The world of cryptocurrency has seen a surge in popularity, with the dominant stablecoin, Tether, taking a significant position in the market. Tether, which is backed by US dollars, has become a critical player in the crypto space, often agreeing to move funds across networks. However, this growing trend of tether loans is not without its risks.

One of the main risks associated with tether loans is the potential for illegal activities. Due to the lack of regulation in the crypto industry, there is a lack of transparency when it comes to disclosing the true risks involved in lending and borrowing stablecoins. This creates a threat to the stability of the overall market and raises concerns about the health of the financial sector.

In addition to the legal risks, there are also significant financial risks involved in tether loans. The volatility of cryptocurrencies, including stablecoins like Tether, can lead to substantial losses for lenders and borrowers alike. If the value of the stablecoin drops significantly, lenders may find themselves unable to liquidate their assets, potentially leading to bankruptcy.

Furthermore, the use of tether loans in the crypto mining industry poses an additional threat. As the mining operations require a significant amount of electricity and funds, miners often turn to stablecoins like Tether to mitigate the risks associated with the volatile cryptocurrency market. However, relying on loans to fund mining activities can lead to a less secure financial position and could potentially create a bubble in the crypto mining sector.

The potential risks associated with tether loans have not gone unnoticed by legal authorities. Attorneys and federal agencies are closely monitoring the stablecoin industry and taking actions to ensure compliance with anti-money laundering and sanctions regulations. This increased scrutiny further highlights the risky nature of tether loans and the need for further regulation in the cryptocurrency industry.

In conclusion, the growing trend of tether loans in the stablecoin crypto industry presents significant risks and challenges. The lack of transparency and regulation, combined with the volatility of cryptocurrencies, creates a precarious environment for lenders and borrowers. As the popularity of stablecoins like Tether continues to rise, it becomes critical to address these risks and implement measures to protect the stability of the financial sector.

The Growing Trend of Tether Loans: Risks in the Stablecoin Crypto Industry

The popularity of stablecoins, such as Tether, is on the rise in the cryptocurrency industry. These digital assets are designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. As a result, they have gained traction as a means of storing and transferring funds in the crypto world.

One of the latest trends in the stablecoin crypto industry is the use of tether loans. These loans involve borrowers using their stablecoin holdings as collateral to access fiat currency, while still maintaining exposure to the stablecoin’s value. This practice has sparked concerns and risks within the industry.

Regulators and enforcement agencies are paying close attention to the use of stablecoins and tether loans. The lack of regulations and oversight in this sector poses risks, as it opens the door for potential criminal activities and money laundering. In a video held by the Board of Governors of the Federal Reserve System, Christopher Troutman, a policy advisor, stated that stablecoins are primarily being used for illicit purposes, including money-market manipulation and criminal transactions.

Furthermore, the stability and usefulness of stablecoins is also being called into question. While these digital assets are designed to maintain a stable value, their popularity and usage can have an impact on the stability of the market. The rising popularity of tether loans could lead to an increased demand for stablecoins, potentially straining their limited reserves and creating volatility in the market.

Additionally, the lack of transparency and limited track record of certain stablecoin companies raise concerns about the safety and security of these digital assets. The recent controversies surrounding Tether, which claims to be backed by reserves, but none of which has been audited or paid any regulatory dues, adds to the risks and uncertainties.

In conclusion, while tether loans offer individuals and businesses a way to access funds using their stablecoin holdings, they also pose risks within the stablecoin crypto industry. The lack of regulations and enforcement, as well as concerns about the stability and transparency of stablecoins, highlight the need for further scrutiny and regulation in this sector.

Recommended Resources – Think Global Health

The growing trend of tether loans poses risks in the stablecoin crypto industry. As more companies look to borrow against their stablecoins, the potential for bankruptcy and unstable financial conditions increases. This is especially concerning as stablecoins are meant to provide stability in the volatile crypto-assets market.

One of the major issues with tether loans is the lack of regulatory oversight. Companies can easily borrow large amounts of stablecoins without proper verification of their financial stability or identity. This creates a risky situation as lenders have no way of knowing if the borrower will be able to repay the loan.

The recent rise of tether loans has also highlighted concerns around the legitimacy of stablecoins. Some experts argue that stablecoins are not truly backed by dollars, as they claim. This raises questions about the actual value of stablecoins and whether they can sustain their pegged value in different market conditions.

In addition, the rapid rise of tether loans has raised questions about the role of central banks and regulators in the crypto sector. While the industry has always been driven by decentralized principles, events like liquidated loans highlight the need for regulatory actions to protect investors and ensure the stability of the financial system.

Furthermore, the rise of tether loans and the potential risks they pose have prompted attorneys and legal experts to explore the legal framework surrounding stablecoins. Christopher Giancarlo, former chairman of the Commodity Futures Trading Commission, has indicated the need for clear guidelines and regulations to address these concerns.

Overall, the growing trend of tether loans in the stablecoin crypto industry is a cause for concern. The lack of regulatory oversight, potential bankruptcy risks, and questions around the legitimacy of stablecoins all indicate the need for careful consideration and proactive measures to mitigate these risks in the future.

What Governments are Doing About This

Governments around the world are closely monitoring the growing trend of tether loans in the stablecoin crypto industry. As digital currencies continue to gain popularity, governments are realizing the potential risks associated with this new form of currency.

Central banks are taking steps to regulate the use of stablecoins and ensure they do not pose a threat to financial stability. The European Union has been actively working on a regulatory framework for crypto-assets, including stablecoins, through their efforts with the Central Bank Digital Currency (CBDC) initiative.

Some countries, such as Russia and China, are taking a more cautious approach, with Russia considering a ban on cryptocurrencies as a means to address potential risks. China, on the other hand, is planning to launch its own digital currency, the Digital Yuan, which aims to have more control and oversight over the digital currency space.

Regulators in the United States are also increasing their scrutiny of stablecoins and tether loans. The Securities and Exchange Commission (SEC) has been cracking down on unregistered crypto firms and has been providing guidance on how companies should navigate the regulatory landscape. Additionally, the US government has proposed legislation that would require stablecoin issuers to obtain a banking charter and adhere to traditional banking regulations.

Overall, governments are recognizing the need to address the challenges and potential risks associated with stablecoins and tether loans. Whether through regulatory frameworks, bans, or the creation of central bank digital currencies, countries are taking different approaches to ensure the stability and future of the digital currency space.

Cryptocurrencies, Digital Dollars, and the Future of Money

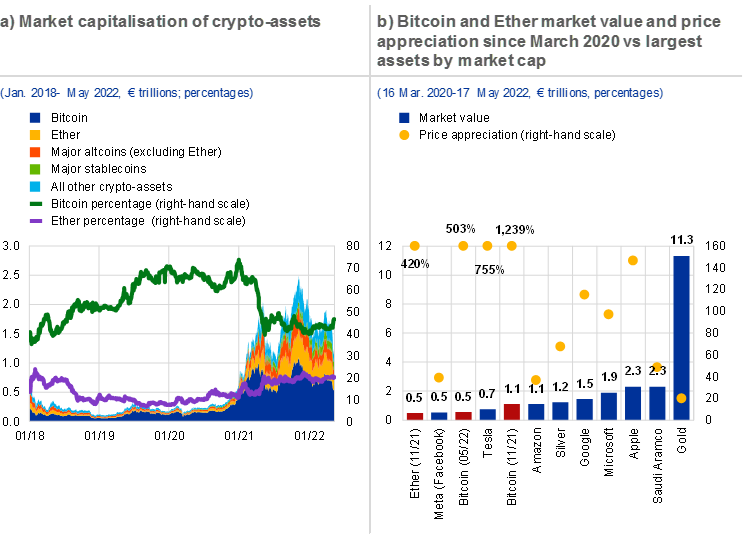

The introduction of cryptocurrencies, such as Bitcoin and Ethereum, has opened up new possibilities for the future of money. With the rise of decentralized finance (“defi”) and digital dollars, individuals and corporates alike are exploring the potential benefits and risks associated with these innovative forms of currency.

One of the major advancements in the cryptocurrency space is the concept of stablecoins. These are digital tokens that are typically pegged to a specific currency, such as the US dollar or the yuan. They provide a way to participate in the crypto market while also maintaining the stability of traditional fiat currencies.

Stablecoins offer a unique value proposition in the cryptocurrency space, as they combine the security and stability of traditional currencies with the speed and efficiency of blockchain technology. However, they are not without their risks. Recent events have shown that there are risks in the stablecoin industry that need to be carefully considered.

One major risk is the growing trend of tether loans. Tether (USDT) is a popular stablecoin that is frequently used as collateral in lending transactions. However, the reliance on tether as a borrowing asset poses risks, as it is not fully backed by an equivalent amount of US dollars. This has led to concerns about the safety and stability of tether loans, as a sudden decline in the value of tether could result in significant losses for those involved.

Regulatory actions have also highlighted the risks associated with stablecoins. Some countries, including China, have taken a critical stance towards stablecoins, banning their use and creating uncertainty in the market. These actions have had a significant impact on the popularity of stablecoins and have raised questions about the future of stablecoins as a viable form of currency.

Despite these risks, stablecoins have become a dominant force in the cryptocurrency market. The ability to easily transfer digital dollars across borders and the potential to earn higher yields through decentralized lending platforms have attracted many participants to the stablecoin space. However, it is important for individuals and corporates to be aware of the risks involved and to take precautions to safeguard their funds.

In conclusion, cryptocurrencies, digital dollars, and stablecoins have the potential to shape the future of money. The rise of decentralized finance and the usefulness of stablecoin assets have shown that there is a demand for innovative forms of currency. However, individuals and corporates must also be aware of the risks and uncertainties associated with these technologies and take recommended precautions to ensure the safety of their assets and transactions.

Rising Loans Adding to the Crypto World

As the popularity of stablecoin cryptocurrencies continues to grow, so does the trend of tether loans, wherein individuals and businesses can borrow funds using their digital assets as collateral. This practice has its risks and implications, which are adding to the complexity of the stablecoin crypto industry.

The Tether Loan Phenomenon

The concept of tether loans involves borrowing against the value of stablecoin cryptocurrency, such as Tether (USDT), which is backed by real-world resources like dollars. This allows borrowers to access funds quickly without selling their crypto holdings, creating less disruption in the market.

Christopher Mallaby, a member of the Stablecoin Association, discloses that the rise of tether loans has come with concerns about potential risks and regulations. He indicated that there is a need for clearer guidelines and regulatory actions from authorities to address the growing demand for these loans.

Risk and Regulation Challenges

While tether loans can provide quick access to funding, they also pose risks in terms of privacy, money laundering, and theft. The involvement of large amounts of crypto assets in lending activities makes it a potential target for hackers and cybercriminals.

The decentralized nature of the crypto industry makes it difficult for regulators to enforce strict regulations and policies. Some argue that banning tether loans altogether would hinder innovation and growth in the field. Others think more comprehensive regulations and reporting requirements should be in place to mitigate risks.

Impact on the Future of Stablecoin Crypto Industry

The rise of tether loans has raised concerns about the stability and dominance of stablecoin cryptocurrencies. If not properly managed, the unchecked growth of tether loans and their associated risks could create a future where a few lenders hold significant power over the stablecoin market.

It is crucial for industry players, authorities, and stakeholders to think about the long-term implications of tether loans and develop strategies to mitigate the associated risks. This includes finding a balance between innovation and regulations to ensure that the stablecoin crypto industry continues to thrive without compromising financial stability.

Why Tether Loans are Popular

The growing popularity of Tether loans can be attributed to several factors:

- Relatively low risk: Tether loans are considered less risky compared to other forms of cryptocurrency lending. These loans are backed by the Tether stablecoin, which is pegged to the US dollar, providing stability and reducing the volatility associated with other cryptocurrencies.

- Privacy: Tether loans offer a level of privacy since they don’t require borrowers to disclose their personal information or undergo extensive background checks. This appeals to individuals who value their financial privacy.

- Services for both individuals and corporate firms: Tether loans cater to both individual borrowers and corporate entities. This flexibility allows a wider range of users to access the benefits of borrowing in stablecoins.

- Efficiency and speed of transactions: Tether loans allow for quick and seamless transactions, as they leverage blockchain technology. The use of smart contracts eliminates the need for intermediaries and significantly reduces processing time.

- Supplementary investment activity: Tether loans can be used as a supplementary investment activity, providing an avenue for individuals and companies to diversify their holdings and potentially generate additional income.

Understanding Cryptocurrencies

In recent years, cryptocurrencies have gained significant popularity as an alternative form of digital currency. Unlike traditional forms of currency that are governed by central banks and governments, cryptocurrencies are decentralized and operate on a peer-to-peer network.

One of the most well-known cryptocurrencies is Bitcoin, which was the first digital currency to be created. Bitcoin’s blockchain technology revolutionized the way transactions are recorded, allowing for a transparent and secure system.

While cryptocurrencies offer many benefits, they also come with risks. Due to their volatile nature, the value of cryptocurrencies can fluctuate sharply, posing financial harms to those involved in the market.

Another threat in the cryptocurrency industry is the potential for illegal activities. As cryptocurrencies provide a certain level of anonymity, they have been linked to various illicit transactions, including money laundering and the funding of terrorist activities.

Furthermore, the lack of regulation and oversight in the cryptocurrency sector has raised concerns among governments and financial institutions. Major central banks have expressed the need for stricter policies to ensure stability and protect consumers.

Despite the risks, cryptocurrencies continue to attract investors and users. The total supply of cryptocurrencies is constantly being updated, with new coins being added to the market regularly.

Overall, understanding cryptocurrencies is crucial for anyone involved in the digital currency space. It is important to stay informed about the latest developments and updates in the industry to make informed decisions and mitigate potential risks.

Exploring the Concept of “DeFi”

DeFi, short for Decentralized Finance, is a rapidly growing trend in the crypto industry that aims to create a financial system that is open, accessible, and transparent. Unlike traditional banks and financial institutions, DeFi platforms operate on a decentralized network, allowing users to interact directly with the protocols using cryptocurrencies.

One of the most popular aspects of DeFi is lending and borrowing. DeFi lending platforms enable users to borrow or lend cryptocurrencies without the need for intermediaries, such as banks. Users can borrow a certain amount of money by depositing collateral, which is held in a smart contract on the blockchain. This way, the lending process becomes more efficient and provides access to capital to individuals who may not have traditional access to loans.

DeFi also extends beyond lending and borrowing. It encompasses a wide range of financial services including decentralized exchanges, stablecoins, yield farming, and synthetic assets. These platforms enable users to trade crypto assets, earn interest on their holdings, and even create their own financial products on the blockchain.

While DeFi presents exciting opportunities for financial innovation, it also comes with its fair share of challenges. One of the primary concerns is the lack of regulation and oversight, which can expose users to risks such as fraud and market manipulation. Additionally, the smart contracts powering DeFi platforms are not immune to vulnerabilities and bugs, leading to potential security breaches and loss of funds.

Furthermore, the relatively nascent nature of DeFi means that there is still a lack of robust infrastructure and standards. This can make it difficult for mainstream adoption and hinder the scalability of the network. Moreover, the decentralized nature of DeFi can also complicate compliance with existing regulations, as it may not be easy to enforce laws and regulations across the decentralized network.

Despite the challenges, the concept of DeFi has gained significant traction in recent years, attracting billions of dollars in investment and creating a vibrant ecosystem of decentralized applications. As the technology matures and regulatory frameworks become more defined, DeFi has the potential to revolutionize the financial industry, offering individuals greater control over their finances and removing barriers to access financial services.

The World This Week

This week, the growing trend of tether loans in the stablecoin crypto industry has raised concerns about potential risks and regulatory challenges. Tether, which is a blockchain-based stablecoin, aims to create a one-to-one relationship between its digital tokens and the US dollar. However, the increasing demand for tether loans has indicated a potentially risky situation.

First of all, the fixed exchange rate between tether and the US dollar might lead to financial harms if the value of tether decreases. The stability of tether relies on the trust in the underlying assets, and any disruptions in the market could undermine this trust and cause significant losses for investors.

In addition, the lack of clear regulations and guidance for tether loans increases the uncertainty and potential risks associated with this practice. Central banks and financial regulatory bodies in various countries have expressed concerns about the use of stablecoins and have emphasized the need for proper regulations to address the potential risks.

Furthermore, the rapid growth of tether loans has raised questions about the transparency and disclosure of information by the companies behind tether. In February, Tether’s parent company, iFinex, disclosed that it had provided a $900 million loan to its subsidiary, but did not provide further details. Such lack of transparency and disclosure can create distrust among investors and hinder the development of the stablecoin industry.

Moreover, the cybersecurity risks associated with tether loans cannot be ignored. As more and more funds are poured into tether loans, the potential for hacking and cyber attacks increases. The use of blockchain technology does not guarantee full protection against such risks, and measures must be taken to ensure the security of tether loans.

Overall, the growing trend of tether loans presents both opportunities and challenges for the stablecoin crypto industry. While it offers a convenient way for investors to access liquidity, it also poses risks due to the lack of regulations, transparency, and cybersecurity. Therefore, careful consideration and regulatory actions are necessary to prevent potential harms and promote the sustainable development of the stablecoin market.

Rising Tether Loans Adding Risk to the Stablecoin Crypto World

The growing trend of tether loans in the stablecoin crypto industry is introducing new risks. Tether is a popular stablecoin that is pegged to the value of the US dollar, providing stability in the volatile world of cryptocurrencies. However, the increasing use of tether loans, where individuals can borrow tether by using their cryptocurrency holdings as collateral, is adding complexity and potential hazards to the stablecoin ecosystem.

While tether loans can provide individuals with easier access to funds, there are several risks associated with this practice. First, there is the risk of bankruptcy of the companies offering tether loans. If a lending company becomes insolvent, the borrowers could potentially lose their collateral and face substantial losses.

Furthermore, the lack of transparency and regulatory oversight in the stablecoin industry raises concerns about the safety of tether loans. The decentralized nature of cryptocurrencies makes it difficult to determine the true financial status of companies offering lending services. There have been reported cases of fraudulent lending firms in the cryptocurrency world, highlighting the need for more stringent regulations and protections for borrowers.

Additionally, tether loans could be exploited for money laundering and other criminal activities. The anonymity and ease of transactions in the cryptocurrency world make it attractive to those seeking to hide illicit funds. The proposed updates to banking regulations in many countries aim to extend the anti-money laundering requirements to include digital assets, but currently, the vast majority of tether loans are not subject to these regulations.

In conclusion, while tether loans can be a useful financial tool for some individuals, the rising popularity of this practice introduces significant risks to the stablecoin crypto world. To minimize these risks, it is essential for regulatory bodies to establish clear guidelines and oversight for tether lending services. Additionally, individuals should exercise caution and thoroughly research the reputation and financial soundness of the companies offering tether loans before engaging in such transactions.

Challenges Created by the Growing Trend of Tether Loans in Stablecoin Crypto Industry

As the stablecoin crypto industry continues to expand, the growing trend of tether loans is raising concerns and posing risks for stakeholders. Stablecoin loans allow users to borrow digital assets by staking their existing crypto holdings as collateral. However, this innovative lending practice comes with various challenges and potential consequences.

1. Regulatory Uncertainty: The status of stablecoin loans in relation to existing financial regulations is still unclear, with governments and central banks showing limited actions in this regard. The lack of a clear policy framework poses a threat to the stability and integrity of the financial system.

2. Lack of Transparency: Tether loans can be an attractive option for consumers looking to access additional funds. However, the terms and conditions of these loans are often not disclosed in a transparent manner, which may lead to unexpected fees or unfavorable borrowing conditions for borrowers.

3. Counterparty Risk: The stablecoin industry is primarily governed by digital wallets, which may carry inherent risks such as hacking or theft. By introducing tether loans into this world, borrowers expose themselves to the potential loss of collateral in case of a security breach.

4. Criminal Activities: Due to the pseudonymous nature of the crypto world, tether loans can be used as a means to launder money or engage in other criminal activities. The lack of proper identity verification and regulations surrounding stablecoin loans makes it difficult to track the flow of funds and prevent illicit transactions.

5. Market Volatility: Stablecoins are designed to maintain a stable value, often pegged to a specific asset like the US dollar. However, if the underlying assets or reserves backing the stablecoin collapse or are less than expected, it can result in a sharp decrease in value. This can lead to significant losses for borrowers and lenders involved in tether loans.

6. Reputation Risk: The recent controversies and investigations surrounding Tether have sparked concerns and raised questions about the stability and credibility of the stablecoin industry. This negative perception can impact the confidence of users and investors in the stability of the industry as a whole.

Conclusion: While tether loans offer a new way for individuals to access capital using their existing crypto assets, the growing trend of such loans presents several challenges and risks. The stablecoin crypto industry needs to address these issues to ensure the long-term sustainability and trust in the system. Proper regulations, transparency, and risk management practices are critical in mitigating the potential drawbacks associated with tether loans.

What is a Central Bank Digital Currency

A Central Bank Digital Currency (CBDC) is a type of digital currency that is issued and regulated by a country’s central bank. Unlike traditional forms of currency like cash or physical coins, a CBDC exists solely in electronic form and is typically powered by blockchain technology.

How CBDC works

A CBDC operates on a decentralized network that ensures the safety and integrity of transactions. It uses electricity and follows specific regulatory guidance set forth by the central bank. Transactions using a CBDC can be completed electronically, making them faster and more efficient than traditional bank transfers.

Central banks have been exploring the possibility of creating their own CBDCs as a way to address the rapid rise of cryptocurrencies like Bitcoin and the growing trend of stablecoins like Tether. By creating a digital form of their national currency, central banks can retain control over their monetary policy and regulatory powers.

Benefits and concerns of CBDCs

One of the main benefits of CBDCs is increased transparency and traceability of transactions. This can help combat criminal activities such as money laundering and tax evasion. Additionally, CBDCs can offer greater financial inclusion by providing access to banking services for those who may not have traditional bank accounts.

However, there are also concerns regarding the privacy of individuals’ financial information and the potential for increased surveillance by central banks. Additionally, the rapid adoption of CBDCs could pose risks to the stability of the banking system and create potential for financial losses for businesses and individuals.

The status of CBDCs across the world

Several countries are currently exploring the development of CBDCs, including China, which has made significant progress in creating its own digital currency, the digital yuan. Other countries, such as the United States, are still in the early stages of researching and evaluating the feasibility of CBDCs.

In conclusion, CBDCs have the potential to revolutionize the way we transact and interact with money. However, there are still many regulatory and technical challenges that need to be addressed before CBDCs can become a dominant form of currency in the world.

Frequently asked questions:

What are tether loans and why are they becoming popular?

Tether loans are loans that are backed by the stablecoin Tether, which is pegged to the value of the US dollar. These loans have become popular because they offer crypto traders and investors a way to access liquidity without having to sell their cryptocurrency holdings.

What risks do tether loans pose to the stablecoin crypto industry?

Tether loans pose several risks to the stablecoin crypto industry. Firstly, there is a risk of price volatility, as the value of the underlying collateral can fluctuate rapidly. Secondly, there is a risk of default, as borrowers may not be able to repay their loans if the value of their collateral drops significantly. Finally, there is a risk of systemic risk, as a large number of tether loans could potentially destabilize the entire stablecoin market.

What is DeFi and how does it relate to tether loans?

DeFi, or decentralized finance, refers to the use of blockchain and cryptocurrency technologies to create financial services that are open, transparent, and accessible to anyone. Tether loans are a part of the DeFi ecosystem, as they allow users to borrow and lend cryptocurrencies without the need for traditional intermediaries like banks. However, the rapid growth of tether loans in the DeFi space has raised concerns about the stability and regulation of the market.

What are governments doing about the rise of cryptocurrencies and central bank digital currencies?

Governments around the world are taking various approaches to the rise of cryptocurrencies and central bank digital currencies. Some countries, like China, are actively working on developing their own central bank digital currencies in order to maintain control over the monetary system. Others, like the United States, are taking a more cautious approach and are closely monitoring the development of cryptocurrencies and digital currencies. Overall, governments are recognizing the potential benefits and risks of these technologies and are exploring ways to regulate and integrate them into the existing financial system.

Video:

Which Stablecoins Are Safe to Use? (USDC, USDT, DAI, etc.)

Are Stablecoins Safe? (Dai, Tether, USDT, USDC, etc)

Tether PUMPING BTC!? Why Stablecoin Market Cap Matters!!