If you’ve been following the world of cryptocurrencies, you may have come across the term “staking” and wondered what it’s all about. Staking is the process of participating in the operation of a blockchain network by holding and “staking” your digital assets. In this guide, we will explore the basics of staking and how to get started in 2023.

Staking is a method used by certain cryptocurrencies, like Solana and Ethereum 2.0 (ETH2), to validate and confirm transactions on their respective networks. Unlike traditional proof-of-work blockchains, which require expensive hardware and significant energy costs, proof-of-stake blockchains offer an alternative approach. Instead of relying on computational power, staking involves holding a certain amount of tokens to have a chance of being chosen to confirm transactions and create new blocks.

One of the main advantages of staking is that it allows users to earn passive income in the form of rewards. By staking your coins, you contribute to the security and operation of the network, and in return, you receive additional tokens as a reward. This is a great way to make your crypto assets work for you while also helping to secure the network.

Getting started with staking is relatively easy. All you need is a compatible wallet that supports staking. Many popular wallets, such as Exodus and Atomic Wallet, offer built-in staking functionality. Once you have a compatible wallet, you simply need to choose the cryptocurrency you want to stake, delegate your tokens to a staking pool, and start earning rewards.

It’s worth noting that staked tokens are typically locked up for a certain period of time, known as the “lock-up” period. This ensures that stakers have a vested interest in the network and encourages long-term participation. During this time, you won’t be able to sell or transfer your staked coins, so be sure to only stake an amount that you’re comfortable holding for the duration of the lock-up period.

In conclusion, staking is a popular and lucrative way to earn passive income in the cryptocurrency market. By participating in the operation of a blockchain network, you not only support the network’s security, but you also have the opportunity to earn additional tokens. If you’re new to staking, this guide provides a detailed overview of the process and offers valuable tips to help you get started in 2023.

Understanding Staking Cryptocurrency

Staking cryptocurrency is an alternative way to earn passive income from your digital assets. Instead of mining, which requires technical expertise and expensive hardware, staking allows you to participate in the validation and security of a blockchain network by delegating your coins to a third-party service or running your own node.

One of the primary benefits of staking is that it provides a low-risk option for individuals who are not interested in the risks associated with trading on exchanges. By staking your coins, you can earn a fixed or variable yield depending on the network’s staking rate and the duration of your staking period. This can be particularly attractive for individuals in developing countries who may not have access to traditional banking systems or for those who prefer a more steady and predictable income.

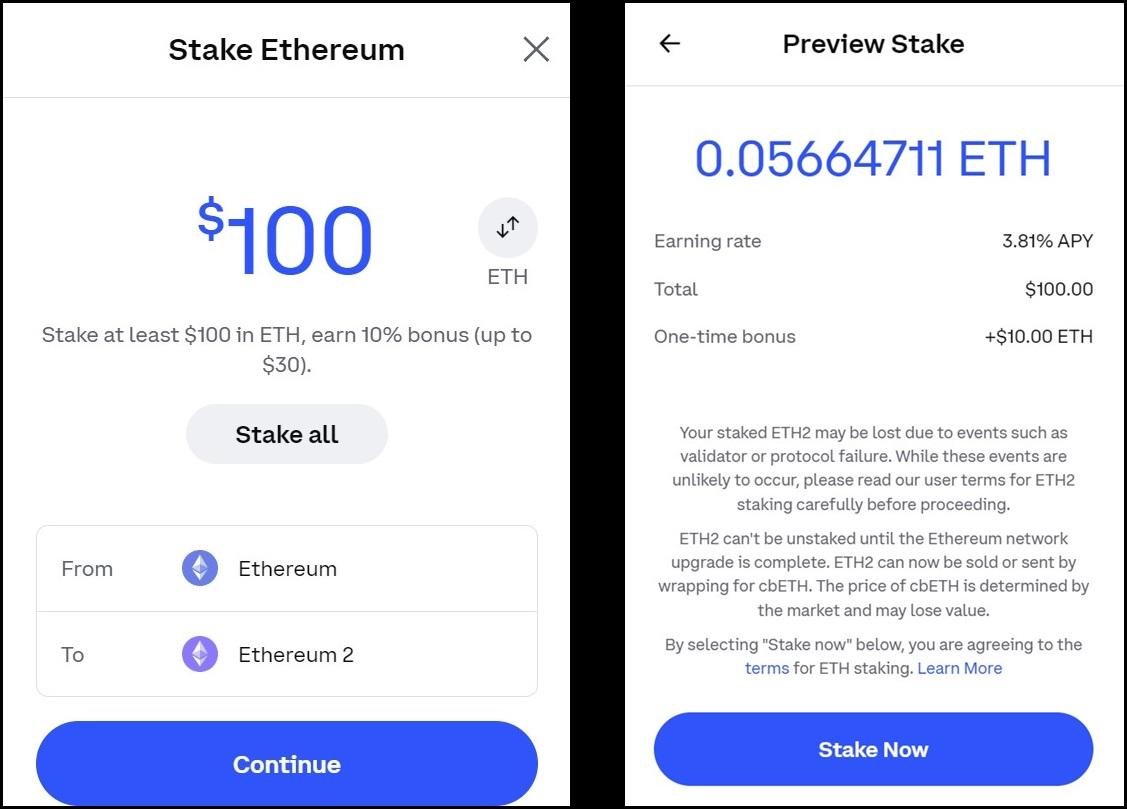

In terms of platforms and services, there are several options available for staking cryptocurrencies. Popular platforms like Coinbase, Trezor, and Zeroion have recently launched staking services, making it easier for users to participate in staking. These platforms often handle the technical aspects of staking, ensuring that participants can stake their coins safely and securely.

When it comes to risks, staking does come with its own set of dangers. There is always the risk of losing your staked tokens if the network experiences a major issue or if the price of the token drops significantly. However, staking generally carries less risk compared to trading or mining, as it involves a long-term commitment and depends on the overall stability and success of the network.

Key Takeaways:

- Staking cryptocurrency is an alternative way to earn passive income.

- By delegating your coins or running your own node, you can participate in the validation and security of a blockchain network.

- Staking provides a low-risk option for individuals who prefer a more steady and predictable income.

- Platforms like Coinbase, Trezor, and Zeroion have launched staking services, making it easier for users to participate.

- While there are risks involved with staking, it generally carries less risk compared to trading or mining.

The Importance of Staking Coins

Staking cryptocurrency has become an increasingly popular practice in recent years, and for good reason. By staking your coins, you can earn a percentage of the crypto asset as a reward for participating in the network. This is a sign of the growing adoption and recognition of cryptocurrencies like ADA, DOT, and Polygon, which offer staking options.

One of the key advantages of staking is the opportunity for passive income. Rather than simply holding your crypto and hoping for prices to appreciate, staking allows you to put your assets to work and earn rewards by participating in the network. Whether you are a beginner or an experienced investor, staking provides a simple and easy way to earn money on your digital savings.

Another important aspect of staking coins is its potential to provide a more eco-friendly alternative to mining cryptocurrencies. While mining often requires high energy consumption and has a negative impact on the environment, staking uses a delegated consensus mechanism that is more energy-efficient and sustainable.

Staking also comes with its share of risks and dangers. The value of staked assets can fluctuate with the market, and there is always a chance of loss. However, by choosing reputable exchanges or staking service providers like Binance, Lido, or Arbismart, you can mitigate some of the risks and ensure a secure staking experience.

Overall, staking coins can be a valuable investment strategy for both beginners and experienced crypto enthusiasts. It allows you to earn passive income, support the network, and potentially grow your savings over time. If you want to ensure the best possible yield for your staked coins, it is important to research the different staking service options available, as well as keep an eye on market conditions and the performance of your chosen cryptocurrency.

Benefits of Staking Cryptocurrency

Staking cryptocurrency is a process that allows you to earn passive income by participating in the validation and security of a blockchain network. There are several benefits to staking cryptocurrency, including:

- Earning Rewards: When you stake your coins, you have the opportunity to earn rewards in the form of additional coins. The amount of rewards you can earn will depend on the network and the number of coins you stake.

- Low-Risk Investment: Staking cryptocurrency is generally considered to be a lower-risk investment compared to other forms of cryptocurrency trading. Since you are participating in the network’s consensus protocol, the risk of losing your investment is reduced.

- Higher Savings Yield: Staking can offer a higher annual yield compared to traditional savings accounts. While savings accounts may offer an interest rate of 1-2%, staking can often provide annual yields of 5-20%.

- Supporting the Network: By staking your coins, you are actively supporting the network and its operations. This helps to ensure the security and reliability of the blockchain network.

- Participating in Governance: Some staking platforms also allow you to participate in the governance of the network. This means that you can have a say in the decision-making process, such as voting on protocol changes or proposing improvements.

- No Hardware Requirements: Unlike mining, which often requires expensive hardware such as GPUs, staking can be done with just a desktop computer or even a mobile device. This makes staking more accessible to a wider range of users.

- Well-Known Platforms: Many popular cryptocurrency exchanges and platforms, such as Binance, support staking for various cryptocurrencies. This makes it easier for users to stake their coins and earn rewards without having to use unfamiliar platforms.

- Lower Minimum Investment: Staking often has a lower minimum investment requirement compared to other forms of cryptocurrency trading. This means that even if you have a small amount of cryptocurrency, you can still participate in staking and earn rewards.

- Increased Coin Value: Staking your coins can contribute to an increase in their value. As more people stake and hold a particular cryptocurrency, the available supply on exchanges may decrease, which can drive up the price due to increased demand.

Choosing the Right Cryptocurrency for Staking

When it comes to staking cryptocurrency, choosing the right one can make all the difference. There are several factors to consider when selecting a cryptocurrency for staking, such as its native staking capabilities and the degree of control and flexibility it provides.

One popular option for staking is Rocket Pool, a decentralized Ethereum 2.0 staking network that allows anyone to safely and easily stake their ETH and earn rewards. With its innovative protocol, Rocket Pool aims to become the go-to platform for staking Ethereum and is expected to gain even more popularity once Ethereum 2.0 is fully implemented.

Another cryptocurrency that is believed to have great staking potential is Cardano (ADA). With its proof-of-stake (PoS) protocol, Cardano offers a low-risk opportunity for staking and making passive income. The project has gained a lot of attention due to its unique approach and the reputation of its founder, Charles Hoskinson.

Solana is another cryptocurrency that is becoming increasingly popular for staking. Solana aims to provide a scalable and high-performance blockchain platform with its proof-of-history (PoH) consensus mechanism. Staking Solana can be more rewarding than staking other cryptos due to its usually steep reward structure.

When choosing a cryptocurrency for staking, it is important to consider factors such as the network’s security, the popularity and reputation of the project, and the potential rewards. It is also essential to understand how the staking process works and what kind of wallet or platform you will need to use.

Many large crypto exchanges like Binance provide staking services, allowing users to easily stake their cryptocurrencies and earn passive income. These exchanges often have billions of dollars worth of cryptocurrencies available for staking, making them a convenient option for those who want to earn staking rewards without the need for technical knowledge or complex setup.

Setting Up a Cryptocurrency Wallet for Staking

One of the primary requirements for staking cryptocurrency is having a secure and reliable wallet. A cryptocurrency wallet is a digital wallet that allows you to store, send, and receive your cryptocurrencies. When it comes to staking, you have a few options for selecting a wallet.

Method 1: Using a Web Wallet

A web wallet is a popular choice for beginners as it allows you to access your coins with just a few clicks. Web wallets usually allow you to stake your coins directly from the wallet interface, eliminating the need for any additional setup. Some popular web wallets that support staking include Cardano (ADA), Solana (SOL), and Binance.

Method 2: Using a Hardware Wallet

If you want to take your security to the next level, a hardware wallet is the way to go. Hardware wallets, such as the Ledger or Trezor, provide an extra layer of security by storing your cryptocurrency offline. These wallets usually require some additional steps to set up, but they offer better protection against potential risks.

Method 3: Using a Mobile Wallet

Mobile wallets are becoming increasingly popular due to their convenience. They allow you to stake your coins on the go and usually come with additional features such as built-in exchange capabilities and push notifications. Some popular mobile wallets that support staking include Exodus, MetaMask, and Trust Wallet.

Once you have chosen your preferred wallet, the next step is to set it up and secure your account. This involves creating a wallet, setting a strong password, enabling two-factor authentication, and storing your wallet backup securely. It’s important to follow these steps to ensure the safety of your funds and prevent any unauthorized access.

Now that you have set up your cryptocurrency wallet, you are ready to start staking your coins and earning rewards. Make sure to do thorough research on the specific staking process for each coin and follow the guidelines provided by the project’s team or community. Staking can be a great way to earn passive income, but it’s important to understand the risks and limitations associated with it. Remember to always do your own research and never invest more than you can afford to lose.

Researching Staking Platforms

When it comes to staking cryptocurrencies, it’s essential to research and choose the right staking platform. With so many options available, it can be overwhelming to decide which platform to use. Here are some key steps to follow when researching staking platforms:

1. Understand the Requirements

Before you start staking, make sure you understand the requirements of the platform you choose. Some platforms may require you to hold a certain amount of tokens, while others may have specific wallet or delegation requirements. Take the time to read the platform’s documentation and terms of service to ensure you meet all the necessary criteria.

2. Evaluate the Platform’s Services

Look into the services offered by the staking platform. Does it provide security features like two-factor authentication or hardware wallet integrations? Platforms such as Trezor offer a higher degree of security as they keep your tokens offline, protecting them from potential hacks. Consider whether you prefer a larger platform with more participants or a smaller, more decentralized one. Additionally, some platforms offer additional services like staking rewards calculators or newsletters to stay up to date with the latest news.

3. Research the Platform’s History and Reputation

To ensure the safety of your funds, it’s important to research the platform’s history and reputation. Look for user reviews, ask other crypto enthusiasts for their experiences, and check if the platform has had any security breaches or issues in the past. This will give you a better idea of the platform’s reliability and trustworthiness.

4. Compare Staking Rewards and Tokenomics

Each staking platform has its own staking rewards and tokenomics structure. Look into the rate at which you can earn rewards for staking your tokens, as well as the native token of the platform and its potential for future growth. Additionally, some platforms offer validation or delegation services, allowing you to earn rewards without even needing to hold the native token. Compare different platforms to find the best rewards and potential for growth.

5. Consider Network and Asset Compatibility

Not all staking platforms support the same blockchain networks or assets. If you have a specific cryptocurrency asset like Polkadot (DOT) or Solana (SOL) that you want to stake, make sure the platform you choose supports it. Some platforms may only support a limited number of assets, so check their list of supported tokens before making a decision.

6. Assess Costs and Locking Periods

When staking, there may be costs involved, such as transaction fees or staking fees charged by the platform. Additionally, some platforms have locking periods where your tokens cannot be accessed or unstaked for a certain period of time. Consider any costs or locking periods associated with the platform and evaluate whether they align with your financial goals and investment strategy.

7. Seek Additional Guidance

If you’re still unsure or new to staking, don’t hesitate to seek additional guidance or consult a staking guide. There are numerous online resources and communities where you can learn from experienced stakers and get advice on the best platforms to use. These resources can provide valuable insights and help you make a more informed decision.

Staking your cryptocurrency assets can be a rewarding way to earn passive income and contribute to the security of blockchain networks. By researching staking platforms thoroughly, you can ensure that you choose the right platform for your needs and minimize any potential risks.

Steps to Stake Coins in 2023

Staking has become a popular way for cryptocurrency holders to earn passive income. In this beginner’s guide, we will take you through the steps involved in staking coins in 2023.

1. Choose the right cryptocurrency

The first step to staking coins is choosing the right cryptocurrency to stake. There are various options available, starting from well-established coins like Ethereum and Cardano to newer ones like Anatol and Stakeaway. Do your research and choose a coin that aligns with your investment goals and risk tolerance.

2. Understand the staking requirements

Each cryptocurrency has its own staking requirements. Some coins require you to have a minimum balance in order to stake, while others may have specific hardware or software requirements. Make sure you understand these requirements before proceeding to stake your coins.

3. Set up a staking wallet

In order to stake your coins, you will need to set up a staking wallet. There are different ways to do this, including using hardware wallets like Trezor or Ledger, or using online wallets like Binance or Exodus. Choose a wallet that suits your preferences and follow the instructions to set it up.

4. Delegate or stake your coins

Once you have set up a staking wallet, you can delegate or stake your coins. Delegating involves selecting a validator to handle the staking process on your behalf. Staking, on the other hand, involves participating in the consensus process and earning rewards directly. Choose the method that suits your preferences and follow the instructions provided.

5. Confirm and start earning rewards

After you have delegated or staked your coins, you will need to confirm the transaction and wait for it to be processed. Depending on the blockchain and network congestion, this process may take some time. Once your coins are staked, you can start earning rewards. These rewards are typically fixed, but their value may fluctuate based on market conditions.

6. Monitor and adjust your staking strategy

Staking is not a set-it-and-forget-it investment. It requires monitoring and adjusting your staking strategy based on market conditions and your investment goals. Stay informed about the latest developments in the cryptocurrency world and make changes to your staking strategy if necessary.

7. Consider different staking options

There are different staking options available, including traditional staking and staking in layer 2 solutions. Traditional staking involves interacting directly with the blockchain and participating in the consensus process. Layer 2 solutions provide a more scalable and efficient way to stake coins. Explore these options and consider diversifying your staking portfolio.

8. Be aware of the risks and advantages

Before staking your coins, it’s important to be aware of the risks and advantages involved. Staking involves locking up your coins for a certain period of time, which may limit your liquidity. However, it also provides the opportunity to earn passive income and contribute to the security of the network. Understand the risks and advantages and make an informed decision.

9. Stay up to date with staking algorithms

Staking algorithms may change over time, so it’s important to stay up to date with the latest developments. Different cryptocurrencies may use different consensus algorithms, such as Proof of Stake or Delegated Proof of Stake. Stay informed about these algorithms and understand how they impact your staking rewards.

By following these steps, you can start staking your coins in 2023 and earn passive income from your cryptocurrency investments. Remember to do your research, choose the right coins, and stay informed about the latest developments in the world of staking.

Calculating Potential Staking Rewards

A key factor to consider when staking cryptocurrency is the potential staking rewards. As the prices of cryptocurrencies fluctuate, the newly minted coins from staking can have varying values. It’s important to have a powerful strategy in place to maximize your staking rewards.

One approach that might yield better results is to bottom-feed, taking advantage of low prices to acquire more coins. However, it’s essential to understand the potential issues that can arise when staking. Many staking platforms are still centralized, meaning you have to trust them with your coins. To combat this, it’s recommended to use decentralized wallets that allow you to stake multiple coins without relying on a single platform.

Another alternative is to stake without the need for hash power. In the world of DeFi, there are platforms like Zerion that detail the staking process and potential rewards. This can be a well-documented way to stake and earn rewards, without the risks or intermediaries.

Investors can also choose among various staking options, such as ETH2, DAI, or Polkadot. Each blockchain works differently, having its own requirements and potential rewards. For beginners, it is recommended to start with a major blockchain like Ethereum or Bitcoin, as they offer well-established staking options. Solana and Polkadot are also gaining popularity and can be good choices for staking.

Pooled staking is also a popular approach, where multiple users pool their money together to stake as a collective. This can help even out the rewards and make staking more accessible to smaller investors. However, it’s important to note that the rewards will be shared among the participants, so the individual yield might be lower compared to solo staking.

When calculating potential staking rewards, it’s crucial to consider the varying value of the coins, the staking requirements, and the overall market conditions. Staking can be a great way to earn passive income, but it also comes with its own set of risks. It’s essential to do thorough research and choose a staking strategy that aligns with your investment goals and risk tolerance.

In recent years, the focus on eco-friendly staking has also increased. Many investors are looking for ways to earn rewards while minimizing their carbon footprint. This has led to the rise of eco-friendly blockchains and staking platforms that prioritize sustainability. By choosing these options, you can contribute to a greener future while earning staking rewards.

Understanding the Risks of Staking

Staking is a popular practice in the cryptocurrency world, particularly in 2023 when more and more people are eager to earn passive income and participate in decentralized finance (DeFi). However, it’s important to understand the risks involved in staking before diving in.

1. Centralization of Power: While proof-of-stake (PoS) works differently than proof-of-work (PoW) blockchains like Bitcoin, it still carries the risk of centralization. Certain platforms or exchanges may have a significant amount of staked coins, giving them greater control over the network. This can potentially lead to manipulation or control over the blockchain.

2. Delegation Risks: Many PoS blockchains provide the option to delegate your coins to a validator, where they are staked on your behalf. While this can be a convenient way to earn rewards without actively managing your staked coins, it also introduces risks. If the validator misbehaves or gets compromised, your staked coins could be at risk.

3. Security and Custody: Staking involves locking up your coins in a wallet or platform, which comes with security risks. If the platform experiences a breach or if your wallet is hacked, your staked coins could be stolen. It’s crucial to use reputable and secure wallet options, such as Trezor or Exodus, to minimize these risks.

4. Volatility and Market Risks: Staking usually involves a lock-up period, during which your coins are unavailable for trading. This means that you may miss out on potential price gains or be exposed to losses if the market takes a downturn. It’s essential to consider the potential impact of market volatility and the length of the lock-up period before staking your coins.

5. New or Experimental Projects: Staking on newer or less-established blockchains carries additional risks. These projects may have vulnerabilities or issues that could lead to loss of your staked coins. It’s important to do thorough research, check the project’s reputation, and assess its security features before staking on a new platform or blockchain.

6. Network Upgrades and Forks: Staking on a blockchain that undergoes regular updates or forks can be risky. Network upgrades may require you to take specific actions or risk losing your staked coins. Forks can also result in the creation of a new blockchain, potentially leaving you with coins that have no value or value on a different network.

While staking can be a great way to earn passive income and support blockchain networks, it’s crucial to understand the risks involved. By staying informed, choosing reputable platforms or exchanges, and implementing proper security measures, you can mitigate these risks and make the most out of your staking endeavors in 2023.

Staking vs. Mining: Which One is Right for You?

When it comes to earning profits in the cryptocurrency world, two popular methods have emerged: staking and mining. But which one is right for you? Let’s take a closer look at how staking and mining work and their key differences.

Staking

Staking involves participants holding a certain amount of a specific cryptocurrency in a wallet, such as Ethereum or Cardano. By doing so, they help validate transactions and secure the network. In return, participants can earn additional coins as a reward. Staking is considered a more environmentally friendly option compared to mining, as it doesn’t require the high computational power and energy consumption that mining does.

Staking works on a more decentralized basis, with participants directly participating in the network’s operation. They lock up their holdings for a set period to ensure trust and security. Many platforms, such as Coinbase or Binance, offer staking services for various cryptos, making it accessible to a wide range of users.

Mining

Mining, on the other hand, involves using specialized hardware to solve complex mathematical problems and validate transactions on a blockchain. Miners compete to be the first to solve these problems and are rewarded with a certain amount of cryptocurrency. This process requires high computing power, resulting in significant energy consumption and environmental concerns.

Miners typically operate in mining pools or join mining contracts to increase their chances of earning profits. Mining is more suitable for those who want to be more actively involved, have access to specialized mining equipment, and are ready to invest in this hardware.

Choosing Between Staking and Mining

When deciding between staking and mining, several key factors should be considered. If you are looking for a more passive and automated approach to earning crypto, staking may be the better option. Staking also offers liquidity, as you can unlock and trade your staked coins at any time.

On the other hand, if you have access to specialized mining equipment and are willing to invest in a more active earning approach, mining might be suitable for you. However, it’s important to be aware of the environmental impacts and high energy consumption associated with mining.

In conclusion, staking and mining are both viable methods to earn cryptocurrency. Whether you choose to stake or mine depends on your preferences, access to resources, and investment capabilities. It is always wise to do your research and carefully consider the pros and cons of each method before making a decision.

Frequently Asked Questions:

What is staking in cryptocurrency?

Staking is the process of participating in the proof-of-stake (PoS) consensus algorithm by locking and holding a certain amount of cryptocurrency in a wallet to support the network’s functions. In return for staking, participants receive rewards, which can be in the form of additional coins or tokens.

How does staking work?

When you stake cryptocurrency, you essentially set aside a certain amount of coins or tokens in a wallet designated for staking. These coins are temporarily locked and used to support the network’s operations, such as validating transactions or creating new blocks. In return for staking, you receive rewards based on the amount staked and the duration of your staking period.

Why would someone stake cryptocurrency?

People stake cryptocurrency for various reasons. One of the main reasons is to earn passive income by receiving staking rewards. Staking also helps to secure and decentralize the network by incentivizing participants to hold and support the cryptocurrency. Additionally, staking can also contribute to the governance and decision-making process of the network, depending on the specific cryptocurrency’s design.

How can I stake Cardano ADA?

To stake Cardano ADA, you need to have a wallet that supports staking and hold ADA in that wallet. You can choose to stake on your own by running a Cardano node, but this requires technical knowledge and significant computational resources. Alternatively, you can delegate your stake to a stake pool, which simplifies the process and allows you to earn rewards without the need for high-end hardware. You can delegate your ADA using the official Cardano wallet or through third-party wallets that support Cardano staking.

What are the benefits of staking Cardano ADA?

Staking Cardano ADA offers several benefits. Firstly, you can earn passive income in the form of ADA rewards. Staking also contributes to the security and decentralization of the Cardano network, making it more resistant to attacks. By staking, you also have the opportunity to participate in the governance of the network and influence decision-making by voting on proposals. Additionally, staking ADA helps to maintain the stability and health of the Cardano ecosystem.

Video:

Pendle (PENDLE) Airdrop on Binance Launchpool – Farm PENDLE by Staking BNB and TUSD

TOP 3 CRYPTO PASSIVE INCOME STRATEGIES | FULL GUIDE 2023

How To Make Money With Coinbase in 2023 (Beginners Guide)

Is staking available for all types of cryptocurrencies or only certain ones?

Staking is available for certain types of cryptocurrencies, not all of them. It depends on the blockchain network and the consensus mechanism it uses. Cryptocurrencies like Solana and Ethereum 2.0 (ETH2) mentioned in the article utilize the proof-of-stake (PoS) consensus, which allows for staking. However, cryptocurrencies that rely on other consensus mechanisms like proof-of-work (PoW) do not offer staking opportunities. It’s essential to research the specific cryptocurrency you are interested in to determine if staking is available.

I’ve been staking cryptocurrency for a while now and it’s definitely a great way to earn passive income. With the increasing popularity of staking, it’s awesome to see more beginner-friendly guides like this one. The step-by-step tutorial and the recommendation for the Zerion Wallet make it even easier for newcomers to get started. Can’t wait to try it out in 2023!

That’s an informative article! I’ve always been curious about staking and how it works. It’s great to see a beginner’s guide for 2023. Thank you for sharing!

Staking has been a game-changer for me. I’ve been able to earn passive income with my crypto investments without the need for expensive hardware. It’s a win-win situation!

Staking is such a game-changer in the crypto world! It’s amazing how we can earn passive income just by holding our coins and supporting the network. I’ve been staking for a while now and the rewards have been fantastic. Definitely recommend giving it a try!

Staking has been a game-changer for me. I’ve been earning passive income with my crypto investments and it’s been incredible. The Zerion Wallet makes it so easy to stake and I highly recommend it!