Are you tired of waiting for your investments to yield results? With the introduction of self-paying loans, you can now immediately invest and start earning without the risks associated with traditional financial institutions.

This groundbreaking concept, known as DeFriday 4, allows you to use your crypto assets as collateral to obtain a loan, which is then used to invest in various projects and opportunities. The best part? The loan pays for itself, allowing you to earn while covering the original loan payments.

How does this self-paying loan magic work? It’s quite simple. You stack your ALCX (the token used by DeFriday 4) as collateral, which is pegged to Ethereum. Your stack of ALCX is then used as collateral to obtain loans, which are invested in various projects. As these investments yield results, the returns are used to cover the loan payments, ensuring the loan pays for itself.

The ability to stack ALCX and obtain self-paying loans provides a level of financial independence like never before. No longer do you have to rely on traditional financial institutions or wait for your investments to become liquid. The self-paying loan concept allows you to immediately invest and start earning, all while using your crypto assets as collateral. This opens up a new world of opportunities and the potential to earn daily.

But what about the risks? The DeFriday 4 platform ensures that your loan is always backed by collateral, reducing the risks associated with default or liquidation. Additionally, the platform is built on blockchain technology, providing transparency and security. Payments are made automatically, and you can track the progress of your investments in real-time. It’s a new way of doing business, one that puts the power of investing and earning in your hands.

The Mind-Bending Magic of Self-Paying Loans

The concept of self-paying loans might sound like something out of a Harry Potter novel, but it’s not magic – it’s finance. One platform that makes this possible is Alchemix, a decentralized finance (DeFi) protocol. With Alchemix, you can take out a loan and have it automatically repay itself over time, without having to make any monthly payments.

So how does it work? Alchemix uses a combination of smart contracts and algorithmic calculations to create a financial instrument called alUSD, which is a synthetic asset that represents the value of your debt. The platform also allows you to deposit assets like Ethereum or other cryptocurrencies as collateral.

Once you deposit your assets, the platform automatically generates alUSD for you to use. You can then use this synthetic asset to make purchases or trade on other platforms. The best part is that the alUSD acts as both the loan and the collateral, so as the value of your collateral increases over time, it continues to pay off your loan.

For example, let’s say you deposit 1 ETH into Alchemix and borrow 500 alUSD. As the price of ETH increases, the value of your collateral goes up, which in turn increases the amount of alUSD that is generated. This creates a scenario where your loan continues to pay off itself without you having to do anything.

This system has several advantages. First of all, it eliminates the need for monthly payments, which can be a hassle and sometimes result in missed payments. Second, it allows you to benefit from the appreciation of your collateral. If the value of your assets goes up, you can repay your loan early by simply withdrawing your collateral.

However, there are also risks involved. Since the value of your collateral is directly tied to the loan, any significant drop in the value of your collateral could cause a liquidation event, where your collateral is sold to repay the loan. Therefore, it’s important to carefully consider the risks before participating in this kind of financial arrangement.

In conclusion, the concept of self-paying loans offered by platforms like Alchemix is a fascinating and innovative way to use decentralized finance. It allows you to leverage your assets to create a continually growing loan that repays itself over time, making it an attractive option for those looking to make their money work for them.

Benefits and Advantages of Self-Paying Loans

Self-paying loans offer various benefits and advantages in the financial world. One of the key advantages is the ability to use borrowed funds for consumption while simultaneously paying off the loan. This unique idea allows individuals to use the funds for any financial needs they have, like purchasing goods or services, without negatively impacting their cash flow.

The self-paying loan scheme works by generating revenue through investment opportunities or other income-generating assets. Depending on the individual’s financial situation, this revenue can directly or indirectly be used to repay the loan, making it a smart and efficient way to manage debt.

Another advantage of self-paying loans is the digital nature of the process. Unlike traditional loans, where borrowers may have to wait for long periods for loan approval and disbursement, self-paying loans can be obtained quickly and easily. This efficient process opens up the possibility for borrowers to have immediate access to the borrowed funds, enabling them to take advantage of opportunities or address financial emergencies promptly.

One of the most significant benefits of self-paying loans is the reduced risk of default. Since the loan repayments are tied to the borrower’s revenue, the risk of financial strain and inability to repay becomes much lower. This structured repayment method ensures that individuals only borrow what they can afford based on their current and projected income.

In addition, self-paying loans offer flexibility in terms of repayment duration. Borrowers can choose from a range of repayment options, including daily, weekly, or monthly payments. This flexibility allows individuals to adapt their repayment schedule to their specific financial situation, making it easier to manage their cash flow and avoid any potential liquidity issues.

Self-paying loans also open up the possibility for individuals to build their savings while repaying their debt. By allocating a portion of the revenue towards savings, borrowers can create a financial safety net for themselves in the long run. This intertemporal approach to borrowing and saving promotes financial independence and stability.

In conclusion, self-paying loans offer a unique and advantageous alternative to traditional borrowing methods. By having access to funds for consumption while simultaneously repaying the loan, individuals can effectively manage their financial needs without putting themselves at risk. The digital nature of the process, the reduced risk of default, and the flexibility in repayment options make self-paying loans an attractive choice for those seeking financial stability and independence.

The Role of Blockchain Technology

Blockchain technology has revolutionized various industries, and the world of finance is no exception. Its impact is particularly significant when it comes to lending and borrowing, thanks to its unique attributes.

One of the key aspects of blockchain technology is its ability to provide a decentralized and transparent platform. Unlike traditional financial systems, where intermediaries are involved, blockchain allows borrowers and lenders to connect directly, eliminating the need for third-party involvement. This not only reduces transaction costs but also increases trust among participants.

In addition, blockchain technology offers improved liquidity. With traditional lending systems, borrowers may face hurdles when seeking liquidity. However, blockchain technology enables the creation of decentralized lending platforms where borrowers can easily access funds and lenders have a wider pool of potential candidates.

Another interesting application of blockchain technology in lending is the concept of self-paying loans. Alchemix Finance, for example, has introduced a system where borrowers can take loans using a stablecoin called alUSD. The borrowed coins are automatically repaid through the yield generated by the borrower’s collateral. This innovative approach aligns the interests of borrowers and lenders and eliminates the need for manual loan repayments.

Furthermore, blockchain technology allows for the creation of decentralized lending platforms where borrowers can use their cryptocurrency holdings as collateral. This opens up opportunities for individuals who may not have traditional forms of collateral, such as property or stocks, to access loans and leverage their crypto assets.

One of the highly interesting aspects of blockchain lending is the use of smart contracts. Smart contracts are self-executing contracts where the terms of the agreement are directly written into code. This ensures that loan agreements are automatically enforced and reduces the risk of default or fraud.

When it comes to lending and borrowing, blockchain technology also addresses the issue of cross-border transactions. With traditional systems, transferring money internationally can be costly and time-consuming. Blockchain technology, on the other hand, enables fast and low-cost transactions, making it easier for individuals in different parts of the world to lend or borrow money.

In conclusion, blockchain technology has transformed the lending and borrowing landscape by offering decentralization, transparency, improved liquidity, and innovative loan repayment models. Whether it’s using stablecoins as a means of repayment or leveraging crypto assets as collateral, blockchain lending provides individuals with more options and flexibility in accessing funds.

How Self-Paying Loans Work

Self-paying loans, such as the ones offered by Alchemix, are a unique financial instrument that combines the concept of borrowing with the power of smart contracts and decentralized finance. This innovative lending model allows borrowers to repay their loans automatically over time without the need for regular payments or interest rates.

When a borrower takes out a self-paying loan, they provide collateral in the form of a cryptocurrency asset, such as Ethereum. The loan amount that is granted is typically a percentage of the collateral’s value. This collateral is then locked into a smart contract and used to generate yields through various DeFi protocols.

As the borrower’s collateral generates returns, these yields are automatically redirected to pay off the loan over time. This process is called “transmuting” and utilizes a component called the Alchemix Transmuter. The transmuter works behind the scenes, constantly monitoring the collateral’s value and generating the necessary stablecoins to repay the loan.

What makes self-paying loans like Alchemix’s so intriguing is that the borrower’s debt is never paid off from their original funds. Instead, it is repaid through the yields generated by their collateral. This opens up a new world of possibilities, as borrowers can effectively borrow against their assets without depleting their own funds.

Furthermore, since the loan repayment is handled automatically, borrowers don’t need to worry about missing payments or facing penalties. The loan process is seamlessly integrated into the DeFi ecosystem, ensuring that borrowers can maintain their financial freedom and flexibility.

It’s worth noting that the amount of time it takes for a self-paying loan to be repaid depends on various factors, including the cryptocurrency’s price volatility and the yield generated by the collateral. However, the Alchemix project strives to provide a reasonable and predictable repayment timeline for borrowers, typically spanning months or even years.

In summary, self-paying loans are a groundbreaking financial tool that leverages the power of decentralized finance to offer borrowers a new way to access liquidity and manage their assets. By combining crypto assets, smart contracts, and yield-generating protocols, self-paying loans like those offered by Alchemix provide a unique solution for anyone in need of funding.

Risks and Considerations of Self-Paying Crypto Loans

When it comes to self-paying crypto loans, there are several risks and considerations that borrowers should be aware of. While the concept may seem like magic, there are important factors to keep in mind.

1. Fixed and Larger Debts:

One risk of self-paying crypto loans is that the debt is often fixed and can be larger than anticipated. Borrowers need to carefully consider their ability to make regular payments before committing to a loan.

2. Stability of Stablecoins:

Self-paying crypto loans often use stablecoins as collateral, which are cryptocurrencies pegged to a stable asset like the dollar. Borrowers need to ensure that the stablecoin they are using has a good track record of maintaining its peg, as sudden fluctuations can harm the collateralization of the loan.

3. Deceptively Simple Payments:

While the auto-payment feature of self-paying loans may seem convenient, borrowers should be aware that these payments may only cover the interest and not the principal amount. This means that more payments are required to fully repay the loan, which could catch borrowers off guard.

4. High Collateralization Ratios:

Self-paying crypto loans often require high collateralization ratios to protect the lender from potential losses. Borrowers need to ensure that they have enough collateral to secure the loan and avoid the risk of getting their assets liquidated in case of a significant price drop.

5. Aggressive Transmuters and Financial Risks:

In addition to collateralization, borrowers need to consider the risk of aggressive “transmuters,” which can change the loan terms and expose borrowers to potential financial risks. It is important to thoroughly understand the terms of the loan before entering into an agreement.

6. Thin Stack of Service Providers:

Currently, the self-paying crypto loan system is relatively new and the number of service providers is limited. This poses a potential risk if a service provider goes out of business or faces technical issues, which could impact the borrower’s ability to make payments or access their collateral.

While self-paying crypto loans have gained popularity due to their automated and efficient nature, borrowers must carefully consider the risks and implications before using this system. It is important to have a good understanding of how the system works, the terms and conditions of the loan, and to carefully evaluate one’s own financial situation before taking on a self-paying crypto loan.

Uses and Applications of Self-Paying Loans

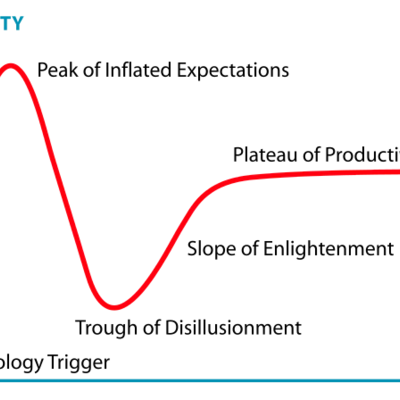

Self-paying loans are a candidate for a growing financial paradigm that changes the way we think about loans and assets. Unlike traditional loans, self-paying loans have the unique function of earning interest and paying themselves off over time.

One popular application of self-paying loans is in the realm of banking. With the use of smart contracts and blockchain technology, it has become possible to create self-paying loans that automatically function without the need for intermediaries. This eliminates the need for banks to sell off debts or assets, resulting in a more efficient and secure lending process.

Another application of self-paying loans is in the daily lives of individuals. For those who struggle with financial discipline, a self-paying loan can provide a viable solution. By building an application that allows individuals to earn interest and pay off their loans automatically, it becomes easier to save, invest, and manage personal finances.

Self-paying loans have also been used in the real estate industry. With the increasing value of mortgage and property, using a self-paying loan can be a simple and effective way to earn interest while also paying off the mortgage. This scenario is known as collateralisation, where the loan is backed by the property’s value.

One of the biggest hurdles in creating self-paying loans is the lack of awareness and understanding surrounding the concept. Many people are still unaware of the potential benefits and application of self-paying loans. However, as the technology and protocols improve, it is expected that self-paying loans will become more popular and widely used in the future.

In conclusion, self-paying loans have a wide range of uses and applications. From personal finance management to real estate investments, self-paying loans offer a unique solution for individuals and businesses alike. With the ability to earn interest and pay off the loan, self-paying loans have the potential to revolutionize the way we think about borrowing and lending.

Comparison to Traditional Loans

When it comes to traditional loans, the process can be quite lengthy and complex. Assuming you meet all the requirements and complete the lengthy application, you may have to wait for weeks or even months to get approved. In contrast, self-paying loans are much simpler and faster to obtain. With just a few clicks, you can borrow funds without the need for extensive paperwork or time-consuming approval processes. This convenience makes self-paying loans a popular choice for those in need of quick financial assistance.

Another key difference between traditional loans and self-paying loans is the returns they offer. Traditional loans typically provide fixed interest rates, while self-paying loans offer daily returns. This means that, with self-paying loans, your borrowed amount gradually decreases over time as the daily returns cover a portion of your outstanding balance. In contrast, traditional loans require you to make regular monthly payments to gradually repay the principal amount, often over several years.

One advantage of self-paying loans is that they are available to a wider range of individuals. Traditional loans often require a higher credit score and proof of income. In contrast, self-paying loans do not have these strict requirements, making it easier for individuals with less than perfect credit or irregular income to qualify. This flexibility in eligibility criteria provides an opportunity for more people to access the funds they need.

Additionally, self-paying loans have an international focus, as they are available to individuals across the globe. In contrast, traditional loans are often limited to residents of a specific country or region. This international accessibility of self-paying loans makes them a suitable option for those who need funds for international travel, business purposes, or any other cross-country expense. The ability to access funds regardless of residence offers great flexibility and convenience.

Moreover, self-paying loans promote financial discipline. With traditional loans, it can be easy to spend the borrowed amount on unnecessary or impulsive purchases. However, self-paying loans require borrowers to exercise discipline and only use the funds for essential expenses. The self-paying nature of the loan encourages responsible spending and helps individuals avoid falling into a cycle of debt.

In conclusion, self-paying loans provide a faster and more convenient alternative to traditional loans. With their daily returns and simpler application process, self-paying loans offer a unique approach to borrowing and repaying funds. They are accessible to a wider range of individuals, have an international focus, and promote financial discipline. Whether it’s for emergency expenses, international travel, business ventures, or any other financial need, self-paying loans can be a reliable option to consider.

The Future of Self-Paying Loans

As the use of self-paying loans continues to grow, the future holds exciting possibilities for this innovative financial concept. One area that shows great potential for development is the use of transmuters. These smart contracts act as a function within the self-paying loan ecosystem, covering the costs of borrowed funds while generating returns for the user.

A key aspect of the future of self-paying loans is their alignment with decentralized finance (DeFi) systems. Platforms like Aave and Alchemix have already made moves in this direction, offering self-paying loan services that integrate with existing DeFi protocols. This integration allows users to leverage their earned assets and stake them as collateral for self-paying loans, further expanding the possibilities of the system.

In the future, self-paying loans could also have international applications. The concept of self-paying loans transcends geographical borders, allowing individuals and businesses from around the world to access this innovative financial tool. This opens up new opportunities for trade and commerce, bringing together different economies and facilitating cross-border transactions.

One hurdle that may need to be addressed in the future is the issue of interest rates. While self-paying loans offer a unique way to cover the costs of borrowed funds, the rates posted by banks and other financial institutions can still be a significant financial burden. Finding innovative solutions to lower these rates or create alternative structures could further enhance the value of self-paying loans and make them more accessible to a wider audience.

The future of self-paying loans is clearly bright, with the potential to revolutionize the way we think about and interact with financial systems. By building on the success of platforms like Alchemix and exploring new avenues, this concept has the power to reshape the entire financial landscape. Whether you’re a business owner, a nomad, or just someone looking for a smarter way to manage your finances, self-paying loans might just be the solution you’ve been waiting for.

Key Players in the Self-Paying Loan Industry

When it comes to the self-paying loan industry, there are several key players that have emerged to provide innovative solutions for borrowers. One such player is Alchemix, a protocol that allows users to take out a loan against their deposited assets, all while earning revenue from those assets.

The Alchemix protocol operates on the Ethereum network and is built on the premise that users can use their deposited assets as collateral for a loan, without the harm of losing those assets. This paradigm shift in lending has caused a wave of excitement in the crypto community, as it opens up new possibilities for borrowers.

Another player in the self-paying loan industry is Celsius Network, a platform that has built a whole ecosystem around providing loans and earning interest on stablecoins. They offer a unique feature where borrowers can take out a loan against their assets and continue to earn interest on those assets, meaning they don’t have to sacrifice their passive income while getting the cash they need.

It’s not just the big players that are getting in on the self-paying loan game. Several smaller protocols and platforms are also building innovative solutions, such as Compound and Aave. These protocols allow users to deposit their assets and take out a loan against them, while also earning interest on their deposits.

One of the key advantages of self-paying loans is that they allow borrowers to keep their assets and continue to benefit from any potential price appreciation. In traditional lending, borrowers have to sell their assets or put them at risk while they repay their loan. With self-paying loans, borrowers can hold onto their assets and potentially even profit from their appreciation.

The self-paying loan industry is still in its early stages, but it holds great promise for the future. As more and more individuals and businesses start exploring the possibilities of this innovative lending model, we can expect to see further development and growth in the sector. It’s an exciting time to be a part of the self-paying loan revolution!

Regulatory Landscape and Compliance

The regulatory landscape surrounding self-paying loans is complex and ever-evolving. Governments and financial institutions across the country are trying to understand and adapt to this new paradigm of borrowing and lending. While some regulators see the potential benefits of self-paying loans, others are concerned about the risks and challenges they pose.

One of the main concerns with self-paying loans is the lack of collateralization. Traditional loans typically require borrowers to provide collateral as a form of security for the lender. However, self-paying loans operate on a different level, as the borrower’s savings are used as collateral. This creates a scenario where the borrower has less control over their savings and may harm their long-term financial stability.

The use of crypto assets in self-paying loans offers new possibilities for collateralization. By borrowing and stacking stablecoins, borrowers can use them as collateral for their loans. This provides a more secure and stable form of collateral, as stablecoins are pegged to a specific asset or currency and aim to maintain a 1:1 ratio. This can help mitigate the risks associated with self-paying loans and provide lenders with more confidence in the stability of their borrowers’ collateral.

Regulators are also concerned about the lack of transparency and oversight in self-paying loan platforms. With the rise of decentralized finance (DeFi) and the increasing popularity of self-paying loans, many platforms operate in a decentralized manner, making it challenging for regulators to monitor and enforce compliance. However, some self-paying loan platforms have implemented robust compliance measures, such as Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, to ensure regulatory compliance and protect the interests of both lenders and borrowers.

Success Stories and Case Studies

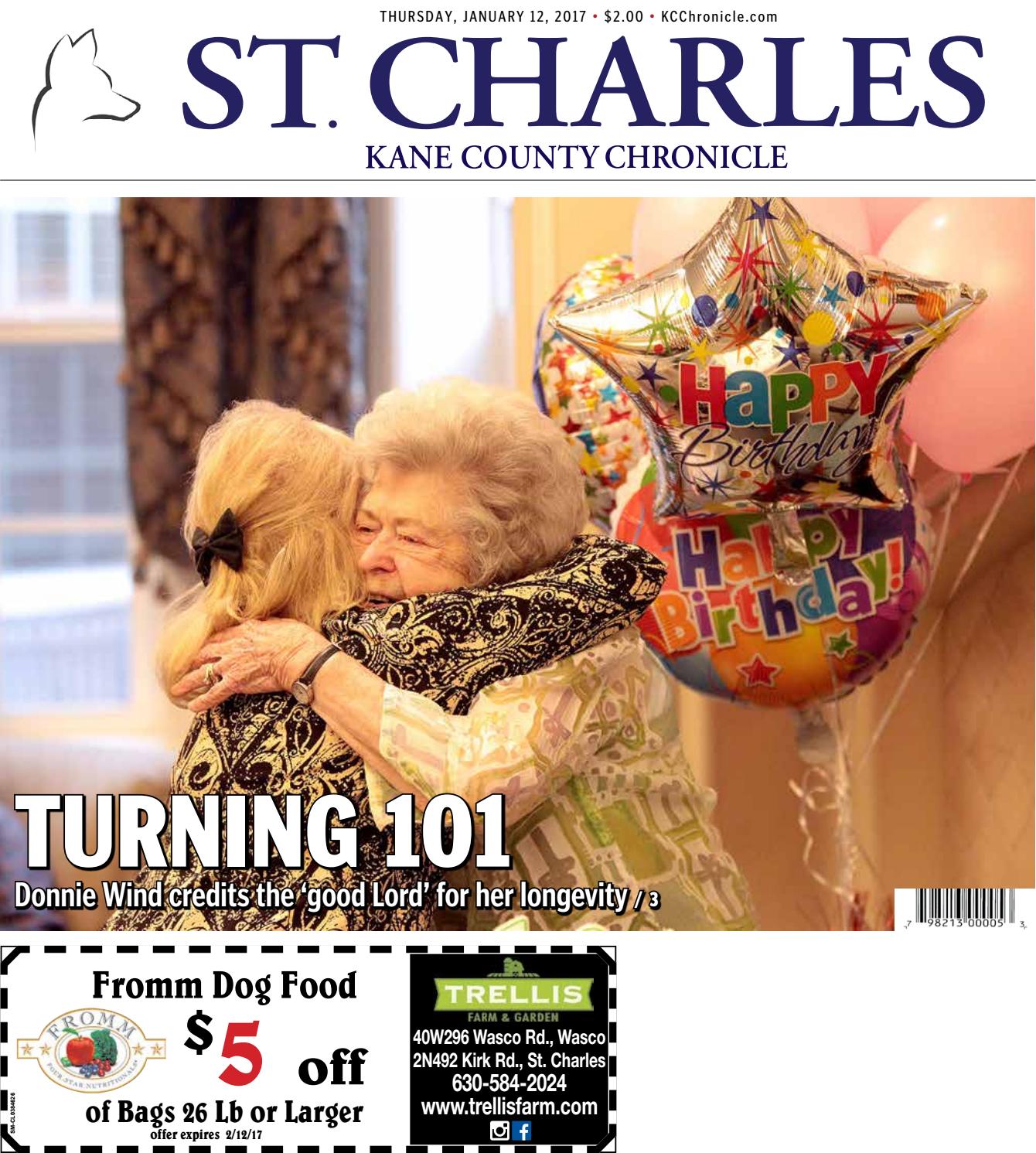

Many individuals have found success and incredible returns through self-paying loans using tokens like stablecoins. One such success story is the case of John Trehan, a young entrepreneur who steadily pays off his loan using the returns earned from his investments.

John had the bright idea of taking out a loan in stablecoins, which are cryptocurrency tokens with stable values. Since stablecoins are pegged to a stable asset, their value remains relatively constant over time. This stability makes them a perfect candidate for self-paying loans.

By taking advantage of the growing popularity of stablecoins, John has been able to avoid the variable yields and associated risks that come with traditional investments. Instead, he receives stable returns that he can withdraw monthly to cover his loan costs.

One of the key factors that make self-paying loans with stablecoins viable is the use of platforms like Zapper or Alchemix. These platforms allow individuals to deposit their stablecoins and earn passive income through lending protocols like Aave. This provides a stable source of income, making it easier to maintain discipline and keep up with the loan repayments.

John is not alone in his success. There are many others who have achieved similar results using self-paying loans. The ability to continually cover loan costs without needing to rely on external sources of income has become a game-changer in the financial world.

While self-paying loans using stablecoins may seem deceptively simple, it is important to know and understand the risks involved. Depending on market conditions, the returns may vary, and there is a possibility of losing the investment amount. However, many individuals, like John, have found that the rewards far outweigh the risks.

Without a doubt, self-paying loans with stablecoins have revolutionized the way individuals approach borrowing and investing. The idea of a loan that pays for itself has opened up new possibilities for financial freedom and independence. As more people become aware of this strategy, we can expect to see even more success stories in the future.

Frequently Asked Questions:

What is the concept of self-paying loans?

The concept of self-paying loans refers to a unique financial arrangement where the loan itself is designed to pay for itself over time through a combination of interest and other financial mechanisms.

How does the Alchemix Mortgage work?

The Alchemix Mortgage is a type of self-paying loan that allows borrowers to pay off their mortgage using the future value of their property. This is made possible through the use of synthetic assets and decentralized finance protocols.

Is the Alchemix Mortgage a safe financial product?

The safety of the Alchemix Mortgage depends on various factors, including the stability of the underlying decentralized finance protocols and the performance of the synthetic assets. While it can provide unique benefits, it also carries risks, similar to other forms of decentralized finance.

What are the advantages of self-paying loans?

Self-paying loans have several advantages. They eliminate the need for traditional monthly repayments, as the loan itself pays for itself over time. This can provide borrowers with increased financial flexibility and potentially result in lower overall costs.

Can self-paying loans be used for other types of loans, such as car loans or personal loans?

The concept of self-paying loans can be applied to various types of loans, including car loans and personal loans. However, the specific mechanisms and arrangements may vary depending on the type of loan and the financial institution involved.

Are self-paying loans a new concept?

The concept of self-paying loans is not entirely new, but it has gained more attention and popularity with the emergence of decentralized finance and blockchain technology. These technologies have enabled the development of innovative financial products, such as the Alchemix Mortgage.

Video:

He Bought a $25,000 Boat For Free: Alchemix Self Paying Loans | #DeFi

Scoopy Trooples: Alchemix – Financial Alchemy Through Self-Repaying Loans #392

How does the DeFriday 4 loan repay itself? I’m really curious about the mechanics behind it!

The mechanics behind the self-paying feature of DeFriday 4 loans are quite fascinating, FinancialWizard23! When you obtain a loan using your ALCX as collateral, the investments made with the loaned amount start generating returns. These returns are then used to automatically cover the loan payments, effectively repaying the loan itself. It’s like a cycle of investment and repayment that keeps the loan going without any additional effort on your part. It’s truly a game-changer in the lending industry!

As an avid investor, I find the concept of self-paying loans incredibly exciting. With DeFriday 4, I can use my crypto assets as collateral and start earning without the traditional risks. It’s a game-changer in the lending industry!

Wow, this self-paying loan concept is truly revolutionary! With this technology, we can now invest and start earning without the long waiting periods and risks. It’s amazing how our crypto assets can be used as collateral for loans that pay for themselves. I’m excited to explore DeFriday 4 and experience the mind-bending magic of self-paying loans.

How reliable are self-paying loans? Can I trust that the returns from investments will always cover the loan payments?

When it comes to self-paying loans, reliability is always a concern. However, with DeFriday 4, the innovative technology and careful risk management provide a high level of confidence in the loan repayments. The investments made with the loan proceeds are thoroughly vetted and chosen to maximize returns. Additionally, the ability to track and monitor the investments ensures that any fluctuations in returns can be addressed. So, you can trust that the returns from investments will not only cover the loan payments but also potentially provide additional earnings. DeFriday 4 truly revolutionizes lending by offering a reliable and lucrative opportunity to borrowers and lenders alike.

This is such a game-changer! I’ve been looking for ways to make my crypto assets work for me, and self-paying loans seem to be the perfect solution. With DeFriday 4, I can now invest and earn without the long waiting times and risks associated with traditional banks. Exciting times ahead!

Wow, this is truly mind-bending! The idea of self-paying loans is revolutionary. With DeFriday 4, I can finally invest and start earning without the hassle and risks of traditional financial institutions. It’s amazing how my loan pays for itself while I cover the original loan payments. This is a game-changer!