If you have been considering taking out a crypto loan, it is important to understand how it may affect your credit score. While cryptocurrency has become increasingly popular, the impact of these loans on credit scores is still a relatively new concept. One company that offers crypto loans is BlockFi, a well-known and trusted player in the industry.

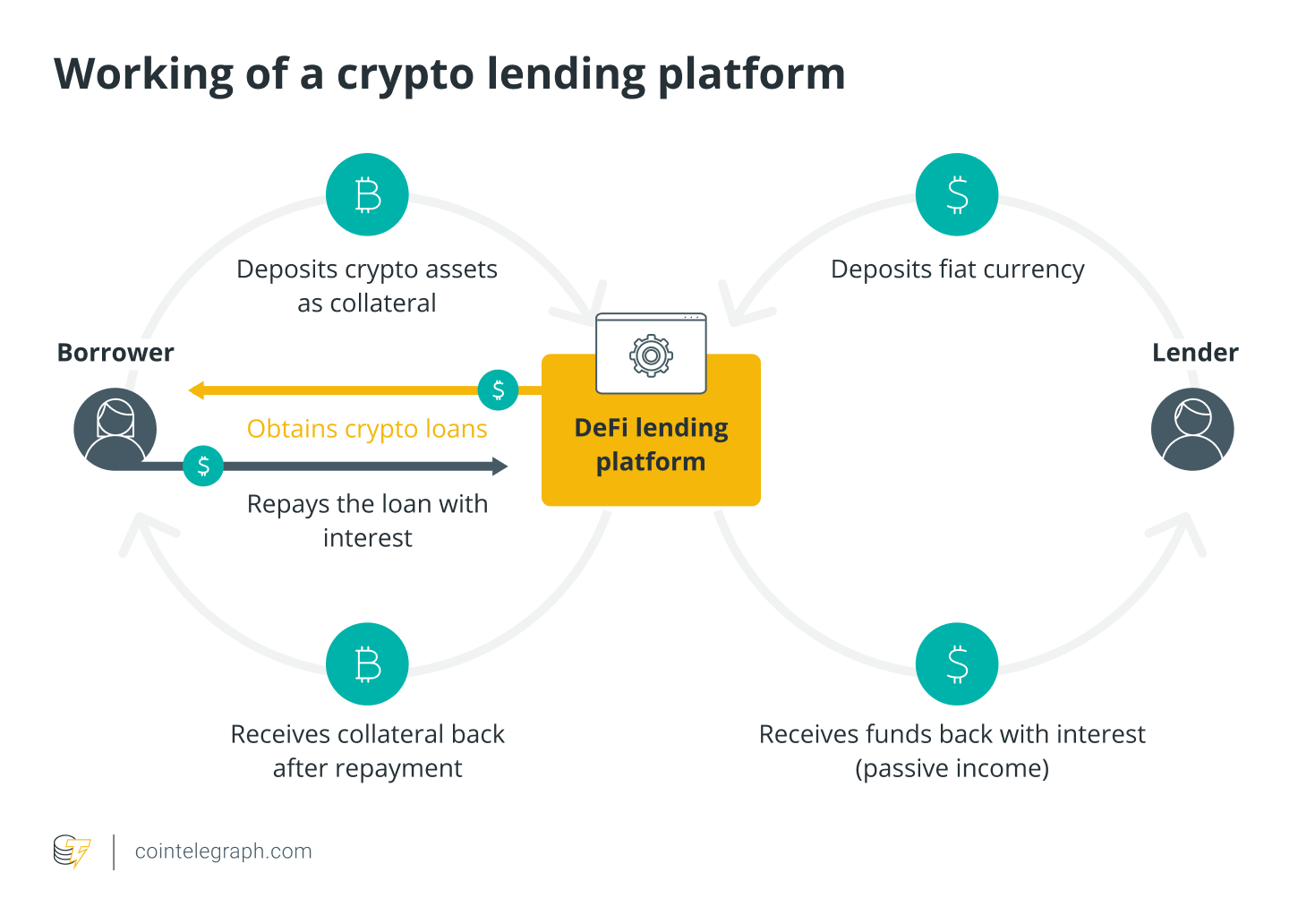

A crypto loan can be a secured loan, where you use your cryptocurrency as collateral. This means that if you fail to make payments on the loan, the lender has the right to liquidate your assets. BlockFi offers this type of loan, allowing you to take out a loan while keeping your physical cryptocurrency in a secure storage center.

One of the best aspects of a crypto loan is that you are not required to sell your cryptocurrency. This means that if the value of your cryptocurrency increases over time, you can potentially make a profit while still using it as collateral. This can be especially beneficial if you believe that the value of your cryptocurrency will continue to rise.

Another advantage of a crypto loan is that it may not appear on your credit report. Because BlockFi is a third-party company, they do not typically report to credit bureaus. This means that even if you were to default on your loan, it may not negatively impact your credit score.

However, it is important to note that if you choose to take out a crypto loan, it is still important to make your payments on time. Just because the loan may not be reported to credit bureaus does not mean that it will not be reviewed by other lenders. Before extending any type of credit, lenders will often review your credit history, including any loans or debts that may not appear on your credit report.

In conclusion, taking out a crypto loan can be a good option if you are looking to use your cryptocurrency as collateral without selling it. While it may not directly improve your credit score, it also may not negatively impact it if payments are made on time. However, it is important to review the terms and conditions of any crypto loan you are considering, as there may be drawbacks such as a freeze on your cryptocurrency assets or high interest rates. Make sure you choose a reputable company like BlockFi and understand all the basics before proceeding.

The Impact of a Crypto Loan on Your Credit Score

When it comes to applying for a crypto loan, it’s important to understand how it can potentially impact your credit score. While some applicants may see a positive effect, others may face challenges due to the unique nature of cryptocurrency.

Understanding Credit Scores and Crypto Loans

Your credit score is a reflection of your credit history and how you manage your debts and payments. Traditional loans are typically reported to credit bureaus, allowing lenders to assess your creditworthiness based on your past financial behavior. However, since crypto loans are relatively new and the industry is still evolving, the impact on credit scores can vary.

One key factor to consider is that crypto loans may not necessarily be reported to credit bureaus. This means that timely payments on your crypto loan may not result in an improvement to your credit score, as it would with a traditional loan. On the other hand, missed or late payments could also go unnoticed by credit bureaus, potentially sparing your credit score from negative effects.

The Role of Crypto Assets and Volatility

The use of cryptocurrency as collateral for a loan can introduce additional considerations. Crypto assets are known for their volatility, meaning their value can fluctuate significantly in a short period of time. In some cases, this volatility can work in your favor. For example, if the value of your crypto asset increases, it can potentially offset any negative impact on your credit score.

However, if the value of your crypto assets drops significantly, it could result in issues with your loan balance or even a margin call, where you’re required to provide additional collateral. Failing to meet these obligations can lead to negative consequences, including a potential impact on your credit score.

Exploring Alternatives and Resources

If you’re concerned about the potential impact on your credit score, it may be worth exploring alternative options. Some platforms offer crypto loans without requiring a credit check or reporting to credit bureaus. These loans are typically secured by your crypto assets, avoiding any potential impact on your credit score.

- However, it’s important to review the terms and conditions of these loans carefully and understand the potential risks involved.

- Additionally, seeking assistance from reputable third-party resources or experts in cryptocurrency lending can help you make a more informed decision about the right approach for your financial situation.

- Please note that the information provided herein is for informational purposes only and should not be considered financial or legal advice. For specific advice regarding your situation, it’s recommended to consult with a professional.

In conclusion, while a crypto loan can offer a quick and potentially secure option for accessing funds, it’s important to consider the impact on your credit score. Understanding the unique aspects of crypto loans, including their potential volatility and the reporting practices of lenders, can help you make an informed decision that aligns with your financial goals.

Understanding the Relationship between Crypto Loans and Credit Scores

When it comes to crypto loans, it’s important to understand how they can impact your credit score. Crypto loans operate in a digital space, allowing individuals to borrow against their cryptocurrency holdings. This approach differs from traditional, physical loans where you borrow money and must repay it with interest.

What You Need to Know

First and foremost, crypto loans may not always have an impact on your credit score. Unlike traditional loans, where the lender reports your repayment behavior to credit bureaus, crypto loans may not be reported, depending on the platform and your specific situation. This means that if you borrow cryptocurrency through a reputable and secure site, it may not appear on your credit report, neither positively nor negatively affecting your score.

While this lack of reporting can be seen as a benefit to those concerned about their credit score, it does have its drawbacks. Not having a crypto loan show up on your credit report means that responsible repayment will not directly improve your credit score. On the other hand, if you fail to repay the loan, it will also not negatively impact your credit score.

Benefits and Risks

The volatility of the cryptocurrency market is one of the major risks associated with crypto loans. Since the value of cryptocurrencies can fluctuate significantly, if the value of the cryptocurrency you borrowed against drops, you might end up having to repay a higher amount than what you initially borrowed. This volatility can make it difficult to predict the total cost of the loan and adds an element of uncertainty to the repayment process.

Additionally, taxes can be a significant concern when it comes to crypto loans. Once you sell your cryptocurrency to repay the loan, you may be subject to capital gains taxes. This is an important factor to consider when evaluating the overall cost of the loan and its impact on your financial situation.

Improving Your Credit Score

If you’re looking to improve your credit score, it’s important to understand that crypto loans may not be the best asset to use for that purpose. Since they may not be reported to credit bureaus, they may not have any impact on your credit score, whether positive or negative. If you’re specifically looking to build credit, it’s best to explore other options, such as traditional loans or credit cards, that are more commonly reported to credit bureaus.

In conclusion, crypto loans operate in a unique digital space where their impact on credit scores can vary. While they can offer quick financing and the ability to borrow against your cryptocurrency holdings, they may not have the same reporting and credit-building benefits that traditional loans have. It’s important to carefully weigh the risks and benefits before applying for a crypto loan and consider alternative options for improving your credit score.

How Crypto Loans Can Affect Your Credit History

Crypto loans can have both positive and negative impacts on your credit history, depending on how they are managed and repaid. It is important to understand the potential effects before considering this option.

Benefits of Crypto Loans:

- Opportunity to improve credit score: If you have a low credit score, obtaining a crypto loan and making timely repayments can help improve your credit history over time.

- Access to financing options: Crypto loans provide an alternative source of funding for individuals who may not qualify for traditional loans.

- Flexible terms: Crypto loans often offer more flexibility in terms of loan amounts, interest rates, and repayment options.

Potential Drawbacks:

- Volatility and market risks: The value of crypto assets can be highly volatile, which can expose borrowers to potential losses if the value of the collateral declines significantly.

- Interest rates and fees: Crypto loans may have higher interest rates compared to traditional loans, so borrowers need to carefully consider the costs involved.

- Credit checks and credit freeze: Some crypto loan providers may require a credit check, which can temporarily lower your credit score. Additionally, if you default on the loan, it could result in a credit freeze and negatively impact your credit history.

Understanding Crypto Loans:

Before taking out a crypto loan, it is crucial to fully understand how they work and their potential impact on your credit history. Research various providers and compare their terms, interest rates, and repayment options. Consider consulting with a financial advisor or someone experienced in crypto lending before making a decision.

Repaying Crypto Loans:

Once you have taken out a crypto loan, it is essential to make timely repayments to avoid negative consequences. Late or missed payments can be reported to credit bureaus, which will negatively impact your credit score. Set up reminders or automatic payments to ensure you stay on track.

Seeking Assistance:

If you have concerns about your ability to repay a crypto loan or need assistance with managing your finances, it is advisable to seek professional help. Financial advisors or credit counseling services can provide guidance and support to ensure you make informed decisions and maintain a healthy credit history.

Reporting Your Crypto Loan

When it comes to crypto loans, one important factor to consider is how they are reported to credit bureaus. Understanding how your crypto loan is reported can give you a better understanding of how it may impact your credit score.

Many crypto lending platforms offer loans backed by digital assets such as Bitcoin or Ethereum. These loans are secured by your crypto holdings and can be a great alternative to traditional loans. However, not all crypto loans are reported to credit bureaus.

If you’re looking to improve your credit score or qualify for other financial opportunities, it’s important to choose a crypto lending platform that reports your loan activity to credit bureaus such as Experian. This allows your loan history and repayment behavior to be reflected in your credit score.

While crypto loans may offer lower interest rates and more flexible repayment terms compared to traditional loans, it’s still important to understand the potential risks and implications of taking out a crypto loan. One significant risk is the volatility of the crypto market. If the value of your crypto collateral drops significantly, it may result in a high loan-to-value ratio, which can impact your credit score negatively.

When a crypto loan is reported to credit bureaus, it will appear on your credit report just like any other loan account. It will show the outstanding balance, payment history, and any delinquencies or late payments. This information can be accessed by lenders and creditors when reviewing your creditworthiness for future loans or financial decisions.

It’s also important to note that not all lenders or credit bureaus may consider crypto loans as a valid form of credit history. If you’re relying solely on crypto loans to build your credit, you may be limited in the types of financial opportunities you can qualify for. It’s always a good idea to have a mix of different credit accounts to demonstrate your ability to manage different types of credit.

In conclusion, if you’re considering a crypto-backed loan, make sure you understand whether it will be reported to credit bureaus. Reporting your loan can have a significant impact on your credit score and ability to qualify for future financial opportunities. By understanding the reporting process and potential implications, you’ll be able to make an informed decision about whether a crypto loan is the right choice for your financial situation.

Why It’s Important to Report Your Crypto Loan

Reporting your crypto loan is crucial for several reasons. First and foremost, it helps you establish a credit history in the crypto lending market. By reporting your loan, you contribute to a transparent and reliable ecosystem where lenders can assess your creditworthiness based on your repayment history.

Additionally, reporting your crypto loan can have a positive impact on your credit score. Just like with traditional loans, timely repayment of your crypto loan will reflect positively on your credit history and can improve your overall creditworthiness.

By reporting your crypto loan, you are helping to create a more accurate and comprehensive image of your financial standing. This can be particularly beneficial if you plan to apply for other types of loans or credit in the future, as lenders will have a complete picture of your financial responsibilities and how you have managed them in the past.

Not only does reporting your crypto loan help you build a good credit history, but it also ensures the security and privacy of your personal information. Trusted platforms and reporting mechanisms have measures in place to protect your data and keep it confidential.

Furthermore, reporting your crypto loan can help to prevent fraud and other illicit activities. By having a record of your loan, lenders can verify the information you provide and detect any suspicious or fraudulent activity in a timely manner.

Overall, reporting your crypto loan offers many benefits. It helps you establish credit history, improve your credit score, maintain privacy, and prevents fraudulent activity. Make sure to report your crypto loan to reap these advantages and contribute to a more transparent lending ecosystem.

Steps to Report Your Crypto Loan

If you have taken out a crypto loan and want to ensure that it is being reported accurately to the credit bureaus, there are several steps you can take:

- Understand the Reporting Process: Before applying for a crypto loan, it’s important to understand how the lender reports the loan to the credit bureaus. Not all lenders will report crypto loans, so make sure to ask about this before proceeding.

- Check Your Credit Report: Before and after taking out a crypto loan, it’s a good idea to regularly check your credit report for any inaccuracies or negative information. This will help you identify any issues and take appropriate action.

- Retain Loan Documentation: Keep all documentation related to your crypto loan, including the loan agreement, payment receipts, and any other relevant information. This will serve as proof of your loan and can be useful if there are any disputes or discrepancies.

- Report to Credit Bureaus: If your lender does not automatically report your crypto loan to the credit bureaus, you can take steps to report it yourself. This may involve submitting a request to the credit bureaus and providing them with the necessary documentation.

- Follow Up: Once you have reported your crypto loan, it’s important to follow up with the credit bureaus to ensure that the information is updated and accurately reflects your loan. This may involve providing additional documentation or answering any questions they may have.

By following these steps, you can ensure that your crypto loan is reported correctly and that it has a positive impact on your credit score. This will help you build a good credit history and open up future financing options.

Reporting Your Crypto Interest Account

When it comes to crypto lending and borrowing, one important aspect to consider is how your activities will be reported and how they can impact your credit score. Many crypto lending platforms, such as BlockFi, offer the option to earn interest on your cryptocurrency holdings. However, it’s important to understand how these platforms report your crypto interest account.

Depending on the platform, reporting methods can vary. Some platforms only report a minimum amount of information, such as your interest earnings, while others may provide a full overview of your borrowing and lending activities. It’s important to understand what information will be reported, as it can impact your credit score.

Generally, crypto loans are not considered traditional loans, and therefore they may not have a direct impact on your credit score. However, some lenders may report your outstanding loan balances, which could potentially have an impact on your credit score. It’s important to check with your lender to understand whether they report to credit agencies and what information they report.

One of the benefits of crypto lending is its privacy and the secure nature of the transactions. Due to the decentralized and anonymous nature of cryptocurrencies, many crypto lending platforms do not require credit checks or other traditional financing hoops to jump through. This means that your personal and financial information is generally not being shared with third parties.

While crypto loans may not directly impact your credit score, it’s important to remember that other factors can indirectly affect your score. For example, if you sell your cryptocurrencies to pay off a loan, it may result in capital gains or losses, which can impact your tax obligations. It’s essential to consult with a financial advisor or tax professional to ensure accurate reporting of your crypto activities.

Overall, reporting your crypto interest account can vary depending on the platform you use. Some platforms may provide more comprehensive reporting, while others may only report minimal information. Understanding how your activities are reported can help you make informed decisions about your crypto lending and borrowing strategies.

The Importance of Reporting Your Crypto Interest Account

When it comes to managing your finances, understanding your credit score is crucial. One area that can have a significant impact on your credit score is your crypto interest account. While opinions may vary on the benefits and drawbacks of cryptocurrency, it is important to consider how these accounts could affect your creditworthiness.

Understanding the Risks:

Unlike traditional banking, cryptocurrency operates in a decentralized and often less regulated space. Where someone could create a traditional bank account with a simple visit to their local bank branch, crypto accounts can be stored on the internet and accessed through a digital wallet. The security risks are higher, making it essential to take precautions to avoid any potential issues.

How Crypto Interest Accounts Work:

A crypto interest account allows you to earn interest on your cryptocurrency holdings. The interest is typically paid out in the same cryptocurrency, and you can choose to keep it stored in your account or transfer it to an external wallet. The interest earned can significantly impact the value of your portfolio, but it’s important to understand how it could affect your credit score.

Reporting Your Crypto Interest Account:

Credit reporting agencies like Experian may not have standardized methods for incorporating crypto interest accounts into credit scores. However, it is a good idea to report your crypto interest account to ensure that the positive impact on your finances is reflected in your creditworthiness. This could help you when applying for loans or other forms of financing.

Why Reporting Your Crypto Interest Account Matters:

By reporting your crypto interest account, you can demonstrate a good credit management approach. This shows lenders that you not only have a good credit score but also a balanced portfolio with diverse sources of income. It also helps to establish a positive credit history, especially if you have a larger balance in your crypto interest account.

The Final Word:

Crypto interest accounts can be a great way to earn passive income from your cryptocurrency holdings. However, it’s important to be aware of the potential risks and drawbacks. By understanding and reporting these accounts, you can ensure that they have a positive impact on your credit score and overall financial health.

How to Report Your Crypto Interest Account

If you have a crypto interest account, it’s important to know how to properly report it to the relevant authorities. While crypto loans can impact your credit score, reporting your crypto interest account can be an additional step to ensure that your financial information is accurately reflected in your credit history.

1. Understand the Basics: Before reporting your crypto interest account, make sure you understand how it may be affected by your credit score and what benefits it can provide. Depending on the lending platform you’re using, your crypto interest account may or may not be considered as a loan by traditional credit reporting companies.

2. Know Where to Report: Start by checking with the company that provided the crypto interest account to see if they provide the option to report it to credit bureaus. Some lending platforms may have a specific process in place, while others may not have this option available.

3. Create an Account with a Credit Reporting Agency: If your lending platform doesn’t offer reporting, you can consider creating an account with a credit reporting agency that allows you to manually add your crypto interest account information. This can be an incredibly important step in protecting and building your credit history.

4. Gather the Required Information: Before applying to report your crypto interest account, make sure you have all the necessary details, such as the account balance, repayment history, and any other relevant information that might be required by the credit reporting agency. This will ensure that your account is accurately reviewed and included in your credit reports.

5. Understand the Drawbacks: While reporting your crypto interest account can provide many benefits, it’s important to be aware of potential drawbacks. Depending on the lending platform and your financial situation, reporting your crypto interest account could impact your credit score, as it may be seen as a higher risk form of lending.

6. Consider Other Alternatives: If you’re concerned about the impact on your credit score, consider exploring other alternatives, such as traditional loans or credit options. Many lending companies offer loans with minimum credit checks and a lower margin of risk, which could be a more suitable option for those looking to retain a good credit score.

Overall, reporting your crypto interest account can be a valuable step in building and improving your credit history. By understanding the risks and benefits, you’ll be able to make an informed decision about whether it’s the right approach for you.

Benefits and Risks of Reporting

The decision to report a crypto loan can have both benefits and risks for borrowers.

Benefits:

- Improved Credit Score: Reporting a crypto loan to credit bureaus can potentially increase your credit score over time, as it demonstrates responsible borrowing and repayment behavior.

- Access to Better Rates and Financing: By having a reported loan, you may qualify for better interest rates and financing options in the future.

- Verification of Assets: Reporting a secured crypto loan can help verify your cryptocurrency assets and provide a valuable resource for lenders when evaluating your financial health.

Risks:

- Negative Impact on Credit Score: If you fail to make timely repayments or default on the loan, it can negatively affect your credit score.

- Loss of Privacy: Reporting a crypto loan means that your loan information, including the amount borrowed and repayment history, will be visible to credit bureaus and potentially other lenders.

- Possible Tax Consequences: Depending on the jurisdiction and regulations, reporting a crypto loan may result in the need to accurately report the loan and potentially pay taxes on any interest or gains.

- Increased Attention from Regulatory Authorities: As cryptocurrencies continue to face regulatory scrutiny, reporting a crypto loan may attract attention from regulatory authorities and require additional compliance measures.

- Volatility of Cryptocurrency: If the value of the cryptocurrency used as collateral fluctuates significantly, it can impact the repayment ability and potentially lead to liquidation of the collateral to cover the loan balance.

Before deciding whether to report a crypto loan, it is important to thoroughly understand the benefits and drawbacks, and consider factors such as your financial goals, risk tolerance, and the specific requirements and regulations of your jurisdiction. Consulting with financial professionals or experts in cryptocurrency lending can provide valuable insights to make an informed decision.

The Benefits of Reporting Your Crypto Loan or Interest Account

If you’re thinking about taking out a crypto loan or opening an interest account using your cryptocurrency, you may be wondering how it will impact your credit score. One of the benefits of reporting your crypto loan or interest account is that it can help you build and improve your credit score over time.

Build Credit History

By reporting your crypto loan or interest account to credit bureaus, you are establishing a credit history that lenders can use to determine your creditworthiness. This is especially important if you have a limited credit history or have never taken out traditional loans or credit cards.

Positive Impact on Credit Score

Successfully repaying your crypto loan or earning interest on your crypto account can have a positive impact on your credit score. Timely repayment and responsible use of credit are factors that can contribute to a good credit score. By demonstrating this with your crypto accounts, you can potentially improve your overall creditworthiness.

Diversification of Credit Types

Having a mix of different credit types, such as a crypto loan or interest account, can also benefit your credit score. Credit scoring models typically consider the types of credit you use when calculating your score. By adding a crypto loan or interest account to your credit mix, you may be able to improve your credit score.

Increased Access to Credit

Having a good credit score can make it easier for you to access credit in the future. This means that reporting your crypto loan or interest account can open up more opportunities for you to obtain loans or credit cards with favorable terms and interest rates.

Accurate Credit Reporting

By reporting your crypto loan or interest account, you can ensure that your credit reports provide a full and accurate representation of your borrowing and repayment history. This can be beneficial when lenders, landlords, or other financial institutions review your credit history as part of their decision-making process.

Consult with Experts

It is always a good idea to consult with credit experts to understand whether reporting your crypto loan or interest account is the best option for your unique situation. They can provide guidance and help you weigh the benefits and drawbacks of reporting your crypto accounts on your credit score.

Potential Risks of Reporting Your Crypto Loan or Interest Account

When considering whether to report your crypto loan or interest account, it is important to be aware of the potential risks that may arise. Reporting these activities can have both positive and negative effects on your credit score and financial situation.

One potential risk is that reporting your crypto loan or interest account could affect your credit score. While there is no full consensus on how crypto loans will be reported or how they will impact credit scores, it is possible that the reporting process may vary among different lenders and credit reporting agencies.

- Some credit reporting agencies, like Experian, have trademarked the term “crypto tradeline” and offer a scoring model that takes into account crypto loans and interest accounts. These agencies may calculate your credit score differently compared to traditional scoring models.

- If the lender reports your crypto loan as a traditional loan, it may require you to have a high credit score in order to qualify. This means that if you have a low credit score, your chances of getting approved for a crypto loan could be lower compared to traditional loans.

- Since the market value of cryptocurrencies can be highly volatile, there is a risk that the price of the cryptocurrency you have pledged as collateral for the loan may decrease. This could result in a margin call, where you are required to either repay a portion of the loan or deposit more collateral to cover the decrease in value.

- In the event of a margin call, if you are unable to meet the lender’s requirements, it could lead to a negative impact on your credit history. This negative history could then affect your credit score and make it more difficult for you to borrow in the future.

It is important to carefully review your credit history and financial situation before deciding whether to report your crypto loan or interest account. Consider speaking with a financial advisor or credit expert to ensure that you are making the best decision for your unique situation.

In some cases, it may be a good approach to consider alternatives to reporting your crypto loan or interest account. For instance, you could choose to use a crypto lending platform that does not report to credit bureaus, or explore other financing options that do not require a credit check.

Overall, the decision to report your crypto loan or interest account should be based on your individual circumstances and financial goals. Make sure to weigh the potential risks and benefits, and take steps to protect your credit score and financial record.

Frequently Asked Questions:

How does a crypto loan work?

A crypto loan is a type of loan that is secured by cryptocurrency assets. It allows borrowers to use their cryptocurrencies as collateral in exchange for a loan. The borrower deposits their cryptocurrency assets into a smart contract, and the lender provides the loan in a stablecoin or fiat currency. If the borrower is unable to repay the loan, the lender has the right to liquidate the collateral.

What happens if I default on a crypto loan?

If you default on a crypto loan, the lender has the right to liquidate your collateral to recover their funds. This means that the lender can sell your cryptocurrency assets to cover the loan amount. If the value of your collateral has significantly decreased, you may still be responsible for repaying the remaining debt even after the liquidation.

Will taking out a crypto loan affect my credit score?

No, taking out a crypto loan typically does not affect your credit score. Since crypto loans are secured by collateral, they do not require a credit check. Therefore, whether you repay the loan or default on it, it will not be reported to credit bureaus and will not impact your credit score.

Can I use my crypto loan to improve my credit score?

No, using a crypto loan will not directly help improve your credit score. Crypto loans are not reported to credit bureaus, so they do not have any impact on your credit history or credit score. However, if you repay the crypto loan on time and in full, it can indirectly improve your creditworthiness and make it easier for you to qualify for traditional loans in the future.

Video:

✅ GET A CRYPTO LOAN WITH BYBIT (SUPER CHEAP & EASY!!!) BORROW BITCOIN, CRYPTO & ALTCOINS!!

What Are Crypto Loans? Is Crypto Loans Without Collateral Possible?

How to Get Crypto Loan on Binance FAST & EASY = FLEXIBLE Crypto Loans

I’ve been using crypto loans from BlockFi and it’s been a game-changer for me. I love that I can use my cryptocurrency as collateral without selling it and still potentially make a profit. Plus, the fact that it doesn’t show up on my credit report is a huge relief. Highly recommend!

A crypto loan is a great option for those who want to leverage their cryptocurrency holdings without selling them. By using my crypto as collateral, I can still benefit from potential gains in value while accessing the funds I need. Plus, since it may not show up on my credit report, I have more flexibility in managing my overall creditworthiness. BlockFi seems like a reliable choice for crypto loans.

As an industry expert, I must say that taking a crypto loan can be a game-changer. With the option to use your cryptocurrency as collateral, it’s a win-win situation. Plus, the fact that it doesn’t affect your credit score is a major advantage. Get onboard and explore the benefits!

I think taking a crypto loan can be a great option for those who want to keep their cryptocurrency assets and potentially make a profit. It’s reassuring to know that even if I were to default on the loan, it may not affect my credit score. BlockFi seems like a trustworthy platform to consider.

Can you provide more information on the interest rates and repayment terms of crypto loans? How does it compare to traditional loans?

As someone who has taken a crypto loan before, I can say that it did not affect my credit score at all. It’s a great way to leverage my crypto assets without worrying about damaging my credit. Plus, if the value of my crypto goes up, I can even make a profit while I have the loan. BlockFi has been a trustworthy platform for me.

Getting a crypto loan is a great option for those who believe in the future value of their cryptocurrency. It’s a win-win situation where you can still hold onto your crypto and potentially make a profit, all while using it as collateral for a loan. Plus, the fact that it may not affect your credit score is definitely a bonus!

Taking a crypto loan is a game-changer for me. I love that I can use my cryptocurrency as collateral and still potentially make a profit. Plus, the fact that it won’t affect my credit score is a big bonus. BlockFi seems like a reliable choice in the industry.