As cryptocurrency becomes more popular, many individuals have questions regarding how to report their crypto transactions on their tax return. This step-by-step guide will walk you through the process of reporting crypto on TurboTax in 2023, using the services of tokentax. Whether you are involved in mining, trading, or receiving crypto as gifts, this guide will provide you with the information you need to accurately report your crypto activities and stay in compliance with the IRS.

One question that often arises is whether or not you need to report crypto earnings. The short answer is yes. While it might seem tempting to overlook reporting small transactions, the IRS requires reporting any gains made from the sale or exchange of cryptocurrencies. This includes not only investments but also activities such as mining or receiving crypto as payment for goods or services.

If you have received a 1099-MISC, you will need to adjust the information provided on your tax return. This form is typically used to report miscellaneous income, and crypto earnings can fall into this category. If you did not receive a 1099-MISC, you will still need to report your crypto earnings, even if they are not summarized on an official form.

Begin the Process: Gather Your Crypto Transactions

To accurately report your cryptocurrency transactions on TurboTax, it is important to gather all relevant information about your crypto activity. While the process can be complex, TurboTax provides a step-by-step guide that will help you navigate through it. However, if you’re unsure about any aspect, it’s always best to consult with a tax expert first.

The first step is to keep track of all your cryptocurrency transactions throughout the year. This includes any purchases, sales, trades, mining rewards, staking rewards, airdrops, or any other form of crypto-related activity. Select a reliable method to document these transactions, such as using a digital wallet or a spreadsheet.

When it comes to reporting taxes, TurboTax recommends providing information related to your crypto transactions using TokenTax. By downloading the desktop version of TokenTax, you can easily import your transactions from various platforms and exchanges. This software supports a wide range of tokens and provides the necessary forms and documents for reporting.

One essential component of reporting crypto taxes is determining whether your transactions are considered short-term or long-term. This distinction refers to how long you have held the coins before making a transaction. Short-term transactions typically occur within a year and are taxed at ordinary income rates. Long-term transactions are held for more than a year and are subject to capital gains tax rates.

If you have received any airdrops or participated in staking, it’s important to report these activities as well. TurboTax offers a question on the reporting screen specifically for these types of transactions. Simply answer the question and provide the necessary details to ensure accurate reporting.

In some cases, you may have received cryptocurrency as payment for goods or services, or even as wages for self-employment. These transactions count as income and should be reported accordingly. TurboTax has a specific section dedicated to reporting income from self-employment, making it easier to include these earnings in your tax returns.

To streamline the process, TurboTax allows you to generate a transaction summary report that includes all relevant information for reporting your crypto transactions. This summary can be easily exported and saved for future reference. If you have any questions or concerns about tax reporting for cryptocurrencies, TurboTax provides resources and support to help you get started.

Understand Your Tax Obligations for Cryptocurrency

When it comes to cryptocurrency, it’s important to understand your tax obligations. As the most innovative financial asset of our time, cryptocurrency has gained popularity and the interest of regulators. Here are some key points to help you navigate your tax responsibilities:

Maintain Accurate Records

Keeping accurate records is critical when dealing with cryptocurrency. You should retain documentation that details every transaction, including the date, the amount, the type of cryptocurrency, and the fair market value at the time of the transaction. Repeat this process for every transaction to ensure you have all the necessary information to report.

Reporting Requirements

The Internal Revenue Service (IRS) recognizes cryptocurrency as property, not currency. Therefore, when you sell or exchange cryptocurrency, it may trigger a taxable event, similar to selling stocks or other assets. It is recommend{‘ed’} to report each transaction separately rather than combining them into a single total.

Understanding Taxable Events

A taxable event occurs when you realize a gain or loss from disposing of cryptocurrency. This can happen when you sell or exchange cryptocurrency for fiat currency, other cryptocurrencies, goods, or services. It’s important to note that simply sending cryptocurrency from one wallet to another does not trigger a taxable event, but selling or exchanging it does.

Uncover All Activity

It’s crucial to uncover all cryptocurrency activities that you have engaged in during the tax year. This includes not only buying and selling, but also receiving cryptocurrencies as a gift, through airdrops, or as part of a fork or protocol split.

Seek Professional Advice

Given the complexity of cryptocurrency taxation, many people find it beneficial to consult with a tax professional or accountant specializing in cryptocurrency. They can guide you through the process of filing your taxes and ensure that you meet your federal and state tax obligations.

Using Crypto Tax Software

There are several software programs available that can help simplify the process of preparing and filing your cryptocurrency taxes. Some popular options include TurboTax, CoinTracker, and CryptoTrader.Tax. These tools allow you to import your cryptocurrency transactions from various exchanges and generate detailed reports in a format suitable for filing your tax return.

By understanding your tax obligations and maintaining accurate records, you can navigate the cryptocurrency tax landscape with confidence. Whether you are a seasoned investor or new to the world of digital assets, ensuring compliance with tax laws is an essential part of your financial journey.

Choose TurboTax: Why it’s the Best Option for Reporting Crypto

TurboTax is the ideal platform when it comes to reporting your cryptocurrency transactions. Whether you are on the side hustle, engaged in self-employment, or simply an individual investor, TurboTax has got you covered.

TurboTax allows you to easily calculate your gains and losses from cryptocurrency transactions. With its user-friendly interface, you can input all the necessary data to accurately report your transactions. This includes long-term or short-term gains and losses, as well as any income you may have received from mining or staking.

One of the main benefits of using TurboTax for reporting crypto is the ability to import your transactions directly from various cryptocurrency exchanges and wallets. This saves you a significant amount of time and ensures that your data is accurately recorded. Additionally, TurboTax automatically searches for any taxable events that may have occurred, such as the sale or exchange of cryptocurrency.

TurboTax also provides detailed guidance on how to report each type of cryptocurrency transaction. Whether you have bought or sold crypto, received it as a gift, participated in airdrops or forks, or even used cryptocurrency in a barter transaction, TurboTax has the coverage and expertise to ensure that you report everything correctly.

If you have experienced any theft or loss of cryptocurrency, TurboTax offers guidance on how to report these incidents as well. While stolen funds are still taxable unless recovered, TurboTax helps you navigate the necessary steps to report the theft and potentially claim a deduction.

When it comes to reporting crypto, TurboTax goes above and beyond by providing detailed instructions on how to report on IRS Form 8949. This includes step-by-step guidance on how to calculate your gains and losses and which details to include in each section of the form. TurboTax takes the complexity out of reporting crypto, making it a hassle-free experience for users.

In summary, with its user-friendly interface, comprehensive guidance, and ability to import data from various exchanges and wallets, TurboTax is the best option for reporting cryptocurrency transactions. Whether you are a beginner or an experienced investor, TurboTax ensures that you accurately report your gains and losses, saving you time and maximizing your potential savings.

Create Your TurboTax Account or Log In

Before you can start reporting your crypto on TurboTax, you will need to create an account or log in if you already have one. TurboTax is a popular online tax preparation software that can help you navigate the complexities of reporting your cryptocurrency transactions.

If you are a new user, simply visit the TurboTax website and sign up for an account. You will be asked to provide some personal information and create a username and password.

If you are an existing TurboTax user, you can log in using your credentials. Once logged in, you will be able to access your previous tax returns and additional features to help you with your crypto reporting.

After you have created an account or logged in, you will have the option to import your crypto transactions into TurboTax. This can save you time and ensure accuracy when calculating your gains and losses. If you choose to import your transactions, make sure to have the necessary documents or reports ready from the platforms you used for crypto trading.

It is important to keep track of all your crypto transactions throughout the year, as the IRS has specific rules regarding the reporting of cryptocurrency income. Crypto is treated as property for tax purposes, so any event that results in a change of ownership, such as buying, selling, or trading tokens, should be reported.

Some important information to gather for reporting includes the date of each transaction, the value of the cryptocurrency at the time of the transaction, any fees or deductions associated with the transaction, and the specific details of each transaction (such as the number of tokens bought or sold).

If you received tokens as part of a staking or mining activity, you should also report these as income. The value of the tokens received should be included in your calculations.

If you received tokens as a result of a hard fork or airdrop, the IRS has not provided clear guidance on how to report these events. However, many tax professionals recommend reporting these tokens as taxable income at their fair market value at the time of receipt.

Once you have gathered all the necessary information, TurboTax provides easy-to-use tools and step-by-step guidance to help you accurately report your crypto transactions. You can enter your transactions manually or import them from popular crypto exchanges or trading platforms.

TurboTax partners with TokenTax and other platforms to provide easy importing options for your transactions. If you have used these platforms, you can connect them to TurboTax and import your transactions with just a few clicks.

If you have any specific questions or concerns about reporting your crypto on TurboTax, TurboTax has a helpful support team that can assist you. You can contact their support team directly or access their extensive knowledge base for answers to commonly asked questions.

Once you have entered all your crypto transactions, TurboTax will automatically calculate any gains or losses based on the information you provided. It will generate the necessary forms and schedules to include with your tax return.

It is important to review your completed tax return thoroughly before filing. Make sure all your transactions, gains, and losses are accurately reflected. If you have multiple years’ worth of crypto transactions, TurboTax allows you to file prior-year returns as well.

After reviewing and double-checking your information, you can file your tax return electronically through TurboTax. If you owe any taxes, TurboTax will help you schedule your payments. If you are expecting a refund, TurboTax will guide you on how to receive it.

Remember to keep records of your crypto transactions, including any documentation or reports provided by the platforms you used for trading. This is an important part of staying compliant with IRS regulations and being prepared for any future inquiries.

In summary, creating a TurboTax account or logging in is the first step in reporting your crypto transactions for tax purposes. Import your transactions, gather the necessary information, and use TurboTax’s tools and guidance to accurately calculate your gains and losses. Review your completed tax return and file electronically, keeping records of all your transactions and payments for future reference.

Select the Appropriate Tax Form for Crypto Reporting

When it comes to reporting your cryptocurrency earnings on TurboTax in 2023, it’s important to select the right tax form. TurboTax provides various forms that cater to different types of income and transactions.

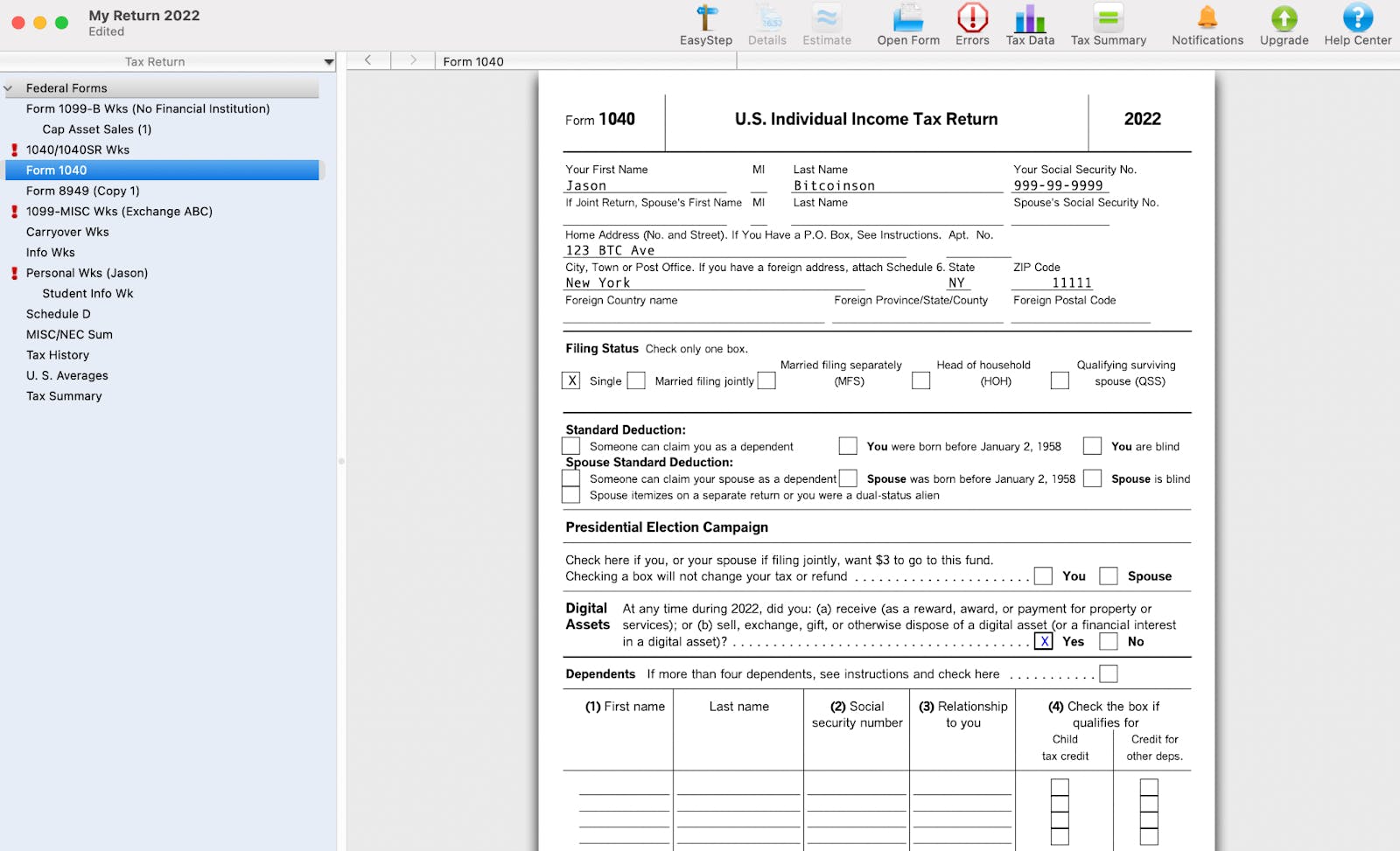

1. Individual Income Tax Form (1040)

This is the most common form used for reporting personal income. If you only occasionally trade or receive cryptocurrency as part of your income, you can report these transactions on Form 1040. Make sure to carefully review any carryovers or deductions from prior years.

2. Schedule C: Profit or Loss From Business

If you regularly mine or trade cryptocurrencies as a business, you may need to report your earnings on Schedule C. This form allows you to deduct expenses related to your crypto activities, such as mining equipment or trading fees. It’s important to correctly enter all the relevant income and expenses to ensure accurate reporting.

3. Schedule D: Capital Gains and Losses

If you’ve bought and sold cryptocurrencies like Bitcoin or Ethereum, you’ll likely need to report these transactions on Schedule D. This form provides a detailed breakdown of your capital gains and losses, including information on the date of purchase, sale, cost basis, and sale proceeds. TurboTax makes it easy to import this information if you have a digital account or online brokerage platform.

4. Schedule 1: Additional Income and Adjustments to Income

If you receive cryptocurrency as payment for goods or services, it should be reported on Schedule 1 as additional income. This form also allows you to report any deductions related to barter transactions. TurboTax has a built-in feature that makes it very easy to enter this type of income and deductions without much hassle.

Important Tips:

- Keep a folder on your computer where you store all your cryptocurrency transaction records. This will help you keep track of your earnings, making tax preparation easier.

- Make sure to review your transactions from the last tax year to ensure all relevant information is provided.

- Use the same user account or online platform to generate the necessary reports for proper reporting.

- If you have lost access to your crypto account or cannot retrieve your transaction history, TurboTax provides a comprehensive guide on how to obtain your transaction history.

- Take advantage of TurboTax’s import feature, which allows you to import your crypto transactions directly from your digital account or online brokerage.

- Remember, accurate reporting of your cryptocurrency earnings is crucial to avoid penalties or audits from the IRS.

- If you’re unsure about how to report certain transactions or need assistance with your crypto tax preparation, it’s recommended to consult with a tax professional.

Enter Your Personal Information

When reporting your crypto transactions on TurboTax in 2023, it is important to start by entering your personal information. This includes your full name, as well as any relevant tax identification numbers, such as your Social Security number or employer identification number.

Additionally, you will need to provide details about your filing status, such as whether you are married or single. This information will determine which tax brackets and deductions apply to you.

If you received a Form 1099-MISC in 2022 for any amounts related to your crypto activities, like receiving income or mining, you must report those amounts on your tax return. Even if you didn’t receive a Form 1099-MISC, you still need to report any taxable transactions, such as selling or trading cryptocurrencies.

Furthermore, you should also consider reporting any deduction for any prior year capital losses you may have incurred from your crypto activities. These losses can be used to offset any gains you have made in the current tax year, potentially reducing your tax liability.

It is important to note that when reporting your crypto transactions, you should provide as much detail as possible. TurboTax allows you to enter a detailed description for each transaction, including the type of cryptocurrency, the amount, the date, and the cost basis. This level of detail will help ensure accurate reporting and minimize any potential questions from the IRS.

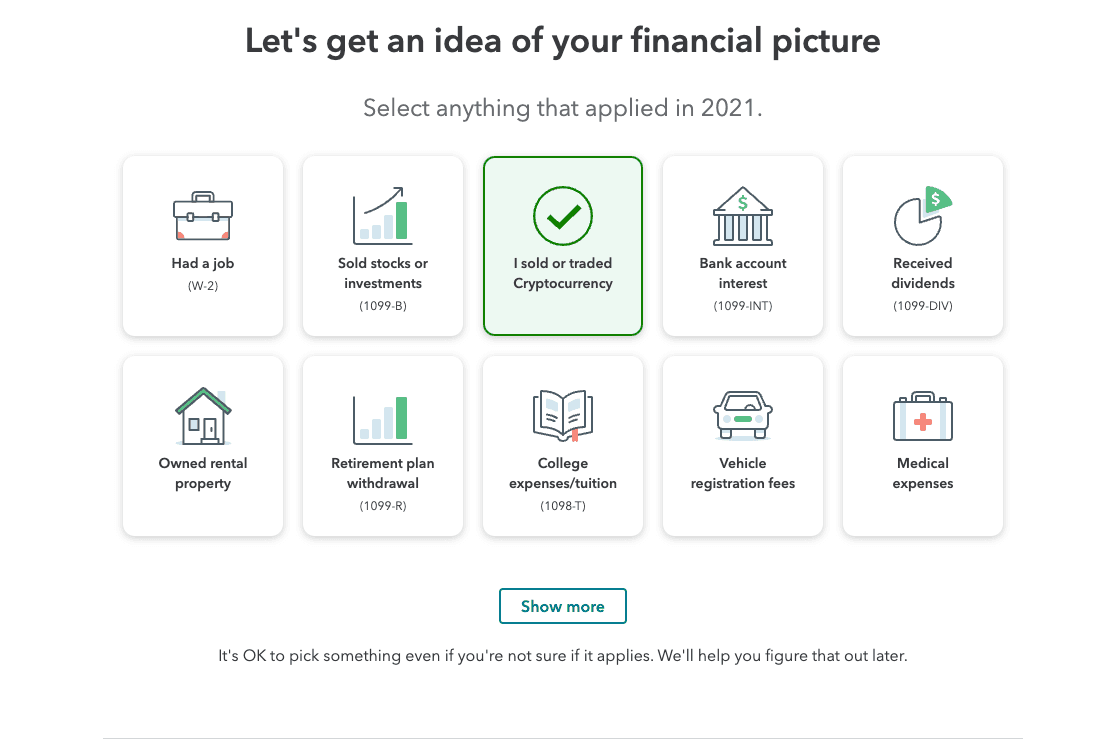

Import or Enter Your Crypto Transactions

When it comes to reporting your crypto transactions on TurboTax in 2023, one question you may have is how to import or enter your crypto transactions into the platform. Whether you’ve made a profit or incurred a loss from trading cryptocurrencies, it’s important to accurately report your transactions to ensure compliance with tax rules and regulations.

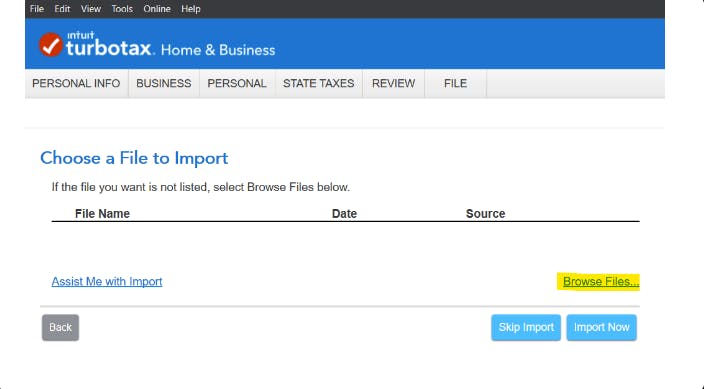

TurboTax provides two options for importing or entering your crypto transactions. The first option is to import your transactions directly from an exchange or platform that is supported by TurboTax. This can be done by clicking the “Import” button on the TurboTax screen and selecting the platform you used for your cryptocurrency activity. TurboTax supports a variety of platforms, including popular ones like Coinbase, Binance, and Kraken. Importing allows you to quickly and easily transfer your transaction data without manual entry.

If your exchange or platform is not supported for direct importing, or if you prefer to enter your transactions manually, TurboTax also provides the option to enter your transactions one by one. This can be done by selecting the “Enter Manually” button on the TurboTax screen. You will need to provide details for each transaction, including the date, type (buy, sell, or trade), amount, and cost basis. If you have multiple transactions, this process may take some time, but it allows you to accurately report all your cryptocurrency activity.

Regardless of which method you choose, it is important to keep track of your crypto transactions throughout the year. This includes transactions on trading platforms as well as transfers between wallets or exchanges. You may also need to consider any additional income or deductions related to your crypto activity, such as self-employment income or business expenses. TurboTax provides a step-by-step guide to help you navigate through these considerations and maximize your deductions.

If you’re new to reporting crypto on TurboTax or if you’ve had difficulties in the past, you may consider using software specifically designed for crypto tax reporting. Platforms like Accointing or CryptoTrader.Tax can help simplify the process by automatically syncing with your exchange accounts and generating tax reports based on your transaction history. While these platforms may come with a fee, they can save you time and ensure accurate reporting.

In summary, when it comes to reporting your crypto transactions on TurboTax in 2023, you have the option to import your transactions from supported platforms or manually enter them one by one. Keeping track of your transactions and accurately reporting them is crucial for staying compliant with tax rules. Consider using specialized crypto tax software if you have a large volume of transactions or complex reporting needs. TurboTax provides a comprehensive guide to help you through the process and maximize your deductions.

Double-Check Your Information for Accuracy

When it comes to reporting your cryptocurrency transactions on TurboTax, accuracy is essential. It’s important to double-check all of the information you provide to ensure that you are correctly reporting your crypto activities. This includes any transactions involving the buying, selling, or trading of cryptocurrencies.

One common mistake is forgetting to include any losses you may have incurred when reporting. Whether you lost money due to a failed investment or experienced a loss from mining activities, these losses should be reported. These losses can be deducted from any gains you may have earned, resulting in a lower taxable income.

Another important aspect to consider is the type of transaction you engaged in. Cryptocurrencies can be used for more than just buying and selling. They can also be used for barter or exchanged for other goods and services. If you made any non-traditional transactions, such as using cryptocurrency to purchase goods or services, you’ll need to report these as well.

Additionally, it’s crucial to accurately report the value of the cryptocurrencies you bought or sold. This value should be reported in US dollars and should reflect the fair market value of the cryptocurrency at the time of the transaction. TurboTax provides tools to help you find the most accurate exchange rates for reporting purposes.

If you received any cryptocurrencies as income or earned them through mining, you’ll need to report them as well. TurboTax has features specifically designed to help you report these types of income. Similarly, if you had cryptocurrencies stolen from you, it’s important to report this as a loss.

Finally, TurboTax allows you to select which cryptocurrency you are reporting on, making it easy to keep track of your different investments. If you made multiple transactions involving different cryptocurrencies, you’ll need to provide a description or other documentation to support your reporting.

In summary, to ensure accuracy when reporting your crypto activities on TurboTax, you need to double-check all provided information, report any losses or gains resulting from your transactions, include non-traditional transactions, accurately report the value of your cryptocurrencies, report any earned or stolen cryptocurrencies, and select the appropriate cryptocurrency you are reporting on.

Review and Calculate Your Cryptocurrency Tax Liability

To accurately report your cryptocurrency activity on your tax return, you need to review and calculate your tax liability. This involves gathering all the necessary information and ensuring that you have a complete record of your cryptocurrency transactions throughout the year.

Firstly, you’ll need to keep track of all your cryptocurrency trades, purchases, and sales. This includes any exchanges from one cryptocurrency to another, as well as any stock or asset trades that you may have made. Without keeping proper records, it can be challenging to accurately calculate your tax liability.

There are many ways to keep track of your cryptocurrency’s activity, including using online tools like TokenTax or manually creating an asset list that details each trade. These records will help you calculate your gains and losses accurately and answer any questions that the tax software may ask during the reporting process.

Once you have all your records in place, you can begin calculating your tax liability. Taxpayers typically report cryptocurrency gains and losses on Schedule D of their tax return. Using the information from your records, you’ll need to calculate the profit or loss from each trade and provide the total on your tax return.

If you have an attachment for charitable purposes or if your cryptocurrencies were stolen, there may be additional steps or deductions to consider. It’s important to review the IRS guidelines or consult with a tax professional to ensure you’re reporting correctly and taking advantage of any applicable deductions.

In conclusion, reviewing and calculating your cryptocurrency tax liability is an essential part of the reporting process. By keeping accurate records and following the necessary steps, you can ensure that your tax return is complete and accurate. Remember to consult with a tax professional if you have any doubts or need further guidance.

Submit Your Completed Tax Return and Pay Any Owed Taxes

Once you have completed your tax return using TurboTax or another tax filing software, it’s time to submit it and pay any owed taxes. Make sure to review all the information you have entered and double-check for any errors or miscalculations. If you are using TurboTax, you can easily file your crypto taxes by following their step-by-step guide.

If you are a Tokentax customer, you can download your completed tax return in a PDF format and submit it online. If you prefer to work with an accountant, you can provide them with the necessary documentation, including your completed tax return and any supporting records or receipts.

When it comes to paying any owed taxes, it is important to note that selling or exchanging cryptocurrencies is a taxable event. If you have sold or exchanged crypto during the tax year, you will need to report the proceeds as income.

Keep in mind that not all transactions are taxable. For example, if you received cryptocurrencies through an airdrop, it is generally considered taxable income. Similarly, if you received cryptocurrencies as payment or for providing a service, it is also considered taxable income.

Furthermore, if you have engaged in activities such as mining or staking, the income you earn from these activities is also taxable. You will need to report the income on your tax return.

It is important to keep track of all your cryptocurrency transactions and records throughout the year. This includes records of the date and time of each transaction, the type of transaction (buying, selling, exchanging), the amount of cryptocurrency involved, and the value of the cryptocurrency at the time of the transaction.

If you have any losses from your cryptocurrency activities, you may be able to offset them against your other income. However, you will need to meet certain requirements and keep proper records to substantiate your losses.

Finally, make sure to review all the information you entered before finalizing your tax return. If you discover any errors or omissions after submitting your return, you may need to file an amended return.

Remember, timely and accurate reporting of your crypto taxes is essential to avoid potential penalties and ensure compliance with tax laws. If you have any questions or are unsure about how to report your crypto taxes, seek the guidance of a tax professional.

Frequently Asked Questions:

Do I have to report my cryptocurrency transactions on TurboTax?

Yes, you are required to report your cryptocurrency transactions on TurboTax. The IRS considers virtual currencies like Bitcoin as property, and any gains or losses from these transactions are subject to taxation. Failure to report these transactions can lead to penalties and fines.

How do I report my cryptocurrency on TurboTax?

To report your cryptocurrency on TurboTax, you will need to use the software’s “Crypto” section. This section will guide you through the process of entering your transactions and calculating your gains or losses. You will need to provide details such as the date of acquisition, purchase price, sale price, and any related transaction fees.

What if I lost or had my cryptocurrency stolen?

If you lost or had your cryptocurrency stolen, you may still need to report it on TurboTax. However, you can potentially claim a loss deduction for the value of the stolen or lost crypto. It is important to keep records of these incidents, such as police reports or evidence of the loss, to support your claim.

Are losses from cryptocurrency transactions tax-deductible?

Yes, losses from cryptocurrency transactions can be tax-deductible. If you have experienced a net loss after calculating your gains and losses from your crypto transactions, you can use this loss to offset any other capital gains you may have made during the tax year. It is important to accurately report these losses on TurboTax to take advantage of this deduction.

Can I claim a loss deduction for stolen cryptocurrency?

Yes, if your cryptocurrency was stolen, you may be able to claim a loss deduction. However, you will need to provide evidence of the theft, such as a police report or documentation from the exchange or wallet in which the theft occurred. It is important to consult with a tax professional or use TurboTax to properly report and claim this loss deduction.

Video:

New and Easy Tax Guide to Cryptocurrency Taxation Rules & Reporting 2023

You DON’T Have to Pay Crypto Taxes (Tax Expert Explains)

✅ Koinly Step-by-Step Guide + TurboTax | Crypto Taxes Done Fast with Big REFUND!! [2023]

I have been using TurboTax to report my crypto transactions for the past couple of years, and it has been a smooth experience. The step-by-step guide provided in this article will definitely be helpful for newcomers. It’s important to stay compliant with tax laws and accurately report your gains. Thanks for sharing this informative guide!

Thanks for the helpful guide! It’s great to see TurboTax providing support for cryptocurrency reporting. As a trader, it can be confusing to navigate the tax implications of crypto earnings, but this step-by-step process makes it easier to ensure compliance with IRS regulations.

I found this guide really helpful. It’s important to accurately report crypto transactions to avoid any penalties from the IRS. TurboTax makes it easier with their step-by-step instructions. It’s great to see tools like this available for the crypto community.

I found this guide extremely helpful in understanding how to report my crypto transactions on TurboTax. It’s important to remember that even small transactions need to be reported to stay in compliance with tax laws. This step-by-step guide breaks down the process and ensures accuracy in reporting. Thanks for the valuable information!