributes to the decentralization of the DBX network, as more validators join the network. Additionally, staking can provide convenience and flexibility, as participants do not need to actively manage their assets, allowing them to focus on other activities.

Market Analysis and Research

When considering DBX crypto staking, it is important to stay informed about market trends and perform thorough research. This involves examining the reputation and track record of staking platforms, analyzing network-specific parameters and reserve ratios, and studying the potential risks and rewards associated with staking. By doing so, participants can make informed decisions and maximize their staking returns.

In conclusion, DBX crypto staking is a mechanism that offers various advantages for participants. From earning staking rewards and supporting network decentralization to the convenience and stability it offers, staking can be a valuable addition to an investor’s portfolio. However, conducting thorough research, staying informed about market trends, and understanding the key statistics is essential for making informed decisions and mitigating potential risks.

Risks and Considerations in Crypto Staking

When it comes to crypto staking, it is important to be aware of the potential risks and considerations involved in this process. By understanding these factors, individuals can make informed decisions about whether to participate in staking or not.

Risks

One of the risks of crypto staking is the possibility of a network failure or attack. Staking relies on the stability and security of the underlying blockchain network. If the network experiences a failure or is targeted by malicious actors, it can result in financial losses for stakers.

Another risk to consider is the potential for slashing. Slashing refers to the penalty imposed on stakers who behave maliciously or violate the staking protocol. This could happen if a staker tries to manipulate the network or acts against the best interests of the community. Slashing can lead to a reduction in staked assets and a loss of rewards.

Additionally, the volatility of cryptocurrency prices can pose risks to stakers. The value of the staked assets can fluctuate significantly, impacting the overall returns and potential profits earned through staking. Stakers need to be prepared for price volatility and potential losses in their staked assets.

Considerations

Before engaging in staking, individuals should consider the minimum deposit requirements and lock-up periods. Different staking platforms and cryptocurrencies may have varying minimum requirements and lock-up periods, which can influence an individual’s decision to participate.

Furthermore, it is essential to research and choose a reputable staking service provider. Stakers should ensure that the platform they choose has a good track record and offers reliable and secure staking services. It is also important to consider factors such as the staking rewards, fees, and support provided by the platform.

Stakers should take into account the amount of time and effort required for staking. While staking offers passive income opportunities, it still requires active participation and monitoring of the staked assets. Stakers must be willing to dedicate the necessary time and attention to maintain their stake and maximize their rewards.

Lastly, staking involves the responsibility of contributing to the security and decentralization of the blockchain network. Stakers become validators who help secure the network by participating in the consensus process. It is crucial to understand the importance of this role and the impact it has on the overall stability and trustworthiness of the blockchain.

In conclusion, crypto staking offers the potential for earning rewards and supporting the blockchain community. However, it is crucial to consider the risks and do thorough research before getting involved in staking. By understanding the risks and taking necessary precautions, individuals can make informed decisions and maximize the benefits of crypto staking.

Frequently Asked Questions:

What is crypto staking?

Crypto staking is the process of locking up a certain amount of cryptocurrency in a wallet to support the operations of a blockchain network. In return for staking their coins, users can earn additional coins as a reward.

How does crypto staking work?

Crypto staking requires users to hold a certain amount of coins in a wallet and keep it connected to the blockchain network. This helps secure and validate transactions on the network. In return for their participation, stakers are rewarded with additional coins.

What are the benefits of staking cryptocurrencies?

Staking cryptocurrencies offers several benefits, including passive income generation, potential capital appreciation, and network participation. Stakers can earn rewards in the form of additional coins, which can then be sold or held for potential price increase.

What is DBX Cryptocurrency?

DBX is a cryptocurrency that allows users to participate in the DBX blockchain network and earn rewards through staking. It is designed to be energy-efficient and scalable, making it ideal for staking and participating in the network.

How can I stake DBX cryptocurrency?

To stake DBX cryptocurrency, you need to have a wallet that supports staking and hold a certain amount of DBX coins. Connect your wallet to the DBX blockchain network and follow the staking instructions provided by the platform.

What are the risks of staking crypto?

Staking crypto carries certain risks, including the potential loss of staked coins in case of network vulnerabilities or attacks. Additionally, the value of staked coins may fluctuate, affecting the overall profitability of staking. It’s important to carefully consider these risks before staking.

Can I unstake my coins at any time?

Unstaking coins depends on the specific platform and staking protocol you are using. Some platforms may have a lock-up period, during which you cannot unstake your coins. It’s essential to check the terms and conditions of the staking platform to understand the unstaking process.

Video:

How to Start Staking Of Your Crypto Project : Crypto Staking Model #stake #staking

How to Make Money by Staking on Binance (Tutorial)

What is Proof of Stake? – Earn Passive Income with Staking

What is the minimum amount of crypto assets required to start staking with DBX Crypto?

To start staking with DBX Crypto, there is no specific minimum amount of crypto assets required. The amount you can stake depends on your preferences and the specific requirements set by DBX Crypto. It’s best to visit their website or contact their support team for more information on the minimum staking amount.

Staking crypto has been a game-changer for me. I’ve been able to earn passive income just by holding my assets. It’s amazing how staking can turn your cryptocurrency holdings into a profitable investment. Definitely recommend giving DBX Crypto Staking a try!

Wow, this is a great guide on staking crypto! I’ve always been curious about how to do it with DBX crypto. It’s amazing that you can earn passive income just by holding your cryptocurrency. I’ll definitely give it a try!

Staking crypto has been a game-changer for me. Not only do I get to earn passive income with my digital assets, but I also have a say in the governance of the blockchain. DBX Crypto Staking has been my go-to platform for staking, and I highly recommend it!

Staking crypto with DBX has been a game-changer for me. I’ve been able to earn passive income while holding my cryptocurrency. It’s a win-win situation!

Staking crypto has been a game-changer for me! I love how I can earn passive income just by holding my assets in a wallet. Plus, with DBX Crypto Staking, I feel confident in the security and reliability of the blockchain network. It’s a win-win situation!

Can you explain how exactly staking helps maintain and secure the blockchain network?