When it comes to getting a loan, going through the standard checks and requirements can often be a hassle. However, with instant crypto loans, you can bypass all of that and get quick and easy access to the funds you need. Instead of waiting for weeks to have your loan approved, you can have it in just a matter of minutes.

One of the best things about instant crypto loans is that there are no credit checks required. This means that even if you have a less than perfect credit score, you are still able to get the loan you need. Instead of relying on traditional factors like income and tax returns, crypto loans are based on the value of your cryptocurrencies. So even if you have a small income or a non-traditional job, you can still earn money through your crypto investments and use it as collateral for a loan.

Another advantage of instant crypto loans is that the repayment terms are very flexible. You can choose the duration of the loan based on your needs and financial situation. Some platforms even offer automatic repayment transfers, which means that you don’t have to worry about making monthly payments. The loan amount can be repaid in one lump sum or in smaller installments over time.

With instant crypto loans, you are also able to make the most of your crypto assets. Instead of selling them and losing potential earnings, you can use them as collateral and still benefit from their value. This way, you can afford to keep your cryptocurrencies and potentially earn even more as their value increases over time.

So, if you are in need of quick and easy access to funds, consider getting an instant crypto loan. It is a simple and efficient way to leverage your crypto assets and get the financial support you need.

Fast and Easy Crypto Loans

Crypto loans have become increasingly popular in recent years, offering a quick and easy way for individuals to access funds using their cryptocurrency holdings. Unlike traditional loans where a lengthy application process and credit checks are required, crypto loans offer a much simpler and faster solution.

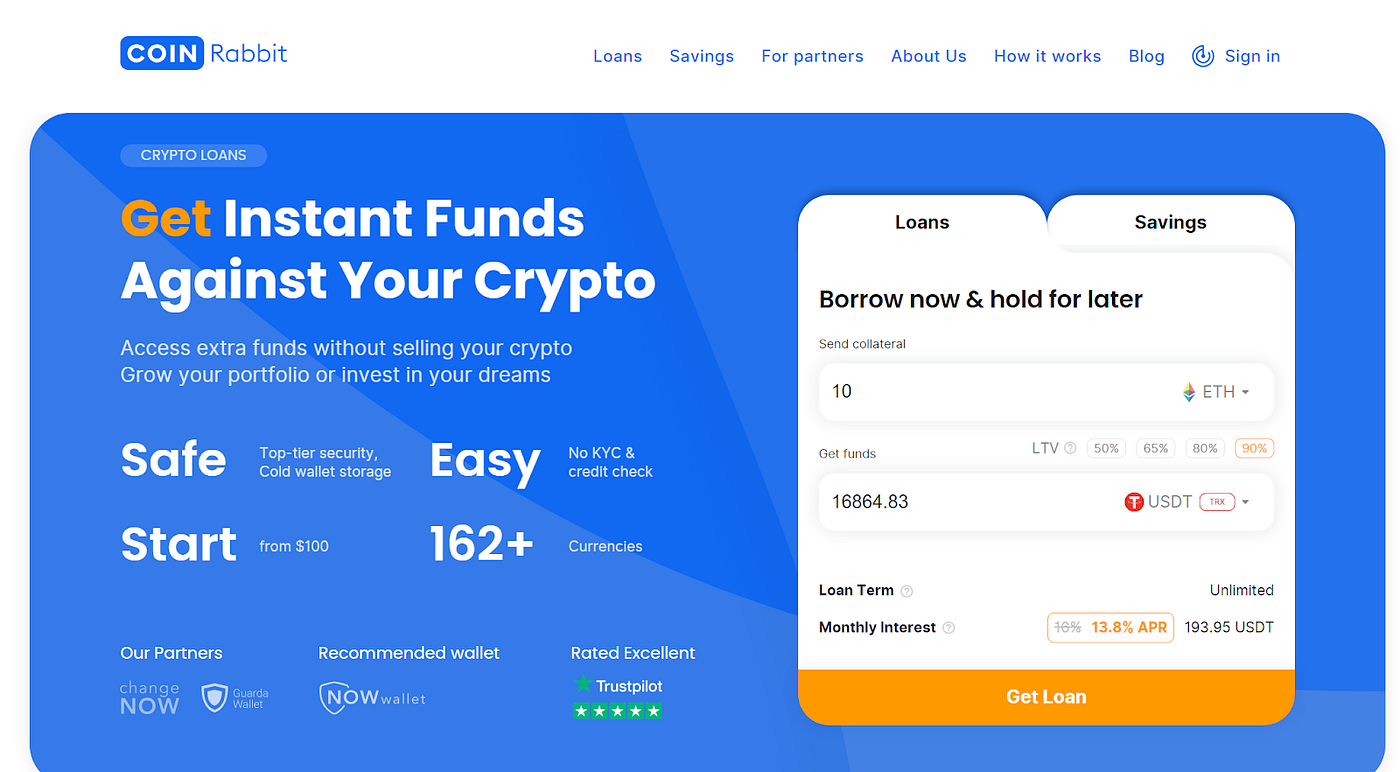

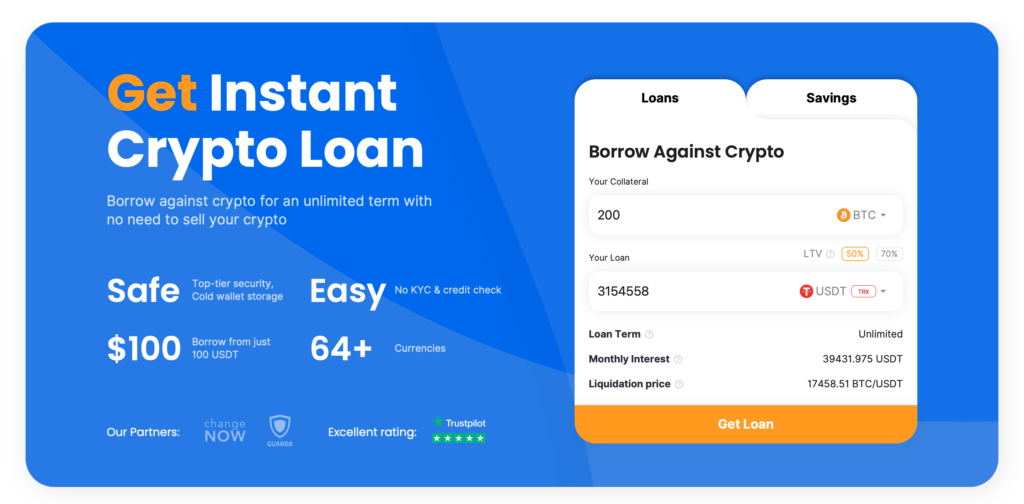

With a crypto loan service, individuals can quickly and easily borrow money using their personal crypto-assets as collateral. The loan amount is determined based on the value of the crypto assets at the time of borrowing, and the process is entirely automatic and secure.

One of the best things about crypto loans is that they can be obtained worldwide, without the need for a bank or any other conventional financial institution. Whether you’re looking to make a big purchase, pay off expenses, or simply need some extra cash, crypto loans can provide the funds you need in a matter of minutes.

Benefits of Crypto Loans

– Fast and easy application process: Unlike traditional loans, crypto loans typically don’t require extensive paperwork or lengthy approval times. With just a few simple steps, you can apply and receive your funds quickly.

– Secure and protected: Crypto loans utilize blockchain technology to ensure the security and privacy of your personal and financial data. Your crypto assets are held securely in wallets, and all transactions are recorded on the blockchain for transparency.

– Flexible loan-to-value ratios: Depending on the loan service, you can borrow against a certain percentage of the value of your crypto assets. This allows you to preserve your holdings while still accessing the funds you need.

– Low interest rates: Crypto loans often come with competitive interest rates, allowing you to borrow money at a lower cost than traditional loans. This can save you money in the long run.

– Automatic repayment options: Many crypto loan services offer automatic repayment options, meaning that you don’t have to worry about making monthly payments. The repayment is taken directly from your crypto assets, making the process hassle-free.

Whether you’re thinking about using a crypto loan service or are already familiar with the benefits they offer, it’s important to do your research and choose a reputable company that you can trust. With the right tools and information, a fast and easy crypto loan can be a convenient and efficient way to access funds when you need them most.

Instant Crypto Loan: Quick Access to Funds

When you need quick access to funds, an instant crypto loan can be a convenient solution. With an instant crypto loan, you can borrow money against your crypto assets, allowing you to unlock the value of your holdings without selling them.

There are several advantages to obtaining an instant crypto loan. First and foremost, you don’t have to sell your crypto, which means you can still benefit from any potential price increases in the future. Additionally, the loan process is quick and easy, often requiring only a few minutes to complete. Once approved, the funds are typically transferred to your account within a matter of minutes, enabling you to meet your financial needs without delay.

Another benefit of instant crypto loans is the flexibility they offer. You can use the funds for a variety of purposes, such as paying off debt, funding a business opportunity, making a large purchase, or covering unexpected expenses. The choice is yours, and there are no restrictions on how you can use the loan.

Furthermore, with an instant crypto loan, you don’t have to worry about credit checks or providing proof of income. The loan is secured by your crypto assets, so your credit score and financial situation don’t impact your eligibility. This makes instant crypto loans accessible to a wide range of users, including those who may have difficulty obtaining traditional loans.

It’s also important to note that instant crypto loans come with competitive interest rates. Depending on the platform or service you choose, interest rates can be as low as 4.9% APR, making them a cost-effective borrowing option compared to traditional loans or credit cards.

If you’re concerned about the security of your crypto assets, rest assured that reputable lenders implement strict security measures to protect your holdings. Additionally, some platforms offer insurance coverage for your crypto assets, providing an extra layer of protection against potential risks.

To apply for an instant crypto loan, you typically need to create an account with a supported platform, like Nexo, and verify your identity. Once this is done, you can select the amount you want to borrow, the loan term, and the crypto assets you wish to use as collateral. The loan-to-value ratio determines how much you can borrow, with most platforms offering loans up to 50-75% of the value of your crypto assets.

When it comes to repayments, you have the flexibility to choose how you want to repay the loan. You can make regular monthly payments, or you can simply repay the loan in full at the end of the term. The choice is yours, and there are no penalties for early repayment.

In conclusion, instant crypto loans provide quick and easy access to funds without the need to sell your crypto assets. These loans offer flexibility, competitive interest rates, and accessibility to a wide range of users. Whether you need to cover unexpected expenses, fund a business opportunity, or simply want to borrow against your holdings, an instant crypto loan can be a valuable financial tool.

Get Premium Rates with Platinum Status

One of the key benefits of having Platinum Status on the Instant Crypto Loan platform is the ability to access premium rates. With Platinum Status, you can enjoy lower interest rates on your crypto loans compared to the rest of the borrowers.

To determine whether you qualify for Platinum Status, the platform takes into account various factors. This includes the amount of fiat or cryptocurrency you have used to secure a loan, the loan-to-value ratio, and the duration of your loan. The higher the value of these factors, the higher the chances of being granted Platinum Status.

By using the Instant Crypto Loan platform, you can work towards achieving Platinum Status and enjoy the benefits it brings. Whether you use your loan to make a big purchase or as a line of credit for your business, having Platinum Status ensures that you get the best possible rates.

With Platinum Status, you also have access to additional perks. For example, you can withdraw your loaned crypto even before the loan maturity date without incurring any penalties. This flexibility allows you to take advantage of potential price increases in the market.

Furthermore, Platinum Status comes with insurance coverage to protect your loaned assets. In the unlikely event of any security breach or loss, your funds are secure and protected. This added layer of security gives you peace of mind while using the Instant Crypto Loan platform.

If you want to learn more about how to achieve and maintain Platinum Status, you can visit the Nexo website to find detailed information and data on the requirements and benefits. By working towards Platinum Status, you can maximize the potential of your crypto assets and make the most of your borrowing experience on the Instant Crypto Loan platform.

Keep Your LTV Below 20 for Best Rates

When taking out a crypto loan, it is important to keep your loan-to-value (LTV) ratio below 20%. Doing so will ensure that you can enjoy the best interest rates on your loan.

By maintaining a low LTV ratio, you can minimize the risk for lenders and demonstrate that you have enough collateral to secure your loan. This is especially crucial in the volatile cryptocurrency market, where significant price changes can occur in a matter of minutes.

If your LTV ratio exceeds 20%, it may have implications on the terms of your loan. Lenders may charge higher interest rates or require additional collateral to mitigate the risk. To avoid these potential issues, it is advisable to keep your LTV below the recommended threshold.

One way to achieve a low LTV ratio is by using stablecoins as collateral. These cryptocurrencies are pegged to a stable asset, like the U.S. dollar, and their value is less likely to fluctuate compared to other cryptocurrencies. Popular stablecoins like Tether (USDT) and USD Coin (USDC) can be used as collateral, providing a secure backing for your loan.

Furthermore, some platforms offer flexible loan terms, allowing you to adjust and monitor your collateral to maintain a healthy LTV ratio. For example, on the Changenow platform, you can easily make changes to your loaned cryptocurrency or add more collateral to keep your LTV ratio below 20%.

In conclusion, keeping your LTV ratio below 20% is crucial for obtaining the best loan rates and ensuring the security of your loan. By using stablecoins as collateral and utilizing the available tools to monitor and adjust your collateral, you can maintain a healthy LTV ratio and maximize your borrowing potential.

Flexible Options to Switch Between Rates

When it comes to accessing crypto loans, it’s important to have flexible options for switching between rates. With our instant crypto loan platform, you have the freedom to choose the rate that works best for your needs. Whether you want a lower rate for more cost-effective borrowing or a higher rate to earn more on your portfolio, you can switch easily and quickly.

By utilizing our platform, you have the ability to switch between rates depending on your desired terms. If you want to optimize your earning potential, you can select a higher rate and borrow against your cryptocurrency. On the other hand, if you want to minimize your debt, you can choose a lower rate and repay your loan in minutes or up to a year.

With our flexible options, you can switch between rates as often as you need, allowing you to secure the best terms for your financial situation. Whether you’re looking to earn more or pay back your loan faster, our platform gives you the opportunity to do so with ease.

It’s important to note that switching rates may have different terms and conditions, depending on the selected rate. However, our platform provides detailed information on the terms and benefits for each rate, so you can make an informed decision.

If you have any questions about switching rates or the terms of our loans, our FAQ section is here to help. We also offer insurance to secure your funds, although it’s not mandatory, giving you further peace of mind while utilizing our platform.

With our instant crypto loan platform, you have the flexibility to switch between rates and tailor your borrowing experience to your specific needs. Whether you’re looking to earn more, pay back your loan quickly, or simply have the ability to switch as needed, our platform provides the flexibility and options you’re looking for.

Our Standard Offering

At Instant Crypto Loan, we understand the importance of quick and easy access to crypto loans. That’s why our standard offering is designed to provide you with the flexibility you need to repay your loan while keeping your assets safe and secure. With our platform, you can borrow against a variety of cryptocurrencies, including Bitcoin, Ethereum, and Ripple.

One of the key features of our standard offering is the option to choose the repayment terms that work best for you. Whether you prefer to make monthly payments or repay the loan in a lump sum, we have the flexibility to accommodate your needs. This allows you to make changes to your repayment schedule as your financial situation changes.

When you borrow from us, you don’t have to worry about spending your loan on just one thing. You can use the funds for anything you desire, whether it be covering unexpected expenses, making a big purchase, or investing in other assets. Our platform is designed to give you the freedom to use the loan in the way that best suits your needs.

In order to ensure the security of your assets, we have implemented a number of measures. Our platform uses top-notch security protocols to keep your funds safe and secure. Additionally, we have a team of experts available to provide 24/7 support and answer any questions you may have.

Why Choose Our Crypto Loan Service

If you are looking for a quick and easy way to get access to instant crypto loans, our service is the perfect choice. We have designed our platform to provide a standard and efficient loan process, ensuring that every borrower has a seamless experience.

With our crypto loan service, you can have funds in your account in just a matter of minutes. Instead of going through the lengthy and cumbersome process of traditional bank loans, we offer a simple and fast solution.

Repaying your loan is also hassle-free with our service. You can easily send the repayment amount directly from your crypto account, eliminating the need for credit checks or complicated paperwork.

When it comes to security, we understand the importance of safeguarding your assets. That’s why we prioritize the highest level of security measures in order to keep your personal and financial information safe.

If you have any questions about the loan process or security measures, our dedicated support team is available to assist you. We provide 24/7 customer service to ensure that all your concerns are addressed in a timely manner.

Our crypto loan service is not bound by geographical limitations. We operate worldwide and provide services in multiple jurisdictions, allowing borrowers from different countries to access our platform.

Moreover, our loan-to-value ratio is designed to give you the maximum benefit. You can borrow up to a certain percentage of your crypto assets, giving you the flexibility to use your funds as desired.

With our service, you can also earn interest on your crypto assets while your loan is active. This unique feature lets you keep your earning potential intact and even grow it over time.

In case you want to add more funds to your loan, we offer an extension option. This allows you to increase your loan amount if needed, ensuring that you have enough funds to cover your expenses.

The entire process of getting a crypto loan through our service is quick and efficient. Within a few hours, you can have the desired funds in your account, making it convenient for your immediate needs.

So, if you are looking for a reliable and convenient crypto loan service, choose us. With our flexible and automatic loan system, we make the whole process seamless and stress-free.

Secure and Reliable Loan Process

At Nexo, we have developed a highly secure and reliable loan process to ensure the safety and trust of our customers. Our platform utilizes state-of-the-art blockchain technology, reducing the risk of any fraudulent activity. Every transaction is encrypted and securely stored, keeping your data safe from any unauthorized access.

With Nexo, you have access to the best loan rates available worldwide. We continuously analyze the market to offer you the most competitive rates, allowing you to borrow at the lowest possible cost. Our automated system quickly evaluates your collateral and approves your loan application, so you can get the funds you need without any delays.

We understand that time is of the essence, so we have designed our loan process to be fast and efficient. Once approved, you can receive your funds in just a matter of minutes. Our 24/7 customer support is always available to assist you with any questions or concerns you may have, ensuring a smooth loan experience.

Nexo’s loan process does not require extensive paperwork or credit checks. We believe in making the loan process as hassle-free as possible for our customers. Simply deposit your cryptocurrency as collateral, and you are able to borrow up to 30+ stablecoins or fiat currencies. Repayments are automatic and can be triggered by the borrower or their accountant, ensuring that you never miss a payment.

In addition to the fast and secure loan process, Nexo also offers flexible repayment conditions. You have the option to choose the repayment schedule that works best for you, whether it’s monthly or at the end of the loan term. We also understand that the value of cryptocurrencies can change, so we allow borrowers to initiate additional transfers to maintain the required loan-to-value ratio.

With Nexo, you can trust that every aspect of your cryptocurrency loan is handled with utmost care and security. Our platform has been operating since 2018, and we have provided loans to customers worldwide. We ensure that every borrower is able to repay their loan without becoming overdue, keeping your assets safe and your finances in good standing.

Competitive Interest Rates

One of the key factors to consider when seeking a crypto loan is the interest rate. With our instant crypto loan service, we offer competitive interest rates to ensure that you get the best deal possible.

How are our interest rates calculated? Well, it’s pretty simple. When you apply for a loan and provide collateral in the form of your digital assets, our system checks the current market value of those assets. Based on this information, we calculate the interest rate that you are eligible for.

Our interest rates are available for you to see before you even start the loan application process. This means you can compare our rates with other providers and make an informed decision about where to get your loan.

What happens if the interest rate changes over time? Don’t worry, our system automatically recalculates your interest rate on a daily basis. This means that if the market conditions change, your interest rate will be adjusted accordingly.

Our competitive interest rates are designed to help you optimize your loan experience. Whether you need the loan for a short-term expense or a long-term investment opportunity, we offer rates that suit your needs.

Additionally, our interest rates are calculated based on the loan-to-value ratio. This means that if you provide more collateral, you may be eligible for a lower interest rate. It’s just another way we strive to provide the best loan options for our customers.

So, if you’re looking for an easy and convenient way to get a crypto loan at competitive interest rates, look no further. Apply today and see how our instant crypto loan service can help you meet your financial goals.

Transparent Terms and Conditions

When it comes to crypto loans, it is important to have transparent terms and conditions. We understand the importance of providing our customers with clarity and ensuring they fully understand the terms of their loan.

Our platform offers transparent terms and conditions that are easily accessible for our customers to review. These terms outline important details such as loan duration, interest rates, and repayment options. By providing this information upfront, we aim to increase transparency and build trust with our customers.

As a credible loan provider, we offer competitive interest rates for our loans. Our platform uses a premium algorithm to determine interest rates based on various factors such as your credit score and the amount of crypto collateral you provide. This ensures that the loan rates our customers receive are fair and reflect their individual circumstances.

Additionally, we understand the importance of protecting our customers’ assets. Our platform uses cutting-edge technology to monitor the market rate of various digital currencies. If the value of your collateral drops by a certain percentage, we will notify you and give you the option to add more collateral or initiate a partial repayment to maintain a healthy loan-to-value ratio. This proactive approach ensures that our customers’ assets are protected.

Our transparent terms and conditions also include a clear process for loan repayment. We offer flexible repayment options, allowing customers to choose between monthly or balloon payments. Additionally, we provide a grace period of 24 hours after the due date to allow for any unexpected delays. If the loan repayment is not made within this period, we will initiate the closure of the loan and sell the collateral to cover the outstanding balance.

In summary, our platform offers transparent terms and conditions for crypto loans, with competitive interest rates, proactive asset protection, and flexible repayment options. Whether you are looking to open a loan or are considering receiving support, we ensure that you are fully informed and have a clear understanding of the terms of your loan.

About 24/7 Customer Support

When it comes to accessing crypto loans quickly and easily, Nexo is here for you with their 24/7 customer support. Whether you have questions about the loan process or need assistance with your account, their dedicated team is ready to help you resolve any issues promptly.

With Nexo, you can access customer support around the clock, ensuring that you never have to wait long to get the answers or assistance you need. Whether you’re on the verge of making a decision or have encountered a problem, having close support at hand can save you time, trouble, and headaches.

When it comes to your money and personal information, you can rest assured that Nexo takes your security seriously. Their customer support team is trained to handle all inquiries with the utmost discretion and professionalism, ensuring that your data remains safe and confidential at all times.

In the event that you need assistance with your loan or have concerns about the repayment process, Nexo’s customer support team can help you navigate the process. They can provide guidance on how to repay the loan, how to optimize your portfolio for the best results, and any other questions you may have regarding the loan terms or options.

Whether you’re new to cryptocurrencies or a seasoned investor, the Nexo customer support team is there to assist you. They can help you learn more about different digital currencies, how they fluctuate in value, and how to navigate the ever-changing world of crypto finance.

No matter where in the world you are, Nexo’s 24/7 customer support is available to help. With support for a variety of countries worldwide, you can count on their team to be there when you need them. So, if you have any questions or concerns about your loan or account, don’t hesitate to visit Nexo’s website or contact their customer support team directly.

How to Apply for an Instant Crypto Loan

Applying for an instant crypto loan is fast and easy. In just a few clicks, you can have access to a crypto loan that is backed by your own digital assets.

Here’s how the process works:

- Choose a trusted lender: Explore different lending platforms and compare their terms and rates. Look for platforms that offer secure and reliable services.

- Register and secure your account: Sign up for an account with the lender of your choice. Provide the necessary information and complete the necessary security measures such as setting up two-factor authentication.

- Verify and deposit your collateral: To secure your loan, you will need to deposit your desired digital assets as collateral. The lender will typically use an oracle or other trusted source to determine the value of your collateral.

- Choose your loan terms: Select your desired loan amount and choose the loan-to-value (LTV) ratio that best fits your needs. LTV ratio refers to the percentage of your collateral’s value that you can borrow.

- Agree to the terms and trigger the loan: Read and agree to the loan terms provided by the lender. Once you confirm your agreement, you can click on the “Submit” or “Request Loan” button to trigger the loan process.

- Receive your crypto loan: Once the lender verifies your collateral and processes your loan, you will receive the loan amount in your designated wallet. This allows you to use the funds for any purpose you like, whether it’s investing, spending, or other financial needs.

- Repay the loan: Make regular monthly payments to repay the loan according to the agreed-upon terms. Failure to repay the loan can result in the lender taking possession of your collateral.

Applying for an instant crypto loan gives you the flexibility to access the value of your digital assets without selling them. It allows you to optimize your investment strategy and take advantage of market opportunities.

If you have any questions or want to learn more about the process, you can visit the lender’s website or contact their customer service for assistance.

With instant crypto loans, you have control over your assets and can take advantage of the fast and convenient application process. So whether you need funds for personal expenses or to seize market opportunities, an instant crypto loan can be the solution you’ve been looking for.

Frequently asked questions:

How quickly can I get a crypto loan?

With an instant crypto loan, you can get your money within minutes, as the process is fast and efficient. No need to wait for days or go through lengthy approval processes.

Are there any requirements to get an instant crypto loan?

Yes, there are some requirements you need to meet in order to qualify for a crypto loan. These requirements may vary depending on the lending platform, but generally, you need to have a sufficient amount of cryptocurrency as collateral and pass the platform’s Know Your Customer (KYC) verification process.

How much can I borrow with a crypto loan?

The amount you can borrow with a crypto loan depends on several factors, such as the value of the cryptocurrency you provide as collateral and the loan-to-value (LTV) ratio set by the lending platform. Typically, you can borrow up to a certain percentage of the value of your collateral.

What happens if I can’t repay my crypto loan?

If you’re unable to repay your crypto loan, your collateral may be liquidated by the lending platform to recover their funds. The specific details and procedures may vary depending on the platform, so it’s important to carefully read and understand the terms and conditions before taking out a loan.

Can I use any cryptocurrency as collateral for a crypto loan?

Most lending platforms accept popular cryptocurrencies like Bitcoin and Ethereum as collateral for crypto loans. However, the specific cryptocurrencies accepted may vary depending on the platform. It’s important to check the list of accepted cryptocurrencies before applying for a loan.

Videos:

Take cryptocurrency loan without deposit at bch.credit

Get Instant Crypto Loans