In a world of ever-increasing financial innovation, decentralized finance (DeFi) has emerged as a new kind of financial ecosystem. With its focus on security, transparency, and accessibility, DeFi offers a host of opportunities to investors looking to tap into the potential of cryptocurrencies and digital assets. Celsius, one of the leading DeFi platforms, has recently made headlines as it pays off its last DeFi loan, marking a significant milestone in its push to reclaim 1 billion dollars from its borrowers.

The volatility of cryptocurrencies has always been a double-edged sword for investors. While it presents the potential for substantial gains, there’s always the risk of significant losses. Celsius, however, has managed to navigate this landscape by offering loans and collateralizing them with digital assets like BTC and ETH. This unique approach has allowed Celsius to attract millions of dollars in loans from its clients, who are willing to deposit their cryptocurrencies as collateral in return for liquidity.

As Celsius pays off its final DeFi loan, it not only demonstrates its commitment to its lenders but also highlights the effectiveness of its business model. By fully collateralizing its loans, Celsius ensures that it can only use the deposited cryptocurrencies to pay off the borrowers. This eliminates the risk of default and provides a level of security that traditional finance cannot match.

By offering high-interest savings accounts and making loans to its customers, Celsius has carved out a niche in the DeFi space. Its main products, including the Celsius Network and its proprietary CEL token, have netted the company with over a billion dollars in deposits and loans. With this latest development, Celsius is on track to reclaiming its capital and strengthening its position as one of the leading players in the decentralized finance industry.

Using Digital Assets as Collateral for Crypto Loans

When it comes to crypto loans, Celsius is making a name for itself by offering customers the option to use their digital assets as collateral. This innovative feature allows borrowers to access liquidity while still retaining ownership of their cryptocurrencies. Celsius does not rely on traditional credit scoring methods, but instead, assesses loan eligibility based on the value of the collateral provided.

The concept of using digital assets as collateral has gained popularity in the decentralized finance (DeFi) space, and Celsius has been championing this approach, allowing borrowers to secure loans backed by their crypto holdings. Since its launch, Celsius has funded over $1 billion in loans, enabling customers to leverage their cryptocurrencies for various purposes.

This method offers several advantages for borrowers. First, it provides access to capital without the need to sell off their assets, allowing them to maintain their investment positions in the volatile crypto market. Second, using digital assets as collateral eliminates the need for credit checks and lengthy application processes, making it a more efficient and convenient option for borrowers.

In terms of risk, Celsius takes a conservative approach by maintaining a low loan-to-value ratio. This means borrowers can only access a portion of their digital asset’s value as a loan, reducing the risk of default. Celsius also performs risk analysis on the collateral provided, ensuring that it meets certain standards of security and reliability.

This innovative lending model has already attracted billions of dollars in collateral, with customers taking advantage of Celsius’ low interest rates and flexible loan terms. In this scenario, borrowers receive their loan in stablecoins or fiat currencies, providing an additional layer of stability to their funds.

Other players in the crypto lending space, such as Salt and Voyager, have also embraced the concept of digital asset-backed loans. While the market for these products is still relatively new, the potential for growth and innovation is significant.

In conclusion, using digital assets as collateral for crypto loans is a game-changer in the world of finance. It allows borrowers to access liquidity without selling off their investments and offers a streamlined and efficient borrowing process. As the market evolves and more players enter the space, we can expect to see even more innovative loan products and solutions.

Lending Out Deposited Cryptocurrency as Crypto Loans

One of the most popular use cases for cryptocurrencies is lending and borrowing. With the rise of decentralized finance (DeFi) platforms, individuals can now lend out their deposited cryptocurrency as crypto loans to other users in the ecosystem. This allows lenders to earn interest on their investments while borrowers can access funds without the need for traditional financial institutions.

The process of lending out cryptocurrency involves depositing the desired digital assets onto a lending platform. These assets can be in the form of Bitcoin, Ethereum, or other popular cryptocurrencies. Once the assets are deposited, lenders can specify the loan terms, including the amount, interest rate, and duration.

Lenders then earn income in the form of interest paid by borrowers for using their assets. The interest rates are usually higher than traditional savings accounts because of the inherent risks and volatility associated with cryptocurrencies. However, borrowers also have the opportunity to earn more if the price of the borrowed asset increases during the loan term.

Platforms like Celsius, BlockFi, and others have become the biggest players in the crypto lending space. They offer various loan products and have attracted a significant number of investors looking to earn passive income through lending. These platforms also focus on marketing efforts to attract new clients and expand their user base.

An important aspect of lending crypto assets is the risk of borrower default. In case a borrower fails to repay the loan, the lender may need to reclaim the value of the loan by selling the borrower’s collateral. This process can be automated through smart contracts and blockchain protocols to ensure transparency and efficiency.

However, in extreme scenarios such as bankruptcy or insolvency of the lending platform, lenders may face challenges in recovering their debts. This is why it is crucial for lenders to conduct thorough analysis and choose reputable platforms with a strong track record.

In conclusion, lending out deposited cryptocurrency as crypto loans has become a popular financial service in the global cryptocurrency ecosystem. It provides an opportunity for investors to earn passive income while borrowers can access funds in a decentralized manner. However, it is important for users to be aware of the risks involved and choose reliable lending platforms for their crypto lending activities.

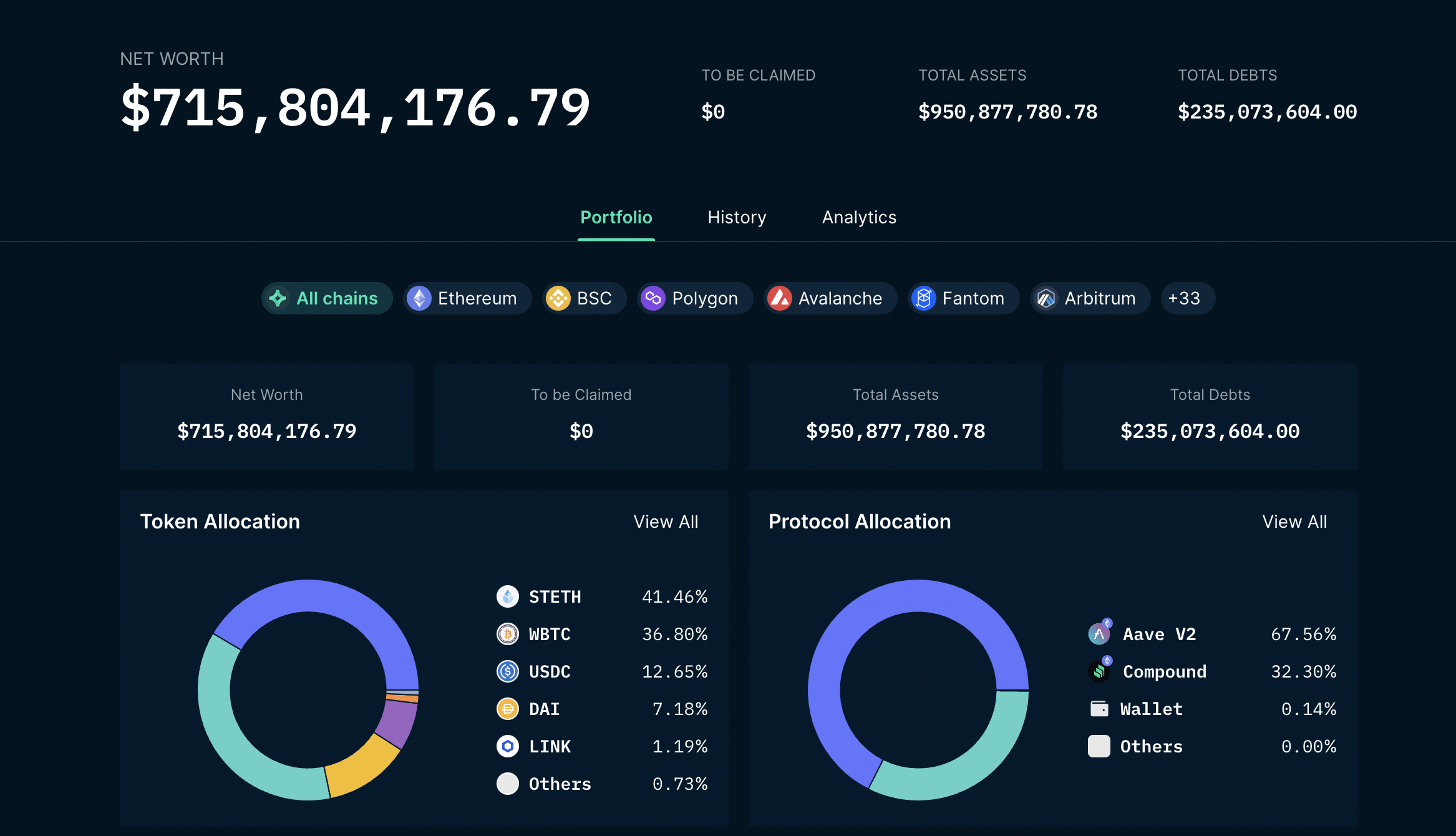

Celsius Has Repaid Its Debts To DeFi’s Biggest Lenders

Celsius, a decentralized finance (DeFi) platform, has successfully paid off all of its debts to DeFi’s largest lenders. The company’s efforts to recoup its 1 billion dollars of outstanding loans have proven fruitful, showing its commitment to fulfilling its financial obligations.

While chasing the ever-changing flavor of the market, Celsius has fully repaid its debts, particularly to Gemini and Compound. These lenders, who were deeply involved in DeFi’s ecosystem, have received their funds back, providing stability and protection for future transactions.

Celsius’s repayment of debts comes at a time when the DeFi industry has witnessed significant volatility, particularly due to the fluctuating prices of Ethereum and other tokens. By settling its outstanding loans, Celsius has demonstrated its commitment to low-risk investments and responsible financial management.

This program has been particularly advantageous for Celsius’s customers, who sent their assets to the platform for savings and investment purposes. With debts now paid off, they can look forward to a more secure and stable financial future.

The repayment of debts is not only a milestone for Celsius but also for the DeFi industry as a whole. It showcases the maturation of decentralized finance and the reliability of its investment platforms.

In this scenario, Celsius’s repayment of debts also highlights the importance of regulatory oversight and consumer protection. By prioritizing the repayment of outstanding loans, Celsius has shown its commitment to maintaining a transparent and trustworthy platform.

Celsius’s repayment of debts is a significant achievement that has created a ripple effect across the DeFi industry. It serves as a reminder that responsible financial management and commitment to obligations are crucial for long-term success in the decentralized finance space.

Reclaiming Over 1 Billion in Collateral

Celsius, the financial company that offers customers to earn interest on their cryptocurrency savings and investments, is making a big push to recoup over 1 billion in collateral that it currently holds. The company is close to repaying the remaining debts from its last DeFi loan program, aimed at helping consumers find liquidity by using their crypto assets as collateral.

Repaying a loan with collateral is a typical process in the world of finance, but Celsius’ program has a unique flavor. Unlike traditional lenders, the company allows borrowers to receive whatever portion of their collateral is returned after an analysis of the market value of their assets.

Since its launch, Celsius has been one of the biggest players in the DeFi space. It currently has over 100,000 accounts, and its model of offering interest on cryptocurrency savings has been well-received by customers. Celsius’ CEO, Alex Mashinsky, says that the company’s main goal is to provide financial services that are beneficial to both lenders and borrowers.

In a recent blog post, Celsius founder Robert Kim noted that the company’s loan program has been a success so far, with borrowers reclaiming close to 1 billion in collateral. He also mentioned that the company is working on a new program to help customers pay off their loans more quickly.

The Push to Reclaim Collateral

The main challenge for Celsius in reclaiming collateral is the volatility of cryptocurrency prices. Since the value of cryptocurrencies can fluctuate wildly, borrowers may find themselves in a situation where the value of their collateral is worth less than their outstanding debts. In this case, Celsius steps in to protect its customers by liquidating a portion of the collateral to cover the outstanding debts.

However, Celsius aims to avoid liquidation whenever possible. The company has developed sophisticated analysis tools to determine if a borrower is at risk of becoming insolvent. This analysis takes into account factors such as the volatility of the borrower’s chosen cryptocurrency, the borrower’s trading history, and the overall market conditions.

By giving borrowers the opportunity to repay their loans with whatever portion of their collateral is returned, Celsius ensures that its customers have the best chance of reclaiming their assets. This approach not only protects borrowers, but it also helps to strengthen Celsius’ reputation as a trustworthy financial company in the cryptocurrency space.

Collateral Reclaiming Process

The process of reclaiming collateral with Celsius is straightforward. Borrowers provide their crypto assets as collateral, and Celsius holds these assets until the loan is repaid. Once the loan is paid off, borrowers receive their collateral back, minus any outstanding debts. This allows borrowers to take advantage of liquidity while still maintaining ownership of their assets.

Celsius’ commitment to reclaiming collateral is part of its broader mission to revolutionize the financial industry through the use of cryptocurrencies. The company aims to provide its customers with a secure and transparent platform for earning interest and accessing liquidity, all while retaining control of their assets. With its innovative loan program and focus on customer protection, Celsius is paving the way for a new era of financial services in the cryptocurrency world.

Celsius Earned Almost 200 Million in Collateral from Compound

In its push to recoup 1 billion, Celsius has successfully earned almost 200 million in collateral from Compound. The financial lending platform, which operates on the blockchain, has been particularly successful in its lending program, with borrowers now being able to secure loans with their cryptocurrencies as collateral.

By leveraging the Celsius platform, clients are able to take out loans against their assets, providing a hedge against market volatility and ensuring they have access to the liquidity they need. With the ability to earn substantial returns on their collateral, Celsius has positioned itself as a trusted financial partner for its clients.

Unlike traditional lenders, Celsius does not require borrowers to fill out extensive paperwork or deal with complex financial regulations. Instead, the platform offers a seamless and user-friendly experience, allowing users to access funds in a matter of hours.

The success of Celsius in earning collateral from Compound demonstrates the sophistication of their lending model. By partnering with other prominent lenders in the industry, such as Maker and Genesis, Celsius is able to provide its clients with a wide range of borrowing options and offer low-risk loans backed by cryptocurrencies.

This approach has resonated with the market, as Celsius has become one of the biggest players in the decentralized finance (DeFi) space. With billions of dollars in funding provided to date, Celsius continues to attract more clients who are looking for a secure and reliable lending platform.

Looking ahead, Celsius plans to further expand its lending program and explore new opportunities in the DeFi space. Despite the regulatory challenges faced by the crypto industry, Celsius remains confident in its ability to navigate these obstacles and continue providing its clients with innovative financial products.

In a recent interview, Celsius CEO Alex Mashinsky stated that they’re doing whatever it takes to reclaim the 1 billion they have lent out. With the collateral they have received from Compound, Celsius is well on its way to achieving this goal.

As more and more individuals and institutions turn to crypto and DeFi for financial services, Celsius aims to be at the forefront of this industry. With its proven track record and commitment to providing a secure and rewarding experience for its clients, Celsius is poised to make a significant impact in the world of decentralized finance.

The Future of Crypto Lending

As the popularity of cryptocurrencies continues to rise, so does the demand for lending platforms that can provide liquidity to investors. In traditional finance, banks have always played a crucial role in offering loans to individuals and businesses. However, with the advent of blockchain technology and decentralized finance (DeFi), the landscape is rapidly changing.

DeFi stands for decentralized finance and refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems. One of the main advantages of using DeFi for lending is the elimination of intermediaries such as banks, making transactions faster and more transparent.

However, the high volatility of cryptocurrencies remains a challenge. The value of digital assets can fluctuate dramatically within a short period of time, making it difficult for lenders and borrowers to predict the future value of their collateral. This highlights the need for sophisticated risk management tools and financial instruments.

Despite these challenges, the future of crypto lending looks promising. Companies like Celsius are leading the way by providing innovative solutions to this fast-growing market. Celsius recently announced the repayment of its last DeFi loan, marking a significant milestone in its efforts to recoup $1 billion in outstanding debts.

In a recent analysis, Celsius found that more than $26 billion of cryptocurrencies are currently used as collateral for loans across various platforms. The company deeply understands the potential risks associated with crypto lending and has responded by implementing a conservative approach to loan underwriting.

One of the reasons why Celsius has been able to successfully navigate the volatile crypto market is its unique business model. Unlike other lending platforms, Celsius pays interest to its users in-kind, allowing them to earn interest from their deposited cryptocurrencies. This approach has attracted thousands of users who are tired of the dead capital in their wallets and are looking for ways to generate passive income.

Another key factor contributing to the success of Celsius is its focus on security. The company has implemented stringent security measures to protect its users’ funds, including a multi-signature wallet system, regular security audits, and insurance coverage for digital assets.

Looking ahead, the crypto lending industry is expected to continue evolving. Regulatory frameworks surrounding DeFi are still unclear, but companies like Celsius are working closely with regulators to ensure compliance and build trust among users and investors.

Overall, the future of crypto lending holds a lot of potential. With the right risk management tools and innovative solutions, lending platforms can bridge the gap between traditional finance and the world of cryptocurrencies, providing both individuals and businesses with access to capital and liquidity.

Sources:

– Celsius blog: celcius.network/blog

– Genesis works: genesisworks.com

– Nexo: nexo.io

Frequently Asked Questions:

What is Celsius?

Celsius is a platform that allows users to earn interest on their cryptocurrency deposits and provides them with the ability to take out loans using their digital assets as collateral.

What is DeFi?

DeFi, or decentralized finance, refers to the use of blockchain technology and cryptocurrencies to recreate traditional financial systems and eliminate the need for intermediaries such as banks or brokers.

How does Celsius repay its loans?

Celsius repays its loans by using the collateral that was deposited by borrowers. In this case, Celsius paid off its DeFi loans by returning the cryptocurrency collateral that it had used as security.

How much collateral did Celsius reclaim?

Celsius reclaimed over 1 billion in collateral from its DeFi loans. The repayment to Compound alone resulted in the recovery of almost 200 million in collateral.

Video:

How To Avoid Crypto Taxes: Cashing out

Celsius Network $215 Million Altcoins Dump: Investors Beware!

As an investor in the crypto space, I have been following Celsius closely and I must say, they never fail to impress me. Their ability to repay their loans and recover such huge amounts of collateral is truly remarkable. It’s a great testament to the potential of using digital assets as collateral for lending. Celsius has definitely solidified its position as a leading DeFi platform in my eyes.

Do you think using digital assets as collateral for crypto lending is a secure approach? What are the risks involved?

As an investor in the crypto space, I believe using digital assets as collateral for crypto lending can be a secure approach if done properly. The risks involved primarily revolve around market volatility and the potential for asset value fluctuations. However, platforms like Celsius have implemented mechanisms to safeguard against these risks. They carefully assess the collateral value to ensure adequate coverage and have introduced risk management protocols. Overall, it’s important to thoroughly research and choose reputable platforms that prioritize security and transparency.

Repaying the last DeFi loan is a major achievement for Celsius! It’s great to see them recovering over 1 billion in collateral. Celsius has truly revolutionized the lending industry by using digital assets as collateral. Keep up the good work!

I believe Celsius has demonstrated its ability to effectively manage risks by successfully repaying its final DeFi loan and recovering a significant amount of collateral. The use of digital assets as collateral for crypto lending is certainly a growing trend that offers great potential for investors. Exciting times ahead for crypto lenders like Celsius!

Interesting article! How does Celsius ensure the security of the collateralized digital assets?

Celsius takes the security of collateralized digital assets seriously. They use a combination of advanced encryption techniques and multi-signature wallets to protect the assets. Additionally, Celsius has partnered with leading custodians and has implemented strict security protocols to safeguard the assets. Rest assured, Celsius goes above and beyond to ensure the safety of investors’ collateral.

I’m really impressed with Celsius’s ability to successfully pay off its last DeFi loan and reclaim over 1 billion in collateral. It’s a testament to their strong position in the crypto lending space. I believe this trend of using digital assets as collateral will continue to grow, bringing more opportunities for investors like myself.