Over the past few years, crypto staking has become an increasingly popular way to earn rewards in the world of cryptocurrency. Stakers, also known as validators, play a crucial role in securing and maintaining the network of various blockchain projects. But what exactly is crypto staking and how much can you earn in rewards?

Staking, at its core, involves locking up a certain amount of cryptocurrency in a digital wallet for a period of time. This locked-up amount acts as a security deposit and is required to participate in the staking process. Validators are responsible for running nodes and validating transactions on the network, and in return, they receive rewards in the form of additional cryptocurrency.

The potential rewards for crypto staking can vary depending on several factors. The annualized yield, or the percentage return on your staked amount, is often cited as an important consideration. Different blockchain platforms and applications offer varying rewards and incentives for stakers, and some platforms even allow for pooling of funds to increase the chances of earning rewards.

When considering whether to participate in crypto staking, it’s important to keep in mind that the value of the cryptocurrency you stake can fluctuate significantly. While the potential rewards can be tempting, there is also a level of risk involved. It’s always advised to do thorough research and understand the underlying technology and risks before deciding to stake your assets.

Many crypto staking platforms and service providers have emerged in recent years, offering user-friendly apps and interfaces to make the staking process more accessible to individuals. These services often handle the technical aspects of running nodes and securing the network, allowing users to earn passive income with just a few clicks.

Overall, crypto staking can be a potentially lucrative opportunity for those looking to earn passive income in the crypto space. However, it’s crucial to fully understand the risks and do your own research before jumping in. With the right knowledge and a careful approach, crypto staking can be a fairygodboss in your investment portfolio.

Understanding Crypto Staking

Crypto staking is an alternative way for cryptocurrency holders to earn rewards by participating in the maintenance and security of a blockchain network. Instead of simply buying and holding cryptocurrencies, staking allows users to actively contribute to the validation and security of the network.

Staking involves locking up a certain amount of cryptocurrency in a wallet, which is then used by the network to validate transactions and participate in the consensus algorithm. In return for this contribution, stakers are rewarded with additional coins or tokens as an incentive for their participation.

One of the main advantages of staking is the potential to earn passive income. By staking their holdings, individuals can make their cryptocurrency work for them and generate additional income over time. This can be especially attractive in an industry where traditional interest rates have been relatively low in recent decades.

Additionally, staking can also help to mitigate some of the security risks associated with holding cryptocurrencies. Since staked funds are locked in a wallet and used for validation purposes, they are less susceptible to hacking and theft compared to funds held on exchanges or in hot wallets.

Staking rewards can vary depending on factors such as the network’s inflation rate, the total amount staked, and the performance of the validators. While the average annual staking rewards can range from 5% to 20%, there are some networks that offer even higher rewards, reaching up to 30% or more.

It’s important to understand the terms and conditions of each staking network before deciding to participate. Some networks may have minimum staking requirements or certain lock-up periods, which can affect the liquidity of the staked coins. It’s also recommended to verify the security and reputation of the staking platform, as there have been cases of scams or unreliable platforms in the past.

In summary, crypto staking is an alternative way to earn rewards by participating in the validation and security of a blockchain network. It offers the potential to generate passive income and mitigate security risks associated with traditional cryptocurrency holdings. However, it’s important to thoroughly understand the terms and conditions, as well as the security and reputation of the staking platform, before getting started.

Benefits of Staking Cryptocurrency

Staking cryptocurrency offers a range of benefits and opportunities for crypto holders. Here are some of the key advantages:

- Earning Rewards: Staking allows crypto holders to earn passive income by participating in the staking-as-a-service model. By pledging their coins to support the network, stakers are rewarded with additional coins in return.

- Lower Risk: Staking can be a less risky investment strategy compared to other crypto activities, like trading or investing. Stakers are less exposed to the daily price movements and market volatility, as their profits primarily come from the staking rewards rather than the fluctuating prices.

- Increased Security: When you stake your coins, you contribute to the network’s security. As a result, the chance of hacking and theft reduces substantially. Staking uses a verification process that ensures the legitimacy of transactions.

- Access to More Cryptos: Staking opens up the opportunity to earn rewards with a wide range of cryptocurrencies. Many popular platforms allow staking of various assets, so you can choose the right crypto to stake based on your preferences and interests.

- Community Engagement: Staking allows you to actively participate in the cryptocurrency community. By becoming a validator node, you play a crucial role in validating transactions and securing the network. This level of engagement can have a positive impact on the growth and development of the crypto ecosystem.

Overall, staking cryptocurrency provides a way for crypto holders to earn rewards, securely contribute to the network, and actively participate in the crypto community. It can be a more stable and profitable investment option, especially for those who prefer a long-term and lower risk approach.

How Staking Rewards Work

When it comes to crypto staking, the power lies in the hands of the token holders. Staking rewards are earned by those who participate in the process of securing and maintaining the blockchain network. The difficulty of staking depends on the particular token and blockchain network, but the concept is generally the same.

To initiate staking, token holders need to lock up a certain amount of their coins and designate it for staking. This process involves delegating the tokens to a chosen validator node which will be responsible for validating transactions on the network. However, it’s important to note that in some cases, staking may be prohibited or require a minimum amount of tokens to participate.

Once the tokens are staked, all that’s left to do is wait for the staking rewards to accumulate. The blockchain network uses a term called “staking rewards” to refer to the rewards earned by participants. These rewards are typically distributed regularly, varying in frequency and amount depending on the specific network.

While staking can be a great way to earn passive income, there are some risks involved. One potential risk is the loss of access to the staked tokens. During the staking period, the tokens are locked up and cannot be used or sold. This lockup period can vary from a few days to several months or even years, depending on the network.

Another risk is the fluctuating value of the staked coins. Cryptocurrency markets are known for their volatility, and the value of the staked coins can rise or fall during the lockup period. If the value of the coins drops significantly, the staking rewards may not be enough to offset the loss in value.

In summary, staking rewards work by allowing token holders to earn rewards by participating in the process of securing and maintaining a blockchain network. By locking up their coins and delegating them to a validator node, participants can earn regular rewards. However, it’s important to understand the risks involved, such as the loss of access to the staked coins and the potential for losses due to market volatility.

Different Cryptocurrencies for Staking

When it comes to crypto staking, there are various cryptocurrencies that offer staking opportunities. These include popular coins such as Ethereum (ETH), Cardano (ADA), Polkadot (DOT), and Tezos (XTZ), among others. Each cryptocurrency has its own staking product and offers different rewards and staking mechanisms.

For example, Ethereum has plans to transition from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism. This means that Ethereum holders will be able to stake their coins and earn rewards for helping to validate transactions on the network. The amount of rewards a staker could earn will depend on various factors, including the total amount of ETH staked and the duration of the staking period.

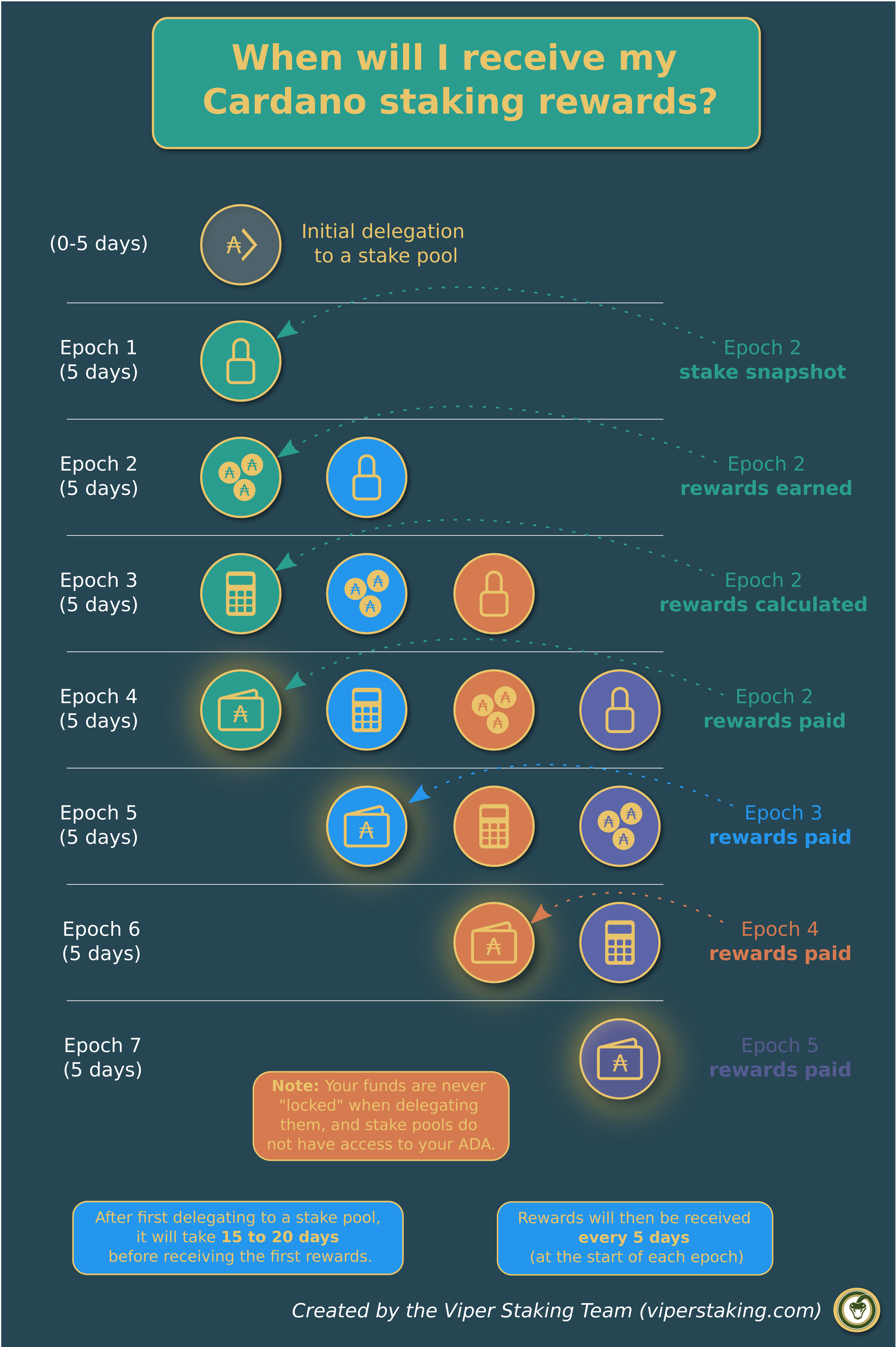

Cardano, on the other hand, already operates on a PoS blockchain and allows users to delegate their ADA tokens to a validator to earn staking rewards. The rewards on Cardano are determined by a combination of factors, including the number of ADA coins being staked, the total supply, and the amount of ADA that a user delegates.

Polkadot and Tezos also offer staking opportunities, allowing users to stake their tokens and participate in the validation process of the respective networks. The rewards for staking on these networks vary depending on factors such as the specific staking protocol being used, the duration of the staking period, and the total number of tokens being staked.

It is important to note that staking rewards can vary greatly between different cryptocurrencies and staking platforms. Therefore, it is essential for users to do their own research and understand the specific staking mechanisms and potential returns before choosing which cryptos to stake.

Calculating Potential Staking Rewards

When it comes to calculating potential staking rewards, there are several factors to consider. One important factor is the staking rate offered by the platform or wallet you are using. Different platforms may offer different rates for staking the same assets. It’s important to compare these rates and choose the platform that offers the best conditions for staking.

Another factor to consider is the specific staking period. Some platforms may offer shorter staking periods, such as 7 days, while others may offer longer periods, such as 30 days. The length of the staking period can impact the potential earnings, so it’s important to understand the terms and choose the staking period that aligns with your investment objectives.

Once you have chosen a platform and decided on the staking period, you can start staking your coins. The amount you can earn in staking rewards will depend on the number of coins you stake and the staking rate offered by the platform. For example, if you stake 100 coins and the staking rate is 5%, you would earn 5 coins in staking rewards.

It’s important to note that staking rewards are not guaranteed and can vary based on market conditions. The rewards are based on the proof-of-stake (PoS) mechanism, which is different from the proof-of-work (PoW) mechanism used in mining. While PoS is generally considered more secure and energy-efficient, it is still subject to market fluctuations and risks.

In addition to individual staking, there are also staking pools or platforms that allow users to pool their assets together for staking. This can provide a more stable and consistent return, but it may also come with additional fees or limitations. It’s important to understand the terms and conditions of these pooling options before making a decision.

Factors Affecting Staking Rewards

When it comes to crypto staking rewards, there are several factors that can influence the amount of rewards you can earn. Understanding these factors is vital in order to make informed decisions about your staking strategy. Let’s take a closer look at some of the key factors:

1. Percentage of Staked Tokens

The percentage of tokens staked by the community can have a significant impact on staking rewards. If a high percentage of tokens are being staked, the rewards may be lower due to increased competition. On the other hand, if the percentage of staked tokens is small, the rewards could be higher as there is less competition for the rewards.

2. Staking Duration

The length of time you stake your tokens can also affect your rewards. Some platforms offer higher rewards for longer staking periods, while others may provide a steady rate of rewards regardless of the staking duration. It’s important to consider the duration that works best for you before making any staking decisions.

3. Provider Integrity

The integrity of the staking provider is crucial in determining the reliability and safety of your staked assets. Choosing a reputable and trustworthy provider is essential to ensure that your rewards are secure and that the staking process is carried out effectively.

4. Market Volatility

The crypto market is known for its volatility, and this can have a direct impact on staking rewards. If the market experiences a decline, the value of your staked tokens may decrease, impacting your potential earnings. On the other hand, a bullish market can lead to higher rewards. Keeping an eye on market trends and adjusting your staking strategy accordingly can help maximize your earnings.

5. Rewards Distribution Model

The way rewards are distributed can vary from platform to platform. Some platforms may distribute rewards evenly among all stakers, while others may give more rewards to top stakers or provide incentives to those who provide liquidity. Understanding the rewards distribution model of the platform you choose to stake with is crucial to managing your expectations and optimizing your earnings.

In conclusion, staking rewards are influenced by various factors, including the percentage of staked tokens, staking duration, provider integrity, market volatility, and rewards distribution model. Each factor plays a significant role in determining the amount of rewards you can earn, so it’s essential to carefully consider these factors before staking your tokens.

Choosing the Right Staking Pool

When it comes to crypto staking, choosing the right staking pool can boost your rewards and validate transactions efficiently. But what’s a staking pool, and how do you find the right one for you? Here are some recommendations to keep in mind:

1. Size and Reputation of the Pool: In general, larger staking pools tend to offer more consistent rewards and have a lower risk of becoming fraudulent. Look for well-established pools with a trusted reputation in the crypto community.

2. Income Distribution: Be aware of how rewards are distributed within the pool. Some pools may offer a higher percentage of rewards to their own token holders or have a specific income distribution model. Consider your investment goals and choose a pool that aligns with your preferences.

3. Staking-as-a-Service: Some newer exchanges and platforms offer staking-as-a-service, meaning they handle the staking process for you. While this can be convenient, keep in mind that you may have less control over your staked tokens and the rewards they generate.

4. Validation and Governance: Consider whether the pool allows stakers to participate in the validation and governance of the network. This can offer more involvement and potentially higher rewards, but it also requires a higher level of technical knowledge and computer resources.

5. Security and Trust: Ensure that the staking pool implements robust security measures to protect your holdings. Look for pools that have undergone third-party audits or have a proven track record of secure operation.

6. Listing and Partnership: Some pools have partnerships with specific networks or token projects, offering additional advantages or rewards for staking their tokens. If you have a specific token you want to stake, consider pools that have established partnerships with the token’s network.

7. Earnings and Rewards: Lastly, consider the potential income and rewards you can earn from the staking pool. Look for pools that provide clear information on their historical rewards and the expected range of rewards. Keep in mind that staking carries some level of risk, and rewards may vary over time.

Choosing the right staking pool is a crucial decision for crypto investors. By considering factors such as size, reputation, income distribution, validation options, security measures, partnerships, and potential earnings, you can make an informed choice that aligns with your goals and reduces risk in the ever-emerging world of crypto staking.

Risks to Understand Before Staking Cryptocurrency

Staking cryptocurrency is a popular way to earn passive income by participating in the validation and securing of blockchain networks. However, there are risks involved in this process that potential stakers should carefully consider before getting involved.

1. Financial Risks

One of the main risks associated with staking cryptocurrency is the potential for financial loss. While staking often offers attractive returns, there is always a possibility that the value of the cryptocurrency you are staking could decrease, resulting in a loss of your principal investment.

2. Technical Risks

Staking cryptocurrency requires technical knowledge and understanding of the underlying blockchain network. Improperly setting up or maintaining your staking infrastructure could lead to potential security vulnerabilities, such as hacks or downtime. It is crucial to ensure that you have the necessary technical skills or reliable service providers to mitigate these risks.

3. Network Risks

Staking involves participating in a blockchain network where the consensus mechanism relies on a certain number of participants acting honestly and in the best interest of the network. However, there is always a risk of dishonest or malicious behavior from other participants. This risk is particularly relevant in proof-of-stake (PoS) networks, where participants can potentially gain control of the network by accumulating a significant amount of staked cryptocurrency, also known as a 51% attack.

4. Platform Risks

Choosing the right platform or service provider for staking is crucial. There are various types of staking platforms, including those offered by cryptocurrency exchanges and dedicated staking-as-a-service providers. It’s important to carefully research and evaluate the platform’s reputation, security measures, fees, and disclosure practices. Some platforms may also have minimum staking requirements or lock-up periods, which can limit access to your staked funds.

5. Regulatory Risks

Regulatory oversight of cryptocurrency and staking practices is still evolving in many jurisdictions. Changes in regulations or the introduction of new laws could potentially impact the legality or profitability of staking. It’s important to stay informed about the regulatory landscape and seek proper legal advice if needed to ensure compliance and minimize potential risks.

In conclusion, while staking cryptocurrency can be a lucrative investment strategy, it’s important to be aware of and understand the risks associated with it. By carefully evaluating the financial, technical, network, platform, and regulatory risks, you can make informed decisions and mitigate potential challenges to your staking endeavors.

Market Volatility

Market volatility is a common concern when it comes to investing in any asset, including cryptocurrencies. The fluctuating prices of cryptos can either provide significant rewards or result in substantial losses. It is essential for individuals interested in crypto staking to understand the risks associated with market volatility and make informed decisions.

One way to mitigate the risks of market volatility is through lock-up periods. Lock-up periods require investors to hold their staked cryptos for a specified period, during which they cannot sell or trade them. This strategy helps stabilize the market and reduces the immediate impact of price movements. However, it also means that investors cannot quickly react to sudden market changes and may miss out on potential gains.

Cryptocurrency networks rely on validators, also known as nodes, to verify and validate transactions. Validators play a crucial role in maintaining the security and integrity of blockchain networks. However, they are also exposed to market volatility. If the price of the staked cryptocurrency drops significantly, validators could potentially lose a portion of their staked assets.

Furthermore, market volatility can affect the performance of staked cryptocurrencies. Rewards earned through staking are influenced by factors like price movements and network activity. If the market experiences significant fluctuations or if network participation decreases, the rewards earned from staking may be lower than expected.

It is essential for individuals looking to earn rewards through crypto staking to do proper research and follow best practices. This includes understanding the risks involved, selecting trusted staking providers, and staying informed about market trends. Additionally, diversifying staking investments across different cryptocurrencies and networks can help mitigate the impact of market volatility.

- Market volatility can affect the prices of cryptocurrencies

- Lock-up periods can help stabilize the market but may limit investors’ ability to react to price movements

- Validators in cryptocurrency networks are exposed to market volatility

- Rewards earned through crypto staking can be influenced by price movements and network activity

- Proper research, due diligence, and diversification can help mitigate the risks of market volatility

Technical Risks

When it comes to staking cryptocurrencies, there are certain technical risks that you should be aware of. These risks stem from the underlying blockchain technology and the access policies and rules set by the network.

Network Integrity: One of the potential technical risks is the integrity of the blockchain network itself. If the network experiences a breach or a critical vulnerability is discovered, it can substantially impact the value of the staked assets and the rewards earned. There have been examples in the industry where networks have had security issues, leading to a decline in trust and a loss of value for users.

Volatility: The volatility of the cryptocurrency market is another technical risk to consider. The value of the staked assets can fluctuate greatly within a short period of time, which may result in a significant decline in the value of the rewards earned. If you’re looking to earn passive income through staking, you should be prepared for potential losses due to market conditions.

Technical Requirements: Staking cryptocurrencies often requires technical knowledge and resources. For example, some networks require users to run their own nodes, which can be a complex and resource-intensive process. Additionally, staking often involves locking up your funds for a certain period of time, which means you won’t be able to access or trade them until the staking term is completed. This lack of liquidity can be a significant drawback for some users.

Reward Distribution: The reward distribution mechanism varies from network to network. While some networks distribute rewards directly to stakers’ accounts, others may require stakers to initiate a claim or perform additional actions to receive their rewards. It’s crucial to understand how the reward distribution works for the specific network you’re staking on to ensure you don’t miss out on any potential earnings.

In conclusion, while staking cryptocurrencies can be a lucrative way to earn passive income, it’s important to be aware of the technical risks involved. Factors such as network integrity, market volatility, technical requirements, and reward distribution policies can all impact the potential rewards and overall experience of staking. By understanding and mitigating these risks, you can make informed decisions and strive for the desired outcomes in your staking endeavors.

Security Risks

When it comes to cryptocurrency staking, there are a number of security risks that investors should be aware of. One of the most common risks is the possibility of a security breach, where hackers gain unauthorized access to your staked assets. This can result in a loss of funds and potentially jeopardize the overall security of the blockchain network.

Another security risk is the potential for manipulation of the staking process. In some cases, individuals or groups may attempt to manipulate the staking rewards by consolidating large amounts of staked tokens and controlling a significant portion of the network’s voting power. This can lead to unfair rewards distribution and undermine the decentralization of the network.

Furthermore, there is a risk of platform or wallet vulnerabilities that could be exploited by attackers. If the platform or wallet used for staking is not properly secured, it may be susceptible to hacking or other forms of cyber attacks. It is important for investors to carefully review the security measures and reputation of the platform or wallet before staking their assets.

Additionally, there is also the risk of unpredictable market conditions. The value of the staked assets can fluctuate significantly depending on market trends and investor sentiment. This means that even though you may be earning rewards in the form of additional tokens, the value of those rewards could decrease in value. It is important for investors to consider the potential risks and rewards before participating in staking.

Overall, while staking offers the opportunity to earn rewards and boost income in the cryptocurrency industry, it is crucial for investors to understand and mitigate the potential security risks associated with staking.

Regulatory Risks

When engaging in crypto staking, there are several regulatory risks that stakers should be aware of. These risks can arise from the use of unregulated platforms, the lack of proper verification processes, and the potential for hacking or fraud.

One of the main regulatory risks is the use of unregulated platforms. Stakers should be careful when selecting a staking pool or platform, as some may not have gone through the proper regulatory processes. It is important to do thorough research and ensure that the platform has been verified and is compliant with regulatory requirements.

Hacking and fraud are also significant risks when it comes to crypto staking. Stakers must be cautious with their funds and ensure that they are using a secure wallet or platform. Without proper security measures in place, there is a risk of losing one’s staked assets to hacking or fraudulent activities.

In addition, regulatory risks can also be linked to the integrity of the staking platform. Stakers should carefully evaluate the reputation and track record of the platform, including the background and experience of the team behind it. Platforms with a history of regulatory violations or suspicious activities should be avoided.

Furthermore, regulatory risks can also arise from the potential lock-up of staked assets. Stakers should be aware that some platforms may require a certain lock-up period, preventing them from accessing their funds whenever they want. This lack of liquidity can be a potential risk, especially in the case of unexpected financial needs or market downturns.

In summary, regulatory risks in crypto staking are a crucial consideration for stakers. It is important to carefully choose a regulated platform, use secure wallets, and stay vigilant against potential hacking or fraud. By taking these factors into account, stakers can mitigate the regulatory risks associated with crypto staking.

Frequent questions:

What is liquidity risk in crypto staking?

Liquidity risk in crypto staking refers to the risk of not being able to quickly and easily convert your staked assets back into a liquid form, such as cash or other cryptocurrencies. When you stake your assets, they are locked up for a certain period of time, and during this lockup period, you may not be able to access or trade them. This lack of liquidity can be a risk if you suddenly need to access your funds for any reason.

What is lockup period risk in crypto staking?

Lockup period risk in crypto staking refers to the risk of not being able to access or use your staked assets for a certain period of time. When you stake your assets, they are typically locked up for a specific duration, which can vary depending on the staking platform or protocol. During this lockup period, you will not be able to sell, trade, or use your staked assets, which can be a risk if you need immediate access to your funds or if market conditions change unfavorably.

How can liquidity and lockup period risk affect my earnings in crypto staking?

Liquidity and lockup period risk can affect your earnings in crypto staking by limiting your ability to access and use your staked assets. If you are unable to quickly and easily convert your staked assets back into a liquid form, you may miss out on opportunities to sell or trade them at favorable prices. Additionally, if your assets are locked up for a long period of time, you may not be able to take advantage of potential price increases or other earning opportunities during that time.

Are there ways to minimize liquidity and lockup period risk in crypto staking?

Yes, there are ways to minimize liquidity and lockup period risk in crypto staking. One approach is to carefully consider the duration of the lockup period before staking your assets. Choosing a shorter lockup period may allow you to have more flexibility and access to your funds sooner. Additionally, it’s important to research and choose reputable staking platforms or protocols that offer options for early withdrawal or secondary market trading, which can provide liquidity even during the lockup period.

What are the potential consequences of liquidity and lockup period risk in crypto staking?

The potential consequences of liquidity and lockup period risk in crypto staking include not being able to access your funds when you need them, missing out on trading opportunities during the lockup period, and potentially losing value if market conditions change unfavorably. Additionally, if you are unable to liquidate your staked assets, you may not be able to take advantage of other investment opportunities or diversify your portfolio as desired.

How can I determine the liquidity and lockup period risk of a staking platform or protocol?

You can determine the liquidity and lockup period risk of a staking platform or protocol by researching and reviewing the terms and conditions provided by the platform. Look for information on the lockup period duration, any early withdrawal options or penalties, and whether the staked assets can be traded on secondary markets during the lockup period. Additionally, it can be helpful to read reviews or seek recommendations from other users to gauge their experiences with liquidity and lockup period risk on the platform.

Can I earn rewards in crypto staking while also minimizing liquidity and lockup period risk?

Yes, it is possible to earn rewards in crypto staking while also minimizing liquidity and lockup period risk. One strategy is to diversify your staking portfolio across multiple platforms or protocols with different lockup periods. By doing so, you can have some assets staked with shorter lockup periods, providing more liquidity and flexibility, while also having some assets staked with longer lockup periods for potentially higher rewards. Additionally, choosing staking platforms or protocols that offer options for early withdrawal or secondary market trading can also provide more liquidity during the lockup period.

Videos:

Earn Staking Rewards on your Solana

Crypto staking has been a game-changer for me. By locking up my cryptocurrency and becoming a validator, I have been able to earn consistent rewards. It’s a great way to passively grow your investments in the ever-changing world of cryptocurrencies.

I’ve been staking my crypto for a while now and the rewards have been great. It’s a great way to earn passive income and contribute to the network security. Definitely recommend it!

What are some examples of blockchain platforms that offer high rewards for staking?

Hi JohnCrypto123! There are several blockchain platforms that offer high rewards for staking. One example is Ethereum 2.0, which is transitioning from a proof-of-work to a proof-of-stake consensus mechanism. Another example is Cardano, which has a unique staking model that allows participants to earn rewards while keeping their funds secure. Additionally, Tezos and Cosmos are known for their attractive staking rewards. It’s important to do your own research and consider factors such as reputation, security, and potential future growth before choosing a platform. Happy staking!

As someone who has been staking crypto for a while now, I can say it’s definitely worth it! The potential rewards can be quite impressive, especially with the annualized yield. Plus, it’s a great way to support and secure the network. Don’t miss out on the opportunities in the world of staking!

Staking crypto can be a great opportunity to earn some passive income. I’ve been staking for a while now and the rewards have been quite satisfying. It’s definitely worth considering if you have some spare crypto sitting around.

I think crypto staking is a great way to earn passive income in the cryptocurrency market. By locking up my assets, I can contribute to the security of the network while earning rewards. It’s a win-win situation!

As a cryptocurrency enthusiast, I’ve been staking for a while now and I can say that it’s a great way to earn passive income. The potential rewards can be quite substantial, especially when you consider the annualized yield. It’s definitely worth considering for anyone interested in the world of crypto!