In recent years, the world has witnessed a surge in the popularity of decentralized finance (DeFi) projects. These projects have revolutionized the financial market by leveraging blockchain technology to create decentralized systems. The market for DeFi has experienced exponential growth, attracting people from all walks of life who are eager to participate in the future of finance.

DeFi projects have become one of the most exciting and innovative areas in the blockchain space. They offer a wide range of different applications and services, including decentralized applications (dApps), smart contracts, and decentralized exchanges. These projects are developed by experienced developers who have a deep understanding of blockchain technology and its potential.

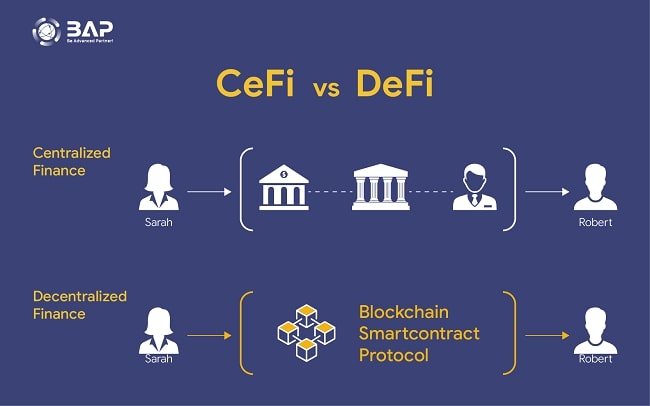

Blockchain technology provides a secure and transparent platform for financial transactions. DeFi projects utilize various layers of blockchain technology to ensure the security and efficiency of their systems. They employ smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This eliminates the need for intermediaries and reduces the risk of fraud or manipulation.

Furthermore, DeFi projects have created a vibrant and inclusive community of developers, investors, and users. The community is constantly evolving, with new projects and ideas being featured and discussed on various blockchain forums and social media platforms. Developers often share their insights and experiences through blog posts and tutorials, providing an invaluable resource for the DeFi development community.

To become a successful DeFi developer, one must have a solid understanding of blockchain technology, programming languages, and smart contract development. It takes time and dedication to acquire the necessary skills and knowledge to navigate the complex world of decentralized finance. However, the rewards are well worth the effort, as the DeFi market is expected to grow exponentially in the coming years.

DeFi Development Market Overview

The DeFi development market is booming with the increasing popularity of blockchain technology and decentralized finance. As more and more people become aware of the potential of DeFi, there is a growing demand for experienced developers to build and maintain decentralized applications (dapps).

In this market overview, we will explore the different layers and systems of the DeFi market. DeFi projects often leverage smart contracts and blockchain technology to create decentralized financial systems. These systems allow users to access financial services without relying on traditional intermediaries.

What sets DeFi apart from the traditional finance market is the ability for anyone to participate as a developer. The community-driven nature of the blockchain allows for innovation and collaboration, resulting in a wide range of DeFi projects. From lending and borrowing platforms to decentralized exchanges, there are countless opportunities for developers to contribute to this growing market.

Furthermore, to become a successful DeFi developer, it is crucial to have a deep understanding of blockchain technology and smart contract development. Developers must be certified and experienced in programming languages such as Solidity and be able to navigate the unique challenges that come with building on decentralized platforms.

The DeFi market has seen significant growth in recent years and continues to attract attention from both developers and investors. It is important for developers to stay up-to-date with the latest trends and best practices in DeFi development to ensure the success of their projects and to seize new opportunities as they arise in this rapidly evolving market.

How to Become a DeFi Developer

As the blockchain technology continues to revolutionize the financial industry, decentralized finance (DeFi) has emerged as a prominent area of development. If you aspire to become a DeFi developer, there are several steps you can take to embark on this exciting journey.

Gain a Solid Understanding of Blockchain Technology

In order to become a successful DeFi developer, it is crucial to have a strong foundation in blockchain technology. Take the time to familiarize yourself with the different layers and systems within a blockchain, such as consensus algorithms and smart contracts.

Get Certified in Blockchain Development

To demonstrate your expertise in blockchain development and stand out in the competitive market, consider getting certified as a blockchain developer. There are various certification programs available that will validate your skills and knowledge in this field.

Learn about DeFi Development

Once you have a solid understanding of blockchain technology, it’s time to delve into the world of DeFi development. Familiarize yourself with the most prominent DeFi projects and platforms, as well as the different protocols and applications that are being used in the DeFi space.

Be Active in the DeFi Community

To stay updated with the latest developments and trends in the DeFi market, it is important to be an active member of the DeFi community. Engage in discussions, follow influential people in the industry, and read informative posts to expand your knowledge and network.

Start Developing Your Own DeFi Projects

Once you have acquired the necessary knowledge and skills, it’s time to start developing your own DeFi projects. Begin with small-scale projects to gain hands-on experience and gradually work your way up to more complex and featured projects.

Collaborate with Others

In the DeFi space, collaboration is key. Reach out to other developers and entrepreneurs in the market and explore opportunities for collaboration. By working together, you can leverage each other’s skills and expertise to create innovative and impactful DeFi applications.

Becoming a DeFi developer takes time and dedication. By gaining a solid understanding of blockchain technology, getting certified, and actively participating in the DeFi community, you can position yourself as a skilled and knowledgeable developer in this rapidly evolving field.

Featured Posts

Here are some featured posts that provide an overview of DeFi (Decentralized Finance) and how it is leveraging blockchain technology to revolutionize the financial systems:

1. Certified DeFi Developer – A Pathway to Becoming an Experienced Developer

Are you interested in the development of decentralized finance projects? If so, becoming a certified DeFi developer could be a great career move for you. This post outlines the steps you need to take to become a certified DeFi developer, including the necessary skills and knowledge you need to have before diving into the world of DeFi development. The post also provides insights into the different layers of DeFi and how they work together to create a decentralized financial ecosystem.

2. How to Leverage Blockchain Technology for DeFi Development

Blockchain technology is the foundation of DeFi, enabling the creation of secure, transparent, and decentralized financial systems. This post explores the role of blockchain in DeFi development, explaining how smart contracts and decentralized applications (DApps) are built on blockchain to offer various financial services. Furthermore, it discusses the benefits of using blockchain technology for DeFi projects, including increased security, reduced costs, and greater accessibility for the global community.

3. Top DeFi Projects to Watch in the Market

The DeFi market is constantly evolving, with new projects emerging all the time. This post highlights some of the top DeFi projects to keep an eye on, showcasing their innovative features and potential impact on the financial industry. Whether you’re looking to invest in DeFi or simply stay updated on the latest developments, this post provides valuable insights into the most promising projects in the field.

The Role of a Crypto Developer DeFi in Shaping the Future of Finance

A Crypto Developer DeFi plays a crucial role in shaping the future of finance by leveraging blockchain technology to create decentralized financial systems. In the traditional market, intermediaries such as banks and financial institutions are responsible for facilitating transactions and managing user’s funds. However, with the emergence of DeFi, these intermediaries are being replaced with smart contracts and decentralized applications (dApps).

DeFi, short for decentralized finance, refers to the use of blockchain technology to recreate financial systems in a decentralized manner. This allows for more transparent and efficient financial services, as well as greater accessibility for individuals around the world.

As a Crypto Developer DeFi, your role is to understand how blockchain technology works and how it can be applied to different financial use cases. You need to have a deep understanding of the underlying technology and be able to develop and deploy smart contracts and dApps on various blockchain platforms.

Furthermore, as the DeFi community continues to evolve, you need to stay updated with the latest developments and trends in the industry. This includes keeping track of the most innovative projects and technologies, as well as understanding the challenges and opportunities that come with building decentralized financial systems.

Before becoming a certified Crypto Developer DeFi, it is crucial to gain experience in the blockchain development field. This can be done by contributing to open-source projects, participating in hackathons, or working on personal projects to showcase your skills and knowledge.

Overall, the role of a Crypto Developer DeFi is instrumental in transforming the traditional financial market into a more inclusive and decentralized ecosystem. By leveraging blockchain technology, developers can create innovative financial solutions that empower people and remove the reliance on centralized intermediaries.

Understanding the Basics of DeFi Development

The world of decentralized finance, or DeFi, has gained significant traction in recent years. DeFi is an innovative concept that leverages blockchain technology to create decentralized systems for financial transactions and services.

Before exploring DeFi development, it’s important to have a basic understanding of blockchain technology. Blockchain is a distributed ledger that allows for secure and transparent transactions. It operates on the principle of decentralization, meaning there is no central authority controlling the network.

DeFi development involves creating decentralized applications, or dApps, on top of existing blockchain platforms. There are several major blockchain platforms that support DeFi, including Ethereum, Binance Smart Chain, and Polkadot. These platforms provide the necessary infrastructure and tools for developers to build DeFi applications.

As a developer interested in DeFi, it’s essential to have a solid understanding of programming languages such as Solidity, which is used for smart contract development on the Ethereum platform. Additionally, having knowledge of web development frameworks like React or Angular can be beneficial for building user interfaces for dApps.

One of the most important aspects of DeFi development is security. Since DeFi applications involve financial transactions and the handling of user funds, ensuring the security of the code is crucial. Developers should follow best practices, such as conducting thorough code reviews and audits, to mitigate potential vulnerabilities.

Furthermore, being part of the DeFi community can be invaluable for a developer. Engaging with the community through forums, social media platforms, and attending conferences can provide valuable insights and help developers stay up to date with the latest trends and developments in the industry.

In summary, becoming a DeFi developer requires understanding blockchain technology, familiarizing yourself with programming languages like Solidity, and being part of the DeFi community. It’s also important to prioritize security in your development projects and stay informed about the ever-evolving DeFi landscape.

The Evolution of DeFi: Opportunities and Challenges

The blockchain technology has revolutionized the way we interact with financial systems. Over the past few years, decentralized finance, or DeFi, has emerged as one of the most promising applications of blockchain technology. DeFi allows individuals to utilize blockchain networks to access financial products and services in a decentralized manner, without the need for intermediaries.

Blockchain developers play a crucial role in the evolution of DeFi. They are responsible for creating decentralized applications, or dApps, that enable users to trade, lend, borrow, and invest in various digital assets. Furthermore, developers are constantly working on improving the security and scalability of blockchain networks to support the growing demand for DeFi.

One of the challenges faced by the DeFi community is the lack of standardization. As DeFi projects are being developed on different blockchain platforms, there is a need for interoperability between these different systems. This requires developers to create bridges and protocols that allow seamless communication between different blockchain networks.

Moreover, the fast-paced nature of the DeFi market poses its own set of challenges. The DeFi market is constantly evolving, with new projects and innovations being introduced on a regular basis. Developers need to stay updated with the latest trends and developments in the DeFi space to remain competitive and deliver the best solutions to the community.

Another challenge is the security of DeFi protocols. As more people invest their funds in DeFi projects, the risk of security breaches and vulnerabilities increases. Therefore, developers need to ensure that their DeFi protocols are thoroughly audited and certified by experienced security firms before they are deployed to the market.

In conclusion, the evolution of DeFi presents numerous opportunities and challenges for blockchain developers. The decentralized nature of DeFi allows for innovative financial solutions, but it also requires developers to overcome technical and security hurdles. With time, as the DeFi market matures and more developers join the community, we can expect to see a stronger and more robust decentralized financial ecosystem.

The Importance of Security in DeFi Development

When it comes to DeFi development, security should be a top priority. With the growing popularity of decentralized finance projects, it is crucial to ensure that the systems and projects built on the blockchain are secure and trustworthy. Considering that most DeFi projects deal with sensitive financial information and transactions, any vulnerability or loophole in the system can lead to devastating consequences.

As a DeFi developer, you need to understand how to implement robust security measures to protect the platform and its users. This includes becoming familiar with different layers of security, such as smart contract auditing, secure coding practices, and encryption techniques. Furthermore, it is essential to stay updated with the latest security vulnerabilities and best practices in the DeFi development community.

Understanding the Layers of Security

DeFi development involves multiple layers of security to ensure the integrity and safety of the platform. At the blockchain level, developers need to ensure that the underlying blockchain network is secure and properly authenticated. This involves working with certified blockchain frameworks and protocols to build a reliable foundation for the DeFi project.

At the application layer, secure coding practices are crucial to prevent vulnerabilities and exploits. This includes conducting thorough code reviews, implementing strict access controls, and regularly testing for common security vulnerabilities. Additionally, developers should be aware of how to integrate secure token standards, authentication mechanisms, and decentralized identity verification systems into their DeFi projects.

Third-Party Audits and Risk Assessments

To further enhance security, DeFi developers should consider engaging third-party auditors and security firms to conduct comprehensive audits and risk assessments. These audits can help identify potential vulnerabilities and weaknesses in the system, allowing developers to address them before the project goes live. Moreover, involving external auditors can provide an independent validation of the project’s security and inspire trust among users and investors.

In conclusion, security is of utmost importance in DeFi development. It is crucial for developers to stay up to date with the latest security practices, implement robust security measures at different layers of the system, and engage third-party auditors to ensure the integrity and safety of the platform. By prioritizing security, DeFi developers can build trustworthy and resilient projects that can thrive in the decentralized financial market.

Best Practices for Securing DeFi Applications

Developing secure and robust decentralized finance (DeFi) applications requires adherence to best practices and the implementation of multiple layers of security. As a DeFi developer, it is crucial to understand the potential risks and vulnerabilities that can arise in the blockchain ecosystem, and take proactive measures to mitigate them.

Thoroughly Audit Smart Contracts

One of the first steps in securing a DeFi project is to have smart contracts audited by experienced professionals. Smart contract audits can help identify vulnerabilities and weaknesses in code logic or design that could be exploited by malicious actors. Furthermore, it is essential to keep up with industry standards and best practices in smart contract development to ensure robustness and security.

Implement Multi-Factor Authentication

Multi-factor authentication (MFA) adds an extra layer of security to user accounts and helps protect against unauthorized access. By requiring users to provide multiple pieces of evidence, such as a password and a unique code sent to their mobile device, MFA can significantly reduce the risk of account breaches. It is important to integrate MFA into DeFi applications to safeguard user assets and personal information.

Stay Updated with Security Patches

In the rapidly evolving blockchain space, vulnerabilities and exploits can be discovered at any time. To prevent potential security breaches, developers should actively monitor the latest security patches and updates released by the blockchain protocol they are utilizing. Regularly updating the underlying system and libraries used in DeFi development helps to address known vulnerabilities and protect against emerging threats.

Engage with the DeFi Community

Being part of the decentralized finance community provides valuable insights into security best practices and exposes developers to peer reviews of their projects. Engaging with the community allows developers to learn from experienced professionals and gain a better understanding of the potential risks and challenges in the DeFi space. Seeking feedback and actively participating in discussions can help developers improve the security of their applications.

Conduct Penetration Testing

Penetration testing, or ethical hacking, can help identify any weaknesses or vulnerabilities in the security infrastructure of a DeFi application. By simulating real-world attack scenarios, developers can uncover potential exploits and take appropriate measures to strengthen their security measures. Regularly conducting penetration testing is crucial to identify and address any vulnerabilities before they can be exploited by malicious actors.

Use Certified Libraries and Frameworks

When developing DeFi applications, it is important to use certified and well-tested libraries and frameworks. These pre-built components have undergone rigorous testing and have a proven track record of security. By leveraging trusted libraries and frameworks, developers can minimize the risk of introducing vulnerabilities into their codebase and improve the overall security of their applications.

Educate Users on Security Best Practices

While developers play a crucial role in securing DeFi applications, users also have a responsibility to follow security best practices. It is important to provide clear and accessible educational resources to users, guiding them on how to protect their private keys, use secure wallets, and avoid falling victim to phishing or scam attempts. Empowering users with security knowledge enhances the overall security of the DeFi ecosystem.

Audit and Testing in DeFi Development

When it comes to DeFi development, audit and testing play a crucial role in ensuring the security and stability of the project. In the decentralized finance market, where people entrust their funds to smart contracts and dapps, it is essential to have a thorough audit and testing process in place.

An experienced blockchain developer knows that even the most experienced developers can make mistakes. Therefore, a comprehensive audit is necessary before the release of any DeFi project. Auditing can help identify potential vulnerabilities and security risks that could compromise the system.

Furthermore, testing is an essential part of DeFi development. It allows developers to identify and fix bugs and issues before they can be exploited by malicious actors. Rigorous testing can involve both unit testing and integration testing, ensuring that all layers of the system are functioning as intended.

There are different ways to approach auditing and testing in DeFi development. Some developers prefer to work with certified auditors who specialize in blockchain technology. These auditors have the expertise and knowledge to thoroughly review the project’s code and identify any potential vulnerabilities.

Moreover, it is important to involve the community in the auditing and testing process. By sharing code and seeking input from the community, developers can benefit from a diverse range of perspectives and identify potential issues that may have been overlooked. This collaboration can help strengthen the security and reliability of the project.

In conclusion, audit and testing are critical steps in the DeFi development process. By conducting a thorough audit and rigorous testing, developers can ensure the security and stability of their projects. Collaboration with experienced auditors and the community can further enhance the reliability of the project and build trust within the decentralized finance market.

The Future of DeFi Development: Trends and Predictions

In the rapidly evolving world of decentralized finance (DeFi), the future holds great potential for innovative and exciting developments. As a crypto developer, it is crucial to stay updated on the latest trends and predictions in the market. The following are some insights that can help shape your approach to DeFi development.

1. Market Expansion and Increased Adoption

DeFi has experienced tremendous growth in recent years, but this is just the tip of the iceberg. The potential for mass adoption of decentralized finance projects and applications is vast. As more people become aware of the benefits and opportunities offered by DeFi, the market will continue to expand.

2. Enhanced Developer Ecosystem

As the DeFi market expands, the need for experienced developers will also increase. There will be a surge in demand for developers who possess the skills and knowledge to create innovative DeFi systems. This presents an excellent opportunity for developers to specialize in this emerging field and become certified experts.

3. Integration with Traditional Finance

In the coming years, we can expect to see more integration of DeFi with traditional finance systems. This will enable the seamless transfer of assets and liquidity between decentralized and centralized platforms. Such integration will further enhance the accessibility and usability of DeFi for a wider range of users.

4. Rise of Layer 2 Solutions

As more people flock to DeFi platforms, scalability becomes a significant concern. Layer 2 solutions, such as state channels and sidechains, will play a vital role in addressing this issue. These solutions offer a way to process transactions off-chain, reducing congestion and increasing efficiency.

5. Increased Focus on Security

With the growing popularity of DeFi, security will continue to be a top priority for developers. The risks associated with smart contract vulnerabilities and hacks are well-known. Developers will need to stay vigilant, continuously auditing and enhancing their projects to ensure the security and trustworthiness of their decentralized applications (dApps).

6. Community Governance and Decentralization

Community governance will become a central aspect of successful DeFi projects. The ability for token holders to have a say in the decision-making process will contribute to the decentralization and trustworthiness of these platforms. Developers will need to create systems that allow for transparent and inclusive community governance.

In conclusion, the future of DeFi development holds immense potential for growth and innovation. By staying aware of market trends and predictions, developers can position themselves as leaders in this exciting field. Emphasizing security, scalability, and community governance will be key to success in the ever-evolving DeFi landscape.

Scaling Solutions for DeFi Applications

As the market for decentralized finance (DeFi) continues to grow, there is a need for scalable solutions to support the development and widespread adoption of these applications. Scaling refers to the ability of a blockchain system to handle a large number of transactions and users without experiencing performance issues or high fees. Several scaling solutions have been introduced to address these challenges and improve the efficiency of DeFi applications.

Layer 1 Scaling

One approach to scaling DeFi applications is through layer 1 solutions, which involve making changes to the underlying blockchain protocol itself. These solutions aim to increase the throughput and reduce the transaction fees of the blockchain. For example, some projects have developed their own blockchain specifically designed for DeFi applications, offering faster transaction times and lower fees compared to other blockchains.

Layer 2 Scaling

Another approach to scaling DeFi applications is layer 2 solutions, which involve building additional layers on top of the existing blockchain. These layers can handle a large number of transactions off-chain and then settle the final transactions on the main blockchain. This helps to reduce congestion and improve the scalability of the system. Projects like Ethereum have implemented layer 2 solutions such as rollups and sidechains to improve the performance of their DeFi applications.

In addition to these solutions, there are also bridging technologies that facilitate interoperability between different blockchains. This allows users to seamlessly transfer assets from one blockchain to another, opening up new possibilities for DeFi applications and expanding the potential user base.

Overall, scaling solutions are crucial for the continued growth and development of the DeFi market. By improving the efficiency and scalability of blockchain systems, these solutions enable more people to participate in DeFi projects and enhance the overall user experience. As the technology evolves and matures, we can expect to see even more innovative solutions emerge, further advancing the capabilities of decentralized finance.

Interoperability and Collaboration in DeFi Ecosystem

Interoperability and collaboration are key elements in the development of a thriving decentralized finance (DeFi) ecosystem. With the increasing number of projects in the market, it becomes crucial to have a seamless flow of information and data across different blockchain systems and layers.

Furthermore, as more developers and users become involved in DeFi, there is a growing need for interoperability between various decentralized applications (dApps) and protocols. This allows for the integration of different functionalities and the creation of new financial products and services.

Collaboration among developers

Developers play a crucial role in the DeFi ecosystem, as they are responsible for building and maintaining the underlying blockchain infrastructure and dApps. Collaboration among developers is essential to ensure the compatibility and interoperability of different projects.

By sharing knowledge and best practices, developers can learn from each other’s experiences and leverage their expertise to create more robust and secure DeFi applications. Collaboration also helps in identifying and addressing potential security vulnerabilities and improving the overall quality of the ecosystem.

Interoperability between blockchain layers

Interoperability between different blockchain layers is another important aspect of the DeFi ecosystem. It enables the seamless transfer of assets and data between different protocols and applications.

By enabling cross-chain transactions, developers can unlock new possibilities and functionalities for DeFi users. This allows for the integration of various blockchain networks and expands the market for DeFi products and services.

Certification and Community

To foster interoperability and collaboration in the DeFi ecosystem, certification programs and community platforms can be established. These programs can certify developers and projects that meet specific standards and requirements, ensuring the quality and compatibility of their work.

The community platforms can serve as a space for developers to communicate, share ideas, and collaborate on new projects. They can also feature posts and updates about the latest developments and innovations in the DeFi space, helping developers stay informed and connected.

In conclusion, interoperability and collaboration are critical for the growth and success of the DeFi ecosystem. By fostering collaboration among developers and enabling interoperability between different blockchain layers, the DeFi market can become more robust and innovative. Certification programs and community platforms further support the development of a thriving and interconnected DeFi community.

Frequently asked questions:

What is DeFi?

DeFi, short for Decentralized Finance, refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems in a decentralized manner. It allows users to access financial services such as lending, borrowing, and trading without the need for intermediaries like banks.

What is the role of a crypto developer in DeFi?

A crypto developer in DeFi plays a crucial role in building and maintaining decentralized applications (dApps) that enable various financial services. They are responsible for creating smart contracts, designing user interfaces, implementing security measures, and integrating different blockchain platforms.

How can one become a DeFi developer?

To become a DeFi developer, one needs to have a solid understanding of blockchain technology, programming languages such as Solidity, Ethereum Virtual Machine (EVM), and other relevant tools and frameworks. It is also essential to stay updated with the latest DeFi protocols and innovations.

What is the current state of the DeFi development market?

The DeFi development market is expanding rapidly, with new projects and protocols being launched regularly. The total value locked in DeFi applications has reached billions of dollars, showcasing the increasing interest and adoption of decentralized finance. The market offers numerous opportunities for developers to contribute and excel.

What are some popular DeFi platforms?

Some popular DeFi platforms include Ethereum, which serves as the foundation for many DeFi projects due to its smart contract capabilities. Other platforms such as Binance Smart Chain (BSC), Polkadot, and Solana are also gaining popularity in the DeFi space.

What are the benefits of decentralized finance?

Decentralized finance offers several benefits, including eliminating the need for intermediaries, providing financial services to individuals without access to traditional banking, reducing transaction costs, enhancing transparency through blockchain records, and enabling permissionless access to financial products and services.

Videos:

Decentralised Finance: Complete DeFi Overview & Outlook

As a crypto developer, I believe that DeFi is the future of finance. Blockchain technology has the power to revolutionize the way financial transactions are conducted. I am excited to be a part of this innovative field and contribute to the development of decentralized systems that can provide security and efficiency.

I’ve been following the DeFi space for a while now and it’s amazing to see how blockchain technology is revolutionizing finance. The transparency and security that DeFi projects offer are game-changers. Excited to see what the future holds for decentralized finance!

How does a crypto developer leverage blockchain technology to build innovative financial solutions in the DeFi space? Can you provide some examples of these solutions?

Sure, smartblockchain2k! A crypto developer leverages blockchain technology in the DeFi space by utilizing smart contracts to create innovative financial solutions. For example, they can develop decentralized lending platforms that allow individuals to lend and borrow digital assets without the need for traditional intermediaries. Another solution could be the creation of decentralized exchanges that enable peer-to-peer trading of cryptocurrencies, eliminating the need for centralized exchanges. These are just a few examples of how blockchain technology is being used to revolutionize finance through DeFi projects.

I find it fascinating how decentralized finance (DeFi) projects have transformed the financial market through the utilization of blockchain technology. As a blockchain enthusiast myself, I am impressed by the innovative solutions that DeFi developers create. It’s incredible to witness the exponential growth of the DeFi market and how it attracts individuals from diverse backgrounds. The steps to become a DeFi developer are certainly worth exploring to join this promising field of blockchain development.

As a crypto enthusiast, I am fascinated by the potential of DeFi projects in revolutionizing the financial market. Blockchain technology has truly unlocked a new era of decentralized finance. Exciting times ahead!

As a crypto enthusiast, I believe that DeFi projects are paving the way for a decentralized financial future. The power of blockchain technology in building transparent and efficient financial systems is truly remarkable. I’m excited to see how these projects will continue to evolve and revolutionize the financial market.

I am amazed by how decentralized finance (DeFi) projects have transformed the financial market. Blockchain technology has unlocked incredible possibilities for innovative financial solutions. As a crypto enthusiast, I am excited to see where the future of finance is headed.