Bitcoin, a digital currency that operates on a decentralized network, has revolutionized the financial ecosystem. One of the emerging aspects of the Bitcoin ecosystem is the concept of Bitcoin loans. In this article, we will delve into how Bitcoin loans work and the steps involved in obtaining and repaying them.

A Bitcoin loan is a loan provided by an exchange, such as BlockFi, where you can borrow a certain amount of Bitcoin for a specific period of time. Instead of traditional loans where you go to a bank and take out a loan, Bitcoin loans take place within the digital realm.

The first step in obtaining a Bitcoin loan is to download and sign up for an account with a reputable Bitcoin lending provider. Once you have created an account, you will need to go through a verification process, which usually involves providing identification documents and undergoing a Know Your Customer (KYC) procedure. This is to ensure that the lending provider complies with legal and regulatory requirements.

After your account is verified, you can proceed to deposit your Bitcoin into the lending platform. The loan-to-value (LTV) ratio is an important factor to consider. LTV is the ratio between the loan amount and the value of the collateral (Bitcoin) used. The higher the LTV, the more risk the lending provider takes, and vice versa.

Once you have deposited your Bitcoin, you can request a loan by specifying the amount you want to borrow and the duration of the loan. The lending provider will then evaluate your request and determine the interest rate and terms of the loan. If you agree to the terms, the loan will be issued, and you will receive the borrowed Bitcoin in your account.

Blockfi Crypto Loans

Blockfi is a trusted provider of cryptocurrency-backed loans for clients who are in need of immediate funds but are unable or unwilling to sell their digital assets. When it comes to crypto lending, Blockfi is a leader in the industry, offering an accessible and affordable service that allows clients to borrow against their crypto portfolio.

Blockfi works by using clients’ digital assets as collateral for the loan. This means that when a client takes out a loan, they do not need to sell their coins or tokens but instead use them as security. Blockfi offers loans in different currencies, including BTC, ETH, LTC, and USD. The loan amount and terms are based on a number of factors, such as the market value of the collateral and the client’s creditworthiness.

When a client takes out a loan with Blockfi, the funds are typically deposited directly into their bank account within one business day. The loan can be used for any purpose, such as funding a business venture or making a large purchase. Additionally, Blockfi offers a range of flexible repayment options, allowing clients to pay back the loan gradually over time.

How Blockfi Crypto Loans Work

1. Sign up: To take advantage of Blockfi’s crypto lending service, clients need to sign up for an account and go through a quick verification process.

2. Custodial Account: Once the account is approved, clients can deposit their digital assets into a licensed and custodial account. These assets will be securely stored until the loan is repaid.

3. Borrowing Funds: Clients can then take out a loan by selecting the desired loan amount and specifying the collateral they wish to use. Blockfi offers competitive interest rates and terms, making it an attractive option for borrowers.

4. Loan Approval: Blockfi will review the loan application and based on the collateral provided and the client’s creditworthiness, approve the loan within a short period of time.

5. Loan Disbursement: Once approved, the loan funds will be deposited directly into the client’s bank account, usually within one business day.

6. Repayment: Clients can make regular monthly payments to repay the loan, and have the option to pay back the loan early without any penalties.

Blockfi’s crypto loans provide clients with a convenient way to access funds without selling their digital assets. The platform offers a transparent and reliable service, backed by industry-leading security measures. If you are in need of a loan and have cryptocurrencies as collateral, Blockfi is a reliable and convenient option to consider.

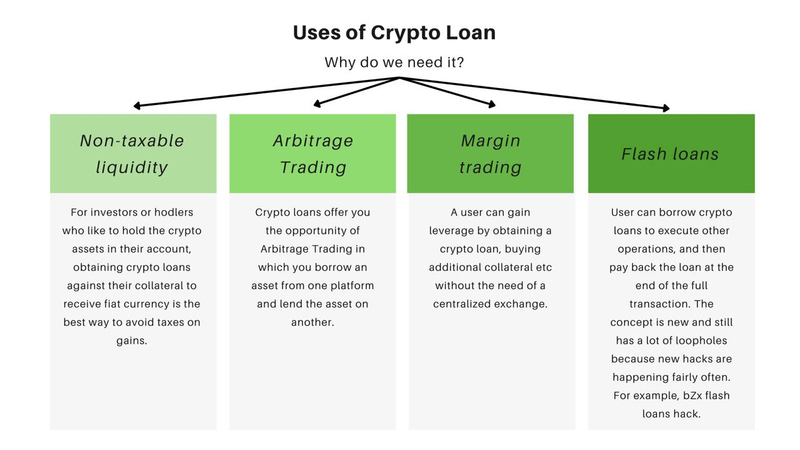

Reasons to Take a Bitcoin Loan

Bitcoin loans offer several advantages to borrowers, making them a popular choice for individuals and businesses. Here are some of the top reasons why you might consider taking a Bitcoin loan:

- Access to Liquidity: One of the most significant benefits of a Bitcoin loan is that it allows you to access liquidity without having to sell your Bitcoin holdings. This means you can keep your digital assets intact while still getting the funding you need.

- No Credit Check Required: Unlike traditional loans, Bitcoin loans typically do not require a credit check. This makes them a viable option for individuals with less-than-perfect credit scores or those who do not have an established credit history.

- Lower Interest Rates: Bitcoin loans often come with lower interest rates compared to traditional loans. This can help borrowers save money on interest payments over the course of the loan term.

- Flexible Loan Terms: Bitcoin loan providers like BlockFi offer flexible loan terms, allowing borrowers to tailor the loan to their specific needs. This includes choosing the loan duration, loan-to-value ratio, and repayment schedule.

- International Availability: Bitcoin loans are not limited by borders and can be accessed by individuals and businesses from anywhere in the world. This makes them an attractive option for those in need of international funding.

Whether you are a cryptocurrency enthusiast or a business owner, a Bitcoin loan can provide the necessary financial support without sacrificing your digital assets. It’s important to conduct thorough research and choose a reputable loan provider like BlockFi to ensure you receive the best service and loan terms.

Details for a BTC to USD Loan

A BTC to USD loan is a financial arrangement where you use your bitcoin as collateral to secure a loan in US dollars. This type of loan allows you to access the value of your crypto assets without selling them.

When you want to take a BTC to USD loan, you need to find a reputable provider like BlockFi. BlockFi is a licensed and regulated financial institution that offers crypto-backed loans. They are a trusted authority in the crypto lending space and provide a secure and reliable service.

The loan amount you can get is usually determined by the loan-to-value (LTV) ratio. This ratio is calculated by dividing the amount of the loan by the value of the bitcoin you are using as collateral. As the value of bitcoin can fluctuate, the loan amount may change accordingly.

BlockFi’s BTC to USD loans have several advantages. First, you can retain ownership of your bitcoin while still accessing funds. Second, there are no credit checks or income verification required, making it accessible to a wide range of individuals. Third, the loan terms are flexible, allowing you to choose the repayment schedule that works best for you.

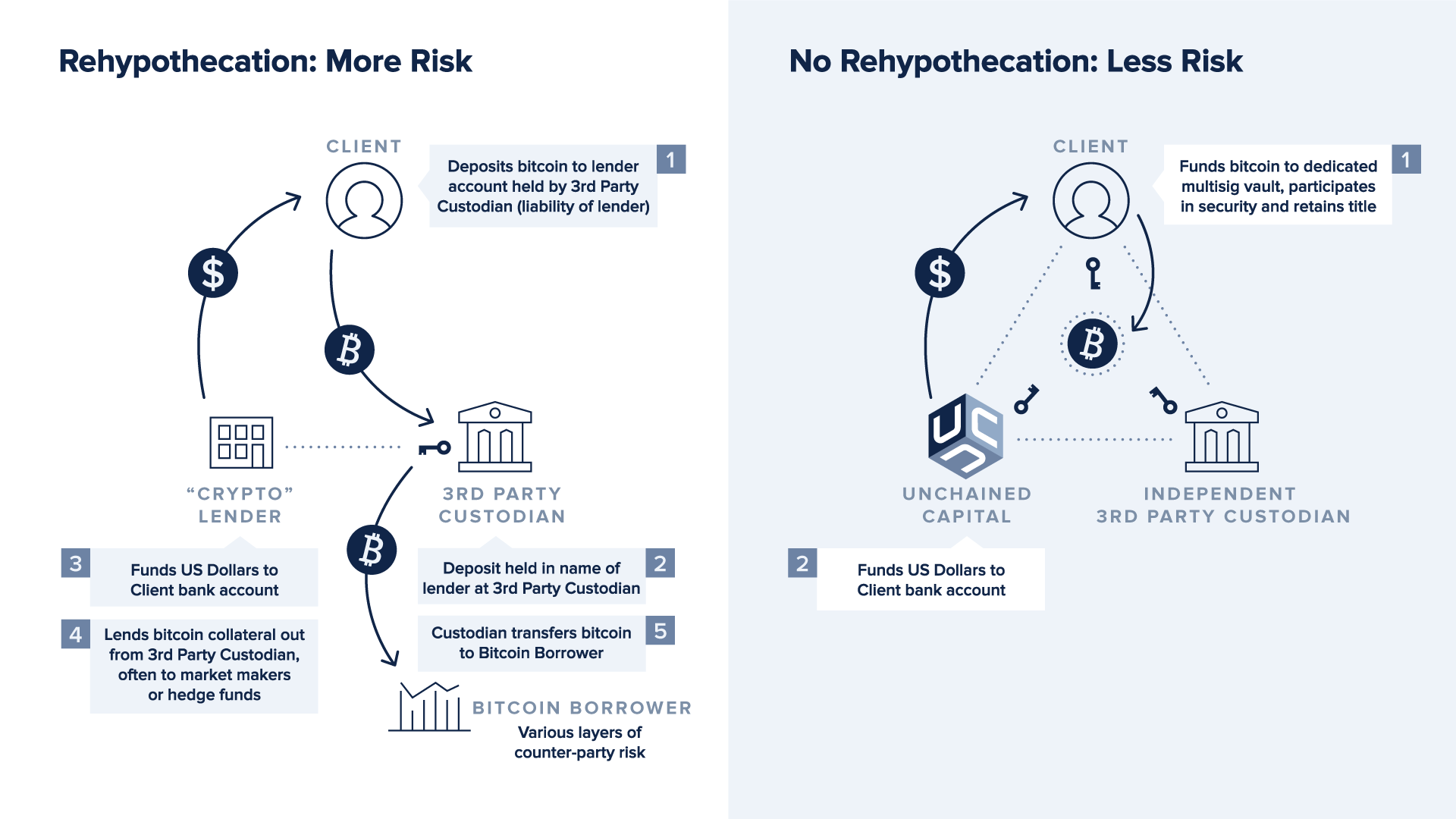

It’s important to note that when you take a BTC to USD loan, you are subject to the terms and conditions set by the loan provider. BlockFi, for example, holds your bitcoin in a custodial account and has certain protections in place to safeguard your funds.

If you are located in Bermuda or other areas where BlockFi’s services are not available, you may need to consider other loan providers. However, it’s crucial to research and verify the credibility and regulations of any crypto loan service you choose to work with.

In conclusion, a BTC to USD loan is a convenient way to access funds without selling your bitcoin. By using your bitcoin as collateral, you can secure a loan from a licensed provider like BlockFi. Just make sure to understand the terms, protections, and applicable regulations before proceeding.

Learn more about BlockFi’s Crypto-Backed Loans

BlockFi’s Crypto-Backed Loans are a unique borrowing option that allows you to use your digital assets as collateral for a loan. Instead of selling your crypto assets, you can borrow against them, providing you with liquidity while still maintaining ownership of your crypto.

When you take out a crypto-backed loan, BlockFi accepts certain cryptocurrencies, like Bitcoin (BTC), as collateral. The loan terms and loan-to-value ratio can vary, but typically, BlockFi allows you to borrow up to 50% of the value of your collateralized assets.

BlockFi acts as a custodial service and holds your collateral in a secure and insured storage. This ensures the safety of your assets while the loan is active. If the value of your collateral decreases significantly, BlockFi may require you to provide additional collateral or make a payment to maintain the loan-to-value ratio.

BlockFi’s crypto-backed loans offer several benefits. Firstly, they provide you with liquidity by allowing you to access the value of your digital assets without selling them. This can be particularly useful if you believe that the value of your crypto will appreciate in the future.

Additionally, by using your crypto as collateral, you can avoid triggering taxable events that would occur if you were to sell your crypto. This means you can potentially save on taxes in the short term.

BlockFi’s accessibility also makes it easy to apply for a loan. They have a streamlined application process, and once approved, you’ll have access to your loan funds promptly. They provide loans in USD and are available to clients worldwide, although certain restrictions apply depending on your jurisdiction.

If you’re interested in learning more about BlockFi’s Crypto-Backed Loans, contact their customer service or visit their website to find out how the loan process works and what terms and conditions apply to your specific situation.

How Does a Bitcoin Loan Work?

A Bitcoin loan is a type of loan that involves the use of digital currency, specifically Bitcoin, as collateral. It works by giving borrowers access to funds while using their Bitcoin holdings as security for the loan.

Here is a step-by-step breakdown of how a Bitcoin loan works:

1. Borrower applies for a loan

The borrower applies for a Bitcoin loan through a lending platform or service that offers crypto-backed loans. The borrower may need to provide certain details and undergo a background check.

2. Collateral is deposited

Once approved, the borrower must deposit a certain amount of Bitcoin as collateral for the loan. The value of the collateral is usually based on a loan-to-value (LTV) ratio, which determines the maximum amount the borrower can borrow.

3. Loan terms and conditions

The borrower agrees to the terms and conditions of the loan, including the interest rate, repayment period, and any applicable fees. These terms may vary depending on the lending platform.

4. Loan disbursement

Once the collateral is deposited and the loan agreement is signed, the loan amount is disbursed to the borrower. The borrower can then use the funds for various purposes, such as starting a business, paying off debts, or making investments.

5. Repayment of the loan

The borrower must make regular payments, typically in Bitcoin, to repay the loan. The repayment schedule and method will be specified in the loan agreement. Failure to repay the loan may result in the loss of the collateral.

6. Loan closure

Once the borrower has repaid the loan in full, including any interest and fees, the collateral is returned to the borrower. If the borrower is unable to repay the loan, the collateral may be sold by the lending platform to recover the outstanding balance.

- Bitcoin loans offer more accessibility to individuals and businesses in areas without easy access to traditional banking services.

- They can provide a more affordable way to borrow money compared to traditional loans, thanks to lower interest rates and fewer administrative costs.

- Bitcoin loans can also be an attractive option for individuals who want to borrow without having to sell their existing Bitcoin holdings.

- Furthermore, since Bitcoin loans are based on a blockchain technology, they offer increased security and transparency compared to traditional lending systems.

In summary, Bitcoin loans are a way to borrow money using your digital currency as collateral. They provide individuals and businesses with access to funds, greater flexibility, and the ability to leverage their Bitcoin holdings without having to sell the coins. However, it’s important to note that Bitcoin loans are subject to applicable laws and regulations, including taxes, and borrowers should be aware of the risks involved in borrowing against their crypto assets.

Increase your stack without selling

BlockFi offers a unique solution for clients looking to increase their stack of Bitcoin without selling their existing coins. With BlockFi’s crypto-backed loans, you can access funds by using your Bitcoin as collateral.

Here’s how it works: BlockFi allows clients to take out loans using their Bitcoin as collateral. The loan-to-value (LTV) ratio is determined by the value of the Bitcoin being used as collateral. BlockFi offers competitive LTV ratios and protections for the client’s assets.

When you take out a crypto-backed loan with BlockFi, you can choose the terms that work best for you. You’ll receive the loan funds directly into your account, allowing you to use them for whatever you need. Whether you want to fund a business, invest in other cryptocurrencies, or simply diversify your portfolio, a Bitcoin loan from BlockFi gives you the flexibility to do so.

BlockFi values accessibility and convenience, which is why their loan process is designed to be quick and straightforward. Within a few clicks, you can apply for a loan and receive your funds. There’s no need to go through the hassle of selling your Bitcoin and potentially missing out on future gains.

With BlockFi’s crypto-backed loans, you can increase your stack of Bitcoin while still maintaining ownership of your coins. When you repay the loan, your Bitcoin collateral is returned to you. This allows you to benefit from any future price appreciation of Bitcoin.

If you’re interested in learning more about how crypto-backed loans work and want to increase your stack without selling, download the BlockFi app or visit their website for more details. BlockFi is a licensed and regulated business, having the necessary authority and license to provide custodial services for digital assets.

If you have any questions or need assistance with crypto loans, don’t hesitate to contact the BlockFi team. They are available to help and provide the support you need.

Frequently Asked Questions:

What is a Bitcoin loan?

A Bitcoin loan is a financial arrangement where a borrower receives funds in the form of Bitcoin, and in return, they pledge their Bitcoin as collateral.

How does a Bitcoin loan work?

A Bitcoin loan works by allowing borrowers to use their Bitcoin as collateral to secure a loan. The borrower transfers their Bitcoin to a lending platform, which then provides the loan amount in fiat currency or stablecoins. The borrower can use the loan amount as desired, and they need to repay the loan plus interest within the agreed-upon time period to retrieve their collateral.

How does a BTC to USD loan work?

A BTC to USD loan allows borrowers to borrow funds using their Bitcoin as collateral, with the loan amount provided in USD. The borrower transfers their Bitcoin to the lending platform, and based on the loan-to-value ratio, they receive a certain amount of USD. They repay the loan plus interest within the agreed-upon timeframe to retrieve their Bitcoin collateral.

How can you increase your stack without selling Bitcoin?

You can increase your stack without selling Bitcoin by using it as collateral for a Bitcoin loan. By borrowing funds against your Bitcoin, you can access the liquidity you need while still holding onto your Bitcoin investment. Once you repay the loan, you can retrieve your Bitcoin collateral and potentially benefit from any increase in its value.

What are BlockFi crypto loans?

BlockFi offers crypto loans, allowing borrowers to use their cryptocurrency, including Bitcoin, as collateral to secure a loan. BlockFi provides loans in USD-backed stablecoins, providing borrowers with flexibility. The loans offer competitive interest rates and can be a convenient way to access liquidity without selling your cryptocurrencies.

Where can I learn more about BlockFi’s Crypto-Backed Loans?

To learn more about BlockFi’s Crypto-Backed Loans, you can visit the BlockFi website or contact their customer support. They provide detailed information about the loan terms, interest rates, collateral requirements, and the application process. They can guide you through the steps of securing a crypto-backed loan and answer any specific questions you may have.

Video:

KuCoin Lending and Borrowing Tutorial (Step-By-Step)

How to Get a Crypto Loan on Binance in 30 SECONDS? (Flash Loan)

As a longtime crypto investor, I have found Bitcoin loans to be a game-changer in the financial world. The ability to increase my stack without selling has been a huge advantage. BlockFi’s crypto-backed loans have provided me with a convenient and secure way to use my Bitcoin as collateral. Highly recommend!

Bitcoin loans are the future! I’ve been using BlockFi for a while now and it’s been great. The process is simple and secure, and the benefits of getting a loan without selling your Bitcoin are amazing. Highly recommend!

Wow, I never knew Bitcoin loans worked like this! It’s amazing how technology is changing the way we borrow money. I’m definitely considering taking a Bitcoin loan to increase my stack without selling. Thanks for the insightful article!

I think Bitcoin loans are a great option for people who want to increase their cryptocurrency holdings without selling. It’s convenient that the process takes place online, without the need to go to a physical bank. The verification process may take some time, but it’s necessary to ensure compliance with regulations.

Bitcoin loans provide a great opportunity for individuals to increase their cryptocurrency holdings without having to sell. I’ve personally found BlockFi’s crypto-backed loans to be a reliable and efficient way to leverage my BTC. The process of obtaining a Bitcoin loan is straightforward, from creating an account to going through the verification process. Highly recommend it!

Is there any risk involved in taking a Bitcoin loan? How secure is the lending platform?

How long does the verification process usually take? I’m interested in taking a Bitcoin loan, but I don’t want to wait too long.

Bitcoin loans have opened up new possibilities for financing. It’s great to see more options for increasing your savings without selling off your precious coins. BlockFi’s crypto-backed loans offer a convenient way to get some extra funds while keeping your Bitcoin safe.