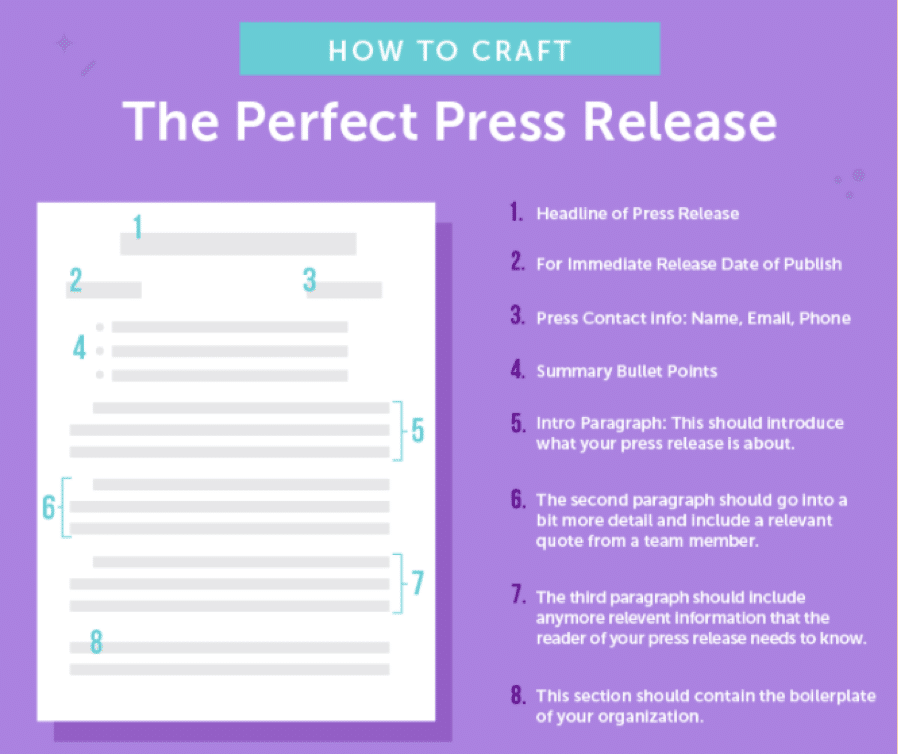

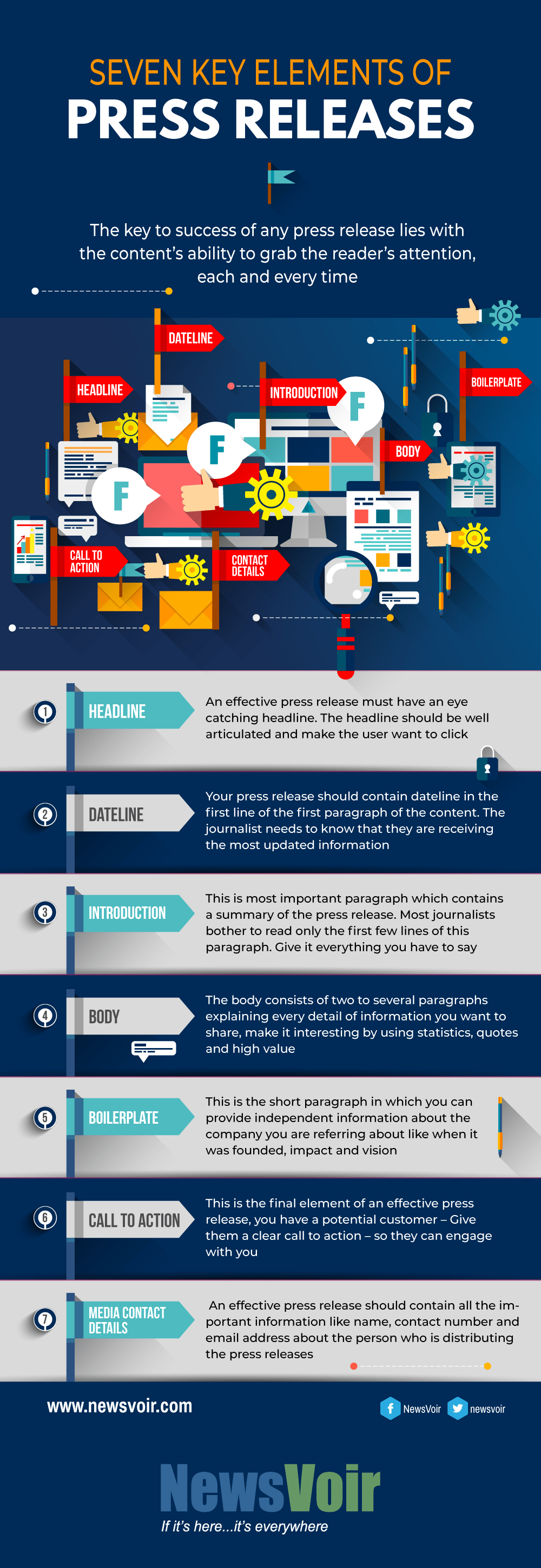

Press releases are a crucial tool for companies to communicate important news and information to the public and the media. They are an effective way for businesses to announce new products or services, share updates on financial performance, and respond to inquiries or issues. A press release is typically a written statement that provides concise and compelling information, designed to capture the attention of journalists and generate media coverage.

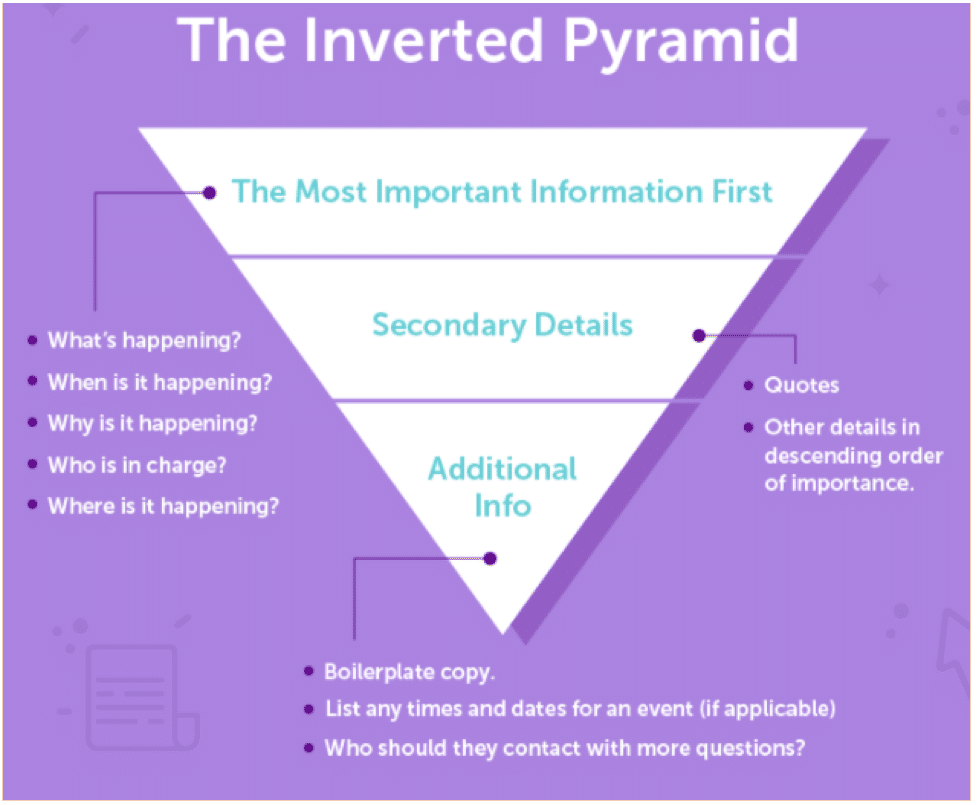

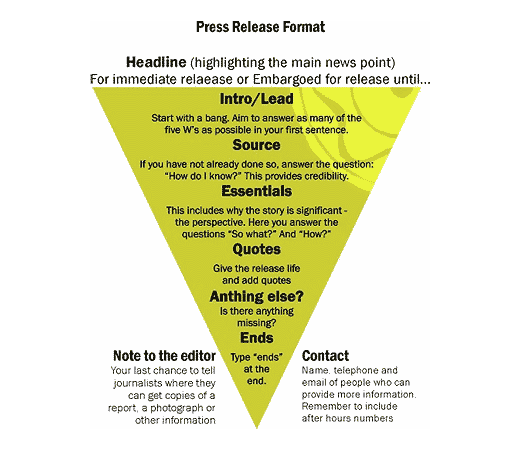

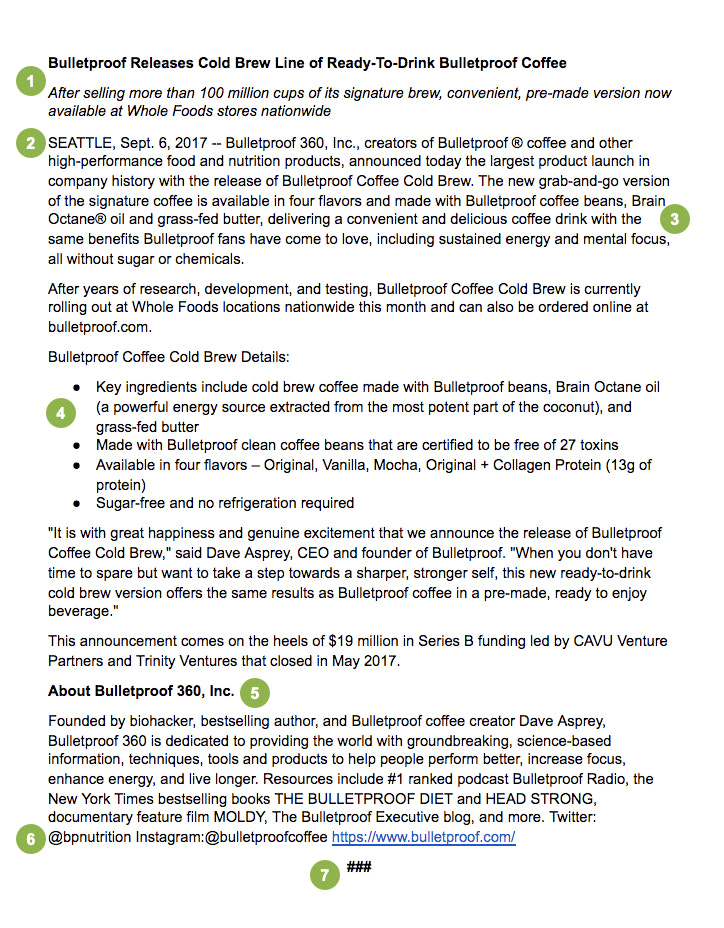

When writing a press release, it is important to create a captivating headline that quickly conveys the main point of the announcement. The release should also include a strong opening paragraph that provides a brief overview of the news, followed by additional details and quotes from key stakeholders. It is essential to maintain a clear and concise writing style, using plain language that is easy for journalists to understand and report on.

Effective press releases are well-structured and organized, with each section serving a specific purpose. The body of the release should provide more in-depth information, including relevant facts, statistics, and details that support the main message. Quotes from company executives or industry experts can add credibility and human interest to the release, making it more likely to be picked up by the media.

In conclusion, a press release is a valuable tool for businesses to disseminate important news and information. By following best practices and incorporating key elements such as a strong headline, concise writing, and supporting details, companies can increase their chances of getting media coverage and reaching a wider audience.

Understanding Press Releases

Press releases are an essential offering in the world of public relations. They serve as a strategic communication tool to inform the active media about important news and developments. Besides keeping the media informed, press releases also help companies and individuals in protecting themselves against potential complaints and legal issues.

One recent example of an effective press release came from the conglomerate Gemini, which terminated its loan agreement with DCG. The press release stated that Gemini was unable to earn the expected yield from the lending assets. This decision was informed by the risk of missing payment deadlines and risking its relationship with lending parties.

The press release also warned other lending platforms and exchanges about the risk in lending and urged them to comply with the laws and regulations set by the Securities and Exchange Commission (SEC). The SEC had earlier sent a letter to Silbert, the CEO of DCG, warning him that the lending activities of the company may come under investigation.

Whistleblowers have informed the SEC about DCG’s lending practices, including the sale of its assets to Gemini at a discount of 630 million dollars. This raised concerns about potential charges of securities fraud against DCG and its CEO. The SEC seeks to facilitate investigations and enforcement actions to protect public investors.

In response to the press release, DCG has stated that it is fully cooperating with the SEC and will comply with all legal requirements. The company also mentioned that it follows a path of transparency and is committed to meeting its obligations to its investors and the public. However, some experts have criticized the company for not being more proactive in addressing the issues raised by the SEC.

The press release from Gemini and the actions taken by the SEC highlight the importance of press releases in the world of cryptocurrency. As the crypto industry evolves, it is crucial for companies to be transparent and proactive in addressing any potential legal or compliance issues to maintain the trust and confidence of their investors.

How to Write an Effective Press Release

Writing an effective press release is crucial in today’s fast-paced digital age. With strict laws and regulations in place, it is important to ensure that your press release is compliant with all applicable guidelines.

One of the first steps in writing a press release is to clearly state the purpose and key details of your announcement. This should include the who, what, when, where, and why of the news you are sharing.

When crafting your press release, it is important to ensure that you do not miss any important information. Take the time to thoroughly research and gather all relevant facts and details to present a comprehensive and accurate picture of your news.

Another important aspect to consider is the format of your press release. While a traditional press release may be suitable for some situations, in today’s digital age, it is often more effective to distribute your release through online platforms and social media channels.

The Securities and Exchange Commission (SEC) has warned against unregistered token sales, saying that they may be in violation of securities laws. In November, the SEC brought charges against a cryptocurrency lending platform, accusing it of operating as an unregistered securities dealer.

If you find yourself in a situation where the SEC is contacting you, it is important to take their requests and warnings seriously. The SEC seeks to protect investors and maintain fair and orderly markets, so it is important to comply with their regulations.

In the case of the cryptocurrency lending platform, the SEC alleged that the company had raised $630 million through an unregistered initial coin offering (ICO). The SEC claims that the company falsely promised investors that they could earn high returns on their investments.

The SEC is now seeking the return of funds to investors and the payment of penalties. The company’s founder, Barry, has been charged with securities fraud and has been barred from serving on the board of any public company. The SEC alleges that Barry misled investors about the company’s financial situation and its relationship with a major asset management conglomerate.

The SEC’s complaint states that the lending platform made false statements to investors about the returns they could earn and the risks involved. The SEC also alleges that the company failed to disclose the full extent of its lending activities and the risks associated with those activities. The complaint seeks a permanent injunction against the company, as well as disgorgement of ill-gotten gains and civil penalties.

Gemini Seeks Extension for $630M Genesis Debt

Gemini, the cryptocurrency exchange, has filed a request for an extension to comply with published charges regarding the $630 million debt owed by Genesis. The bankruptcy case has been ongoing, and Gemini is seeking more time to provide the necessary information to the parties involved.

The debt owed by Genesis, a cryptocurrency conglomerate, is in the form of unregistered securities. Gemini, through its parent company DCG, warned investors last year about the situation, saying that Genesis was unable to earn enough to yield the expected returns.

Gemini has terminated its offer to make other parties earn the assets from the bankruptcy process and has requested the funds back, citing the inability of Genesis to comply with applicable enforcement laws. The bankruptcy case has been under investigation for some time now, and Gemini is seeking an extension until the investigations are completed.

The $630 million debt is worth more in crypto than in any other currency, and Gemini has warned that the sale of these securities could have a significant impact on the public crypto market. The extension request has been filed to provide a path for the sale of the securities until the investigations and enforcement actions are resolved.

Gemini’s Warning to DCG: Risk of Default

Gemini, the crypto exchange founded by Cameron and Tyler Winklevoss, has issued a warning to Digital Currency Group (DCG), stating that there is a risk of default on loans worth $630 million. Gemini alleges that DCG has violated securities laws by issuing unregistered securities and has failed to comply with obligations to its investors.

The warning comes after Gemini filed a complaint with the Securities and Exchange Commission (SEC) and the District Attorney’s Office in November, seeking investigations into DCG’s activities. The complaint accuses DCG of misleading investors about the yield and risks associated with their investments, and alleges that DCG has been selling unregistered securities through active loan agreements.

According to Gemini’s complaint, DCG has been actively involved in the sale and issuance of securities, including loans, to its customers. The co-founder of DCG, Barry Silbert, has been named in the complaint as the individual responsible for these activities. The complaint also states that DCG has been unable to make payments on its loans, and as a result, creditors have warned of potential default.

The investigation into DCG’s activities could have wide-reaching implications for the crypto industry. If found guilty of securities violations, DCG could face significant fines and other penalties, and could potentially be forced to halt its operations. The deadline for DCG to respond to the complaint and comply with the investigations is set for January, and failure to do so may result in further enforcement actions by regulatory bodies.

Gemini’s warning and complaint against DCG highlight the importance of regulatory compliance in the crypto industry. As the industry continues to evolve, it is crucial for companies to ensure that they are operating within the bounds of the law and are transparent with their investors. Failure to do so can not only lead to significant financial repercussions, but can also damage the reputation of the entire industry.

Gemini Claims DCG Missed $630M Genesis Loan Payment

Gemini, a well-known cryptocurrency exchange founded by the Winklevoss twins, has recently claimed that Digital Currency Group (DCG) has missed a $630 million loan payment from its Genesis lending platform. The loan payment was due on a specific date, but DCG allegedly failed to comply with the payment deadline.

Gemini has accused DCG of violating applicable lending laws and brought charges against the conglomerate for defaulting on its obligations. In a published complaint, Gemini states that it has warned DCG about the situation and the legal consequences of defaulting on the loan payment.

Gemini seeks the return of the funds lent to DCG, including the interest it was supposed to earn from the loan. The exchange claims that it has repeatedly requested DCG to pay off the loan and comply with the legal requirements, but the conglomerate has been unable or unwilling to do so.

Violation of Lending Laws and Loan Default

Gemini accuses DCG of violating lending laws by providing unregistered loans to various creditors, including Gemini. The exchange claims that DCG’s Genesis lending platform offered loans to customers without proper registration, which is a violation of financial regulations.

Gemini has stated that it is not the only one who has filed a complaint against DCG. Other creditors have also claimed that DCG defaulted on their loans and failed to fulfill their obligations. The exchange warns that it will take legal action and cooperate with enforcement agencies to hold DCG accountable for its actions.

About the Genesis Loan Program

The Genesis loan program, operated by DCG, allows customers to borrow funds and earn interest by lending their cryptocurrency holdings. The loans are meant to be used for various purposes, such as trading on cryptocurrency platforms or funding personal investments.

However, the recent situation with DCG’s missed loan payment raises concerns about the stability and reliability of the Genesis loan program. Customers who have invested their funds into the program may now face difficulties in withdrawing their loans or earning the promised interest.

DCG’s Response and Future Implications

DCG, which is a major player in the cryptocurrency industry, has not yet publicly responded to Gemini’s claims and the allegations of loan default. The outcome of this legal dispute and the actions taken by enforcement agencies will have significant implications for DCG’s reputation and its future operations.

Whistleblowers who have knowledge of DCG’s lending practices may potentially provide valuable information and evidence to support Gemini’s claims. This case may also shed light on the need for stricter regulations and oversight in the cryptocurrency lending market to protect investors and prevent similar situations in the future.

Gemini Terminates Genesis Loans and Crypto Yield Program

Gemini, a cryptocurrency exchange platform, has decided to terminate its loans and crypto yield program with Genesis, a leading cryptocurrency trading firm. The decision comes after concerns were raised about compliance and regulatory violations within the program.

Gemini had initially partnered with Genesis to offer loans against crypto assets and allow users to earn interest on their digital currencies. However, with increasing scrutiny from regulatory bodies and the need to comply with stricter guidelines, Gemini has chosen to end its relationship with Genesis.

The termination of the loans and crypto yield program means that users will no longer be able to make loans or earn interest through Gemini’s platform. This decision was made in order to avoid any potential legal charges or violations of regulatory laws.

While Gemini has not disclosed the exact reasons for terminating the program, the move is seen as a proactive measure to protect the platform from any potential risks. By ending its relationship with Genesis, Gemini is ensuring that it is in full compliance with regulatory standards.

Barry Silbert, the co-founder of Genesis and the CEO of Digital Currency Group (DCG), which owns Genesis, has stated that the termination of the program was a mutual decision between the two parties. He also emphasized that Genesis will continue to operate independently and offer its services to other exchanges.

It is estimated that the loans and crypto yield program had generated about $630 million in loans and had over $630 million in assets under management as of November. With the termination of the program, both Gemini and Genesis will need to find alternative solutions to manage these assets and meet the needs of their customers.

This move comes at a time when the crypto industry is facing increased regulatory scrutiny, with many exchanges and trading platforms seeking to become fully compliant and avoid any potential legal issues. The termination of the loans and crypto yield program between Gemini and Genesis is just one example of how exchanges are working to ensure a secure and transparent environment for their users.

SEC Charges Genesis and Gemini for Unregistered Offer and Sale

The Securities and Exchange Commission (SEC) has brought charges against two cryptocurrency lending platforms, Genesis and Gemini, for engaging in an unregistered offer and sale of securities. According to the SEC, both companies offered and sold digital assets in the form of loans without registering the offerings with the agency.

The SEC’s complaint states that Genesis and Gemini were acting as lending platforms that allowed investors to lend their cryptocurrencies to the platforms in exchange for an interest-bearing account. The SEC alleges that these interest-bearing accounts constituted securities under the federal securities laws and should have been registered with the SEC.

The charges against Genesis and Gemini come after a whistleblower brought the violations to the SEC’s attention. The whistleblower alleged that both companies were offering and selling loan products that were actually securities without proper registration. Following the whistleblower’s complaint, the SEC initiated investigations into both platforms and found evidence of unregistered offerings and sales.

The SEC says that Genesis and Gemini failed to comply with the deadline for registering the offerings with the agency. As a result, the SEC has filed charges against both companies for violating the registration provisions of the federal securities laws. The charges include allegations of engaging in the unregistered offer and sale of securities, as well as failing to provide proper disclosures to investors.

If found liable, Genesis and Gemini could face significant fines and penalties. The SEC has the power to impose monetary fines, bar individuals and companies from certain securities activities, and pursue other enforcement actions. The exact penalties will depend on the outcome of the legal proceedings.

The SEC’s actions against Genesis and Gemini highlight the regulatory scrutiny faced by cryptocurrency lending platforms. The SEC has been increasingly focused on ensuring compliance with securities laws in the crypto space, as it seeks to protect investors from potential fraud and misconduct. This case serves as a reminder to other platforms operating in the cryptocurrency industry to carefully evaluate their offerings and ensure compliance with applicable securities laws.

In response to the SEC charges, both Genesis and Gemini have stated that they are cooperating with the SEC and are committed to resolving the situation. They have published statements affirming their commitment to comply with securities laws and protect the interests of their investors.

Crypto Exchange Gemini’s Involvement in SEC Charges

Gemini, a popular cryptocurrency exchange, finds itself in hot water as the Securities and Exchange Commission (SEC) seeks charges against the platform for unregistered securities offerings. The SEC alleges that Gemini participated in a loan offering program called the “Genesis Loan Program” without properly registering the securities with the commission.

The Genesis Loan Program, brought to the public’s attention by the SEC, involved the sale of unregistered loans to investors. The SEC claims that Gemini failed to comply with the necessary regulations and guidelines for offering these securities to the public. As a result, the SEC is taking legal action against Gemini to enforce these regulations and protect investors.

The SEC’s district office, responsible for overseeing compliance with securities laws, alleges that Gemini’s involvement in the Genesis Loan Program falls under the category of an unregistered offering. This violation carries significant consequences as it poses risks to investors and the integrity of the cryptocurrency market.

Gemini, founded by the Winklevoss brothers Barry and January, had been an active platform for trading various cryptocurrencies, promising investors the opportunity to earn significant yields. However, the SEC’s charges have put a halt to Gemini’s operations and have severely impacted its ability to offer these lucrative loan programs.

The SEC seeks to bar Gemini from engaging in unregistered securities offerings, imposing penalties for its violations. If the charges hold, Gemini may be facing bankruptcy as it will need to return the millions of dollars raised through the Genesis Loan Program to its investors.

Investors and creditors who participated in these unregistered loan offerings are now left in a state of uncertainty, unsure if they will be able to recoup their investments. The SEC’s enforcement actions also raise questions about the level of oversight and regulation needed in the cryptocurrency market to protect investors and maintain market integrity.

Gemini Earn Lending Program: Overview

The Gemini Earn Lending Program is a platform and service provided by Gemini, one of the leading cryptocurrency exchanges. This program allows users to lend their digital assets to Gemini, earning interest on their holdings.

Through the lending program, users can put their cryptocurrencies to work by loaning them to borrowers in need of capital. Gemini manages the entire lending process, including borrower requests, loan extension, and repayment of the loan with interest.

Gemini offers a variety of lending options for different cryptocurrencies, including Bitcoin, Ethereum, and others. The program provides a fixed yield percentage to lenders, giving them the opportunity to earn a passive income on their digital assets.

This lending program should be utilized by users who are comfortable with the risks associated with lending and are willing to hold their assets for a certain period of time. Lenders should also be aware of the laws and regulations governing lending and ensure that their participation in the program is within the legal bounds.

Gemini’s lending program has been well received by users, with over a million dollars in loans already processed. The platform has implemented measures to comply with KYC (Know Your Customer) and AML (Anti-Money Laundering) laws, ensuring a secure and transparent lending process.

It is worth noting that Gemini is a regulated exchange and operates in compliance with the laws set by regulatory bodies such as the SEC (Securities and Exchange Commission). This provides an additional layer of trust for users participating in the lending program.

Genesis and Gemini Face Consequences of Unregistered Crypto Asset Securities

The SEC published a letter earlier this month, warning Genesis and Gemini that they were operating unregistered securities offerings. Both platforms were facilitating lending programs that allowed creditors to earn a yield on their assets. However, these programs were deemed to be unregistered securities by the SEC, putting the platforms at risk of facing legal enforcement.

Genesis was offering a lending program that allowed creditors to earn a yield of up to 9 percent on their assets. The SEC found that this program constituted an unregistered securities offering with over $630 million in active funds. As a result, Genesis may face consequences for defaulting on its obligations to the SEC and its creditors.

In January, Gemini announced that it was terminating its lending program after receiving a warning from the SEC. The program allowed users to lend their crypto assets to Gemini’s institutional borrowers. However, the SEC determined that this offering was an unregistered security as well. Gemini’s co-founder, Cameron Winklevoss, stated that the decision to terminate the program was made to maintain a positive relationship with the SEC.

Both Genesis and Gemini now face the challenge of how to pay back their creditors if they are unable to offer the lending program. With over $630 million at stake, the platforms are seeking a path that allows them to fulfill their obligations without risking further legal action from the SEC.

Whistleblowers have also played a role in bringing attention to the unregistered securities offerings of Genesis and Gemini. This highlights the importance of whistleblowers in the crypto space, as they can help uncover potential violations and protect investors from financial risks.

The consequences of operating unregistered securities offerings can be severe. Companies like Genesis and Gemini could face significant financial penalties and damage to their reputation. This case serves as a reminder to other platforms in the crypto industry to ensure they comply with securities regulations to avoid similar legal and financial consequences.

Gemini’s Impact in the Crypto Market

Gemini, a cryptocurrency exchange platform, has made a significant impact in the crypto market since its launch in January. With its user-friendly interface and a wide range of available digital assets, Gemini has quickly become one of the go-to platforms for crypto enthusiasts.

One of the notable features of Gemini is its compliance with applicable regulations and its commitment to transparency. The platform has undergone thorough investigations and audits to ensure that it operates within legal boundaries, earning the trust of both individuals and institutional investors. This has been especially important in an industry that has faced scrutiny and concerns about security breaches and fraudulent activities.

Gemini’s impact in the crypto market is also evident through its association with prominent names in the industry. In 2015, Gemini became a certified Trust Company under the New York State Department of Financial Services, making it the world’s first regulated exchange for digital currency. This achievement further solidified Gemini’s position as a trustworthy and reliable platform for trading cryptocurrencies.

In addition to its compliance and partnerships, Gemini has made headlines with its innovative offerings, specifically its master agreement for digital currency trading. This agreement allows institutional investors to trade multiple cryptocurrencies through a single contract, simplifying the process and reducing transaction costs.

Gemini’s impact in the crypto market extends beyond its trading platform. The company actively engages with its community through educational initiatives and research, aiming to foster a better understanding of cryptocurrencies and their potential benefits. This commitment to education and awareness sets Gemini apart from other platforms and contributes to the overall growth and acceptance of digital currencies.

In conclusion, Gemini has had a significant impact in the crypto market since its launch. Its compliance with regulations, partnerships with industry leaders, innovative offerings, and commitment to education make it a key player in the ongoing evolution of cryptocurrencies.

Frequently Asked Questions:

What is a press release?

A press release is an official statement provided by an organization to the media to announce something newsworthy. It is typically used to inform the public about a product launch, a company event, a new partnership, or any other important information related to the organization.

Why is writing an effective press release important?

Writing an effective press release is important because it helps to generate publicity and media coverage for the organization. A well-written press release can grab the attention of journalists and can result in news articles, interviews or mentions in the media, which can ultimately help in building brand awareness and boosting the organization’s reputation.

What is the issue between Crypto exchange Gemini and DCG?

The issue between Crypto exchange Gemini and DCG is related to a missed loan payment. Gemini had warned that DCG was risking defaulting on its obligations if unable to pay the $630 million Genesis debt.

What action has the SEC taken against Genesis and Gemini?

The SEC has charged Genesis and Gemini for the unregistered offer and sale of crypto asset securities through the Gemini Earn Lending Program. This means that the SEC believes that Genesis and Gemini violated securities laws by offering and selling these crypto asset securities without proper registration.

What is the status of the Gemini Earn Lending Program?

The Gemini Earn Lending Program has been terminated by Gemini. They have also sought an extension and are currently in a situation where DCG has missed a $630 million Genesis loan payment.

Video:

What Is A Press Release?

How to Write a Press Release for Your Small Business (so you actually earn coverage)